NCH Express Accounts is a desktop accounting software that works without an internet connection. It can account for invoices and perform bank reconciliations. When I tested the free version of the software, I liked its bank reconciliation feature. The only downside is it doesn’t connect with bank feeds, which means I have to manually upload or enter bank transactions. Besides that, NCH Express Accounts is relatively easy to use compared to other desktop accounting software, which is a big plus, in my opinion.

Pros

- Offers a free version for companies with five or fewer employees

- Easy to use if compared to other desktop accounting software

- Has outstanding bank reconciliation features, even in the free version

- Doesn’t have user limits in a single installation

Cons

- Requires downloading newer versions to update the software

- Has no bank feed connection

- Can’t record cost of goods sold in inventory tracking

- Has no collaboration features where two or more people can work simultaneously

- Limited to one computer installation per license

Pricing | For businesses with five or fewer employees (not users), the software can be downloaded for free.

|

Discounts | ✕ |

Free Trial | No free trial, but users can download the free version |

Payroll | ✕ |

Standout Features |

|

Scalability | Highly scalable for more users but requires a paid plan if the business has five or more users |

Ease of Use | It has moderate difficulty for users with experience in desktop accounting software. For first-time users, it has a steep learning curve. |

Customer Support | Email and self-help information |

Average User Reviews | 3.91 out of 5 |

- Small businesses with up to five employees looking for free desktop accounting software: It offers a free program for operations with five or fewer employees. For larger companies needing a free program, check out our guide to the best free accounting software.

- Companies seeking inexpensive accounting software with inventory management: NCH Software’s proprietary stock management software, Inventoria, is available as an add-on at a lower price than what most other accounting programs offer.

- Bank reconciliation: NCH Express Accounts is one of our leading bank reconciliation software, with similar functionality as higher-end software. Also, users can create adjusting entries for book reconciling items without leaving the reconciliation.

NCH Express Accounts Alternatives & Comparisons

| Users Like | Users Dislike |

|---|---|

| Affordable software | Limited customer support and tutorials |

| Customizable invoices and estimates | Problems with printing checks |

| Integration with other Express accounts products | Steep learning curve |

Here are the common user sentiments, along with my expert insights:

- Form customization features: Some users like the customization features of NCH Express Accounts in forms. I agree with this feedback because when I tried the software, it allowed me to change field information. However, it has limited invoice designing features, which might be a big problem if you want to issue professionally designed invoices.

- Learning curve: A few users mention that the software can be cumbersome to learn, especially for those using the Mac version. I have tried both the Windows and Mac versions. I agree that there’s a learning curve when using the software, but I find no difference between Windows and Mac.

- Printing issue: Some users have experienced problems with printing settings, such as the software resetting paper size preferences when switching between different printing formats. I tried printing a sample check and couldn’t get it on the first try, but it worked the second time.

In my opinion, the overall user reviews are limited. Here are the average NCH Express Accounting review scores from third-party sites:

- Capterra[1]: 3.9 out of 5 based on less than 10 reviews

- G2[2]: 4 out of 5 based on less than five reviews

I compared NCH Express Accounts with QuickBooks Enterprise and Sage 50cloud Accounting using our case study.

NCH Express Accounts vs Competitors FSB Case Study

Touch the graph above to interact Click on the graphs above to interact

-

NCH Express Accounts

-

QB Enterprise

-

Sage 50cloud

In terms of value, NCH Express leads only by a few points over QuickBooks Enterprise, mainly because NCH Express offers competitive features amid its low price point. Another strength of NCH Express is bank reconciliation. The software allowed me to reconcile accounts, but I had to upload bank statements manually because the software didn’t have a bank feed connection.

NCH Express falls short in project accounting and integrations. Unfortunately, it lacks the project tracking capabilities needed to monitor project-specific income and assign related expenses. It didn’t have the features I was looking for, like the ability to track income and expenses per project. It enabled me to create estimates, but that is only a project-related feature.

NCH Express’s limited integration with non-NCH third-party software is a drawback if you need payroll, bill pay, or sales tax integrations. If project accounting and integrations are priorities and you’re looking for a more budget-friendly option than QuickBooks Enterprise, Sage 50cloud is a solid choice. For those with the budget, QuickBooks Enterprise remains the most feature-rich solution.

NCH Express Accounts Pricing

In our case study, the pricing score is one component of the overall value score. The value score encompasses both the software’s quality score—evaluated independently of price—and the cost-effectiveness of its features. For example, NCH Express Accounts achieves a strong value score of 4.20 out of 5, which significantly outperforms QuickBooks Enterprise and Sage 50cloud, both scoring 3.00.

This higher score reflects NCH Express Accounts’ ability to deliver exceptional value to users, particularly because it offers a free version that includes features typically found in premium software. For instance, advanced functionality like tracking timing differences during bank reconciliations is included at no cost. This makes NCH Express Accounts a compelling choice for users seeking robust capabilities without the burden of high licensing fees.

NCH Express Accounts is a one-time, single-installation desktop accounting software. However, it also offers a quarterly plan. In my opinion, I’d recommend that you choose the one-time payment option if you’re planning to use NCH Express Accounts for more than one year.

- Express Accounts Plus: $159 one-time fee

- Express Accounts Basic: $129 one-time fee

- Express Accounts Plus (Quarterly): $26.46 for three months ($8.83 monthly)

A free version is available for download for businesses with less than five employees, but it doesn’t have features catered to larger organizations. Such features include multicompany accounting and multicurrency support.

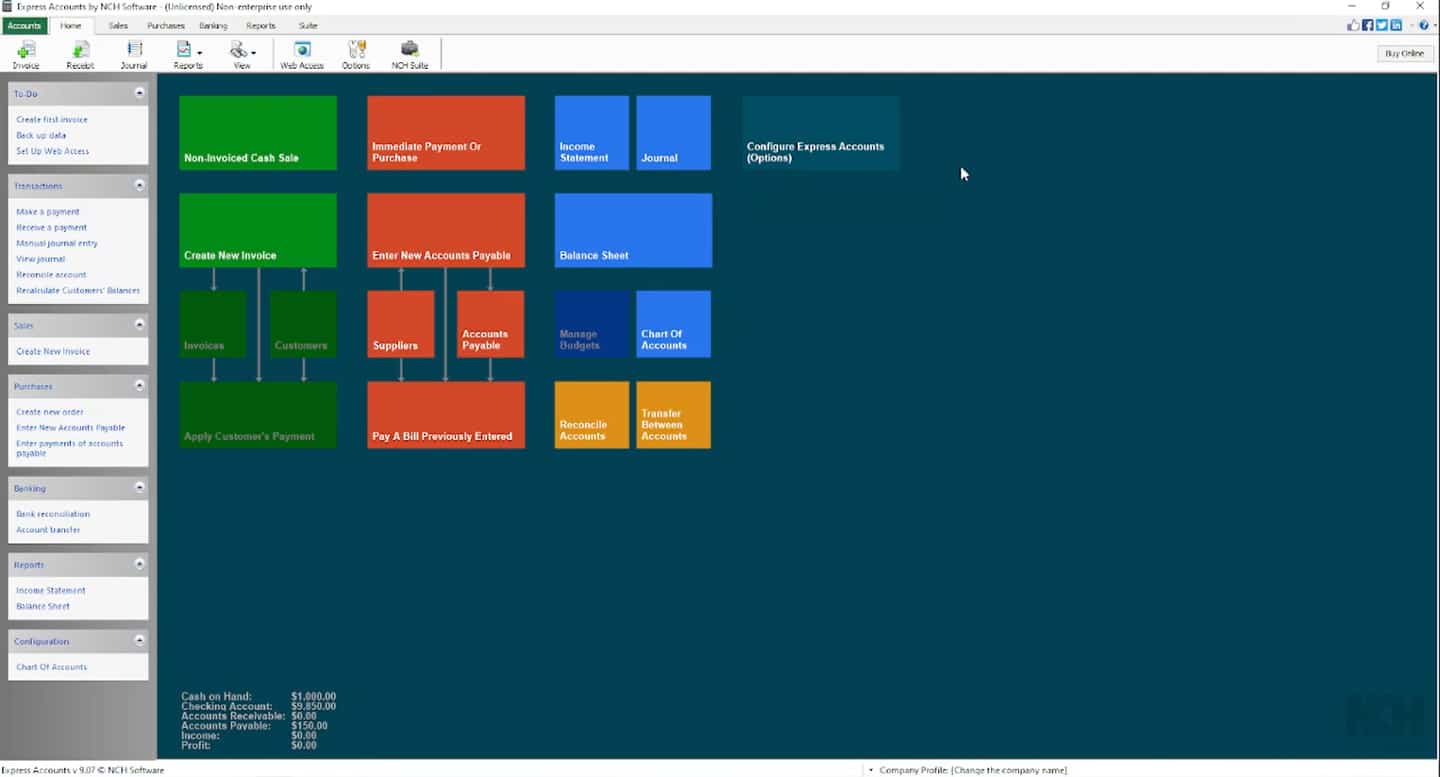

NCH Express didn’t perform strongly in my evaluation of its general features, though I wouldn’t say it’s a complete miss, as it still managed to impress me in some areas. In my experience, NCH Express Accounts’ interface feels like a nice upgrade over traditional desktop accounting software. They’ve refreshed the font style and window layout to match the look of Windows 10 and 11, which gives it a more modern feel. The Mac version has a similar design, though the dashboard text is more spaced out than on the Windows version.

Dashboard

For users with visual impairments, the small font size could be challenging. While they’ve made navigation simpler by using tabs instead of drop-down menus, I think a few more tweaks to the interface could make NCH Express Accounts even more user-friendly for those who need larger text or a more accessible layout.

The software allowed me to set up a company in the options menu. The experience would’ve been better if there had been a setup wizard to walk you through it step-by-step. I was able to change the business name, set a fiscal year-end, assign prefixes and numbering systems, and adjust several other settings. However, while I appreciate all these customization options, setting up a large chart of accounts could take a fair amount of time, as there’s no option to import a CSV file to speed things up.

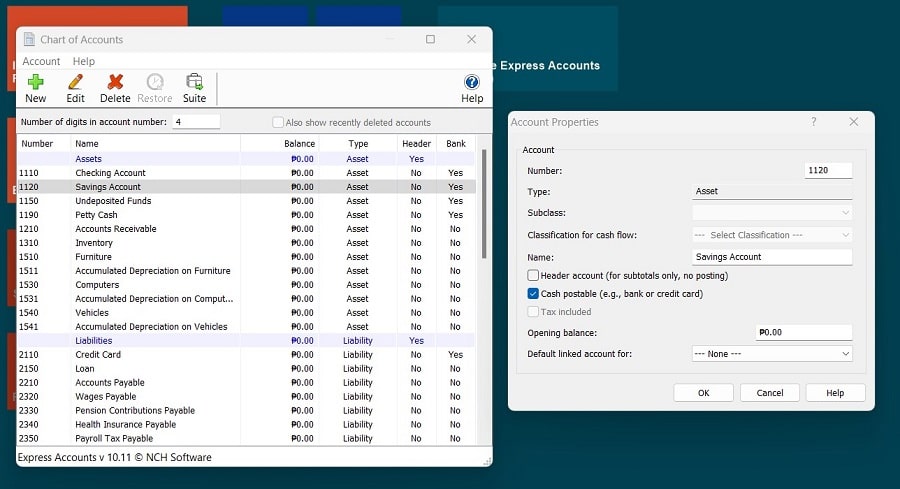

Chart of Accounts

The default chart of accounts in NCH Express Accounts is well-rounded and includes all the essential accounts, making it a solid fit for small businesses. When I reviewed the default accounts, I can say that it already covers most needs, so there’s minimal adjusting required. However, one unique feature here is that the software allowed me to classify accounts manually for the statement of cash flows, which many accounting programs handle automatically based on account type.

This setup might present a challenge for business owners who intend to manage their own bookkeeping. Certain settings, like cash flow classifications, require some accounting knowledge, which could be a hurdle for those without a background in finance.

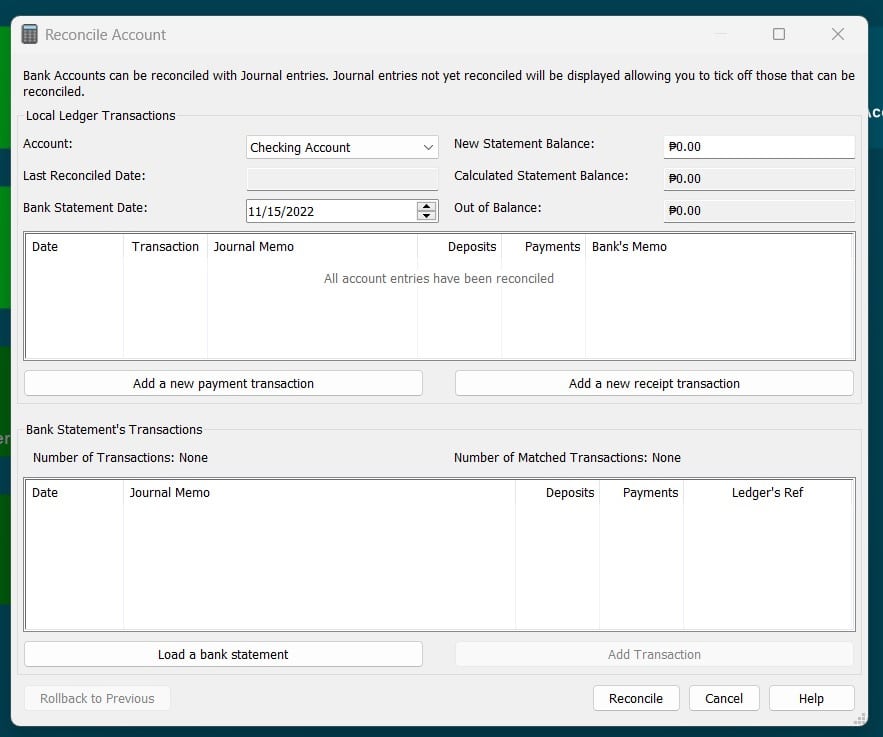

Banking is one of NCH Express Accounts’ strongest features, and I particularly liked the detail in its bank reconciliation module. Hence, it got a high score in my evaluation. Though NCH Express Accounts didn’t have an option to connect directly to a bank account, it does have a CSV upload option.

When I clicked the CSV upload option, an import wizard guided me in mapping the transaction fields. However, the downside I immediately realized was the amount of manual work needed to map and upload CSV files, which is the reason why I subtracted a few points in my evaluation. If you frequently handle multiple bank accounts, it might be better to consider an alternative with bank connection capabilities for ease of use. For this feature, I’d recommend QuickBooks Enterprise or QuickBooks Online.

Pre-bank Reconciliation Window

Moreover, its bank reconciliation module is decent but not “aesthetically pleasing” in terms of user interface design. The functionality is quite comparable to the ideal bank reconciliation systems found in higher-end software. What I particularly appreciate is that you can create adjusting entries directly within the reconciliation for bank transactions not yet recorded in the books, such as interest collections, bank charges, or NSF checks. This feature is a great addition, as it streamlines the accounting workflow and saves time.

NCH Express Accounts also did great in accounts receivable (A/R) but I had to dock a few points due to its limited invoice design capabilities and advanced invoice features that I discuss below.

The A/R module is located under the Sales tab, along with invoicing. However, I found the invoice customization options in the settings, which I think is counterintuitive. NCH Express Accounts offers limited options for customizing invoice appearances. While there are a few templates available, the customization experience isn’t as comprehensive as what you’d find in competitor accounting software.

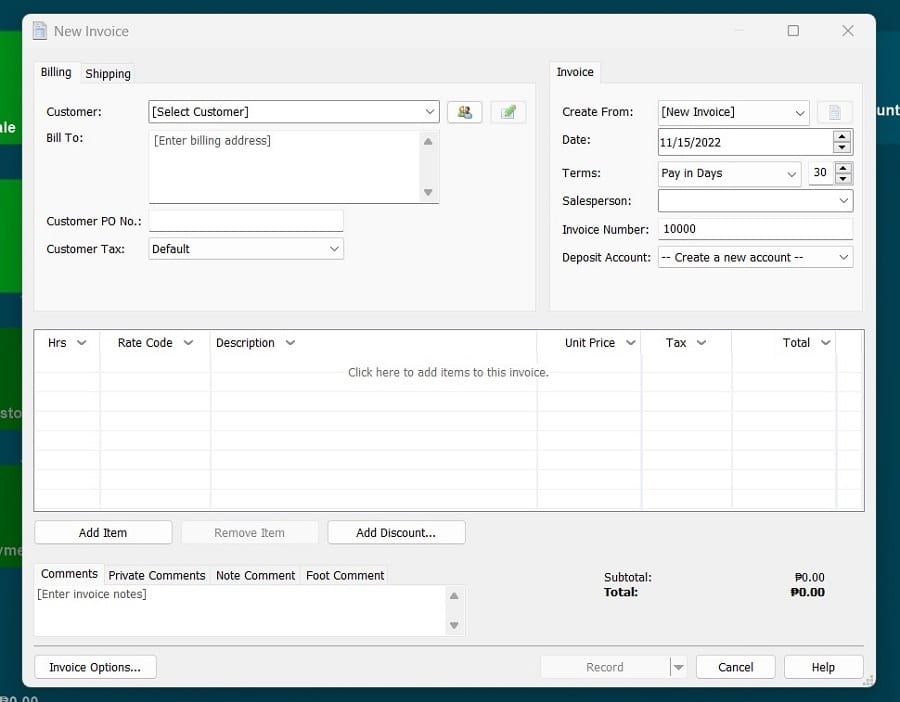

Creating an invoice

Before creating a test invoice, I had to add a customer first. What threw me off was that NCH Express didn’t prompt me about this requirement. The experience would have been smoother if there had been a tooltip or hint indicating that I could click the People icon beside the field to add a new customer. On the upside, if I just want to add customers separately, I can simply select the “Add New Customer” button from the left-side navigation menu.

For invoicing items, you’ll need to add them beforehand. A limitation here is that you can’t directly create a service item; instead, you have to add service items as part of the inventory list. This approach is a bit unconventional, as service items typically don’t have trackable quantities, but it’s the only workaround to include services in invoices.

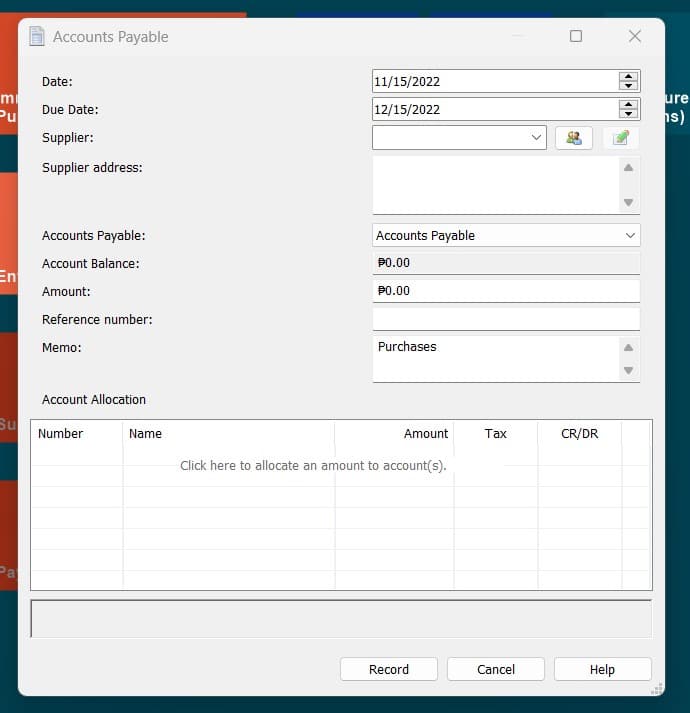

Unfortunately, NCH Express scored low in our accounts payable (A/P) evaluation mainly because it didn’t have receipt capture and advanced A/P features. I found the main A/P module under the Purchases tab, which features a workflow diagram that doubles as quick access to essential A/P functions. The diagram showed details on how to create and view purchase orders (POs), enter and view bill details, check vendor information, pay bills, and generate A/P reports.

Creating a bill

To create a bill, I first had to go to the suppliers list. I clicked on “Suppliers” on the workflow diagram, which opens the Suppliers list window. Then, I clicked the green plus button at the top left to add a new supplier, entering details for each one. Once set up, creating a bill is straightforward. In the Accounts Allocation box, the software allowed me to specify the accounts to be debited, which I believe makes things easy for bookkeepers.

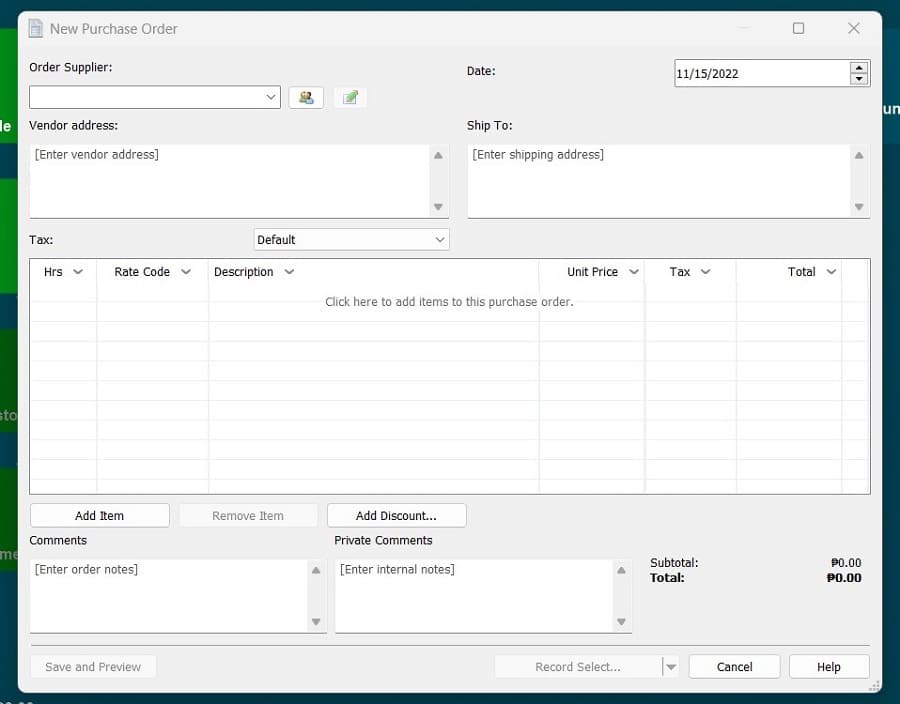

Creating a Purchase Order

Before creating a PO, it’s necessary to set up your inventory list. I went to the Sales tab first and selected “Add New Item” under Invoice Items in the left navigation menu. With inventory items set up, you can proceed to create a PO. If you’ve fully entered supplier details, the vendor and shipping addresses will automatically populate when entering the supplier’s name.

Once an order is filled, POs can be converted into bills and even record partial bill payments—a nice feature that many free accounting programs don’t offer.

One major issue in the A/P module is how the PO function handles inventory. When I recorded a PO, it showed the ordered quantity as inventory on hand. In most accounting software, inventory is only reflected as available once it’s received. In my expert opinion, this difference skips a crucial step, and recording the PO prematurely could overstate inventory balances. To avoid this, it’s best to hold off on recording POs until the goods are received—which kind of defeats the purpose of the purchase order.

NCH Express Accounting had mixed results in our evaluation of inventory. It included some useful inventory features but missed out on others that would have enhanced its current functionality. In my walkthrough, I saw the inventory items in the Sales tab, where the software allowed me to create items, set ideal quantities, and establish a warning quantity. This warning quantity feature is useful, as it helps set reorder points based on economic order quantities or any level you find suitable.

However, as mentioned in the A/P section, prematurely recording POs as inventory on hand results in overstating inventory levels. Another limitation is that NCH Express Accounts doesn’t automatically calculate COGS or the cost of ending inventory, which is one of our major considerations in evaluating inventory.

You have to manually assign inventory purchases to either the inventory asset or the COGS expense and then make journal entries at the period end to allocate these costs accurately. This manual process can be very time-consuming, so if you’re managing inventory, I highly recommend integrating Inventoria to streamline COGS calculations.

There’s no separate video since NCH Express Accounts inventory management is evaluated across the videos for the other categories.

NCH Express Accounts didn’t do well in my evaluation because it didn’t have the specific project accounting features that I was looking for. First, it didn’t allow for tracking income and expenses by project, which is crucial for project accounting. Though it allowed me to create job estimates, this feature isn’t enough. And on top of that, it also can’t show actual expenses for comparison with budgeted costs.

Create an Estimate

To create an estimate, go to the Sales tab and select “Create Quote.” Once the estimate is ready, you can record and email it to the customer, with NCH Express Accounts generating a PDF version of the quote. If the client accepts, you can quickly convert the estimate into an invoice.

For project-based businesses, I’d recommend using an accounting application with built-in project accounting features. Zoho Books is an excellent choice, offering robust project management tools and budget-to-actual reporting to help you evaluate project profitability.

Tracking sales tax in NCH Express Accounts is possible but it could be difficult if there are multiple states needed to track. The software allowed me to create sales tax items and view the detailed sales tax liability for each sales tax item.

Charging sales tax is seamlessly integrated into the invoice creation process, but it doesn’t automatically set the sales tax based on the customer’s address. You’ll need to set up a separate sales tax item for each sales tax jurisdiction, including the applicable sales tax rate.

If you issue credit memos, the software also allows adjusting the sales tax based on the credit memo amount. However, the software doesn’t support paying sales tax liability or filing sales tax returns, which is not a major miss for NCH Express Accounts because competitors also share this weakness.

Here are the available and unavailable reports in NCH Express Accounts:

Available Reports | Unavailable Reports |

|---|---|

|

|

Because the unavailable reports are important in my expert evaluation, I had to dock a few points in NCH Express Accounts’ score. I find it a major drawback that NCH Express Accounts lacks a general ledger report. While you can access most account information within the individual modules, having a general ledger report to display all transactions across every account would be ideal. This report is typically essential for tax accounting and is often provided to tax accountants for a comprehensive view of all account activities.

NCH Express Accounts lacks a mobile app, which is typical for desktop software. Mobile app functionality became popular with the rise of cloud-based accounting solutions, which offer flexibility for on-the-go access. If a mobile app is a priority, I suggest switching to cloud-based accounting software like QuickBooks Online.

NCH provides a broad range of in-house products that integrate seamlessly with NCH Express Accounts. The downside, however, is that it only supports integration with NCH products, not with third-party software. This limitation led me to give it a lower score in integrations. Below are the NCH products that Express Accounts can integrate with:

- Express Invoicing for making invoices

- Copper Point of Sales for a point of sale system that works with a cash register

- FlexiServer Productivity & Attendance for tracking staff hours and productivity

- PicoPDF Editor for editing and manipulating PDF files

- Inventoria for managing inventory costs and items

Payroll, sales tax management, bill payment, payment processing, and time tracking are missing integrations that can often be useful. The more popular accounting software, such as QuickBooks Online, FreshBooks, and Xero, have all of these integrations.

In terms of usability, NCH Express Accounts took a hit in customer service, ease of setup, and bookkeeping assistance. The software doesn’t have a network of bookkeepers, so getting assisted bookkeeping assistance isn’t possible. There are also no tutorials or detailed documentation in using the software, which makes it less accessible to small businesses that want to do DIY accounting. And lastly, setting up NCH Express Accounts can be hard. It would require a lot of manual data entry, especially in the chart of accounts.

Overall, I find NCH Express difficult to use for users with no knowledge of desktop accounting software. But for experienced bookkeepers, the learning curve will be less steep, especially if they have experience with more complex software like QuickBooks Enterprise.

How I Evaluated NCH Express Accounts

I evaluated NCH Express Accounts and other leading small business accounting software using the Fit Small Business accounting team’s internal scoring rubric with 13 major categories. You can read a more detailed description of our methodology by visiting the accounting team’s case study.

5% of Overall Score

We first determined a pricing score by assessing the software’s price for one, three, and five users. We also considered whether there was a free trial, monthly pricing, and a discount for new customers. After determining the pricing score, we assigned a value score based on the pricing score and the solution’s total score across all categories except Value.

5% of Overall Score

We evaluated general features like the flexibility of the chart of accounts, the ability to add and restrict the rights of users, and how your information can be shared with an external bookkeeper. We also searched for ways to provide more granular information like class and location tracking and custom tags.

10% of Overall Score

This assessed the ability to print checks, establish live bank feeds, and import bank transactions from a file. We also looked closely at the bank reconciliation feature. We wanted to see the ability to reconcile bank accounts with or without imported bank transactions and a list of book transactions that have not yet cleared the bank.

10% of Overall Score

In addition to the basics of issuing invoices and collecting customer payments, we evaluated the software’s ability to create customized invoices. We also assessed whether it could handle non-routine transactions like short payments, credit memos, and the refund of credit balances in customer accounts.

10% of Overall Score

The A/P score consisted of the basics like tracking unpaid bills, recording vendor credits, and short-paying invoices, but it also included some more advanced features—such as paying bills electronically, creating recurring expenses, and working with purchase orders. Receipt capture and the ability to automatically generate bills from captured receipts were also part of our A/P evaluation.

10% of Overall Score

10% of Overall Score

At the very least, we looked for software that could create multiple projects and separately assign income and expenses to those projects. We also searched for the ability to create estimates and assign those estimates to projects. Ideally, the program would then compare the actual expenses to the costs on the original estimate.

5% of Overall Score

Software should be able to track sales tax for multiple jurisdictions with varying tax rates. It’s helpful to have a function to easily record the remittance of the sales tax by jurisdiction. The very best tool will also help determine which jurisdictions sales are taxable to based on the address of the customer or delivery.

10% of Overall Score

I evaluated basic financial reports (such as a balance sheet, income statement, and general ledger) and common management reports (like A/R and A/P aging).

5% of Overall Score

Ideally, a mobile app should have all the same features as the computer platform, including the ability to capture receipts, send invoices, receive payments, enter and pay bills, and view reports.

5% of Overall Score

While it’s nice to have as many integrations as possible, we focused our evaluation on the four integrations we believe are most critical for small businesses: payroll, online payment collection, sales tax filing, and time tracking.

10% of Overall Score

The largest component of usability is the ability to find bookkeeping assistance when users have questions. This could be in the form of a bookkeeping service directly from the software provider or from independent bookkeepers familiar with the program. Other components of usability include customer service and ease of use.

5% of Overall Score

Our user review score is the average user review score reported by Capterra and G2. Other review sites might be used if a score from Capterra or G2 is unavailable.

Frequently Asked Questions (FAQs)

You can install NCH Express Accounts on Windows 10, 8, 7, or Vista. However, for a smoother experience, I recommend choosing the latest Windows version.

Yes, but you have to purchase a separate license per computer. NCH offers bundle discounts if you purchase several licenses from them.

Bottom Line

NCH Express Accounts offers robust accounting features from the get-go. Among all the desktop accounting software products we’ve reviewed, NCH Express Accounts has the easiest user experience. However, the absence of online connectivity features puts it at a disadvantage over desktop accounting software that can be hosted online or has remote features.

Overall, NCH Express Accounts is a worthy choice for very specific users like freelancers, solopreneurs, and startups with up to five employees. However, because of the level of difficulty, consider alternatives with an easier bookkeeping experience.