The W-2 and W-4 forms are important IRS documents for your business and staff. Form W-4 provides information about how much tax should be withheld from your employees’ paychecks, while Form W-2 is used to report annual income and taxes to the IRS. In this guide, we’ll compare both in detail and walk you through when to use each of them.

Key Takeaways:

- W-2 forms (Output Document)

- Completed by employers

- Filled out and provided to all employees by January 31st

- Tells IRS & employees how much money they earned in a calendar year

- W-4 forms (Input Document)

- Completed by employees

- Filled out upon hiring or when there are life/work changes that affect taxes

- Tells you how much tax to withhold from each paycheck

W-2 & W-4 Forms Compared

The primary difference between the two payroll forms is that the W-4 is an input document and the W-2 is an output document. Employees, typically new hires, use the W-4 form to provide their company’s payroll department with information on how much tax to withhold from their earned income. Then, at the end of every year, employers use the W-2 form to report an employee’s annual income and taxes withheld.

Here is how data flows from the W-4 form to the W-2 form for a typical employee.

The W-2 is also provided by the employer to the employee at the end of each year. Aside from showing a summary of the annual gross income, the form includes information on how much was taken out of the gross pay for deductions (such as state and local taxes).

W-4: When to Use It & Where to Get It

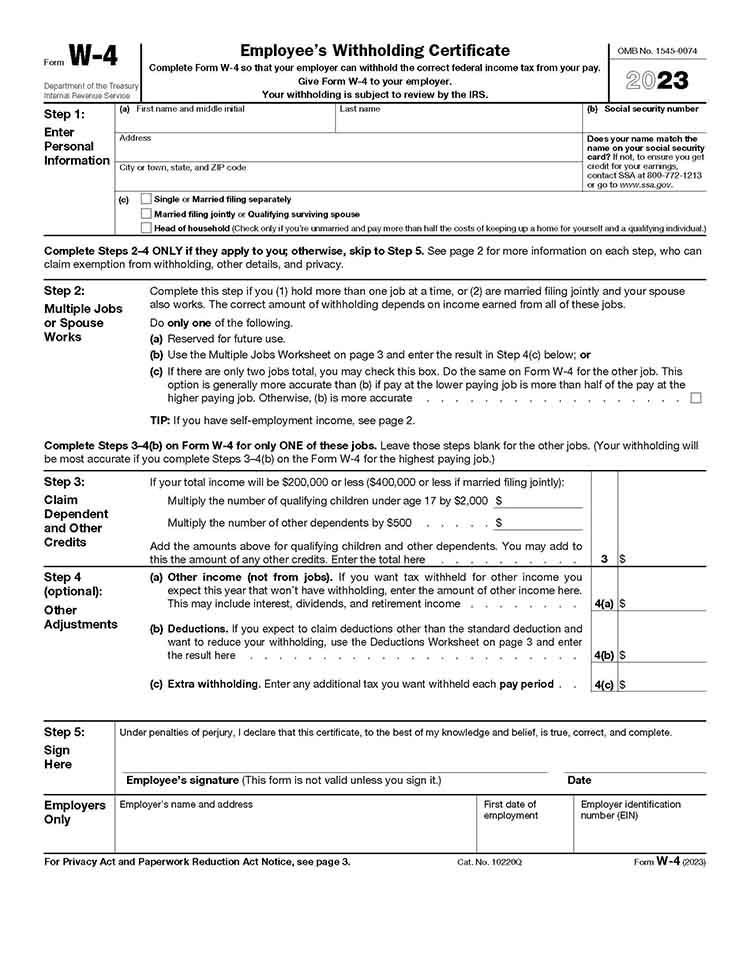

The W-4 form, also known as the Employee’s Withholding Certificate, is provided by the employer once an employee has accepted an offer of employment. New hires need to complete and submit the form to their company’s HR or payroll department before receiving their first paycheck. Aside from new hires, existing employees with life and work changes that may affect their taxes (such as marriage, divorce, a new baby or dependent, and having more than one job) also have to complete a new W-4 form.

Note that the Tax Cuts and Jobs Act required significant changes to the W-4 form. It’s also a bit simpler and more straightforward.

- Removal of Allowances: Previously, W-4 forms included a system of allowances tied to personal exemptions. However, personal exemptions were eliminated by the Tax Cuts and Jobs Act, so the new W-4 no longer uses this system.

- Introduction of a Five-Step Process: The new W-4 form now includes a five-step process for indicating how much should be withheld from an employee’s paycheck. Steps one and five are mandatory, while steps two through four are optional, depending on the employee’s situation.

- Greater Accuracy: The new form aims to provide more accurate withholding, reducing the chances of over- or under-withholding taxes. This change may mean that employees owe less tax when they file their returns, or receive a smaller refund.

Upon receiving the form, the payroll department will use the information on the W-4 to determine how much in federal, state, and local taxes need to be deducted from the employee’s paycheck. In addition, a copy of the signed W-4 should be kept by the employer in case the IRS requests it.

If newly hired employees fail to complete the W-4 before their first pay cycle, the company should process payroll as if the employee had chosen a “single” civil status with zero children or dependents—this will result in you withholding taxes at the highest rate. Employers can also use the staff’s Form W-4 from the previous year as the basis for calculating how much tax to withhold.

If you want to help guide your employees in accomplishing the form, then check out our W-4 article, which contains tips on how to complete it.

State-specific W-4 Forms

There are several states (such as Colorado, Minnesota, and Mississippi) that use the W-4 as is to determine state tax withholding. Most other states (Georgia, Illinois, and Kentucky, for example) have their own versions of the W-4.

For more details on state-specific W-4 forms and everything else you’ll need to know to ensure that your employees’ taxes are handled properly, check out our state payroll directory.

Where to Find a W-4

The employer provides the W-4 form to their employees. It is downloadable from the IRS website, either in English or Spanish.

- Download IRS Form W-4 from the IRS website.

- Download IRS Form W-4 (Spanish) from the IRS website.

- View instructions for completing IRS Form W-4 from the IRS website.

Employers can also get the form from their payroll system or payroll service provider. Some companies include this form, along with I-9 and other documentation, as mandatory documents that new hires need to complete and submit during onboarding.

However, if you’re a small business running payroll by hand, managing employee and employer payroll taxes and preparing tax forms can be time-consuming. You may want to consider using a full-service payroll solution, like Gusto, to help you streamline processes and avoid potential payroll compliance issues.

Aside from processing employee pay, Gusto automatically calculates, files, and pays federal, state, and local payroll taxes. It also offers hiring, onboarding, employee benefits, and simple time tracking tools. You can even get direct access to certified HR professionals who can provide expert advice if you upgrade to a premium plan. Sign up to get 1 month free payroll (this offer will be applied to your Gusto invoice while all applicable terms and conditions are met or fulfilled).

Common Mistakes When Filling Out W-4

The W-4 is filled out by employees to let employers know how much tax to withhold from their paychecks. Because employees fill this form out on their own, mistakes can happen.

Here are some examples of mistakes made by employees completing the W-4:

- Providing incorrect information on the form, knowingly or unknowingly

- Not updating their W-4 when their life situation changes

- Not using the updated W-4

Compliance Note: You can help an employee complete the form by answering questions, but you cannot take any action or make statements that might influence how an employee completes the form. You can assist but you cannot give advice.

W-2: When to Use It & Where To Get It

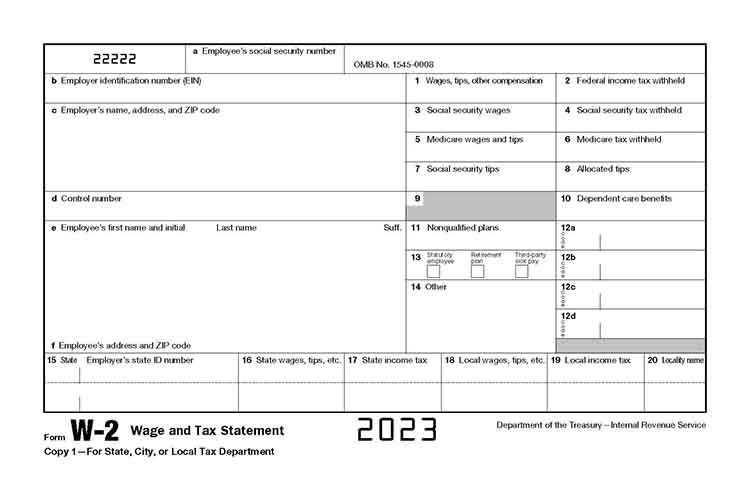

Officially known as IRS Form W-2 Wage and Tax Statement, the W-2 is a year-end tax document that employers must provide. It contains information about the employee, their earnings (such as gross pay, bonuses, and tips), and any deductions taken for taxes, savings, retirement, and childcare.

The prior year’s W-2 must be sent to the IRS and your employees by Jan. 31. For example, for the 2023 tax year, W-2 forms must be sent by Jan. 31, 2024. Note you have to provide a W-2 to every person who worked for you as an employee during the prior tax year—whether they are still employed with your company.

For businesses that use payroll systems, some offer self-service options that allow employees to download their own year-end W-2. This is helpful in case they’ve moved and you don’t have an updated mailing address. You can send them a secure email link to their W-2 instead of mailing the forms, enabling you to comply with IRS requirements and making it possible for employees to file their taxes.

Note that it’s not legal for employers to email a W-2 to an employee. You can create ways to send a W-2 electronically to employees who consent, but email is not a secure way allowed by the IRS. If you use a payroll provider, they’ll most likely have a secure portal where employees can access and download their W-2.

If you want to know how to fill out the forms, check out our W-2 guide. Not only does it contain helpful tips, but it also provides useful information on how to submit it.

Where to Get a W-2

Employees can get their year-end W-2 forms from current and former employers (in case they worked at different companies for the prior tax year). Employers either send the form through mail, or you can download the document through an online self-service portal.

If you’re handling payroll yourself, you can download a blank W-2 from the IRS.gov website.

- Download blank IRS Form W-2

- View instructions for IRS Form W-2

The IRS also provides customized W-2 forms. Some of these include forms for American Samoa (W-2AS), Guam (W-2GU), and US Virgin Islands (W-2VI).

Note that contractors don’t receive a W-2. Instead, they get a Form 1099-NEC. For a summary of the differences between the 1099 and other IRS tax forms, read our W-2 vs 1099 and W-9 vs 1099 guides.

Common Mistakes When Filling Out W-2

If your company uses a payroll service or even a local accounting firm, they’ll probably handle your W-2 forms for you each year. If you’re doing it yourself, however, be extremely careful as it’s easy to make mistakes. Here are some examples of mistakes to avoid:

- Incorrect social security numbers

- Incorrect employer identification number (EIN)

- Using the wrong tax year

- Misclassifying your workers

- Filing the form past the Jan. 31 deadline

W-2 vs W-4 Form Frequently Asked Questions (FAQs)

If you notice an error on a W-2 form after it’s been sent to an employee, you need to correct it immediately. To do this, you’ll need to fill out a W-2c and a W-3c. Besides sending both forms to the government for processing, you’ll also need to send the W-2c to your employee.

While you, as an employer, cannot instruct your employees on how to fill out form W-4, you can provide employees with assistance. Each employee’s tax situation is individual and they have the autonomy to decide their own withholding based on their personal circumstances. As such, you are not allowed to guide an employee on how to fill out the form or suggest specific answers. However, offering general help, such as explaining what each field means or directing them to IRS resources, is permissible and often appreciated by your employees.

If W-2 forms are filed late, you may be subject to a penalty by the IRS. The amount of the penalty depends on how late the forms are filed.

Yes, as an employer, you should keep copies of all W-2 and W-4 forms for at least four years. This will allow you to respond to any potential inquiries from the IRS or SSA, or from your employees, past and present.

If an employee fails to give you a completed W-4, the IRS instructs employers to withhold tax as if the employee is single with no other adjustments. This means tax will be withheld at a higher rate.

Bottom Line

While the W-2 and W-4 are both important IRS tax documents, each has a different purpose. A W-4 form is the input form used to gather an employee’s tax-related information, while the W-2 is an output form that employers provide to the IRS and employees at year-end so they can file payroll taxes. Understanding these forms can prevent you and your employees from being caught off guard at tax time.

If you need help preparing your W-2 forms or collecting W-4s, consider using a payroll solution like Gusto. With its self-service portal, your employees can enter all of their W-4 information online, and it will automatically transfer into your payroll system. In addition, the software will prepare your year-end W-2 forms and make it accessible for your employees to download on demand, so you don’t have to do it manually. Sign up to get 1 month free payroll today.