The main differences between Quicken vs QuickBooks Online are their purposes and target audiences. Quicken focuses on personal finance features, such as budgeting, investment tracking, and bill management. However, it does have features to track the income and expenses of rental houses and simple one-person businesses.

Meanwhile, QuickBooks Online is a double-entry accounting system A double-entry bookkeeping system tracks assets and liabilities as well as income and expenses. This enhances the reliability of income and expenses by ensuring that all changes in assets and liabilities are reflected in net income. that provides a broader set of features tailored to business needs, such as invoicing, payroll, vendor management, and financial reporting:

- Quicken: Best for tracking personal finances and rental property income

- QuickBooks Online: Best for small businesses seeking accounting software that will track income and expenses

We are driven by the Fit Small Business mission to provide you with the best answers to your small business questions—allowing you to choose the right accounting solution for your needs. Our meticulous evaluation process makes us a trustworthy source for accounting software insights. We don’t just scratch the surface; we immerse ourselves in every platform we review by exploring the features down to the finest nuances.

We have an extensive history of reviewing small business accounting software, and we stay up-to-date with the latest features and enhancements. Our first-hand experience, guided by our internal case study, helps us understand how the different products compare with each other and how they work in real-world scenarios.

|  | |

|---|---|---|

Monthly Pricing | $4.49 to $9.99, billed annually | $30 to $200 |

Number of Users Included | 1 | 1 to 25 |

Double-entry Bookkeeping System | ✕ | ✓ |

Payroll Add-on Available | ✕ | ✓ |

Inventory Tracking | ✕ | ✓ |

Separate Business & Personal Expenses | ✓ | ✓ |

Schedule C & E Reports | ✓ | ✕ |

Print Income Statement & Balance Sheet | ✕ | ✓ |

Rental Property Center | ✓ | ✕ |

Grant Access to Accountant | ✕ | ✓ |

Ease of Setup & Use | Moderate | Easy |

Mobile App | iOS and Android | iOS and Android |

Average Rating on Third-party Sites |

Use Cases and Pros & Cons

Is Quicken or QuickBooks Best for You?

User Reviews: Tie

|  | |

|---|---|---|

Average Rating on Third-party Sites | ||

Users Like |

|

|

Users Dislike |

|

|

Although QuickBooks Online technically scored higher, the user reviews were too close to call one clear winner. We analyze the reviews for each below.

Quicken users said that they appreciate that the platform is inexpensive and offers an easy way to track personal expenses. Reviewers also praised its ability to track retirement assets. The software’s biggest drawback is its inability to perform basic bookkeeping tasks such as invoicing clients.

Quicken earned the following average scores on popular review sites:

Users who left QuickBooks Online reviews said that the software is easy to set up and use, adding that it has a simple and clean user interface and intuitive features. Some also praised all of the available integrations. However, some noted that it doesn’t allow for unlimited users.

These are its average scores on popular review sites:

Pricing: Quicken Wins

Quicken | QuickBooks Online | |

|---|---|---|

Monthly Pricing | $4.49 to $9.99, billed annually | $30 to $200 |

Numbers of Users | 1 | 1 to 25 |

Special Promo | 30-day money-back guarantee | 70% off for three months or a 30-day free trial |

When it comes to comparing Quicken vs QuickBooks for pricing, we declare Quicken as the winner because it offers great value—provided that all you need is to track income and expenses. QuickBooks Online is priced much higher than Quicken, with QuickBooks Simple Start costing three times as much as Quicken Home & Business. However, the cost of QuickBooks Online will be worth it if you need the features of a full bookkeeping system, such as tracking assets and liabilities and printing a balance sheet.

Features: QuickBooks Online Wins

Quicken | QuickBooks Online | |

|---|---|---|

Platform | Web browser and desktop | Web browser |

Print Complete Financial Statements | ✕ | ✓ |

Integrated Payroll | ✕ | ✓ |

Track Inventory & COGS | ✕ | ✓ |

Separate Activity by Class & Location | ✕ | ✓ |

Track Employee Time & Add to Customer Invoices | ✕ | ✓ |

Double-entry Bookkeeping | ✕ | ✓ |

Track & Categorize Spending | ✓ | ✓ |

Track Unpaid Bills | ✓ | ✓ |

Connect Bank Accounts | ✓ | ✓ |

Manage Lease Terms, Rental Rates & Security Deposits | ✓ | ✕ |

Investment Reporting Features | ✓ | ✕ |

Quicken and QuickBooks Online offer very different features. QuickBooks Online takes the lead in this category because it is a full-featured accounting software. It tracks the assets, liabilities, income, and expenses of a business accurately. It also includes features many businesses require, such as collecting and remitting sales tax, paying employees, and tracking the cost of inventory.

Meanwhile, Quicken’s features are geared mostly toward managing personal expenses and investments. However, the Home & Business edition adds some business income and expense tracking, along with a suite of rental management tools.

Ease of Use: QuickBooks Online Wins

Quicken | QuickBooks Online | |

|---|---|---|

Overall Ease of Use | Moderate | Easy |

Online Help Section | ✓ | ✓ |

Community Support | ✓ | ✓ |

Email Support | ✕ | ✕ |

Live Chat Support | Monday to Friday, 5 a.m. to 5 p.m. PT | ✓ |

Phone Support | Monday to Friday, 5 a.m. to 5 p.m. PT | QuickBooks Support will call you |

Third-party Support | Limited | Extensive |

QuickBooks Online is easier to set up than Quicken because it is purely web-based and can be accessed from any browser, so you have nothing to download or install. It is also easier to track business income and expenses because that’s its primary focus.

Meanwhile, Quicken—which has many personal finance features that can be confusing and unnecessary for tracking business income—offers Quicken for Web. This is a companion app to the desktop version; however, you still need to purchase Quicken for desktop to use its web version.

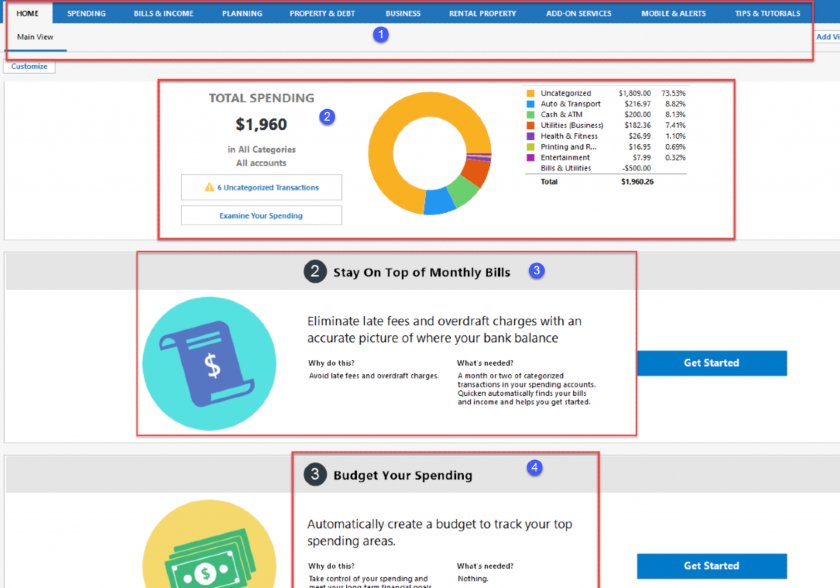

Quicken Dashboard

Quicken Dashboard

- Menu bar: Click on the top menu bar to navigate to the various areas of the program like Bills & Income, Rental Property, and Tips & Tutorials.

- Total spending: Keep tabs on where your money is going by reviewing the graph that shows the amount spent by category, such as Auto or Utilities.

- Bills to pay: Stay on top of monthly bills that you pay using the Bill Pay feature.

- Budget: Create a budget to help you find ways to decrease your spending and save more money.

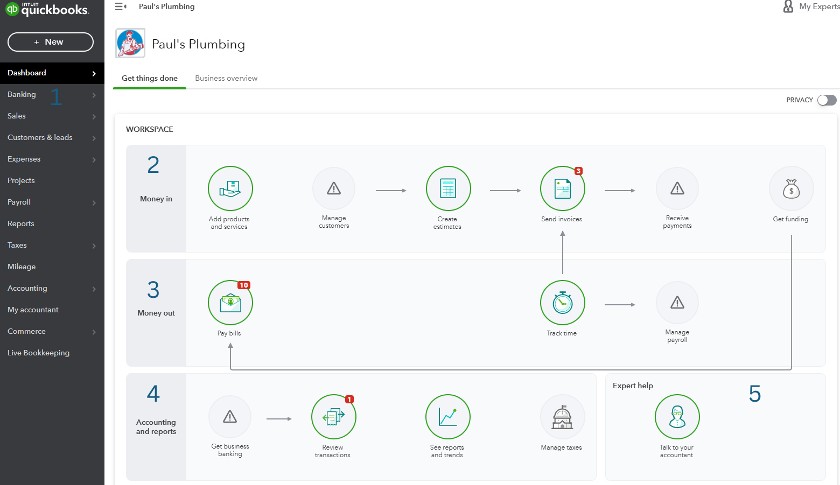

QuickBooks Online Dashboard

QuickBooks Online dashboard

- Left menu bar: You can access just about any task from the left menu bar, including creating invoices, bank accounts, and reports.

- Money in: In this section, you can add products and services, manage customers, create estimates, send invoices, receive payments, and apply for funding.

- Money out: In this section, you can pay bills, track time, and manage employee payroll.

- Accounting and reports: View your bank accounts, review transactions, see reports and trends, and manage taxes (sales and payroll) in this section.

- Expert help: If you need assistance, you can either invite your accountant to view your file or request expert help through QuickBooks Online.

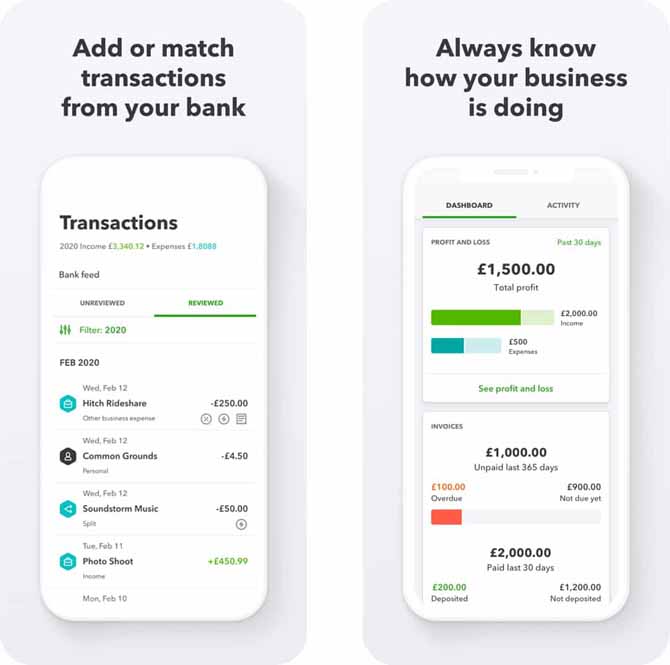

Mobile App: QuickBooks Online Wins

Quicken | QuickBooks Online | |

|---|---|---|

Availability | iOS and Android | iOS and Android |

Attach Receipts | ✓ | ✓ |

Create Invoices | ✕ | ✓ |

Enter Vendor Bills | ✕ | ✓ |

View Transactions & Account Balances | ✓ | ✕ |

See Budgets | ✓ | ✕ |

Add Customers & Vendors | ✕ | ✕ |

Both solutions allow you to access your data on the go with their mobile apps, but Quicken’s mobile app is limited in functionality, which is why QuickBooks wins this category. For example, Quicken’s mobile app doesn’t allow you to create invoices and enter vendors, two features that are available with QuickBooks Online’s app. However, neither app is as good as the web and desktop platforms.

Integrations: QuickBooks Online Wins

Quicken has limited integrations, while QuickBooks Online has more than 750, making QuickBooks the clear winner. It even has built-in integrations, like QuickBooks Payroll, QuickBooks Time, QuickBooks Payments, and Intuit Merchant Services. On top of these, you can add apps like Shopify and Square to manage your ecommerce business.

Meanwhile, Quicken integrates with PayPal for accepting online credit card payments from customers; Dropbox to store important documents, such as rental agreements and contracts, and Zillow Zestimate, a tool that you can use to calculate the value of your home. Similar to QuickBooks Online, it has a built-in bill payment tool, allowing you to pay bills online.

Frequently Asked Questions (FAQs)

The main difference between Quicken and QuickBooks is that Quicken focuses on the finances of individuals, whereas QuickBooks focuses on accounting for small businesses. Although Quicken does have a version of its software for both rental property owners and small businesses, it is not double-entry accounting software and thus is not as advanced as QuickBooks.

Yes, Quicken has a mobile app for both iOS and Android users, but its functions are limited. You can view transaction and account balances, attach receipts, and view budgets, but not add customers and vendors, create invoices, or add vendor bills.

Yes, Quicken is less expensive than QuickBooks at prices that range from $4.49 to $9.99 per month, billed annually. QuickBooks charges $30 to $200 per month, depending on the features and number of users you need.

Yes, it can also be used to manage the finances of very small businesses or self-employed individuals with basic bookkeeping needs, though it is primarily designed for personal finance management.

QuickBooks Online offers a 30-day free trial, whereas Quicken offers a 30-day money-back guarantee.

Bottom Line

When we compare Quicken vs QuickBooks for small business bookkeeping, QuickBooks Online is the clear winner. However, Quicken is better for businesses with a maximum of three rental properties and solopreneurs whose business activities are integrated with their personal bank and credit card accounts. Most businesses need more than Quicken offers, but it is a good option if you’re also looking for a personal finance app.

User review references:

[1]G2.com | Quicken

[2]GetApp | Quicken

[3]G2.com | QuickBooks Online

[4]GetApp | QuickBooks Online

[5]TrustRadius | QuickBooks Online