Worldpay (formerly known as Vantiv) is a global merchant service that supports over 300 payment types in about 145 countries. Acquired by Fidelity Information Services (FIS) in 2019, it is one of the largest in the world, integrating with hundreds of third-party applications for payment processing of all types.

In our review of best merchant services for small businesses, Worldpay earned an overall score of 3.33 out of 5. Its lack of pricing and terms transparency makes it generally difficult to recommend to small merchants although its wide range of payment processing tools can be ideal for growing businesses with experience in negotiating for a merchant account.

Why We Don’t Recommend Worldpay From FIS

Worldpay is a major player in the merchant services industry, but it’s difficult to give it a strong recommendation because of its history of hidden fees and, more recently, for its non-transparent terms and pricing.

In the past (2018), Worldpay faced and settled two class-action lawsuits for hidden fees, which according to an article on CardFellow, were embedded in the interchange rates. When FIS acquired the company in 2019, it said it would look into its practices. Nonetheless, Worldpay continues to receive negative reviews, mostly around its billing and fees.

Also, as of this writing, fees and contract terms for US merchants are not disclosed on its website, which does not help in building confidence in Worldpay’s transparency and billing practices.

However, Worldpay is, indeed, one of the largest merchant services in the world, with over a trillion dollars in transactions annually, so it does have satisfied customers. We believe larger companies and those with experience in negotiating contracts and knowing what to look for in their payment processing bill would fare better with this type of company.

Instead, small businesses should consider one of our recommended merchant account providers.

Not sure what to look for? Check out our article on what a merchant service should do for you.

While fees are publicly available for its European merchants, there is so little certainty with Worldpay’s pricing for its North American clients. This lack of transparency makes it difficult to provide higher marks in our evaluation.

Payment Processing

Worldpay’s website differs depending on the country. The UK website offers three small business paid plans for businesses processing up to £300k per year, plus payment processing rates that start at 2.75% for online and 1.5% for in-person transactions. Additional monthly fees are also possible for merchants accessing more payment tools such as the payment gateway, that cost £19–£45 per month.

Meanwhile, the US site provides no information but invites you to call for a custom quote. A third-party website reports a number of Worldpay rate increases for contactless payments and incidental fees in October of last year and for April of this year.

You’ll also likely need to pay extra monthly fees to access your cloud dashboard and virtual terminal, which are all on top of a standard monthly fee that Worldpay charges every account.

Hardware

Worldpay offers its own line of POS hardware called the Smartpay Series. Each terminal is designed to accommodate unique business needs such as mobility for large stores and tableside payments and a variety of hardware accessories and software applications for countertops.

|  |  |

|

|

|

In addition, Worldpay’s Smartpay Series can include accessories. The included software has bundled packages of apps for everything from sales to scheduling, inventory tracking, and even payroll. Naturally, all the devices accept swipe, chip, or tap payments. Prices are not listed on the website or brochures.

Worldpay also offers several countertop and mobile card terminals by Ingenico, Trinity, and SwipeSimple. It also integrates with many POS systems, so you can choose your own hardware if desired.

Large merchant service providers like Worldpay often offer equipment rentals, which will likely involve long-term contracts. However, I recommend partnering with a merchant service provider that lets you purchase equipment outright (so it can be reprogrammed later if needed) or through an interest-free payment plan.

Contract & Terms of Service

Again, Worldpay’s contract and terms for North American merchants are not publicly available. There’s a Pay-as-you-go plan on the UK website, so it’s likely to be offered to US merchants as well.

In general, the rates you find on a Worldpay contract will always depend on the information you provided on your business profile such as estimated sales volume, average ticket size, and even the method by which you accept payments.

And like other merchant services providers, expect Worldpay to make changes to your agreed transaction rates if your sales do not fall within these specifications. If your sales volume figures change dramatically throughout the year for any reason, consider an alternative merchant service provider that offers automatic volume-based pricing like Helcim, so you don’t always have to keep negotiating your rates and disrupting your business operations.

Setup & Application

US merchants interested in a Worldpay account can go on the website to build an instant quote. After that, account representatives will reach out to you to customize your rates further and guide you through the application process.

Note that traditional merchant services providers like Worldpay have a stringent merchant application process in place, so expect that you will be asked for business documentation and other financials. You may be asked for additional information depending on your business model.

First time applying for a merchant account? Check out our step-by-step merchant account application guide.

Once you’re approved, you will receive login details for your merchant account and other platforms you signed up for. Any POS hardware included in your contract will be sent out to you and should arrive in a few days. Worldpay’s website contains a detailed guide to help you set up your dashboard, but you will need to call customer support to activate your POS device.

Like other direct processors, Worldpay supports all types of payment methods, but the question is which ones are available directly to small businesses and if there are any additional costs involved. Worldpay charges extra for using its payment gateway, although there is no specific pricing available. You will need to build a quote and speak to a representative to get custom rates.

Worldpay supports almost all payment methods, including most card payment types, technologies, and card brands. It works with SwipeSimple for mobile payment processing and can integrate with most digital and mobile wallets.

In addition, Worldpay has the SoftPOS app (merchant-facing, similar to SwipeSimple) and the GoCart app (customer-facing) for mobile payments, which allows merchants to accept credit card payments without the need for a mobile credit card reader. Note that these apps will likely cost you additional monthly fees.

Worldpay offers its Biller-Solutions software for businesses that requires invoicing and recurring billing functionality. This digital bill presentment feature allows merchants to create, schedule, send, and track eBills. It also comes with a link to a hosted webpage that provides customers with full detail of their current bill, which can then be paid by clicking on the payment button.

Merchants can choose to send either a one-time or a recurring payment portal. Customers can then opt to pay with their preferred credit/debit card, bank, or digital wallet such as ApplePay. They also have the option to enroll in an auto debit function for recurring payments.

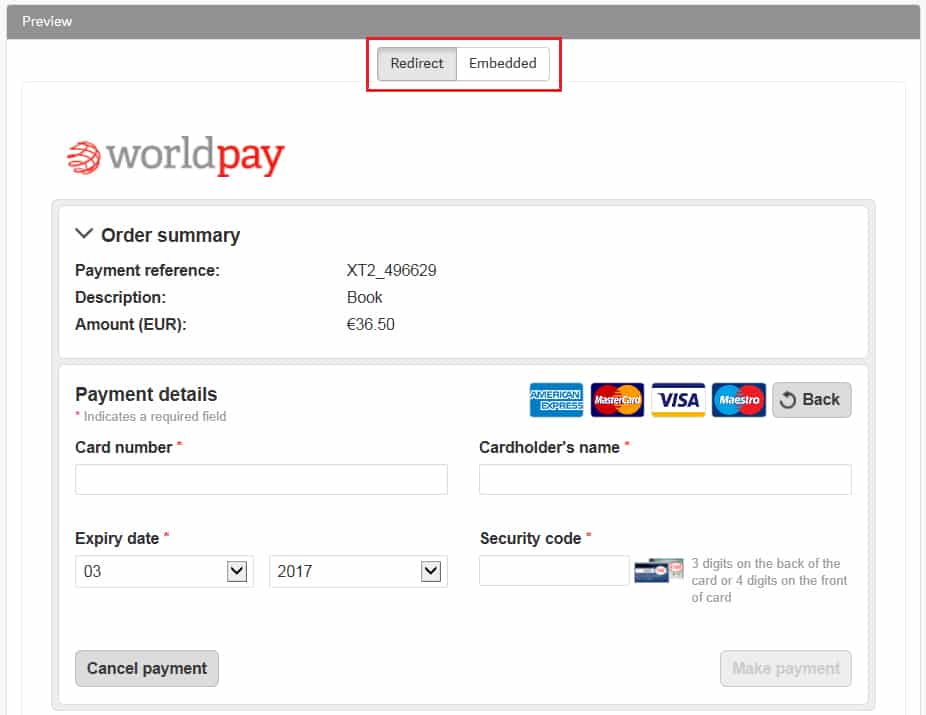

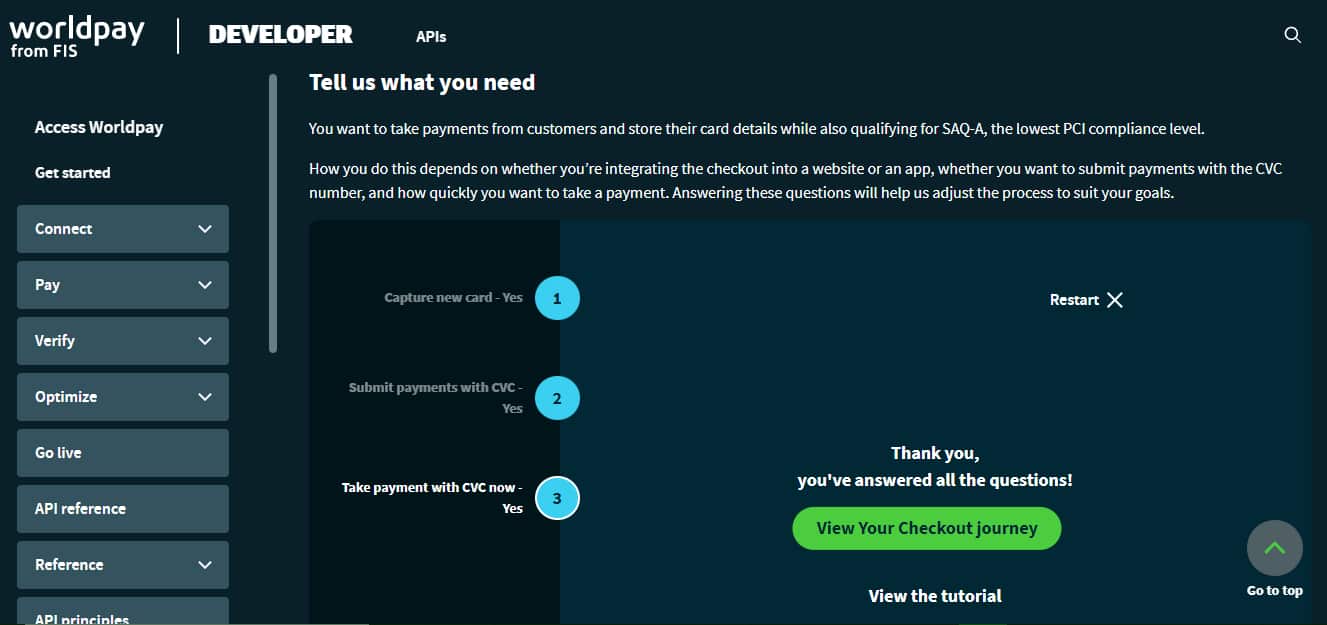

Use Authorize.net or Worldpay’s payment gateway with Pay360 by Capita to process online transactions. This feature allows you to create payment links and checkout pages that you can easily add to your website in minutes. Also, Worldpay’s payment gateway allows you to accept international payments in over 120 currencies, which is why most of Worldpay’s merchant account holders are large, international B2B businesses.

Not all payment processors can work with PayPal, but Worldpay does. Worldpay can arrange for the setup of your PayPal account and integrate it into Worldpay’s gateway. And while your fees will reflect PayPal’s rates, Worldpay will help you with the reporting and settlement of your PayPal transactions.

Create a checkout page and accept over 120 currencies with Worldpay’s payment gateway. (Source: Worldpay)

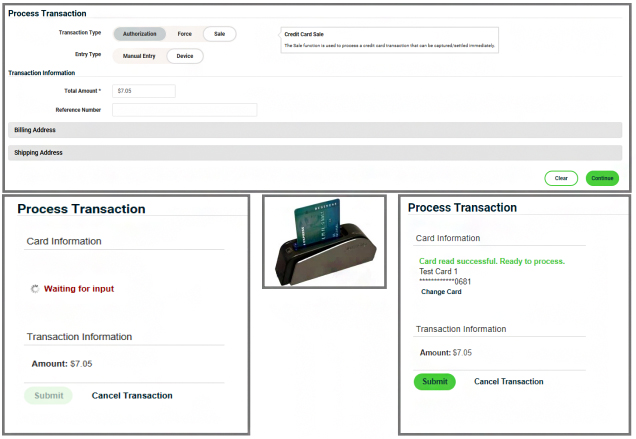

OmniFlex is Worldpay’s proprietary virtual terminal, allowing merchants to process card-not-present transactions on their customer’s behalf. It offers similar features as Authorize.net, with additional tools for accepting cash payments, echeck processing, gift cards, and level 2 and 3 payments. The difference is that OmniFlex is a merchant-facing platform already built into Worldpay’s payment ecosystem, so it does not require any integration.

The virtual terminal is clean and straightforward (Source: Worldpay)

As a large company, Worldpay’s features are impressive. It provides same-day funding, a range of payment processing software for different business models, plus a whole suite of point-of-sale, ecommerce, and business integrations. However, as there is no specific pricing available, expect that most of these functions will likely carry additional fees.

As a direct processor, Worldpay provides you with a dedicated merchant account rather than working with a third party. Working with a direct processor allows you access to more payment processing features at a lower cost—sometimes even at no extra cost.

Some of the advantages of working with a direct processor are:

- Enterprise-level security for your small business

- Being able to accept multiple currencies

- Faster turnaround time for your deposits to reach your bank

- Access to a large list of partner integrations

There are only a handful of direct processors in the market, and Worldpay is as good as any. However, you might find alternatives like Chase Payment Solutions more open with their pricing and fees.

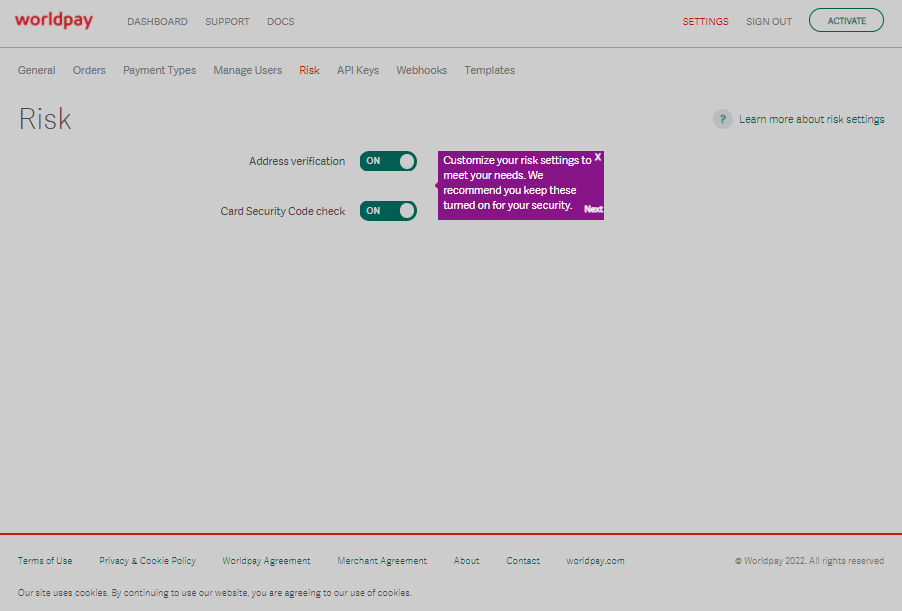

Worldpay has programs to monitor transactions for fraud, keep customer data secure, maintain Payment Card Industry (PCI) compliance, and prevent chargebacks. It mainly offers point-to-point encryption of data and indemnification of up to $100,000 of costs associated with a data breach but also has other fraud prevention tools available; some are required for businesses that Worldpay may consider at a higher risk of fraudulent transactions than others.

Other Worldpay security services are:

- OmniShield Assure: Provides merchants with multilevel payment security features such as PCI compliance assistance, security breach assistance, EMV support services, and encryption services.

- eProtect: Provides security for card-not-present transactions from the moment of capture of payment details, processing, and approval of payments.

Set the level of acceptable risk for your online payments from your Worldpay ecommerce dashboard (Source: Worldpay)

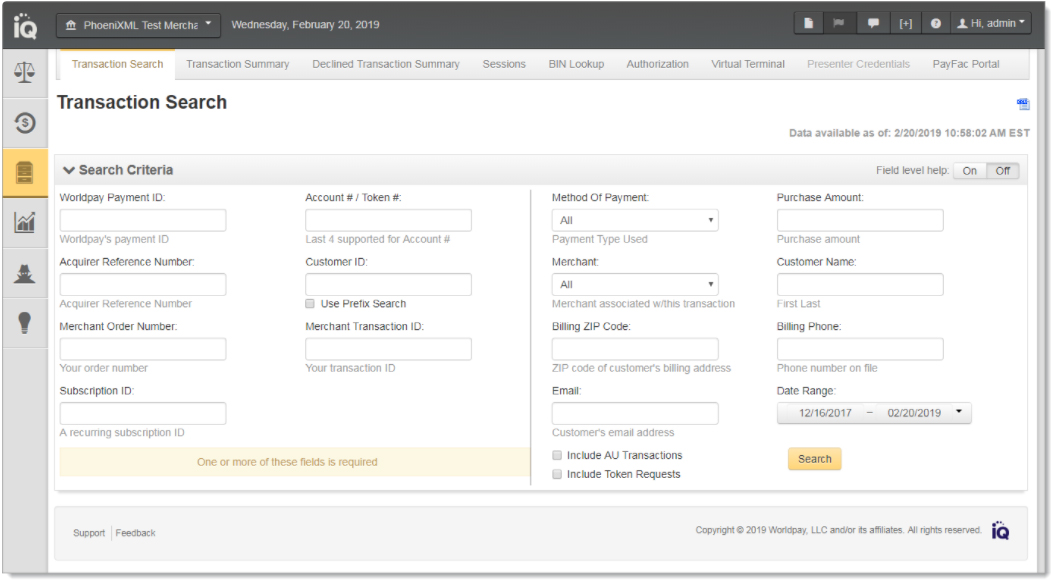

Worldpay iQ is a desktop and mobile application that lets you see your payment transactions, view trends, reconcile statements, and view payment history for up to 18 months. Worldpay also offers analytics through BizShields and Insights powered by Womply, which can help you compare performance and get insights for customer retention.

Worldpay iQ lets you search your transaction history for specific transactions using unique payment IDs or search parameters to generate a set of transactions (Source: Worldpay)

Worldpay Working Capital can provide funding based on your business potential in terms of an advance on anticipated profits. You pay a fixed charge based on a percentage of the advance you receive, and payment is taken each month as a percentage of your card transactions so that in busy times, you pay off more, and in slower months, your obligation is less.

Worldpay ISOs can use this program to pay their customers in as fast as 30 minutes. Worldpay targets this program to the gaming industry, where game operators and players get funds sent directly to paycards.

Worldpay integrates with nearly 250 third-party applications and has direct partnerships with over a dozen. It also provides well-documented APIs for developers wanting to customize the look and feel of their checkouts.

Below are some examples:

- Accounting: KashFlow, Xero, QuickBooks

- Booking/Ticketing: EventSmart, SimpleTix, Ticketing.events

- CRM: Asperto, LimeLight CRM, SAP Anywhere

- ERP: Swan Retail, CardIntegra, AgilPay

- Invoicing: Orders2Cash, Spindle Invoice Payments, HealthAsyst, AcceptEasy

- POS Software: Oracle, Revel, Lightspeed

- Shopping Carts: BigCommerce, Wix, X-Cart

- Subscription Management: Piano, Zoho, Recurly

- Taxation: Avalara Avatax, RBOS Retail

You can customize Worldpay’s API tutorials based on the type of transaction and processes you want to include during checkout (Source: Worldpay)

Worldpay customer support is available 24/7/365, with a choice of phone numbers for different departments. In addition, you can find support guides and FAQs on its support page. It also offers informational and how-to videos on its YouTube channel, Worldpay TV. These videos are simple, direct, and numerous. They cover everything from how to install a terminal to how to take payments over the phone or generate reports.

Worldpay did not do as well as other direct processors like Chase that we have also evaluated. And while it came as no surprise, it would be remiss on my part not to mention why there are merchants that do like this provider.

For one, Worldpay is easy to use. Once integrated into your systems, it works just like any payment provider for processing chip, swipe, or tap payments, as well as online payments and ACH. And because of its wide reach, Worldpay can provide valuable insights, offering real-time data not only on a merchant’s orders and conversions, but also on industry trends and benchmarks. Creating reports also takes only a couple of clicks.

On the other hand, applying for a merchant account with Worldpay is not as easy. While client merchants do get 24/7 customer support, sales representatives and tech support during onboarding are only available during extended office hours. It offers a long list of payment software, but there is no certainty as to how much any of its services would cost until you request a quote.

Overall, Worldpay would be difficult to recommend for new, small, and first-time merchants even without the threat of hidden fees. Midsize to fast-growing businesses also have an array of alternative merchant service providers to choose from that offer comparable payment technology and a high level of security with competitive and transparent pricing.

What Users Say in Worldpay Reviews

In our previous update (February 2022), there were no particular complaints against Worldpay in the Better Business Bureau. But as of this writing there are now 189 complaints against Worldpay, of which 48 have been resolved, and nearly all had to do with billing and overcharges.

Other user review sites offer mixed feedback. Customers praise Worldpay’s ease of use and call out the reporting and analytics (Worldpay iQ). However, those who complain almost always cite its expense or problems with their bills. Customer service got good marks for setup but horrible ones when it came to resolving billing issues.

A common theme was, “they said they’d resolved the problem, but the next month, I was billed again.” Some review sites have an abundance of generic, one-line “good service” reviews that are sometimes a sign of spam.

- Capterra: ↓3.6 out of 5 stars with around 20 reviews

- Trustpilot: ↑4.3 out of 5 stars with more than 4,000 reviews

- G2: ↓3.3 out of 5 stars with over 30 reviews

Other recent trends that we noticed:

| Users Like | Users Don’t Like |

|---|---|

| Reporting and analytics | Customer support is difficult to reach |

| Great integrations | High level of system outages/downtime |

| Helpful customer service | Overbilling and hidden fees |

Methodology—How We Evaluated Worldpay from FIS

We test each merchant account service provider ourselves to ensure an extensive review of the products. We compare pricing methods, identifying providers that offer zero monthly fees, pay-as-you-go terms, and low transaction rates. We then further evaluate according to a range of payment processing features, scalability, and ease of use.

The result is our list of the best overall merchant services. However, we adjust the criteria when looking at specific use cases, such as for different business types and merchant categories. This is why every merchant services provider has multiple scores across our site, depending on the use case you are looking for.

Click through the tabs below for our overall merchant services evaluation criteria:

25% of Overall Score

We awarded points to merchant account providers that don’t require contracts and offer month-to-month or pay-as-you-go billing. Additionally, we prioritized providers that don’t charge hefty monthly fees, cancellation fees, or chargeback fees and only included providers that offer competitive and predictable flat-rate or interchange-plus pricing. We also awarded points to processors that offer volume discounts and extra points if those discounts are transparent or automated.

30% of Overall Score

The best merchant accounts can accept various payment types, including POS and card-present transactions, mobile payments, contactless payments, ecommerce transactions, and ACH and echeck payments—and offer free virtual terminal and invoicing solutions for phone orders, recurring billing, and card-on-file payments.

25% of Overall Score

We prioritized merchant accounts with free 24/7 phone and email support. Small businesses also need fast deposits, so payment processors offering free same- or next-day funding earned bonus points. Finally, we considered whether each system has affordable and flexible hardware options and offers any business management tools, like dispute and chargeback management, reporting, or customer management.

20% of Overall Score

We judged each system based on its overall pricing and advertising transparency, ease of use―including account stability―popularity, and reputation among business owners and sites, such as the Better Business Bureau (BBB). Finally, we considered how well each system works with other popular small business software, such as accounting, POS, and ecommerce solutions.

Worldpay Review Frequently Asked Questions (FAQs)

Worldpay has over 180 user complaints on The Better Business Bureau website in the past 12 months, and nearly all are around issues related to products and services, overcharges, and hidden fees. This makes it far from a reliable option for small businesses, particularly those who have no experience in working with merchant services providers.

There is no publicly disclosed Worldpay pricing for merchants from North America, so those who are interested will have to contact Worldpay for a custom quote. But to give you an idea, Worldpay offers its UK merchants a month-to-month plan that starts at £19.95 and transaction rates from 2.75%.

You will need to contact Worldpay and submit a formal written request to cancel your merchant account. It’s also important to:

- Check your contract before canceling your account: There are a number of user complaints citing additional fees that were imposed because the merchant requested to cancel after their contract was automatically renewed

- Get a written confirmation that your account has been closed: We found numerous complaints from Worldpay clients that they continue being charged monthly fees after they requested to close their account.

Bottom Line

Worldpay is among the largest merchant services provider and direct processors in the world, supporting hundreds of payment methods and advanced technologies for almost any business model. However, it’s had a difficult history of customer complaints and accusations of hidden fees, so it’s the best option for small merchants who are just starting out. For merchants who are experienced in dealing with merchant service providers and would like to explore Worldpay pricing and features, contact its account representatives to get a clear explanation of the fees and charges before signing up for an account.