As you explore insurance for your small business, you’ll likely encounter terms in your policy or in conversations with your provider that will give you pause. We’ve put together a business insurance glossary of the most commonly used business insurance terms for small businesses to help you better understand the lingo.

A

ACORD Certificate of Liability (COI)

A certificate of liability is a short document showing proof of insurance. Vendors, contractors, and consultants are the industries that will most frequently need to provide a COI. ACORD is the organization that standardizes nearly all insurance documents in the industry.

Actual Cash Value

On a commercial property policy, some insurers designate the property as “actual cash value.” This is a way to determine the property’s value while taking depreciation into account.

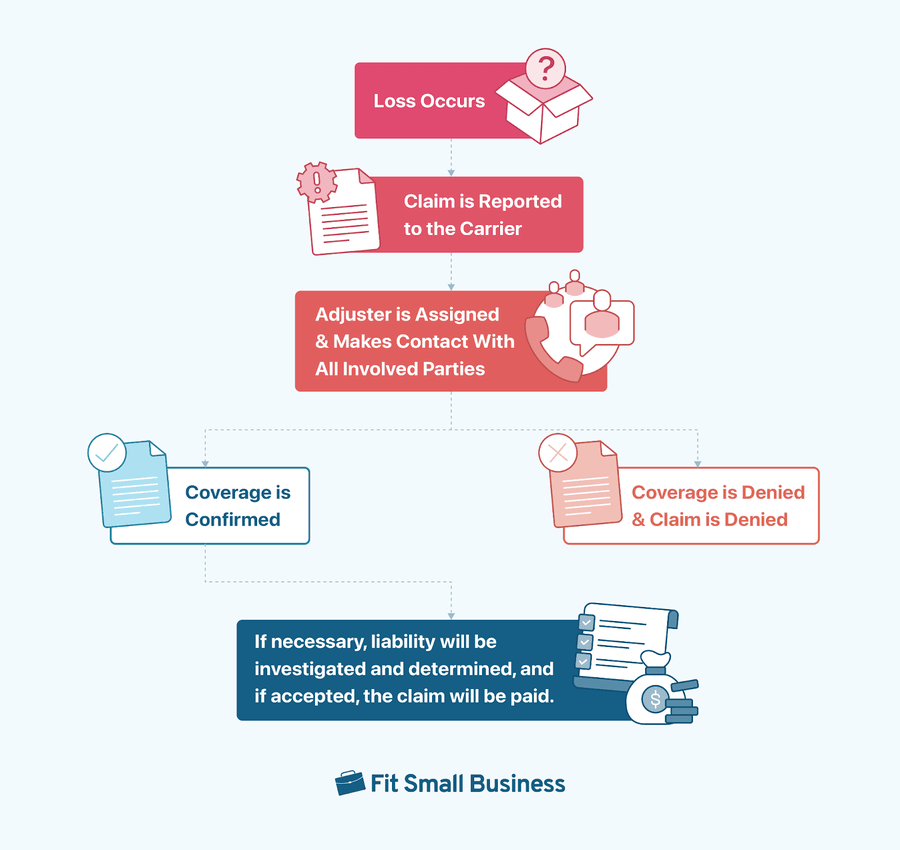

Adjuster

This is the title of an individual who will investigate, determine applicable coverages, and resolve any loss a business files with an insurance company. Adjusters are usually licensed by a state or multiple states.

Additional Insured

When you need to add someone, like a vendor, contractor, or landlord, to your policy, the added individual is referred to as an additional insured. This is the term used to address them because while they are not the policyholder, the policy still provides coverage for them.

Agent

An agent is a licensed and appointed representative of an insurance company or multiple insurance companies. They have the express authority to market and sell products on behalf of the insurance company. Companies can hire an insurance agent to be a captive agent (working for one company) or an independent agent (selling for multiple companies).

Aggregate Limit

General liability insurance and other liability policies carry an aggregate limit. This is the ceiling amount that the policy will pay out over the policy period. For example, if a general liability aggregate limit is $2 million and you have a claim that costs $500,000, then the remaining limit for the policy period would be $1.5 million.

B

Blanket Coverage

This special type of property insurance covers multiple items (or properties) at different locations. The advantage here is that instead of needing multiple policies, you have one policy for everything.

Bodily Injury

This type of liability coverage is typically found in general liability or commercial auto insurance. In both instances, bodily injury covers the same: an injury to a person brought about by a negligent act on behalf of or by the business. Like auto insurance, bodily injury sometimes covers intangible losses like “pain and suffering.”

Broker

A broker is like an agent. If you’re comparing insurance brokers vs carriers, the key difference is that while an agent works for an insurance company, a broker works on behalf of the customer. A broker also works with multiple carriers.

Builder’s Risk Policies

This is a specialized property policy that protects a building project. It can be purchased as an endorsement or a stand-alone policy. There is a lot to this kind of policy, so we have in-depth coverage of how builder’s risk policies work, approximate costs, and providers.

Business Interruption Insurance

Typically included in a business owner’s policy (BOP), business interruption insurance provides your business with income during a covered loss that interrupts the business. So, if a windstorm tears off part of the roof and you have to close for a week to repair it, business interruption insurance can help offset the lost income.

Business Owner’s Policy (BOP)

A BOP is a special policy for small businesses that combines three coverages into one policy: general liability, property, and business interruption insurance.

Business Personal Property (BPP)

This policy provides first-party property coverage for nonstationary property like officer furniture, equipment, merchandise, or tools.

C

Care Custody and Control

This is a very specific term related to garage keeper’s liability (although it extends to businesses like veterinarians). When someone’s property is in your business’s care, custody, and control, then the rules of insurance change.

Claim

This is the formal name for notifying an insurance company of a loss suffered by your business. A claim can be filed for a first-party loss, like smoke damage, or a third-party loss, like a slip and fall in your store.

Claimant

There are two parties in a claim: the insured and the claimant. The claimant is the one who is not insured by the insurance company handling the claim.

Claims-made Policy

Insurance companies will sell insurance on certain types of forms, one of them being a claims-made policy. This means coverage is only available for losses that happen while the policy is active. After the policy is canceled, if you file a loss, even if it happened during the policy period, there is no coverage for it.

Coinsurance

In property insurance, coinsurance refers to the minimum amount the property owner must have the property insured for. Typically, it is a percentage of the total value of the property.

Collision

This is a first-party coverage for auto and semitrucks. Collision is a no-fault coverage, meaning it doesn’t matter who is at fault. If your vehicle is in an accident and is damaged, you can use collision to handle the damages. Collision notably does not cover weather-related incidents or accidents with living animals.

Commercial Auto Insurance

Auto, vans, trucks, semitrucks, and any type of vehicle need commercial auto insurance. There are state minimums for liability that must be met to legally operate the vehicle. Additionally, first-party coverages can be purchased.

Comprehensive Coverage

Another first-party coverage for commercial auto insurance is comprehensive. Sometimes referred to as other-than-collision (OTC), this handles weather-related losses like hail, theft, vandalism, and damage from a collision with an animal.

Commercial Property Insurance

A first-party coverage for small businesses, the commercial property covers buildings, along with the contents, tools, equipment, and merchandise owned by a business. There are specific types of commercial property insurance under the general term.

Cyber Liability Insurance

Like a BOP, cyber liability insurance can carry first-party and third-party protection. This coverage helps your business when it is the victim of a cyberattack. From ransomware to a data breach, cyber insurance can help restore data, replace property, and facilitate public relations.

D

Data Breach Insurance

As a type of cyber insurance, data breach insurance is limited to helping with the consequences of your business suffering a data breach. Usually, this insurance is for losing sensitive information, like personal health information. It helps manage the notification of impacted victims and even monitors credit for those affected by the breach.

Declarations Page

Part of the insurance policy, the declarations page provides key takeaways about the policy: policy period, policyholder, covered locations, and the types of coverage provided by the policy. Commonly, this is something that will be requested to see if an auto policy is active or inactive.

Deductible

All first-party policies and professional liability carry a deductible. This is the amount of money the policyholder agrees to pay before the insurance company covers the loss. The deductible applies to every claim, and the money is not paid to the insurance company.

Directors and Officers Liability (D&O)

This specialized liability policy protects directors, officers, and their families by protecting their personal assets in the event of a lawsuit.

E

Employment Practices Liability (EPLI)

EPLI gives an employee coverage for allegations of unfair hiring or hiring practices, along with charges of discrimination. This is an important but often overlooked coverage because of the numerous types of losses it can protect you from. Read more about its application and areas of coverage in our guide to EPLI insurance.

Endorsement

An insurance endorsement is a way to modify existing coverage. If you have a policy but need some specialized form of protection, the insurance company may sell an endorsement offering this.

Errors & Omissions (E&O) Insurance

E&O insurance is a type of liability for the service industry. It covers mistakes involving contracts or services and is especially applicable if the error caused financial harm. The coverage is also called professional liability.

G

General Liability Class Codes

Each job or industry is assigned class codes by insurance companies. These class codes reflect the insurer’s conclusion of the level of risk involved for that particular job.

General Liability Insurance

This is an important type of coverage for small businesses, offering third-party liability coverage for bodily injury, property damage, and claims of personal harm and advertising injury.

Grace Period

This is the period between when the premium payment is due and when the policy will be officially canceled for nonpayment.

H

Hired & Non-owned Auto (HNOA) Insurance

HNOA extends liability coverage to vehicles not owned by a business but driven for business purposes. Typically, this can be purchased as an endorsement of general liability.

Home-based Business Insurance

This is another name for small business insurance. The main difference is that the limits are more in line with the type of risk exposure you’d expect from a business operating out of a home.

Host Liquor Liability Insurance

This policy provides liability protection to hosts of events where alcohol is served. It is similar to liquor liability insurance but limited to special events and the hosts’ exposure to risk.

I

Insurance

Insurance is the transfer of risk from one party to another party. A small business pays an insurance company in exchange for the company agreeing to accept some of the risk of the business.

Insured

The proper name for the party who is the recipient of insurance coverage.

Insuring Agreement

This is an important part of an insurance policy because it is the basis of the contract upon which the insurance policy is built. It is where the insured promises to pay the premium, and in exchange, the insurance company promises to cover qualified losses.

Inland Marine Insurance

This is a type of property insurance for items that move around from place to place. Tools for a handyman can be insured under an inland marine insurance policy.

L

Liable

In a third-party claim, one party is liable for the loss. This means their negligent actions contributed to or directly led to the loss.

Liability

Liability is the term used by an insurance company to describe the individual or business that is the majority contributor to the loss.

Liquor Liability Insurance

This type of coverage is purchased to cover the liability exposure restaurants and bars have for serving alcohol. This policy is needed because general liability does not cover liquor-related loss.

M

Managing General Agent (MGA)

An MGA will often function like—and market itself as—an insurance company. An MGA has underwriting authority and can even develop insurance programs. It does not handle claims.

Material Misrepresentation

This is the act of intentionally hiding or misrepresenting information about yourself or your business when applying for insurance. This is a type of fraud that, if discovered, can make your policy null and void.

Medical Payments Insurance

A no-fault coverage is available for auto insurance and as part of a general liability policy. This helps with medical bills if someone is injured.

Minimum Earned Premium

If you cancel your policy, you will not get all your money back. The portion the insurance company keeps is the minimum earned policy, which is used to help cover a loss.

N

Named Insured

The primary policyholder to which a policy is issued is the named insured. This can be a business or individual.

Named Perils

Peril is another word for loss. Named perils are policies that name specific types of covered losses. Usually, this type of policy is found in the property branch of insurance. An example of a named peril is wind.

Nonrenewal

Sometimes, an insurance company will choose not to offer you the option to renew your policy—this is a nonrenewal. Functionally, it is a cancellation at the end of the policy period.

O

Occurrence-based Policy

This type of policy provides coverage based on when the loss happened. It doesn’t matter if you file a claim after the policy is no longer active as long as the loss actually happened during the active period of the policy.

Open Peril Policy

Unlike a named peril, an open peril policy covers all perils or losses. Instead of naming what is covered, the policy will specifically name the types of losses excluded from coverage.

P

Policy Limit

Every type of insurance policy has a maximum limit to the amount it will pay out during the policy period. This limit is the policy limit. It can also be referred to as the aggregate limit.

Per Claim Limit

Policies usually break down the policy limit to sublimit per claim or the total amount it will pay out per claim. So, if the policy has $1 million for a total limit, it may have $500,000 for the per-claim limit.

Personal and Advertising Injury Insurance

General liability covers claims of personal injury, say through slander or advertising injury by your business.

Personal Injury Protection

This type of auto coverage helps with medical costs from an auto accident. It can also provide additional assistance, such as wage reimbursement or paying for household services. In some states, this is a required coverage.

Premium

The premium is the amount of money the insured agrees to pay the insurance company in exchange for coverage. The premium can be paid in a variety of ways, but most usually, it is paid monthly or annually.

Premium Audit

Workers’ compensation rates are tied directly to the premium. A premium audit is how the provider makes sure the premium paid is accurate.

Products-completed Liability

Most general liability policies contain a provision for product-completed liability, offering the same types of coverages for bodily injury and property damage at job locations where you have completed work.

Product Liability

Available with general liability or as a stand-alone policy, this protects your business if there is a loss from the result of a product you sell.

Professional Liability

Also called E&O insurance, professional liability is an important coverage for service industry businesses, covering allegations of negligence over contractual promises, advice, or service given. Often, the loss leads to financial harm.

Proof of Insurance

Proof of insurance is given through a document or certificate of insurance that demonstrates you have active insurance, other insureds listed on the policy, and policy dates and limits.

Property Damage

Property damage can refer to one of the coverages in general liability or auto liability. Both policies cover the same: damage to someone else’s property.

R

Reinstatement

If a policy is canceled, usually for nonpayment, you can apply for the coverage to be reinstated. This is a reinstatement of a policy.

Rental Property Insurance

This is a type of commercial property insurance for rental properties. Rental property insurance can include lost income and liability, too.

Replacement Cost Value (RCV)

This will cost the insurance company to replace your damaged or lost item. Unlike ACV, depreciation is not factored into RCV.

Retroactive Date

This date puts a limit on the extent of coverage for claims-made policies. Specifically, it provides coverage that can be used before you purchase the policy.

For instance, if you purchase a policy on April 1st with a retroactive date of January 1st, and in May, you learn of a loss that happened in March, then this loss would be in the time between the retroactive date and the start date. Hence, you could file a claim on it.

Rider

A ride is another name for an endorsement. The additional coverage “rides along” with the existing coverage, hence the name “rider.”

Rideshare Insurance

Rideshare is a special type of liability insurance for individuals who share their vehicle with others for business purposes. This is essential coverage for people who drive for any transportation network company.

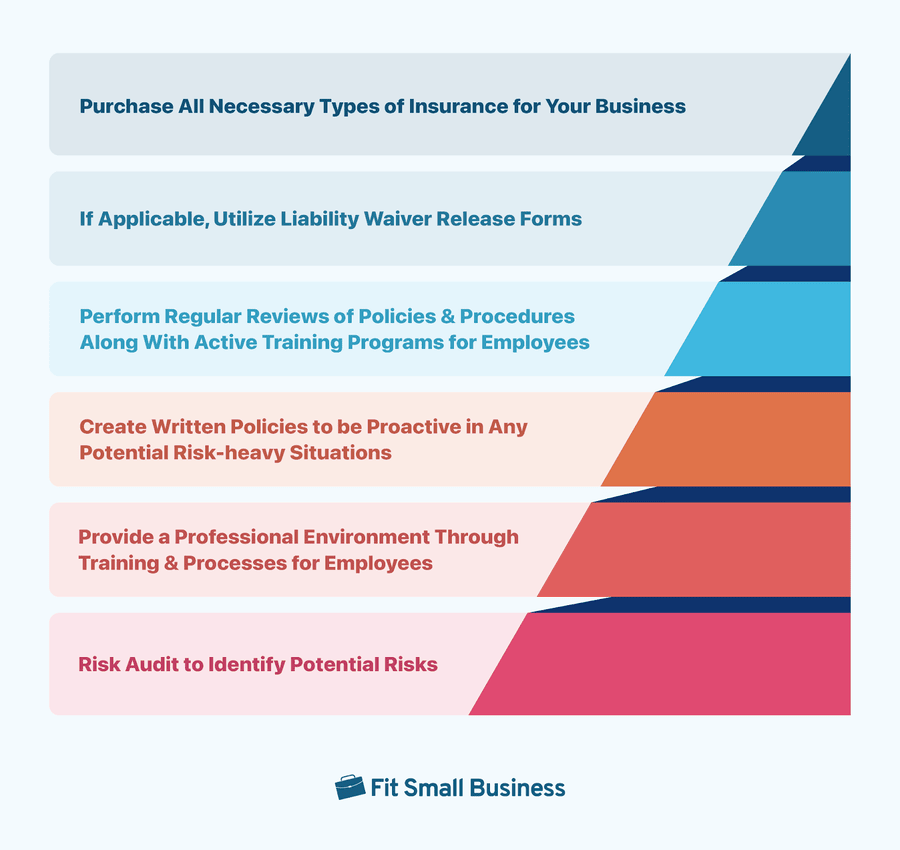

Risk Management

Risk management is the process of putting policies and procedures into place to minimize the risk of a loss at your business.

S

Self-insured

Being self-insured is the process of proving financial responsibility. This means you have enough funds set aside to cover a loss out of your own pocket instead of purchasing a policy.

Short-term Liability Insurance

Short-term liability is a normal policy that is purchased for a short period of time. This can be for hours, a day, days, weeks, or even a month.

Special Event Insurance

Similar to a short-term liability policy, special event insurance covers a specific event. This could be a festival your organization organizes and puts on or a company holiday party where alcohol is served.

State Compensation Insurance Fund

Four states—Ohio, North Dakota, Wyoming, and Washington—administer workers’ comp. What this means is you cannot purchase workers’ comp from a private employer in those states; instead, you can purchase them through a government program.

Stop Gap Coverage

This is a type of employee liability protection employers can purchase for a “gap” in their workers’ comp policy. Most workers’ compensation policies carry liability. But for the four compensatory states, employers will generally need to purchase stop-gap coverage, too.

Subrogation

This refers to the act by an insurance company after it pays a claim and its insured is not liable; after the claim is resolved, it will pursue financial restitution against the liable party. If the liable party is uninsured, the insurance company can still seek compensation for the loss.

Surety Bond

Bonds are not insurance, but they are similar. A bond is an agreement to pay a fixed amount if specific terms or conditions are not met.

T

Third-party Cyber Liability

Third-party cyber liability protects your business from accusations that a cyber incident caused them harm. This can include financial help for attorney fees, fines, and penalties, and even settlements and judgments by a court.

Terrorism Risk Insurance Act (TRIA)

Following September 11, the US government made it possible to purchase terrorism insurance since terrorism was previously an excluded incident. When getting a quote, providers will ask if you want the quote to include TRIA, which refers to terrorism coverage.

W

Waiver of Subrogation

This provision in the insurance policy keeps an insurer from pursuing subrogation from a third party to recover its losses.

Workers’ Compensation Class Codes

A key part of calculating the workers’ comp premium is class codes. These codes classify the risk associated with jobs within specific industries.

Bottom Line

The next time you’re bidding on a job and are asked to provide a COI with the contractor listed as an additional insured, you’ll know what that means. Business insurance terms can be confusing, but they don’t have to be. Bookmark this insurance glossary because we update it continuously, making it a valuable tool for your small business.