While FreeTaxUSA offers free federal income tax filing for all US taxpayers, TaxSlayer offers low-cost tax filing that can include a consultation with a tax pro specializing in the issues faced by self-employed taxpayers. We recommend TaxSlayer for self-employed taxpayers seeking professional advice and FreeTaxUSA for self-employed individuals looking for a free DIY federal tax return that includes Schedule C.

In this article, we compare TaxSlayer vs FreeTaxUSA to help you make an informed decision and simplify your tax filing process. Keep in mind that the choice between the two depends on your individual tax needs, preferences, and budget considerations.

TaxSlayer vs FreeTaxUSA At-a-Glance Comparison

| ||

|---|---|---|

Best For | Self-employed individuals who require advice from tax professionals | Self-employed individuals seeking free federal filing of complex returns and low-cost state filing |

Pricing |

|

|

Schedule C Business Income & Loss | ✓ | ✓ |

Data Import | ✕ | ✓ |

Audit Guidance and/or Defense | ✓ | Add-on for $19.99 |

Deduction Finder | ✕ | ✓ |

Tax Pro Assistance | Premium & Self-employed only | Add-on for $39.99 |

S Corporation (S-corp) & Partnership Returns | ✕ | ✕ |

Average User Review Score on Third-party Sites | 4.3 out of 5 | 2.6 out of 5 |

For More Information |

Taxes are easier with clean books. Get on top of your financials today with Merritt Bookkeeping. |

|

When To Use

TaxSlayer vs FreeTaxUSA: Pricing

TaxSlayer and FreeTaxUSA both offer a base plan that provides all the forms to file any form 1040. While FreeTaxUSA’s plan is free, TaxSlayer’s Classic plan is $22.95 which is still very reasonable – especially for a return with a Schedule C for which TurboTax charges $129. Both TaxSlayer and FreeTaxUSA provide the option to pay extra for a consultation with a tax pro. FreeTaxUSA charges a flat $39.99 for all filers whereas TaxSlayer requires an upgrade to the Premium or Self-employed plan depending on whether you want your tax pro to have a specialization in self-employed taxation.

Neither TaxSlayer or FreeTaxUSA offers full-service filing or support for business returns (Forms 1120, 1120S, and 1065). See our review of TurboTax if you’re interested in full-service tax return preparation.

TaxSlayer vs FreeTaxUSA: Live Assistance

TaxSlayer | FreeTaxUSA | |

|---|---|---|

Communication Method | Phone, email, and live chat | Email or live chat; Pro Support subscribers can schedule a virtual meeting |

Qualifications of Professionals | CPAs, EAs, or tax specialists | CPAs, EAs, or tax specialists |

Tax Pro Assistance for Self-employed Returns | ✓ | ✓ |

Tax Pro Assistance for Business Returns | N/A | N/A |

TaxSlayer excels in the area of live assistance, as it provides free year-round phone and email support for all of its users. Premier and Self-employed subscribers also receive live chat support and can hold virtual meetings with a tax pro. In contrast, FreeTaxUSA doesn’t provide phone support – only email and live chat support. Pro Support subscribers can schedule a virtual meeting. Neither provide full-service filing services.

TaxSlayer vs FreeTaxUSA: Helpful Tools

TaxSlayer | FreeTaxUSA | |

|---|---|---|

Accuracy Guarantee | ✓ | ✓ |

Amended Returns | ✓ | ✓ |

Prior Year Return Filing | ✓ | ✓ |

Free Plan Available | ✓ | ✓ |

Audit Support | ✓ | Available with Deluxe upgrade |

Audit Defense | ✓ | ✕ |

Tax Calculator | ✓ | ✕ |

Import W-2s & 1099s | ✓ | ✕ |

Deduction Maximizer | ✕ | ✓ |

Data Import | ✕ | ✓ |

Cryptocurrency Support | ✕ | ✕ |

TaxSlayer has several helpful tools that FreeTaxUSA doesn’t provide, such as a tax calculator, the ability to import W-2s and 1099s, and audit defense. However, FreeTaxUSA also has an edge over TaxSlayer by offering a deduction maximizer and the ability to import data from other tax software providers.

Both provide an accuracy guarantee, some level of audit support, a free plan, and the ability to file both amended and prior-year returns. Unfortunately, neither supports cryptocurrency transactions, so if you need the functionality, we recommend TurboTax. Learn more about the solution through our review of TurboTax.

TaxSlayer vs FreeTaxUSA: Mobile App

TaxSlayer App | FreeTaxUSA App | |

|---|---|---|

Availability | iOS and Android | N/A |

Talk Live With Tax Specialist | ✓ | N/A |

E-File Return | ✓ | N/A |

Scan & Upload W-2 | ✓ | N/A |

IRS Refund Tracking | ✓ | N/A |

View, Print & Save Return as PDF | ✕ | N/A |

Only TaxSlayer offers a mobile app, and it is useful for remote filers as it provides the ability to talk live with a tax specialist, track your IRS refund, prepare and e-file your return, and upload your W-2. However, it cannot view, print, or save your return as a PDF.

TaxSlayer vs FreeTaxUSA: Customer Service & Ease of Use

TaxSlayer | FreeTaxUSA | |

|---|---|---|

User Interface (UI) | Easy to use | Easy to use |

Support Channels | Phone, email, and live chat | Email or live chat; Pro Support subscribers can schedule a virtual meeting |

Expert Help Offered | ✓ | ✓ |

Additional Services | Zero out-of-pocket fees, Ask a Tax Pro, and tax refund calculator | Free prior year returns and tax extensions |

TaxSlayer’s UI is clean and easy to navigate, and its interview process allows you to skip around if needed. Its support options include free phone and email support for all filers. If you purchase the Premium or Self-Employed version, you’ll have access to live help from tax professionals.

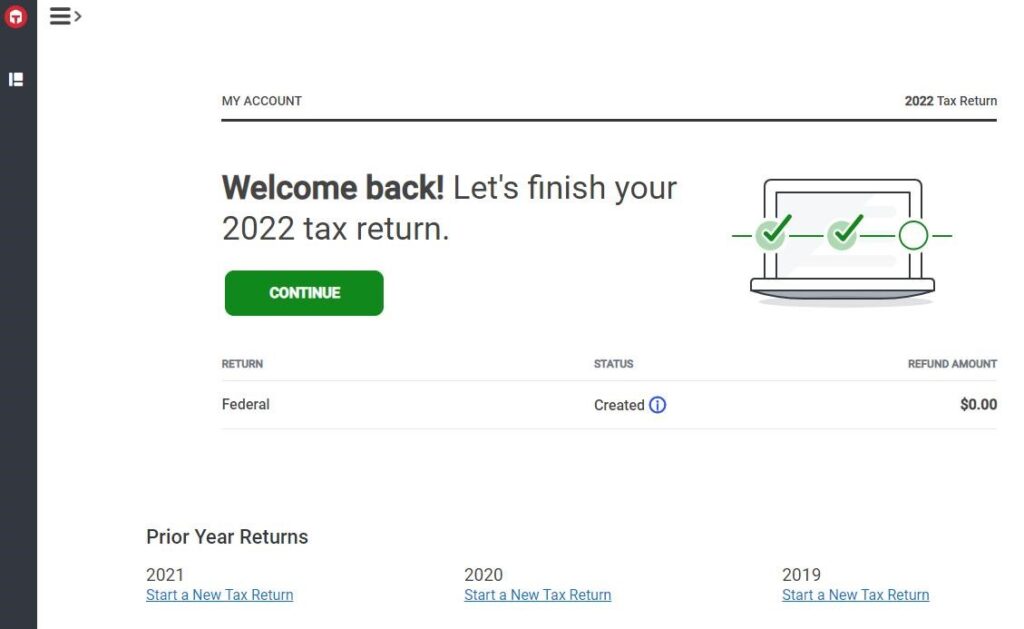

TaxSlayer Dashboard

Meanwhile, FreeTaxUSA’s UI is very straightforward, with no downloads or special plug-ins required. It allows you to set up your account information easily upon logging in, and its navigation tabs are user-friendly. It also includes helpful explainers of tax concepts for clarification.

Support is available via email or live chat. However, if you upgrade to Pro Support, then you’ll receive access to a CPA or enrolled agent who will provide phone support and live screen sharing.

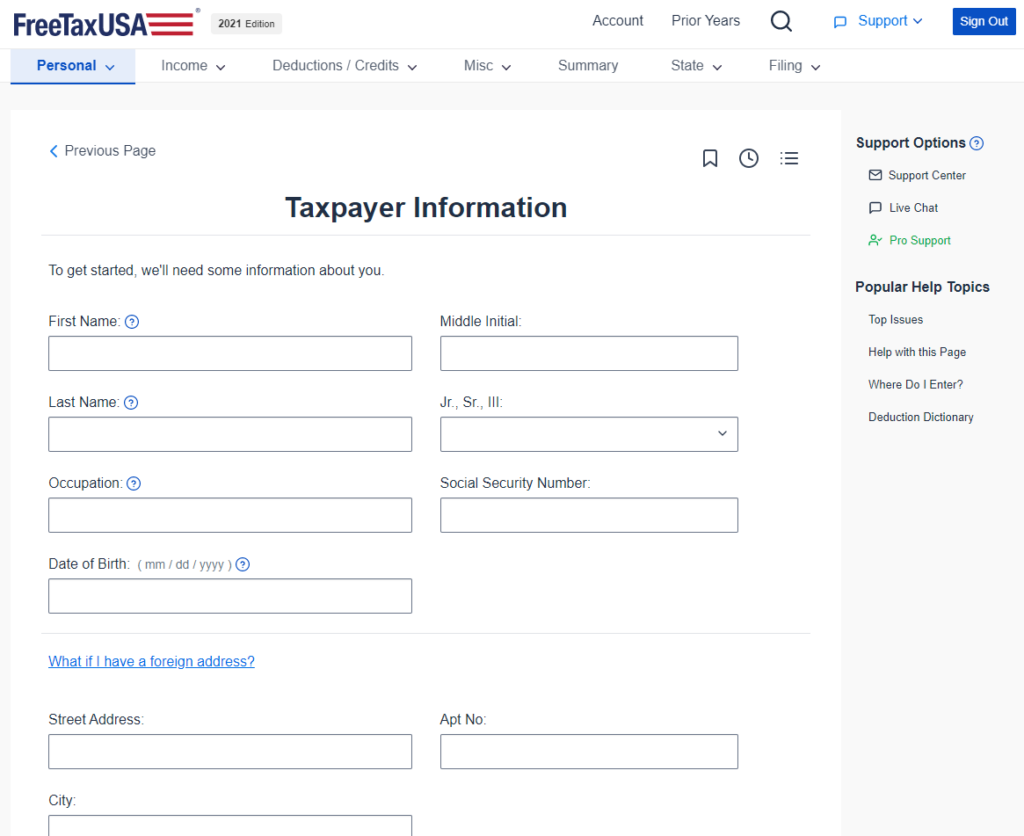

FreeTaxUSA Dashboard

FreeTaxUSA vs TaxSlayer: User Reviews

We find that all tax preparation software uniformly receives pretty bad reviews from users. We attribute this to the stress and frustration users feel when trying to file their tax returns. Compared to the other tax software providers we’ve reviewed, both FreeTaxUSA and TaxSlayer score very well with users.

For direct comparison, we found reviews for both providers at Trustpilot and sitejabber. Those who left TaxSlayer reviews said that they appreciate that the software is easy to use and that it provides extensive support and guidance throughout the tax filing process, including access to live phone support. Reviewers also praised its useful tools, such as its robust mobile app. Its inability to import data and lack of a deduction maximizer are the software’s biggest drawbacks.

TaxSlayer earned the following average scores:

- Trustpilot1: 4.3 out of 5 based on 25,578 reviews

- Sitejabber2: 1.5 out of 5 based on 44 reviews

Meanwhile, FreeTaxUSA users appreciate that the platform is free for all personal returns, even for more complicated tax returns and Schedule C for self-employed individuals. Reviewers also praised the low fee of $14.99 per state tax return. One of the solution’s limitations is that it doesn’t handle business tax returns.

FreeTaxUSA has the following average scores:

- Trustpilot3: 3.4 out of 5 based on 55 reviews

- Sitejabber4: 2.5 out of 5 based on 286 reviews

Frequently Asked Questions (FAQs)

It depends on your specific tax situation. If you are self-employed and seeking advice from a tax professional, then TaxSlayer may be a good fit. However, if you need free federal filing and low-cost state filing, consider FreeTaxUSA.

No, only TaxSlayer offers a mobile app. It can file more complicated federal returns.

Yes, both platforms support state filing. However, additional fees apply for state tax returns.

Both FreeTaxUSA and TaxSlayer strive to be user-friendly, but users may have different preferences. FreeTaxUSA is often praised for its straightforward and easy-to-use interface, while TaxSlayer provides step-by-step guidance.

Bottom Line

Both providers are reputable online tax preparation platforms that offer free federal tax filing options. TaxSlayer provides various pricing tiers depending on the complexity of your tax return, and FreeTaxUSA offers a flat-rate fee for all tax situations. While TaxSlayer may cater to users looking for more extensive support and features, FreeTaxUSA is praised for its user-friendly interface and straightforward approach.

User review references:

1Trustpilot | TaxSlayer

2Sitejabber | TaxSlayer

3Trustpilot | FreeTaxUSA

4Sitejabber | FreeTaxUSA