I’ve compiled and analyzed the latest data from the National Retail Federation, Adobe, Salesforce, Square, and Shopify to bring you the most noteworthy Black Friday 2024 insights.

21 Black Friday Statistics to Know: 2024 Sales Data

This article is part of a larger series on Retail Management.

2024 Black Friday Highlights

- 81.7 million people shopped in-store.

- 87.3 million shopped online.

- Consumers spent $74.5 billion worldwide.

- Shoppers spent $8 more on gifts over the 2024 Black Friday weekend than in 2023.

Black Friday 2024 sales data is officially in and shows consumers were serious about shopping this year. Black Friday, the day after Thanksgiving, was the most popular shopping day of 2024 (so far) for both online and in-store sales. In fact, Black Friday 2024 was the busiest in-store shopping day since the pandemic.

In addition to a record number of people shopping, spending also hit new highs. While last year’s spending increased just a modest 2.5%, this year’s Black Friday spending increased 3.4%. And, while last year’s spending increase did not outpace inflation (a 2.5% increase compared with 3.2% inflation), this year’s spending did outpace inflation, with a 3.4% increase in spending compared with a 2.6% inflation rate over the past 12 months.

Before we dive deeper into the numbers, here are the trends and macro factors impacting this year’s Black Friday numbers:

- Shorter shopping window: This year, there are only 27 days between Thanksgiving and Christmas (compared with 32 last year). This shorter timeframe means overall holiday spending is more condensed.

- Cash-strapped consumers: While Black Friday is synonymous with deals, this year, many retailers advertised early Black Friday deals, seasonal price-matching offers, and promotions that extended after Black Friday. So, although many shoppers are searching for the best deals, there is less pressure to purchase on Black Friday itself.

- Presidential election year: Election years typically impact consumer spending in unorthodox ways that can be hard to predict.

- Weather: An unusually warm fall can impact apparel buying, which is typically the most popular shopping category for the holidays.

Overall, the results we’re seeing this Black Friday continue trends we’re seeing broadly across the retail industry: more shoppers heading into stores, though online spending—particularly on mobile—continues to make up a larger slice of the pie.

Here’s my full Black Friday statistics breakdown:

2024 Black Friday Statistics

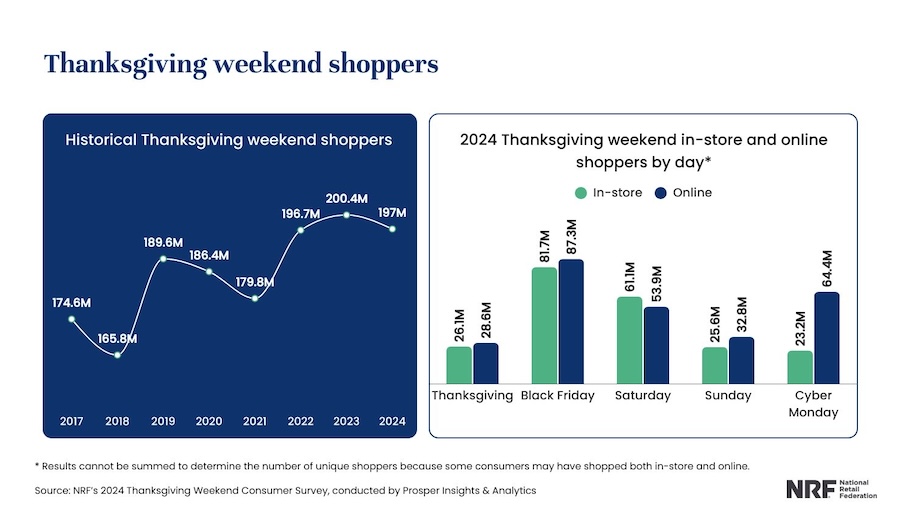

Source: NRF

US Black Friday sales were up 3.4% over 2023

According to Mastercard, year-over-year (YoY) Black Friday spending is up 3.4%, excluding automotive and not adjusted for inflation. This number slightly outpaces US inflation rates and is a modest increase over last year.

Since I’ve been tracking holiday spending data over the past 10 years, YoY growth rates between 3% and 3.5% have been the norm.

Consumers spent $74.4 billion worldwide on Black Friday

According to Adobe, total Black Friday spending reached $74.4 billion worldwide and $17.5 billion within the US.

While Black Friday started as a US shopping day, the tradition has spread globally as more and more global retailers advertise deals for the occasion.

Black Friday ecommerce sales grew 14.6%

While total Black Friday sales saw a steady growth rate, online sales growth outpaced brick-and-mortar sales growth. According to Mastercard, online Black Friday spending increased 14.6% compared with 2023.

Meanwhile, Mastercard data also shows that in-store sales on Black Friday were up by just 0.7% compared with last year. While Black Friday continues to bring foot traffic, more and more of the actual spending is happening on smartphones.

Mastercard also attributes higher ecommerce sales to sporting events, keeping people home, as well as shoppers using all tools available to scour for deals and the lowest prices.

Consumers spent $10.8 billion online during Black Friday

According to Adobe Analytics, online shopping was huge during Black Friday—even more than on Cyber Monday. Online spending was up 10% from 2023, not accounting for inflation. This tracks with the larger industry trends of online shopping, making up a larger and larger percentage of total retail spending.

81.7 million people shopped in-store on Black Friday

Black Friday remains the most popular day for both in-store and online shopping. According to the NRF, 81.7 million consumers shopped in stores on Black Friday, up from 76.2 million last year and the highest level since the pandemic.

87.3 million shopped online during Black Friday

NRF also reports that approximately 87.3 million shopped online, down slightly from 90.6 million in 2023.

What Shoppers Bought

Typically, gift cards, apparel, toys, electronics, and jewelry are among the most-wished-for and most-purchased items during the holiday season. This Black Friday was no exception.

Personal care and toys were top-sellers

Adobe reports that makeup and skincare, smartwatches, and Harry Potter- and Wicked-themed items were the hottest buys on Black Friday 2024.

This is an interesting shift from last year, where electronics including TVs, smartwatches, and headphones were top sellers, as well as KidKraft playsets and Mini Brands.

Apparel and jewelry topped gift lists

Similar to last year, Mastercard reports that while experiential gifts remain popular, jewelry, electronics, and apparel were the top gift sectors over the holiday weekend, with apparel having particularly notable ecommerce sales on Black Friday.

Mastercard’s spending data aligns with NRF’s polling around the most-wished-for gifts this holiday season:

Gifts consumers want the most in 2024

2023 | 2024 | |

|---|---|---|

Gift cards | 55% | 53% |

Clothing and accessories | 49% | 49% |

Books and media | 28% | 28% |

Personal care or beauty | 25% | 25% |

Electronics | 23% | 22% |

Jewelry | 22% | 20% |

(Source: NRF) | ||

13% of Black Friday shoppers are willing to wait in lines over two hours

Customers are willing to wait for good deals. On Black Friday, more so than any other day of the year, shopping is an event that people plan to dedicate lots of time to. Drive Research reports that 13% of shoppers will wait over two hours—up from 11% last year.

The average Black Friday discount was 28% in 2024

Average discount remained the same compared with 2023, when the average Black Friday discount in the US was 28% according to Salesforce.

Average Black Friday Discounts Over Time

- 2024: 28%

- 2023: 28%

- 2022: 27%

- 2021: 26%

- 2020: 34%

(Source: Salesforce)

Shoppers purchased 450k gift cards from Square sellers.

Square sellers, a majority of which are small businesses, sold 450,000 gift cards over Black Friday weekend. This marked a 29% increase from last year. Top gift card categories included food, retail, leisure and entertainment, and beauty and wellness.

Where Consumers Shopped on Black Friday

Though Black Friday shopping is best known for doorbuster crowds at dawn, more and more Black Friday shopping is happening online—and at small businesses.

Most consumers (87.3 million of them) shopped online

According to NRF, Black Friday was also the most popular day for online shopping. Roughly 87.3 million consumers shopped online on Black Friday, down from 90.6 in 2023 but on par with 87.2 million in 2022.

By comparison, approximately 64.4 million consumers shopped online on Cyber Monday, down slightly from 73 million last year.

Black Friday In-store and Online Shoppers

In-store | Online | |

|---|---|---|

2024 | 87.3 million | 64.4 million |

2023 | 90.6 million | 73 million |

2022 | 87.2 million | 77 million |

(Source: NRF) | ||

Ecommerce sales increased 14.6% YoY

Mastercard reports a 14.6.5% increase in online sales during Black Friday. The convenience of online shopping is hard to argue with the day after Thanksgiving, when many folks are watching sports and spending time with family.

Buying online also makes it easier to compare prices, which is always a top purchasing factor, especially on Black Friday.

Shopify sellers peaked at $4.6 in sales per minute during Black Friday

It’s hard to talk about ecommerce performance without mentioning Shopify, which powers many online businesses of all sizes, including many small businesses. During Black Friday, Shopify sellers raked in up to $4.6 million per minute, hitting peak sales at 12:01 p.m. EST.

Learn more:Shopify Statistics to Know

Square sellers saw peak traffic at 3:10 a.m. during Black Friday

Square, which powers millions of small businesses, interestingly saw peak traffic at 3:10 a.m. EST on Black Friday.

Last year, Square sellers saw peak traffic at 2:09 p.m. on Black Friday. In 2022, the peak happened on Cyber Monday.

44% used an AI shopping assistant on Black Friday

AI is playing an increasingly large role in consumers’ daily lives, and Black Friday was no exception. According to a survey by Attest, more than 44% of Americans shopping on Black Friday planned to use an AI shopping assistant.

Of shoppers using AI, 56% use it to find the lowest prices

As we know, deals and discounts are what drive Black Friday sales. And shoppers are increasingly savvy. Attest also found that 56% of shoppers who plan to use AI Black Friday shopping would use it to find the lowest prices.

Black Friday Trends

Now that we’ve covered what happened over Black Friday 2024, including what people bought and where they shopped, let’s zoom out to see some bigger-picture consumer trends and YoY patterns.

Black Friday has the traffic, but Cyber Monday has the spending

Black Friday has the highest number of in-store and online shoppers of the entire five-day period from Thanksgiving through Cyber Monday. However, the most spending happens on Cyber Monday.

According to Adobe Analytics’ Black Friday sales data, the shopping holiday raked in $10.8 billion in online revenue, while Cyber Monday brought in $13.3 billion in online sales.

Every year, more people shop online than in-store for Black Friday

For at least the past several years, more people have shopped online than in-store for Black Friday. Granted, the COVID-19 pandemic likely accelerated this shift, and we are seeing more and more people returning to stores for Black Friday shopping.

In-store vs Online Black Friday Shoppers YoY

In-store Shoppers | Online Shoppers | |

|---|---|---|

2024 | 81.7 million | 87.3 million |

2023 | 76.2 million | 90.6 million |

2022 | 72.9 million | 87.2 million |

2021 | 66.5 million | 88 million |

(Source: NRF) | ||

Shoppers are spending less because of inflation

According to Drive Research, specifically, rising costs of living and groceries are the top reasons some consumers are spending less this holiday season.

Specifically:

- Rise in cost of living (80%)

- Increasing grocery costs (66%)

- High inflation (59%)

- Fewer people to shop for (24%)

- Job uncertainty (21%)

- Fluctuating interest rates (7%)

15% of shoppers wear pajamas during shopping trips

Which makes sense, considering 30% start their shopping between 5 a.m. and 10 a.m. on Black Friday, which is the most popular time to head out, according to Drive Research.

12% of shoppers are finished with holiday shopping after Black Friday

Drive Research reports that 42% of shoppers wrap up holiday shopping by early to mid-December, but 12% of folks are done by the end of the day on Black Friday.

However, a sizable 22% don’t finish holiday shopping until the week leading up to Christmas.

Frequently Asked Questions (FAQs)

In 2024, the average Black Friday discount across all product categories in the US was 28%, according to Salesforce.

In 2024, 76.2 million people shopped in-store,, and 90.6 million people shopped online during Black Friday, according to the National Retail Federation.

The most-sold items on Black Friday in 2024 were makeup and skincare products, according to Adobe. Electronics, toys, apparel, and jewelry also typically sell well during Black Friday.

Bottom Line

Black Friday is one of the biggest shopping days of the year. Yet, the 2024 holiday season is far from over—consumers still have over half of their shopping left to do, according to the NRF.

Use the Black Friday stats and figures above to learn, get insights into what consumers expect, and anticipate trends for the rest of the season.

Follow up with our guides to Black Friday marketing strategies and Holiday Readiness to put this data into action.