Chase Payment Solutions is ideal for small businesses looking for an affordable direct payment processor that does not charge monthly fees and offers free same-day funding.

Chase Payment Solutions Review (formerly Chase Merchant Services)

This article is part of a larger series on Payments.

Chase Payment Solutions (formerly Chase Merchant Services) stands out as one of the few global financial institutions that offers both banking and merchant service solutions directly to small businesses. This results in affordable rates, seamless transactions, better customer service, and faster access to funds.

Chase has also spent the past year improving its small business merchant services with a healthier mix of card-present and card-not-present payment solutions—all of which earned Chase an overall score of 4.21 out of 5 and best direct processor in our evaluation of best merchant services.

Merchants with existing business checking accounts with Chase will find it easy and seamless to use Chase Payment Solutions for their payment processing needs. Small businesses that do not have Chase bank accounts will also find value in signing up with Chase Payment Solutions, especially if they are after a traditional merchant account.

Chase Merchant Services Overview

When to Use Chase Payment Solutions

With Chase Payment Solutions, small businesses—with or without a Chase business bank deposit account—can apply directly for a merchant account, although those with a Chase deposit account do have the advantage of faster access to funds. Merchants processing retail payments and looking for multiple payment methods, including business-to-business (B2B), and a unified reporting function ideal for multichannel sales will find it worth switching to Chase.

While it did not make our list of top international payments processors, a global banking institution like Chase is also perfect for accepting cross-border payments.

When to Use Chase Payment Solutions Alternatives

Occasional sellers and merchants with commonly low-ticket sales, such as less than $5, may find other payment providers with a lower flat percentage rate or interchange-plus pricing a better alternative. These businesses can refer to our lists of cheapest credit card processing companies or free merchant accounts. High-risk businesses may also have a hard time getting approved for a merchant account with Chase and are better off with a high-risk merchant account provider.

However, large banking institutions like Chase rarely offer payment processing services directly to small merchants. So, for those who already have a Chase deposit account, using Chase to run their business and accept payments should be an easy choice.

Chase Payment Solutions Fee Calculator

Chase Payments Solutions Payments Calculator

Enter your current in-store and/or online sales volumes and average order values for an estimate on the monthly fees you would pay using Chase.

We love that Chase offers zero monthly fees and a very competitive flat rate for payment processing (similar transaction rates with Square). One advantage it has over its competitors for this criteria is that it can offer custom interchange rates for qualified merchants. However, Chase does not offer free or discounted hardware and imposes significant chargeback fees that ultimately affected its score.

In general, Chase Payment Solutions does not charge monthly fees or require long-term contracts, and its fees depend on the type of transaction you are processing. You’ll get customized rates if you have a Chase Business Account, but since it’s also a direct processor, you can access Chase’s merchant services from numerous platforms.

- Monthly fee: $0–$15*

- In-person transaction fee: 2.6% plus 10 cents

- Online transaction fee: 2.9% plus 25 cents

- Keyed-in transaction fee: 3.5% + 10 cents

- Automated clearing house (ACH) processing fee:

- Real time deposits: 1% (capped at $25), non reversible

- Same-day deposits: 1% (capped at $25), reversible

- Standard deposits (1-2 business days): $2.50 for the first 10 transactions, 15 cents for additional, reversible

- Chargeback fee: $25 to $100 per transaction depending on dispute volume

*Note that if you sign up for a Chase Business Checking account to access specific payment processing features, you are required to maintain a minimum balance of $2,000 or a monthly service fee of $15 will be imposed.

Chase has a range of mobile card readers that run from $49.95 to $399. It also offers several credit card processing terminals that work with chip, swipe, or tap payments. However, if you have credit card terminals or POS software, you can also have them reprogrammed to work with Chase Payment Solutions.

Chase Mobile Checkout | Mobile Card Reader w/ POS Setup | Stand-alone POS Terminal |

|---|---|---|

|  |  |

EMV chip, NFC, and magstripe payments, Bluetooth enabled, | EMV chip, NFC, and magstripe payments, Bluetooth enabled, dock for countertop set up | EMV chip, NFC, and magstripe payments, Wi-Fi and 4G-enabled, built-in POS app and thermal printer |

$49.95 | $79-$109 | $499 |

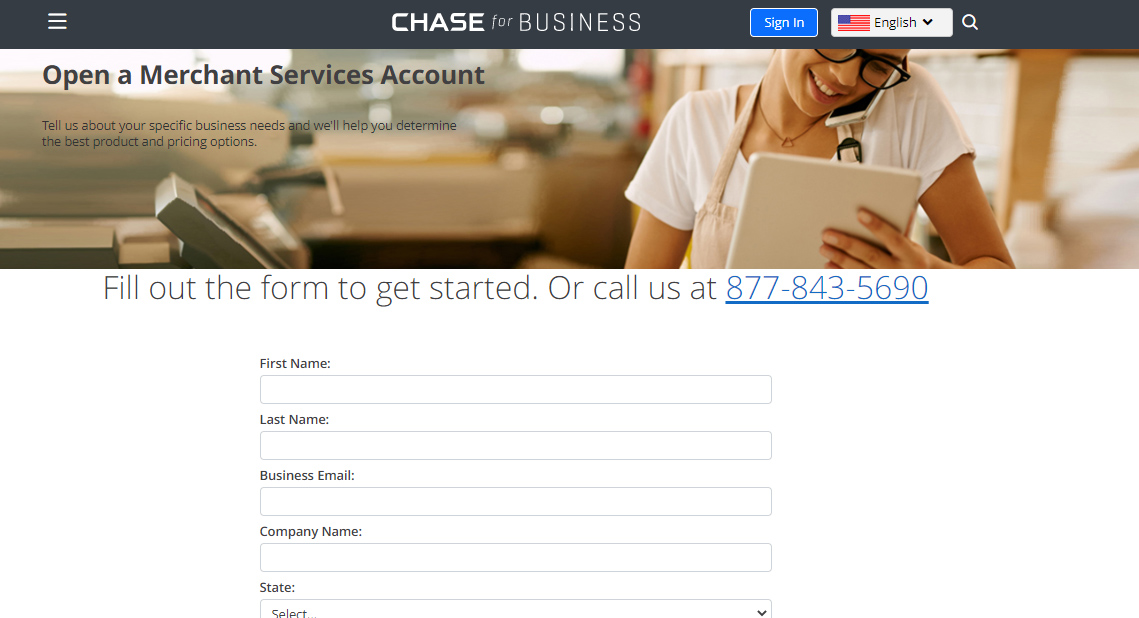

Signing up with Chase Payment Solutions is easy—you can call or fill out the contact form on the website. Someone will discuss your needs with you and get you set up. Equipment can be purchased from Chase or existing hardware can be reprogrammed. You can integrate Chase Payment Solutions into your POS and online store or take advantage of Chase’s partnerships with vendors like BigCommerce and Vend by Lightspeed.

The application process will depend on the type of payment processing you need, as some services require you to sign up for both merchant and checking accounts. For US merchants, it usually takes only a few days to set up accounts and get trained, whereas international merchants may need up to two weeks.

Generally, Chase doesn’t impose long-term merchant agreements, but its website specifies that it offers several different contracts. This should be expected, as all merchant accounts are customized, and the actual contract length and fees will always depend on your unique business needs. For instance, you may get exclusive promotional rates if you subscribe to a Chase partner POS system integration; however, you’ll likely have to sign up long-term to use its hardware.

Most merchants get a pay-as-you-go contract, with no monthly account maintenance, account setup, or early termination fees associated with opening a Chase merchant account. While applications are approved based on estimated volume, Chase Payment Solutions will review the terms of the agreement for businesses whose sales consistently exceed or fall below their original estimated sales volume.

Chase offers a complete suite of payment types for small businesses, from mobile to B2B payment processing. While it did not receive a perfect score because some methods require integrations with possible add-on fees, we recognize Chase’s ability as a direct processor to provide faster access to funds without any extra cost as a major advantage to consider for small businesses.

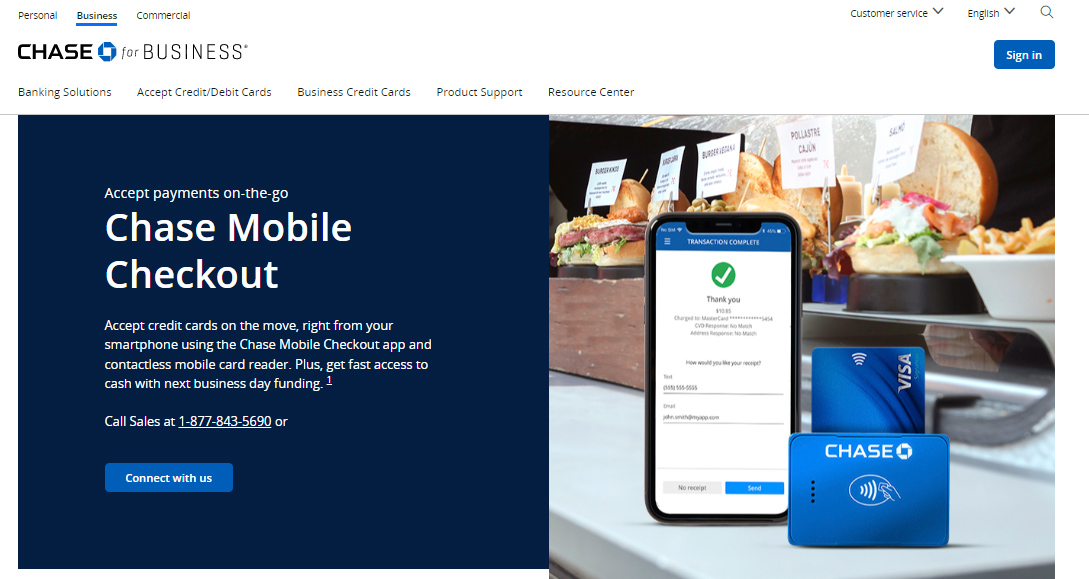

For: Merchants without a Chase Business Account

Chase Payment Solutions comes with a free mobile checkout feature that allows merchants to accept payments on the go with their mobile devices connected to a Chase 3-in-1 mobile card reader ($49.95). The app includes an image-based product catalog and the ability to customize taxes and tips. This payment method works similarly to a mobile POS and is great for service professionals and outdoor market sellers.

Chase Mobile Checkout is ideal for outdoor market sellers, home contractors, tutors, coaches, and other solo professionals. (Source: Chase Payment Solutions)

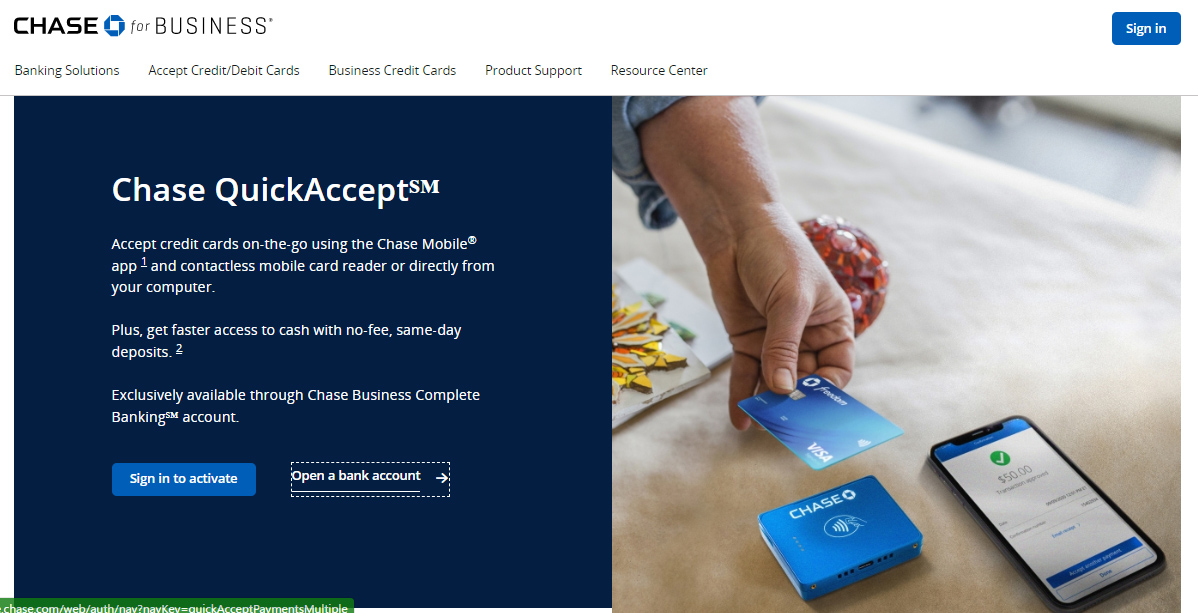

For: Chase Business Complete Banking Account holders only

Chase QuickAccept is the mobile payment service available to merchants with a Chase business deposit account. It also comes with the free Chase mobile app and 3-in-1 credit card reader ($49.95), along with options to accept payment from your computer through the Chase website (note that this method charges the keyed-in transaction rate).

The advantage of QuickAccept over Mobile Checkout is that with a Chase bank account, merchants enjoy free same-day deposits for faster access to funds.

You can apply for a Chase business deposit account directly from the Chase website to qualify for Chase QuickAccept. (Source: Chase Payment Solutions)

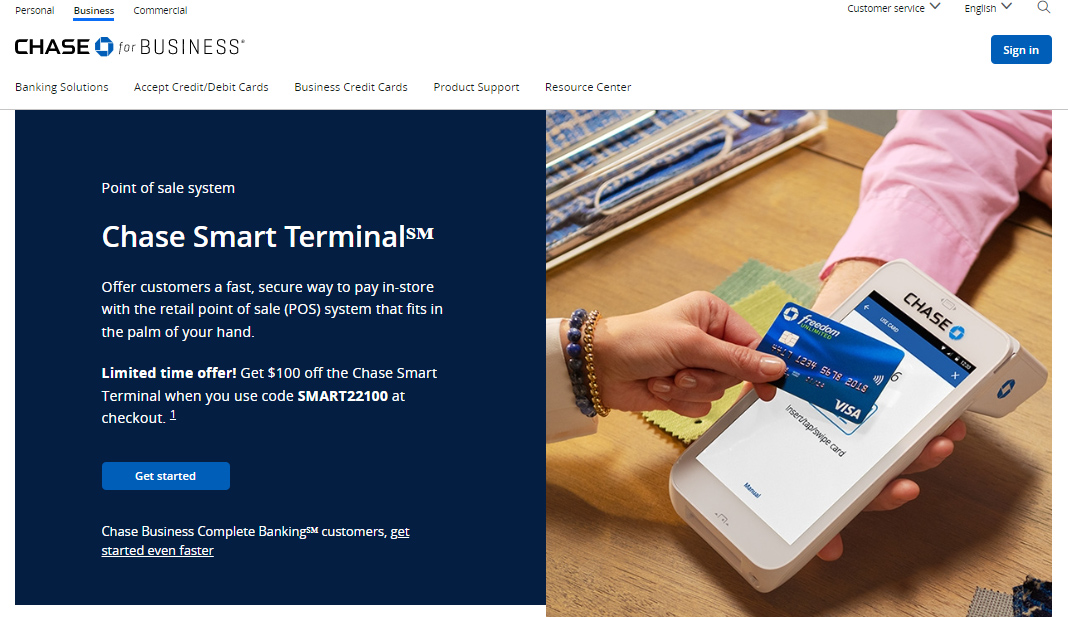

For: Both users and non-users of Chase Business Account

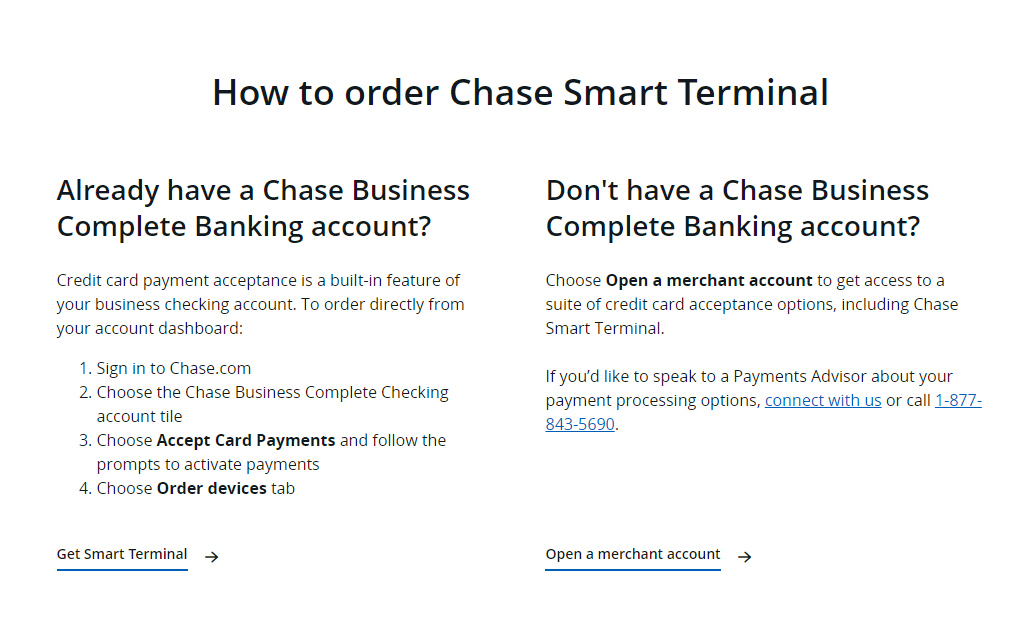

The Chase Smart POS Terminal is an in-person payment service designed to allow merchants to accept payments anywhere in the store, including curbside. It has the same mobile POS software with product catalog management, so the hardware ($399) can be set up as an extension of your countertop POS or an independent POS for smaller establishments. Like QuickAccept, it requires merchants to sign up for a Chase business deposit account.

Chase Smart Terminal ($399) comes with mobile POS software that allows merchants to sell anywhere in-store. (Source: Chase Payment Solutions)

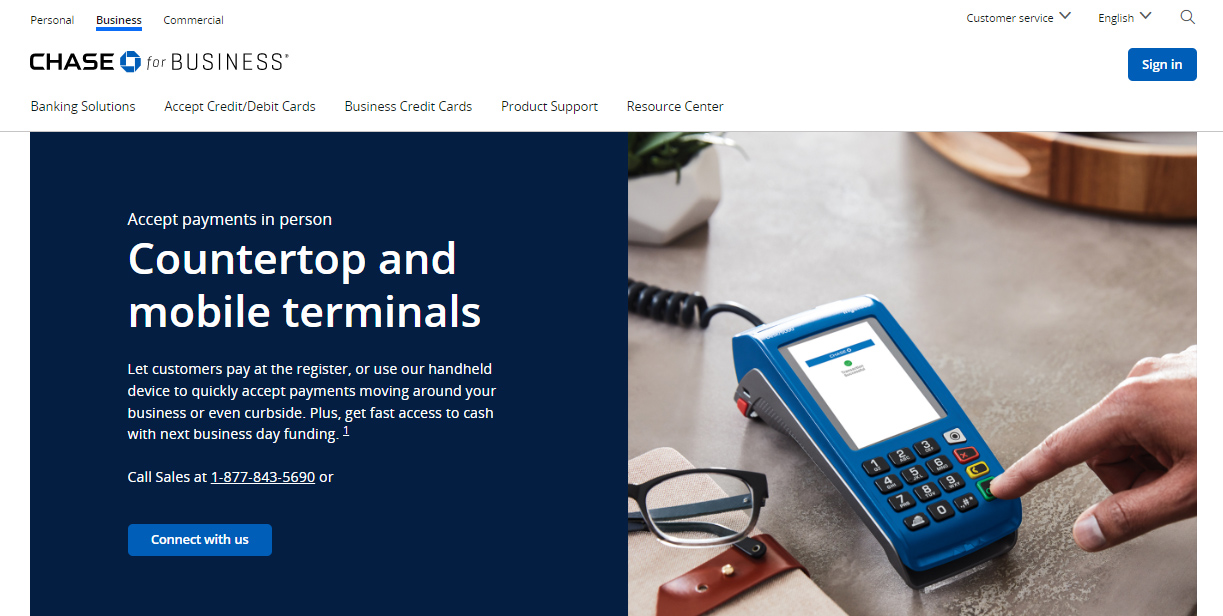

For: Merchants without a Chase Business Account

Chase countertop and mobile terminals are in-store payment methods that do not require merchants to sign up for a Chase business deposit account. The device itself offers color screens and built-in receipt printing and supports on-screen tipping. It also allows users to accept swiped, dipped, and tapped payments within the store, including curbside, but it does not have mobile POS software, unlike the Smart POS terminal.

Chase traditional payment terminals come in countertops or wired ($299) and mobile ($399) options. (Source: Chase Payment Solutions)

For: Both users and non-users of Chase Business Account

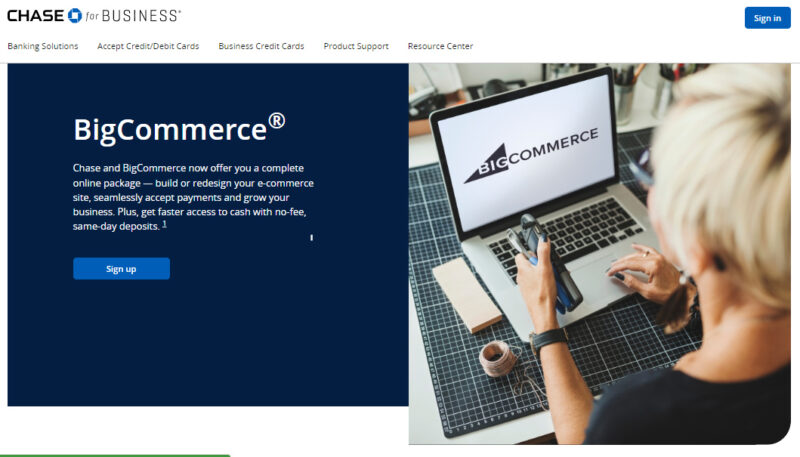

With Chase Payment Solutions, merchants can accept payments online through their ecommerce website or on any device with a browser via a payment gateway. This is made available through direct integrations with BigCommerce (for those with a Chase business deposit account) and Authorize.net.

- BigCommerce: Chase offers direct integration with BigCommerce that allows users to create or redesign their website through BigCommerce’s easy-to-use website builder tools. It also includes features such as inventory management, personalized shopping, fraud security, and more. Note that there is a monthly subscription fee to use this service ($29.95 to $299.95) and requires a Chase business deposit account. Read our BigCommerce review.

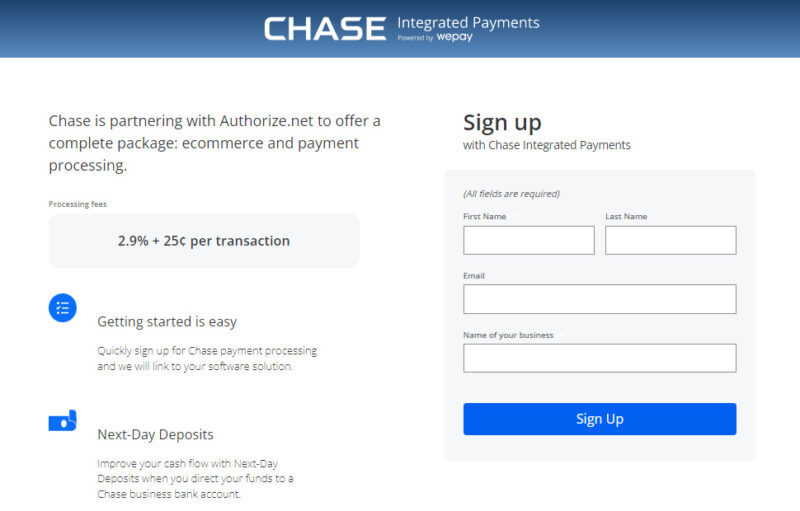

- Authorize.net: Businesses that use Authorize.net with their Chase merchant account get access to features like custom payment buttons, recurring billing service, customer portal, and customer information manager that allows customers to save billing, payment, and shipping information. It also comes with a virtual terminal that lets users accept payments over the phone. Read our Authorize.net review.

For: Both users and non-users of Chase Business Account

Orbital is Chase Payment Solutions’ proprietary virtual terminal that supports a wide range of online payment functions, including B2B payments. It allows merchants to process recurring billing, set custom taxes, cancel orders, issue refunds, view transaction histories, and safely save cards on file. The system is also equipped to accept cross-border payments and has Level 2 and Level 3 credit card processing. It can also provide custom B2B transaction rates for merchants with high-ticket sales.

B2B merchants can sign up for Chase’s Orbital virtual terminal to get custom B2B pricing for high-ticket transactions. (Source: Chase Payment Solutions)

Chase Payment Solutions already stands out for offering free same-day deposits, faster access to funds, and B2B and cross-border payment processing—all backed with advanced fraud detection and payment security you can expect from a well-established name in the banking industry. However, there is still a huge room for improvement in terms of business management tools, which are currently somewhat limited and mostly available only through paid integrations.

When Chase acquired Paymentech, it became a direct processor, meaning it works both as the payment processor and the acquiring bank in transactions. This streamlines the process of getting the money into your accounts, allowing you faster access to your funds without sacrificing security. Additionally, direct processors are naturally a hub for business integrations such as accounting, POS systems, and ecommerce platforms, so you get a variety of options for building your business.

However, having a merchant account with a direct processor doesn’t automatically mean you get the lowest rates. It’s still important that you do your due diligence and look around to find the best match for your business needs. What’s great about a direct payment processor, though, is that you’ll always get the best banking and financial tools, no matter the type of business you have.

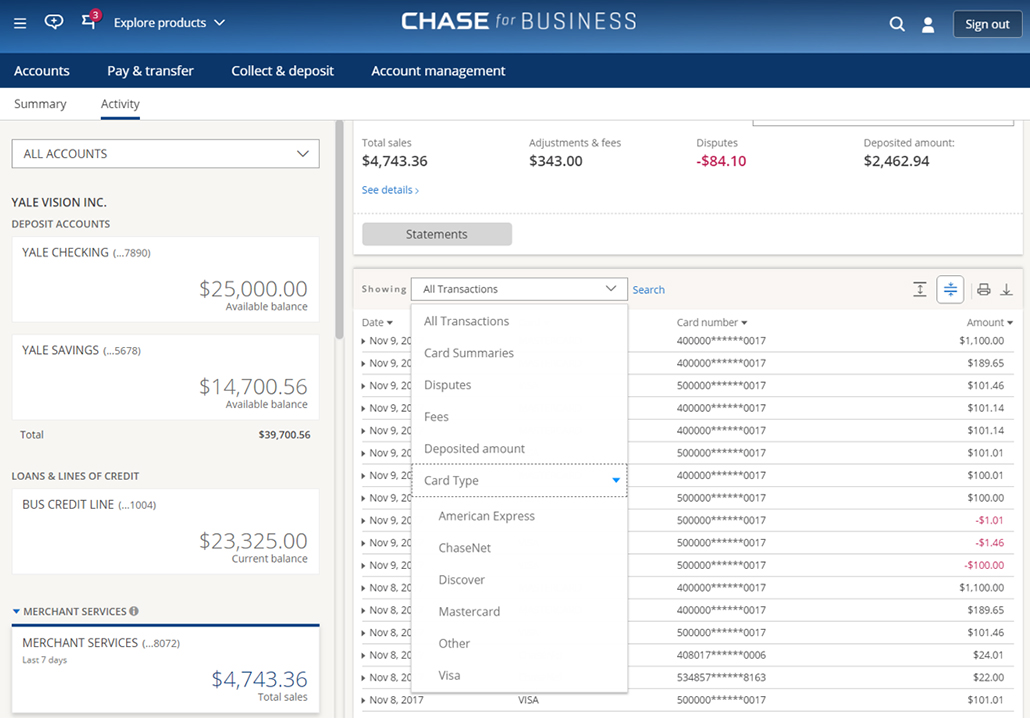

Get an overview of your sales and filter your list according to card type and date range. (Source: Chase Payment Solutions)

Depending on the type of service you use, you can qualify for Chase’s same-day deposits at no extra cost. Local businesses that process payments through Authorize.net and Chase Integrated Payments (powered by WePay) or deposit into a Chase business account are qualified automatically for same-day deposits upon signup.

If you have a Chase business checking account, generally you can get your funds the next business day. There are some conditions, such as having business credit approval.

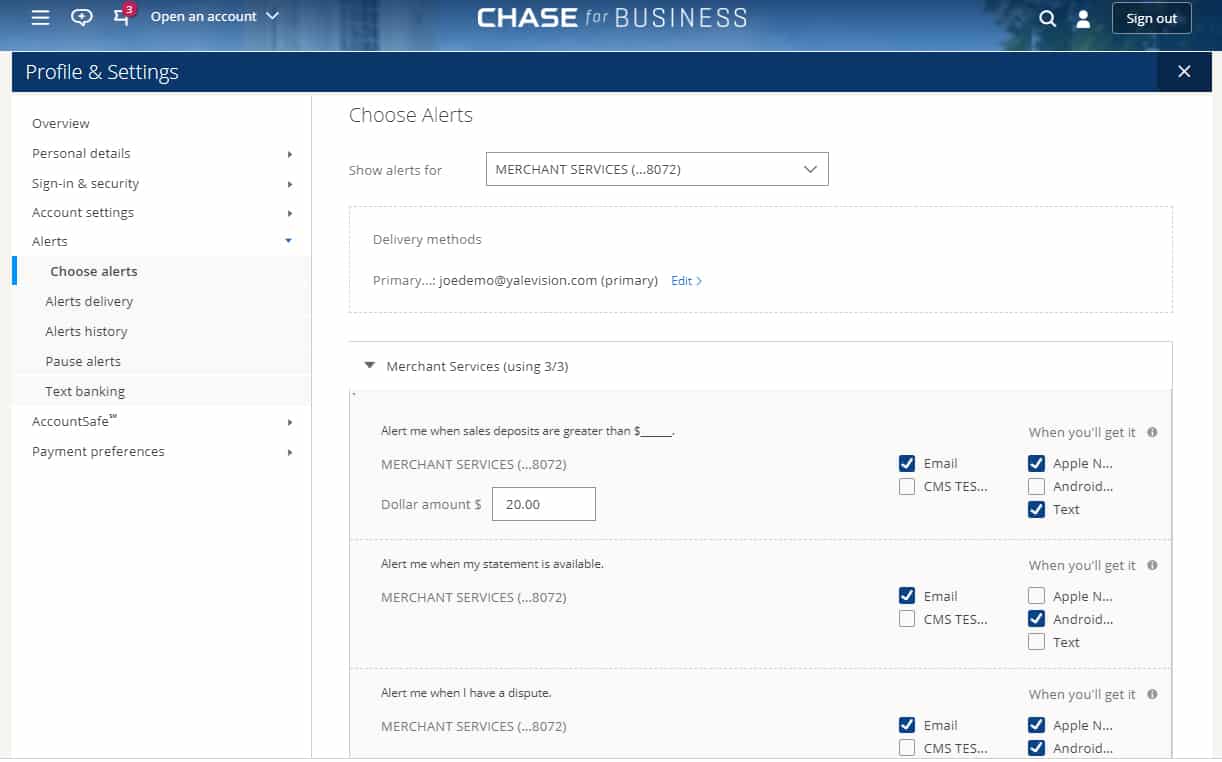

Chase has several fraud protection tools for its business customers. You can set up dispute alerts, and Chase offers instructions on how to deal with chargebacks.

- Fraud protection services: This applies to business checking account holders subscribed to check protection services, check monitoring, and ACH debit block service.

- Check monitoring: This is a complimentary service for all Chase business checking customers.

- Account alerts: The account alerts service is another free service from Chase, and you can get notifications on your phone for any activity on your account. Message and data rates may apply.

- Zero liability protection: Chase will reimburse unauthorized debit card transactions for customers using certain platforms.

Customize alerts for your merchant account by specifying dollar amounts and mode of delivery. (Source: Chase Payment Solutions)

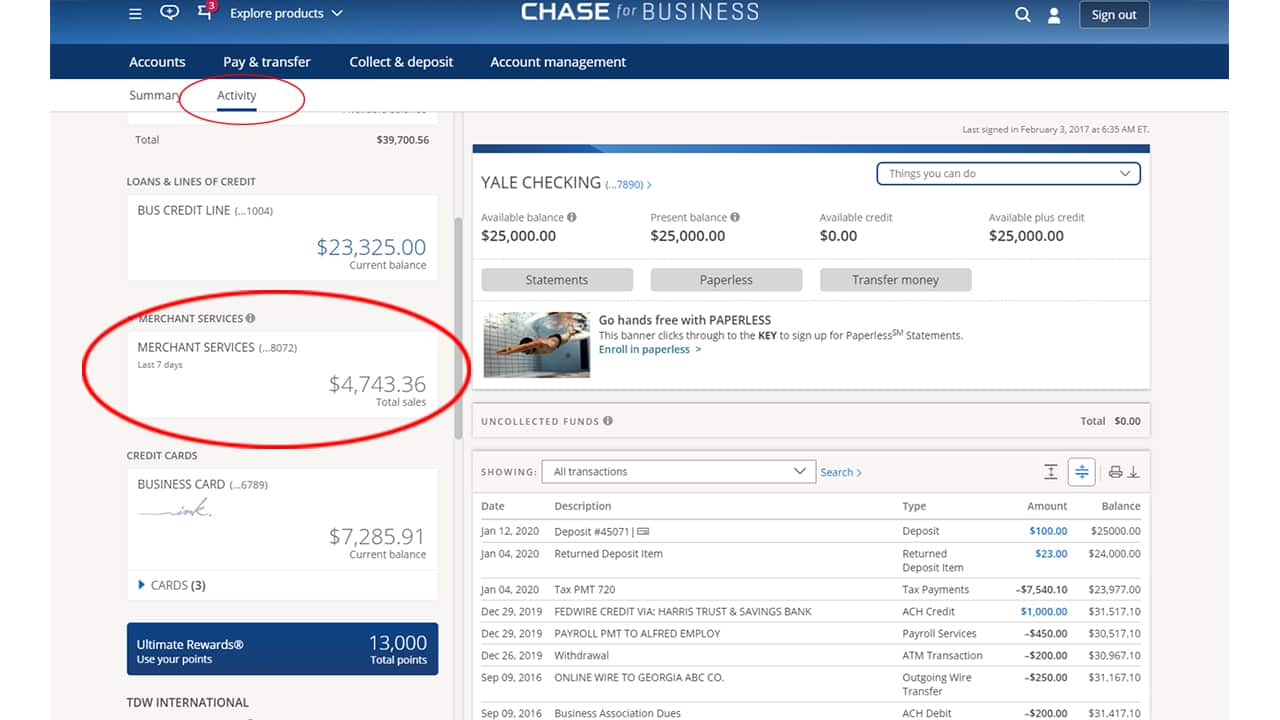

Chase offers a complete suite of business banking, from checking accounts to loans to credit cards. It also offers business services like global wire transfers.

Access all your merchant services transactions and business bank activity from one platform. (Source: Chase Payment Solutions)

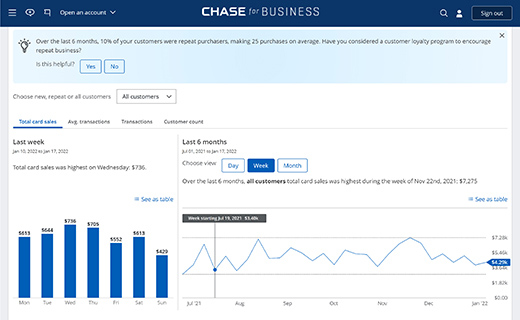

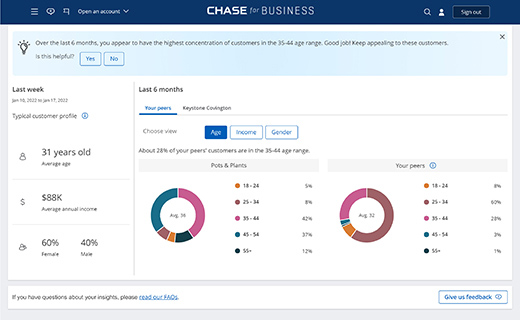

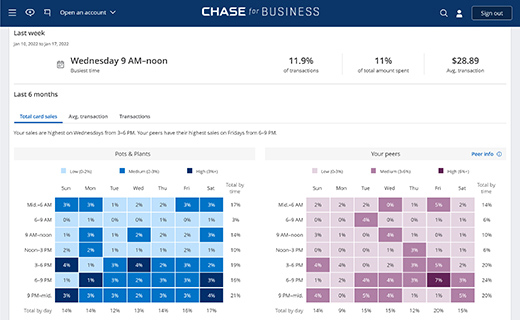

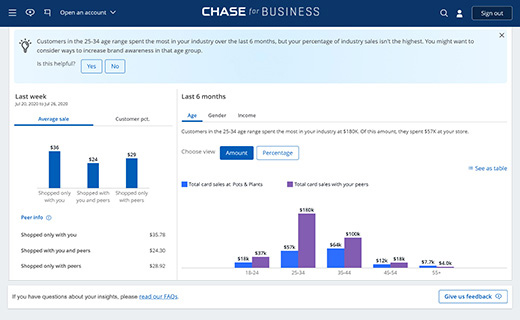

Perhaps one of its biggest highlights for 2022 is the launch of Customer Insights—Chase’s powerful business analytics tool, which provides users with actionable insights from customer data. It includes information—such as detailed sales overviews, shopping and purchasing trends, and in-depth customer profiles—that is compared against competitor data, which merchants can use to make critical business decisions.

Aside from harnessing Chase’s massive merchant-acquiring and card-issuing data to produce game-changing insights, another great thing about this feature is that it’s fairly easy to use and comes free with every Chase Payment Solutions merchant account.

Chase Payment Solutions supports a variety of integrations that cover everything from online payments to business management tools. Note that on top of unique transaction rates attached to each platform, most of these third-party integrations come with additional monthly costs, while some may require long-term contracts.

Some of Chase’s notable integration partners are:

Additional Cost | Tools For | |

|---|---|---|

Orbital (In-house) | Custom rates for B2B and large-ticket discounted rates | Virtual terminal |

Authorize.net | Interchange pricing based on sales volume | Payment gateway |

FreshBooks | Contact FreshBooks for monthly fees | Accounting and invoicing |

BigCommerce | $29.95 to $299.95 per month | Website builder |

Chase Payment Solutions provides you with same-day deposits and next-day funding for certain services. This is one of the advantages of signing up with a direct processor like Chase.

- Live support 24/7 year-round

- Online support center with guides and articles

- Online guides for hardware

- Error message support online

The online resource and support section is a good place to start when getting to know your Chase hardware or software. While there are a few videos and FAQs, most of the articles are tutorials with clear steps and illustrations. There’s also a section devoted exclusively to error codes, making it easy to troubleshoot and solve common problems. If you need further assistance, you can contact its support center anytime, night or day.

It’s easy to look at Chase as a large financial institution and think that it can provide better merchant services than smaller payment processors. But what sets Chase apart is its focus on expanding its small business solutions. It has not only diversified its suite of payment methods but also launched an advanced analytics tool that provides merchants with unique and very specific customer insights using Chase merchant-acquiring and card-issuing data.

In our evaluation, Chase lost points for pricing, specifically for chargeback fees and hardware cost, but it can also do well with a better selection of business integrations. With a promised “robust Chase Payment Solutions roadmap for 2023,” what I’m really looking forward to seeing is Chase’s plans for improving its support for business management tools to round out its small business services.

What Users Say in Chase Payment Solutions Reviews

There are zero new user reviews online since our last update in July 2023. CardFellow still has the same number with an overall 2 out of 5 rating and complaints that include terminated accounts with little warning and bad customer service. To some, this lack of feedback could reflect poorly―the constant rebranding may have affected Chase Payment Solutions’ popularity―while others would take the lack of recent negative reviews as a good sign.

Chase Payment Solutions did not have any reviews on other user review sites, but its virtual terminal, Orbital, has received 3.8 out of 5 from 14 reviews on G2 and 5 out of 5 from 2 reviews on Capterra.

| What Users Liked | What Users Did Not Like |

|---|---|

| Fraud detection | High fees |

| Easy-to-use application | Account termination with little to no warning |

| Easy integrations | Bad customer service |

| Responsive customer service | |

Methodology—How We Evaluated Chase Payment Solutions

We test each merchant account service provider ourselves to ensure an extensive review of the products. We then compare pricing methods and identify providers that offer zero monthly fees, pay-as-you-go terms, and low transaction rates. Finally, we evaluate each according to a range of payment processing features, scalability, and ease of use.

The result is our list of the best overall merchant services. However, we adjust the criteria when looking at specific use cases, such as for different business types and merchant categories. This is why every merchant services provider has multiple scores across our site depending on the use case you are looking for.

Click through the tabs below for our overall merchant services evaluation criteria:

25% of Overall Score

We awarded points to merchant account providers that don’t require contracts and offer month-to-month or pay-as-you-go billing. Additionally, we prioritized providers that don’t charge hefty monthly fees, cancellation fees, or chargeback fees and only included providers that offer competitive and predictable flat-rate or interchange-plus pricing. We also awarded points to processors that offer volume discounts, and extra points if those discounts are transparent or automated.

Chase somewhat struggled in this category. While it offers transparent and competitive pricing, it missed the mark for automated volume discounts, hardware costs, and chargeback fees.

30% of Overall Score

The best merchant accounts can accept various payment types, including POS and card-present transactions, mobile payments, contactless payments, ecommerce transactions, and ACH and echeck payments, and offer free virtual terminal and invoicing solutions for phone orders, recurring billing, and card-on-file payments.

Chase scored well in this section, only missing points for add-on fees

25% of Overall Score

We prioritized merchant accounts with free 24/7 phone and email support. Small businesses also need fast deposits, so payment processors offering free same- or next-day funding earned bonus points. Finally, we considered whether each system has affordable and flexible hardware options and offers any business management tools, like dispute and chargeback management, reporting, or customer management.

Chase Payment Solutions received a respectable score in this criterion, but points were docked for business management integrations.

20% of Overall Score

We judged each system based on its overall pricing and advertising transparency, ease of use (including account stability), popularity, and reputation among business owners and sites like Better Business Bureau. Finally, we considered how well each system works with other popular small business software, like accounting, point-of-sale, and ecommerce solutions.

Again, Chase scored well in this category, with minor points docked for pricing, popularity, and integrations.

Chase Payment Solutions Frequently Asked Questions (FAQs)

Here are the answers to questions commonly asked about Chase Payment Solutions.

No, there are Chase merchant services that do not require you to sign up for a Chase bank account. Small businesses can sign up for Chase Mobile Checkout (for in-person mobile payments), Chase Countertop and Mobile Terminal (for in-store payments), and Authorize.net integration (for online payments).

A Chase Payment Solutions merchant account is free to use and does not require a long-term contract. However, note that some tools such as integrations and credit card readers require a separate fee.

Chase is the best merchant service option for small merchants who already have a Chase deposit account. This cuts a significant amount of the application process plus free same-day deposits and access to funds.

Bottom Line

Chase is a major bank and credit card processor with a merchant account service that integrates with more than 140 applications. With its pivot to make Chase more accessible to small businesses, merchants can enjoy better transaction rates, faster access to funds, and security from a strong banking infrastructure. If you already have a Chase deposit account or are planning to open one for your business, contact Chase for a custom quote.