Quicken is a personal finance management application for creating budgets, tracking expenses, and managing investments. Its personal finance tracking solution, Simplifi, is great for managing your finances, investments, and debt; however, it lacks rental property management features. Quicken’s monthly fee ranges from $5.99 to $10.99 (billed annually), whereas Simplifi is priced at $3.99 per month (billed annually).

Quicken has received strong reviews on third-party sites that praise its versatility and ease of use. However, some users report issues with connecting bank accounts and lost data when updating the software. Nevertheless, it is an excellent choice for sole proprietors or small businesses without employees seeking affordable software with robust expense and income tracking capabilities.

The Fit Small Business editorial policy is rooted in the company’s mission, which is to deliver the best answers to people’s questions. This serves as the foundation for all content, demonstrating a clear dedication to providing valuable and reliable information.

We leverage our expertise and extensive research capabilities to identify and address the specific questions our audience has. This ensures that our content is rooted in knowledge and accuracy and offers in-depth insights and recommendations.

Fit Small Business maintains stringent parameters for determining the “best” answers, including accuracy, clarity, authority, objectivity, and accessibility. These criteria see to it that our content is trustworthy, easy to understand, and unbiased.

Pros

- Manage personal finances in addition to rental property

- Email custom invoices and collect payments online

- Powerful budgeting capability

- Obtain detailed information on your investments and monitor your portfolios

- Easily pay and manage your bills in one place

Cons

- Not a double-entry accounting system

- Not a fit for those with a large number of rental properties

- Only annual billing

- Mobile and web companions are limited in features

- Have to sync Quicken web and desktop manually before and after using

Monthly Pricing (Billed Annually) |

|

|---|---|

Free Trial | 30 days |

Standout Features |

|

Customer Support | Live chat, phone support, self-help guides, community forum, and help center |

Average User Reviews | Generally positive for ease of use and affordability; however, some reviewers dislike that not all versions are available for Mac users. |

- Individuals seeking personal finance software: Quicken is primarily a personal finance software that can track your spending, savings, and retirement accounts and help you prepare a budget. This makes it one of our best QuickBooks Self-Employed alternatives.

- Landlords needing an alternative to Xero: Quicken is named one of our leading Xero competitors, and we ranked it as the best alternative for individuals with a few rental properties. This is because it allows property managers to keep track of their tenant payments, rental rates, and lease terms, which isn’t possible with QuickBooks. You can also track property values via Zillow.

- Simple businesses wanting an affordable bookkeeping solution: Quicken’s Business & Personal version lets you invoice customers, track A/R and A/P, and generate financial reports. It is ideal for self-employed individuals and provides an affordable solution if you need an easy-to-use bookkeeping software for managing your books.

Quicken Alternatives & Comparison

Quicken Reviews From Users

| Users Like | Users Dislike |

|---|---|

| Add recurring future-dated transactions | Issues with connecting bank accounts and lost data when updating software |

| Versatile solution, depending on your situation | No monthly billing |

| Easy to use and affordable | No free version |

Users who left a Quicken review gave high ratings for ease of use and the straightforward layout that is easy to navigate, and reviewers reported a short learning curve to get it up and running. Some also appreciated its affordability and range of plans that cater to different needs.

However, a few said that they dislike that Quicken’s service is billed annually. Others complained about issues with updating software and connecting bank accounts and lamented the fact that it doesn’t offer a mobile app.

Based on user reviews from popular third-party review sites, Quicken received the following scores:

- Software Advice[1]: 3.9 out of 5 based on over 400 reviews

- G2[2]: 4.2 out of 5 based on around 70 reviews

- Trustpilot[3]: 3.6 out of 5 based on more than 33,000 reviews

Quicken Pricing

Quicken offers a choice of three desktop app-based plans: Deluxe, Premier, and Business & Personal. Prices run from $5.99 to $10.99 per month (billed annually). Quicken also offers a mobile and web app called Simplifi, which is priced at $3.99 per month (billed annually).

Simplifi | Deluxe | Premier | Business & Personal | |

|---|---|---|---|---|

Monthly Price (Billed Annually) | $3.99 | $5.99 | $7.99 | $10.99 |

Free Trial | 30 days | 30 days | 30 days | 30 days |

Platforms | Mobile and web app | Desktop or web app (Windows & Mac) | Desktop or web app (Windows & Mac) | Desktop or web app (Windows & Mac) |

Free Quicken Phone & Chat Support | ✓ | ✓ | ✓ | ✓ |

Priority Access to Live Agents | ✕ | ✕ | ✓ | ✓ |

Automatic Download of All Transactions | ✓ | ✓ | ✓ | ✓ |

Add Manual Accounts | ✓ | ✓ | ✓ | ✓ |

Auto categorization of Income & Expenses and Define Custom Rules | ✓ | ✓ | ✓ | ✓ |

Create Custom Income & Expense Categories | ✓ | ✓ | ✓ | ✓ |

Add Notes & Memos to Transactions | ✓ | ✓ | ✓ | ✓ |

What-if Analysis | ✕ | ✓ | ✓ | ✓ |

Create a 1-Month Budget | ✓ | ✓ | ✓ | ✓ |

Create Multiple Budgets | ✕ | ✓ | ✓ | ✓ |

Auto-detect Bills | ✓ | ✕ | ✕ | ✕ |

Bank Bill Pay | ✕ | ✓ | ✓ | ✓ |

Customize Your Portfolio View to Meet Your Investment Needs | ✕ | ✓ | ✓ | ✓ |

Make Same-day Online Payments | ✕ | Starts at $9.95 monthly | ✓ | ✓ |

Import Tax Information From TurboTax | ✕ | ✕ | ✓ | ✓ |

Buy/Sell Tool to Model Tax Implications of Planned Transactions | ✕ | ✕ | ✓ | ✓ |

Business & Rental Property Reports | ✕ | ✕ | ✕ | ✓ |

Track A/R, A/P, P&L, and Cash Flow | ✕ | ✕ | ✕ | ✓ |

Email Custom Invoices From Quicken With Payment Links | ✕ | ✕ | ✕ | ✓ |

Track Income & Expenses Across Multiple Businesses | ✕ | ✕ | ✕ | ✓ |

Track Tenants & Rent Across Multiple Properties | ✕ | ✕ | ✕ | ✓ |

Quicken Features

Quicken offers many useful features, whether you’re subscribed to the Deluxe, Premier, Business & Personal plan, or the Simplifi app. Your dashboard is easy to navigate, and you can access key sections such as rentals and accounts there. For personal finance, you can create a budget, manage your bills, or plan for retirement. Business tools enable you to invoice clients and track A/P and A/R, while rental tools let you manage tenants, track your property’s market value, and scan receipts.

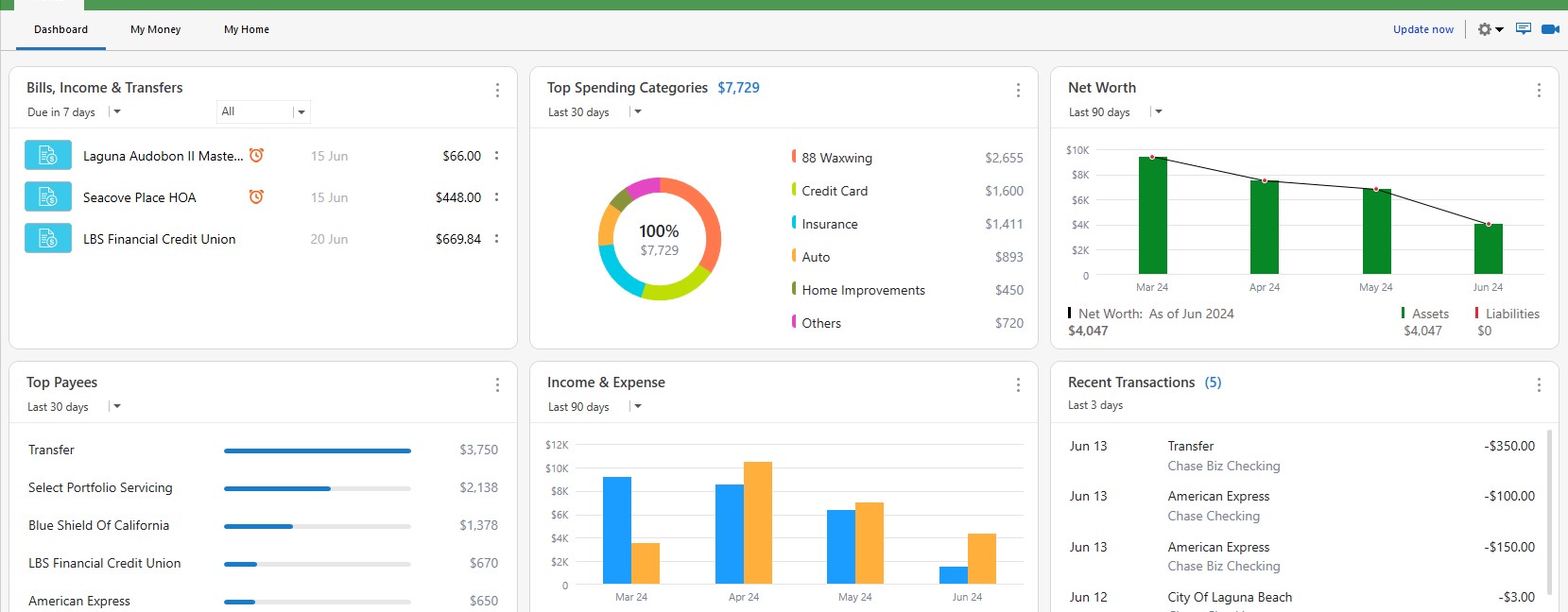

Your financial management journey begins on the dashboard or Home tab, which gives you a comprehensive view of your finances. The dashboard allows you to manage and track your budget, spending, and bills. You can customize the Home tab by creating multiple views and customizing which financial areas are viewable.

Quicken’s dashboard

Get a better handle on your household spending with Quicken’s personal finance management tools. Whether you’re creating a budget, managing your bills, or planning for your retirement, it has the features you need to reach your goal.

- Expense management: Understand where your expenses go by sorting your accounts and transactions in one place. Create customized categories, track spending by categories and amounts or types of expenses, see spending trends, and get an idea of what your future finances will look like. You can also categorize transactions using multiple expense categories.

- Budgeting: Plan your personal or household expenses and compare them to your actual spending. You can track your budget on the web or a mobile device easily. The software lets you create multiple budgets based on categories that you select—or Quicken chooses for you based on your income and expense patterns. You can view your progress in a graphical format and adjust your budget as needed.

- Bank feed integration: Connect your bank accounts to track your income and spending effortlessly.

- Bill management: Very few other personal finance apps include bill payment, and you can use its free Bill Manager. Send your payments through Quick Pay for digital bills and Check Pay for physical checks. You can also set up automatic billing alerts so that you’ll never miss payments again. Note that same-day payments processed electronically through Quicken Deluxe incur an additional fee of $9.95 per month.

- Retirement planning: Quicken gives you an overview of your assets, holdings, and investments, including 401(k)s, 403(b)s, and individual retirement accounts (IRAs). It includes a Lifetime Planner―available in Windows―which helps you envision all kinds of financial scenarios.

As compared to its competitors which focus on shorter-term horizons like a year or two out, Quicken gives you a lifelong timeframe that analyzes your progress toward retirement and significant life events like buying a home or having a child.

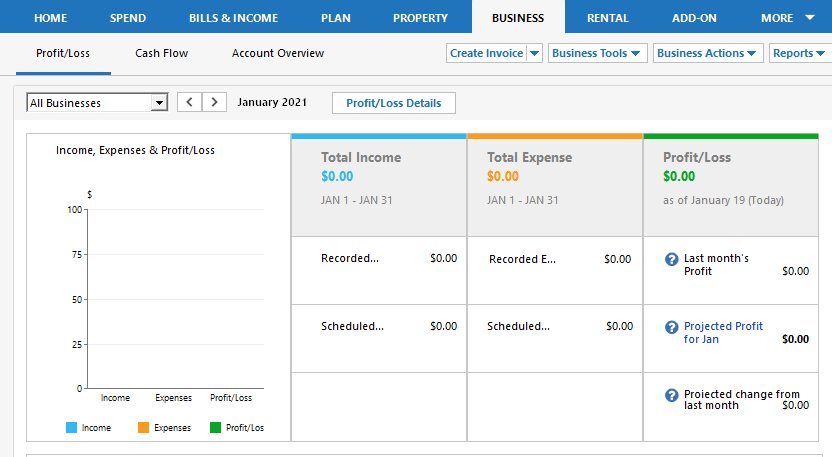

Quicken Business & Personal is suitable for freelancers needing basic support for creating customer estimates and invoices, tracking A/R and A/P, and creating several reports.

- Invoicing: Choose from several templates to create customized invoices, and add a payment link to PayPal. You can print your invoice or email it directly to your client.

- Estimates: Create an estimate, and then print or send it to your customer through email. You can track your estimates in the Estimate list.

- A/P and A/R tracking: Purchase Quicken Business & Personal to start tracking your A/R (invoices), A/P (bills), loans, and fixed assets.

- Deduction finder: Know if you qualify for over 100 common tax deductions. If you do, Quicken lets you add the tax-related categories you need to simplify tax time.

- Business forecasting: Quicken can help you explore various “what-if” scenarios. For example, small business owners can forecast how their business might perform in a recession.

Quicken’s Business tab

Simplifi by Quicken focuses on personal finance. Unlike Quicken, it’s purely cloud-based since it has no desktop app. While it doesn’t have features for freelancers, like Quicken Business & Personal, it offers more streamlined personal finance tracking because it has both mobile and web browser access.

Essentially, the program analyzes your current income and spending habits to automatically generate a budget, which is less work and time-intensive than doing it yourself.

Here are some of Simplifi’s notable features:

- Spending and savings management: Track your spending across all of your bank accounts, create income and expense categories, and set custom saving goals on Simplifi. The custom saving goals feature is unavailable in the Quicken for Mac version.

- Budgeting: Create a one-month budget, budget for savings, and track spending history. As a personal finance tracker, Simplifi only offers one budget per month. If you need multiple budgets and rollover budgeting features, we recommend any other Quicken plan.

- Bill management: Simplifi can auto-detect bills, alert you about unusual bills, set spending alerts, and project cash flow. These features are useful in planning your spending and ensuring healthy liquidity. You can even share a snapshot of your finances with a financial planner or advisor.

- Debt, investments, and mortgage tracking: If you have debt and equity securities, Simplifi can serve as a tracker. You can include education (529) and custodial accounts, retirement 401(k), IRAs, and 403(b). You can also track your home value and net worth.

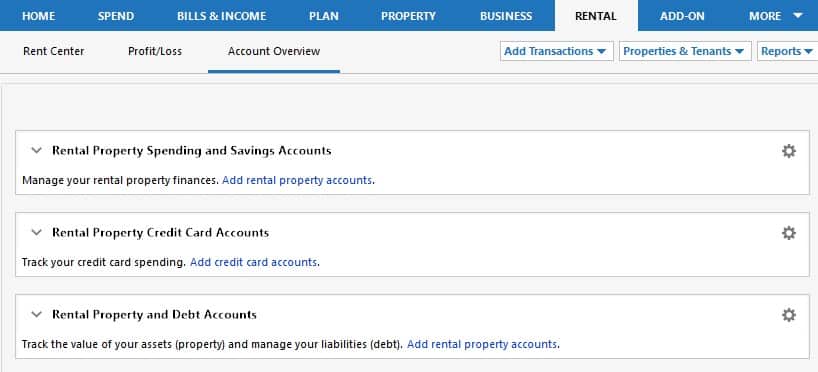

Quicken’s rental property manager provides helpful features to streamline landlord responsibilities. These features are available only on Quicken Business & Personal. Its key rental features include the following:

- Contact management: Organize and manage all your contact details—including rental agreements, security deposits, and move-in and move-out dates—in one place.

- Tenant management: Stay on top of your tenant listings (including tracking rent across multiple listings), income, expenses, bank accounts, documents, loans, and property value. You can also track occupancy rates and send reminders as needed.

- Market value tracker: Gain insight into your holdings, and view snapshots of your portfolio by type, sector, or allocation using Quicken’s integrated Morningstar X-ray tool.

- Receipt scanning: Make expense tracking a breeze by saving your receipt data as a QIF file or importing it to Quicken.

- Document storage: Store and manage documents related to your properties, tenants, and projects.

Quicken’s Rental tab

In every Quicken plan, you can use the web companion for more accessibility. However, you still need to buy the desktop version to use the web version. There’s no difference between the desktop and web versions. The major downside is that the desktop and web versions don’t sync automatically, so you’ll have to sync before and after using them to ensure that the two are up to date.

Download the Quicken mobile app on Google Play or App Store to manage your finances anytime and anywhere. After you set up your mobile app, your information will be synced between the mobile app and your desktop program via the Quicken Cloud.

Quicken generates ample financial reports, including cash flow, P&L, account balances, transactions, payee comparisons, budget spending, cash flow comparisons, and banking summaries. However, it cannot generate a balance sheet for your small business or rental properties. If you need a balance sheet, you’ll need a double-entry bookkeeping software like QuickBooks Online.

Quicken Ease of Use

While Quicken is generally easy to use, some of its features are not intuitive, and you’ll need to devote time to learning to use them. The platform offers multiple options for customizations, so you can completely personalize it to your needs.

Quicken Customer Service

Quicken offers plenty of support options to help you get the most out of the software, such as a “Getting Started” guide, a community forum, and a help center. Quicken can respond to your questions over the phone and through live chat. If you subscribe to Premier or Business & Personal, you get unlimited priority access to its customer care phone support for one year.

Frequently Asked Questions (FAQs)

The most notable difference between Quicken and Simplifi is that Simplifi is a web and mobile app, meaning that there isn’t a desktop application that needs to be installed.

Simplifi isn’t the mobile version of Quicken—it’s an entirely different personal finance app that was designed for iOS and Android users and web platforms. Quicken’s mobile app, on the other hand, offers mobile access to Quicken data for Quicken subscribers.

If you manage only a few rental properties and need a basic solution for creating invoices and tracking bills and tenant payments, then Quicken Business & Personal may be right for you.

Yes—specifically for landlords. Quicken is especially useful for individuals with real estate properties. You may want to read our comparison of Quicken vs QuickBooks to determine if Quicken is a good fit for your business.

No, Quicken doesn’t provide tax preparation services. However, you can use it to organize your tax-related data and export it to tax software like TurboTax.

Yes, Quicken has a mobile app that is available for iOS and Android users. The app allows users to track their expenses, view account balances, and receive alerts.

Bottom Line

If you’re looking for a fairly straightforward solution for managing your business and personal finances side-by-side, then Quicken offers pretty good value for your money. It has a good set of features, plus its mobile app gives you the ability to manage and view your finances on the go. Quicken Business & Personal delivers the most value to small businesses and rental property owners looking for a simple way to manage their finances.