The best farm accounting software can be a general-use bookkeeping solution like QuickBooks Online or specialized farm accounting software, such as FarmBooks and EasyFarm. While some farmers require farm-specific features like crop and livestock tracking and cost allocation, others may find that general accounting functions like invoicing and expense tracking are sufficient for their needs.

Here are the six best accounting software for farmers:

- QuickBooks Online Plus: Best overall for farmers and ranchers

- FarmBooks: Most affordable farm management software

- Traction Ag: Best cloud-based software for farm management

- Wave: Best free software for part-time and hobby farmers

- EasyFarm: Best for self-employed farmers

- The Farmer’s Office: Best for detailed cost accounting for large farms and ranches

Quick Comparison of the Best Farm Accounting Software

QuickBooks Online Plus: Best Overall Accounting Software for Farmers and Ranchers, Including Those With Employees

Pros

- Is easy to use and accessible online—perfect for farmers managing their own bookkeeping

- Has a customizable chart of accounts designed to match your farm’s unique operations

- Has class and location tracking that helps measure profitability across specific farm activities

- Integrates with farm management tools to enhance budgeting and reporting

- Lets accountants and advisors access your financial data seamlessly through its real-time collaboration

Cons

- Is a bit expensive for small-scale and part-time farmers

- Lacks farm management features like pesticide application reporting

- Requires a separate subscription to keep separate books for multiple businesses

- Can’t be used to track personal income and expenses

Plans Pricing |

I recommend the Plus plan for most farmers to track income and expenses for separate cost centers by using the class and location tracking. However, the less expensive plans still have great accounting if you don’t need detailed tracking. To help you decide whether the Plus plan is right for you, see our QuickBooks Online plans comparison. |

|---|---|

Add-ons Pricing | N/A |

Discount | 50% off for three months (can’t be combined with the free trial) |

Free Trial | 30 days |

Customer Support Channels | Phone (callback only), live chat, chatbot, online resource guides |

Average User Review Rating | 4.3 out of 5; read what users have said via our QuickBooks Online review |

QuickBooks Online Plus is my top pick for farm accounting software because it can be tailored to nearly any type of business. Its biggest advantage is how widely it’s used by businesses and accountants, which means there’s a massive network of QuickBooks ProAdvisors ready to help if you need professional bookkeeping guidance.

While it’s not specifically built for farms, it offers advanced features like class and location tracking. For example, you can separate income and expenses for your orchard, cattle operation, and roadside farm stand, all within one system. This makes it easier to track profitability for different parts of your farm and see where you’re thriving or where costs need attention.

If you have employees, QuickBooks Online connects directly with QuickBooks Payroll. It simplifies paying your team, handling tax withholdings, and generating W-2s or 1099s, saving you time and effort. You can learn more about it in our full QuickBooks Payroll review.

Standout Features

- Direct payroll integration: QuickBooks Online integrates seamlessly with QuickBooks Payroll, making employee management, tax deductions, and form filings—like W-2s and 1099s—more efficient.

- Class and location tracking: QuickBooks enables you to track income and expenses by class and location, allowing you to see which of your herds, fields, or crops are the most profitable.

- ProAdvisor network: There is a large network of independent QuickBooks ProAdvisors that you can hire to help you with your bookkeeping.

Use Cases

- Farmers with multiple farm locations: QuickBooks Online’s location tracking lets you track which of your farms is the most profitable.

- Farmers needing remote access to their data: As cloud-based software, you can access your accounting files anytime and on any internet-connected device.

- Farmers managing different crop types: You can get detailed reports by using project tracking to track small parts of an enterprise, such as a particular breeding stock, field, or crop.

QuickBooks Online is the only provider in this guide to score perfectly in general accounting, which reflects its position as our top small business accounting software overall. It also earned high marks for ease of use, thanks to its intuitive cloud-based interface. Farmers benefit from remote access to their financial data and can seamlessly share information with accountants through the cloud, earning it top scores for accessibility.

However, QuickBooks Online Plus falls short in areas where farm-specific software excels. It loses points for lacking specialized tools like crop and livestock management, as well as fixed asset accounting. For those needs, upgrading to QuickBooks Online Advanced or using a farm-focused solution like FarmBooks may be necessary. Additionally, it misses out on scoring for personal vs farm finance tracking, a feature that EasyFarm delivers.

While reasonably priced for small farms, QuickBooks Online’s cost reduces its score for affordability for part-time or hobby farmers. For simpler accounting needs, Wave emerges as a more cost-effective alternative.

FarmBooks: Most Affordable Farm-specific Software

Pros

- Is the most affordable farm-specific accounting software on the list

- Tracks personal and farm income and expenses for complete financial management

- Has real-time inventory tracking for crops and livestock

- Has farm-specific reporting tools to simplify taxes and planning

- Has multiyear data tracking to monitor farm performance over time

Cons

- Supports only a single farm per license, limiting use for multifarm operations

- Lacks bank account integration, requiring manual entry of transactions

- Has outdated user interface, which feels less intuitive compared with modern accounting software

- Has limited third-party integrations, making it harder to connect with other tools farmers might already use

- Lacks automated invoicing features, creating extra work for billing customers or vendors

Plans Pricing |

|

|---|---|

Add-ons Pricing |

|

Discount | N/A |

Free Trial | Free demo version that lets you enter up to 30 transactions |

Customer Support Channels | Phone and email, paid live training, self-help guides, such as blogs and FAQs |

Average User Review Rating | None as of this writing |

For a one-time payment of $595, FarmBooks packs in all the essential tools to handle both farm and nonfarm transactions. Its affordable price makes it a solid choice for farmers who need reliable accounting without ongoing subscription fees.

FarmBooks offers real-time inventory tracking for crops and livestock, as well as tools to manage both farm and personal income and expenses. However, it charges extra for each additional farm, which may not work for those juggling multiple farms. In that case, Traction Ag is a better fit, as it supports multiple farms under one subscription, even on its lowest plan.

A standout feature of FarmBooks is its enterprise codes, which allow you to track both personal and farm-related expenses in detail. For instance, you can pinpoint how much fertilizer was used on specific fields, helping you understand where your resources are going.

Standout Features

- Unique code system: FarmBooks uses a unique code system to record transactions, which can be tricky to master initially. However, professional bookkeepers can use these codes to generate detailed and accurate reports for better financial insights.

- DIY payroll module: The platform allows you to pay both hourly and salaried employees using its DIY payroll feature, simplifying payroll management for farm operations.

- Specialized chart of accounts: It comes with a chart of accounts and reports specifically tailored for farmers, ensuring that all transactions are categorized accurately for farm-specific accounting needs.

- Fixed asset management: FarmBooks lets you manage and track fixed assets, such as land and farming equipment, helping you maintain a clear overview of your valuable resources.

Use Cases

- Small-scale farmers: FarmBooks is the least expensive farm-specific accounting software we’ve reviewed.

- Farmers commingling personal and farm funds: The system uses a single checking account to manage both farm-related and personal funds.

FarmBooks is the only software on this list to score perfectly for farm-specific features, making it a strong contender for farmers needing tools tailored to their operations. It also earns high marks in general accounting, with essential features like accounts payable (A/P), accounts receivable (A/R), and bank reconciliation.

However, FarmBooks loses points for advanced functionality, as it lacks tools like recurring invoices and aging reports for A/P and A/R—features that QuickBooks Online offers. It also takes a hit in ease of use because of its unique coding structure, which can be difficult to navigate without prior accounting experience. This complexity makes it a better fit for farms with in-house bookkeepers. For farmers managing their own books, Wave or QuickBooks Online may be better depending on their budget and feature needs.

Traction Ag: Best Cloud-based Software for Farm Management

Pros

- Combines accounting and farm management tools for complete operational control

- Tracks real-time inventory for crops, inputs, and supplies to simplify resource management

- Monitors fixed assets like machinery, land, and equipment for accurate depreciation

- Generates cost analysis reports to help track expenses for crops, inputs, and other farm operations

- Offers multiyear financial tracking to compare performance across growing seasons

- Includes integrated payroll processing for managing farm employee wages and taxes

Cons

- Charges extra for optional priority onboarding, increasing upfront costs

- Lacks livestock management tools, limiting its use for ranches

- Has no monthly plans

- Has limited third-party integrations, reducing compatibility with other farm tools

- Lacks mobile app for on-the-go accounting and farm management

- Has higher pricing tiers that may be expensive for smaller farms or part-time farmers

Plans Pricing |

All plans are billed annually. |

|---|---|

Add-ons Pricing |

|

Discount | N/A |

Free Trial | 30 days |

Customer Support Channels | Phone support, live chat, knowledge base, paid onboarding (additional fee) |

Average User Review Rating | 4.9 out of 5 based on around 50 reviews on Capterra |

Traction Ag stands out as the only cloud-based farm management software on my list. If you’re using tablets to track production across multiple sites, it works as a central hub for reporting yields, sales, and costs. Because it’s cloud-based, you can access your data from anywhere with an internet connection.

It also offers both monthly and annual plans, giving users the flexibility to choose what works best for their business. The monthly plan is particularly helpful for those just starting out, as it allows you to use the software without a long-term commitment—you can cancel anytime if needed.

Standout Features

- Crop inventory: This lets you manage and track your crop inventory in real-time, ensuring accurate records of your farm’s produce.

- Land agreement management: You can manage agreements related to land, such as leases or contracts, helping you keep track of important land use terms and costs.

- Equipment cost tracking: This offers tools to track the costs associated with your farming equipment, from purchase to maintenance, giving you a clear picture of equipment-related expenses.

Use Cases

- Those looking for farm and accounting features: Traction Ag combines farm accounting and management. You can generate basic financial statements and track income and expenses while managing farm-specific aspects like crop inventory, field profits per acre, and supplies.

- Valuing agricultural produce at market value: In Traction Ag, you create a market-based balance sheet to see the market value of your produce. This report is very useful since market prices of agricultural produce change on a whim, and showing them at their market values will help you assess the net worth of your farming business.

In my evaluation, Traction Ag earned high marks for farm-specific features like field profit analysis per acre or bushel and tools for managing land agreements with landlords. I also gave it points for its ability to generate market-value balance sheets, which I find incredibly valuable for farms. Since prices for agricultural products fluctuate quickly, having real-time, market-based insights makes decision-making much easier.

However, I had to dock points for affordability because of the extra charge for priority onboarding. I also lowered its score for flexibility since it doesn’t allow partial payments from customers, a feature that could make billing smoother and more efficient.

Overall, Traction Ag scored above average, but it may not suit everyone. If you want stronger accounting tools, I recommend QuickBooks Online, and if farm-specific features are your priority, FarmBooks is a better fit. For farmers who need the best mix of accounting and farm management, Traction Ag is still the top choice.

Wave: Best Free Accounting Software for Part-time and Hobby Farmers

Pros

- Offers free accounting and invoicing, making it perfect for part-time or small family farms

- Has simple setup and intuitive interface for farmers without accounting experience

- Supports recurring invoices for regular sales, such as livestock or produce subscriptions

- Tracks income and expenses with clear, easy-to-read financial reports

- Integrates with payment processors to simplify receiving payments from customers

Cons

- Limits access to one user on the free plan, restricting team collaboration

- Lacks farm-specific tools like crop or livestock inventory management

- Has no class tracking to separate income and expenses by farm activities

- Offers limited reporting features, with no options for customized farm reports

- Provides no live customer support unless you upgrade to a paid plan

Plans Pricing |

|

|---|---|

Add-ons Pricing |

|

Discount | N/A |

Free Trial | N/A |

Customer Support Channels |

|

Average User Review Rating | 4.4 out of 5; check out user comments in our Wave review |

Farmers who can’t justify the cost of paid farm accounting software or want to take a hands-on approach to their farm’s finances should consider Wave’s free Starter plan. It covers all the basics of accounting and invoicing at no cost. You only pay if you need extras like receipt scanning, payment processing, payroll management, or additional users.

What’s impressive is that despite being free, Starter includes advanced features you’d usually expect from paid software. You can set up recurring invoices for regular customers and automate reminders to nudge them about overdue payments, which makes managing farm cash flow much easier.

Standout Features

- Free income and expense tracking: You can track your basic income and expenses without any cost, ideal for small businesses or freelancers looking to manage their finances without a paid subscription.

- Automated sales tax calculation: Wave makes it easy to add sales taxes to transactions and automatically calculates the totals, ensuring accuracy in your tax reporting.

- Branded invoices: Wave allows you to create professional, customizable invoices with your business logo and colors, helping you maintain a consistent brand image.

Use Cases

- Part-time farmers: Farmers who want to save money and only need a way to track income and expenses for tax purposes will find Wave Starter useful.

- Farmers wanting to simplify record keeping: Wave Starter’s receipt scanner for $8 per month with OCR capabilities allows you to extract information from your receipts and store them digitally easily, removing the need for paper files and filing cabinets.

Wave stands out to me for its pricing because it offers a free plan for accounting and invoicing. It’s perfect if you only need basic tools like income and expense tracking. But if your farm business requires specialized features, I’d suggest upgrading to something like EasyFarm or FarmBooks, which are still affordable options.

I also find Wave incredibly easy to use, which makes it ideal for self-employed or hobby farmers who just want to manage their own books without any hassle. That said, the free Starter plan has its limits—no live customer support, which isn’t surprising for free software. If live chat or email support is important to you, you must pay for an add-on or upgrade to a paid plan. For more comprehensive support, including phone access, I’d look at QuickBooks Online or FarmBooks instead.

EasyFarm: Best for Self-employed Farmers

Pros

- Is focused mostly on the needs of self-employed farmers as the payroll module doesn’t meet IRS requirements

- Uses a unique “single-entry input” approach for entering transactions—ideal for farmers without an accounting background

- Includes farm-specific management features, like ag inventory tracking

- Supports crop and livestock management

- Allows you to manage both farm and personal funds

Cons

- Is a bit expensive compared with similar programs

- Needs the A/R add-on to send invoices

- Doesn’t allow you to connect to bank accounts

- Lacks fixed asset accounting features

- Has no mobile app for managing accounting on the go

- Has limited customization for farm-specific reports and categories

Features

Plans Pricing | EasyFarm is available in seven different editions with one-time fees.

|

|---|---|

Add-ons Pricing |

|

Discount | N/A |

Free Trial | N/A |

Customer Support Channels | Phone and email, reference and training manuals, and online self-help guides like tutorial videos |

Average User Review Rating | 4.5 out of 5; see customer feedback in our EasyFarm review |

EasyFarm stands out as software I’d recommend to farmers looking for something simpler than traditional bookkeeping tools. Its interface uses farm-specific jargon and includes preset calculations and reports, making it especially helpful for unincorporated farmers who need user-friendly features tailored to agriculture.

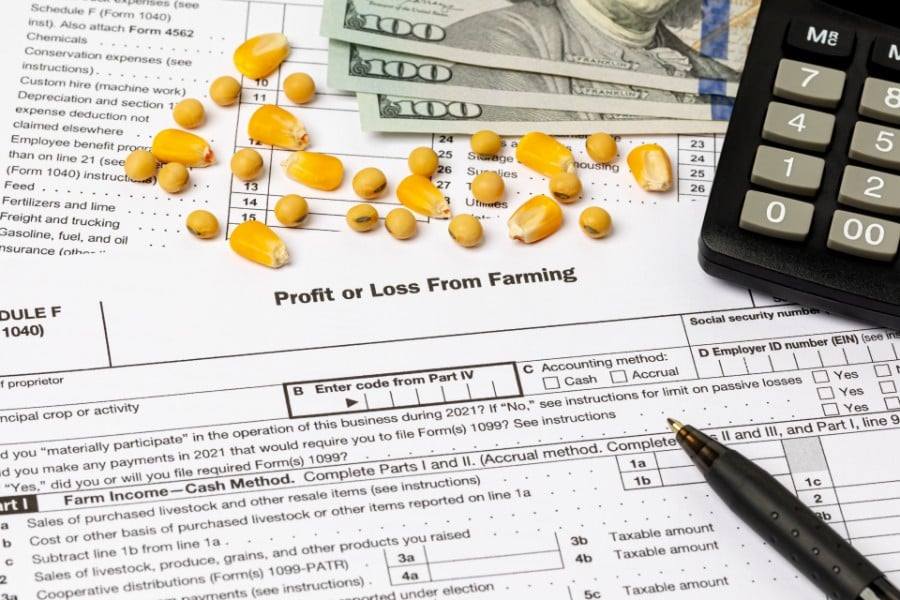

What I appreciate most is its combination of farm management and accounting tools. It handles bookkeeping tasks while also covering crop and livestock management, which feels like a complete solution. Many self-employed farmers even use EasyFarm to organize their income and expenses for filing Form 1040, Schedule F, which shows how well it’s designed for agricultural needs.

Standout Features

- Cost center tracking: You can create cost centers to monitor profitability for specific areas like fields or herds, giving you a detailed view of which segments of your farm are most profitable.

- Data export: You can easily export your farm data to Excel or FINPACK, enabling further analysis and reporting to enhance your decision-making process.

- Track inventory by quantity and weight: EasyFarm allows you to manage both the quantity and weight of your inventory, giving you more control over tracking valuable resources.

- Customized chart of accounts: Tailored for the agricultural industry, EasyFarm includes a specialized chart of accounts that helps categorize transactions in a way that aligns with farming operations.

Use Cases

- Farmers managing livestock: EasyFarm has a livestock manager that allows you to manage and track the growth of any livestock species.

- Farmers mixing personal and farm funds: As with FarmBooks, EasyFarm uses a single bank account for managing both farm funds and nonfarm family living expenses.

EasyFarm is simple to use, but in my scoring, it earned a lower mark for ease of use because of its limited integration options and the lack of an assisted bookkeeping service. Another downside is its limited accounting features—it doesn’t let you track unpaid bills, and creating and sending invoices requires an additional fee. For all three features, I’d recommend QuickBooks Online as a better option.

That said, EasyFarm scored above average for pricing, even with its relatively high one-time fee. The long-term cost-effectiveness is clear since there are no recurring subscription charges. However, if the upfront cost feels too steep and you’d prefer a monthly plan, I’d suggest looking into QuickBooks Online or a free option like Wave.

The Farmer’s Office: Best for Detailed Cost Accounting for Large Farms & Ranches

Pros

- Provides detailed cost accounting features to track profitability

- Includes an A/R module for sending and tracking invoices

- Allows you to track income and expenses by cost centers

- Comes with a chemical inventory management and a pesticide application reporting system

- Has a built-in payroll for agriculture

Cons

- Can’t be used to track personal income and expenses

- Lacks upfront pricing; can be an issue for farmers with serious budget considerations

- Requires bookkeeping knowledge; unideal for farmers managing their own books

- Has no mobile accounting app

Plans Pricing | Prices aren’t publicly disclosed, but The Farmer’s Office is offered in three editions: Small Farm, Standard, and Enterprise. Each license is designed to be used on a single computer. If you wish to install it on another computer in the same office, a secondary site license fee applies, which is 25% of the price of the product. |

|---|---|

Add-ons Pricing | N/A |

Discount | N/A |

Free Trial | Offers an evaluation copy that you can try for free for 30 days |

Customer Support Channels | Phone and email, blogs, and training videos |

Average User Review Rating | No significant user reviews as of this writing |

The Farmer’s Office by Datatech is a step above EasyFarm and FarmBooks, offering more advanced farm-specific features designed for professional bookkeepers at larger farms and ranches. Its enhanced cost accounting tools provide deeper insights into income, expenses, and yields. For example, you can group expenses by crop year, create equipment cost centers, and track different commodities for each crop year—a feature especially valuable for managing open-ground fields.

What really sets it apart is its chemical inventory and pesticide application reporting. These tools help prevent overapplication, keeping both crops and compliance in check. On top of that, its customized payroll features make managing farm employees’ salaries, deductions, and taxes much easier for farm managers.

Standout Features

- Enhanced cost accounting module: This allows you to track detailed farm-related costs, helping you understand and manage the financial aspects of various farming activities.

- Budgeting module: With this, you can monitor expenses and apply for loans, providing a structured way to manage your finances and plan for future needs.

- Inventory and fixed asset management: You can manage and track your agricultural inventory, as well as fixed assets like equipment and land, keeping a clear overview of your resources.

- Customized payroll for Form 943 reporting: The payroll system is designed specifically for agricultural employees, allowing you to manage wages and comply with Form 943 reporting requirements for farm laborers.

Use Cases

- Farmers needing detailed cost accounting: The program is ideal for farmers and ranch managers wanting to rely on detailed cost accounting to see which of their crops, farms, and livestock are profitable.

- Ag firms with multiple employees: The Farmer’s Office has built-in payroll features for firms that pay wages to agricultural employees.

- Farmers looking to track pesticide activities: A unique feature is the pesticide application reporting module that helps you manage your tank mixes, pesticide usage, and chemical inventories easily.

The Farmer’s Office doesn’t allow you to separate personal and farm-related expenses, which makes sense since it’s built for larger operations rather than solo farmers. However, it excels in general accounting features, offering tools to track unpaid bills and send invoices at no extra cost—clear advantages over EasyFarm.

In my evaluation, it scored lower for pricing and ease of use. The lack of transparent pricing can be a concern for farmers working with tight budgets. Its Microsoft-based interface feels outdated, especially for those used to cloud-based tools. Adding to the inconvenience, it lacks live chat support, and phone support requires an additional fee. If you’re looking for locally installed software, FarmBooks is a great alternative, while Traction Ag offers a more user-friendly, cloud-based solution with excellent farm-specific features.

How I Evaluated Farm Accounting Software

Using an internal scoring rubric, I examined our six best farm accounting software for farmers based on their affordability, ease of use, available support, and ability to manage general accounting and farm-related accounting tasks.

20% of Overall Score

Each application is evaluated based on its upfront cost and the number of users included. Software providers that don’t disclose pricing information received the lowest scores.

25% of Overall Score

General accounting features like bill tracking, invoicing, and bank account reconciliation are essential to farm operations.

25% of Overall Score

The main farm features we like to see include the ability to track personal income and expenses, track and manage fixed assets, create cost centers or enterprises, and manage farm inventory.

20% of Overall Score

Most farmers have no bookkeeping experience, so the best farm accounting software should be easy to use and provide reliable customer service for first-time users.

10% of Overall Score

Our experts conducted a subjective evaluation of each software program across several factors, such as ease of use, features, and popularity.

Frequently Asked Questions (FAQs)

In addition to general bookkeeping features, accounting software for farmers has special features, such as the ability to track inventory depending on the type of crop you’re selling, manage livestock, and create cost centers for tracking farm-related expenses.

Yes, you can—as long as you require only general accounting features. As an example, you can use QuickBooks to track unpaid bills, send invoices, track expenses, and reconcile bank accounts.

No, as some software has a user-friendly interface that’s easy to learn and navigate. For instance, EasyFarm uses farm-specific language and preset calculations and reports, making it easy to use even for farmers with no accounting background.

Bottom Line

The best software for farm accounting depends on your budget and farm business needs. If you need locally installed accounting software with powerful accounting features, choose FarmBooks. If you’re working with a remote bookkeeper and prefer a cloud accounting solution, you might prefer QuickBooks Online. If you’re looking for features specific to farm management, such as the ability to track farm inventory items, The Farmer’s Office and Traction Ag are great options.