Any business owner who takes card payments for the first time will encounter a situation where the transaction needs to be voided. This means reversing the transaction—as if there was no transaction at all. Understanding and managing void transactions is essential for businesses to maintain financial accuracy and operational efficiency.

Key takeaways

- Void payment transactions are initiated by merchants. They reverse pending transactions before settlement—addressing common issues like customer errors, transaction mistakes, or fraud suspicions.

- Void transactions help prevent refunds and chargebacks, which may both incur additional fees.

- Understanding void transactions is crucial for businesses to ensure accurate payment processing, minimize risks, and preserve financial integrity and customer satisfaction.

What Is a Void Transaction?

A void payment transaction is a reversal of a previously authorized card transaction before the transaction is settled by the banks involved, effectively canceling it as if it never occurred. A transaction that has reached the settlement stage, which means the transaction amount has been received by the merchant’s bank, cannot be voided anymore.

The settlement stage in payment processing is the point at which funds are transferred from the cardholder’s issuing bank to the merchant’s acquiring bank. It occurs after the transaction has been authorized and captured by the merchant. Settlement ensures that merchants receive payment for transactions and that cardholders’ accounts are appropriately debited.

For customers, one way to know if the transaction has not yet reached the settlement stage is if it is still marked “Pending” on their end. During this period, the amount on the customer’s account has already been put on hold but has not yet been moved to the merchant’s account. On the customer’s card statement, the transaction has been settled already if it is showing the hard statement descriptor.

When a transaction needs to be voided, the key element is quick action. The merchant should void the transaction as soon as possible before it reaches the settlement stage. When a transaction has been settled, the only option is for the merchant to process a refund.

Common Reasons for Void Transactions

Why would a merchant need to void a transaction? Here are some of the most common reasons for void transactions:

Customer Request

One of the most common reasons for void transactions is a customer request. This could happen if the customer changes their mind about a purchase, decides to cancel an order, or realizes they made a mistake in the transaction details. Voiding the transaction in response to the customer’s request ensures that they are not charged for a purchase they no longer want to proceed with.

Transaction Error

Errors in transaction processing can occur for various reasons, such as entering the wrong amount, selecting the wrong payment method, or experiencing technical issues during the transaction. Voiding the transaction allows the merchant to correct these errors before the transaction is fully processed, ensuring accurate record-keeping and preventing any unintended financial consequences for both the customer and the business.

Fraud Risk

Void transactions may also be initiated as a preventive measure against potential fraudulent activity. If a merchant suspects that a transaction may be fraudulent, such as if the payment details provided by the customer raise red flags or if the transaction appears to deviate from typical purchasing patterns, they may choose to void the transaction to prevent any unauthorized charges from being processed.

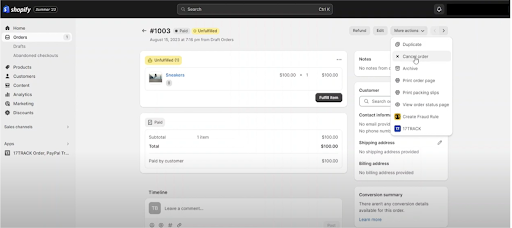

For example, Shopify store owners get a form of risk assessment for each transaction. A transaction where the card billing address is thousands of kilometers from the IP address location at the point of purchase may get tagged as a possible high-risk transaction. The merchant can then review the transaction and if assessed to be a real fraud risk, may choose to cancel it, effectively voiding the transaction.

This helps protect both the merchant and the customer from potential financial losses and maintains the integrity of the payment system.

To lower fraud risk, make sure your business has a secure payment system. Learn more in our secure payment system guide for small business.

Voids vs Refunds vs Chargebacks

After a payment transaction is initiated, there are three common ways it can be reversed: through void transactions, refunds, and chargebacks. Each method serves a distinct purpose in rectifying transactional issues, from customer errors to fraudulent activities.

Here is a comparison of void transactions, refunds, and chargebacks.

Void | Refund | Chargeback | |

|---|---|---|---|

What is it? | A reversal of a pending transaction before it is settled or processed | Reimbursement of funds to the customer after a transaction has been completed | A dispute initiated by the cardholder to reverse a transaction |

Who initiates? | Merchant or payment processor | Merchant | Cardholder through their issuing bank within the chargeback time frame. |

When does it happen? | Shortly after transaction authorization, before settlement | After transaction settlement and completion | Weeks or months after the transaction, depending on the reason for the dispute |

What are the fees involved? | None | Transaction fees | Transaction fees and chargeback fees |

Expert tip: When possible, it is best to void a transaction that needs to be reversed. If a customer requests a refund or you’ve received a chargeback you do not want to dispute, always check first if the transaction has not yet been settled. If the transaction has not reached the settlement stage, void the transaction instead of refunding it or going through the chargeback process. This will help you avoid transaction or chargeback fees.

Related:

How to Void a Transaction

Voiding a transaction involves steps that are often specific to your payment processor or terminal. Here is a quick guide to get you started:

Step 1: Take Immediate Action

Void transactions should be initiated as soon as the need arises, ideally before the transaction is settled or processed. Prompt action minimizes the likelihood of complications and ensures a smoother process.

Step 2: Access Your Payment Dashboard or Terminal & Locate the Transaction

Log into the payment system or terminal used for the transaction. Navigate to the section or menu option designated for transaction management. Identify the transaction that needs to be voided. Search for the relevant transaction details, such as transaction ID, date, amount, or customer information, to locate the correct transaction record. Make sure that the transaction has not been settled yet and that it can still be voided.

Step 3: Initiate the Void Process

Follow the prompts or instructions provided according to your payment processor to initiate the void process. Depending on the system used, this may involve selecting the transaction and choosing the void option or entering specific transaction details.

Step 4: Confirm Void Transaction & Status

Verify the details of the transaction being voided, ensuring accuracy and correctness. Confirm the void transaction to initiate the reversal process and monitor the transaction to ensure it is successfully voided.

Step 5: Document the Transaction

Maintain proper records of void payment transactions for accounting and reconciliation purposes. Keep track of voided transactions, including transaction details, reasons for voiding, and any relevant documentation.

How to Prevent a Void Transaction

Avoiding the need for void transactions altogether is preferable, and there are several proactive measures businesses can take to prevent them:

- Process Transactions Accurately: Ensure that employees are adequately trained in transaction processing procedures and equipped with the necessary tools to perform their tasks accurately. Prioritize double-checking details of the transactions, such as verifying payment amounts and customer information, before finalizing transactions to ensure that transactions are processed correctly.

- Improve Fraud Awareness and Utilize Strong Fraud Protection Tools: Educate employees about common fraud schemes and warning signs of fraudulent transactions. Implement robust fraud detection and prevention tools, such as address verification systems (AVS), card security codes (CVV/CVC), and fraud detection algorithms, to mitigate the risk of fraudulent transactions. The goal is to spot potentially fraudulent transactions or prevent them before they occur, eliminating the need to void one because of fraud risk.

- Have Clear Cancellation and Refund Policies: Establish clear and concise cancellation and refund policies that outline the conditions under which transactions can be canceled or refunded, and communicate them to the customers clearly. This will help minimize misunderstandings and prevent requests from customers to void or cancel a transaction because of important policies they were not made aware of.

- Implement Secure Payment Processing Systems: Utilize secure and reliable payment processing systems that adhere to industry standards and compliance regulations. Secure payment solutions with robust security features will help reduce fraudulent activities and transaction errors.

- Regularly Review and Update Procedures: Conduct regular reviews of transaction processing procedures and policies to identify areas for improvement and address any issues or vulnerabilities promptly. Stay informed about emerging trends, technologies, and regulations in the payment processing industry and update procedures accordingly to maintain compliance and effectiveness.

Related:

Frequently Asked Questions (FAQs)

Click through the sections below to read answers to common questions about void transactions:

The time it takes for a transaction to be voided can vary depending on factors such as the payment processor and card issuer. In many cases, voiding a transaction can occur almost instantly. There are times when the transaction is shown as void on the merchant’s side, but it may be pending for several days on the customer’s end.

Yes, voiding a transaction cancels it. When a transaction is voided, it is reversed as if it never occurred, preventing it from being settled or processed further. This means that the funds are not transferred, and the transaction is removed from the transaction record, effectively canceling it.

In a void transaction, money is not transferred or deducted from the customer’s account in the first place because the transaction is canceled before it is processed or settled. Therefore, customers do not need to wait to get their money back from a void transaction because they were never charged for it. If any authorization holds were placed on the customer’s funds, those holds are typically released immediately or within a few hours or days after the void request is processed.

Bottom Line

Void transactions offer a swift and efficient way to reverse pending transactions before they’re settled, minimizing financial impact and preserving customer satisfaction. Understanding what void transactions are and how they impact business operations is crucial for maintaining financial accuracy and customer satisfaction. Managing void transactions and implementing efficient procedures can help businesses mitigate risks, streamline payment processing, and utilize void transactions effectively.