GnuCash is open-source small business accounting software that helps you manage and track your bank accounts, stocks, income, and expenses. Its features include statement reconciliation, scheduled transactions, double-entry accounting, and a checkbook-style register for tracking cash flow. It is free and available for Windows, Mac, and Linux.

I’m impressed with its banking features, but I find it very difficult to use. I won’t recommend it for DIY bookkeeping, although it does have the potential to be good software once you learn to use it. See if it’s right for you through my detailed GnuCash review.

Pros

- Features double-entry accounting

- Has good banking and cash management features, like the ability to print checks

- Is completely free open-source software that can be customized by programmers

- Doesn’t require an internet connection after installation

- Is available for Windows, Mac, and Linux

Cons

- Is difficult to use; unideal for DIY bookkeeping

- Offers very limited customer support options

- Lacks project management and inventory accounting features

- Has no mobile app

Pricing | Free |

|---|---|

Paid Option | ✕ |

Number of Users | 1 only |

Internet Connection | Not required once the program is installed |

Storage and Backups | Company data is stored locally and must be backed up by the user |

Customer Support | Customer support is limited to a user community and self-help information |

Average User Review Ratings |

- Open-source programmers: GnuCash has poor UX and is difficult to use, so I only recommend it to users who enjoy the flexibility and challenge of working with open-source software. While I find the base product lacking, a good programmer can customize GnuCash to do virtually anything. We choose GnuCash as the best open-source alternative to QuickBooks Desktop.

- Bank reconciliation: GnuCash is one of the few small business accounting programs—including paid programs—that can do a “real” bank reconciliation. By “real,” I mean it can reconcile your check register with your bank statement even when there are timing differences between them, like outstanding checks and deposits in transit.

- Managing and paying bills: GnuCash is a free solution for entering bills as they are received, tracking their due dates, and printing a check to pay them.

GnuCash Alternatives & Comparison

GnuCash Reviews From Users

| Users Like | Users Dislike |

|---|---|

| Personal data is stored on a local computer | Glitchy |

| Can import Quicken (QFX) files | Multiple users report QIF file import fails |

| Open-source | Not that popular |

There aren’t any recent GnuCash reviews, but based on older feedback, many reviewers like that it’s open-source software. This means they never have to worry about the vendor going out of business and losing their data. Even if all GnuCash support were to disappear, everything users need to continue to keep their books will be on their computer. Some also noted that it can import QFX files designed for Quicken—which are available for download from many banks.

Other users reported various issues, including the program completely shutting down, vague error messages, or the program freezing. One mentioned having trouble with importing QIF files, so I recommend importing your data in a QFX file instead. Some shared that they felt stuck when facing issues because they didn’t know other GnuCash users to ask for help. Additionally, since GnuCash isn’t as widely recognized as software like QuickBooks, it can be challenging to find a bookkeeper proficient with it.

Here are the user ratings of GnuCash on popular review sites:

Fit Small Business Case Study

I used our internal case study to evaluate GnuCash’s features across several key areas essential for small business accounting software. Here are the results of my evaluation.

GnuCash vs Competitors

Touch the graph above to interact Click on the graphs above to interact

-

GNUCASH FREE

-

WAVE PRO $16 PER MONTH

-

ZOHO BOOKS PRO $50 PER MONTH

-

QUICKBOOKS ONLINE PLUS $99 PER MONTH

GnuCash’s highest scores come from value and reporting, but they are still mediocre, especially when compared with QuickBooks Online and Zoho Books. GnuCash did better than Wave in terms of banking due to its ability to print checks and do a true bank reconciliation, which isn’t possible in Wave.

GnuCash lost to all its competitors in most of the categories. In the future, I’d like to see and evaluate new features, like a mobile app, inventory, and project accounting. I also wish it were easier to use out of the box so that I could give a higher score for usability.

GnuCash Pricing

GnuCash is completely free, but its team of volunteers created a donation page for those wanting to contribute to the open-source community. It’s available to download for Linux, Microsoft Windows, and Mac OS X devices.

I couldn’t give it a perfect rating because my evaluation isn’t just about the cost—it also considers the quality of the software.

General Features

I gave GnuCash a low score for general features because it lacks essential tools to simplify company and user setup and manage and track transactions. For instance, while I can customize the chart of accounts, it doesn’t allow me to use account numbers, which would make tracking much easier. Additionally, I can’t set up additional users or provide my accountant with direct access to my books. It also won’t let me categorize transactions by unique metrics, like class and location.

Banking & Cash Management

GnuCash is not easy to use out of the box and not as comprehensive as other software, which cost it points in my assessment. For instance, it will take some technical knowledge to connect your bank to the software, and you can’t combine multiple checks into a single deposit for easier reconciliation.

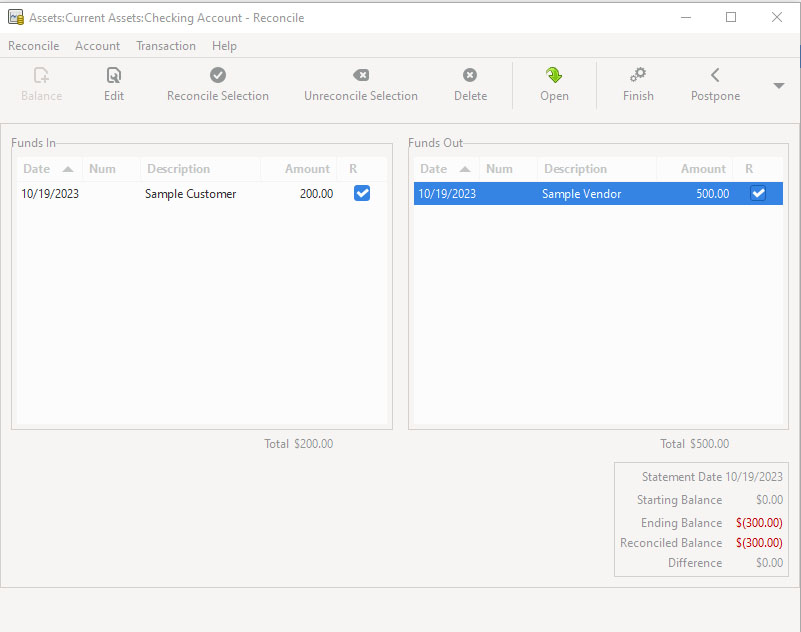

However, for a free program, I’m pleasantly surprised with GnuCash’s banking and cash management features and consider it the main strength of the software. The reconciliation feature is excellent as it presents cash receipts and disbursements side-by-side. You can tick the box if the records match the items listed in your bank statement:

Reconciling accounts

If items that haven’t been recorded appear on the bank statement, you can exit the reconciliation window and create an expense entry for bank service charges. Don’t worry because GnuCash will remember the items you’ve ticked, and you’ll also see recent transactions added. After you reconcile accounts, GnuCash won’t generate a bank reconciliation statement automatically—you’ll have to go to Reports to create one.

A/P Management

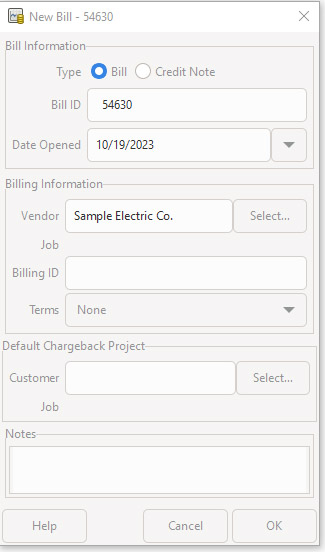

GnuCash took a hit in my evaluation of A/P management because it has no receipt capture features and other advanced tools like purchase order management and a vendor portal. However, it still provides basic payable features through its dedicated A/P module. This module isn’t the most visually appealing as it utilizes a lot of windows when creating vendors, editing vendors, creating payment terms, and entering bills.

Creating a Bill

When using the A/P module, ensure that you have entered all jobs, items, and vendors before creating a bill—it would be tedious to do it all as you create the bill. GnuCash also doesn’t have an auto-record function, so it won’t record a new vendor automatically just by entering the vendor’s name in the field. Overall, I find the A/P module challenging to use—even for CPAs. The navigational flow isn’t as streamlined as other accounting software programs I’ve reviewed.

However, what I like about its A/P feature is that I can assign billable expenses to customers and add them to the customer’s invoice at a later time. This feature is often present in paid accounting software programs but is a rarity in free tools. Another nice feature is the ability to create recurring bills for ongoing monthly expenses.

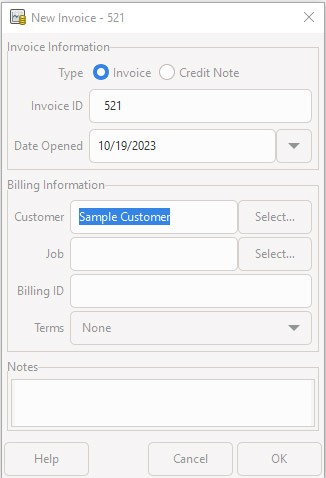

A/R Management

Just like the A/P module, I gave the A/R module a low mark because it’s not that robust and easy to use. I was able to create an invoice, but there’s no option to email it directly to my customer from within the program. Also, there’s no way to customize invoices—so if professional invoicing is important to you, I recommend considering a solution from our roundup of the top small business invoicing software.

If you have basic A/R needs and have the patience to learn GnuCash, you may still do well with it. It has a dedicated A/R module where you can manage your customers and create and track invoices.

Creating an Invoice

The invoice form is similar to the billing form. Once the invoice is created, you can view invoice details in a separate tab. You can change the income account affected, quantity, price, applicable discounts, and taxes. After posting the invoice, you can print the invoice. Its design is traditional, and it has no attractive template or colors.

Sales & Income Tax Management

Adding sales taxes to invoices is convenient in GnuCash, and taxes are presented in the printable invoice. The only struggle here is that it’s hard to view sales tax liability in detail. I prefer seeing detailed sales tax liability so that users can see all transactions with sales tax plus sales tax adjustments from credit memos. Also, I wish it could allow users to file their tax returns or at least integrate with tax software like Avalara.

Reporting

Reporting isn’t one of GnuCash’s noteworthy features. It can generate basic financial reports, but I didn’t find it useful enough for small business reporting. I was able to generate a few reports, such as a P&L, a balance sheet, and A/P and A/R aging reports. However, some important reports are missing, like income/loss by month, unbilled charges, unbilled time, and expenses by vendor reports.

GnuCash received zero scores for project accounting, inventory management, and mobile app since it doesn’t have such features.

- If project accounting and mobile accounting are crucial, check out our top recommendations for the best project accounting software and leading mobile accounting apps.

- If inventory management is important to you, consider Zoho Books; read our Zoho Books review for details.

Usability

My usability rating is based on my evaluation of four key aspects: ease of setup, ease of use, customer support, and bookkeeping assistance.

I find GnuCash challenging to set up, especially for those who are not tech-savvy. It’s a good thing there are some tools you can use, such as a new company onboarding wizard and features for importing beginning balances, charts of accounts, and vendors.

However, GnuCash is pretty complicated to set up, and you can easily get lost along the way. I recommend working with an experienced bookkeeper when setting up your company file.

GnuCash is hard to use for small businesses that wish to DIY bookkeeping. It has a confusing interface, and I find it odd that it combines personal finances with business income and expenses. This makes it difficult for business owners to manage and track business-related income and expenses. Also, we have updated this article several times now, and I haven’t seen any additional features added to the software.

There is no way to contact GnuCash by phone, email, or live chat. The only help available is to check the self-help information online. It provides extensive self-help guides, which you’ll need to consult frequently to master all the software’s features.

As I mentioned earlier, you’ll struggle to find third-party accountants who are familiar with GnuCash and can assist you. If you anticipate needing the help of a professional bookkeeper, consider QuickBooks Online, which has a vast network of QuickBooks ProAdvisors for assisted bookkeeping support.

How I Evaluated GnuCash

I evaluate GnuCash using our case study below.

5% of Overall Score

We first determined a pricing score by assessing the software’s price for one, three, and five users. We also considered whether there was a free trial, monthly pricing, and a discount for new customers. After determining the pricing score, we assigned a value score based on the pricing score and the solution’s total score across all categories except Value.

5% of Overall Score

We evaluated general features like the flexibility of the chart of accounts, the ability to add and restrict the rights of users, and how your information can be shared with an external bookkeeper. We also searched for ways to provide more granular information like class and location tracking and custom tags.

10% of Overall Score

This assessed the ability to print checks, establish live bank feeds, and import bank transactions from a file. We also looked closely at the bank reconciliation feature. We wanted to see the ability to reconcile bank accounts with or without imported bank transactions and a list of book transactions that have not yet cleared the bank.

10% of Overall Score

In addition to the basics of issuing invoices and collecting customer payments, we evaluated the software’s ability to create customized invoices. We also assessed whether it could handle non-routine transactions like short payments, credit memos, and the refund of credit balances in customer accounts.

10% of Overall Score

The A/P score consisted of the basics like tracking unpaid bills, recording vendor credits, and short-paying invoices, but it also included some more advanced features—such as paying bills electronically, creating recurring expenses, and working with purchase orders. Receipt capture and the ability to automatically generate bills from captured receipts were also part of our A/P evaluation.

10% of Overall Score

10% of Overall Score

At the very least, we looked for software that could create multiple projects and separately assign income and expenses to those projects. We also searched for the ability to create estimates and assign those estimates to projects. Ideally, the program would then compare the actual expenses to the costs on the original estimate.

5% of Overall Score

Software should be able to track sales tax for multiple jurisdictions with varying tax rates. It’s helpful to have a function to easily record the remittance of the sales tax by jurisdiction. The very best tool will also help determine which jurisdictions sales are taxable to based on the address of the customer or delivery.

10% of Overall Score

I evaluated basic financial reports (such as a balance sheet, income statement, and general ledger) and common management reports (like A/R and A/P aging).

5% of Overall Score

Ideally, a mobile app should have all the same features as the computer platform, including the ability to capture receipts, send invoices, receive payments, enter and pay bills, and view reports.

5% of Overall Score

While it’s nice to have as many integrations as possible, we focused our evaluation on the four integrations we believe are most critical for small businesses: payroll, online payment collection, sales tax filing, and time tracking.

10% of Overall Score

The largest component of usability is the ability to find bookkeeping assistance when users have questions. This could be in the form of a bookkeeping service directly from the software provider or from independent bookkeepers familiar with the program. Other components of usability include customer service and ease of use.

5% of Overall Score

Our user review score is the average user review score reported by Capterra and G2. Other review sites might be used if a score from Capterra or G2 is unavailable.

Frequently Asked Questions (FAQs)

Yes, GnuCash is totally free, with no hidden charges, ads, or in-app purchases. Once you download and install it, you can use all its features.

No, it’s a very complex software, and you need time and patience to be able to get its full value.

GnuCash is a desktop application, not a cloud-based software. It stores data where you choose, like on your desktop’s hard drive, so it’s up to you to ensure its security from loss and hackers.

Bottom Line

GnuCash is free software without hidden charges or credit card requirements. Like most open-source platforms, it’s difficult to use. The interface is old-school; even experienced bookkeepers will need time to learn the program.

If you have plans to modify the source code to enhance GnuCash, I recommend speaking with a programmer. Overall, if you’re looking for software that can be used out of the box, there are better free options available, like Wave.

[1]Software Advice

[2]G2