The Thanksgiving holiday weekend, beginning on Thanksgiving Day and ending on Cyber Monday the following week, is one of the busiest times of the year for retailers. Last year, it was the biggest yet, with an estimated 200.4 million people shopping in-store and online.

While Black Friday and Cyber Monday (BFCM) take the largest share of sales during this period, consumers spend on Thanksgiving Eve and Thanksgiving Day on preparations and celebrations.

We’ve gathered some key Thanksgiving spending and holiday sales trends to help you navigate these peak shopping dates.

Key Takeaways:

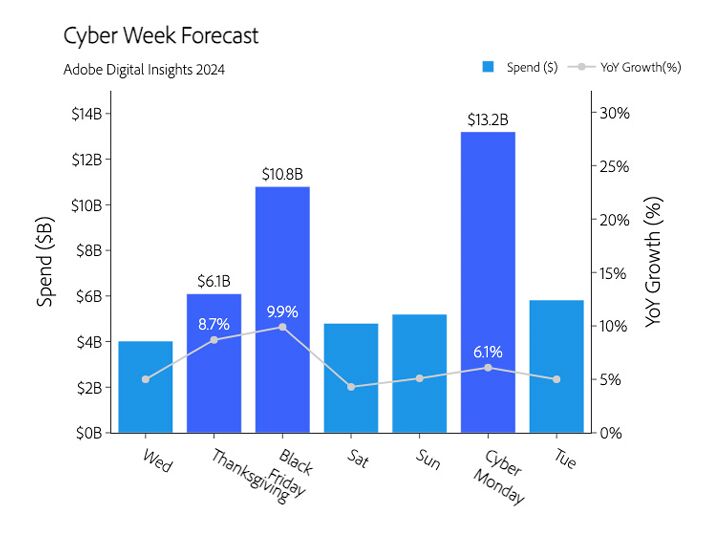

- More people plan to shop online for Thanksgiving than last year, with online sales anticipated to reach $6.1 billion on Thanksgiving day.

- The average spend for Thanksgiving goods is $100.

- People are spending the most on food and in grocery stores on Thanksgiving Day.

2023 Thanksgiving Holiday Sales Review

Last year’s Thanksgiving holiday sales results reveal strong consumer spending, particularly on the weekend following Thanksgiving Day. Let’s look back at a quick overview of Thanksgiving spending in 2023.

1. More people than ever shopped over the Thanksgiving holiday weekend

According to the National Retail Federation (NRF), over 200 million people shopped during last year’s five-day Thanksgiving holiday weekend (also known as Cyber 5 or Cyber Week). This figure exceeded NRF’s initial forecast of 182 million shoppers by more than 18 million and surpassed 2022 traffic by 3.7 million. The NRF attributes robust shopper turnout to consumer resilience and the strength of the economy.

2. Fewer people shop on Thanksgiving Day than BFCM weekend

While Thanksgiving Day kicks off the year’s peak shopping season, most consumers allocate their shopping days to Black Friday and Cyber Monday (BFCM) weekend. According to NRF findings, a total of 22.5 million people shopped in-store, and 35.1 million shopped online on Thanksgiving Day 2023.

Black Friday continues to be the most popular shopping day of the five-day period—76.2 million people made their holiday purchases in-store, and 90.6 million shopped online.

3. Shoppers spent $5.6 billion online on Thanksgiving Day

Online shopping outpaced in-store during the 2023 holiday season. Per data from Adobe, Thanksgiving Day online spending revenue landed at $5.6 billion, representing a 5.5% year-on-year increase. Cyber Monday, which drew $12.4 billion in revenue (a growth of 9.6% YOY), saw the highest online spending out of the five-day period.

Did You Know? In the same report, Adobe found that 2023 was a big year for mobile commerce, reaching $464.8 billion in overall revenue. The share of ecommerce revenue made through mobile devices peaked during Cyber Week at $19.7 billion.

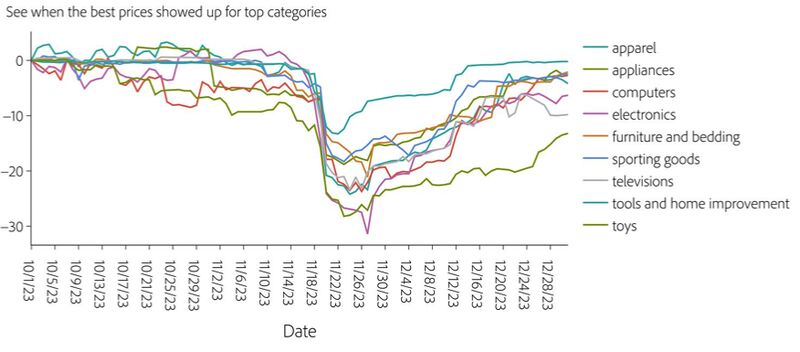

4. Shoppers enjoyed steep discounts throughout Thanksgiving weekend

Retailers ran competitive seasonal sales on Thanksgiving and throughout Cyber Week to encourage customer spending. Adobe found that discounts were in the double digits, typically between 10% and 30%.

The top discounted categories were electronics, toys, computers, and apparel. Clothing, accessories, and toys were also among the most popular gift items over Thanksgiving weekend.

Source: Adobe

5. Total holiday sales landed at $964 billion

NRF and U.S. Census Bureau data show that core retail sales reached $964.4 billion during the holiday season—spanning November 1 to December 31—representing a growth of 3.8% over 2022. Overall, holiday spending was consistent with NRF’s forecast of an average annual holiday increase of 3.6% from 2010 to 2019.

More on Cyber Week in our resources:

Forecasts for 2024 Thanksgiving Shopping

2024’s holiday shopping season will be shorter than last year’s. Along with the economic effects of the US presidential elections and the hurricane season, the NRF forecasts slow but steady sales growth over the holidays.

But consumers are not necessarily spending less—they’re using more channels, spreading out their shopping, and relying on promotions and discounts. Read on for insights into Thanksgiving shopping trends this year.

6. Online spending on Thanksgiving Day is projected to reach $6.1 billion

Online shopping will be a primary driver for overall retail sales growth during this year’s holiday season. According to data from Adobe, online spending is expected to reach record levels of $240 billion. Additionally, Adobe projects this year to be the first truly mobile-first holiday season, with $128 billion in projected mobile revenue.

On Thanksgiving Day, online spending is forecast to reach $6.1 billion, while Thanksgiving Eve spending will amount to $4.1 billion. Both figures represent an increase from the previous year.

Source: Adobe

Holiday forecasts indicate that consumers continue spending despite tight economic conditions. Read more on consumer behaviors that might impact the holiday season:

- Retail Inflation & What Your Business Can Do About It

- (Doom) Spending for a Bleaker Future

- The Lipstick Effect: Small Luxuries Shaping Economic Trends

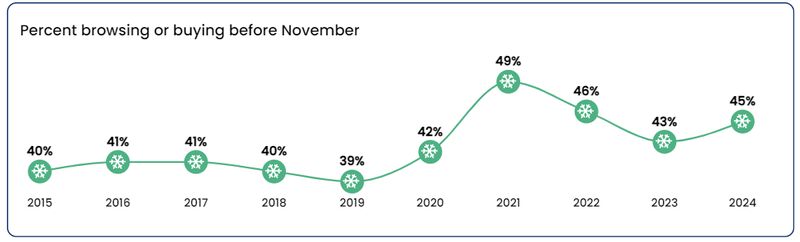

7. Consumers continue to shop early

Almost half of all shoppers (45%) have already started browsing and buying items before November, according to the NRF. This has been a consistent trend in recent years. Consumers like to get a head start on their shopping to:

- Spread out their gift shopping budget (59%)

- Avoid the stress of last-minute shopping (45%)

- Avoid crowds (42%)

- Take advantage of prices and promotions (42%)

- Get more time to enjoy/celebrate the holidays (31%)

- Avoid missing out on specific items (28%)

However, most (62%) don’t expect to finish their holiday shopping until December.

Source: NRF

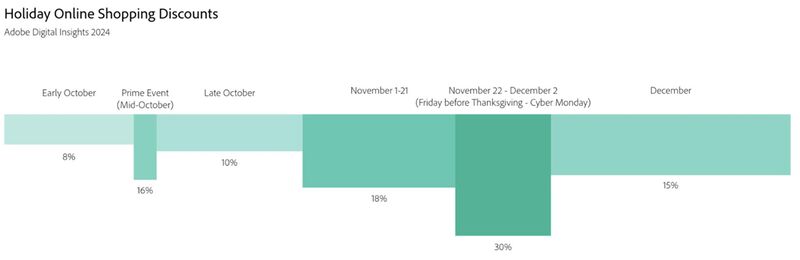

8. Strong discounts are expected to drive sales

Similar to last year, Adobe predicts significant seasonal discounts from retailers to draw in price-sensitive consumers. Deep discounts are projected to begin from the first three weeks of November at 18%, peaking at 30% between the Friday before Thanksgiving through Cyber Monday.

Source: Adobe

Televisions, appliances, furniture, and sporting goods are items that are expected to see the highest discounts around Thanksgiving.

Source: Adobe

Need Thanksgiving marketing ideas? Our retail holiday readiness guide covers everything you need to know to capture shoppers, even those who are making last-minute purchases.

Thanksgiving Spending for Consumers

As one of the major US holidays, Thanksgiving is shaped by traditions that also determine how consumers spend. See how Americans are planning to celebrate Thanksgiving this year.

9. About 87% of people plan to celebrate Thanksgiving

Numerator’s Q4 2024 holiday survey found that most Americans (95%) will celebrate at least one of the four major holidays (Halloween, Thanksgiving, Christmas, and New Year’s Eve). Approximately 87% anticipate they will celebrate Thanksgiving specifically—including 85% of millennials, Gen Z and Gen X, and 90% of baby boomers.

10. Most Americans plan to gather for Thanksgiving

According to the Numerator survey, gathering is the most common way people intend to celebrate. Of those celebrating Thanksgiving, 70% plan to gather with family and friends, and 55% plan to cook and bake at home.

11. The average planned spend for Thanksgiving goods is $100

Thanksgiving shoppers are allocating $100 on average for their Thanksgiving purchases. The majority of Numerator’s respondents plan to spend $50 to $99 (31%) or $100 to $199 (32%). Only 5% expect that they would spend more than $300.

Interestingly, when asked about this year’s Thanksgiving expenditures versus last, 31% of respondents expect to spend more this year. Meanwhile, 55% said that they would spend more or less the same amount, and 14% said that they would spend less.

12. Food is expected to be the top purchase on Thanksgiving Day

Not surprisingly, the majority of people (89%) plan to purchase food over other items for Thanksgiving, per Numerator. This is followed by non-alcoholic beverages (32%) and alcoholic (31%). Wine is the most common beverage option (70%) for Thanksgiving celebrations, followed by beer (52%).

Other purchase categories are decorations (18%), candy (13%), and party supplies (10%). Roughly 5% of respondents said they won’t purchase anything at all.

Did You Know? The top food purchases for 2023, according to Numerator, were:

- Turkey or turkey breast

- Dinner rolls or bread

- Holiday pies

- Stuffing or dressing

- Vegetable sides

13. The majority of consumers expect to shop in-store for Thanksgiving

Respondents to the 2024 Numerator survey said that they will do most or all of their Thanksgiving shopping in-store. However, approximately 12% still plan to shop from online retailers (such as Amazon and Etsy). This represents an increase from last year, with 6% of Thanksgiving shoppers making their purchases online.

14. Grocery stores are the top destination for shopping for Thanksgiving goods

Per Numerator, three-quarters of consumers plan to shop at grocery stores (such as Kroger and Publix), followed by big box stores such as Target, Costco, and Walmart (49%).

Other notable shopping destinations are liquor stores (20%), discount or dollar stores (15%), and local shops or small businesses (14%).

Bottom Line

Most consumers will come together on Thanksgiving Day, an important tradition for families in the US. While you can expect more shopping and deal-hunting over the BFCM weekend after the holiday, Thanksgiving marks the start of the peak season for sales in November and December. This year’s shorter shopping season means that the Thanksgiving holiday weekend is the perfect time to capture customers seeking to complete their holiday shopping lists.