Payroll templates are pre-designed spreadsheets and forms that help organize, calculate, and track payroll data. They’re best for business owners preparing to hire their first employees and wanting to better manage payroll. You can use these templates instead of, or in conjunction with, payroll software to eliminate extra costs for add-ons like time tracking.

Consider Gusto if you need an easy way to process payroll and automatically sync time tracking to payroll without using templates. It is an affordable option that offers automatic payroll tax payments and filings at no additional cost.

If you prefer to use our free printable templates, however, simply click below to download the ones that best suit your specific needs.

Key Takeaways:

- Payroll templates are best for very small businesses

- If you have tipped employees, make sure you’re using a template designed for that type of workforce

- Once you hire more than a handful of employees, it’s best to consider payroll software

How Payroll Templates Work

Payroll templates are pre-formatted, so all you need to do is fill them in with the applicable information. If you need to personalize the templates, make sure you have an editable copy so you can add or change rows, columns, and cells.

Free payroll templates created through spreadsheet programs (like Microsoft Excel and Google Sheets) can help you save time, especially if these use formulas to automate calculations. These formulas work as a calculator and automatically figure solutions once you enter the required numerical information.

There are also simpler templates, such as employee information sheets and vacation trackers, that may be printed and filled in by hand. However, some documents (like pay stub templates) require data to be typed versus handwritten as it appears more professional.

Note that if you opt to use an online payroll template instead of creating one from scratch, be prepared to download and save it to your computer. If you start using a template before saving it, you could risk losing valuable data in the event of a system or website crash.

Below, you can click on the template you’re interested in for more specific information on what it offers and how it can help you with your small business’s payroll:

What it is: A comprehensive organizer for yearly payroll activities

Why use it: To ensure accuracy and compliance in annual financial reporting

How to use it: Compile all payroll records from the year, ideally using the monthly tabs to enter payroll as you go. Input data into the designated fields, reconcile totals, and ensure accuracy in tax filing and financial reports.

Our 12-month template is pretty extensive and can calculate gross and net pay for each month as well as taxes for each employee provided that you enter the required tax rates. You can even see payroll expenses broken down by month and totaled as annual expenses. Benefit contributions, payroll taxes, and reimbursements are a few other components managed in the spreadsheet.

Another useful feature is the PTO summary tracker within the “Set Up” tab. As long as you enter the annual number of PTO hours each employee is entitled to along with the credits used each pay period (in the monthly tabs), the spreadsheet will keep a running total of available PTO per employee.

There’s also a separate tab for employer payroll taxes and workers’ compensation expenses. It automatically calculates how much you owe each month—provided you enter the rates you’re required to pay. Note that FICA tax rates are already built-in, so you won’t need to re-enter them.

What it is: A forecasting tool for managing payroll expenses

Why use it: To maintain financial health through precise budgeting

How to use it: Estimate future payroll expenses based on current data and projected growth. Enter estimated figures to forecast payroll costs, and adjust budgeting strategies accordingly.

Creating a payroll budget is essential, especially for those preparing to either become an employer or continue business operations for a new year or month. You need a way to plan for the expenses ahead so you can avoid cash shortages and issues with the IRS.

With a payroll budget template, you can plan and track expenses for staff wages, benefits, and Social Security taxes. This form has five tabs, wherein the first one contains instructions. It provides you the option of budgeting for a month, a year, or both. Regardless of which time frame you choose to budget, you should always start with the corresponding “Wage Budget by Employee” tab. It feeds into the “Payroll Expense Budget” tabs and automatically calculates FICA taxes.

In addition, this template enables you to budget for both salaried and hourly employees. There’s even a special place to add in projected bonus payments. Plus, you can use it to plan for overtime expenses.

One item that doesn’t fit in the template is tips. If you have tipped employees, note that while you will need to pay taxes on employee tips received, the tips won’t be a payroll expense to your business.

In terms of budgeting tip payments, if you are paying tipped employees below minimum wage (meaning you are eligible for the tip credit—something not every state allows), budget at or above the minimum wage amount. This is a conservative practice that will ensure you have enough money to pay employees should they not receive enough tips to boost their hourly wage to the required minimum wage amount. It also ensures your tax budget is sufficient.

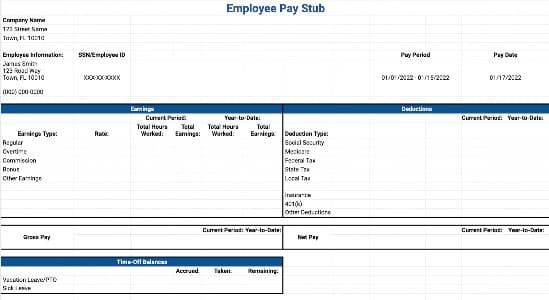

What it is: A detailed record of employee earnings and deductions

Why use it: To enhance transparency and trust with employees, and to meet state pay stub laws

How to use it: Gather individual employee wage and deduction information. Fill out the template for each pay period and give pay stubs to employees.

Depending on your state laws, you may be required to provide your employees with pay stubs that list how much you paid in wages, the period for which you paid them, and other pay-related details. To find out all the nuances related to pay stubs, check out our guide on creating pay stub templates. You can also check our forms below to find one that may work for your business.

In addition to the general pay stub we’ve provided, we also have a few specific pay stub templates that you can use if they fit your business.

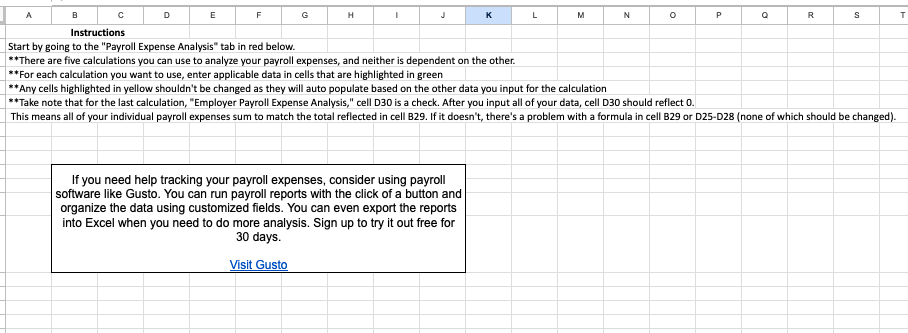

What it is: A tool for in-depth examination of payroll costs

Why use it: To identify opportunities for cost savings in payroll expenses

How to use it: Input payroll expenses into the template, analyze data for trends and outliers, and identify opportunities to streamline costs without compromising employee productivity, satisfaction, or legal compliance.

A payroll expense analysis template is good for any company that’s undergone at least a month of payroll expenses. It provides key metrics to help you identify any red flags you should monitor going forward. With our template, you have five calculations that you can choose to use. You can enter annual payroll expense totals to see if there are any noticeable trends. The other analyses perform various calculations for you, while the payroll trend analysis is more of an observation than a calculation.

There’s even an option to evaluate management wage expenses as a percentage of total expenses. If you want to make comparisons, you can substitute management costs with labor costs for other staff types (like dishwashers, hosts, and chefs). Having access to this data can help you review how you schedule certain employees to drive down costs or identify whether you’re overpaying in some areas.

For example, if you own a restaurant, you can use the template to calculate how much of your revenue is used to cover payroll expenses. Restaurateurs typically aim to keep labor costs below 30% of sales, according to Indeed. Imagine finding out your business is spending 50% on labor costs after entering the required data into the payroll template. This allows you to perform further analysis to figure out what’s driving the excessive costs.

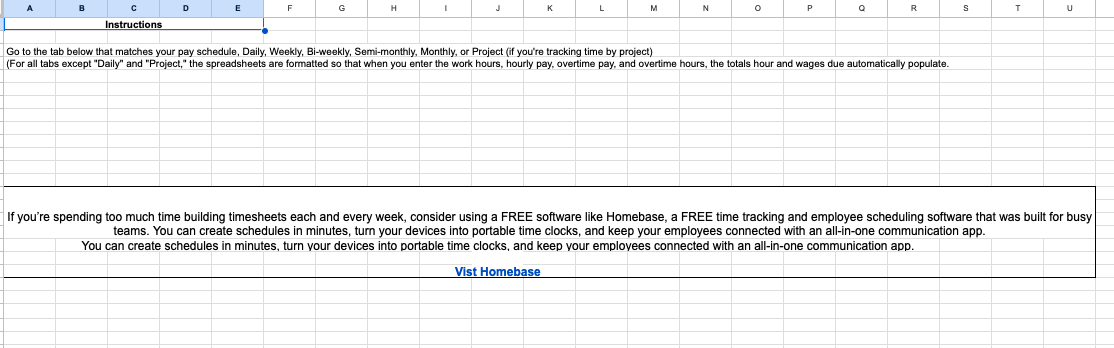

What it is: A tracker for hours worked by employees

Why use it: To simplify payroll calculations to ensure accurate pay

How to use it: Have employees record their daily hours worked. Enter this data into the template and calculate pay based on hours worked plus any overtime, ensuring accurate employee compensation.

If you don’t have a time tracking software like Homebase, you need a timesheet to track employee work hours for payroll processing. This is critical for businesses that hire hourly employees like restaurant servers.

We have six different free payroll time sheet templates available for you to use. There’s a time sheet for employers that pay daily, weekly, biweekly, semimonthly, monthly, and by project.

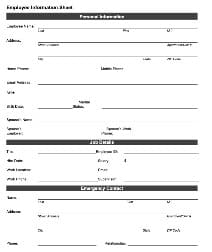

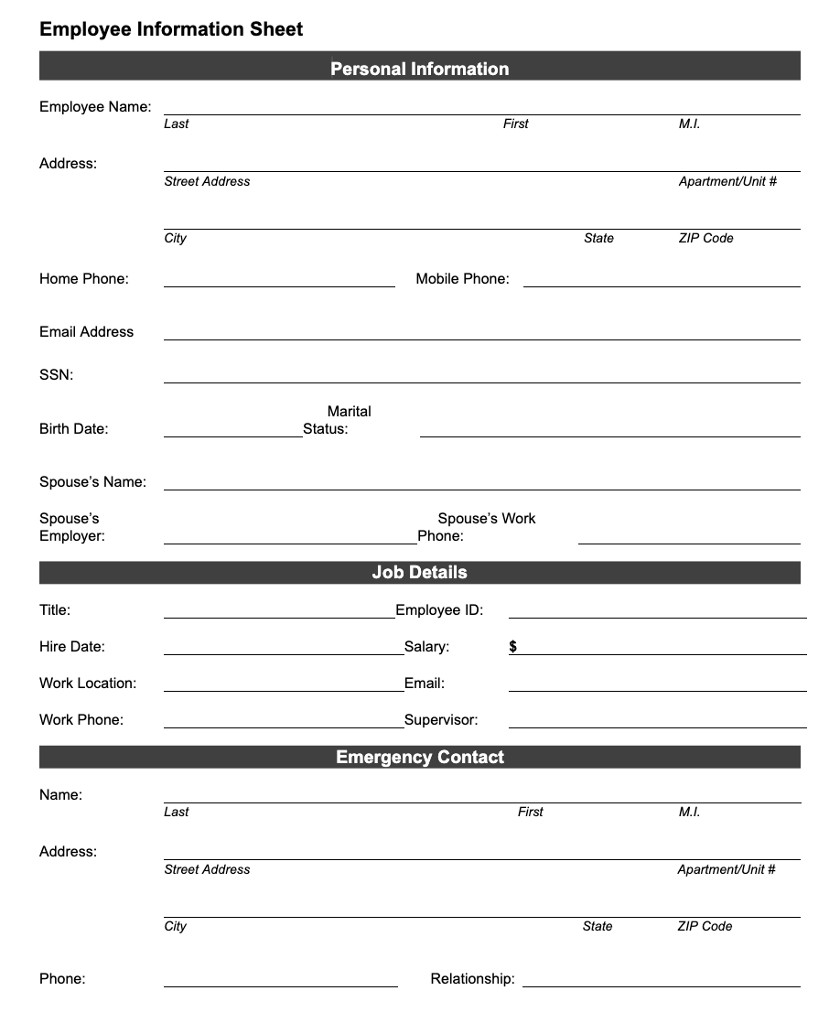

What it is: A database for storing essential employee information

Why use it: To streamline personnel management and record-keeping

How to use it: Collect essential information from each employee. Input data into the template, creating a comprehensive database. Update regularly to keep records current.

If you’re not using payroll software, like Gusto, for pay processing, our employee information sheet is useful for organizing new hires. You should print several copies so you can have the templates on hand when new employees start. It’s also pretty self-explanatory—new hires enter their personal information, like their name, date of birth, and emergency contact information, in specific data fields. There’s even a section for job details with spaces for pay-related information and a supervisor’s name that you can complete.

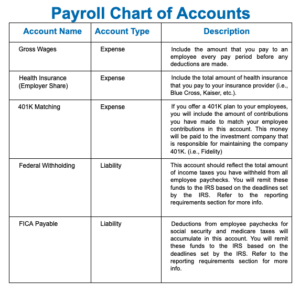

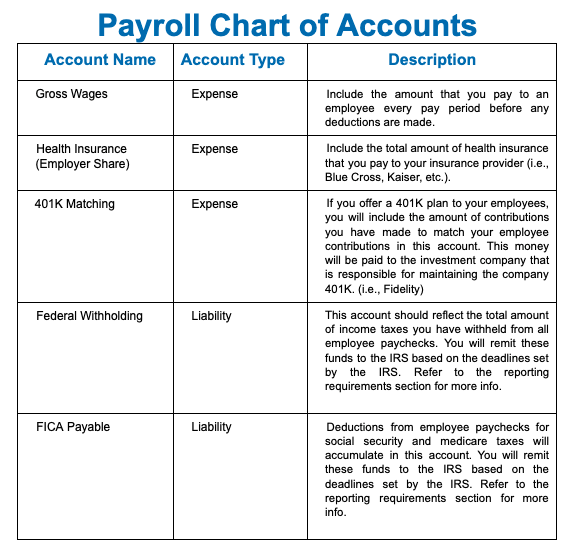

What it is: An organizational tool for categorizing payroll expenses

Why use it: To maintain clear and accurate financial records

How to use it: Categorize each type of payroll expense. Use the template to allocate expenses correctly within your accounting system. This organization provides clear financial oversight and reporting.

Before recording payroll transactions in your company’s financial ledger, you must have a chart of accounts that includes payroll accounts. Our payroll chart of accounts template can be used and printed as is without adding any information to it. However, if you need to personalize the template—whether by renaming an account or updating a description—you can copy the data and paste it into a Word file.

To start an effective payroll accounting system, click on the button below to download our free payroll chart of accounts.

What it is: A system for monitoring employee vacation leave

Why use it: To manage staffing needs efficiently throughout the year

How to use it: Record employee vacation requests and approvals. Monitor remaining leave balances to manage staffing needs efficiently. Update the tracker regularly to reflect accurate leave data.

If you offer your employees PTO or paid vacation time—one of the best types of employee benefits to offer—then you’ll need to track the PTO hours used. Our free vacation tracker can be used either as an electronic spreadsheet or in printed form. It tracks vacation hours by day and month and has 12 tabs labeled by month.

If you opt to use the template electronically, note that the total hours will automatically populate as you enter data. This makes it easy to monitor how much PTO each employee has earned.

You can also print the tracker and post it in your office for easy access. However, be sure to delete all the data in Column AG (titled the “Total Hours” column) before printing. Currently, it has a formula that sums all the cells to the left of it, which explains why it reflects zero. Once you delete the formulas, the cells will become blank, leaving space for you to enter a total at month-end manually. You can track employee vacation hours using the spreadsheet, or print it for easy access.

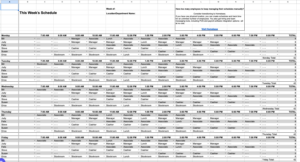

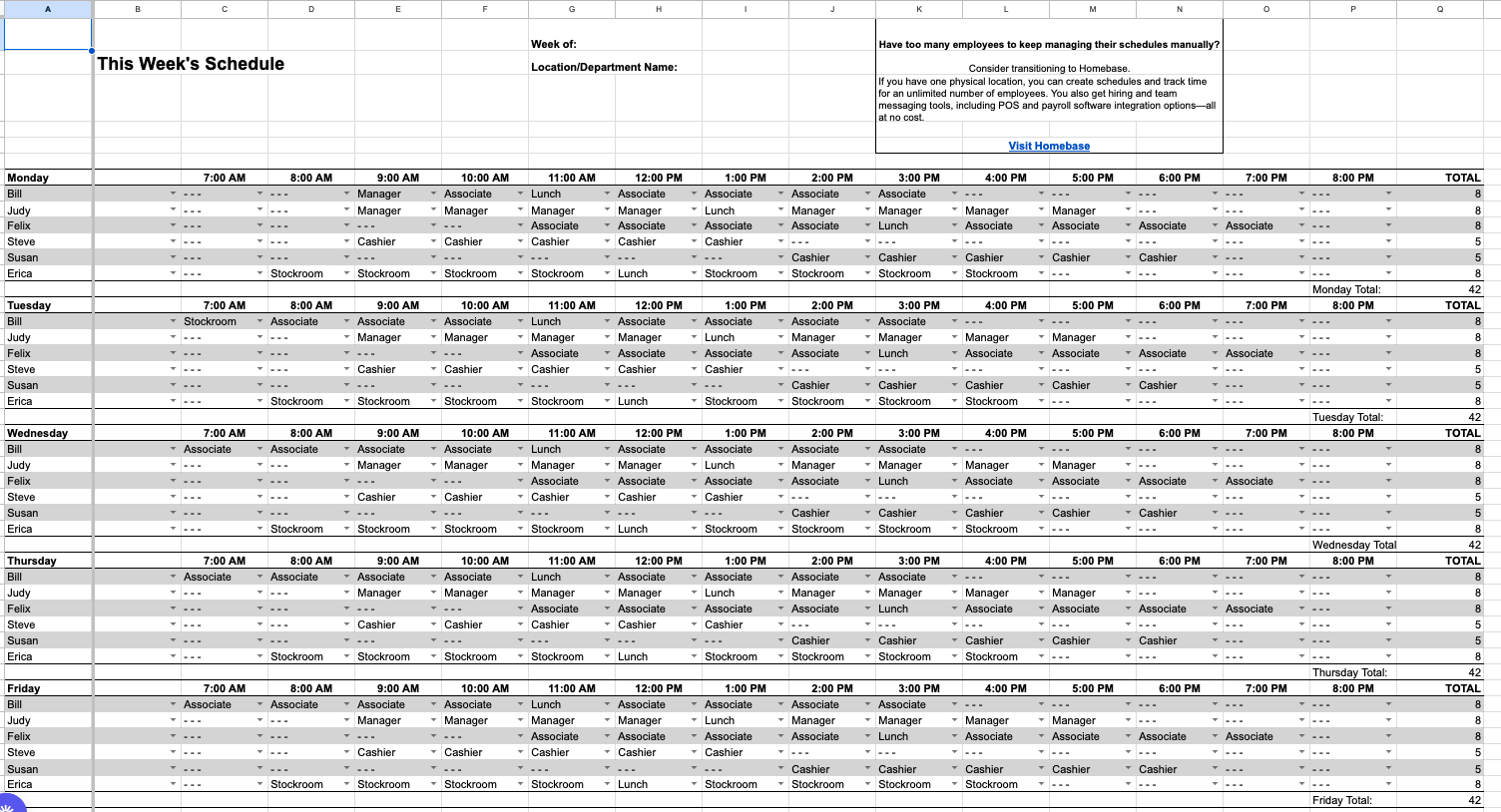

What it is: A planner for assigning work shifts and hours

Why use it: To ensure optimal staff allocation and meet operational demands

How to use it: Optimize workforce allocation, addressing fluctuations in demand effectively. This is essential for industries like healthcare and hospitality where appropriate coverage is essential.

Having an employee scheduling template is useful, especially if your company operates outside of normal business hours (8 a.m. to 5 p.m.). We have two templates available for you—one allows your employees to request changes within the spreadsheet, while the other doesn’t. Both forms help you create weekly schedules as far into the future as you’re willing to plan.

Integrating Payroll Templates with Your Accounting System

Integrating payroll templates with your accounting system streamlines financial management and ensures accuracy in reporting and budgeting. Follow these tips for seamless integration.

- Choose compatible formats. Ensure your payroll template is in a format that’s easily importable to your accounting system. Common formats include CSV or Excel files, which you can easily create from Google Sheets. Compatibility eliminates the need for manual data entry, reducing errors.

- Automate data transfer. Use tools or features within your accounting system that allow for the automatic import of payroll data. This automation saves time and ensures data is transferred accurately and consistently.

- Use consistent data fields. Maintain consistency in how data is categorized in both your payroll template and accounting system. For example, employee names, pay rates, and deduction types should be uniform across both platforms. With our templates, you can customize these fields to meet your needs.

- Schedule periodic reconciliations. Regularly schedule reconciliations to ensure data in your payroll templates matches what is recorded in your accounting system. This practice helps identify discrepancies early and maintains the integrity of your financial data.

- Train your team. Ensure your payroll and accounting employees are trained on both the payroll templates and the accounting system. Understanding how to navigate and troubleshoot integration issues is crucial for smooth operation.

Choosing Between Payroll Templates and Payroll Software

Deciding whether to use payroll templates and payroll software depends on several key factors.

- Business size: Small businesses with a handful of employees may find templates efficient and cost-effective. As your team grows, the complexity and time required to manage payroll manually increases. Payroll software becomes more appealing for medium to large businesses because of its scalability.

- Payroll complexity: Businesses with straightforward payroll processes can easily use templates. However, if your operations involve varying pay rates, benefits management, or multi-state tax compliance, software offers automated solutions which help to reduce errors and save time.

- Budget constraints: Templates are cost-effective, requiring only initial setup time. They’re ideal for businesses prioritizing budget control. Payroll software, while initially more costly, offers long-term efficiency gains and potential savings by automating complex calculations and filings, justifying the investment.

- Scalability and automation: Software provides scalability and automation features that templates simply cannot match. Automated tax updates, direct deposit capabilities, and integration with other business systems streamline payroll processes. These features are crucial for businesses planning growth or facing fluctuations in payroll demands.

Ultimately, the choice between payroll templates and payroll software hinges on assessing your business’s current needs and future growth expectations. For small operations with limited budgets, templates offer a straightforward solution. Businesses facing complexity in payroll management should consider the long-term benefits of investing in payroll software.

Need options for payroll software? Check our roundups of the best payroll software for some options.

Payroll Templates Frequently Asked Questions (FAQs)

Using a payroll template is essential for streamlining your payroll process, ensuring accuracy, and maintaining compliance with laws. It acts as a safeguard against common payroll errors by providing a structured format for calculating wages, taxes, and deductions accurately. If you’re not using payroll software, a payroll template can help reduce the time spent on payroll management, allowing more focus on core business activities.

Yes, and they should be. Payroll templates offer flexibility and should be tailored to meet the unique requirements of your business. Whether you need to account for specific types of deductions, overtime rates, or benefit contributions, templates can be adjusted accordingly. This adaptability ensures the template remains relevant as your business grows and as payroll regulations change.

Choosing the right payroll template depends on several factors unique to your business, including size, the complexity of payroll needs, and the frequency of your payroll cycle. For businesses with straightforward payroll needs, a basic template covering employee details, hours worked, and simple deductions might suffice. If your payroll involves more complex calculations, like varying tax rates, benefits, or multiple pay rates, you’ll need a more comprehensive template or a payroll software.

No. Larger companies and those with more complex payroll needs should not use templates to run any aspect of their business—such companies should find suitable payroll software to limit the risk of errors. For small businesses and startups, however, payroll templates can be attractive because of their cost-effectiveness and simplicity. Templates can provide a viable solution for managing payroll efficiently without significant overhead.

Security in payroll templates primarily hinges on how data is stored and managed. The templates themselves do not offer built-in security features. So it’s crucial to implement external measures to protect sensitive payroll information. Employing password protection on the templates, using encrypted drives for storage, and limiting access to authorized personnel are all effective strategies. Considering the sensitive nature of payroll data, adopting robust security practices is key.

Update your payroll template at least annually or whenever there are significant changes in payroll, employee headcount, or tax laws. As your business grows, updating the template to reflect new roles, departments, or compensation structures might be needed. Keeping your payroll template current ensures accuracy in payroll processing and adherence to legal requirements, safeguarding your business against potential penalties.

Bottom Line

When doing payroll yourself, free payroll templates are a great tool to utilize. Aside from being free, they’re also customizable and easy to use. When deciding which templates are right for you, consider your business needs. While these are great for organizing, tracking, and calculating, some of these forms aren’t the best at handling unique employee- and payroll-related situations.

If you’re interested in using a flexible payroll provider that can handle various situations (like multiple pay types), consider Gusto. Starting at $40 plus $6 per employee monthly, it can automate your payroll and handle payroll tax payments and filings (federal, state, and local taxes). All documentation is stored electronically, and the provider offers numerous templates to make your hiring process smoother. Sign up for a Gusto plan today.