Real estate wholesaling is a cost-effective way to start investing in real estate if you have limited funds and are looking for a short-term investment approach. The low financial barrier to entry and not having to manage tenants and rental properties, or house-flipping projects, make real estate wholesaling a great option for new investors. However, learning how to wholesale real estate can be tricky for beginners due to state legal regulations and complex contracts that demand careful consideration. We’ll cover how wholesaling works, the pros and cons, and how to find properties for your wholesale venture.

What Is Real Estate Wholesaling?

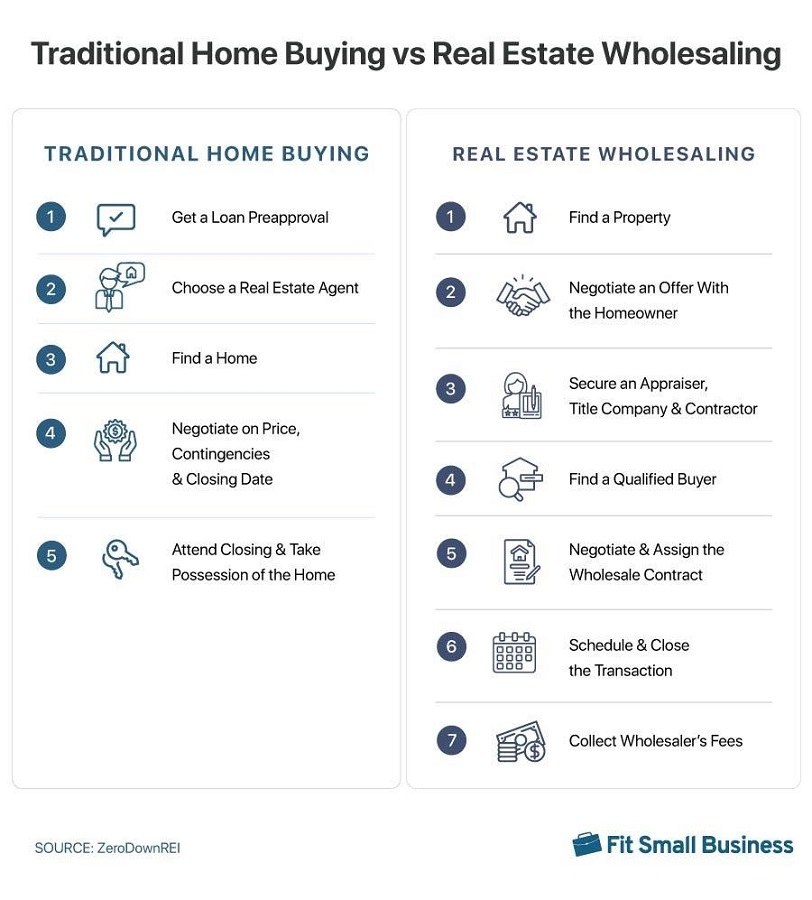

Wholesaling is a real estate investment strategy where an individual (the wholesaler) finds and contracts a property, typically at a significant discount, and then assigns or resells the contract to another buyer (typically an investor) for a profit. Wholesalers act as intermediaries, facilitating transactions between sellers and buyers without owning or renovating the property themselves.

Instead of managing properties, wholesalers assign contracts.

Although sometimes confused with a fix and flip, the wholesaler’s intention isn’t to repair or sell the property themselves. Instead, they market the property and prospect for buyers. The buyers are not always investors. Sometimes, they’re homeowners or other wholesalers. In most cases, however, the buyer is a buy-and-hold or fix-and-flip investor.

Who Real Estate Wholesaling Is Best For

Wholesaling is a good option for beginner investors who want to get into real estate investing but don’t have access to a lot of capital. It is also suitable for contractors and investors with an eye for distressed properties and those with solid negotiation skills. Wholesaling takes time to learn, but it can reap significant rewards if done correctly.

There are a lot of gray areas to consider, and it requires time to find the properties and buyers and bring them together, so knowing how to do research will be critical to your success. Having the right people in your network, such as real estate professionals, contractors, lenders, appraisers, and other investors who buy investment properties from real estate wholesalers, is also essential.

Wholesaling is not for investors who don’t want to do the upfront work of building their network and understanding the real estate market. Also, while there can be a low financial barrier to entry in this type of real estate investment, it will require some upfront cash for an earnest money or “good faith” deposit, appraisal and inspection fees, office expenses and supplies, and monies paid to your lawyer and accountant.

Legal Considerations of Wholesaling

Real estate wholesaling is legal in the United States. However, the legal requirements and regulations for real estate wholesaling can vary from state to state and even within local jurisdictions. It’s essential for individuals involved in property wholesaling to be knowledgeable about the real estate laws and regulations in their area and to conduct their activities in compliance with those laws.

Engaging in wholesaling without understanding and adhering to the legal requirements can lead to legal issues, financial loss, and potential penalties. It’s advisable to seek legal counsel and consult with local real estate authorities beforehand to ensure full compliance with the law in your particular area.

How Does Wholesale Real Estate Work?

To succeed as a real estate wholesaler requires a solid network, strong negotiation skills, and speed. The wholesaler needs time to assign the contract to a new owner, but sellers don’t want their property tied up indefinitely. Wholesalers typically want to resell the contract within 30 days. It’s ideal for owners of distressed properties because they can sometimes get their home under contract with a qualified buyer faster than listing it with a realtor. However, they may not get the total market value for their home.

Here’s how real estate wholesaling typically works:

- Property identification: The wholesaler identifies wholesale homes that are potential deals, often distressed or in need of repairs, which investors can purchase below market value.

- Contract negotiation: The wholesaler negotiates a purchase contract with the property owner, usually with favorable terms, such as a low purchase price and flexible closing timelines.

- Assignment: Instead of closing on the property, the wholesaler assigns the contract to an end buyer willing to purchase the property. This assignment is typically for a fee, which is the wholesaler’s profit.

- End buyer purchase: The end buyer completes the property purchase according to the contract terms.

Back-to-Back Closing

Another way real estate wholesalers invest is by purchasing the property. Instead of assigning a contract to the buyer, the wholesaler sells the property with back-to-back closings, also known as a “double closing” or “simultaneous closing.”

There is potential for greater profit with a double closing since the wholesaler purchases the property well below market value and sells it for a profit. The wholesaler gets to keep all of the net proceeds from the sale instead of just collecting a fee for facilitating the transaction. This type of transaction requires a large amount of capital for a down payment and closing costs. It also requires excellent credit and is best for investors with some experience since the risk is greater.

Pros & Cons of Real Estate Wholesaling

There are some excellent benefits to wholesaling real estate, including the low financial barrier to entry and not having to own, manage, maintain, or renovate the property like other investment properties. However, there are also negatives, like finding properties and qualified buyers. Let’s glance at the top five pros and cons you need to know when learning how to start wholesaling real estate.

Wholesaling Pros | Wholesaling Cons |

|---|---|

Low upfront capital: Real estate wholesaling typically requires minimal upfront capital since you're not purchasing or renovating properties. | Legal complexity: Wholesaling may involve legal challenges, including compliance with local real estate laws and regulations. |

Quick profit: Wholesaling can lead to faster profits than traditional real estate investment strategies. | Limited control: Wholesalers have limited control over the final property transaction since it depends on the buyer's decision. |

No property ownership: Wholesalers don't have to deal with property management, repairs, or long-term ownership responsibilities | Inconsistent income: Income in wholesaling can be inconsistent, and deals aren't guaranteed. |

Flexibility: You can do wholesaling part time or full time, offering flexibility in your real estate investment activities. | Lower profits: Wholesaler fees are typically lower than profits from a fix-and-flip or long-term investment property. |

Networking opportunities: Wholesalers often build a network of real estate professionals, including investors, agents, and contractors, to help them grow their businesses. | Competition: The real estate wholesaling market can be competitive, making it challenging to find good deals. Building a solid network is critical. |

How to Wholesale Real Estate

There are several steps to learn how to wholesale real estate. The skills needed include research, negotiation, project management, a solid network, and moving quickly from a contract with the seller to assignment to a buyer, then closing. Preparation is crucial. The more prepared you are, the less time and money is wasted.

Here’s how to start wholesaling real estate step by step:

1. Find Distressed Properties

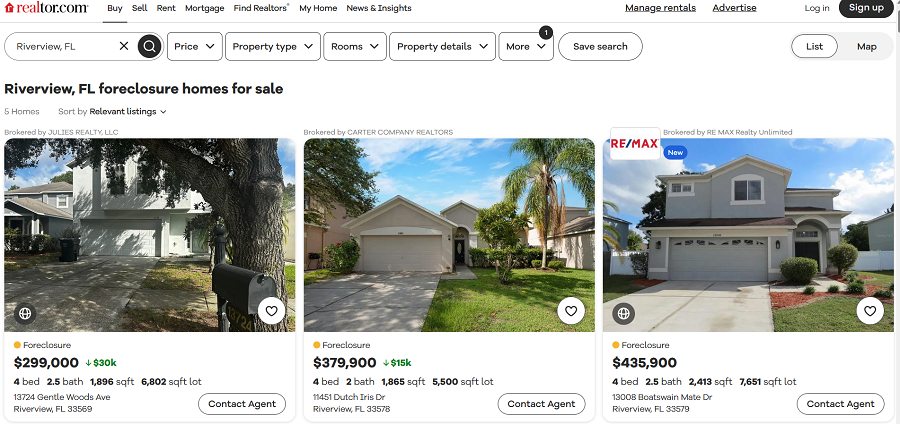

To succeed in wholesaling, start by finding distressed properties. These property types offer potential profit. Distressed properties, often in poor condition or owned by motivated sellers, can be bought below market value. They may be in foreclosure or bank-owned. New investors often use free or low-cost methods like real estate groups, online sites, and assistants to find these properties. Experienced investors have additional resources and a larger network.

REDX preforeclosure leads database (Source: REDX)

Working with homes in preforeclosure provides a unique opportunity to support and assist distressed homeowners during a challenging transition, unlike any other sales scenario. With accurate contact information, a mailing address, and a phone number to establish a viable lead, REDX compiles this data, saving you the effort of doing so yourself.

2. Negotiate an Offer With the Seller

Negotiating a deal and convincing property owners to sell is crucial. Building trust with the owner is the initial step. A wholesaler should be professional and punctual when approaching homeowners. Emphasize the benefits of selling, like relieving financial stress or deferred maintenance.

Let the seller know you will handle the contract, inspections, appraisals, and closing, alleviating the homeowner’s burdens. Mention the necessary repairs you will need to make to improve the property’s condition and value to justify your offer. If they agree, the homeowner signs the contract that you have provided. Remember to have your contracts reviewed by a real estate attorney beforehand to ensure they comply with federal, state, and local laws.

3. Secure a Title Company, Appraiser & General Contractor

You will need a title company, appraiser, and contractor on your team. So, it’s best to establish these relationships beforehand since time is of the essence. An appraiser provides property valuation to ensure profitable deals. A title company conducts title searches to ensure there are no liens on the property and that the owner is entitled to sell.

A reliable contractor estimates repair costs, helping with buyer confidence. You can find professionals through referrals from your network, online searches, and recommendations from wholesaling networks or experienced wholesalers and investors in your area.

Assessing property renovation needs determines costs and potential profits. A distressed property needing renovations offers a higher margin for the investor. Providing the repair estimate to the buyer ensures transparency in negotiations. It’s a valuable tool to secure better offers. Knowing renovation costs helps estimate the property’s after-repair value (ARV), demonstrating its value to potential investors and profit potential.

4. Find a Qualified Buyer, Negotiate & Assign a Contract

Now it’s time to find a buyer for your wholesale property if you don’t have one in mind already. Your target buyers are typically investors or contractors looking to buy and renovate, but could also be potential homeowners looking for a renovation project. Quickly finding a buyer is crucial due to the closing date on the contract. As a newbie wholesaler, consider cost-effective methods to locate buyers:

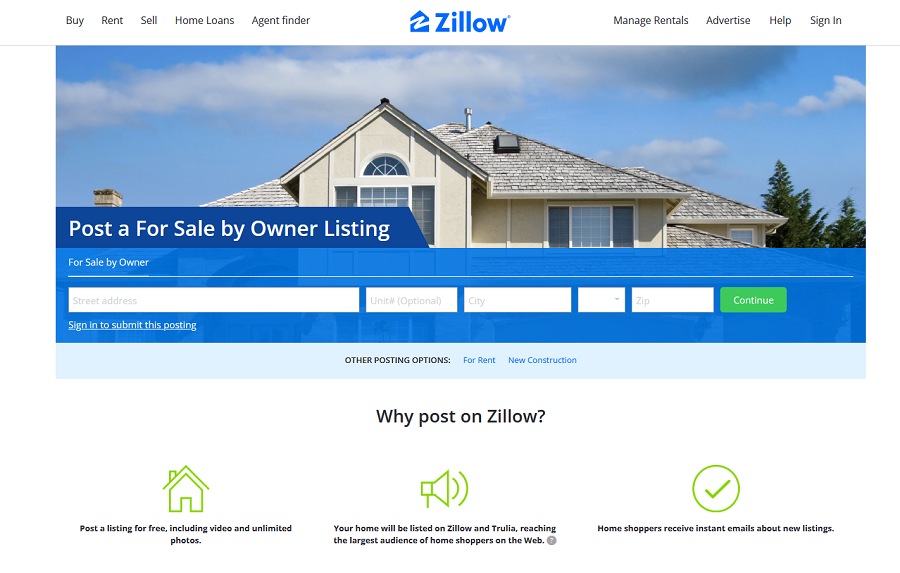

- Advertise on free platforms like Craigslist and Zillow.

- Distribute property flyers in the neighborhood.

- Email property details to investors you met at networking events.

- Reach out to other real estate professionals in your network, such as lawyers, agents, and contractors.

Once you find an interested buyer, negotiate the deal and assign the contract. Use the contractor’s estimate to your advantage and stress the urgency. The buyer should provide a good faith deposit, payable to you or the title company in escrow. Ensure your costs, including appraiser and contractor fees, title, and marketing expenses, are covered. Make sure the profit justifies your time and expenses. Discuss the after-repair value (ARV) to encourage the buyer to proceed with the transaction.

Post your wholesale property on Zillow for free. (Source: Zillow)

As a real estate wholesaler, your goal is to assign the contract. So, take advantage of free sites like Zillow to attract prospective buyers or assignees. Make sure the homeowner is on board with your posting and upload photos and property details. You can leave out the address to stay discreet. Create a listing for free on Zillow today.

5. Schedule & Close the Deal

Your contract must specify a closing date based on your projected timeline. The closing, or settlement, occurs at the title company’s or real estate lawyer’s office. Deed transfer concludes the wholesale deal. Buyers typically cover closing costs unless the seller agrees to provide this concession.

At the closing, you’ll collect your contract assignment and facilitation fee (or your net proceeds if you went the double closing route). Use your profits to invest in another real estate wholesale project or pay yourself. Be sure to talk with a real estate accountant to ensure you’re putting money aside for income and capital gains taxes, as necessary.

Where to Find Wholesale Properties

Real estate wholesalers can employ various strategies to find properties to wholesale. Each has advantages and may be more or less effective depending on your specific market. Combining these approaches can enhance your chances of finding suitable properties to wholesale.

Here are some methods to consider:

Real Estate Wholesaling Business Tips

Starting a real estate wholesaling business requires careful planning and execution. Remember that real estate wholesaling, like any business, involves risks. It’s important to approach it with professionalism, ethics, and a focus on long-term success. Don’t be discouraged by initial challenges. Success in wholesaling often comes with experience and perseverance.

Here are additional tips to help you get started:

-

- Invest in learning about real estate laws, regulations, and wholesaling strategies. Consider taking online real estate investing courses or attending workshops to build your knowledge.

- Understanding your market will help you source and evaluate properties effectively.

- Develop a comprehensive real estate investment business plan outlining your goals, strategies, marketing plans, and financial projections.

- Define your target markets, such as focusing on specific neighborhoods or property types.

- Ensure you understand and comply with local real estate laws and regulations. Consult with legal and tax professionals if needed.

- Implement marketing strategies to generate or buy real estate leads.

- Keep accurate financial records and manage your finances wisely. Recordkeeping includes your marketing, legal, and operational expenses.

- Conduct thorough due diligence on properties, including inspections and property evaluations. Ensure you’re aware of any potential issues before committing to a deal.

- Keep up with industry trends and market changes. Staying informed can help you make informed decisions.

- Consider finding a mentor or coach in the real estate industry who can provide guidance and share their experiences.

How Much Do Real Estate Wholesalers Make?

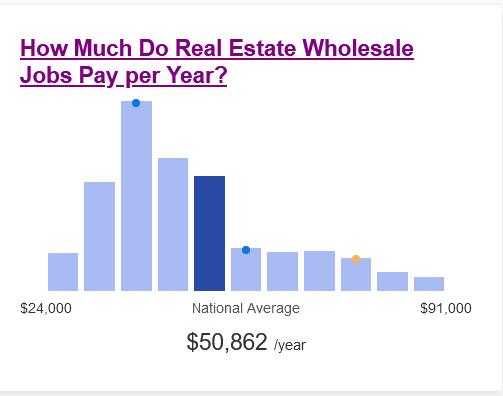

The average real estate wholesaler salary in the U.S. is about $50,862 per year. Average salaries can range from $24,000 per year to $91,000. These ranges depend on location, how many transactions are completed, the real estate market and available inventory, and the wholesaler’s fees.

Real estate wholesalers’ average annual salary (Source: ZipRecruiter)

Frequently Asked Questions (FAQs)

The amount of a wholesaler’s fee can vary widely depending on several factors, including the specific deal, the market, and the property’s perceived value. According to different sources across the web, wholesalers’ fees typically range from 10% to 15% per deal. However, it’s important to note that some deals may yield lower fees, while others could result in higher fees, especially for properties with greater profit potential. Due diligence and knowing how to calculate your expenses will help you determine what to charge.

Wholesaling real estate can be challenging. It requires finding motivated sellers and investors or buyers, understanding market conditions, and managing contracts effectively. Success depends on your ability to negotiate favorable deals and build a reputation as a reliable wholesaler. While it offers low financial entry barriers, it demands commitment, education, and perseverance to overcome challenges and become profitable.

Wholesaling can be a good strategy for beginners in real estate investing due to its low capital requirements. It allows entry without property ownership. However, it requires an understanding of legal and contractual complexities. Beginners should seek legal advice, build a network, and ensure compliance with state laws. It offers accessibility but requires proper education and diligence.

Bottom Line

Real estate wholesaling is a short-term investment method distinct from property flipping. It’s cost-effective for those with limited funds but can involve legal complexities and intricate contracts. While accessible for beginners, when learning how to do wholesale real estate, legal considerations should not be overlooked. Consult a real estate attorney to understand laws and craft or review contracts. Build a relationship with a tax expert to ensure profitability and compliance, avoiding costly errors and potential legal issues.