Oyster offers a suite of online solutions for hiring, paying, and managing a global workforce. It has employer of record (EOR) services for finding and recruiting both international employees and contract workers. Compliance solutions and support are also available to ensure that you remain up to date with local labor, payroll, and tax regulations. Monthly fees start at $599 per employee for its EOR services and $29 per worker for its contractor plan. In our evaluation of the best international payroll services, Oyster earned an overall score of 4.23 out of 5.

Pros

- Global HR services cover 180-plus countries and support salary payouts in more than 120 currencies

- Discounts for nonprofit organizations and companies hiring refugees

- User-friendly platform with automated hiring and employee management solutions

- Offers free hiring guides and HR tools to analyze worker misclassification risk

Cons

- Monthly fees for EoR services vary by country

- Localized benefits plans are paid add-ons

- Lacks phone support

- Dedicated hiring support available only in highest tier

- Charges a refundable security deposit

What We Recommend Oyster For

Need more info on EORs? Check out our guide on what an EOR is and how it works.

Oyster Deciding Factors

Supported Business Types | SMBs, nonprofit organizations, and B-corp companies that need online tools and solutions for managing global hiring, payroll, and compliance |

Free Trial | None, but you can create an online account and explore its features for free. Oyster will only charge you once you hire workers. |

Pricing |

|

Setup Fees | None, but Oyster requires a security deposit (refundable) that’s equivalent to one month of your total employment cost |

Paid Add-ons | Oyster health plan: Starts at $82.30; pricing is based on the age of the employee, the location, and the benefits package selected |

Discount |

|

Standout Features |

|

Ease of Use | Oyster’s cloud-based platform is relatively easy to learn and use, but you need to have basic understanding of how to pay global employees and how to process international contractor payments |

Customer Support |

|

Are you looking for something different? If you only want online tools to pay US-based employees, check out our list of the best payroll services and top payroll software for small businesses. If you need help deciding which payroll solution to get, read our guide to finding the right payroll solution.

How Oyster Compares With Top Alternatives

Best For | Starter Monthly Fees | Number of Countries* | Our Reviews | |

|---|---|---|---|---|

Businesses that want strong global onboarding and payroll support | $599 per employee** | 130+ | ||

Companies needing EOR with payroll data accuracy and workforce analytics | $650 per employee | 160+ | ||

Businesses that want global HRIS and software/IT onboarding | $599 per employee*** | 150+ | ||

Companies looking for multiple payment options | $599 per employee | 100+ | ||

*Covers countries where the providers’ EOR services are available

**Discounted rates are available if you pay annual expenses in one payment, upfront

**Pricing is from a quote we received

Since Our Last Update: Oyster has introduced a new Scale plan, which is ideal for companies that often hire global employees. Also, it removed its free starter contractor package, which allowed companies to hire and pay up to two workers at zero cost.

Oyster earned perfect ratings in our evaluation given its multiple plan options, transparent pricing, and reasonable fees. For companies that only want to hire and pay international contract workers, Oyster has a Contractor package with monthly fees that start at $29 per worker.

Meanwhile, Oyster offers an Employee plan for hiring and paying global workers. Pricing is based on the country to which you plan to expand. Monthly fees start at $599 per employee if you pay month to month, or $499 per employee if you pay annually (paid in a lump sum). You can also check its website for a list of country-specific pricing.

For large businesses, Oyster offers a custom-priced Scale tier that comes with dedicated HR support. Its pricing scheme is slightly different from the Employee plan, which charges on a per-worker basis. With the Scale plan, you can pre-purchase employee seats at locked, discounted rates if you hire more than five and more international team members.

Contractor | Employee | Scale | |

|---|---|---|---|

Starter Monthly Fees* | Starts at $29 per worker | Starts at $599 per employee | Custom-priced** |

Plan Covers Contractors and Employees | Contractors only | ✓ | ✓ |

Minimum Headcount Requirement | None | None | At least five workers |

Reusable Employee Seats | ✕ | ✕ | ✓*** |

Global Hiring, Onboarding, and Payroll Tools | ✓ | ✓ | ✓ |

Invoice and Expense Management | ✓ | ✓ | ✓ |

Time-off Management and IP Protection | ✕ | ✓ | ✓ |

Dedicated Hiring Success Team | ✕ | ✕ | ✓ |

Compliance Support | ✓ | ✓ | Dedicated support |

Access to Local Benefits Plans | Starts at $82.30 | ||

*Annually billed plans are available with slightly lower rates, but you have to pay the annual fees upfront and in a lump sum

**Discounted pricing is locked in for 12 months if you purchase five or more employee seats

***Employee seats are reusable during the 12-month contract period, provided it has become empty (due to resignation or termination)

For the benefits plans, this add-on solution is offered through Oyster’s partner, Allianz. Pricing varies, depending on the country, the age of the employee, and the benefits package. Oyster also charges a monthly support fee of $25 per team member (or £20 and €23, in GBP and euro currencies, respectively). This covers market and vendor research, benefits package creation, and round-the-clock assistance in managing and administering employee benefits.

Apart from the three plans and the benefits add-on, Oyster offers special discounts for qualified companies. In addition, new users will be charged with a security deposit. To know more, click the tabs below.

Pricing Calculator: Check Potential Costs

Want to know how much you’ll need to use Oyster? Use our online calculator to compute the estimated monthly and annual fees.

Global payroll processing with Oyster is easy given its user-friendly platform that can handle fully compliant salary payments, including expense reimbursements and bonus payouts. In our evaluation of its payroll functionalities, Oyster earned a 4.13 out of 5 score. It didn’t get a perfect rating in this criterion because it lacks time tracking features (only offers time-off management tools).

However, we still find Oyster a great payroll partner for multicountry payments. You get one platform to process both employee and contractor payroll. It partners with payroll experts and has local entities in the countries it services, allowing the provider to run payroll and manage local taxes compliantly. You can choose your preferred currency and payroll frequency. Salary payouts are typically done monthly, but this can change to twice a month, depending on country payroll regulations.

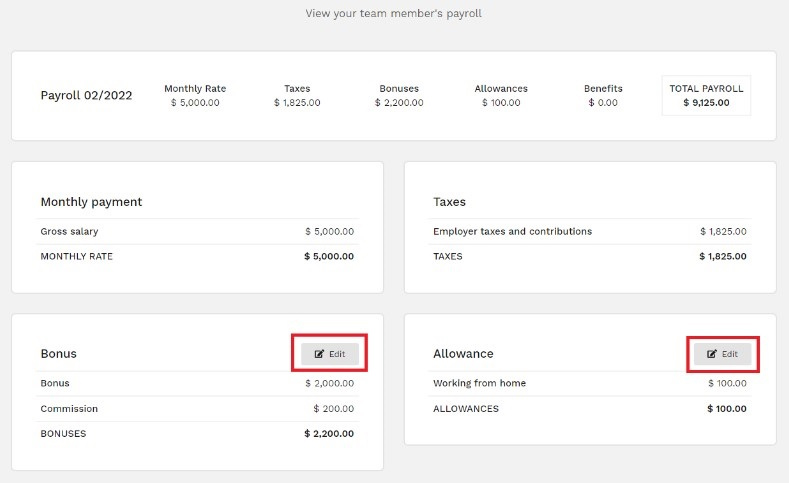

Oyster has an edit function in case you need to revise or delete payment details for bonuses, commissions, and allowances. (Source: Oyster)

If you have bonus and commission payments, Oyster lets you add this information via its “Add Payroll Change” feature. You can even set these payments as a one-time or monthly recurring transaction. While these payment details can be inputted directly into Oyster’s platform at any time in the year, the system won’t allow you to make payroll changes to the current month if the pay period’s cutoff date has passed.

Aside from showing each team member’s payment and tax details, Oyster’s payroll dashboard lets you add payroll changes for bonus and commission payouts. (Source: Oyster)

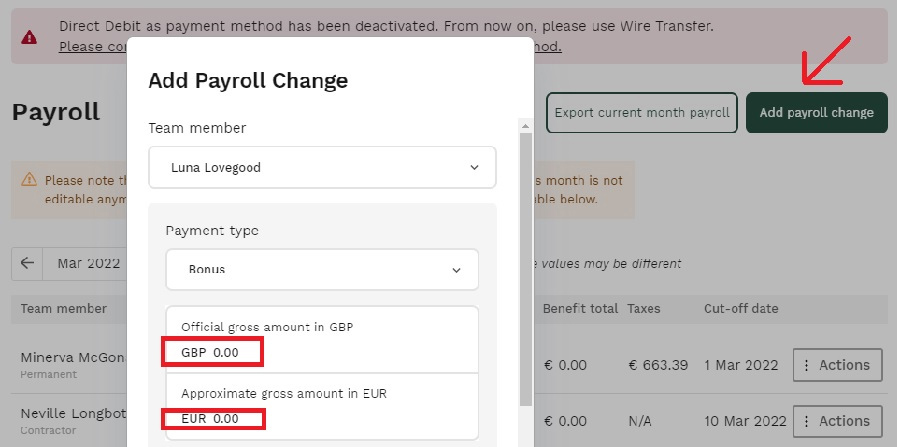

Cross-border payments are made possible through international money transfers, allowing you to pay workers in more than 120 currencies. However, for Oyster to pay employees, you have to set up a payment method by connecting your bank account to its system. Payroll funds will be pulled from your account automatically, based on employee and contractor pay runs that you approve.

Oyster supports automated clearing house (ACH) direct deposits, but only if you have a US-based bank account and pay global employees in USD ($). If you pay workers in GBP (£) and euro (€), Oyster allows you to set up payments via Bankers Automated Clearing Services (BACS) and Single Euro Payments Area (SEPA) direct deposits, respectively, provided your bank allows these transactions.

With Oyster, you can easily add and modify your company’s bank account and payment method details. (Source: Oyster)

When setting up direct debit payments in Oyster, note that the system will require you to verify your account. Some banks’ verification process includes depositing small amounts into your bank account and you have to input those amounts into Oyster. For SEPA direct deposits, you have to click the “Authorize account” button after you have input your account details into the system.

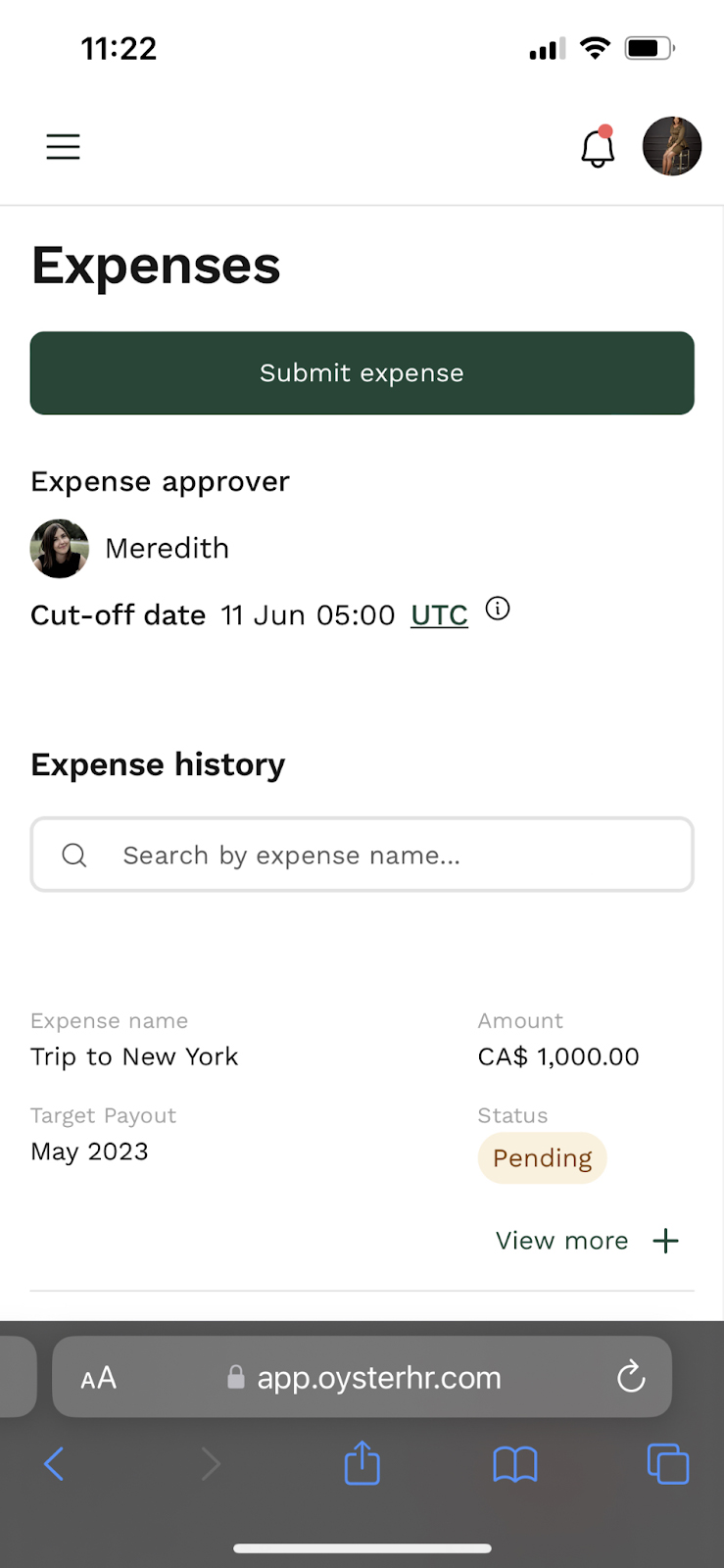

Oyster has an “Expenses” module where employees can submit expense reimbursements and upload the related receipts. Reimbursement requests are sent to you for review and approval. Then, Oyster will process all approved expense reimbursements in the next pay cycle.

Oyster’s mobile-responsive platform allows you to access its system and submit expense reimbursement claims through smartphones and tablets. (Source: Oyster)

However, employees can only attach one receipt for each expense claim. They will need to submit different expense claim transactions for each reimbursement. In addition, you have to follow Oyster’s payment cutoff dates, which are the 6th and 10th of the month for it to be processed on the same and next month, respectively.

For example, an expense claim that has been submitted and approved on June 30 will be reimbursed in the July pay cycle. Meanwhile, an expense reimbursement that has been submitted and approved on July 5 will be paid out in the same month.

Note that different cut-off dates may apply to specific countries. You can contact the provider to inquire about the payment timelines, or you can open the Oyster platform and navigate to the Payroll page to see the cut-off dates per team member.

Oyster processes salary payments based on approved invoices submitted by fixed contract workers (individuals who receive the same amount each month) and pay-as-you-go contractors (workers who are paid a defined rate for a specific task or unit, such as the number of hours worked).

Fixed contractors don’t need to create and submit invoices because Oyster automatically generates these for them monthly. Pay-as-you-go contractors will need to create and submit invoices through Oyster manually. All submitted invoices will go to you for review and approval. Note that Oyster will only start the payment process after you have approved the contractor invoices.

Contractors can track the status of submitted invoices through Oyster’s “Payments” module. (Source: Oyster)

Approvers or system administrators can approve expense reimbursement requests one by one or in bulk. System administrators can even raise an expense claim on behalf of the employee. Note, however, that these transactions are marked “approved” automatically in Oyster.

Two things you’ll notice highlighted in our OysterHR reviews article are its solid self-onboarding tools and locally compliant contracts. These functionalities, coupled with Oyster’s robust compliance support, contributed to this provider getting nearly perfect marks (4.75 out of 5) for HR features. It lost points because while it provides competitive local benefits plans, you have to pay extra to access “Oyster Health”—a global health insurance plan (through Allianz) that covers more than 165 countries.

Despite the add-on benefits plan, Oyster’s EOR service makes international hiring less complicated for business owners. It’s designed to help you avoid compliance mistakes, providing you access to local experts who can assist you in finding qualified candidates and guide you through the entire process. Oyster even assigns dedicated hiring success managers to clients who sign up for its Scale plan, which is great for businesses that plan to ramp up global recruitment activities.

Oyster also has free-to-use online tools for calculating global employment costs, analyzing worker misclassification risks, and assessing potential costs if you want to convert contractors into employees. It even has country hiring guides to help you learn best practices for recruiting, paying, and managing global employees.

In addition to locally compliant contracts and new hire onboarding, Oyster offers free tools to help you manage global hiring and an international workforce. (Source: Oyster)

New clients can access these tools once they have created their accounts. What’s great about Oyster is that you can easily sign up online and immediately start using its free HR solutions, including the online learning programs available through Oyster Academy. While the library isn’t as robust as other HR or payroll providers, it provides sufficient materials to ready your global team for remote work and collaboration.

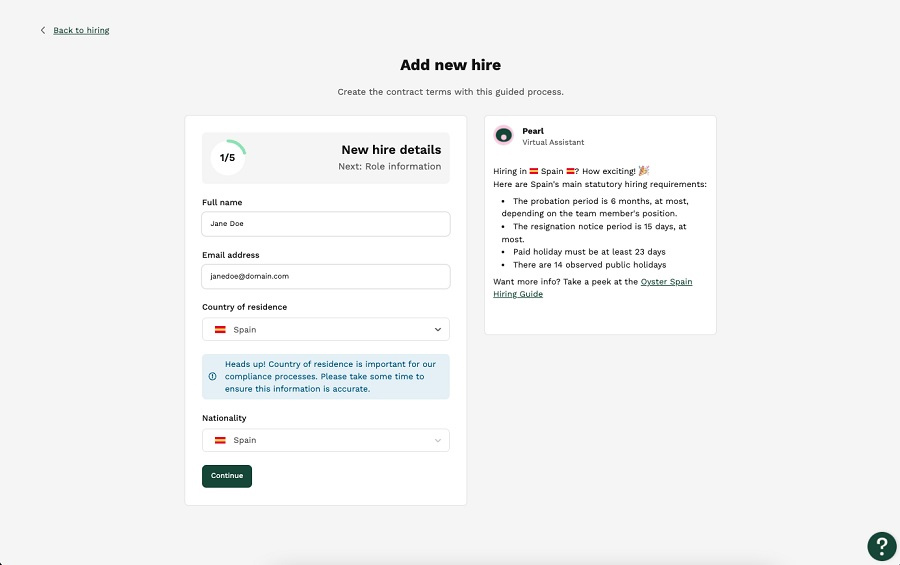

In addition to EoR services and hiring support, Oyster’s online platform has automated tools for building competitive and locally compliant employment packages. Its in-platform virtual hiring assistant, Pearl, not only guides you through the system’s hiring and onboarding processes but also helps you select the best employment terms, such as the standard probation period and vacation leave credits, for your new hires based on their location.

Oyster’s virtual assistant, Pearl, provides country-specific employment term options and basic hiring requirements to help you remain compliant with local labor laws. (Source: Oyster)

Note that Oyster hasn’t completely rolled out its automated global hiring solution and virtual hiring assistant to all the countries it services. If these are important to your business, check the list of countries where these functionalities are already live.

After you have decided on the candidate to recruit, you can raise a hiring request via Oyster’s online platform to start the contract creation process. The system will require you to select the employment type as employee or contractor and input your candidate’s basic information, such as full name, email address, and location/country. Then, you can choose the best employment terms from the country-specific hiring requirements and options offered by Oyster’s virtual hiring assistant, Pearl.

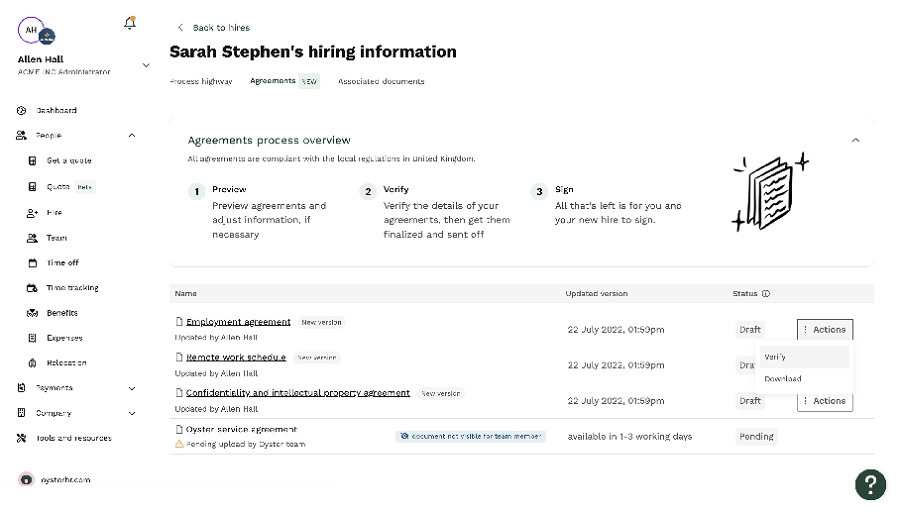

The system will generate the contract automatically based on the choices you made. It will also use a template with the employment conditions specific to the country where your new hire will be employed in. After you have reviewed the contract, submit the hiring request online and Oyster will get started with the process. This process includes the creation and approval of a service agreement between you and Oyster as well as the provider preparing the next steps to onboard the employee.

Oyster has an “Agreements” tab where you can review, track, and manage contracts. (Source: Oyster)

While you can use Oyster’s built-in contract templates, you can upload your own employment agreements into the system. Also, for countries where Oyster’s automated hiring tools have yet to go live, the contract creation process isn’t as streamlined and may require manual contract status updates from the Oyster team.

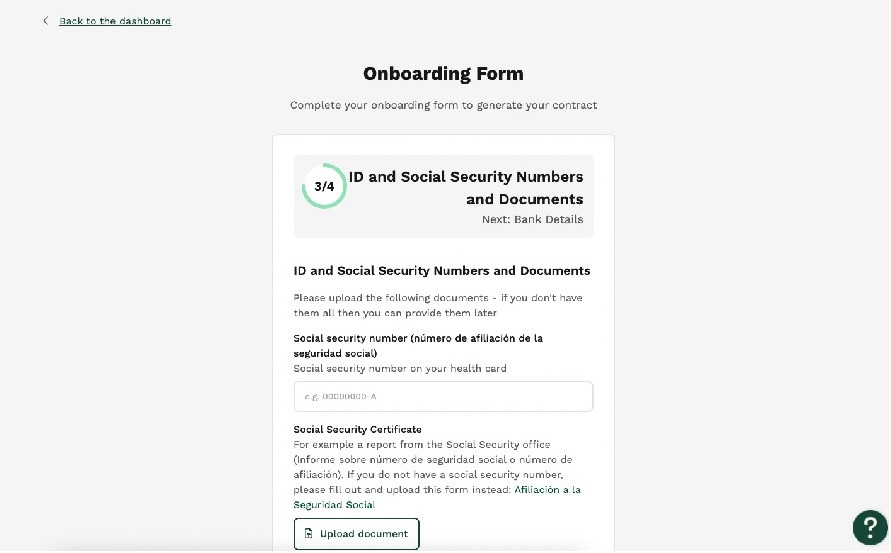

Oysters will send an email to your new hires, inviting them to join the Oyster platform and create their own online accounts. Your employees and contractors will be asked to input their personal details―such as full name, address, and phone number―bank account information, Social Security number, and other new hire requirements. Oyster will use the data that both employees and employers have inputted into the system to create all the necessary contracts and agreements, such as noncompete and confidentiality agreements, which new hires will need to review and sign.

Employees who complete the onboarding process and have signed work contracts can access Oyster’s tools, such as time-off and expense reimbursement requests. They can also view their payslips online and generate employment verification letters for tourist visa or housing loan applications.

Apart from inputting the required ID numbers, your new hires can also upload onboarding documents directly into Oyster. (Source: Oyster)

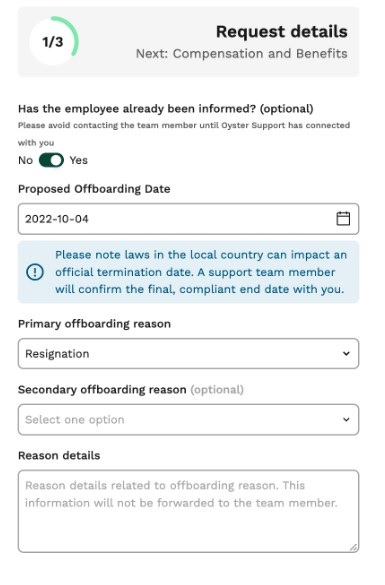

If an employee resigns, retires, or will be terminated from your company, Oyster requires that you provide them with at least 30 days’ notice (except for cases of gross misconduct). You can do this by raising an offboarding request through its platform and providing the reason for the contract termination or separation.

After receiving the request, Oyster will contact you to confirm the details. Then, it will manage the entire offboarding process—from notifying the worker to preparing the necessary documents for signature. It will also provide you with a summary of the offboarding process and what to expect for each step.

Oyster’s online offboarding form requires you to input the employee’s proposed offboarding date, severance details, and other information. (Source: Oyster)

Oyster’s partnership with Allianz allows it to offer localized benefits to your employees. Its Oyster Health plan is available in more than 165 countries and even includes mental health support, adult and child vaccinations, and an option to add maternity benefits. It also covers all pre-existing health conditions, in-patient hospital treatments, and cancer treatments. Pricing starts at $82.30 per month and is based on the benefits package selected and your employee’s age and location.

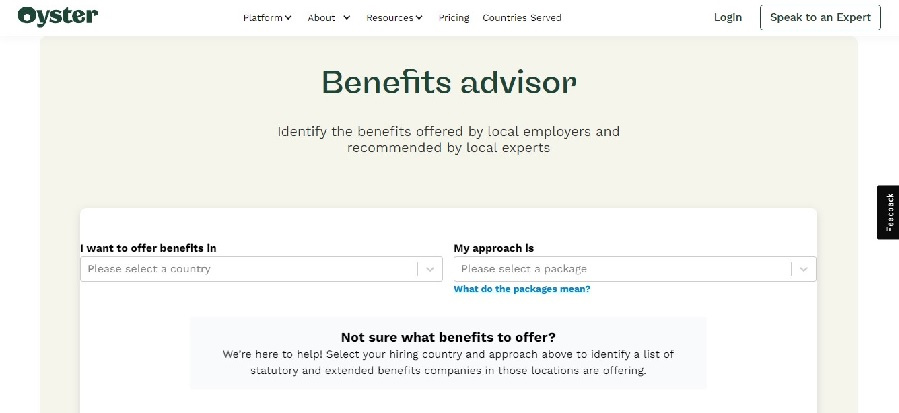

Aside from providing access to competitive employee benefits, Oyster has an online “Benefits Advisor” tool that lists the benefits that local companies offer and local experts recommend. It has four categories:

- Statutory: Benefits required by law

- Bronze package: Basic extended benefits offered by 60% of the companies that Oyster analyzed

- Silver package: Locally optimized benefits offered by 25% of the companies that Oyster analyzed

- Gold package: Best-in-class benefits offered by 5% of the companies that Oyster analyzed

These categories help you gain a better understanding of the mandatory benefits you should provide, including the options that will make you stand out from other companies. What’s also great about this tool is that it is free to use and you can easily choose the category you want for the selected country.

A screenshot of Oyster’s online “Benefits Advisor” tool (Source: Oyster)

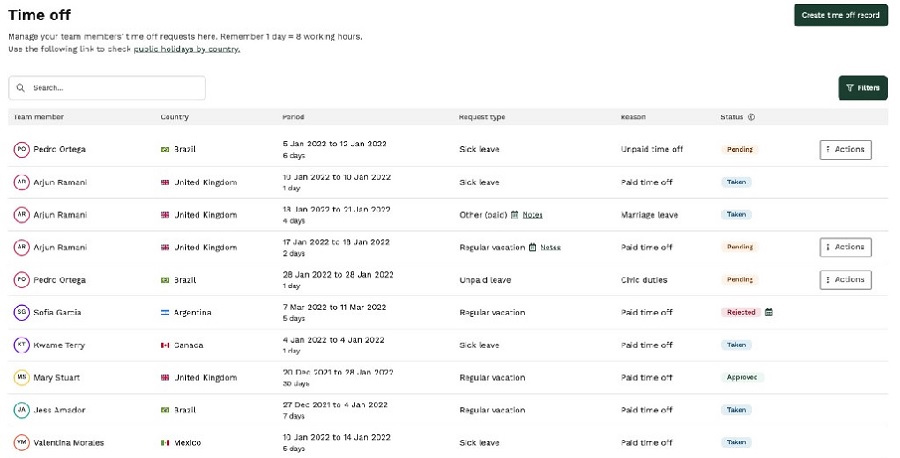

Oyster can handle time-off requests for vacation, sick, and other paid (and unpaid) leaves. Employees can raise the requests via the system, and administrators can approve or reject these online. Administrators can also create a time-off request on behalf of an employee. Note that this type of transaction will still require admin approval.

System administrators can view and manage all leave requests in Oyster’s “Time off” module. (Source: Oyster)

The provider only received a 2.5 out of 5 rating for reporting functionalities. While Oyster has locally compliant contracts, built-in agreement templates, and reports you can download either as a PDF or Excel file, its reporting options are limited. Plus, its inability to customize the report by country cost it some points.

As of this writing, Oyster can generate four reports:

- Payroll report: A report containing all of your full-time employees’ payroll, from the date that you set up your Oyster account (this doesn’t include data before March 2022; you have to get this separately from Oyster’s payroll module)

- Team member report: A report that shows your employees’ and contractors’ personal and employment details

- Invoice report: A report of all invoices for both employees and contractors

- Expense report: A report of all expenses for both employees and contractors

Oyster scored 4.5 out 5 in this criterion because of its intuitive platform and easy-to-use online tools. Its solid compliance solutions, comprehensive hiring guides, and dedicated support also contributed to its high score. It didn’t get perfect marks because it lacks phone support—you can only contact customer support via email, chat, and help tickets raised through its platform.

- User-friendly and intuitive platform

- Automated hiring and onboarding processes

- In-app virtual hiring assistant (Pearl)

- Access to local hiring and compliance experts

- Dedicated customer success manager

- Online global hiring guides and tools

- Locally compliant contracts

- FAQs and how-to guides

- Email and chat support

Oyster makes global hiring easy with its user-friendly platform, compliance support, and automated online tools. We’re impressed with its virtual hiring assistant, Pearl, as it provides not only the basic hiring requirements but also recommends employment terms and options to help you build a strong and competitive package.

In addition, it handles international payments with ease, and you don’t have to worry about keeping track of deductions and tax payments—Oyster will handle these for you. It even lets your global employees file expense reimbursement requests online. If you need to provide allowances or bonuses, you can input these details directly into Oyster for pay processing.

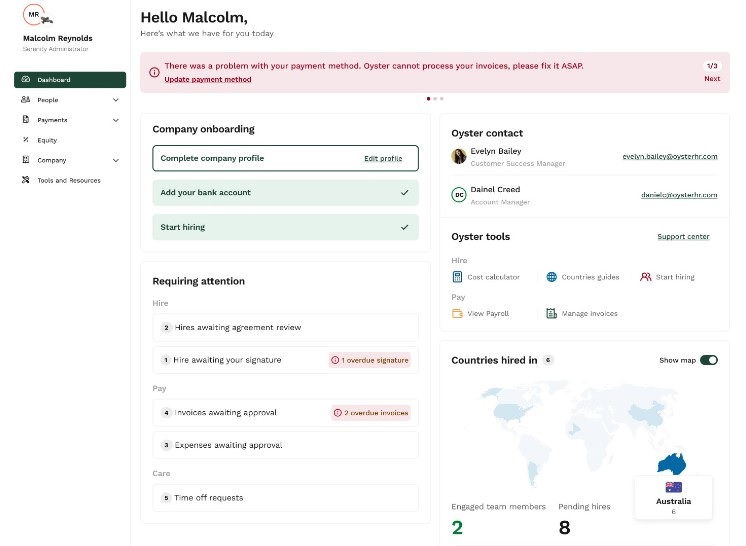

Tasks that require your attention are added to your Oyster dashboard automatically. This includes notifications for invoices, expenses, and time-off requests that require your approval. Links to some of Oyster’s online tools can also be found on the dashboard, enabling you to access country guides, manage invoices, and raise hiring requests quickly.

A screenshot of Oyster’s main dashboard (Source: Oyster)

If you use third-party business software, Oyster integrates popular accounting, expense management, applicant tracking, and HR information management solutions. However, its network isn’t robust. Here are some of its partner systems.

- Xero

- QuickBooks Online

- NetSuite

- Expensify

- Greenhouse

- BambooHR

- HiBob

- Workday

Oyster earned a 4.38 out of 5 rating in our expert assessment given its reasonably priced plans, efficient EOR and payroll services, compliance support, and automated solutions for hiring and onboarding international workers. However, its limited HR features prevented this provider from getting a perfect score in this criterion. It doesn’t have the wide range of HR solutions that similar providers offer, such as Rippling. Note that with Rippling, you get time tracking, learning management with a robust library of training programs, and employee survey functionalities in addition to hiring, onboarding, and pay processing tools.

| Users Like | Users Don’t Like |

|---|---|

| User-friendly and intuitive software | More customization options in amending contracts |

| Ease of hiring and onboarding remote teams | Lacks phone support |

| Generally good customer support | Runs slow and glitches at times |

| Affordable contractor plan | Can get expensive as you add more employees |

Oyster’s low score in this criteria is due mainly to the small number of user reviews (the average number didn’t exceed 1,000) on third-party review sites like G2 and Capterra. Those who left positive OysterHR reviews mentioned that its generally helpful support team, solid onboarding tools, and efficient global hiring solutions are its best features. Several users also like its easy-to-use platform and automated solutions that help streamline processes.

Meanwhile, there are only a handful of negative OysterHR reviews online. Some complained about having experienced occasional software glitches, while others dislike not having access to phone support. A few reviewers also wished for more features like additional contract customizations and a more robust expense claim tool.

At the time of publication, Oyster software reviews earned the following scores on popular user review sites:

- G2: 4.3 out of 5 based on 130 reviews

- Capterra: 4.7 out of 5 based on more than 20 reviews

How We Evaluated Oyster

We looked at the provider’s features (both HR and payroll) and payment options. We also considered ease of use, transparency in pricing, HR and compliance support, and customer support. Access to third-party integrations, employee benefits plans, and onboarding tools is also important. We even check the feedback that actual users posted on popular user review sites.

Click through the tabs below for our full evaluation criteria:

25% of Overall Score

We looked for convenience features like automatic pay runs, local tax filing, and the ability to pay contractors and employees with manual check capabilities and direct deposit. Providers rank better if their services are available in more than 100 countries, with a team of in-country payroll and HR compliance experts.

20% of Overall Score

We highly favored providers that showed straightforward pricing with multiple plan options. In addition to each software’s per-employee pricing, we checked if any required setup fees. We also gave more points to providers that allow unlimited pay runs and have multiple plan options.

15% of Overall Score

The best global payroll service includes essential HR features, such as onboarding, self-service portals, and benefits. We favored companies that offered tools to help with legal compliance issues. We also considered PEO services and benefit and deduction assistance.

15% of Overall Score

The global payroll software should have no setup fee and be easy to use. We also looked for an intuitive user platform, including live phone support, training options, and flawless integration with other software.

10% of Overall Score

In addition to the number of payroll reports, we considered whether they are customizable or if you could create special reports for your specific need.

10% of Overall Score

Sometimes, a service can check all the boxes but not be the best fit for a small business. The expert review is our opinion on how well a service meets SMB needs for payroll and HR, including its general value for the dollar.

5% of Overall Score

We took the average review ratings from third-party sites like G2 and Capterra, which are also based on a 5-star scale. Any option with an average of 4-plus stars is ideal. We also favored software with more than 1,000 reviews on any third-party site.

Bottom Line

Expanding your business in other countries most likely means hiring either contract workers to handle special projects or local employees who can manage your company’s day-to-day operations. With Oyster, you can find, hire, and pay both international contractors and employees with ease. Its EoR services cover more than 180 countries and include compliance support to ensure that you remain compliant with local labor laws and regulations.

You also get an online platform that’s intuitive, simple to learn, and easy to navigate through. What’s also great about Oyster is that it has an in-app virtual hiring assistant and an online benefits tool to help you understand country-specific hiring requirements and determine the best employment terms and benefits options for recruiting global employees.

Sign up for an Oyster plan today.