The data from this past weekend is in—more people shopped during 2023 Black Friday than ever before. However, spending was lackluster, only increasing 2.5% over 2022, which does not keep pace with inflation, which is 3.2% over the last 12 months.

There are several potential causes for lower spending, including:

- Less appealing deals: Data shows that the average discounts across popular product categories didn’t reach higher than 28%, with many product categories being much lower.

- A more spread out shopping season: 59% of shoppers started buying holiday items by early November.

- Cautious consumers: Economists predict that consumer spending will slow in the final months of 2023, as debts rise.

Though 2023 Black Friday wasn’t the doorbuster-frenzy we’ve seen in years’ past, there was still plenty of spending and interesting consumer behaviors to examine. Let’s look at the top stats about Black Friday, what people bought, where they shopped, and Black Friday trends over the years.

2023 Black Friday Overview

Key Statistics

- Consumers spent $9.8 billion in online sales during Black Friday

- 76.2 million people shopped in-store on Black Friday

- 90.6 million people shopped online on Black Friday

1. US Black Friday sales were up +2.5% from 2022

According to Mastercard, year-over-year Black Friday spending is up 2.5%, excluding automotive and not adjusted for inflation. This number does not pace with inflation and is a sizable deceleration from last year, when Black Friday sales were 12% higher in 2022 compared to 2021.

The National Retail Federation (NRF) reports that per-person spending over the whole holiday weekend decreased by about $4—$321.41 on average this year compared to last year’s $325.44 per person.

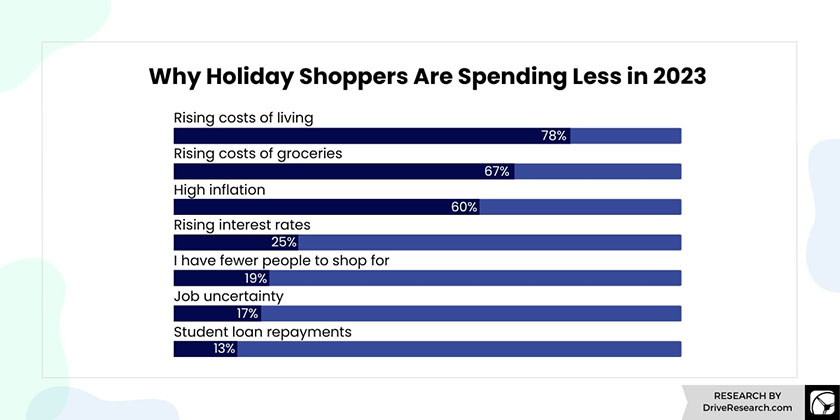

Dive Research conducted a poll on why consumers are spending less this season:

(Source: Drive Research)

Interestingly, the report also shows that more women (34%) will decrease their spending this year compared to men (23%).

2. Black Friday ecommerce sales grew 8.5% Year-over-year

Mastercard also found that online sales saw huge growth this year. The financial company attributes this to sporting events keeping people home, along with a growth in restaurant sales.

3. Consumers spent $9.8 billion in online sales during Black Friday

According to Adobe Analytics, online shopping was huge during Black Friday—even more than on Cyber Monday. Online spending was up 7.5% from 2022, not accounting for inflation. This tracks with the larger industry trends of online shopping making up a larger and larger percentage of total retail spending.

4. 76.2 million people shopped in-store on Black Friday

The NRF reports that 76.2 million people shopped in person on Black Friday. By comparison, the second-highest in-store shopping day was Small Business Saturday, with 59 million shoppers.

5. 90.6 million people shopped online on Black Friday

As has been the case in recent history, there were more online shoppers during Black Friday than in-store shoppers. However, in-store shopping is growing at a faster clip coming out of the COVID-19 pandemic.

6. 70% of Black Friday weekend spending was on gifts

Most of the spending over Thanksgiving weekend (95%) was on holiday-related items. Shoppers spent an average of $321.41 over the weekend, with 70%, or $226.55 of that being on gifts.

Did you know? Twenty-four percent of shoppers plan to buy gifts from small businesses this year, the same number as last year.

What Shoppers Bought During Black Friday

Typically, gift cards, apparel, toys, electronics, and jewelry are among the most-wished for and most-purchased items during the holiday season. This Black Friday was no exception.

7. Toys and electronics were top sellers

According to Adobe Analytics, the hottest products on Black Friday were:

- KidKraft Playsets

- Mini Brands

- TVs

- Smartwatches

- Headphones

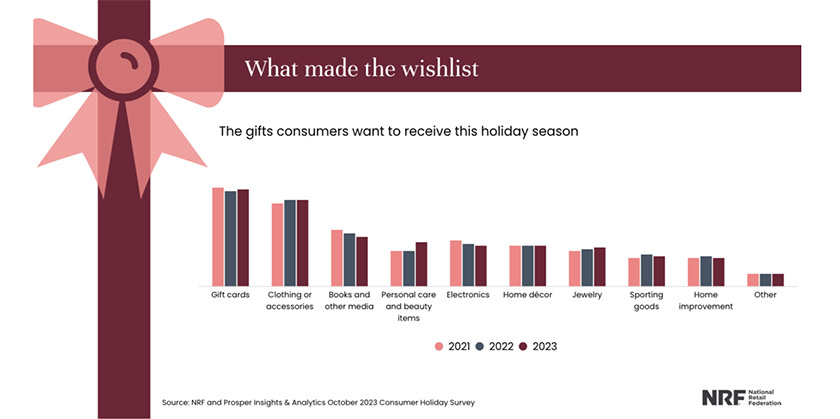

8. Jewelry and apparel topped gift lists

Mastercard reports that while experiential gifts remain popular, apparel and jewelry were the top gift sectors during Black Friday.

Mastercard’s spending data aligns with NRF’s polling around the most-wished for gifts this holiday season:

(Source: NRF)

9. 11% of Black Friday shoppers are willing to wait over 2 hours to enter a store

Customers are willing to wait for good deals. On Black Friday, more so than any other day of the year, shopping is an event that people plan to dedicate lots of time to.

Tip: Shoppers are only willing to wait for doorbuster deals. Speed is still a premium with online shopping. See more:

10. The average Black Friday discount was 28% in 2023

Surprisingly, this average discount of 28% is a few percentage points higher than in recent years, but significantly lower than historical savings.

Average Black Friday Discounts Over Time

- 2023: 28%

- 2022: 27%

- 2021: 26%

- 2020: 34%

(Source: Salesforce)

Where Consumers Shopped on Black Friday

Though Black Friday shopping is best known for doorbuster crowds at dawn, more and more Black Friday shopping is happening online—and, at small businesses.

11. Most consumers (90.6 million of them) shopped online

According to NRF, Black Friday was also the most popular day for online shopping. Roughly 90.6 million consumers shopped online on Black Friday, up from 87.2 million in 2022. By comparison, approximately 73 million consumers shopped online on Cyber Monday, down slightly from 77 million last year.

(Source: NRF)

12. Ecommerce sales increased +8.5% YOY

This increase in online shopping traffic also resulted in an increase in sales. Mastercard reports an 8.5% increase in online sales during Black Friday. The convenience of online shopping is hard to argue with the day after Thanksgiving, when many folks are watching sports and spending time with family.

Buying online also makes it easier to compare prices, which is always a top purchasing factor, but especially so on Black Friday.

13. Shopify sellers peaked at $4.2 million in sales per minute during Black Friday

It’s hard to talk about ecommerce performance without mentioning Shopify, which powers a large number of online businesses of all sizes, including many small businesses. During Black Friday, Shopify sellers raked in up to $4.2 million per minute, hitting peak sales at 12:01 p.m.

Learn more: Shopify Statistics to Know

14. Square sellers saw peak shopping traffic at 2:09 p.m. on Black Friday

Square, which powers millions of small businesses, saw peak traffic at 2:09 p.m. on Black Friday. Last year, Square sellers saw peak traffic on Cyber Monday. This aligns with the larger trend we’re seeing with more and more people shopping online on Black Friday than any other day over the holiday weekend.

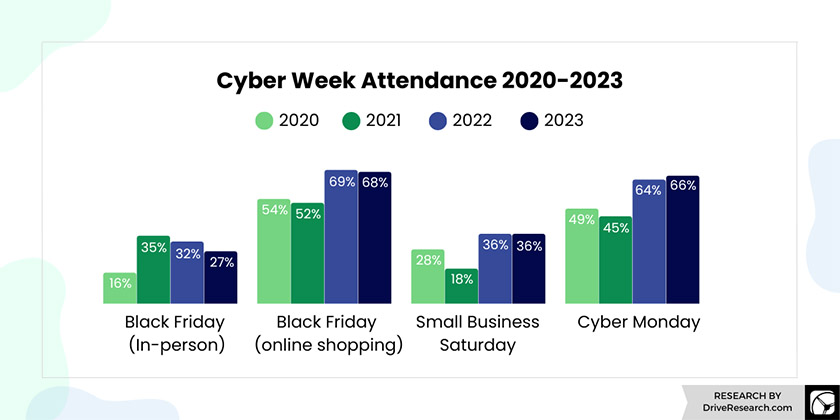

15. More people planned to shop in-store on Small Business Saturday than Black Friday

Drive Research’s study showed that for the first time since the company started polling in 2020, in-person Black Friday shopping was the least popular shopping method during the holiday weekend, with only 16% of people shopping in stores.

Small Business Saturday, however, is becoming increasingly popular—36% of shoppers planned to shop on Saturday.

(Source: Drive Research)

16. Online cart sizes were 3.9x bigger than in-store cart sizes

In addition to more shoppers, online sales also had higher spending. According to Square’s seller data from the holiday weekend, online shopping cart sizes were 3.9x bigger than in-store purchases.

Learn more: What is Square?

Black Friday Trends

Now that we’ve covered what happened over Black Friday 2023, including what people bought and where they shopped, let’s zoom out to see some bigger picture consumer trends and year-over-year patterns.

17. Black Friday has the traffic, but Cyber Monday has the spending

Black Friday has the highest number of in-store and online shoppers of the entire five-day period from Thanksgiving through Cyber Monday. However, the most spending happens on Cyber Monday.

According to Adobe Analytics’s Black Friday sales data, the shopping holiday raked in $9.8 billion in revenue, while Cyber Monday brought in $12.4 billion.

18. Every year, more people shop online than in-store for Black Friday

For at least the past several years, more people have shopped online than in-store for Black Friday. Granted, the COVID-19 pandemic likely accelerated this shift, and we are seeing more and more people returning to stores for Black Friday shopping.

In-store vs Online Black Friday Shoppers Year-over-year

In-store Shoppers | Online Shoppers | |

|---|---|---|

2023 | 76.2 million | 90.6 million |

2022 | 72.9 million | 87.2 million |

2021 | 66.5 million | 88 million |

(Source: NRF) | ||

19. 48% of consumers believe that brands push low-quality products during Black Friday

Nearly half of consumers believe that retailers sell lower-quality goods during Black Friday to offer great deals. While this is not a great public perception, it has improved since 2021, when 56% of consumers carried this belief.

20. 67% of consumers are more interested in Black Friday deals due to rising inflation rates on everyday goods

While many consumers have low expectations for Black Friday discounts, that doesn’t mean they won’t be shopping. In fact, over two-thirds of shoppers are interested in shopping on Black Friday and taking advantage of deals due to the rising cost of living.

Frequently Asked Questions (FAQs)

In 2023, the average Black Friday discount across all product categories was 28%.

In 2023, 76.2 million people shopped in-store and 90.6 million people shopped online during Black Friday.

Bottom Line

Black Friday is one of the biggest shopping days of the year. Use the Black Friday stats and figures above to learn, get insights into what consumers expect, and anticipate future shopping trends.

Follow up with our guide to Black Friday marketing strategies to put this data into action.