SBA Form 1919, also known as the Borrower Information Form, is designed to gather various information about the borrower, the owners of the business, and the financing request. This can include basic identifying information, the purpose of the loan, and the nature of the company’s products and services.

Lenders use the information provided to determine your eligibility for financing. Completing the form correctly can minimize delays and get you access to funds more quickly.

Who Completes SBA Form 1919

The form must be completed by all business owners, with the SBA defining the following business entities as owners of the applicant:

- Sole proprietor: An individual who owns and operates a business by themselves

- Partnership: All general partners, including limited partners with 20% or more ownership interest in the firm

- Corporation: All individuals with 20% or more equity ownership in the company

- Limited liability company: All members who have 20% or more ownership of the business

How to Fill Out SBA Form 1919 by Section

To obtain the most current copy, you can get SBA 1919 on SBA’s website or use our download link below. The form linked below currently has an expiration date of June 30, 2027.

SBA Form 1919 consists of seven pages, although only the first four contain information that must be filled out or signed by you or an authorized representative of your company. Below, we’ve provided instructions for how to fill out each part of this form.

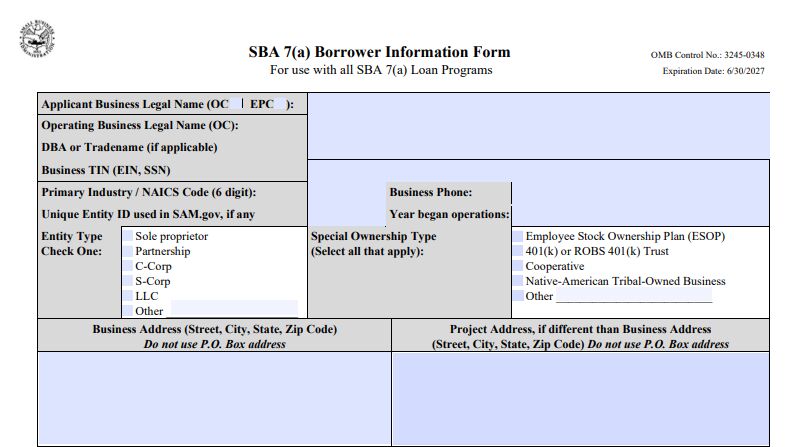

Section 1: Applicant and Business Information

The top half of the first page requires you to provide basic information about the business. You can elect to have an authorized representative of your company complete this section and other sections of the form—as long as they are willing to sign and attest to the accuracy of the information provided.

- Applicant Business Legal Name & Operating Business Legal Name: Here, you’ll need to enter your company’s legal name. This may be listed on your business tax return, business license, or articles of incorporation. You’ll also need to indicate if the business is an Operating Company (OC) that plays an active role in operations or if it’s an Eligible Passive Company (EPC) that might own assets but does not materially participate in business operations.

- DBA or Trade Name: If you conduct business under a different name, it should be listed in this section. DBAs can be useful if you have multiple types of businesses or have had recent changes to an individual’s legal name, something we discuss in our DBA guide.

- Business TIN (EIN, SSN): Provide your company’s business tax identification number (TIN). You may be able to find this information on your business tax returns. In some cases, it may also be the same as your employer identification number (EIN) or social security number (SSN).

- Primary Industry / NAICS Code: The North American Industry Classification System (NAICS) provides a list of codes to categorize businesses based on the industry they operate in. The NAICS code can be found on your business tax return, and you can also visit the US Census website for a list of codes applicable to other industries.

- Unique Entity ID: If applicable, provide the unique entity ID assigned to your business via the SAM.gov website.

- Entity Type (check one): Check the box that matches the tax structure of your company.

- Business Phone: Indicate your company’s phone number here.

- Year Began Operations: Enter the year your business began operating.

- Special Ownership Type: Here, you can check all boxes that describe special ownership types applicable to your company.

- Business Address: Provide the full mailing address of your company, including the street number, street name, city, state, and ZIP code.

- Project Address: If you plan on financing real estate or business operations at a different location than your primary business address, you’ll need to provide that address here.

Top section of page 1 of SBA Form 1919

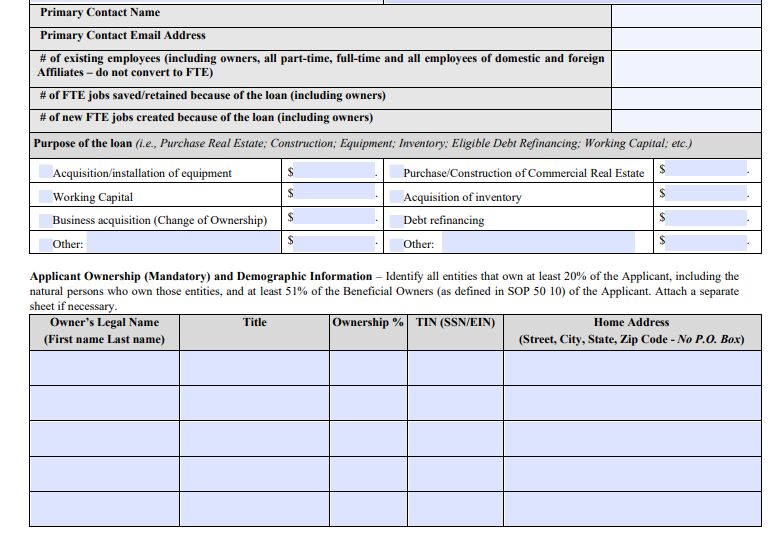

Section 2: Contact Information, Loan Purpose, and Business Owners

The bottom section of page 1 of SBA Form 1919 involves providing information regarding the primary contact, business information, purpose of the loan, and contact information for all other business owners.

- Primary Contact Name: Enter the name of the primary contact for the business. This can be the same individual filling out the form.

- Primary Contact Email Address: Provide the email address of the primary contact for the loan.

- Number of Existing Employees: Enter the total number of individuals employed by the business. This should include all full-time, part-time, and overseas employees.

- Number of FTE Jobs Saved/Retained: Provide an estimate for the number of full-time equivalent jobs that will be saved or retained if the financing request is approved.

- Number of New FTE Jobs Created: Provide an estimate for the number of FTE jobs that will be created, assuming the funding request is granted.

- Purpose of Loan: Check all boxes that describe how you plan on using the loan proceeds. You’ll also need to enter an estimate for how much you plan on using in each area you’ve checked.

- Business Ownership Information: Provide certain contact information for each entity or individual that owns 20% or more of the company. This information consists of the individual’s legal name, title, ownership percentage, TIN, and home address.

Bottom half of page 1 of SBA Form 1919

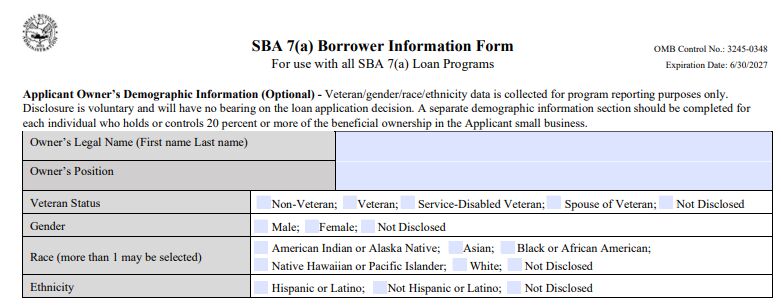

Section 3: Optional Demographic Information

The top of page 2 of SBA 1919 is completely optional. It consists of demographic information that is collected only for reporting purposes by lenders and the SBA. Information in this section will not have any impact on your loan decision.

For situations where there are multiple owners with 20% or more ownership each, a separate demographic information section should be completed.

- Owner’s Legal Name: Provide the legal name of the owner of the business.

- Owner’s Position: Enter the owner’s position within the company.

- Veteran status: Check the box that describes the veteran status of the owner.

- Gender: Check the box to indicate the gender of the owner.

- Race: Check all boxes that describe the race of the owner.

- Ethnicity: Check the box that describes the ethnicity of the owner.

Top half of page 2 of SBA Form 1919

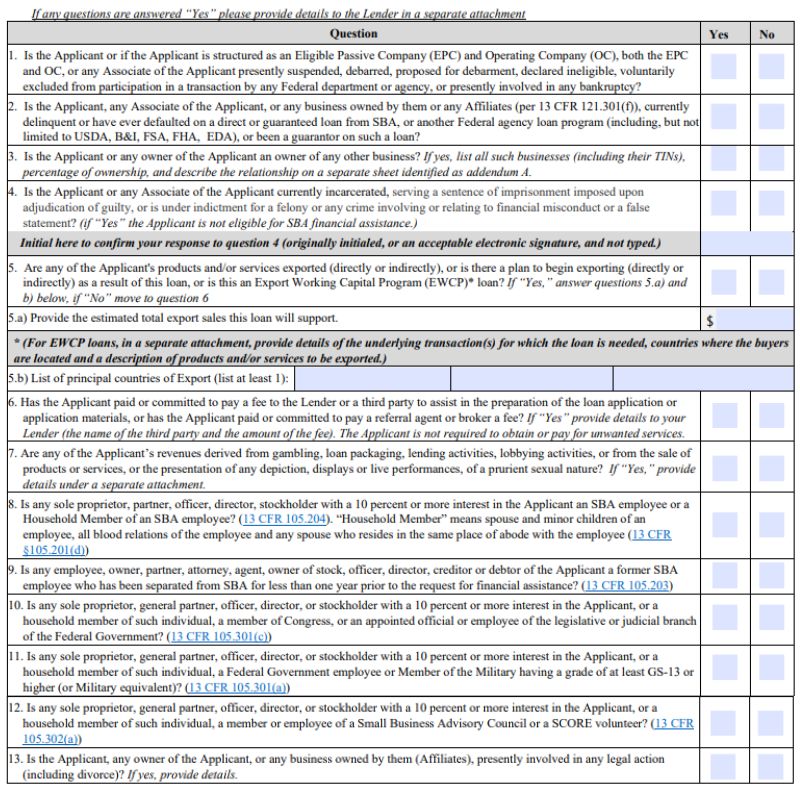

Section 4: Yes/No Questions

The last part of page 2 of SBA Form 1919 consists mostly of Yes/No questions. If you answer Yes to any of the following, you should provide a separate attachment with an explanation.

- Bankruptcy and federal eligibility status: Indicate if the loan applicant, business, or any associate of the applicant has been suspended, debarred, involved in bankruptcy, or otherwise declared ineligible from any transactions with the federal department or agencies.

- Federal loan delinquency: Indicate if the applicant, business, or associate of the applicant has ever defaulted or been a guarantor on a federally insured loan.

- Ownership of other businesses: Indicate if the loan applicant or associate of the applicant has ownership interest in any other businesses. If so, provide a separate attachment detailing the business names, TINs, ownership percentages, and positions/responsibilities within those companies.

- Incarceration status: Check the applicable box and provide your initials to indicate whether the applicant or any associate of the applicant is currently incarcerated, or is under indictment for a felony or crime relating to financial misconduct or false statement.

- Exported goods: Check the box to indicate if any of your company’s products or services are exported, or will be exported. If so, provide the estimated dollar amount of exports and a list of export countries.

- Third-party fees for assistance with the SBA loan: If you have or will pay fees to a third party in exchange for assistance completing your SBA loan application, mark the box for Yes.

- Income sources: Here, you’ll need to indicate if any of your company’s revenues come from gambling, loan packaging, lending activities, lobbying activities, or other potentially ineligible sources.

- SBA employees: Indicate whether any individual with 10% or more ownership interest in your company, or a household member of said individual, is also an SBA employee.

- Former SBA employees: Indicate whether certain individuals associated with your company were separated from the SBA less than one year prior to the current request for financial assistance.

- Federal Government affiliation: Indicate whether any partner, individual with 10% or more ownership, officer, director, or household member is a member of Congress or is an appointed official or employee of the legislative or judicial branch of the Federal Government.

- Military affiliation: Indicate whether any partner, individual with 10% or more ownership, officer, director, or household member is a Federal Government employee or Member of the military with a pay grade of GS-13 or higher.

- Small Business Advisory Council affiliation: Here, you’ll need to indicate if any partner, individual with 10% or more ownership, officer, director, or household member is a member or employee of a Small Business Advisory Council or is a SCORE volunteer.

- Party to legal action: Here, you’ll need to indicate if the applicant, any owner of the Applicant, or any business owned by them is currently involved in any legal action.

Table of Yes/No questions on page 2 of SBA Form 1919

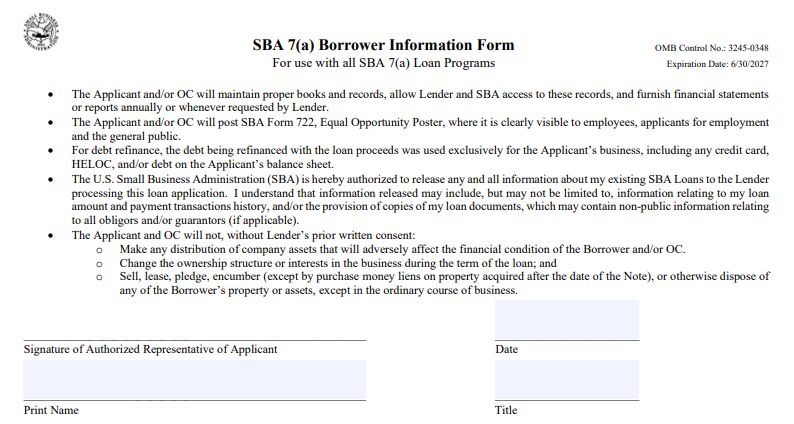

Section 5: Signature Fields

The final portion of SBA Form 1919 requires the signature of the authorized representative of the loan applicant. The signer should also print their name, date the form, and provide their title in the applicable fields.

Signature page of SBA Form 1919

Frequently Asked Questions (FAQs)

SBA Form 1919 is required if you’ll be applying for an SBA 7(a) loan. The 7(a) loan program is one of several programs made available by the SBA, and loan proceeds can be used for many business purposes including working capital, equipment, inventory, and more. For information on other SBA programs, head to our guide on SBA loan types as each program has varying rates, terms, and allowable uses.

Yes. SBA loans generally require good credit and finances, typically require a large amount of paperwork, and can take up to 90 or more days to get approved. Our guide on how to get an SBA loan, however, breaks down the process into five simple steps to help you navigate the nuances of this financing program so that you can get funded more quickly.

Yes. For example, SBA 1919 asks certain questions about your past debt payment history and the nature of your business. Your answers to these questions may make you ineligible for financing.

Bottom Line

SBA Form 1919 is one of many requirements involved with getting an SBA 7(a) loan. Filling out the form correctly can help minimize the chances of getting denied for a loan. For details on other loan requirements and insights on how lenders may evaluate your credit and finances, check out our guide on how to get a small business loan. There, we provide tips on commonly required documentation you can prepare ahead of time to expedite your funding request.