A business credit card can be a great source of funding for your small business, especially if you cannot yet qualify for a business loan. Business credit cards can provide immediate working capital whenever you need it, and most offer rewards on purchases. Using a business credit card can also help you build your business credit, allowing you to access a wider range of business financing options in the future.

Here are a few good reasons to use a credit card to fund business expenses.

- You can’t qualify or don’t want to apply for a bank loan: There is a chance for your bank loan application to be rejected due to a low credit score, lack of collateral, excessive debt, and/or insufficient income. Further, both traditional bank loans and SBA Small Business Administration loans can be difficult to qualify for and do not offer the perks, rewards, and bonuses business credit cards do.

- You need fast or flexible financing for your business: Applying for a business credit card usually results in fast approval and avoids the paperwork required for a bank loan. Once approved, you have a revolving line of credit, which means you’ll have access to the original card limit as you pay down the balance on the card.

- You require less than $50,000 in financing: Most small business credit cards have a peak limit of $50,000. Few have higher limits—and it’s difficult to qualify for a credit card limit of over $50,000 as a small business owner, especially if you’re just starting out. Hence, assess what purchases you plan to make with the card carefully.

Are you a new business needing over $50,000 in financing? Consider applying for startup business loans. If you have been in business for a few years, check out our best high-limit business credit cards for more options.

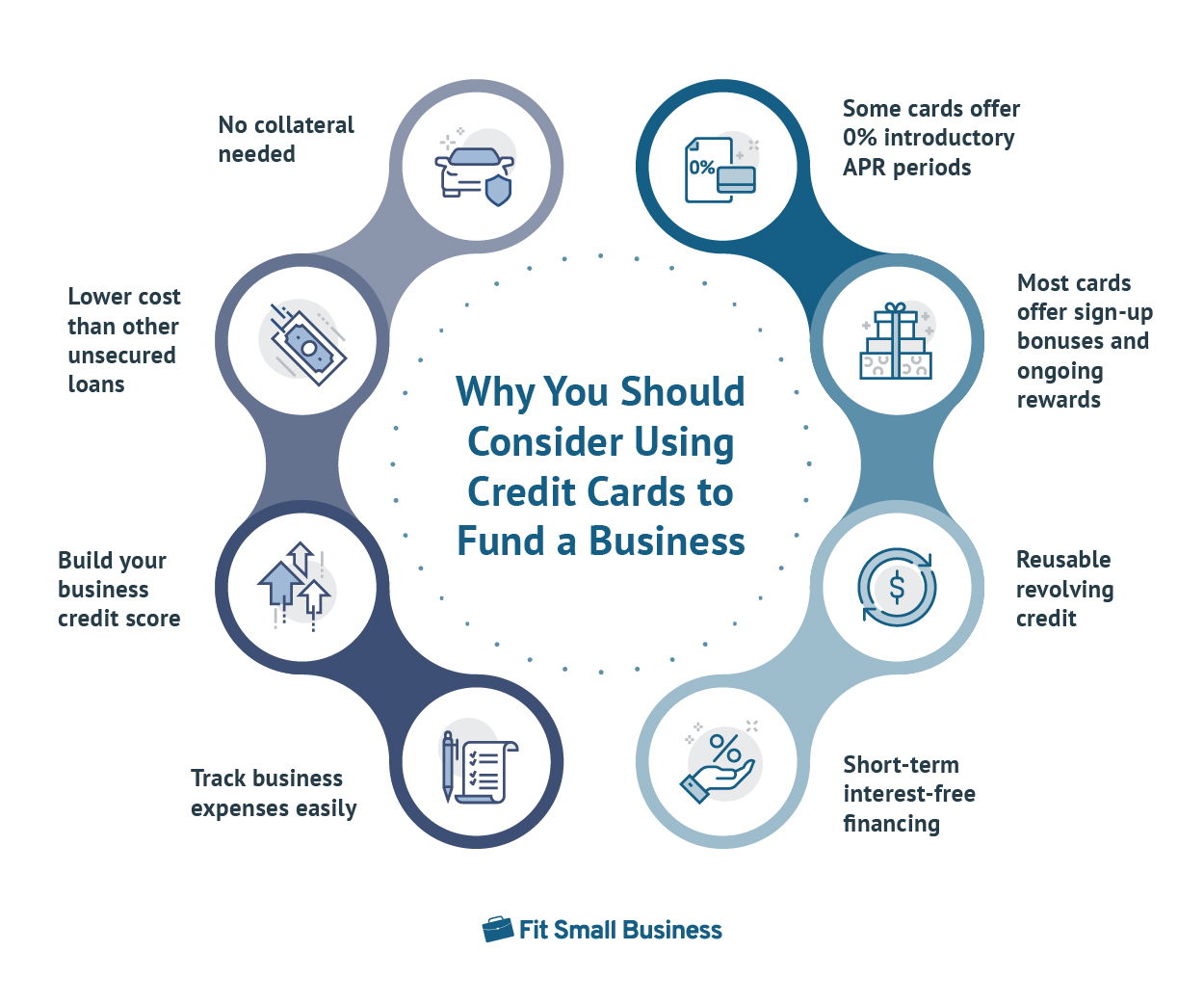

Advantages of Using a Credit Card to Fund Businesses

Below are some of the benefits that you can enjoy if you choose a business credit card over other forms of business financing.

1. Doesn’t Require Collateral

Majority of business credit cards are unsecured, though almost all issuers will require a personal guarantee as part of their qualification processes. But if you have at least a good personal credit score, there is a high chance for you to qualify for a card that offers rewards and perks suitable for your business.

2. Offers an Introductory 0% APR Period

An introductory 0% APR Annual Percentage Rate period is a fixed period when any new purchase or transfer you make will not incur interest. This can be anywhere from 6 to 12 months—but some issuers offer up to 18 months of interest-free financing.

Having a credit card with 0% introductory APR is useful for business owners needing ample time to grow their business before they start paying for expenses. It is also ideal for those needing to make large purchases and new business owners using credit cards to start a business.

Some cards also offer 0% financing periods for balance transfers. This means you can transfer your balance from an existing high-interest credit card and pay it down over time without interest.

Related buyer’s guides:

3. Has a Lower Cost of Capital Than Other Unsecured Debt

Business credit cards typically have an average interest rate of 21.59% for existing accounts and 22.85% for new cardholders. While small business credit cards charge high interest rates, they are still considered less expensive given that they do not require collateral.

While business credit cards often charge fees on things like cash advances and balance transfers, you can easily avoid these additional fees with careful budgeting and planning.

It’s worth noting that there are small business financing options that offer much lower interest rates than credit cards. However, in addition to requiring collateral, the less expensive forms of financing—such as SBA loans and commercial real estate (CRE) loans—have lengthy application processes, are more difficult to qualify for, and often restrict the use of funds.

Types of Business Financing & Typical APRs

Financing | |

|---|---|

Up to 16.50% | |

Up to 15% | |

Small Business Credit Cards | Up to 35.99% |

Up to 60% |

4. Offers a Welcome Bonus & Ongoing Rewards

Many small business credit cards offer welcome bonuses—-which are typically in the form of cash back, points, statement credits, or miles. These are rewards you can earn after meeting specific spending requirements. Even after the introductory period, you can still earn rewards as most cards have ongoing cash back, points-based, or travel rewards.

Related buyer’s guides:

5. Helps Build Business Credit

Building business credit is essential if you need access to other forms of financing with better plans. When you use your business credit card responsibly and pay your bills on time regularly, you will not only improve your personal credit score, but you’ll also establish your business credit.

6. Acts as Revolving Credit

You can treat your small business credit card like revolving credit—which means that you can use up to your approved credit limit, pay your credit card balance to free up your credit limit, and use it again. Unlike a traditional business loan, you don’t have to reapply every time you need to access more funds.

With traditional business credit cards, you are required to pay down at least a portion of your balance every month. It’s important to pay off your balance in a relatively short period to avoid high financing costs. For business charge cards, you need to pay your full balance every billing cycle.

7. Helps You Monitor Business Expenses

Small business credit cards allow you to monitor any business-related expenses easily. You can use your monthly statements and set account alerts to help you stay on track. In addition, most business credit cards integrate with accounting software—such as FreshBooks, QuickBooks, and Xero—to save time on bookkeeping.

8. Offers Short-term Interest-free Financing

A business credit card is a great option if you only need short-term financing. It essentially offers interest-free financing for almost a month because if you pay your balance in full every billing cycle, you won’t be charged with interest. Plus, if you get a credit card that doesn’t charge an annual fee, you will save on your overall credit cost.

Meanwhile, business loans, even short-term ones, come with interest right away. And, in most cases, you also need to pay certain fees.

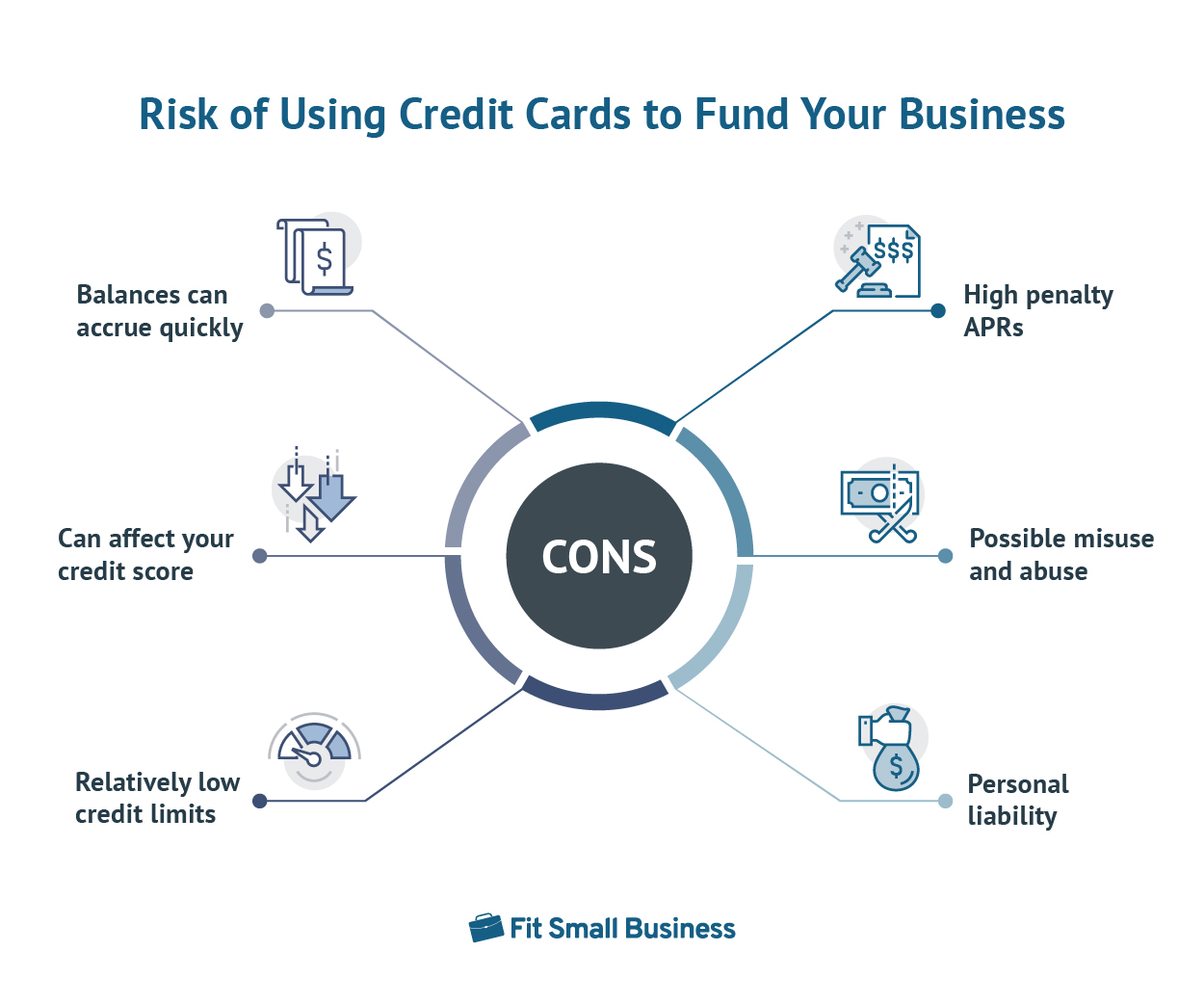

Disadvantages of Using a Credit Card to Fund Businesses

Using a credit card to fund your business also comes with risks and drawbacks. You need to keep track of your purchases to avoid overspending and ensure that payments are made on time, as late or missed payments can negatively impact your credit score.

1. Has Balances That Can Accrue Quickly

Since credit cards are relatively easy to use (and you can use them almost anywhere), it is easy to spend beyond your intended budget—or worse, beyond your means. If you are not careful, your balance can accrue quickly, and you might end up being unable to pay off your balance on time.

However, there are business credit cards that allow you to spend beyond your assigned credit limit—one of which is the American Express Blue Business Cash. Read our American Express Blue Business Cash review to learn about its rewards, features, and fees.

2. Has Penalty APRs That Can Increase the Cost of Capital

While it’s possible to use credit cards to lower your cost of capital, this won’t be the case if you fail to make a payment and end up being charged a penalty APR—the rate providers charge once you fall behind on payments. Penalty rates are usually 30% or higher. If this happens, you could talk to the card issuer and try to negotiate a new rate, but the best course of action might be to transfer the balance to a new credit card or seek a less expensive form of financing.

3. May Affect Your Credit Score Adversely

Most card issuers will perform a hard credit check when you apply for a card, and this will typically affect your credit score. Also, using up your credit card’s limit can impact your overall credit utilization ratio Credit utilization ratio refers to the amount of revolving credit you use versus the total credit available to you. This is generally expressed as a percentage. , which may also harm your credit. Once your credit score is adversely affected, you will have difficulty getting approved for funding in the short term, such as if you decide to take out a small business loan.

4. May Be Misused & Abused

Credit card misuse and abuse are possible, especially if you are not careful. To avoid this, you should identify employees and business partners with access to your business credit card account and check your monthly bills to ensure all expenses are approved and accounted for. Also, be mindful of potential identity theft and see to it that all monthly transactions are consistent with the intended use of the credit card.

5. Has Relatively Low Credit Limits

If you’re using credit cards to start a business, you’ll be restricted to an approved credit card limit. Most often, small business credit cards have credit limits of up to $50,000, which might not be enough to fund your business. For larger borrowing needs, you can seek out other financing options. One solution is credit card stacking, the practice of applying for multiple credit cards to have a much larger line of credit. You can do this yourself or pay a company to do it for you.

6. Holds You Personally Liable for Debt

Most card issuers require a personal guarantee for a business credit card. If your business fails to repay any outstanding balances, you are personally liable to repay the debt. If your business is unsuccessful, it can result in putting your own personal credit history and credit score at risk.

While this is no different than what’s required for most small business loans, this is something that you should be aware of. Note that while there are business cards that don’t require a personal guarantee, they typically come with restrictions and have more rigid requirements.

How to Use Credit Cards to Fund Your Business

Using a business credit card to fund your business is a good idea if you need immediate financing. However, it’s crucial that you use the card responsibly and make on-time payments to avoid unnecessary fees, maintain good personal credit, and build business credit. Building good business credit can help you qualify for future business financing options.

Issuers offer a wide variety of cards—from those that let you earn rewards, those with low interest rates, and those that can help build your business credit. All business owners need to determine the best business credit card based on their businesses’ needs.

Before applying for a business credit card, it’s important to know the card’s rates and fees (e.g., annual, balance transfer, and foreign transaction fees). Usually, business credit cards charge an annual fee ranging from $0 to $695 (or more) and interest rates as high as 35.99%. Other fees that you need to be aware of are penalty and cash advance APRs, overdraft fees, returned payment fees, and late fees.

While major credit card issuers will let you apply for a card online in just a few minutes, there are some that require you to visit a branch. It’s worth noting that issuers usually require you to provide basic personal and business information. After getting approved, issuers usually send your card through the mail within 7 to 10 business days.

Once you receive your card and activate it, you can start using it. Avoid using it for personal expenses, as it is a violation of your cardholder agreement. Combining your personal expenses with your business purchases will also make it difficult to track your business transactions—which can cause problems with the IRS when tax season comes.

Ensure you pay your balance down or pay it off completely promptly so that you can avoid getting charged with an APR and late fees as well as maintain good credit.

Best Business Credit Cards to Fund Your Business

The best business credit card to fund your business would depend on your business type and other features you are looking for. We have several buyer’s guides that you can browse through to find the card that fits the bill.

General cards:

- Best small business credit cards

- Best purchasing cards (p-cards)

- Best secured business cards

- Best corporate cards

Rewards cards:

Cards for specific business types:

- Best cards for new businesses with no credit history

- Best business cards for LLCs

- Best business cards for restaurant owners

- Best business cards for startups

Cards with specific features:

- Best 0% APR business cards

- Best business cards with no foreign transaction fee

- Best business cards with no annual fee

- Best business cards for balance transfers

- Best business cards with airport lounge access

Alternatives to Credit Card Funding

- Bootstrapping: Bootstrapping is using your own personal funds to get a business started. It may be a good choice if you’re not in a rush to grow your business. It will require in-depth financial planning on your part to separate your personal expenditures from your business expenses.

- Home equity loan (HELOAN) and home equity line of credit (HELOC): If you’re a homeowner, you can borrow funds against the equity in your home. HELOANs tend to have fixed rates, while HELOCs typically have variable rates. These can add to your personal debt significantly, so they’re not great for long-term use. Read our guides on how to get a HELOAN to finance your business and how to use a HELOC to fund your business to learn more.

- SBA loans: A small business loan from the SBA offers low-interest rates and a limit of up to $5 million. To qualify, you need to have an established small business, have good personal credit, demonstrate the need for financing, and be able to pay back the loan. Our article on SBA loans goes over the different types of loan programs.

- Small business line of credit: You can apply for a business line of credit through a bank, a credit union, or an online lender. Typically, your small business needs to be in operation for at least two years, and you need to have good personal credit to qualify. Moreover, you must prepare the necessary paperwork to show your revenue history. For our recommendations, see our roundup of the best small business lines of credit.

- Crowdfunding: This is the practice of raising funds from investors to finance your small business in exchange for goods, services, or even equity in your company. This financing method has grown in popularity as an alternative to applying for a business loan. Read our guide on how to crowdfund a business, and check out our list of the best crowdfunding sites for more information.

Frequently Asked Questions (FAQs)

A credit card might not be the best option if you need a larger loan, your business is already established, or you can’t qualify for a business credit card. In this case, you may want to consider other alternative funding methods to fund your small business.

It’s possible to use a personal credit card for business, especially if your business is new and couldn’t qualify for a small business credit card. Some personal credit cards also offer rewards and perks that may be useful for your business. However, it’s important to separate your personal and business expenses to keep your accounting organized and avoid getting in trouble with the IRS.

Yes—but only with proper budgeting and the right business credit card. Keep in mind that using a credit card comes with charges for additional fees for paying your balances late, making a transfer from one card to another, and issuing cash advances.

Bottom Line

Most business owners can benefit from using a small business credit card to fund a business—it may be the easiest and fastest way to finance your small business while earning rewards. Ensure you use your card responsibly and pay your bills on time, as late payments can cause unnecessary charges and hurt your credit score. Also, keep your balance low relative to your total credit line so that your credit utilization ratio remains favorable. This can increase your chances of getting additional credit and qualifying for other financing options in the future.