The holiday season is a bustling and profitable time for retailers. Unfortunately, a surge in holiday sales almost always results in a wave of post-holiday returns. However, this past holiday season, retailers saw a decrease in both return rates and the total value of merchandise returned.

There are several factors contributing to this surprising decline:

- The rising costs of handling returns: 49% of retailers implemented return fees last year in the form of shipping or restock fees to offset losses from reverse logistic expenses.

- Changes in retailers’ return policies: 42% of retailers planned to reduce the return window for the holiday season. 24% opted for store-credit-only return policies. With holiday shopping starting earlier than ever, many shoppers may have simply missed out on the opportunity to return items they otherwise may have.

Fewer returns may be a result of shoppers being satisfied with their purchases. After all, increases in diverse product photos, user-generated video reviews across social media platforms, buy-now pay later (BNPL) payments, and emerging technology like artificial intelligence (AI) and virtual reality (VR) help online customers buy more confidently. However, shorter return windows and fees likely also contribute to a lower holiday return rate.

This article delves into this decline and other holiday return statistics from the 2023 season, providing a data-backed overview to help retailers confidently prepare for the 2024 holiday season.

2023 Holiday Returns Seasonal Overview

Key statistics:

- 15.4% of all holiday purchases were returned

- Holiday return rates were 2.5% lower in 2023 than 2022

- Return rates are higher for ecommerce (17.6%) than brick and mortar (10%)

- 16.5% of holiday returns were fraudulent

1. Shoppers returned 15.4% of all holiday purchases

According to the National Retail Federation (NRF), holiday return rates were 15.4% in 2023. 15.4 is just slightly higher than the rate for all of 2023, which was 14.5%.

2. Holiday return rates were 2.5% lower for the 2023 holiday season

Compared to the data the NRF released for the 2022 holiday season, returns were 2.5% lower this year. And, despite inflation and the rising costs of goods, the dollar amount of returned merchandise was significantly lower as well—$23 billion lower, in fact.

3. Return rates are higher for ecommerce (17.6%) than brick-and-mortar (10%)

Unsurprisingly, holiday return rates for online products were over 7% higher than those purchased in-store. In general, ecommerce has higher return rates than brick and mortar since shoppers better understand sizing, colors, and quality when purchasing in-store.

However, it is important to note that the decline in returns following the 2023 holiday season is not a result of more in-store holiday purchases. While total holiday sales were up 3.8% over 2022, online sales, specifically for the holiday season, were up 8.2%, far outpacing any growth for in-store sales.

4. 16.5% of holiday returns were fraudulent

The hustle and bustle of the holiday season provides extra opportunities for fraudsters, as they benefit from crowded stores and stressed associates. The 2023 holiday season was no different, as 16.5% of all returns were fraudulent. Fraudulent returns result in both monetary and inventory losses.

What makes a return fraudulent? There are many ways thieves intentionally commit return fraud. However, some of the most common include:

- Returning shoplifted merchandise

- “Returning” a product off the shelf with a stolen, found, or falsified receipt

- Filling the packaging with decoy filler instead of the item when returning a product

- Altering the label to receive a higher rate for the return than the item initially cost

- Purchasing the item with the intent of using it for a short time before returning it

5. 89% of retailers say returns are a moderate to severe problem for their business

Heading into the holiday season in September 2023, a total of 89% of retailers said that returns are a moderate to severe problem for their business, with the following breakdown:

- Moderate: 17%

- Significant: 23%

- Severe: 49%

The remaining 11% labeled returns as a “minor” problem for their business. Notably, in September 2022, only 2% of retailers said returns were a severe problem. In 2023, that number increased to 49%, marking an enormous uptick in concerns around returns.

Why are retailers increasingly concerned about returns?

- Higher logistics and carrying costs: According to a report from Modern Retail, as of December 2023, “the average return costs a retailer $30, and the cost of processing returns has gone up about three times over the course of the ecommerce shopping boom of the Covid-19 pandemic.”

- Increased fraud rates: Last year, 44% of retailers reported increased returns for shoplifted or stolen merchandise. Customer-friendly return policies also make retailers more vulnerable to fraudsters.

- Higher inventory levels: In recent years, retailers have struggled to maintain inventory levels due to the supply chain and demand disruptions during and following the COVID-19 pandemic. However, that is no longer the case.

- Faster trend cycles: Especially for fashion, beauty, and home decor, trend cycles are moving faster than ever. So, when a product is returned, it’s even less likely to be salable.

How Retailers Handled Holiday Returns

We know that retailers saw returns as a huge problem heading into the holiday season. And, while shoppers returned 15.4% of holiday purchases, this number is decently smaller than last year’s holiday return rate.

Let’s examine how retailers prepared for holiday returns and how customers responded.

6. 42% of retailers shortened their return window this holiday season

As mentioned earlier, almost half of retailers cited returns as a “major” concern for their business heading into the holiday season. To reduce the number of returns, 42% of these retailers planned to shorten their return window this past holiday season.

Notably, on top of shortened holiday return windows, 40% of retailers had already tightened their general return window in the 12 months leading up to the holiday season.

7. 49% of retailers imposed return fees

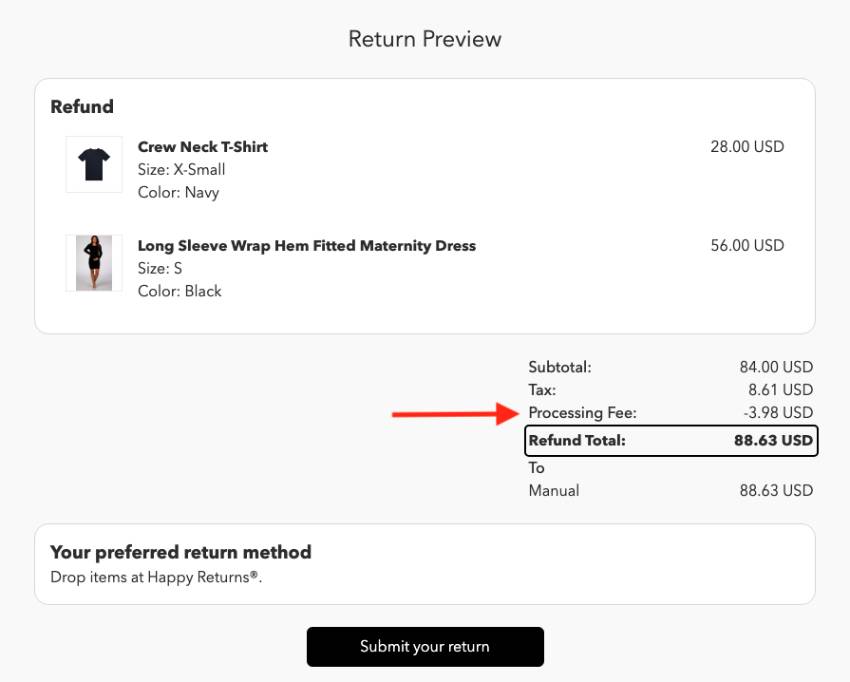

Return processing, restocking, and shipping fees all fall under the umbrella term “return fees.”

In addition to shortened return windows, 49% of retailers imposed return fees, mainly in the form of shipping costs or restocking fees. Exact policies differ across retailers but were most common for online returns.

For example, T.J. Maxx deducts $11.99 from the customers’ return or store credit for online returns. However, there are no fees for returning products in-store.

8. 59% of retailers offer “keep it” services for items that are not economical to return

Increasingly, retailers are finding that it is more expensive to process a return than to absorb the cost of the product altogether. A majority 59% of retailers have adopted “keep it” return policies due to this expensive new shipping and handling reality.

Policies where customers can receive their money back without returning the item are most common with products that are unlikely to make up the costs in a re-sale:

- Low-cost or bulky items where the shipping costs outweigh the profits

- Damaged, broken, or defective goods that can’t be resold

In addition to being a cost-savings for retailers, “keep it” policies can benefit customers, too, as they don’t need to go through the hassle of driving to the store or repackaging and shipping the item.

9. 42% of retailers saw an increase in buy online, return in-store transactions

This past holiday season, many shoppers returned their ecommerce purchases in-store instead of online. In fact, 42% of retailers reported an increase in buy online, return in-store (BORIS) shopping patterns.

BORIS transactions could result from convenience—it’s easier for shoppers to swing by the store than to package and ship a product. Alternatively, customers could prefer to browse in-store if they are looking for an exchange or replacement item.

However, an increase in BORIS sales could also result from retailers’ newly implemented return fees for online sales, which we covered above.

Tips for Planning Your Holiday Return Strategy

There is no one-size-fits-all return policy that is perfect for every store. Use a data-driven approach to find the right mix of customer-centric and profit-protecting for your holiday return policy.

10. Examine Year-over-ear holiday data against your broader return data

Of course, the best way to mitigate returns is to try and prevent them in the first place.

Start by looking at your returns data: your holiday season returns and overall return rates. Look not only for which rate is higher but also for any trends among the products, departments, or sales channels.

Higher return rates among a specific product or category could indicate opportunities for improvement, either with product quality, pricing, or marketing.

Higher return rates within a particular sales channel indicate an opportunity to improve your communication around the product. Better photos, a 360-degree view, detailed product specs, more user-generated content, or reviews can give shoppers a more accurate depiction.

11. Test initiatives and collect data throughout the year

Once you have an idea of where and how you can work to reduce returns, measure the effectiveness of your efforts throughout the year by continuing to monitor your return rates.

12. Calculate the typical cost per return

After doing your due diligence to prevent returns, calculate a rough cost per return. Your return cost includes shipping fees, time and labor for receiving and restocking, and inventory storage costs.

As mentioned earlier, Modern Retail reported that the average return costs retailers $30.

If you sell both in-store and online, consider calculating these metrics separately for each channel. For example, your costs may be significantly lower for in-store returns if there are no shipping costs, and re-stocking is a much simpler process.

Tip: 48% of retailers try to encourage in-store vs online returns.

See how your average return cost compares against other metrics, like if customers typically buy more items during the return process, whether customers returning items are loyal or repeat customers, how often you can resell returned items to make up the cost, etc.

These considerations will give you some insight on whether you are losing money with returns or if they balance out over time. If returns significantly affect your profits, consider encouraging in-store returns, implementing a shipping or restocking fee, or shortening your return window.

Alternatively, if customer returns typically result in more sales or if you can typically resell the returned item, consider keeping a customer-friendly return policy to encourage brand loyalty.

Remember, around the holiday season, initiating a return or exchange might be the first time a customer interacts with your store. If they have a pleasant experience, it’s less likely to be the last.

Holiday Return Statistics FAQs

Returns and return policies are a hot topic for retailers and their customers alike. Here are some of the most commonly asked questions.

The average return rate for the 2023 holiday season was 15.4%, according to the National Retail Federation.

Transparent and flexible return policies can motivate customers to buy, especially when the item is a gift.

Small businesses should weigh the cost of handling the return against the potential resale profit of an item and consider offering “keep it” or free return policies. Analyze return data for trends or commonalities that could indicate possibilities to improve product quality, description, or packaging. No matter what your policy is, make sure it is prominently displayed and transparent for customers.

Bottom Line

The 2023 holiday season has highlighted the critical role of effective returns management and return policies within retailers’ overall sales strategies. As ecommerce continues to make up a larger percentage of retail sales, it will only be more important for retailers to mitigate losses from returns while also keeping return policies customer-focused and transparent.