Are you looking to maximize profits? When used appropriately, dynamic pricing can help. If executed poorly, it can harm the customer experience and your brand name.

What Is Dynamic Pricing? Types, Examples & Benefits

This article is part of a larger series on Retail Management.

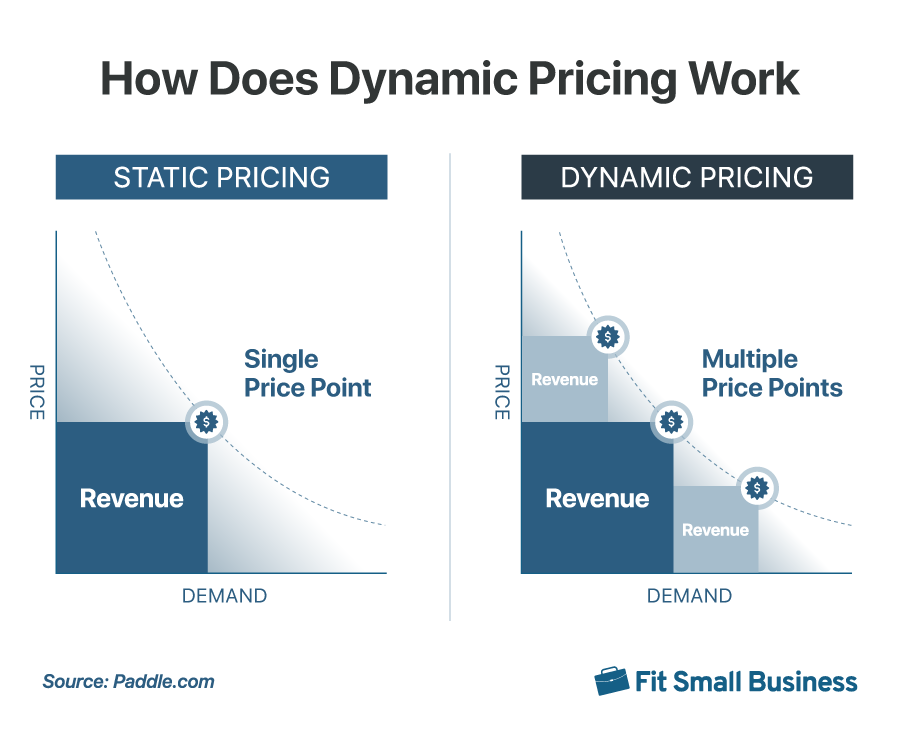

Dynamic pricing is a pricing strategy where prices fluctuate based on certain market factors, like demand, customers, or competition. The idea is that these price fluctuations maximize profits by capitalizing on changing market conditions.

Unlike fixed pricing, which you see at grocery stores and boutiques and will adjust over time, dynamic pricing is much more instantaneous. That’s why it is sometimes referred to as “surge pricing” or “demand pricing.”

Static pricing offers a single selling point no matter the circumstances, but dynamic pricing has a range of selling prices based on market conditions.

Dynamic pricing is a strategy that you typically find in businesses like ride-sharing services and airlines. It can require lots of real-time data collection and analysis. However, there are many examples of lower-tech dynamic pricing strategies that can be used creatively in standard retail operations.

Read on to learn more about types of dynamic pricing, pros and cons, real-life examples, and how you can implement dynamic pricing in your business.

Types of Dynamic Pricing (+ Examples)

There are a few different types of dynamic pricing. While the general principle remains—price fluctuates with market factors—the exact factors and goals of the fluctuation differ among the dynamic pricing variations.

Segmented

Segmented pricing is a type of dynamic pricing in which there are different prices for different customer groups, like seniors, adults, and kids; students and gen pop; or men and women.

Goal: Appeal to and maximize profits from different target markets

Market Factor: Customer profile

Example: AMC Theatres

AMC uses segmented pricing to attract all ages to their showings. (Source: CNN)

AMC Theatres uses segmented dynamic pricing, offering different ticket prices to seniors, adults, kids, and students. This helps them attract all audiences, and less expensive kids’ tickets incentivize parents to make movies a family event.

Segmented pricing is a popular strategy for ticketing business, as it incentivizes families and groups to attend together and buy larger numbers of tickets.

Time-based

In time-based pricing, prices vary based on the time of day.

Goal: Capitalize on peak demand periods and create incentives during demand lulls

Market Factor: Time of day demand

Example: Blue Island Oyster Bar

Blue Island Oyster Bar uses time-based dynamic pricing for its happy hour special to attract diners during typically slow times. (Source: Denver Life)

Blue Island, an oyster bar in downtown Denver, uses time-based pricing for its happy hour menu. Every day from 2 p.m. to 6 p.m. and Sunday from open to 6 p.m., Blue Island offers discounted drinks, appetizers, and oyster specials. Early afternoon and evening are typically the restaurant’s slowest hours, but the happy hour specials make getting a table difficult even at this time of day.

Traffic-based

With this type of dynamic pricing, prices fluctuate based on customer traffic, increasing as traffic increases and decreasing as traffic decreases. The idea here is that peak traffic correlates to peak demand, so you can get away with higher prices. Traffic variables are typically easier to track and react to for online retailers, and you will not typically find this pricing strategy for primarily brick-and-mortar retailers.

Goal: Capitalize on peak demand

Market Factor: Customer traffic/shopper volume

Example: Uber

Uber uses surge pricing when there is massive demand for drivers, like after an event or late at night when bars close down. (Source: Business Insider)

Uber, the ride-share service, uses surge pricing to adjust its rates when there is high demand for drivers. You typically find surge pricing after an event, late at night, or even at random times when there is a burst in traffic on the Uber app. When app traffic and demand go down to normal levels, so too do ride prices.

Penetration

Penetration pricing is a type of dynamic pricing in which a brand will offer a low price for a first-time purchase or during a product launch and then raise those prices at a later date. This is supposed to create buying incentives for new customers or products. Once customers have used the new product, they will be “hooked” and willing to pay the higher price to repurchase the item.

Penetration pricing works best for products that people own multiples of or items they have to replace regularly.

Goal: Get customers to try the brand or product/penetrate new target market

Market Factor: Brand/product awareness and trust

Example: Girlfriend Collective

Girlfriend Collective used penetrative pricing to get people hooked on its butter-soft leggings and launch its brand to its current $8 million status. (Source: Ombre Digital)

Girlfriend Collective, a sustainable activewear brand, is an example of a company that used penetrative pricing. When it launched, new customers were able to order their first pair of black leggings for just $10 plus shipping. The brand received thousands of orders. Once those initial buyers got their first pair of leggings, loved them, and wanted another pair or more colors, Girlfriend Collective raised their prices to $100 per pair. With people already convinced that the product was a good one, they were willing to pay the steep price.

Competitive

Competitive pricing is a type of dynamic pricing in which prices fluctuate based on brand competitor prices. This is most common among brands that sell a standard good that can be found at lots of retailers, like gas or groceries.

The size and location of your relevant pricing competitors, whether that be the other stores on your block or competitors across the country, will largely depend on the products you sell.

Goal: Charge the highest price while remaining competitive

Market Factor: Competition pricing

Example: Sinclair

Sinclair uses competitive pricing to stay competitive with other gas stations in the surrounding area. (Source: Sinclair Oil)

Sinclair, as with most gas stations, uses a competitive dynamic pricing model where its prices fluctuate based on the prices of other gas stations in the immediate area, like the same exit or street corner. This ensures that Sinclair is staying competitive while also charging the highest price that it can.

Pros & Cons of Dynamic Pricing

Dynamic pricing comes with a lot of benefits, but there are also some disadvantages that you should consider.

| PROS | CONS |

|---|---|

| Higher profits at peak times | Lower profits during lulls in demand |

| Capitalize on demand | Difficult implementation |

| Attract new markets | Time-consuming |

| Create demand during lulls | May lead to customer dissatisfaction |

| Create repeat customers | Risk of pricing war |

| Reveal customer behaviors | Prone to errors |

While dynamic pricing can help boost profits, better match your pricing with the state of the market, and reveal customer demand and behavior, it is generally difficult to implement and can lead to customer confusion and dissatisfaction. This is especially the case if implemented in an industry where it is not typically used.

In general, dynamic pricing should not be implemented if you run a retail business that sells products that are not typically dynamic in price. Things like clothes, tech, home goods, and other nonessential items are not typically subject to dynamic pricing and, if used in these settings, pricing changes might lead to customer dissatisfaction. However, it is worth taking on the dynamic pricing process for industries like gasoline, food, and transportation, as well as in special cases like product launches.

How to Implement Dynamic Pricing

If you think that a dynamic pricing strategy might make sense for your business, here are the steps you should take to implement the strategy.

1. Define Your Objective

As we explored above, every type of dynamic pricing has a different goal. You should understand the goal of adopting dynamic pricing for your specific business before implementation so that you can choose the right type of dynamic pricing.

The goals of dynamic pricing include:

- To be able to charge the highest price possible while remaining competitive and attracting customers

- Get customers to try a new brand or product

- To penetrate a new market

- To capitalize on peak demand and maximize profits

- To create demand during lulls

- Appeal to and maximize profits from different target markets

2. Choose Your Dynamic Variable

Once you know the objective of adopting dynamic pricing in your business, you should then determine the market factor or variable with which your pricing will fluctuate. For example, if my goal is to appeal to and maximize profits from different target markets, then the variable I would look at would be customer groups and my pricing would fluctuate with the different groups.

3. Create a Variable Monitoring Strategy

Once you know the goal and market variable of your dynamic pricing, the next thing you should do is create a plan for how you will monitor your dynamic variable. This will allow you to detect changes in your variable and then reflect those changes in your prices.

For example, as we looked at in the step above, I will target different customer groups with my dynamic pricing strategy to appeal to and maximize profits from different target markets.

To monitor customer groups and their fluctuating demand, I might plan to perform market research quarterly to see if demand for my product has changed within groups. Alternatively, I could review my internal sales data to see which customer groups are spending the most and the least and adjust my prices accordingly.

4. Determine Price Adjustment Procedures

Once you know how you are going to detect the need for a pricing change, you should then define the procedures for implementing that change. This might be as easy as updating your website or point-of-sale (POS) system, but it might include a more complicated process if you have physical products. Create a price change plan, record the steps, and give it a practice run to ensure ease of implementation.

5. Observe Feedback & Adjust

As time goes on and your dynamic pricing strategy is in action, you should continue to monitor two things:

- The accomplishment of your initial goal: Ask yourself if you are coming closer to your goal. Are you seeing positive or negative results from having dynamic prices?

- The correlation of your variable, price, and demand: Do changes in your variable accurately reflect how you should change your prices and thus result in higher demand?

From these questions, you will be able to determine if you have targeted the right type of dynamic pricing and if you are basing your pricing on the most relevant variable. These insights will help you determine if you should adjust your strategy or if your dynamic pricing is in line with market conditions and is maximizing your potential.

Dynamic Pricing Frequently Asked Questions (FAQs)

Click through the questions below to get answers to some of your most asked dynamic pricing questions.

Dynamic pricing is most commonly used among new brands, utility providers (like gas and electricity), ticketed businesses, ride-share services, and restaurants.

This question largely relies on your market and customer behavior data. Being able to determine demand and what being competitive in your market looks like can be a challenge, but sales forecasting and market research are generally a good place to start.

When used appropriately in industries where it is expected or in ways that benefit the customer, dynamic pricing is a great practice for maximizing profits. It can be “bad,” however, if it causes customers to feel taken advantage of or if it causes you to lose profits.

Dynamic pricing works because it allows businesses to react to current market conditions and raise prices to capitalize on demand when demand is high, and lower prices to create additional demand when demand is low.

Dynamic pricing is used to capitalize on demand when it is high by implementing higher prices and to create demand when it is low by decreasing prices.

Bottom Line

Dynamic pricing is a great pricing strategy for businesses that exist in tumultuous markets with big swings in demand. While dynamic pricing can be tricky to implement as it involves close monitoring of your market and constant pricing changes, there are lots of benefits to be had from adopting the pricing strategy.

With this guide above, you have all the tools you need to understand and implement dynamic pricing that works for your business.