Fyle is an expense management software that accepts Visa, Mastercard, and American Express corporate card programs. You can connect any corporate card program in Fyle and wait for the transaction to be recorded in the system. For added convenience, you can also add expenses sent through Gmail, Outlook 365, and Slack. Fyle pricing starts at $8.99 per active user, per month, with a minimum of five users—this is on the higher side, and some small businesses may find it above their budget. Fyle reviews from users are mostly positive, although most share the same sentiment about its pricing.

At Fit Small Business (FSB), we are committed to delivering thorough and dependable software reviews. In adherence to the FSB editorial policy, we seize every opportunity to try the accounting practice software we review firsthand, allowing us to test how the features work in real-world scenarios. This approach allows us to customize our reviews and provide more relevant insights and recommendations tailored to the unique needs of your accounting firm.

Pros

- Has real-time feeds for Visa and Mastercard transactions

- Integrates with QuickBooks Online and Xero in the most basic plan

- Adds expenses from Gmail, Slack, and Outlook 365

- Has Unlimited receipt storage

- Can connect to multiple card programs

Cons

- Has no free trial

- Requires expense reports before expenses are routed for approvals

- Doesn’t issue employee cards

- Has no live bank feeds in the Standard plan

- Has a slightly higher cost per user if compared with competitors

Fyle Alternatives & Comparisons

Fyle Reviews From Users

| Users Like | Users Dislike |

|---|---|

| User-friendly | Site glitches and app problems |

| Easy to upload expenses | Can’t track mileage in real time |

| Excellent user interface | Higher price point than competitors |

Users who left a Fyle review said that they’re happy with the platform’s features. Others mentioned that the software made it easy for them to capture, monitor, and process expenses. On the flip side, some highlighted mobile app problems and site glitches. Our expert analysis of these reviews reveals that positive reviews coincide with our understanding of Fyle as an expense tracker, while some negative reviews tend to be far-fetched.

Here are Fyle’s ratings from top user review websites and app stores:

- Software Advice[1]: 4.5 out of 5 stars based on around 140 reviews

- G2.com[2]: 4.6 out of 5 stars based on more than 1,100 reviews

- App Store[3]: 4.2 out of 5 stars based on about 30 reviews

- Google Play[4]: 2.9 out of 5 stars based on around 600 reviews

Fyle has three pricing plans. It has no free trial but you may request a demo instead. Our expert analysis of its pricing is very good as it provides flexibility and scalability. However, it’s at a slightly higher price point than its competitors, which is the major reason why its pricing score dipped in our evaluation. However, we still consider this rating high and believe that Fyle’s outstanding features can compensate for its higher price point.

Standard | Business | Enterprise | |

|---|---|---|---|

Monthly Pricing per Active User (Billed Monthly) | $8.99 | $14.99 | Custom |

Monthly Pricing per Active User (Billed Annually) | $6.99 | $11.99 | Custom |

Receipt Scanning & Mileage Tracking | ✓ | ✓ | ✓ |

Bulkfyle (Upload Multiple Receipts) | ✓ | ✓ | ✓ |

Offline Mode | ✓ | ✓ | ✓ |

Fylemail, Slack, Outlook 365 & Google Workspace | ✓ | ✓ | ✓ |

Multicard Programs | ✕ | ✓ | ✓ |

Live Feeds From Banks | ✕ | ✓ | ✓ |

Multilevel Approvals | ✕ | ✓ | ✓ |

Automated Clearing House (ACH) Payments, Bulk Payments, Microdeposit Verification & Transaction Status | ✕ | ✓ | ✓ |

Single Sign-on (SSO) | ✕ | Add-on | ✓ |

Trusted Internet Protocol (IP) Restrictions for Viewing Sensitive Payments | ✕ | ✕ | ✓ |

Fyle only bills for users who have created at least one expense report during the month. You can onboard all of your employees, but you’ll only pay for the users that were active during the month.

Fyle Features

Fyle is a multisolution tool for your business. After reviewing its features, we discovered that it combines mileage tracking, receipt scanning, and project finance management into one software.

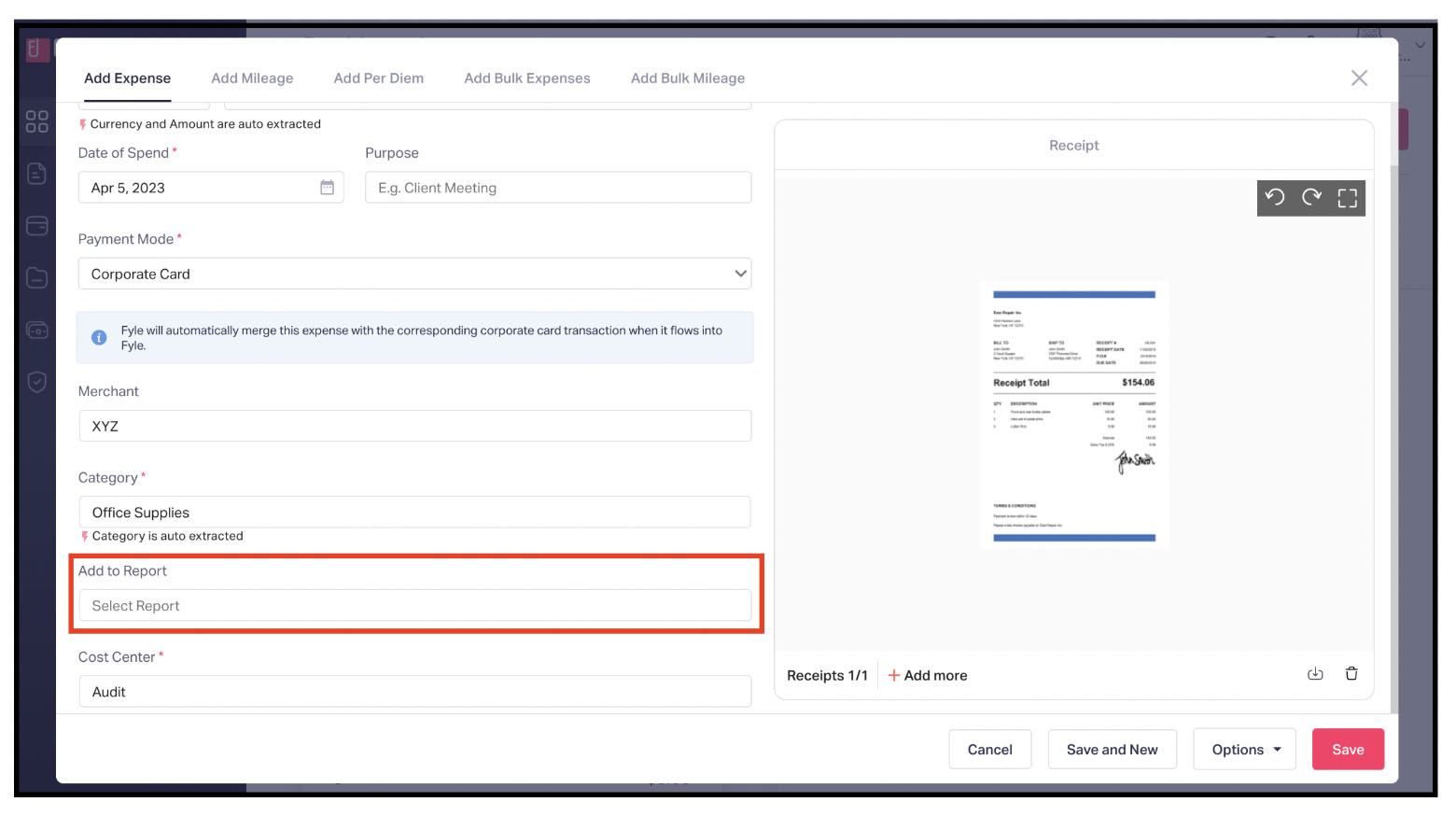

Fyle’s expense tracking features scored well in our rubric. It only took a slight dip in our scores because expenses need to be in reports before reviewed and approved. Though we don’t see this in a negative light, some of Fyle’s competitors have real-time expense tracking that don’t need expense reports to process expenses. Fyle could add this feature to speed up expense processing.

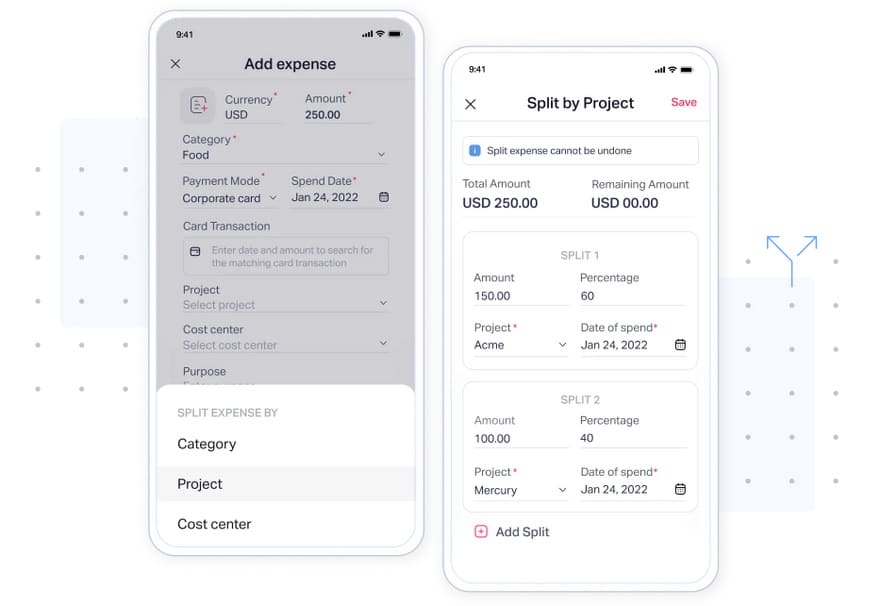

Adding a New Expense to a Report (Source: Fyle)

Fyle can capture expense data that you might need to analyze how expenses move in your business. You can classify or assign expenses to departments, cost centers, projects, and more. As a result, you can track individual performance of a particular business area accurately and relate this performance to overall business goals.

Splitting Expenses (Source: Fyle)

Moreover, Fyle’s split expense feature lets you report expenses on cost centers, departments, or specific expense categories. You can track billable expenses from clients, as Fyle has a dedicated feature for tracking billables so that you don’t lose them when it’s time to invoice clients.

You also get a mileage tracker built into the expense tracking system. The mileage tracking feature of Fyle uses Google Maps to track your location and distance. We have reviewed the best mileage tracker apps and think that Fyle offers a good mileage tracking solution, though not as comprehensive as other trackers. However, the monthly price of $14.99 per active user is a steal because you get an expense and mileage tracker in one app.

Mileage Tracking in Fyle (Source: Fyle)

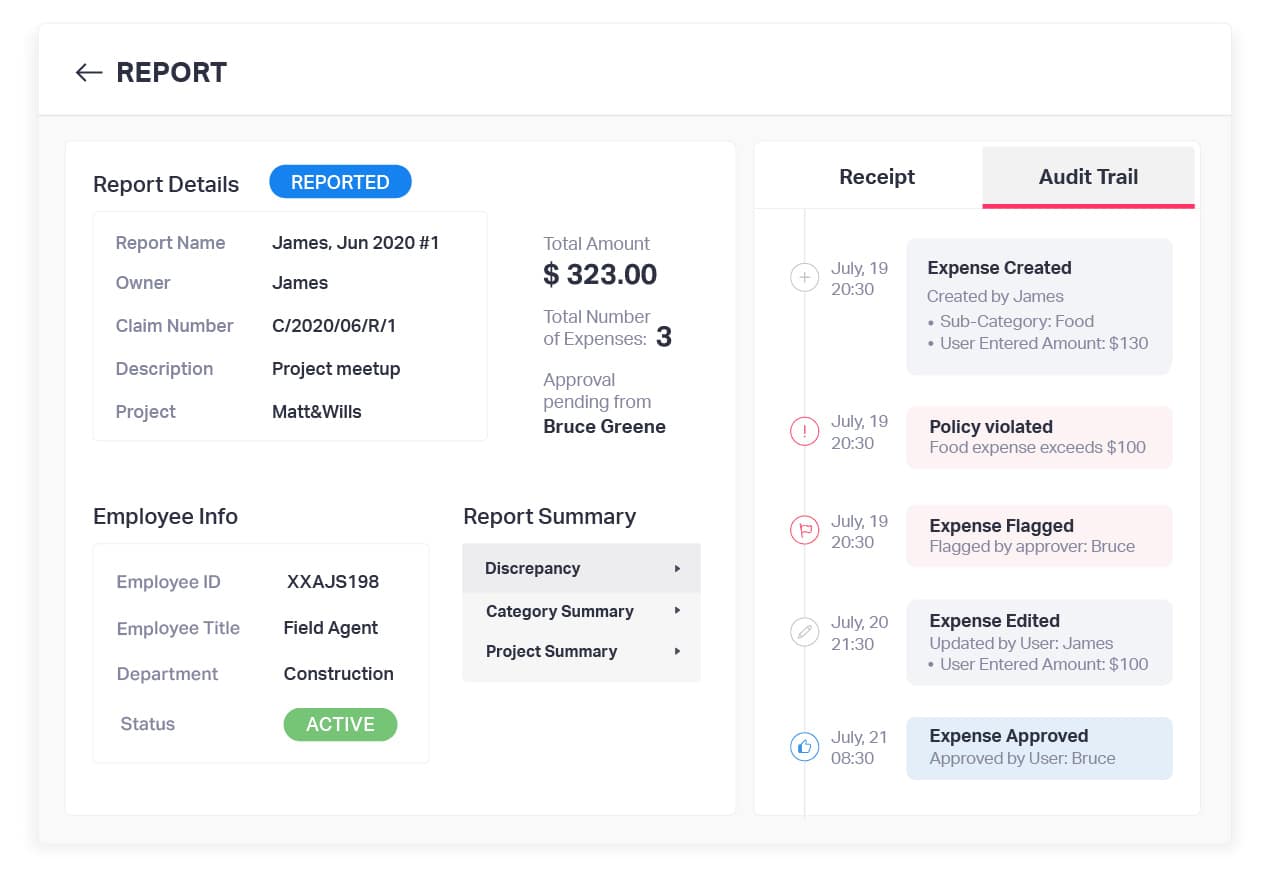

When some employees don’t follow expense rules and reimbursement requirements, you can count on Fyle to keep these irregularities checked and filtered. You can set rules so that specific expenses that aren’t allowed or beyond limits don’t go through the approval process. Fyle’s audit trail feature can even provide additional information about the expense entry and its status along the approval pipeline.

Digital Audit Trail (Source: Fyle)

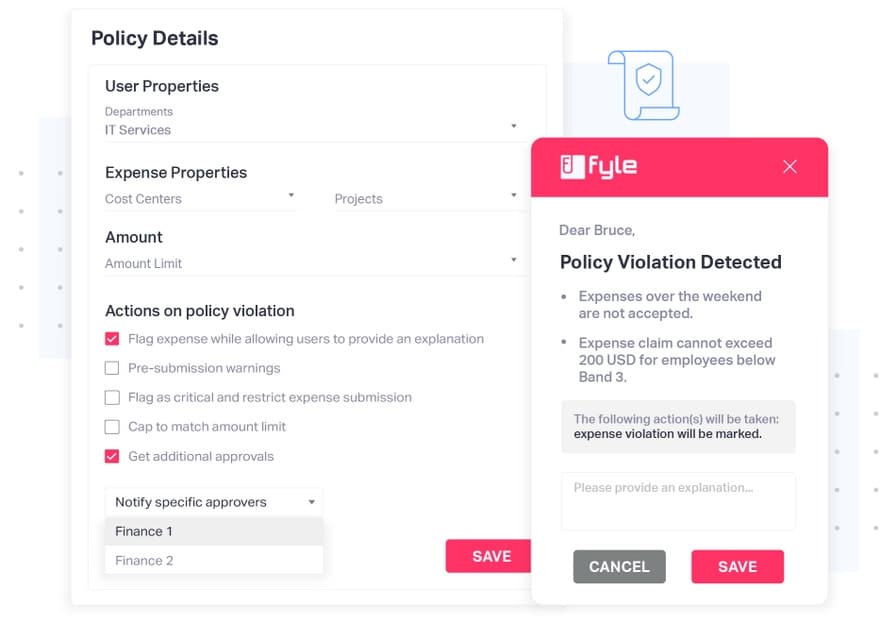

Fyle also lets you set intricate rules and policies to limit or prevent employees from using corporate cards for nonbusiness-related purposes. These rules are integrated into the system, and there’s no need for human interaction to reject an expense. Fyle can detect if a particular expense violated an existing policy.

Setting Expense Policies (Source: Fyle)

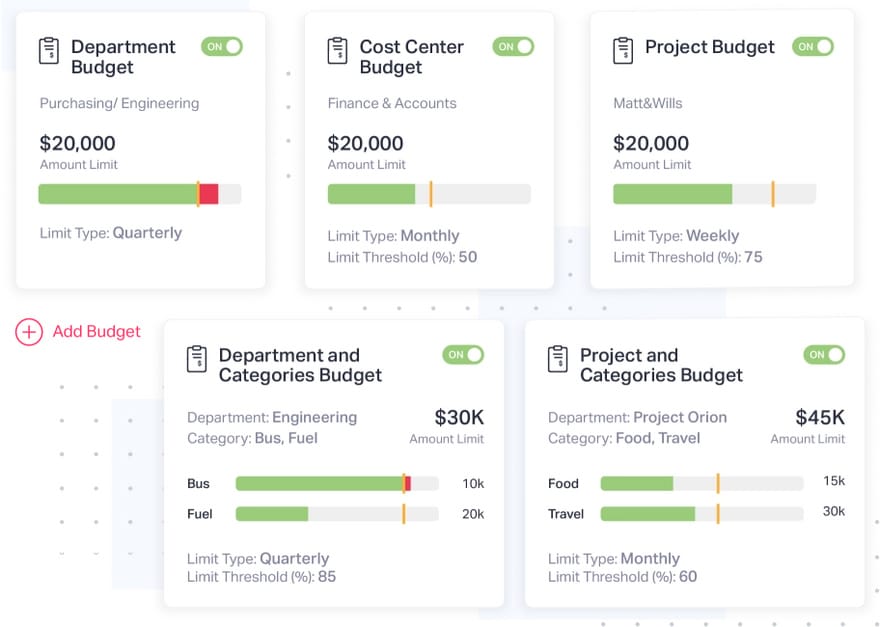

If you have multiple projects, Fyle is your headquarters for tracking budgets. Tracking budgets is one way of controlling expenses and, with Fyle’s dashboard of actual-to-budget comparison, you can see if you’re still within budget, beyond budget but still within limit, or nearing the maximum limit. However, you won’t need to check these dashboards to know you’re nearing the red line as Fyle has customized alerts that will notify you when you’re nearing the limit.

Budget Overview (Source: Fyle)

Fyle offers flexibility when it comes to corporate cards. It isn’t like the other expense trackers in the market that offer an in-house card to users. Instead, it can accept any card program you have and track every card expense. You connect American Express, Visa, Mastercard, and Diner’s Club from virtually any bank, including Chase and Bank of America.

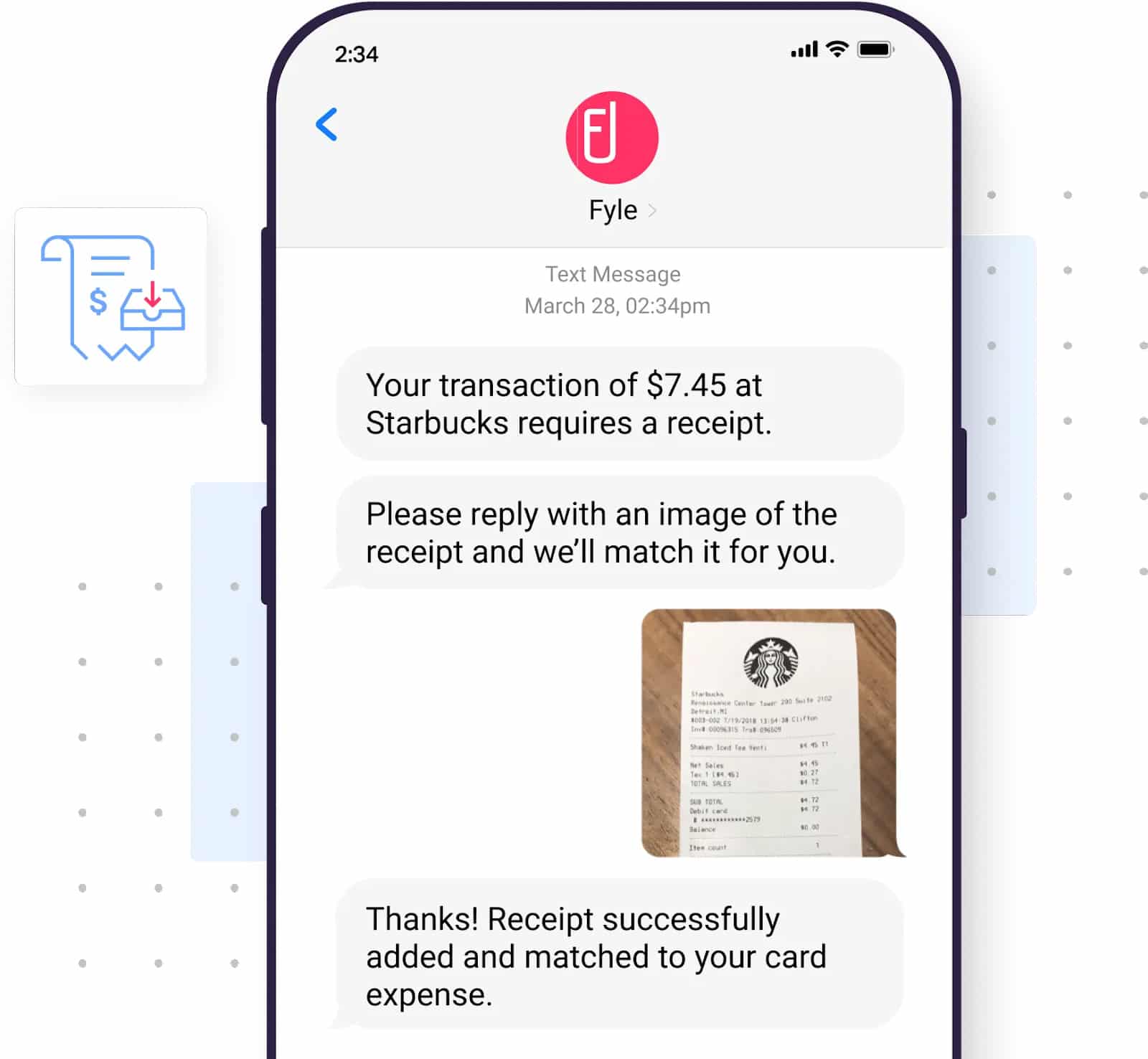

The image below shows what will happen if you use a corporate card integrated within Fyle. When you use the card to purchase something, Fyle will send a text message and ask you to reply with a receipt. You may simply take a picture of the receipt and submit. Fyle will match these receipts to the expense

Submitting a Receipt via Text After Using a Corporate Card (Source: Fyle)

Fyle stands out when it comes to Visa and Mastercard real-time notifications. After you use a connected Visa card, you’ll receive a notification from Fyle to upload a receipt. This way, you won’t forget about forwarding receipts. Fyle will match the receipt with the transaction automatically, so you don’t have to when it’s time to report. You can do this on a short message service (SMS) or Slack.

There is also a budget feature for Visa and Mastercard. You can set a budget for the card to minimize overcharges and control expenses, and you can set these budgets per department and category.

Fyle’s intuitive user interface is one of the reasons why it scored outstandingly in ease of use. It has in-app live chat support, a comprehensive knowledge base, and email support. Besides that, its application programming interface (API) feature is another avenue for some businesses to create custom integrations. Overall, Fyle is an easy-to-use software with adequate customer support. We’d appreciate it more if Fyle would add phone support as another support channel.

Integrations

We like Fyle because it integr

ates with many third-party apps that are common in modern small businesses. It can integrate with the following software services:

- Oracle NetSuite

- QuickBooks Online

- Sage Intacct

- Xero and Bill

- Google Workspace

- Slack

- Microsoft 365

- HRMS

- TravelPerk

How We Evaluated Fyle

As part of best business expense tracker apps buyer’s guide, we evaluated Fyle’s features and capabilities based on the following criteria:

15% of Overall Score

Pricing is an important part of your decision. In evaluating this criterion, we considered factors, such as a free trial, monthly and annual billing options, scalability, plan customizability, and price comparison with competitors.

40% of Overall Score

Since we’re evaluating expense trackers, we placed significant weight on expense tracking features. We evaluated this criterion based on the major expense workflow steps: recording, review, approval, and reimbursement.

25% of Overall Score

We include card programs in our rubric since we believe that expense tracking should be tied to the business’ card program. Here, we considered whether the provider can issue cards or enroll in third-party corporate programs.

20% of Overall Score

The ease of use score revolves around customer support channels, integrations, user reviews, and our expert rating. The software must make it easy for users to access support in case of problems. Moreover, it must have adequate integrations with other software so that it would be easier to insert it into existing business processes. We looked at user reviews from third-party websites for the user review scores. We weighed the comments and made sure that we remained objective in our evaluation.

Frequently Asked Questions (FAQs)

It’s the process of reviewing, approving, and refunding expenses initiated by employees. Expense management can also be a system within a company that helps in gathering, classifying, and organizing expense data into meaningful reports.

Expense management reduces expense fraud and ensures that company resources are used efficiently and appropriately. Proper expense management helps your company gain control over spending and assess periodic cash needs.

Getting an expense tracker is never a bad idea regardless of the business size. There are free and paid expense trackers available. If your business can’t yet afford a paid tracker, you can first try free apps, then switch to paid ones once there’s a business need for premium expense tracking features.

Bottom Line

Fyle is a convenient expense tracker that supplements your small business accounting software. You can manage expenses on the platform, and then transfer everything to your accounting platform. However, we don’t recommend using it as a substitute for accounting software as it is only an expense tracker and can’t track profit and loss (P&L).