Merchant financing is a way for a business to get a lump sum of funds, with repayments generally determined by a percentage of the company’s sales. This source of funding tends to be easier to get as eligibility criteria are less strict for things like credit score and time in business. The tradeoff, however, is…

What is

What Is Personal Trainer Insurance Coverage?

Personal trainer insurance coverage refers to a policy or group of policies designed to protect a personal trainer’s business assets. Personal trainers need muscular coverage, so to speak, and it typically starts with a general liability policy, which covers the costs of common lawsuits business owners face. Additionally, personal trainers should consider bulking up with…

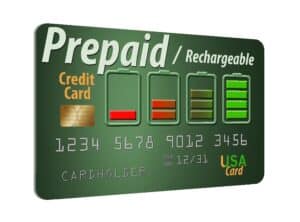

Business Prepaid Card: What It Is & How It Works

Editorial and Partnership Disclosure A business prepaid card is a payment card that you load with funds before use. Unlike credit or debit cards, which are tied to a credit line or bank account, prepaid cards prevent overspending and debt. By limiting spending to the available balance, you can control employee expenses like travel, meals,…

Demand Forecasting: Comprehensive Guide for SMBs

Demand forecasting is a type of predictive analytics that helps anticipate upcoming consumer demand so you can make better supply chain, management, inventory, and budgeting decisions. An accurate understanding of your upcoming demand is incredibly important in retail as it determines your inventory quantities, the types of products you should stock, and when you should…

Hiring Minors: Child Labor Laws & Best Practices

Keeping up with what and how many hours a minor can work can be challenging. Additionally, several states are changing their child labor laws. Learn more.

Child labor laws exist to ensure the safety, well-being, and educational opportunities of minor employees. If your small business employs minors (those aged 14 to 17), you must know and follow federal and state child labor laws. These laws limit work hours and restrict the types of jobs minors can hold, among other things. This…

Pros and Cons of Merchant Financing for Small Businesses

If you’re having trouble getting approved for a traditional loan, merchant financing can provide you with the funds needed to cover daily expenses or other funding needs. It is typically easier to get and rarely requires any additional collateral since your sales are considered collateral for the loan. Additionally, since repayments are often calculated based…

What Is Market Research? [+ Tips on How to Do It]

Market research is the process of assessing market conditions. It reveals insights about the best ways to prepare your business, whether you’re starting a new business or taking a new direction in an existing business. Market research is vital for small businesses; it helps them determine the viability of their business strategies based on the…

What Is Affiliate Marketing and How Does It Work?

Affiliate marketing is a specific type of digital marketing where third-party promoters earn commissions from selling a merchant’s product(s) to customers. It can help your small business increase its brand awareness and make more sales, all while keeping costs low and saving time. Some common types of affiliate marketers include social media influencers, bloggers, publishers,…