Purchase order (PO) financing is a form of short-term financing that involves a creditor paying your supplier for goods or services to be delivered to your customers.

Purchase Order Financing: What It Is & How It Works

This article is part of a larger series on Business Financing.

For businesses without the resources to fulfill orders, PO financing can help avoid turning away customers or processing delays if you have insufficient funds or limited stock. Take note that it requires that you sell finished goods to either a business (B2B) or the government (B2G).

The process is simple—the financing company reviews the order, and if approved, then it will issue payment to your supplier to deliver the goods. When the goods are delivered, your client will then make payment to the financing company, at which point it will deduct its fee and issue the remaining balance to your business.

If you’re sure that PO financing is the right choice, consider SMB Compass for your funding needs. You can get up to $10 million in funding in as little as 24 hours.

How Purchase Order Financing Works

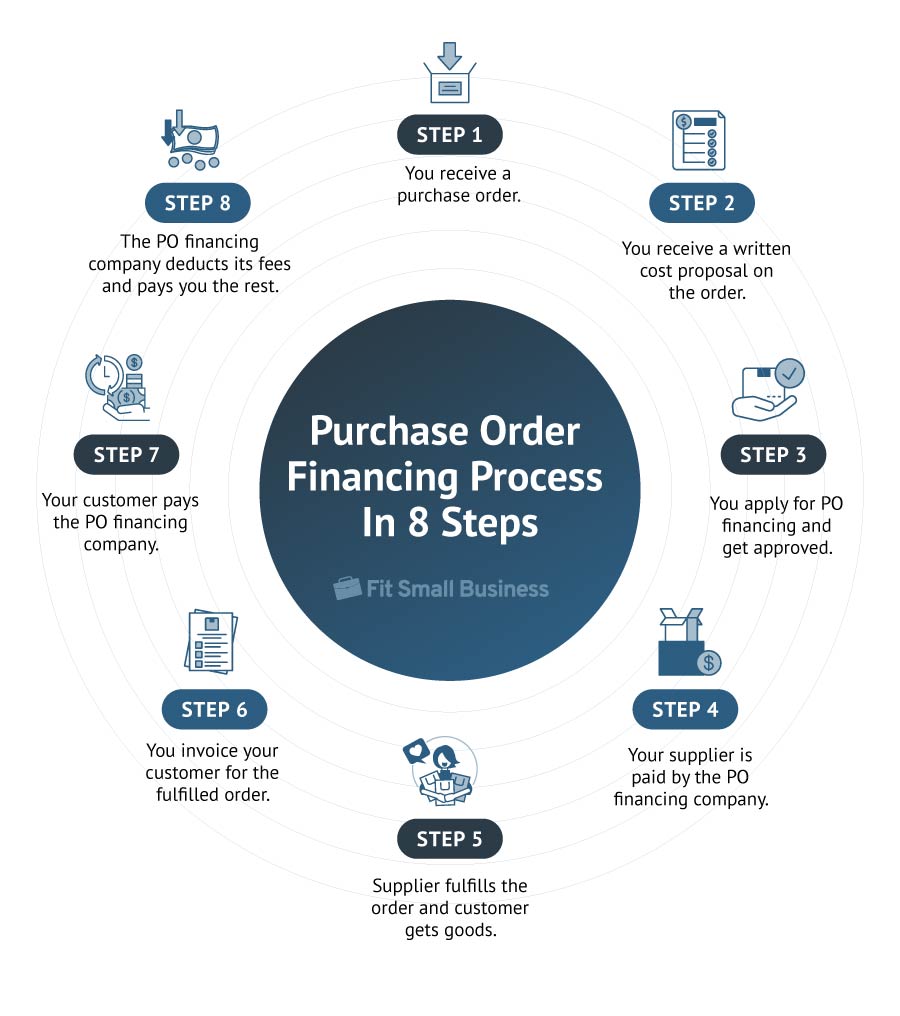

PO financing has many elements that require the involvement of multiple parties—including your business, the supplier, the customer, and the financing company. There are then a series of steps involved with the evaluation of your application, issuance of funds, and collection of payment.

Parties Involved in PO Financing

PO financing involves at least four separate parties, each with its own purpose.

Party Type | Purpose |

|---|---|

Your Business | As the borrower, your business must be the one to apply for PO financing. |

Your Supplier | Your supplier is the company responsible for delivering or providing the goods needed to fulfill an order your business has received from a customer. Suppliers typically require payment before they can fulfill your customer’s order. |

The Customer | Your customer must be a business or government entity to be eligible for PO financing. Your customer will place an order with your business for certain goods that will ultimately be provided by your supplier. |

Your PO Financing Company | This is the company responsible for issuing funds to your supplier. |

The PO Financing Process

Step 1: Your Business Receives a PO

The first step in the PO financing process occurs when your business receives an order from a B2B or B2G customer and you’re potentially unable to fulfill the order due to inventory or cash flow shortages.

Step 2: You Obtain a Cost Estimate From Your Supplier

After you’ve received the order, the next step is to obtain an estimate from your supplier for how much it will cost to fulfill the order. Cost estimates should include expenses for any applicable manufacturing costs, materials, transportation, and delivery fees. From here, you can determine if you need to apply for PO financing.

Step 3: You Apply for PO Financing

Once you’ve received the estimate for what it will cost to fulfill your customer’s order, you’ll need to find a PO financing company and submit a loan application. It will review the details of the order and evaluate the creditworthiness of not only your business but also that of the customer.

Step 4: Your Supplier is Paid by the PO Financing Company

If approved for financing, the PO financing company will then issue funds to the supplier. In most cases, the financing company will cover up to 100% of the order costs. Funding speed is dependent on the PO financing company itself, as well as the details and complexity of the order. In most cases, it can take between 1 and 21-plus days from the time you submit a loan application.

Step 5: Your Supplier Delivers the Goods to Your Customer

Once your supplier has received payment, it will proceed with fulfilling the order. This can include completing the manufacturing or assembly process. Suppliers typically deliver the finished goods directly to your customer—although, in some instances, you can elect to have it delivered to your business instead. Once delivered, the order is considered complete.

Step 6: Your Customer Is Invoiced for the Order

Depending on the PO financing company you choose, it may handle the process of invoicing the customer on your behalf. If not, you will need to complete this step yourself and provide invoices to both the customer and the financing company. Invoices should show the terms of repayment, including the total amount owed and when payment in full must be made.

Step 7: Your Customer Pays the PO Financing Company

For your customer, the final step is to make payment in full to the PO financing company according to the directions on the invoice. Most PO financing companies require full repayment within 30 to 120 days.

Step 8: You Receive Payment From the PO Financing Company

After the PO financing company has received payment from your customer, it will deduct its fees and issue the remaining balance to your business. The loan is then considered paid off and complete. From start to finish, PO financing generally has a quick turnaround time and is a way to bridge the gap between order demand and fulfillment.

Rates, Terms & Qualification Requirements for PO Financing

Typical Rates & Terms | |

Rate & Fees | 1% to 6% per 30 days of financing |

Estimated Annual Percentage Rate (APR) | 20% to 80% |

Loan Amount | $10,000 to $10 million |

Repayment Schedule | Satisfied when customer pays the invoice |

Repayment Term | 30 to 120 days |

Collateral Required? | No |

Minimum Down Payment | 0% to 10% |

Funding Speed | 1 to 21+ days from time of application |

Typical Qualification Requirements | |

Time in Business | 0 to 12 months |

Profit Margin | 20% to 30% |

Qualifying Order Types | Finished, tangible goods |

Eligible Customers | B2B and B2G entities |

Ineligible Customers | Individual customers |

Credit Score | Varies, but you and your customer must both be considered creditworthy |

Rates & Terms

Most PO financing providers charge varying rates based on a 30-day period. As a result, the longer your customer takes to pay the invoice, the more expensive this type of financing will be. Depending on your business needs, loan amounts, and funding timelines can range depending on the PO financing company you choose.

Qualification Requirements

As with rates and terms, there are also some nuances to qualification requirements you should be aware of. For instance, depending on your chosen lender, your order will need to have a high enough profit margin to be eligible for financing.

Other things to be aware of are that:

- Qualifying orders must be for finished goods only

- Your customers must be either a business or government entity

PO financing providers will also evaluate the creditworthiness of your business and of your customer. This is determined by varying criteria, which can include things like a credit score or a history of late payments to other creditors.

Pros & Cons of Purchase Order Financing

| PROS | CONS |

|---|---|

| Has easier qualification requirements compared to traditional loans | Is only eligible for tangible, finished goods |

| Allows your business to accept and fulfill larger orders | Can be more expensive than other types of financing |

| Doesn’t require monthly payments, which can help with business cash flow | Could have a slow funding speed, particularly for international customers |

Who Purchase Order Financing Is Right For

PO financing can be a great option for businesses needing to cover short-term expenses. Here are a few circumstances in which PO financing could be a good fit for your business.

- You have customer orders to fulfill but do not have enough cash to pay the supplier: If you’re unable to pay the costs associated with fulfilling customer orders, PO financing can be a good option. This can occur if you have seasonal products, if you experience a spike in demand, or if you receive a larger-than-typical order. PO financing can help you avoid needing to decline or cancel any such orders so that you can still collect the additional revenue.

- You are currently out of inventory and need to keep up with orders: In the instance you’re currently out of stock of a product and don’t want to turn away customers, you can use PO financing to fulfill the order via the supplier and finance the transaction in the short term before you’re able to restock.

- You have cash flow concerns and do not want to use your own funds: Since PO financing allows you to preserve your own business funds, it can be a good option if you believe you may need to use your business funds for other aspects of your business in the near future. Some examples of this can include saving for an upcoming large repair bill and saving funds to cover unexpected expenses.

- You were turned down for other loans: PO financing typically has easier qualification requirements compared with a traditional loan. You’re more likely to get approved with bad credit because a larger emphasis is placed on the creditworthiness of your customer. PO financing is also available to startups and well-established companies that have experienced credit or financial challenges.

How to Get Purchase Order Financing

There are several steps necessary to get PO financing.

Many lenders offer PO financing, including banks, credit unions, brokers, and online lenders. If you’re unsure where to start, you can begin with our recommendations of the best PO financing companies.

When choosing a lender, here are some things you may want to consider:

- How knowledgeable is the team with PO financing?

- What are the most common industries it works with?

- What other loan products are offered?

- What are the typical rates, fees, and terms offered?

- Does the lender have any flexibility when it comes to qualification requirements?

- How quickly can the lender review, approve, and issue funding?

- Does the lender communicate directly with your customers?

- How and when does the lender issue payment to suppliers?

- Does the lender have consistently high customer reviews and ratings?

PO financing generally doesn’t require much documentation for approval. Commonly requested items include the following:

- PO from your customer

- Cost estimate from your supplier

- Financial documents, such as balance sheets, tax returns, or cash flow statements

If you’re approved for PO financing, you’ll need to review and accept the terms of the agreement. Read this final documentation carefully to ensure it’s what you initially agreed to and to address any questions or concerns. At a minimum, important items to review should include:

- Rates and fees

- Funding amount

- Repayment terms

- Order details (including order type and customer name)

- Requirements for collateral or personal guarantee as a condition of financing

Alternatives to Purchase Order Financing

PO financing can be a useful tool for your business—but if it’s not quite right for you, or if you’re looking to explore more affordable options, then you can consider the following alternatives.

- Invoice factoring: Invoice factoring is similar to PO financing in the sense that it gives you an advance on payments for customers you’ve invoiced. The key difference here is that it is used after you’ve sent an invoice to a customer. PO financing, on the other hand, is used before that happens. Learn more about the differences in our comparison of PO financing vs factoring.

- Small business line of credit: A business credit line is a revolving credit facility that allows you to request a draw on the line, have the funds deposited into your account of choice, and use the funds on an as-needed basis to cover various business expenses. You make payments based on the current balance, which can be repaid over time. Head over to our guide to the best small business lines of credit for some options.

- Business credit cards: Similar to a business line of credit, you can use a credit card to fund your business expenses on an as-needed basis. Funds are flexible, and you can make purchases at any time. Our list of the leading small business credit cards is a good place to start if you need options.

- Term business loans: These are loans that can issue a lump sum of funds to be used for a variety of business purposes, such as equipment financing or other working capital. You can view our top-recommended working capital loans to find financing options applicable to your business needs.

Frequently Asked Questions (FAQs)

With PO financing, a financing company pays your suppliers on your behalf. This allows the supplier to fulfill your customer’s order, allowing your business to retain working capital without delaying or declining customer orders. When your customer issues payment to the financing company, it will deduct its portion of the fees before sending the remaining balance to your business.

Most of the risk with purchase order financing lies with the lender. In the instance the customer doesn’t pay the invoice, the lender can lose money. This is why most PO financing companies require good credit history from both the customer and your business and also require upfront fees to help mitigate the risk of loss in the event of default.

The main difference between invoice financing and PO financing is when they are used. Meaning, invoice financing occurs when a business has already delivered a product to a customer without yet receiving payment, whereas PO financing takes place before the product is delivered and includes all processing, product, and delivery expenses.

Bottom Line

PO financing can allow a business to avoid cash flow or inventory shortages by providing an advance to fulfill orders. By paying the supplier and invoicing the customer on your behalf, using a PO financing company can offer short-term financing solutions that can help a business keep up with order demand. Keep in mind, depending on your business needs, it may not be the most cost-effective option. Be sure to consider all of your financing options before proceeding with PO financing.