A payroll budget is a financial plan that outlines the amount your company expects to spend on its employees’ wages, salaries, and related expenses. This includes regular pay, overtime, bonuses, benefits, taxes, and any other compensation-related costs. It’s crucial for managing cash flow, ensuring employees are paid fairly and on time, and planning future business growth or changes.

To create your payroll budget, you’ll need a map of sorts—which comes in the form of your previous year’s payroll expenditures. Don’t forget to include all items related to payroll, including often forgotten components, like taxes. Once you have these ready, follow the steps below to create your payroll budget.

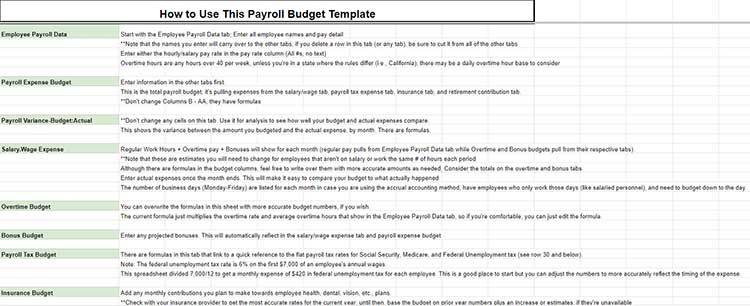

Pro Tip: Download our free payroll budget template to start planning for your 2023 payroll expenses.

Step 1: Create a List of Positions

Start with current positions, including yours. Categorize them by criticality as well as the department. Consider all the people you pay:

- Yourself (if you are on payroll)

- Administrative staff

- Sales team (may need to estimate commissions)

- Hourly employees

- On-location employees

- Remote employees

- Contract employees (flag them, as you will not be paying taxes or benefits and may have a different pay schedule)

- Temporary employees

Step 2: List Payroll Expenses for Each Position

Next, figure out the expenses associated with each position.

If you use a payroll software like Gusto, you may be able to pull historical numbers from reports. If not, review last year’s figures, using a spreadsheet like Excel or Google Sheets to total the expenses. Estimate annual pay for each position, factoring in raises and bonuses.

If you are creating a new position that you don’t have data for, check with your local employment agency or sites like Glassdoor for average salaries in your area or salaries offered by your competitors.

When estimating, try to be cautious and budget more than you think you’ll need rather than less. If factoring in bonuses and compensation increases, break those numbers out from regular wages so you can see them for each employee and as a whole.

For expenses that don’t pertain to a specific position, identify it with a general name, like “Corporate,” that indicates the expense benefits the entire company.

Before inputting the payroll numbers for the prior year, do a review. While you’re looking over the numbers, ask yourself the following questions:

- Are there any employees that deserve a raise?

- Should you do an audit on overtime to see how you can reduce those expenses?

- Are there hourly employees that should be salaried? Or vice versa?

If some of the figures you’re using are annual totals, try breaking them down into months. Working in a more fixed period of time may make these questions easier to answer.

Budgeting for salaried employees is pretty easy—just take their gross wages and divide by 12 months if you’re doing a monthly budget. However, if you pay on a two-week schedule, some months will have three paychecks. Be sure to consider how often your pay periods are here.

Hourly workers can get more complex. You’ll need to consider the hours worked per month, which may not be consistent throughout the year. Be sure to account for busy seasons and slow times based on your individual business. If you add staff during the busy season, you’ll want to make sure to include them as temporary workers in your budget, as well.

You may also want to do a study to make sure you are scheduling your people most effectively. For example, if your restaurant is always slow on Thursday afternoons, you might reduce the number of staff that day and schedule them for Friday night’s rush, which would result in a lower budget amount for that period.

All employers must pay payroll taxes, so be sure to budget for them. Check the current tax tables to make sure your numbers are correct, but these are the most current:

- Federal Unemployment: 6% on the first $7,000 of each employee’s pay

- Social Security: 6.2% of each employee’s pay

- Medicare: 1.45% of each employee’s pay

- Additional Medicare (for employees earning over $125,000 married filing separately, $250,00 married filing jointly, and $200,000 for all others): 0.9%

A Note on Income Taxes:

Since income taxes come from employee wages, you won’t consider them in your payroll budget. However, it can be useful to know these figures so you can plan for withholdings each month. Compute them using average wage amounts. If you have historical data to work with, this will be pretty simple. For new positions, use historical data of similar positions as a guide.

In general, most companies estimate overtime to total 10% to 15% of their annual payroll budget. However, using a general estimate is not an effective way to create an overtime budget. Rather, think about which positions are most likely to accrue overtime and when. Then, calculate the anticipated overtime for that month and enter it into the budget. Use our overtime calculator and learn the nuances of how to compute overtime in our guide.

Consider the following:

- Do some workers regularly earn overtime because it’s better for the company than hiring additional help?

- Are certain days of the week or seasons of the year always extra busy?

- Do certain positions work more overtime than others?

- Are you anticipating an event that will cause a surge, such as a new product launch, a big software update, or a special event at your store?

Remember, some states, like California, calculate overtime in ways more favorable to employees. Make sure you’re reviewing the state laws where you have employees working—something incredibly important in today’s remote work environment.

If you pay employee bonuses, you need to budget for them. If they are performance-based, you may want to look at last year’s statistics for a guideline. If they are event-oriented, such a bonus for years in service, determine which employees will receive the bonus and place it in the appropriate month.

Be sure to note what the bonus is for; for example, if you anticipate a performance bonus in November, but the employee does not earn it, you will know not to include it in their paycheck.

If you pay an annual bonus across the board, then you should estimate how much it will be, and set aside some money each month. This may be a standard amount or a percentage of company profits. This would be a good case in which you would tag the expense as “Company bonus” instead of tying it to each individual position.

These are the regular costs of maintaining employees. They include employee benefits like contributions to health insurance premiums and matching fund programs like 401(k). Be sure to check with your insurance and/or retirement service providers to get the most accurate charges for the coming year. Don’t forget to include administrative and other fees.

If you use a payroll software like Gusto, you can broker employee benefits for your team directly through the software. This allows you to select plans and set up deductions, in addition to your employees completing open enrollment directly through an employee dashboard. Managing all aspects of your payroll in one place makes budgeting a breeze. Try it free for 30 days.

When considering new positions, place their projected wages in the month you intend to add them. For example, if you are opening a new location in May, you don’t need to budget all the employees for that location in January. Also, be sure to prioritize them. That way, if your budget will not allow for all the hires you want, you can see which ones you can push to a later date.

If you have contract employees you depend on, or you intend to hire freelancers in the future, you should budget for them as well. However, they are often in a different part of the budget than payroll.

These employees are easier to plan for, as you only need to consider how much you pay per contract plus any administrative costs in acquiring them if you use a service. If you are planning to use a temp service to hire additional employees for part of the year, contact the agency to get an estimate of any administrative costs that go into hiring, and include those when you calculate expenses for them.

Account for New or Open Positions

When considering new positions, place their projected wages in the month you intend to add them. For example, if you are opening a new location in May, you don’t need to budget all the employees for that location in January. Also, be sure to prioritize them. That way, if your budget will not allow for all the hires you want, you can see which ones you can push to a later date.

Freelancers/Contract/Temp Employees

If you have contract employees you depend on, or you intend to hire freelancers in the future, you should budget for them as well. However, they are often in a different part of the budget than payroll.

These employees are easier to plan for, as you only need to consider how much you pay per contract plus any administrative costs in acquiring them if you use a service. If you are planning to use a temp service to hire additional employees for part of the year, contact the agency to get an estimate of any administrative costs that go into hiring, and include those when you calculate expenses for them.

Step 3: Total Each Expense Category

Now that you have all the data put into the spreadsheet or program, you can view your totals for each month and the full year. You need to be able to see payroll expense totals for each position and category: gross wages, taxes, benefits, and more.

Look at the totals for each month as well as the annual sum to ensure reasonableness.

Step 4: Do a Budget Review

Now that you have the numbers, check to make sure they are reasonable. Create charts or graphs to better understand the flow of the data. Pivot charts can help you dig into the data by quickly reorganizing it into a manner that best answers your questions.

- Check that the information is correct: Get a second set of eyes to make sure the numbers were entered correctly and all spreadsheet formulas (if any) are right. Also, run it past department heads for “sanity checks,” just in case they have more current information.

- Compare it to last year’s projected vs actual expenditures: If you had problems with payroll last year, are you going to have similar issues? If you miscalculated an area (such as overtime) last year, did you correct it for this year?

- Compare it to projected earnings: Especially if hiring new employees, do you expect to make enough profit to cover all of their expenses? If not, how will you change this budget or other areas of your budget to compensate?

If you’re new to doing payroll, you should take a look at our guide on payroll compliance to ensure you always stay on the right side of the law.

Why You Should Create a Payroll Budget

Now that we’ve reviewed the steps required to create an effective payroll budget, it’s important to understand the value of creating one. It helps you understand what percentage of your budget should go to payroll and enables you to stay on track throughout the year.

Understand How Much of Your Budget Should Go to Payroll

Generally, payroll should account for about 15%–30% of the company’s gross revenue, according to financial consultant The Bottom Line Group. However, experts say that in certain industries (such as service businesses) payroll costs can be as high as 50%.

It’s important to remember that as your business grows, so will your payroll expenses. As your business has more needs, additional resources will be required to support it. Building flexibility within your budget allows for changes in payroll as your business grows and evolves.

Stay on Track Throughout the Year

Once you have a budget in place, you should track actual expenses as you do payroll throughout the year. Record them on a monthly basis. Maintaining good payroll records will help you maintain your payroll accounting or if you ever do a payroll audit.

It can help to create a new spreadsheet for a revised budget or to use a budget for forecast comparison as the year progresses. In this scenario, actual expenses overwrite budgeted expenses of the months that have already passed—and the totals are added to the budget numbers of future months. This will help you stay abreast of how well you’ve budgeted and signal whether you need to shift some budget funds to keep business flowing smoothly.

To help establish a solid payroll budget and process, check out our free payroll templates.

Why Payroll Budgeting Is Important

- Cash flow management: Your payroll is likely one of your most significant expenses. By budgeting for this expense, you can ensure you always have enough cash on hand to meet your payroll obligations. If you don’t, not only could you face legal consequences, you’ll lose the trust of your staff. Read more cash flow management tips for your small business.

- Financial planning: A payroll budget helps you project your future financial needs and assess the overall health of your business. This can be especially beneficial when seeking financing or investment.

- Regulatory compliance: Ensuring you have budgeted for all payroll-related expenses, including taxes and benefits, can help you avoid costly penalties and stay in compliance with labor laws.

Budgeting for Future Growth & Non-Standard Payroll Expenses

Creating a payroll budget isn’t just about accounting for the current year’s expenses. It’s also about planning for your business’s future growth and considering non-standard payroll costs that could arise.

Legal Considerations for Payroll Budgeting

While there are no laws directly related to payroll budgeting, there are ancillary regulations that warrant a brief discussion. Payroll budgeting isn’t just about numbers and calculations but also about compliance with laws and regulations. Here’s what to consider:

- Minimum wage laws: Especially if you have remote employees in different states, you must ensure your payroll budget adheres to different minimum wages. These rates can also change, so you’ll need to stay updated and adjust your budget accordingly.

- Overtime rules: Again, with remote workers, overtime rules can vary by jurisdiction. Make sure your payroll budget accounts for these different overtime rates.

- Taxes: Both you and your employees have tax obligations. You need to withhold income taxes from your employee wages and pay employer taxes wherever you have employees working. This means you may need to pay different tax rates in different states.

- Employee benefits: If you offer benefits, these costs must be included. If you have remote workers in some states like California, you may be required to provide certain benefits. Ensure your payroll budget accounts for these requirements.

Payroll Budget Frequently Asked Questions (FAQs)

How often should I update my payroll budget?

You should review and update your payroll budget at least annually—and ideally, once per quarter. However, any changes in your business that impact payroll, like hiring new employees, giving raises, or changing benefits, should trigger an immediate budget update.

What should I do if my actual payroll costs are consistently higher than my budgeted costs?

If your actual payroll costs are consistently exceeding your budget, it’s time to review and adjust your budget. You might be underestimating certain costs, or there could be inefficiencies in your payroll process that need to be addressed.

How can I reduce my payroll costs without cutting wages or laying off employees?

There are several strategies you can consider. These include improving scheduling efficiency to reduce overtime costs, offering benefits that are valuable to employees but low-cost for you (like flexible work hours), and investing in training to improve employee productivity.

What payroll expenses are often overlooked when creating a payroll budget?

Some common overlooked expenses include training costs, costs associated with employee turnover, bonuses, and benefits. Also, businesses often forget to account for increases in wage rates due to raises, promotions, or minimum wage adjustments.

Can I use payroll software to help create my payroll budget?

Yes, many payroll software programs, like Gusto, can help you create and manage your payroll budget. They can automate much of the calculation work, track your actual costs against your budget, and even project future payroll costs based on trends in your data.

Bottom Line

Having an accurate payroll budget can help you with one of the greatest and most important expenses of your business—paying employees. Be sure to consider wages, taxes, benefits, and other expenses. Also, break it out by month to account for changes in labor hours, bonus months, and other seasonal expenses. With a proper payroll budget that has been reviewed for accuracy, you can plan more effectively and ensure the year goes smoothly.