NCH Express Accounts is a good desktop accounting software that offers a free downloadable version. Its accounts payable (A/P), accounts receivable (A/R), and bank reconciliation features are commendable, which we’ll explain in greater detail in our NCH Express Accounts review. However, its inability to connect bank accounts and steep learning curve might hinder you from using its full potential. NCH Express Accounts starts at a one-time purchase of $139 but also has a free version for businesses with less than five employees.

We are driven by the Fit Small Business mission to provide you with the best answers to your small business questions—allowing you to choose the right accounting solution for your needs. Our meticulous evaluation process makes us a trustworthy source for accounting software insights. We don’t just scratch the surface; we immerse ourselves in every platform we review by exploring the features down to the finest nuances.

We have an extensive history of reviewing small business accounting software, and we stay up-to-date with the latest features and enhancements. Our first-hand experience, guided by our internal case study, helps us understand how the different products compare with each other and how they work in real-world scenarios.

Pros

- Free forever for companies with five or fewer employees

- Among the most easy-to-use accounting programs for desktop, but still difficult compared to cloud-based programs

- Intuitive workflow dashboard to navigate between tasks

- Integrates with other NCH products

Cons

- Cannot automatically import transactions from your bank account

- No project accounting features

- Doesn’t automatically record cost of goods sold (COGS) without an integration

- No mobile app

NCH Express Accounts Alternatives & Comparisons

Is NCH Express Accounts Right For You?

Is NCH Express Accounts Right for You?

NCH Express Accounts User Reviews

| Users Like | Users Dislike |

|---|---|

| Invoicing and creating estimates | Desktop software bugs |

| Journal entry module | Inconsistencies in bank reconciliation |

| Bank reconciliation | Steep learning curve |

There are little to no NCH Express Accounts reviews. Only a handful of feedback is available on user review sites:

- Software Advice[1]: 4.2 out of 5 stars based on less than 10 reviews

- PAT Research[2]: 7.7 out of 10 points based on around 15 reviews

If you’re using Windows 10 and above, you can download NCH Express Accounts for free in the Microsoft Store. As of this writing, NCH Express Accounts remains unrated (no reviews) in the Microsoft Store.

Fit Small Business Case Study

We compared NCH Express Accounts with FreshBooks and QuickBooks Online. Both QuickBooks Online and FreshBooks are part of our best small business accounting software.

NCH Express Accounts vs Competitors FSB Case Study

Touch the graph above to interact Click on the graphs above to interact

-

NCH Express Accounts Starts at $139 one-time purchase

-

Wave Wave Free as tested

-

QuickBooks Online $90 per month as tested

NCH Express Accounts offers a free program for small businesses with five or fewer employees. Larger companies need to purchase a license to use the software. Each license is valid for a single installation only. Multiple computers can simultaneously access the NCH company file through NCH’s Web Access feature. This can be setup to allow access from either the internet or limited to the local network.

NCH Express is very affordable even though separate licenses must be purchased for each computer. For example, Express Accounts Plus can be purchased for five computers for a total of $975 ($195 x 5). If you use the program for 24 months before upgrading to a newer version, that is only $40.63 ($975 / 24) per month. For comparison purposes, QuickBooks Plus and FreshBooks are $90 and $110 per month, respectively, for five users.

Express Accounts Basic | Express Accounts Plus | |

|---|---|---|

Pricing per Single License | $139 | $195 |

Quarterly Plan | N/A | $23.16 |

Billing & Invoicing | ✓ | ✓ |

A/P & A/R Tracking | ✓ | |

Web Access | ✓ | ✓ |

Quotes & Sales Order Generation | N/A | ✓ |

Sales Analysis by Customer/Salespersons | N/A | ✓ |

Creating & Printing Checks | N/A | ✓ |

Access to NCH Express Via Email | N/A | ✓ |

NCH Express Accounts Features

NCH Express Accounting Software offers a good selection of features that enable you to create professional quotes, invoices, and sales orders. You can track sales and A/R, manage A/P and pay bills, generate financial reports, reconcile accounts, and create estimates. We performed the case study using the free version of the software.

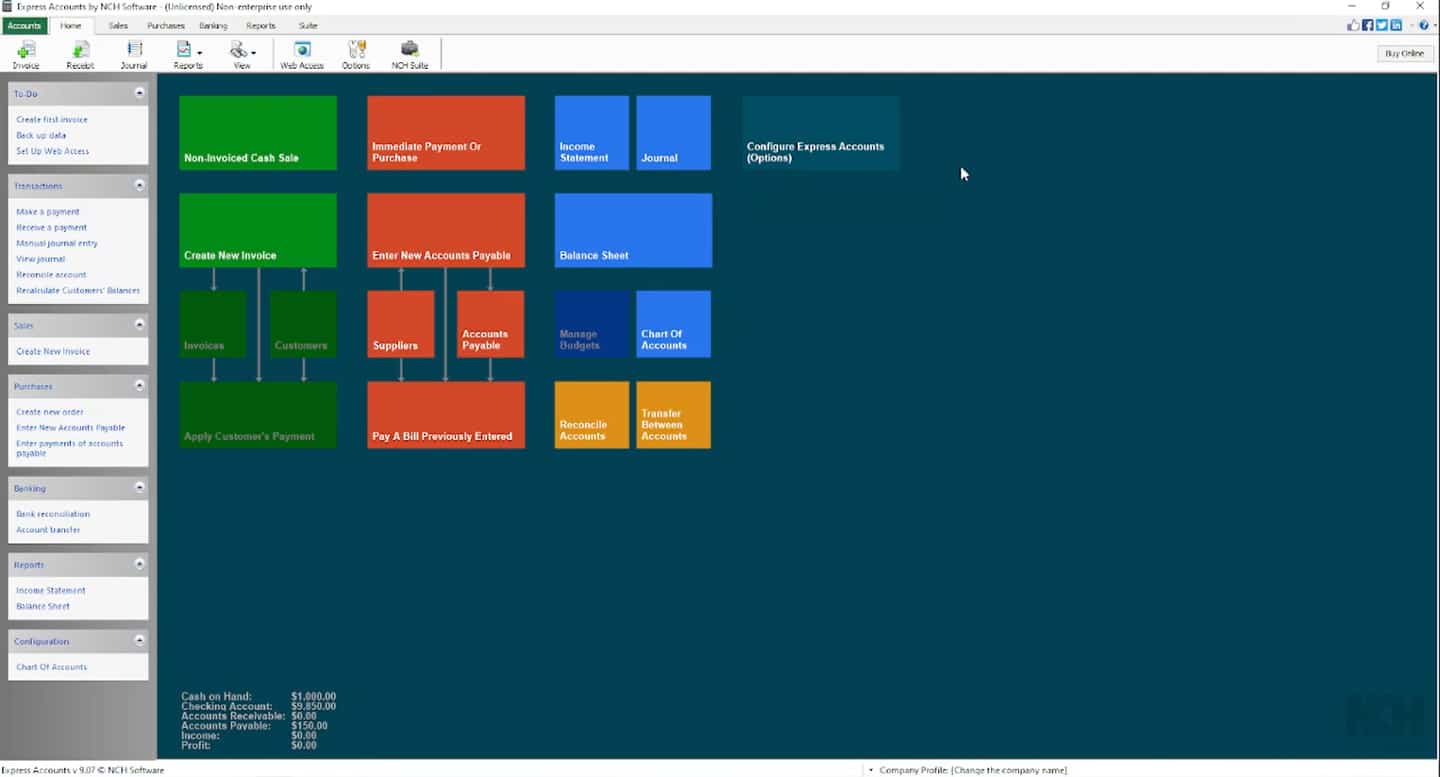

NCH Express Accounts’ interface experience is an improvement on traditional desktop accounting software. They updated the font style and window design to the latest Windows 10 or 11 interface design. However, there’s no change regarding the font size. The Mac version has a similar look but the text on the dashboard is more spaced out than in the Windows version.

Users with less-than-perfect eyesight might have a hard time with the small font size. Though the navigation menus use tabs instead of drop-down menus, a more user-friendly interface could make NCH Express Accounts more accessible to users with impaired vision.

Dashboard

You can set up your company in the options menu, but there’s no setup wizard to guide you. You can change your business name, adjust fiscal year-end, assign prefixes and numbering systems, and much more. In terms of customization, NCH Accounts Express provides a lot of options. Even though we appreciate the software’s customization options, it could be time-consuming to set up a large chart of accounts in NCH Express Accounts because there’s no import feature that lets users upload a CSV file.

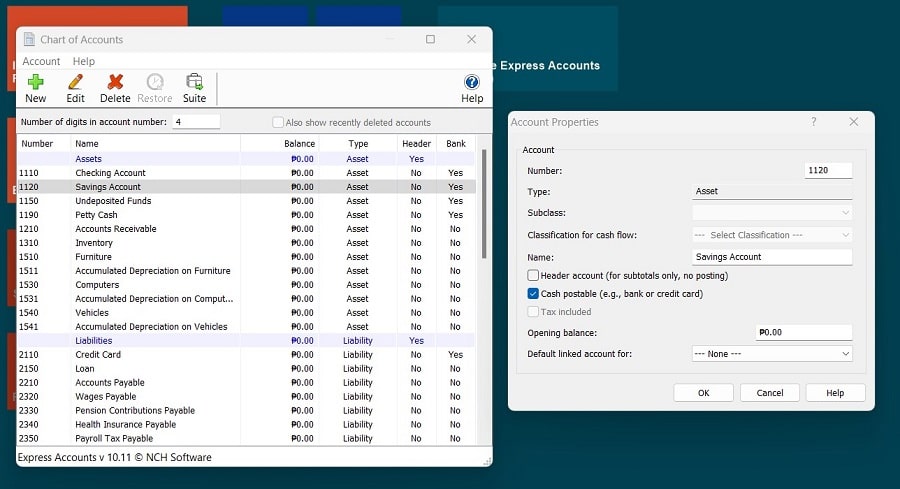

Chart of Accounts

The Chart of Accounts is also comprehensive; it contains all the necessary accounts. The default Chart of Accounts is more than enough for small businesses. Another interesting feature to note is that you must classify accounts for the statement cash flows. This feature is unique because most accounting programs do this automatically, based on account type.

Business owners who plan to do their business’ bookkeeping themselves may have difficulty setting up their company, as some settings require accounting knowledge, such as cash flow classification of accounts.

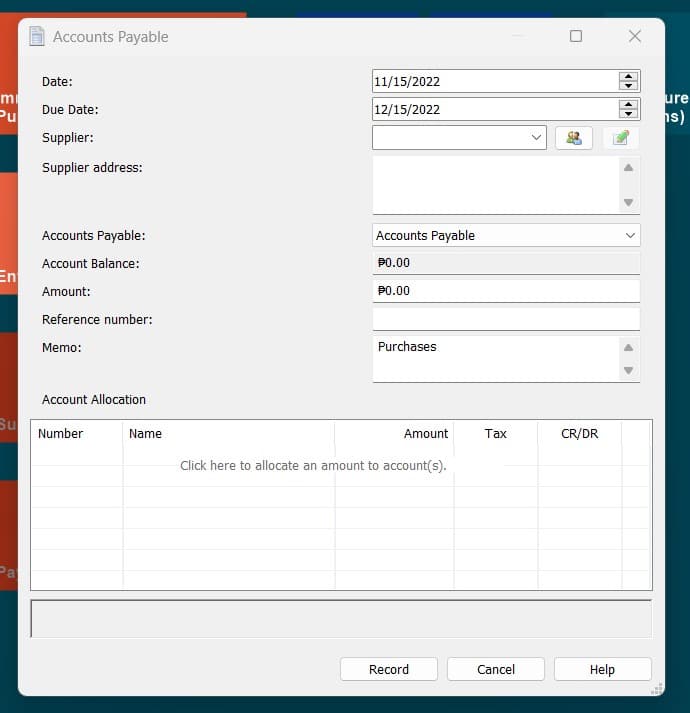

The A/P module is on the Purchases tab. It has a workflow diagram that also serves as quick access to A/P functions like creating and viewing purchase orders (POs), entering and viewing A/P details, viewing vendor details, paying bills, and generating an A/P report.

Creating a bill

Creating a bill in the A/P module requires you to set up the suppliers or vendors list first. Click on “Suppliers” in the workflow diagram, and it’ll show you the Suppliers list window. Next, click the green plus button at the top left of the window to add suppliers. Fill out the information and repeat the same process for all suppliers.

Once you’re done, you can create a bill, which is fairly easy. In the Accounts Allocation box, you’ll have to supply the accounts debited as a result of recording the bill. For bookkeepers, this part is easy. However, this part can be tricky for those without accounting knowledge.

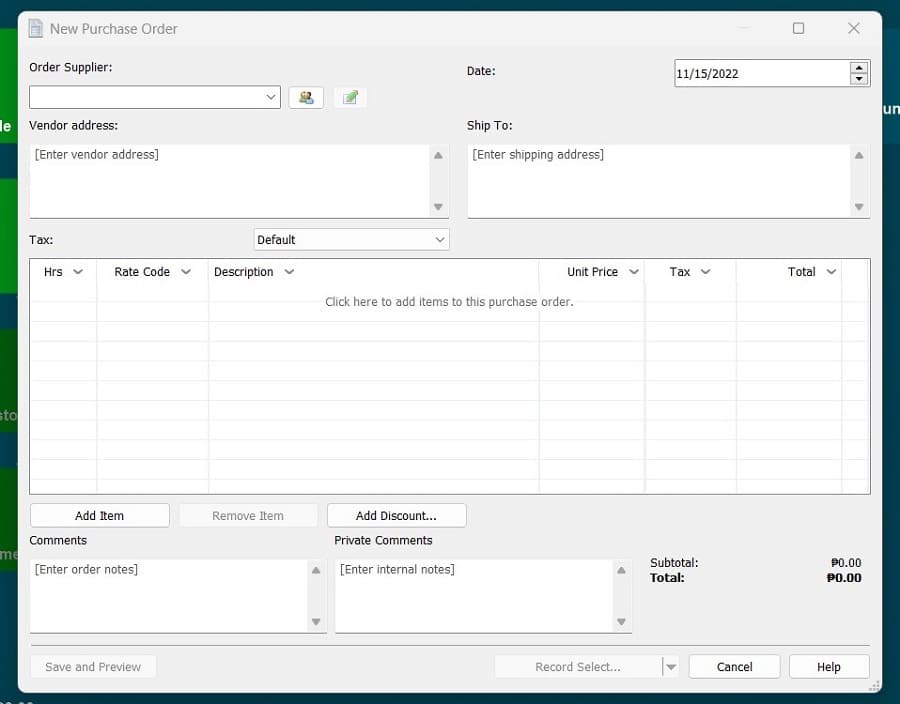

Creating a Purchase Order

Before you create a PO, you need to set up your inventory list first. Go to the Sales tab and click “Add New Item” under Invoice Items in the left navigation bar. Once you’re done, you can start making a PO as seen in the image above.

If you completely set up supplier information, entering the supplier’s name will populate the vendor address and shipping address automatically. For our case study, we opted not to complete supplier information for expediency.

POs can be converted into bills once the order is filled. You can also enter partial payments for bills, which is great for free software. Most free accounting applications we reviewed don’t include this kind of feature.

A major problem in the A/P module is that the PO function operates differently from what we usually see in accounting software programs. When you record a PO, the quantity of inventory ordered appears as inventory on hand in the inventory list. In a standard A/P transaction cycle, goods aren’t reflected in inventory available until they’re received, not when they’re ordered.

Because of this, the PO function of NCH somehow skips a step and records the inventory you ordered as inventory already on hand automatically. Because of this transaction flow, entering a PO prior to receipt -would overstate inventory balances. So, a good workaround here would be to not record any PO until the receipt of the goods.

The A/R module is under the Sales tab. Invoicing is also under the Sales tab, but invoice template and design customization are in the settings. NCH Express Accounts doesn’t have a lot of features for customizing the look of your invoice. You can find a few invoice templates, but the overall customization experience isn’t as robust as other accounting software products.

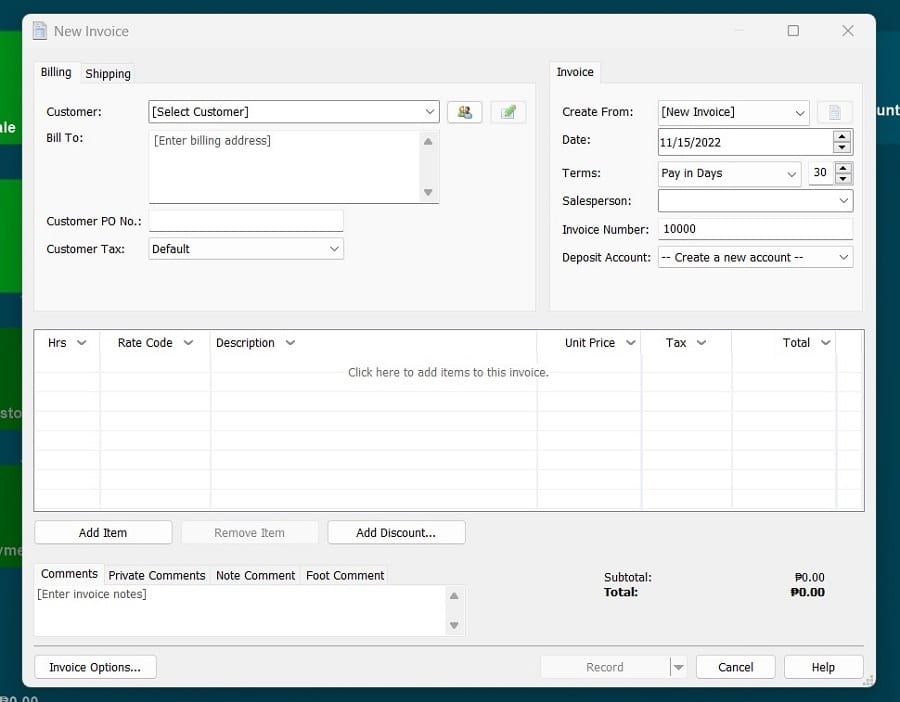

Creating an invoice

Before you create invoices, you must first add new customers. You can do that by going to the left-side navigation menu and clicking “Add New Customer.” Once you’re done, proceed to “Create New Invoice” to prompt the invoice creation window. Within the invoice creation window, you can also add a new customer, but NCH won’t prompt you to do so.

For invoicing items, you must first add invoice items, just like what we did in A/P. One limitation we saw here is that you can’t create a service item. Instead, you have to create service items as part of the inventory list. We find it a bit unusual since service items don’t usually have trackable quantities, but it’s the only workaround available so that we can include services in invoices.

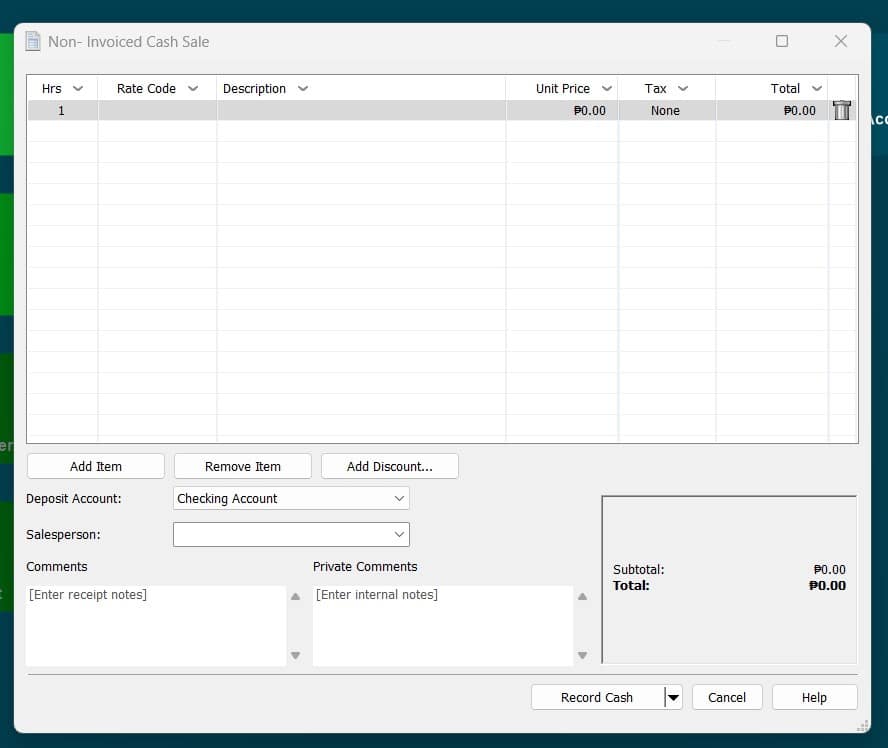

Non-Invoiced Cash Sale

Suppose a walk-in customer buys your products. NCH Accounts Express can help you immediately record cash sales without the need to go through invoice processing. Enter the details and click “Record Cash” at the bottom of the screen. The software will generate a receipt automatically that you can print, email, or fax to the customer. This receipt feature is commendable because we mostly see this feature in higher-end software.

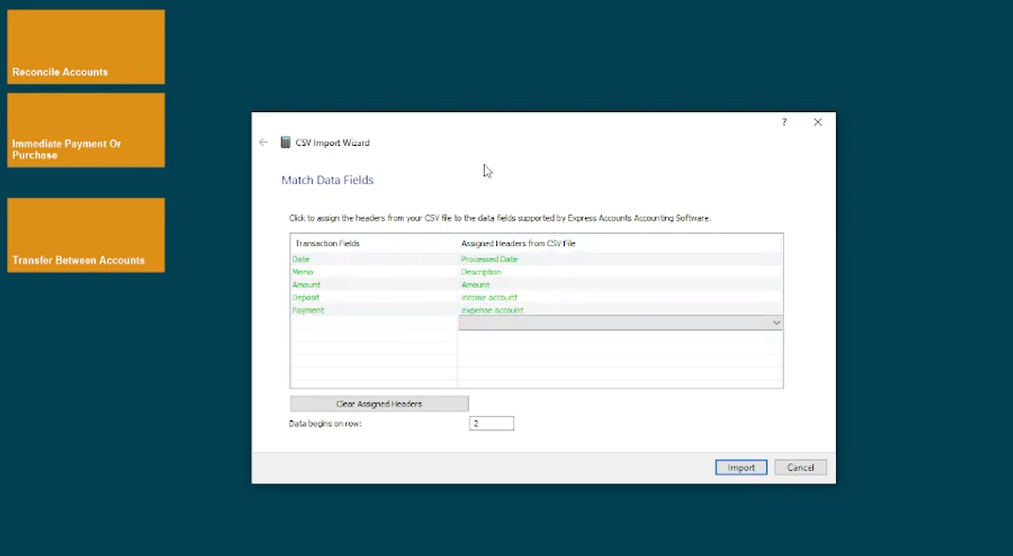

You can’t connect your bank account to NCH Accounts Express, but you can upload your transactions from a comma-separated values (CSV) file. When you upload a CSV file, an import wizard will help you map the transaction fields. If you have a lot of banking transactions online, it would be wiser to look for an alternative that can connect to your bank. For this bank connection feature, we recommend QuickBooks Desktop.

Mapping Transaction Fields from CSV file import

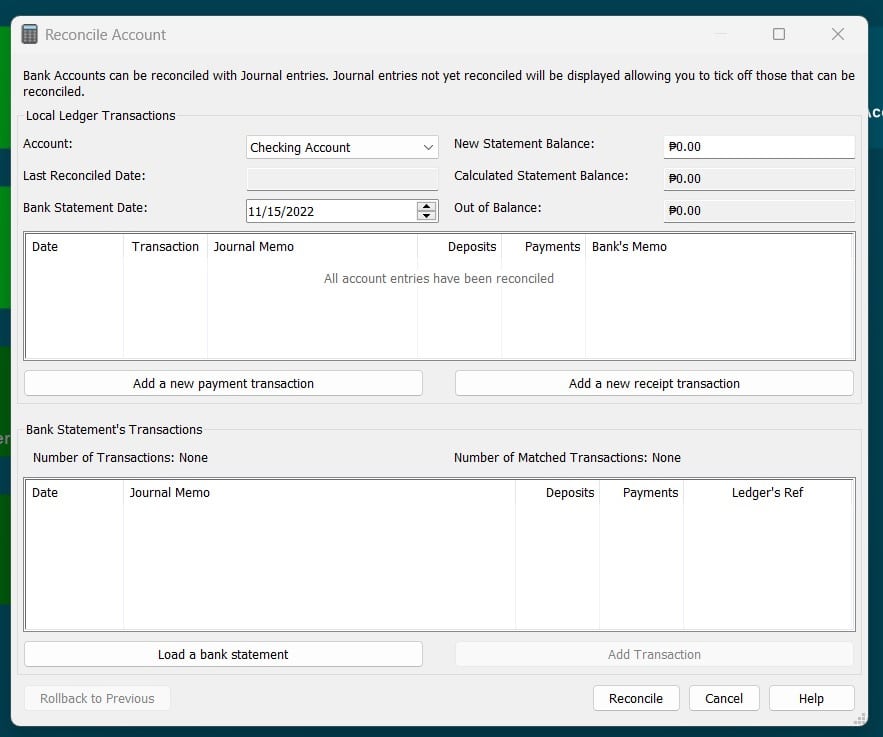

Bank reconciliation is decent, except that it doesn’t show line items, such as deposits in transit and outstanding checks, on the reconciliation report when you’re finished. The interface layout is also unconventional but manageable if you’re an experienced bookkeeper or certified public accountant (CPA). Nonaccountants will find this part difficult, so we recommend asking for expert help to learn this part.

Reconciling Accounts

The bank reconciliation module isn’t the best in terms of how NCH Express Accounts presents it. However, the functionality is more or less the same as the ideal bank reconciliation systems we’ve seen in higher-end software.

What we appreciate here is that you can directly create adjusting entries for bank statement transactions not yet recorded in the books (like collections of interests, bank charges, or NSF checks) without leaving the reconciliation. This feature is a plus since it makes the accounting workflow faster.

NCH Express Accounts can’t accumulate income and expense by project. You can create job estimates but can’t track the actual expenses for comparison. To create estimates, go to the Sales tab and click “Create Quote.”

Create an Estimate

Once you’re done with the estimate, you can record and email it to the customer. NCH Express Accounts will generate a PDF version of the quote as well. If the client agrees with your quote, you can quickly convert the estimate into an invoice.

If you’re a project-based business, we recommend getting another accounting application that has project accounting features. Our top pick would be Zoho Books because it has excellent project accounting features that can help you manage projects and create budget-to-actual reports to evaluate profitability.

Users can create sales tax items in NCH Express Accounts and view sales tax liability in detail. Charging sales tax is also easy because it’s a part of the invoice creation process. If there are credit memos, you can also adjust sales taxes based on the credit memo amount. It’s not possible to pay sales tax liability and file sales tax returns in the software. We have no separate video for this part since the discussion is already integrated into the A/P and A/R videos.

As discussed in the A/R section, inventory items are found in the Sales tab. You can create inventory items, assign ideal quantities, and set a warning quantity. The warning quantity is a great feature because it can help you set reorder points based on economic order quantities or whatever amount you deem appropriate for it.

Also, as mentioned in the A/P section, we encountered a problem in recognizing inventory on hand. The system records inventory on PO as inventory on hand, which overstates inventory until the order is received.

More importantly, NCH Express Accounts doesn’t compute COGS and the cost of ending inventory. Inventory purchases must be assigned to either the inventory asset or the COGS expense. You then must make manual journal entries to allocate the cost at the end of the period properly. The manual calculation of this COGS allocation is extremely time-consuming, so we recommend getting the Inventoria integration if you have inventory.

NCH Express Accounts lacks many specialized accounting reports, mostly because of its lack of project accounting features.

Available Reports | Unavailable Reports |

|---|---|

|

|

It’s disappointing that NCH Express Accounts doesn’t have a general ledger report. Though most account information can be accessed within the modules, it would be better if a general ledger could be generated to show all transactions in every account. The general ledger is usually one of the reports typically given to your tax accountant.

NCH has a wide library of software products that can work with NCH Express. However, given that NCH Express is a desktop application, it will have limited integration with popular software like project management or business communication software. Moreover, our research reveals that it also doesn’t have existing integration with third-party software.

NCH Express Accounts doesn’t have a mobile app, but the absence of mobile apps for desktop software is common. Mobile app functionality only began to gain popularity when cloud accounting software services were introduced as an alternative to desktop software. So, if you want a mobile app, we recommend shifting to cloud-based software services. Zoho Books is our recommendation if you want a mobile app with excellent functionality.

On a tangent, the nearest “mobile access” you can get with NCH Express Accounts is through its Web Access feature. This feature isn’t a mobile app per se and is more of a web connection feature that hosts the desktop software to the web by accessing a certain internet protocol (IP) address. However, you still need to set this up.

While it is very time consuming to transfer a company to NCH, once your company is set up we find NCH is reasonably easy to use. We don’t like the user experience (UX) as well as more modern cloud-based systems as it could be more spread out and easier to read. It also lacks a dashboard that provides important financial information at a glance. However, we think NCH is easier to use than its desktop accounting counterparts, such as GnuCash and QuickBooks Desktop.

First-time users of NCH Express will find it difficult to set up the system. The provider doesn’t offer onboarding sessions for software implementation. Moreover, users can’t import customers and vendors via comma-separated values (CSV) file to immediately store them in the system. Overall, setup may take a long time for first-time users depending on the volume of information that needs to be manually input into the system.

Customer service isn’t a strong point for NCH Express Accounts. If you need technical support, you must first go through a technical support wizard. This wizard will ask several questions about your NCH product, and we think the entire process is tedious. They’ll initially give you a list of video tutorials and frequently asked questions (FAQs) before you can fill out the technical support form.

This kind of support isn’t user-friendly because it takes several clicks before accessing support. Moreover, premium support is offered at an additional cost, which can be disadvantageous to very small businesses and entrepreneurs. It would be better to have a technical support hotline so that users can call the number in case they encounter software problems.

Moreover, The support team doesn’t operate 24/7, which makes contacting support more difficult for users to access support. Though we don’t expect all software providers to open 24/7 support channels, we’d appreciate it more if NCH Express would have additional support channels like phone hotline, chat, and live chat.

FAQs

You can install NCH Express Accounts on Windows 10, 8, 7, or Vista. However, we recommend choosing the latest Windows version for a smoother experience.

Yes, but you have to purchase a separate license per computer. NCH offers bundle discounts if you purchase several licenses from them.

Bottom Line

NCH Express Accounts offers robust accounting features from the get-go. Among all the desktop accounting software products we’ve reviewed, NCH Express Accounts has the easiest user experience. However, it’s still difficult to use if compared with cloud-based accounting services like Zoho Books and Lendio Accounting.

It’s also impossible to connect bank accounts in NCH Express Accounts, and recording COGS isn’t an automatic feature of the software. Overall, NCH Express Accounts is a worthy choice for very specific users like freelancers, solopreneurs, and startups with up to five employees. But because of the level of difficulty, consider alternatives with an easier bookkeeping experience.