Gusto and QuickBooks Payroll are affordable software options for small business owners. Both offer full-service payroll with unlimited pay runs and direct deposit payments, including payroll tax processing and filing. However, Gusto has contractor-only pricing, a wider selection of benefits options, and more human resources (HR) tools. QuickBooks Payroll, on the other hand, provides faster direct deposits, connects seamlessly with other Intuit QuickBooks products, and slightly better health insurance coverage (available in 48 states vs Gusto’s 38 states).

Here’s where we particularly recommended Gusto vs QuickBooks Payroll:

- Gusto: Best for small businesses needing to run payroll―for employees and/or contractors―plus access to some complementary HR tools and services

- QuickBooks Payroll: Best for small businesses already using other Intuit Quickbooks software and looking for fast direct deposits

There are instances where neither Gusto nor QuickBooks Payroll is the best option. If you’re looking for HR payroll software with 24/7 customer support, we recommend:

- Justworks: Best for companies that need low-cost PEO services to outsource HR and payroll administration

Don’t have an in-house HR team or need expert help managing day-to-day HR and payroll tasks? Consider Justworks |

|

Gusto vs QuickBooks Payroll At-a-Glance

|  | |

|---|---|---|

Overall Score | 4.46 out of 5 | 4.11 out of 5 |

Best for | Small businesses wanting full service payroll with HR | QuickBooks users; Businesses in states where Gusto does not offer health benefits |

Starter Monthly Pricing | $6 per employee plus $40 base fee | $6 per employee plus $45 base fee (plus subscription to QuickBooks) |

Direct Deposit Processing Timelines | Minimum two and four days; next-day process with higher plans | Minimum next-day process; same-day with higher plans |

Health Benefits Coverage | 38 states only, plus D.C. | Not available in Vermont, Hawaii, and District of Columbia |

Workers' Compensation | Can purchase and manage within all plans | Can purchase and manage only with higher plans |

Payroll Tax Payments, Filings, and Year-end W2/1099 Reports | Yes to all | Local tax payments and filings available in higher tiers only |

Other HR Features | Job postings, applicant tracking, performance reviews, employee surveys, HR resource center, and HR advisers | HR support center and HR advisers |

Software Integration | Robust | Limited to Intuit products; requires QuickBooks Accounting to unlock all integrations |

Ease of use | Excellent | Good; help section is for all Intuit products and can get confusing |

Customer support | Phone, email, and chat support from Monday to Friday; premium support available in higher tiers | 24/7 chat; phone support from Monday to Saturday; premium support available with Elite plan |

Real-world user score* | 4.53 out of 5 | 4.36 out of 5 |

*User scores are averaged from multiple third-party user review sites.

Gusto and QuickBooks Payroll are highly versatile, easy to use, and well-priced. As such, you’ll find them both in our lists for:

- Best Payroll Software for Small Businesses

- Best Human Resources Payroll Software

- Best Payroll Software for Accountants

- Best ADP Competitors

- Best Payroll Series for Nonprofits

- Best Church Payroll Services

- Best Payroll Services for Trucking Companies

- Best Construction Payroll Software

When to Use QuickBooks vs Gusto vs Something Else

Most Affordable: Tie

|  | |

|---|---|---|

Score | 5 out of 5 | 5 out of 5 |

Free Trial | None | 30 days |

Monthly fee | Simple: $40 + $6 per employee Plus: $80 + $12 per employee Premium: Contact Gusto for quote | Core: $45 + $6 per employee Premium: $80 + $8 per employee Elite: $125 + $10 per employee |

Contractor-only monthly fee | $6 per person monthly + $35 base fee monthly | $15 monthly for up to 20 contractors (plus $2 for each additional worker) |

Multiple State Tax Filings | No extra cost but included in Plus and Premium plans only | All plans include 1 state filing; $12 for each additional state monthly for Core and Premium plan holders (Elite plan supports multiple state filings at no extra cost) |

Add-ons | Priority Support or HR services (Plus Plan + $8 per month, per person) Time Tracking ($80/month + $12 per person or less) | Time Tracking ($40/month + $10 per person) |

Both Gusto and QuickBooks Payroll offer reasonably priced product plans that come with unlimited pay runs. On our rubric, they both earned perfect scores for pricing. Thus, it depends on the use cases.

Gusto

Gusto’s lower base fees for its Simple plan make it more affordable than QuickBooks Payroll’s Core plan. Here’s a comparison of the two providers’ pricing for 10 employees for their starter plans:

- Gusto: $100 per month, calculated as ($6 per employee x 10 employees) + $40

- QuickBooks Payroll: $105 per month, calculated as ($6 per employee x 10 employees) + $45

For $45 plus $6 per employee monthly with QuickBooks Payroll’s Core plan, you get full-service payroll, next-day direct deposit, federal and state tax payments and filings, and access to 401(k) plans and health benefits. You get similar features with Gusto’s Core plan for $40 plus $6 per employee.

QuickBooks Payroll

If you only employ contractors, QuickBooks’ Contractor Payments Plan is more affordable. For companies with 20 contractors, it will only charge you $15 monthly, while Gusto will bill you $155 per month (computed as $6 per contractor x 20 workers + $35 base fee).

If you need time tracking, QuickBooks Time is less expensive than Gusto’s time tracker; however, Gusto has third-party add-ons that may be cheaper (including Quickbooks Time).

Gusto vs QuickBooks Payroll Pricing Calculator

If you want to quickly compare costs, use our online calculator to compute the estimated monthly and annual fees for these two providers.

Best for Payroll Features: Gusto

|  | |

|---|---|---|

Score | 4.75 out of 5 | 4.63 out of 5 |

Full-service Payroll With Unlimited Pay Runs | ✓ | ✓ |

Automated Tax Filings and Payments | ✓ | Local tax payments and filings available in higher tiers |

Year-end Tax Report Prep and Online Delivery (W2s/1099s) | ✓ | ✓ |

Multistate Payroll | Available in higher tiers | ✓ |

Direct Deposit Timelines | Next-day, two days, and four days | Next-day and same-day |

Manual Paychecks and Pay Card Option | ✓ | Manual paychecks only |

Pay on Demand | ✓ (via Gusto Cashout) | ✕ |

Wage Garnishment Deductions and Payments | ✓ (Payment services unavailable in South Carolina) | Wage garnishment payments not included |

International Contractor Payroll | Costs extra* | ✕ |

Gusto Payroll vs QuickBooks Payroll is a close call, as they have similar feature sets. Both offer automated payroll and tax processing, including year-end tax report preparation and online delivery of Form W-2s and 1099s. However, Gusto comes out ahead thanks to Gusto Wallet and the tools it offers.

Gusto

Gusto Wallet is a payment app with a paycard that lets you pay employees on demand. QuickBooks Payroll doesn’t have this option. It has a higher savings interest rate than most banks and includes budgeting tools to help employees spend their money wisely.

Gusto pays local taxes; QuickBooks will only handle local tax payments and filings for you if you subscribe to either its Premium or Elite plans. In addition, Gusto offers global contractor services (as a paid add-on), something QuickBooks lacks.

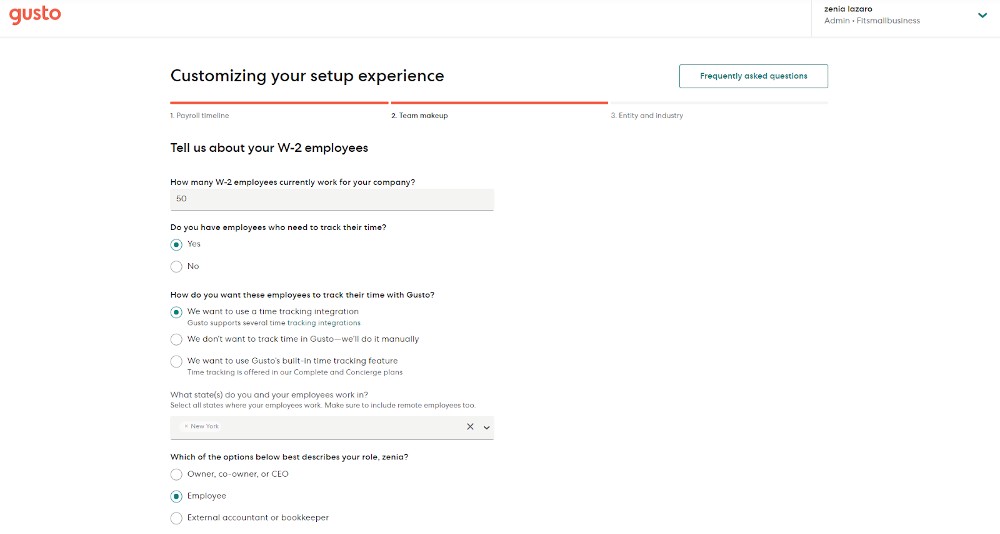

With Gusto, you can run payroll in four easy steps. (Source: Gusto)

QuickBooks Payroll

If you require same-day direct deposits, then you may want to consider QuickBooks Payroll. Gusto provides two-day direct deposits for its Simple package and next-day processing for its higher tiers (the first payroll takes four days, however). Also, if your business is located in more than one state, Gusto offers its multistate payroll functionalities only for Plus and Premium plans—this is available in QuickBooks Payroll’s starter tier.

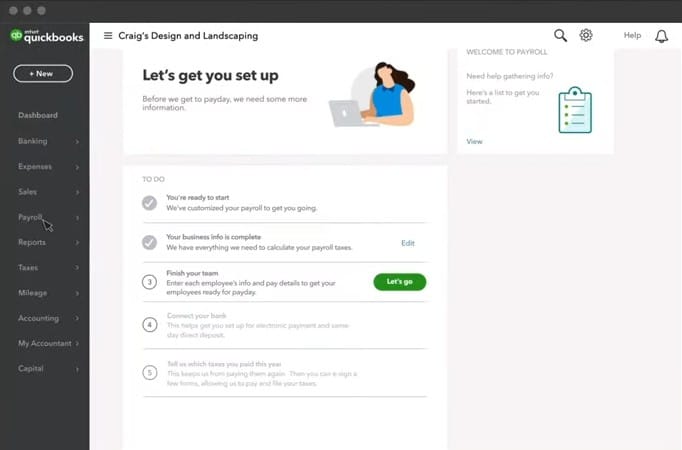

With QuickBooks Payroll, you can process employee payments with just a few clicks. (Source: Gusto)

Best for HR Tools: Gusto

|  | |

|---|---|---|

Score | 4.13 out of 5 | 3.31 out of 5 |

Workers’ Compensation | ✓ | ✓ |

Employee Benefits | Health insurance, retirement, flexible savings accounts (FSA) and health savings accounts (HSA), and commuter benefits | Health and retirement plans |

Employee onboarding | ✓ | ✓ |

Self-service portal | ✓ | ✓ |

HR experts | Higher plans | Higher plans |

Health insurance | 37 states + DC | 48 states (excludes HI, VT, and DC) |

Job templates, posting | Higher plans | ✕ |

Time Tracking | Add-on | Add-on, or highest plan |

Performance Reviews | Higher plans | ✕ |

Employee Surveys | Higher plans | ✕ |

Since Our Last Update: QuickBooks lets you purchase workers’ compensation in all plans. QuickBooks also files state new hire paperwork with certain plans.

With Gusto and QuickBooks Payroll, you get a self-service portal that employees can use to view their pay slips and employee benefits online. Both providers also offer access to expert professionals whom you can contact to get HR, payroll, and compliance advice. However, Gusto offers more services to assist with active employees.

Gusto

Some of Gusto’s essential HR features include new hire state reporting, hiring, performance review management, and a wide range of employee benefits options, such as health insurance, commuter benefits, and flexible spending accounts.

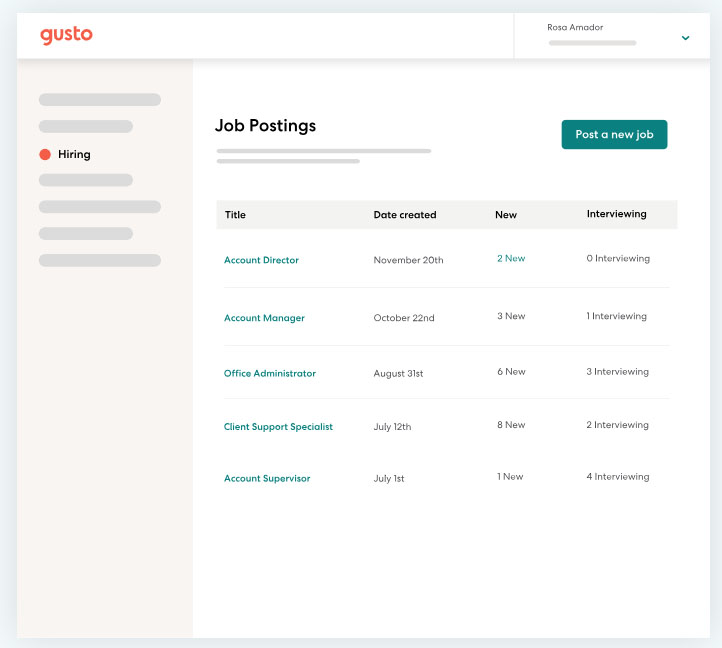

Additionally, you get access to job postings, online offer letters, customizable onboarding tools, and employee surveys. Gusto’s Plus and Premium Plans also have a performance evaluation tool to help you share and track feedback with employees. It includes goal-setting and self-evaluation functions.

Gusto lets you create job listings, post, and track them. (Source: Gusto)

QuickBooks Payroll

While Gusto’s benefits options are robust, you may end up not having access to health plans if your business is located in one of the 13 states that it doesn’t cover (Alabama, Alaska, Hawaii, Louisiana, Mississippi, Montana, Nebraska, North Dakota, Rhode Island, South Dakota, Vermont, West Virginia, and Wyoming). This is unlike QuickBooks Payroll’s health plans, which are unavailable only in two states—Vermont and Hawaii—and the District of Columbia.

Gusto also offers time tracking at a lower price than Gusto and includes it in its Premium Plan. Gusto requires an add-on, and the one it offers is significantly more expensive, although it includes PTO management.

Best for Reporting: Gusto

|  | |

|---|---|---|

Score | 3.5 out of 5 | 3.06 out of 5 |

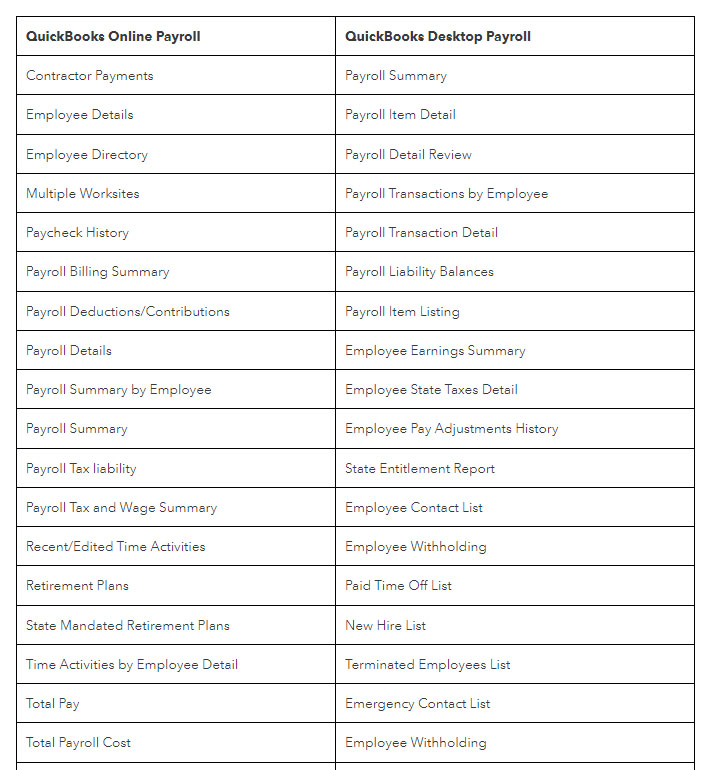

Number of premade reports | 25 | Online: 20 Desktop: 23 |

Reports customizations | ✓ | ✓ |

Can build new reports | ✓ | ✓ |

When it comes to reports, we found Gusto and QuickBooks Payroll to be even in the number of offerings, but Gusto offers more variety and additional tools that put it ahead.

Gusto

Gusto creates 19 reports you can access at any time, plus five reports that depend on your situation, like tax deferrals or R&D tax credits. We didn’t find tax credit reports in QuickBooks Payroll’s list. You can also build your own reports using the “break down by” fields and then save the template under custom reports.

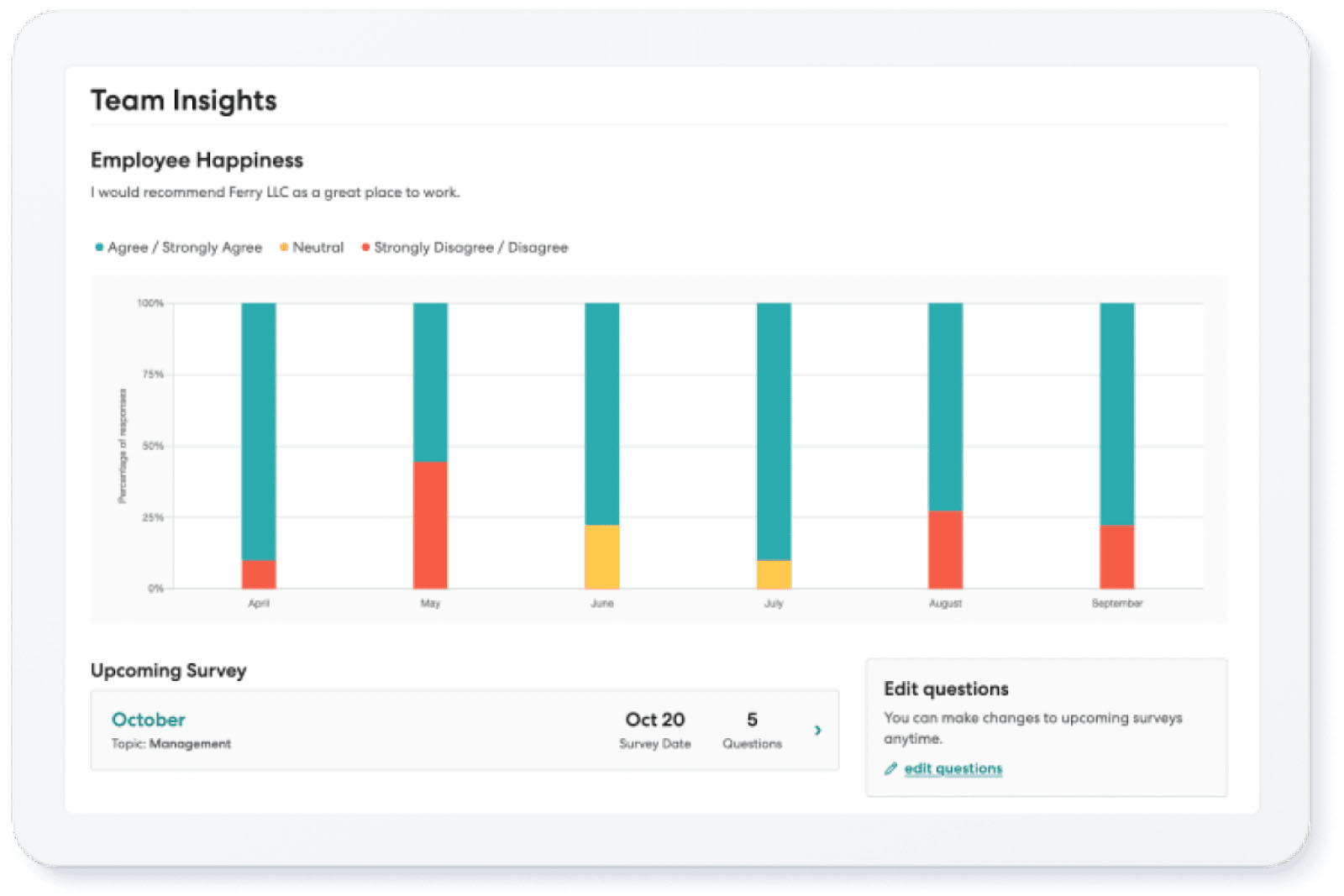

Gusto also lets you create employee surveys to get reports on employee happiness and areas of concern. It also has project costing tools to generate reports on expenses. It can also generate custom reports for applying for the Paycheck Protection Program or Economic Injury Disaster Loan Program.

In addition to standard payroll reports, you can get reports on company culture and happiness. (Source: Gusto)

QuickBooks Payroll

Interestingly, QuickBooks Payroll’s pre-made reports vary greatly by whether you have the online or the desktop version. The desktop version has more reports and several are for more details, but the online version has reports like retirement plans. Several have different names but provide the same information. Only Desktop lets you create and then “memorize” a report with its current custom settings to make it easier to run in the future.

The type of reports offered by QuickBooks Payroll depends on the version. (Source: QuickBooks)

Best for Popularity: Gusto

|  | |

|---|---|---|

Score | 5 out of 5 | 3.13 out of 5 |

User Feedback | Mostly positive | Mostly positive |

Average User Ratings* | 4.53 out of 5 | 4.36 out of 5 |

Average Number of Reviews* | 5,800+ | 890+ |

*Based on third-party user review sites.

Since Our Last Update: Gusto’s ratings have gone up, while QuickBooks Payroll’s have gone down slightly.

Gusto takes the lead here not only for having a higher score from real-world users, but also for more user reviews. However, both products are highly rated by users for features, ease-of-use, and customer support.

Gusto

Users who left reviews on G2 and Capterra rated it 4.5 and 4.6 out of 5, respectively. Reviewers highlighted ease of use, straightforward and intuitive interface, and good customer support as Gusto’s top features. It also helps small businesses to be compliant legally with wage laws. The complaints, meanwhile, include occasional software glitches and a desire for a wider offering of HR tools, reporting features, and software integration options.

QuickBooks Payroll

Users gave QuickBooks Payroll 3.8 and 4.4 stars on G2 and Capterra, respectively. Most of the positive comments it received include “easy to implement” and “user-friendly.” There are mixed reviews about its customer support—some users noted its support team isn’t knowledgeable, while others said they received good service. Some also mentioned that it needs to have more robust reporting features.

Best for Ease of Use, Customer Support, and Integrations: Gusto

|  | |

|---|---|---|

Score | 3.75 out of 5 | 3.63 out of 5 |

Access to HR Advisers | Higher plans | Higher plans |

How-to Guides | Good; no illustrations | Good, but can be difficult to find right version and even software |

Setup Help | Highest Plan | ✓ |

Third-party Software Integrations | 130+ | Limited to Intuit products; requires QuickBooks Accounting to access all integrations |

Access to a Community Forum | ✕ | ✓ |

Customer Support | Phone, email, and chat; premium support available in higher tiers | 24/7 chat; phone and email; premium support available in higher tiers |

Support Hours | Monday–Friday, from 6 a.m. to 6 p.m., Mountain time | Monday–Friday, from 6 a.m. to 6 p.m., Pacific time, Saturday from 6 a.m. to 3 p.m., Pacific time |

Since Our Last Update: Gusto has changed its customer support hours.

When it comes to ease of use, Gusto and QuickBooks Payroll have user-friendly and intuitive platforms. Both offer phone support, including access to HR advisers and how-to guides. However, we prefer Gusto’s how-to section over QuickBooks, and it’s hands-down the better for integrations.

Gusto

Gusto’s how-to sections are not illustrated, but they are complete and easy to follow. It’s also easy to find what you need. When we search for QuickBooks’ Payroll help, on the other hand, we tend to pull up articles for other Intuit products as well.

For third-party software integrations, Gusto has a more robust selection, with over 100 integrations covering accounting, hiring, learning management, legal and compliance, rewards and recognition, and even point-of-sale systems.

Meanwhile, QuickBooks Payroll primarily offers integration with Intuit products. If you use your existing accounting software, you’ll have to manually input data from your accounting software into QuickBooks Payroll.

Gusto’s W-2 employee information setup (Source: Gusto)

QuickBooks Payroll

QuickBooks Payroll is a great option if you’re a QuickBooks user or are considering using other Intuit products. The integration with QuickBooks solutions is seamless, making it easy for you to manage data across multiple Intuit products—from employee attendance (via QuickBooks Time) to pay processing (through QuickBooks Payroll) and general ledger updates (with QuickBooks Accounting). QuickBooks Accounting has more integrability so you can integrate through it, but you’re working through the accounting app.

QuickBooks’ help articles are a little more difficult to get to and are more brief than Gusto’s; however, it offers a community forum for seeking answers and advice, something Gusto does not have. If you need help setting up your account, you can call customer support for a guided setup and tips.

QuickBooks Payroll’s main dashboard has a to-do list to help you complete your account setup. (Source: QuickBooks Payroll)

How We Evaluated

To compare Gusto vs Intuit QuickBooks Payroll, we started with our rubric for the best payroll services. Then we modified it to dig deeper to better compare these two strong payroll providers. We looked at price, features, and user feedback.

25% of Overall Score

We checked to see if the provider has transparent pricing, zero setup fees, and multiple plan options with unlimited pay runs. Both did excellent here.

25% of Overall Score

We looked for direct deposits in two days or less, multiple payment options, year-end tax reporting, tax payments and filings (federal, state, and local taxes), and a penalty-free guarantee. The paycard option was where Gusto stood out, although QuickBooks Payroll’s tax guarantee is more all-encompassing.

10% of Overall Score

Here, we modified because both offered the basics for onboarding and self-service, new hire reporting, and experts on staff. Health insurance in all states, and HR tools for hiring, performance evaluation, and the like separated QuickBooks vs Gusto.

5% of Overall Score

Preference was given to software with built-in basic payroll reports and customization options. Both did very well here, although Gusto’s ability to save templates brought it ahead.

10% of Overall Score

We considered online user reviews and customer service quality trends from popular review sites like G2 and Capterra. Since both had high ratings, we gave the most points to the highest user rating and most reviews.

25% of Overall Score

We looked for features that make the software easy to use, such as having an interface that’s intuitive and customizable. Extra points were given to providers that offer integration options, set-up assistance, live phone support, and a dedicated representative.

Gusto vs QuickBooks Payroll FAQs

To help you choose a payroll solution that’s best for your business—be it Gusto or QuickBooks Payroll—start by assessing how many employees you have and plan to have in the future, along with your need for HR support and software integrations. You should also determine if you want to offer benefits and, if so, consider if any are negotiable.

Gusto is a payroll service that offers health care benefits in 37 states and Washington D.C. Gusto also offers HR tools like job posting and performance reviews. It integrates with over 130 applications, including QuickBooks.

QuickBooks Payroll, meanwhile, is part of the Intuit family of products. While it has fewer HR tools than Gusto, it integrates seamlessly with other Intuit products, including QuickBooks Accounting and QuickBooks Time. It offers benefits in 48 states as opposed to Gusto’s 37.

Based on our evaluation, Gusto is a better payroll software than QuickBooks Payroll because it offers more HR tools, integrations, and benefits.

Gusto can integrate with QuickBooks Desktop, QuickBooks Online, and QuickBooks Time.

Gusto’s payroll plans are comparable to other payroll services, and its contractor-only plan is one of the least expensive (although QuickBooks Payroll is cheaper).

Bottom Line

If you’re already using QuickBooks’ accounting software, then QuickBooks Payroll may be a better option. The learning curve will be much lower than you’d get with other small business software, and you can provide your employees with health insurance benefits in almost any state.

However, if you need more than just health insurance benefits to build a quality team or your business and employees are in an eligible state, consider Gusto. You’ll get more onboarding and HR support plus more affordable plan options. Get one month free when you run your first payroll. Offer will be applied to your Gusto invoice(s) while all applicable terms and conditions are met or fulfilled.