Common invoice payment terms include Net 15, Net 60, and 2% 10 Net 30—with the most popular term being 30 days (or Net 30). Setting payment terms is an essential part of accounts receivable (A/R) management, and making terms transparent to customers by displaying them on every invoice that’s issued is an important bookkeeping task.

Invoice payment terms are the conditions that outline how, when, and by what method your customers or clients will provide payment to your business. They are an agreement that sets your expectations for payment, including when your client needs to pay you and the penalties for missing a payment.

Invoice payment terms allow you to make accurate cash flow projections, which in turn help you plan for taxes and manage your business’s growth. Payment terms are essential when negotiating a contract, and they should maximize how quickly your clients pay you while minimizing inconvenience for your customers.

1. Net 7, 10, 30, 60, 90

These common invoice payment terms refer to the number of days in which a payment is due. For example, Net 30 means that a buyer must settle their account within 30 days of the date listed on the invoice.

It’s up to you to give your customers the best invoice payment terms. You may want to start with Net 7 for new customers and give Net 90 to your loyal and long-time customers.

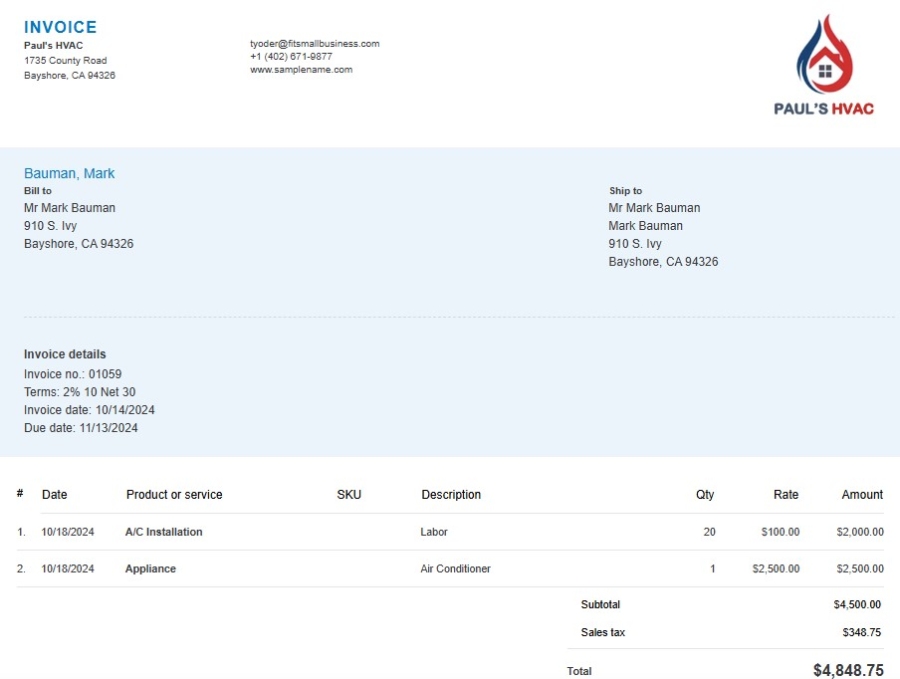

2. 2% 10 Net 30

Customers will receive a two percent discount if the invoice is paid within 10 days; otherwise, the full amount is due in 30 days. For example, an invoice for $1,000 could be settled for $980 if paid within 10 days.

3. Payment in Advance

This is a deposit or payment made by a customer before work starts on a project. For example, a customer might make a 50% deposit to start work on the project, with the balance due upon the completion of the project.

You can use this invoice term if the amount of resources needed to start a project is significant. Payment in advance is common for construction projects since construction firms need to purchase materials and assign workers.

4. Due Upon Receipt

A payment due upon receipt is a payment that customers must make immediately upon receiving the invoice for a transaction. Typically, businesses use payment due upon receipt to signify that payment is due by the following business day.

5. Line of Credit Pay

Most common among larger corporations, line of credit pay gives the customer the ability to pay their invoices over a period of time, such as monthly or quarterly.

6. End of Month (EOM)

The invoice due date is at the end of the month of the invoice, regardless of when the invoice was created. For example, an invoice dated January 25 with an EOM invoice term is due on January 31.

Considerations for the Best Invoice Payment Terms for Your Business

Choosing the best invoice payment terms for your business is essential, as it helps to regulate your cash flow and also impacts your customers’ payment habits.

Here are a few things to consider before setting your terms:

Cash Flow

Although you have to keep customer expectations in mind when setting invoice payment terms for your business, your primary consideration should be your company’s cash flow needs. The best invoice payment terms are the ones that provide enough cash to keep your business running while carefully considering your clients’ needs.

While using the “Due Upon Receipt” payment terms on your invoice can provide a quicker payment turnaround and more reliable cash flow, it can also be inconvenient for your clients. It could also potentially be off-putting to them and make you seem difficult to work with, resulting in even slower payment or a decreased likelihood of repeat business.

Industry Standards

You’ll also want to consider industry standards when setting your invoice payment terms. While the most common invoice payment terms is Net 30, it’s also important to know the standard for your industry.

For example, the most common payment term in the construction industry is Net 90, but in the landscaping industry, it’s Net 7. Ensuring that your invoice payment terms align with industry expectations is a crucial way to ensure that you’re paid on time while keeping your customers happy.

Client History

If you have done business with the client before, you can base the invoice payment terms on your experience with them. Do they pay on time, or do they still owe on a previous invoice? Depending on the experience, you may want to set a shorter deadline for payment. However, if things are going well with the current terms―Net 30, for example―you may want to keep things as they are.

Working with a new client always has some level of uncertainty. You may want to consider asking for payments at different phases of a project once a milestone has been reached or asking for a deposit upfront. This will help demonstrate to your customers that prompt payment is important to your business.

Size of the Invoice

Always consider the invoice amount when determining the payment terms. The smaller an invoice is, the less time you want to spend chasing payment on it. If an invoice is for a small amount, requiring immediate payment or a Net 10 deadline may be most suitable.

Larger invoices may merit a longer deadline so that your client has more time to come up with the funds. If you’re working on a large project with a new client, consider asking for an upfront deposit to reduce the risk of nonpayment.

Our related resources:

Early Payment Discounts

Early payment discounts offer an incentive to customers to pay you before the invoice due date, ultimately saving them money. These discounts help you get paid sooner so you can meet your own financial obligations.

Most invoices with Net 30 and longer terms are coupled with early payment discounts. For example, if a customer pays you within 10 days on a 30-day invoice, you might give them a 2% discount. On the invoice, this would be noted as 2% 10 Net 30.

We selected QuickBooks Online as the best small business accounting software, partly because it makes it easy to offer early payment discounts to customers. When you add a new customer, you can select the payment terms for all their invoices. Assigning payment terms will allow QuickBooks Online to send you an alert when invoices are coming due. If desired, you can send customers a reminder email to ensure invoices are paid on time.

Here’s a snapshot of an invoice that was created in QuickBooks with early payment terms:

Example of invoice with early payment discount terms

Late Fees and Interest

Consider adding late fees or interest charges to your invoice terms to enforce your payment expectation, but be sure to indicate this clearly on the invoice. It’s customary to charge 1.5% to 2% of the invoice amount as a late fee for past-due invoices. You can follow up on delinquent invoices by sending a friendly payment reminder email to customers.

If you need assistance with payment reminders, read our guide on asking for payment via email. We also included three professional templates that you can use—with one being for when payment is past due.

Tips for Encouraging Early Payments

Encouraging early payments is a great way to improve your company’s cash flow and reduce the hassle of chasing late payments. Following are some effective tips to help incentivize your clients to pay promptly:

- Offer early payment discounts. Provide a small percentage discount (i.e., 2% 10 Net 30) for payments made within a shorter timeframe. This can be very appealing for clients who are looking to save money.

- Highlight discounts prominently. Clearly display the discount terms on your invoice by using bold text, a different color, or a prominent position to draw attention to the offer.

- Provide multiple payment options. Offer various options like online payments, credit card payments, ACH transfers, and traditional checks. The easier it is for clients to pay, the more likely they are to do so quickly.

- Send invoices promptly. Issue invoices as soon as goods are delivered or services are rendered. The sooner clients receive invoices, the sooner they can process them.

- Use online invoicing software. Get features like automated reminders, payment tracking, and online payment portals from online invoicing tools. They make it easier for clients to pay and for you to manage invoices. Check out our best invoicing software for top choices.

- Communicate clearly. Ensure your invoices are clear, concise, and easy to understand. Clearly state payment terms, due dates, and accepted payment methods.

- Reward loyal customers. Consider offering additional incentives or perks to clients who consistently pay on time.

- Offer flexible payment plans when needed. Consider extending a payment plan to make it easier for a client facing financial constraints to pay installments.

Strategies for Handling Late Payments

Dealing with late payments is an unfortunate reality for many businesses, but by implementing a clear and

consistent approach, you can minimize their impact on your business and maintain healthy cash flow. Here’s a breakdown of strategies to handle them effectively:

- Take preventive measures. Lay the groundwork by setting clear payment expectations from the start. State your payment terms on quotes, contracts, and invoices—and ensure that your invoices are accurate, detailed, and easy to understand. Include all necessary information (invoice number, due date, payment methods, contact information), and even use accounting software or online tools to send automatic payment reminders before and after the due date.

- Send reminders or make calls: As soon as payment becomes overdue, ask for payment politely via email or make a collection call, as it could be an honest oversight. If the client communicates a reason for the delay, try to understand their situation and work with them if possible.

- Escalate. If initial reminders don’t work, write a collection letter or email reiterating the overdue amount, late payment fees (if applicable), and consequences of non-payment. For larger invoices, consider offering a payment plan to help your client manage their debt. For ongoing services, you may choose to suspend work temporarily until the outstanding invoice is settled.

- Engage a collections agency. If all else fails, consider doing this to recover the debt. Be aware of potential fees and the impact on client relationships. In extreme cases, you may need to pursue legal action to recover the payment. This is typically a last resort.

Frequently Asked Questions (FAQs)

Invoice payment terms outline when a buyer is expected to pay for goods or services they’ve received. They are a crucial part of the agreement between the seller and the buyer, ensuring both parties are clear on payment expectations.

While payment terms can be negotiated and tailored to specific situations, some terms are considered standard practice. The most common is Net 30, which means the invoice is due in full 30 days from the invoice date. It strikes a balance between giving the buyer time to process the invoice and ensuring the seller receives timely payment.

Other common payment terms include Net 15, Net 60, and 2% 10 Net 30, which means that a 2% discount is offered if the invoice is paid within 10 days; otherwise, the full amount is due in 30 days. You can also request Cash on Delivery (COD) or Cash in Advance (CIA) if you require payment upon delivery or before the goods or services are delivered.

Payment terms should be clearly stated on your invoice, typically in a dedicated section under the date and invoice number. It is important to ensure payment terms are easy to find and understand.

Clear payment terms are essential because they help maintain healthy cash flow by knowing when to expect payments. Terms that are well-defined help to minimize misunderstandings and encourage timely payments. Also, transparency in payment expectations can foster trust and strengthen business relationships.

Bottom Line

There’s a lot at stake when choosing your invoice payment terms. They set the tone for your future relationship with customers and affect your business financially. When deciding what invoice terms to offer, you need to weigh the client’s payment history and the potential revenue the job will bring in.