Papaya Global offers a suite of solutions to simplify global payroll, hiring, and workforce management. If you have foreign contract workers, its contractor management solutions can help you process payments and avoid worker misclassification errors. Monthly fees start at $25 per employee for Papaya Global’s payroll plans. For its EOR service, which enables it to manage your global recruiting and payroll needs, you can expect to pay monthly fees that start at $599 per employee.

In our review of the best international payroll services, Papaya Global earned an overall score of 4.6 out of 5. It lost points because it charges a setup fee and the number of online user reviews it has on third-party review sites is smaller than similar providers. And, unlike most EOR providers, it works with local partners instead of setting up business entities in countries that it services.

Want to learn more about EOR? Check out our EOR guide to understand how it works and if it fits your business needs.

Papaya Global Overview

Pros

- Transparent pricing with reasonably priced global payroll solution

- Payroll, contractor management, and EoR services cover 160+ countries

- Compliance support includes worker classification checks for contractors

- Dedicated account manager

- Global payroll payments in as fast as 72 hours

Cons

- Can get expensive depending on the services you require and number of employees you have

- Basic HR solution; doesn’t have learning management and performance review tools

- Charges additional fees for initial setup and for every payroll payment transaction

- Doesn’t own legal entities in countries that it services

Papaya Global Deciding Factors

Supported Business Types | Small to large sized businesses that need global hiring, onboarding, payroll, and contractor management tools and services. |

Free Trial | None, but you can request a free demo |

Pricing |

|

Standout Features |

|

Ease of Use | Its online platform is generally simple to learn and use, but you need to know the basics of paying international employees and global contractors. |

Customer Support | Online FAQs and how-to guides; “Countrypedia” containing country hiring guides; dedicated account manager; access to compliance experts |

Papaya Global Is Best For

- Businesses planning to expand into other countries: Papaya Global has a network of in-country partners to help you hire, onboard, and pay international staff in over 160 countries. And, if you’re sending employees to work in your international offices, it can help you get your staff’s required permits (such as work and residence permits).

- Companies needing global payroll tools: Papaya Global can securely handle cross-border payments and multicurrency payouts with ease. If you don’t need its full EOR and AOR services, it has separate payroll and payment products that include automated local currency payouts directly to worker bank accounts.

- Employers requiring assistance managing international contractors: Its AOR service is designed to help you find and recruit global contractors in over 160 countries. Papaya Global will even assess each contractor’s worker classification to avoid compliance issues. And, when paying international contractors, its platform collects and validates all contractor invoices, making it easy for you to provide accurate payments.

Papaya Global Is Not Ideal For

- Small businesses that only need US payroll tools: Papaya Global’s payroll solution is designed to handle international pay processes and has features that small businesses don’t need (such as cross-border payments). Its services can also get pricey depending on the number of employees you have, so for more affordable options, consider our top-recommended payroll software for small businesses.

- Companies needing robust HR solutions: Papaya Global may have the essential tools you need to manage employee data, attendance, and onboarding, but it lacks advanced HR solutions for tracking performance reviews and training programs. If you’re looking for an all-in-one system to manage the entire employee lifecycle, check out our guide on the best HR software.

Top Papaya Global Alternatives

Best For | Starter Monthly Pricing for EOR | Starter Monthly Pricing for Global Payroll | Learn More | |

|---|---|---|---|---|

| International pay runs and global payments | $599 per employee | $25 per employee | |

| EOR and intellectual property (IP) protection | $699 per employee | $50 per employee | |

| Multiple payment options and immigration support | $599 per employee | Contact sales | |

Automated compliance and all-in-one HR, payroll, and IT | ||||

Looking for something different? If you don’t require a global payroll solution, check out our list of the best payroll services. If you need help deciding which one to get, read our guide to finding the right payroll solution.

Papaya Global Pricing

Papaya Global would have earned a perfect rating in this criterion, if not for its add-on fees for initial setup and payment transactions. However, we gave it top marks for its transparent pricing, reasonable rates, multiple plan options, and separate payroll plans for contractors.

Since Our Last Update: Papaya Global has changed its plan options, reduced monthly fees for EOR services, and added an Agent of Record tier for hiring and paying global contractors.

It offers five packages, wherein each covers different services. To know more, either click on the option you’re interested in or scroll through the content below.

Note that all Papaya Global packages come with compliance tools, reporting features, and payments in over 160 countries. Customized user roles and system permissions are also available, including access to the provider’s online knowledge base and 24/7 chat support.

Ideal for companies that need to pay global employees, this package includes automated payments, fraud protection, digital payslips, time tracking tools, and access to Papaya Global’s cloud-based platform and mobile app. You’re also assured of secure payments, with its full liability coverage, and accurate pay calculations, with its artificial intelligence (AI)-based payroll validation feature.

The Papaya Global pricing for this package is based on the number of employees you have. It has three plans: Grow Global, Scale Global, and Enterprise Global.

Grow Global | Scale Global | Enterprise Global | |

|---|---|---|---|

Starter Monthly Pricing | $25 per employee | $20 per employee | $15 per employee |

Minimum User Requirement | 101–500 employees | 501–1,000 employees | Over 1,000 employees |

Number of Entities | Up to 4 | Up to 10 | Over 10 |

Full Liability Coverage | ✓ | ✓ | ✓ |

Unlimited | Unlimited | Unlimited |

While this package’s starter plan requires at least 101 employees, the Papaya Global representative we spoke with mentioned that small to medium-sized businesses (SMBs) can also use its global payroll solution. However, it may be a costly option because you would need to pay for 101 users even if your actual headcount is less than the minimum user requirement.

Further, apart from the above fees, Papaya Global charges extra for the following:

- New client setup or onboarding: Contact sales to request pricing

- Payment transaction: Starts at $2 per transaction

If you plan to expand company operations to other countries but don’t want to set up local business entities to recruit workers, Papaya Global’s EOR service can help you pay and hire international employees. Monthly fees start at $599 per employee and you get the same payment features included in Payroll Plus but with additional solutions, such as:

- Automated onboarding

- Country-specific employment contracts

- Contract tracking and signing tools

- Online wizard for adding new EOR workers

With this package, you can onboard, manage, and pay global contractors. Monthly fees start at $30 per worker and, similar to the EOR plan, it comes with onboarding, country-specific contracts, contract signing and tracking tools, and pay processing in over 160 countries.

If you’re worried about worker misclassification, you can check the provider’s online knowledge base. It has a library of resources that tackle global employment and contractor classification. You also get the following Papaya Global features:

- Contractor invoicing

- Recurring invoices

- Automated payment reconciliation

This package has similar functionalities as Papaya Global’s EOR service, except instead of employees, this is focused on paying and hiring contractors. Monthly fees start at $200 per worker.

You also get the same payment features included in the Contractors Payment package. However, Agent of Record comes with additional compliance support, such as worker classification and ongoing compliance checks.

With this package, you get a global workforce payments solution for paying global workers and local authorities, such as tax agencies. It also supports statutory payments for local pension and health insurance plans. Fees start at $2.5 per transaction.

In addition to fraud protection features, this solution has a data connector tool that automatically converts your payroll data (such as worker bank details, benefits, and salaries) into global payroll payment disbursements for easy processing. You can even use Papaya Global’s online wallet to securely store your workforce funds and send payments.

Papaya Global Payroll Features

With Papaya Global, you get a fully automated platform with flexible workflows that help you save time while streamlining global payroll and workforce management processes. In our evaluation of its payroll features, the provider earned a score of 4.5 out of 5. It didn’t get a perfect rating in this criterion because it doesn’t own local entities in the countries it services.

Papaya Global asserts that it can pay your global workforce in as fast as 72 hours. (Source: Papaya Global)

Even without locally owned entities, Papaya Global relies on its network of in-country partners to process payments for your international employees and contractors. It provides local tax filing assistance, pays in over 100 currencies, and handles payroll requirements in more than 160 countries.

Processing cross-border payments is easy with its payment solution and online wallets. Papaya Global leverages J.P. Morgan payment rails and account infrastructure to provide you full visibility of payment processes, as well as keep your funds and money transfers secured. While it sends payments within 72 hours, its instant payment rails deliver 95% same-day payouts if you need it.

What’s also great about its workforce payments is the full liability coverage that Papaya Global offers. With its built-in fraud protection, you can ensure compliant payments to workers and local authorities (such as tax agencies). Papaya Global also utilizes AI-based tools to conduct anti-money laundering checks, screen payments, and verify transactions.

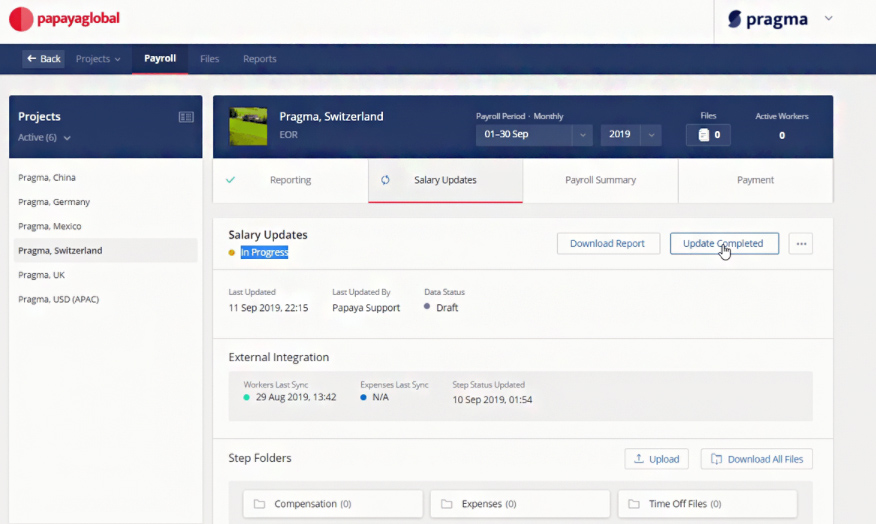

You can directly input the employee salary changes into Papaya Global’s platform. This is great if you have up to 20 employees, but for a large workforce, Papaya Global has a sample Excel spreadsheet you can download. It contains the required data fields for updating employee salaries, and you only need to input the necessary information (such as new salary and bonus amounts) and upload it into Papaya Global.

Papaya Global also supports bulk salary updates for multiple locations if you have teams working in several countries. It also has a spreadsheet you can use to capture all salary-related changes that need to be uploaded into its system.

Clicking the “Update Completed” button will notify your Papaya Global contact to add the new salary data into the system, locking adjustments for the pay period. (Source: Papaya Global)

If you submitted salary updates via its platform but need to make additional changes, you have to contact Papaya Global for assistance. Note that these changes might not be included in the pay period for when the updated salaries are scheduled to be processed. You may request an out-of-cycle pay run, but this will cost extra.

Papaya Global’s AI-enabled data validation engine allows it to run payroll audit checks, especially if there are salary changes. It also keeps track of when employee salaries were updated and who made the changes, providing you with an audit trail and a way to verify whether the necessary checks have been completed.

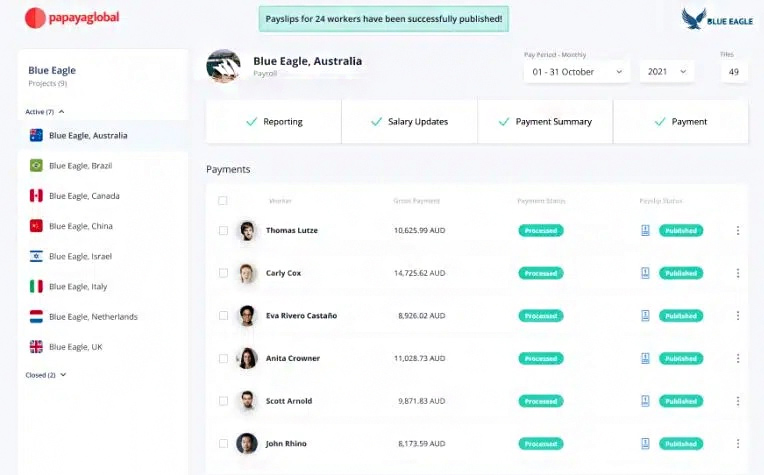

While its in-country partners will process global salary payments for you, it’s still your responsibility to conduct a payroll audit from time to time. You also have to approve the final payroll report for every pay run.

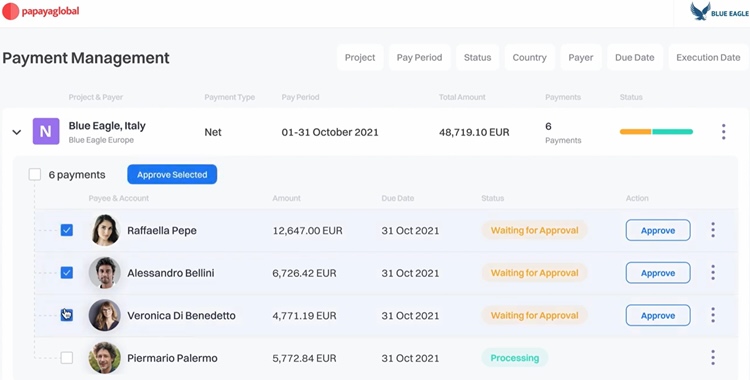

Papaya Global will automatically push the pay period’s payroll summary into its platform for you to review and approve. (Source: Papaya Global)

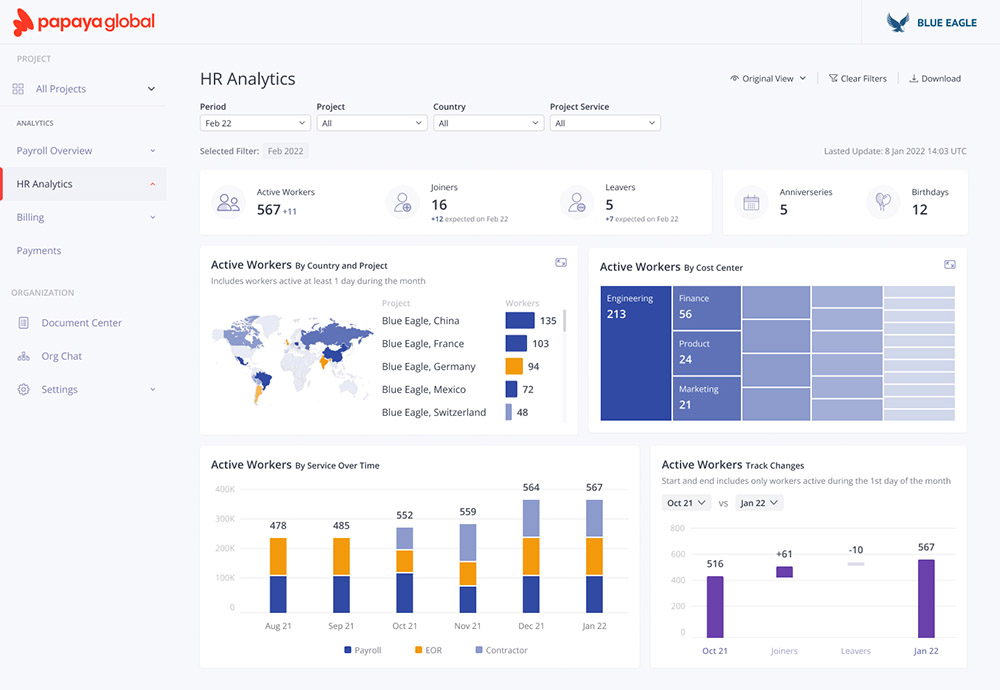

Papaya Global HR Features

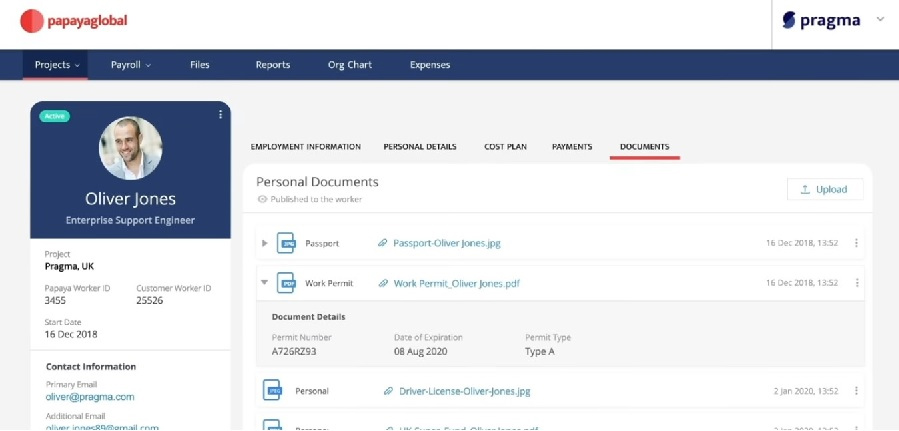

Papaya Global earned perfect marks here given the EOR, compliance, benefits, and HR tools that it offers. It also comes with employee profiles, online org charts, and digital storage for workers’ documents and company files (such as policies and handbooks). Papaya Global even offers immigration services if your employees need work permit assistance.

Papaya Global’s employee profiles contain all of your workers’ personal and pay information, including new hire requirements and compliance documents. (Source: Papaya Global)

If you need to hire international employees, you have to set up local entities in countries you plan to expand in and familiarize yourself with local labor laws. With Papaya Global’s EOR service, you can compliantly recruit qualified candidates, even if without a local entity.

Further, its in-country partners will assume responsibility for managing your global workforce, but you get to direct employees when it comes to their daily tasks. If you have multicountry business locations, its cloud-based platform provides you with the tools you need to manage all EOR in-country partners.

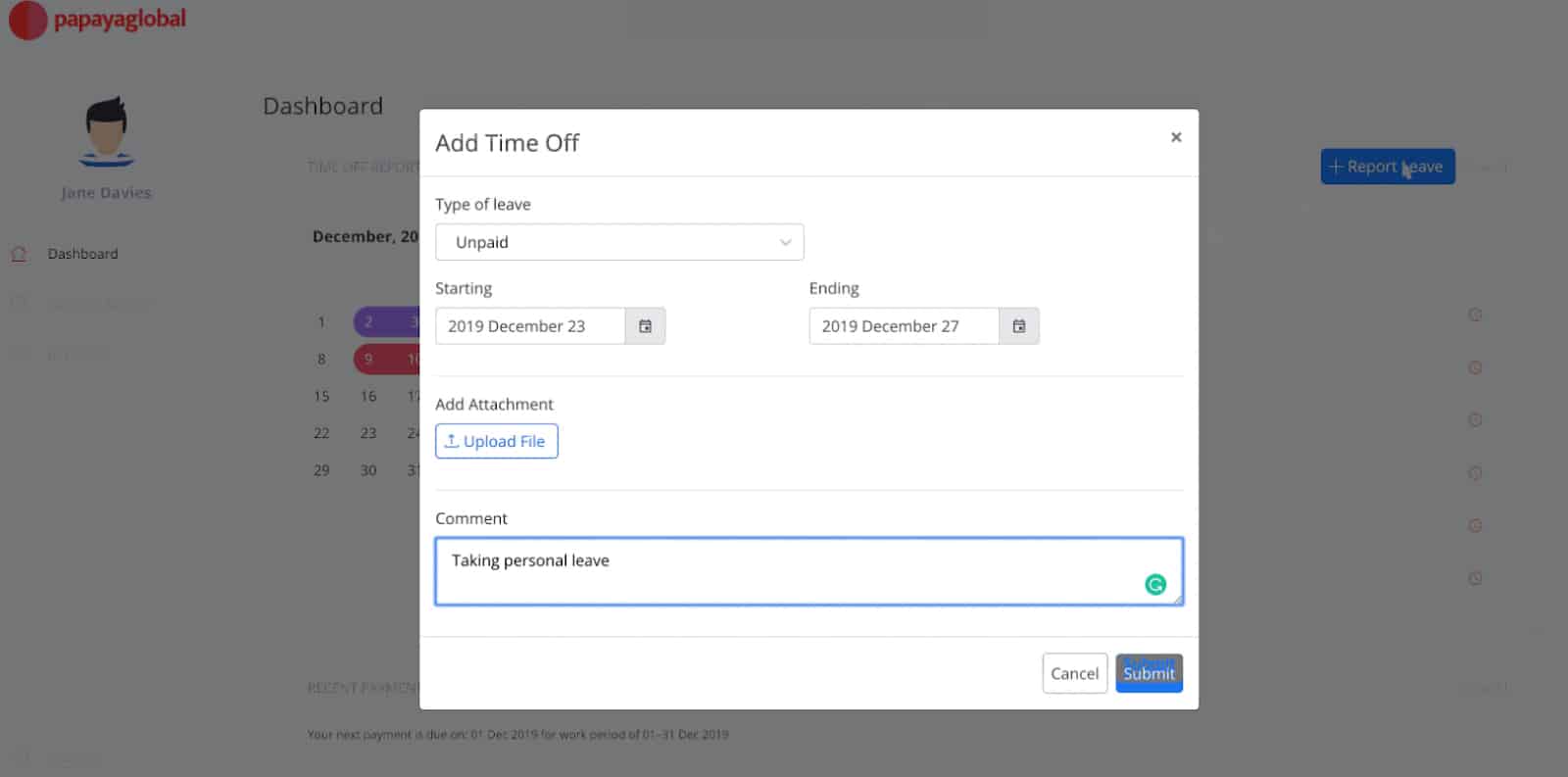

Papaya Global has essential HR features, such as a human resource information system (HRIS) that securely stores employee information. Time tracking and paid time off (PTO) monitoring tools are also available. However, if you’re using a third-party time and attendance system, you can extract the time data and then upload it into Papaya Global for pay processing.

Papaya Global lets you add comments and upload file attachments to PTO requests. (Source: Papaya Global)

You also don’t have to worry about generating and reviewing employment contracts. Country-specific contracts that have been validated by the provider’s local partners and legal experts are easily available through its platform.

When it comes to onboarding new hires, its system is equipped to collect new hire documents. Onboarding workflows are even customized to follow country requirements. If some of the submitted new hire documents require additional attention, Papaya Global will automatically notify you.

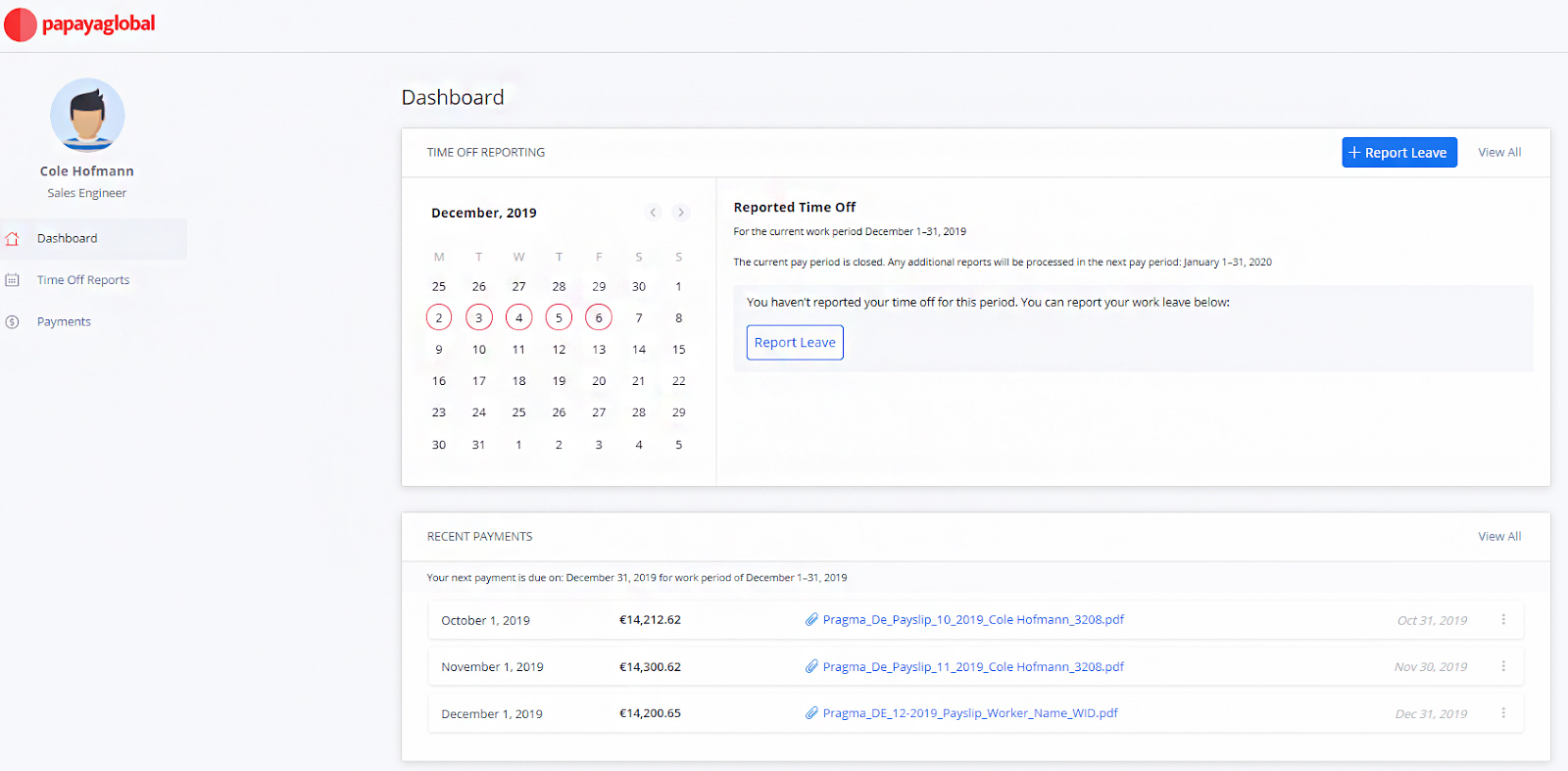

Employees can view pay stubs (in their local language), request PTO, and track attendance through the Papaya Global platform or via its mobile app, Papaya Personal. If workers have questions about their payslips, they can contact Papaya Global’s support team through the employee portal or its 24/7 chat service (via WhatsApp).

A screenshot of Papaya Global’s workers portal (Source: Papaya Global)

Papaya Global’s AOR and contractor management solutions are designed to help you avoid worker misclassification errors. If you get the AOR service, Papaya Global will assist in determining the correct worker classification of every contractor. And if you’re wary about signing work contracts with international contractors, Papaya Global will do that for you. It willingly accepts the full legal liability for your contractors, including handling the day-to-day tasks of managing contractors (such as payment processing).

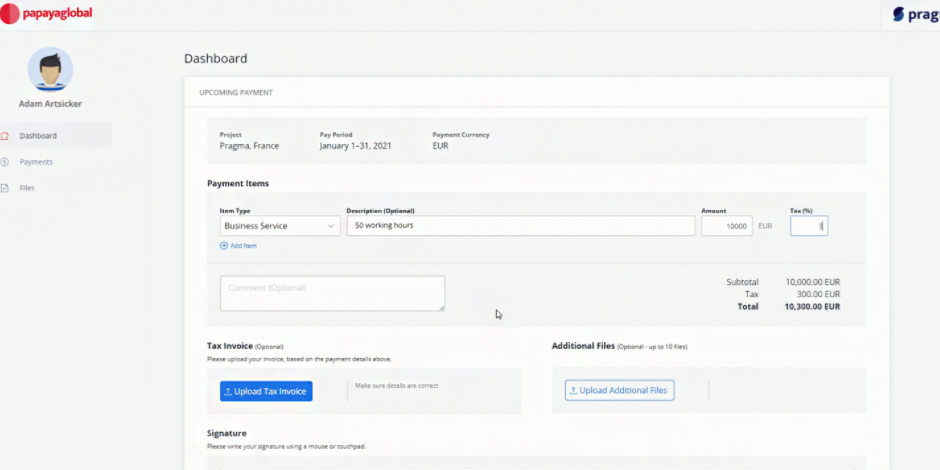

Independent contractors can log in to their self-service portal to prepare and send payment requests. A blank payment request template is available on the online dashboard if they don’t have a form to use. Once they complete and submit the form via its platform, Papaya Global will automatically send the payment requests to the appropriate employee for approval.

With Papaya Global, contractors can upload additional documents (like tax invoices and other files) to support payment requests. (Source: Papaya Global)

Offering global benefits to an international workforce can be a nightmare for HR teams, as it entails coordination with various providers in different countries. With Papaya Global, you get a health plan that provides both physical and mental health coverage for employees. Available in over 160 countries, it includes access to telehealth services and allows employees to choose whether to keep their current doctors or use new providers.

You get a dedicated customer success manager (CSM), who serves as your single point of contact and will oversee all of your payroll, EOR, and contractor management processes. Its in-country partners will also keep you up-to-date with the latest labor and tax regulations. If you need additional support, Papaya Global’s “Center of Excellence” connects you with payroll, compliance, and legal experts who can offer advice.

Papaya Global can help obtain work permits for your expatriates and employees on international short-term assignments, including spouse and family permits. The provider will handle all the paperwork and compliance for you. Its immigration experts will also guide you through the process—and if there’s something that requires your attention, you’ll receive an alert via the Papaya Global platform.

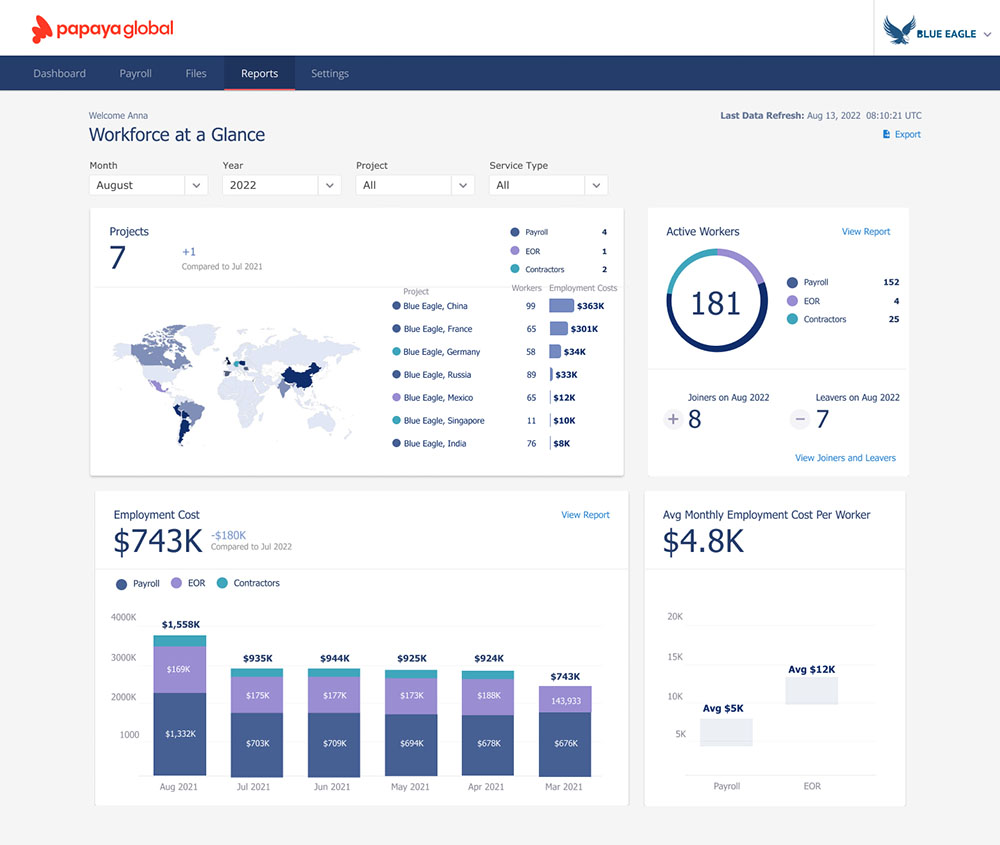

Papaya Global Reporting

This is another criterion where Papaya Global earned a perfect rating. Its extensive HR and payroll report options contributed to its high scores. It has more than 50 standard reports, which include payroll summaries, cost simulations, HR workforce data, billing comparisons, annual statutory reports, and an audit trail.

Papaya Global Ease of Use

Papaya Global earned perfect marks here because of its user-friendly interface, comprehensive EOR and contractor solutions, and solid global payroll tools. Compliance support is also available when you need it, including access to forms (like contracts) that you can use. These functionalities take the stress away from finding, hiring, paying, and managing international workers.

- User-friendly platform

- In-country partners/specialists

- Access to legal and compliance experts

- Dedicated CSM and support team

- 24/7 chat support

- Online FAQs and help articles

- Downloadable forms and contracts

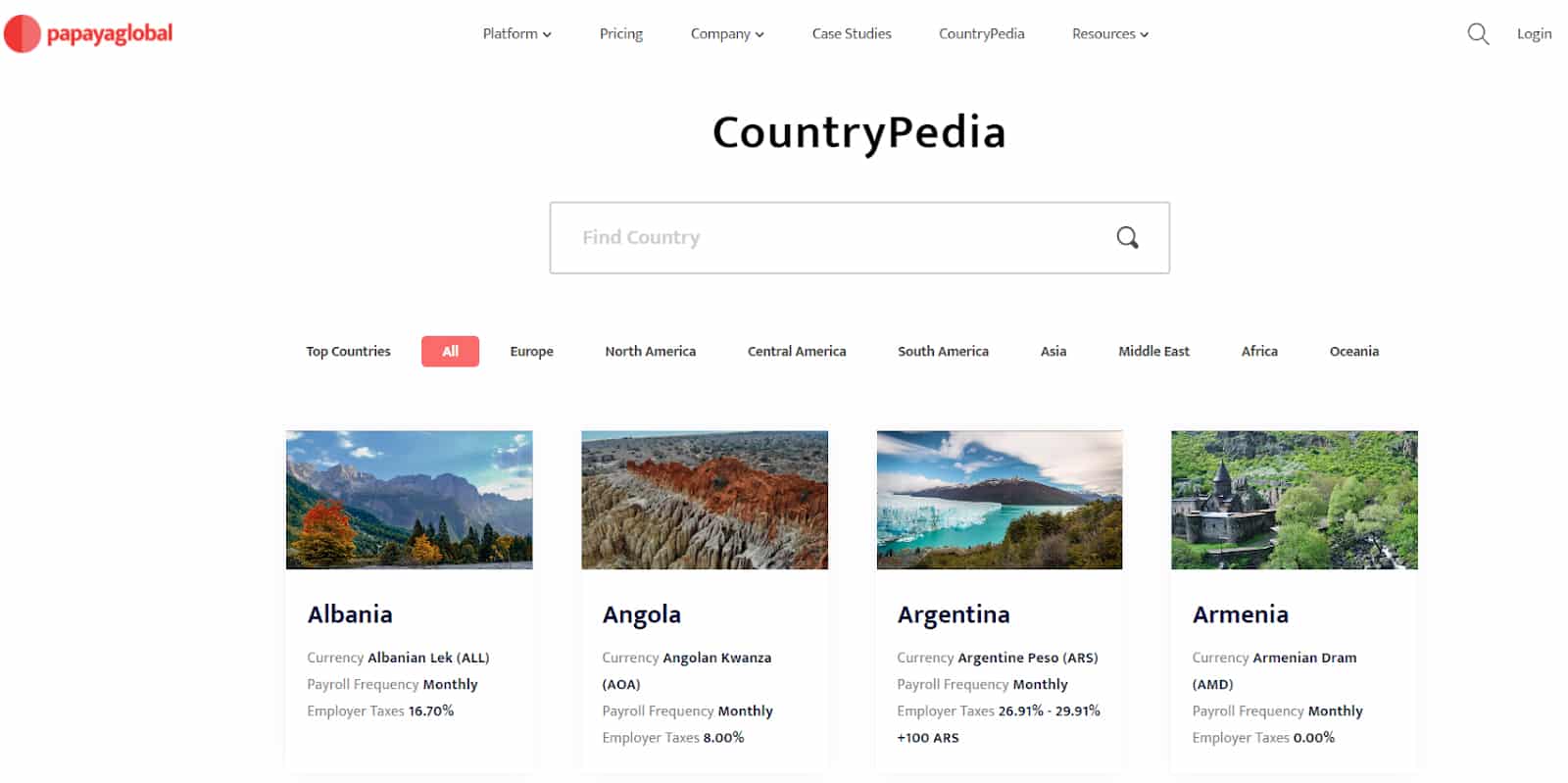

- “CountryPedia” guides with per-country employment details

You don’t have to constantly check the employment and tax rules in countries where your business operates. Papaya Global and its in-country partners are always up-to-date with the latest regulations to ensure that it remains compliant at all times. If you have questions about its features and services, Papaya Global offers 24/7 chat support—although, you can also contact your dedicated CSM or its “Center of Excellence” teams of payroll, compliance, and legal experts.

Further, researching local employment laws is easy with Papaya Global online “CountryPedia.” It features a library of guides that show important information about a country’s payroll and tax regulations, mandatory benefits and PTO entitlements, minimum wage details, and work visa requirements among others.

Papaya Global’s “CountryPedia” has over 150 guides. (Source: Papaya Global)

If you need integration options, note that Papaya Global doesn’t have a robust network. However, the software it connects with are systems most businesses use. These include HRIS, expense management, time and attendance, ERP, and compensation software. Here are some of its partner systems:

- Expensify

- BambooHR

- Namely

- HiBob

- SAP SuccessFactors

- Oracle NetSuite

- Oracle HCM

Papaya Global Expert Score

Papaya Global earned perfect marks in our expert assessment. Its reasonable pricing, user-friendly interface, robust global payroll solutions, and efficient EOR services contributed to its high score. Plus, it has the essential HR tools that businesses need to manage international hiring, onboarding, and pay processing.

Papaya Global Reviews: What Users Think

Papaya Global’s low score in this area is primarily due to the very limited number of reviews on third-party review sites like G2 and Capterra. Those who left positive Papaya reviews appreciate its solid EOR services, user-friendly interface, and online tools that help simplify month-to-month payroll and HR processes. They also like the quality of support they received, adding that its representatives are knowledgeable and responsive.

On the other hand, some users said that its custom reporting and integration features need to be further developed. Other reviewers commented that while Papaya Global offers a good EOR solution, it is a bit expensive.

At the time of publication, Papaya Global earned the following scores on popular review sites:

- Capterra: 4.6 out of 5 based on nearly 30 reviews

- G2: 4.5 out of 5 based on more than 30 reviews

Methodology: How We Evaluated Papaya Global

For this Papaya Global review, we used a scoring rubric for international payroll solutions. Payment options, payroll coverage, and basic HR functionalities (like onboarding and PTO tracking) are some of the features we looked for. We also considered ease of use, transparency in pricing, third-party integrations, compliance tools, and customer support. We even checked the feedback that actual users posted on popular user review sites.

Click through the tabs below for our full evaluation criteria:

25% of Overall Score

We looked for convenience features like automatic pay runs, local tax filing, and the ability to pay contractors and employees with manual check capabilities and direct deposit. Providers rank better if their services are available in more than 100 countries, with a team of in-country payroll and HR compliance experts.

20% of Overall Score

We highly favored providers that showed straightforward pricing with multiple plan options. In addition to each software’s per-employee pricing, we checked if any required setup fees. We also gave more points to providers that allow unlimited pay runs and have multiple plan options.

15% of Overall Score

The best global payroll service includes essential HR features, such as onboarding, self-service portals, and benefits. We favored companies that offered tools to help with legal compliance issues. We also considered PEO services and benefit and deduction assistance.

15% of Overall Score

The global payroll software should have no setup fee and be easy to use. We also looked for an intuitive user platform, including live phone support, training options, and flawless integration with other software.

10% of Overall Score

In addition to the number of payroll reports, we considered whether they are customizable or if you could create special reports for your specific need.

10% of Overall Score

Sometimes, a service can check all the boxes but not be the best fit for a small business. The expert review is our opinion on how well a service meets SMB needs for payroll and HR, including its general value for the dollar.

5% of Overall Score

We took the average review ratings from third-party sites like G2 and Capterra, which are also based on a 5-star scale. Any option with an average of 4+ stars is ideal. We also favored software with 1,000+ reviews on any third-party site.

Bottom Line

Finding a reliable partner who can handle all of your global hiring and payroll needs is critical if you plan to expand your business operations outside of the US. With Papaya Global, you get solid EOR services and strong compliance support to help prevent employment and tax issues.

What’s also great about it is that it has fully transparent pricing—some global payroll providers require you to call and request a quote. Plus, it has efficient online tools that can handle the payroll needs of employees and contractors in more than 160 countries, so sign up for a Papaya Global account today.