Looking to make money while you sleep? Discover the most profitable passive income strategies that small business owners can implement.

Passive Income Ideas to Generate Cash Flow in 2025

The digital economy has made it easier than ever for small business owners to turn their skills, assets, and investments into ongoing income streams. From selling digital products and monetizing content to real estate and automated services, these passive income ideas can help diversify your revenue while freeing you from constant hands-on work.

For small business owners juggling multiple responsibilities, setting up these additional revenue streams can be a game-changer. In this article, I’ll walk you through the best passive income opportunities for 2025 — some requiring more upfront effort than others, but all designed to generate consistent cash flow with minimal day-to-day involvement.

What is passive income?

Passive income refers to earnings that require minimal ongoing effort to maintain after the initial setup. While no income is truly 100% passive, the right ones can get pretty close, allowing you to earn with only occasional maintenance or oversight.

Top passive income ideas

1. Sell digital products

Creating and selling digital products remains one of the most accessible passive income streams for small business owners. After investing time in development, you can sell these products repeatedly without additional production costs.

Online courses

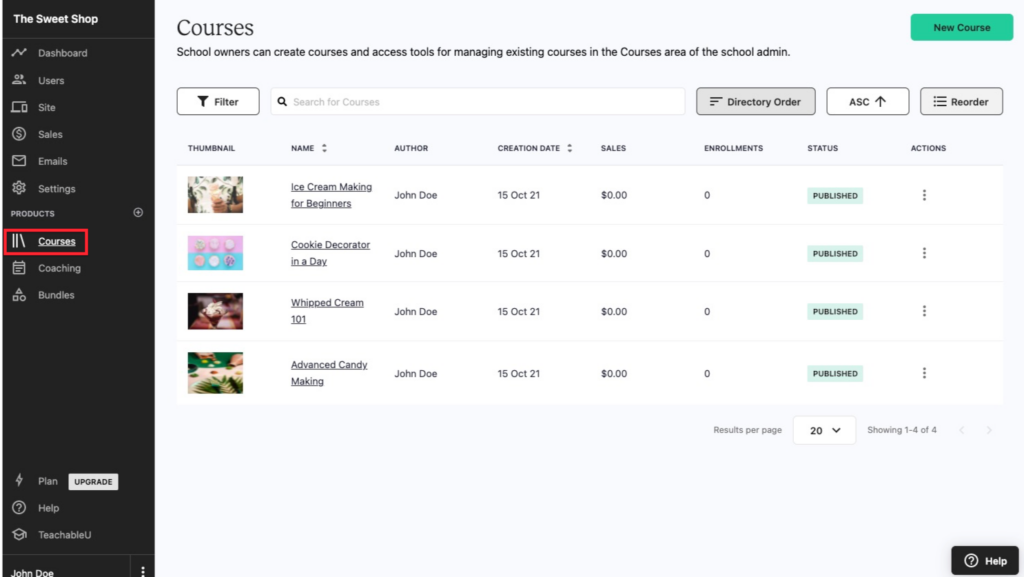

Online courses are particularly lucrative, especially when focused on your area of expertise. Whether you’re a marketing whiz, financial consultant, or industry specialist, packaging your knowledge into a structured course can generate substantial recurring revenue. Course creation platforms like Teachable and Kajabi have simplified the process with built-in marketing and payment processing tools.

Teachable makes it easy to create online courses. (Source: Teachable)

E-books and digital guides

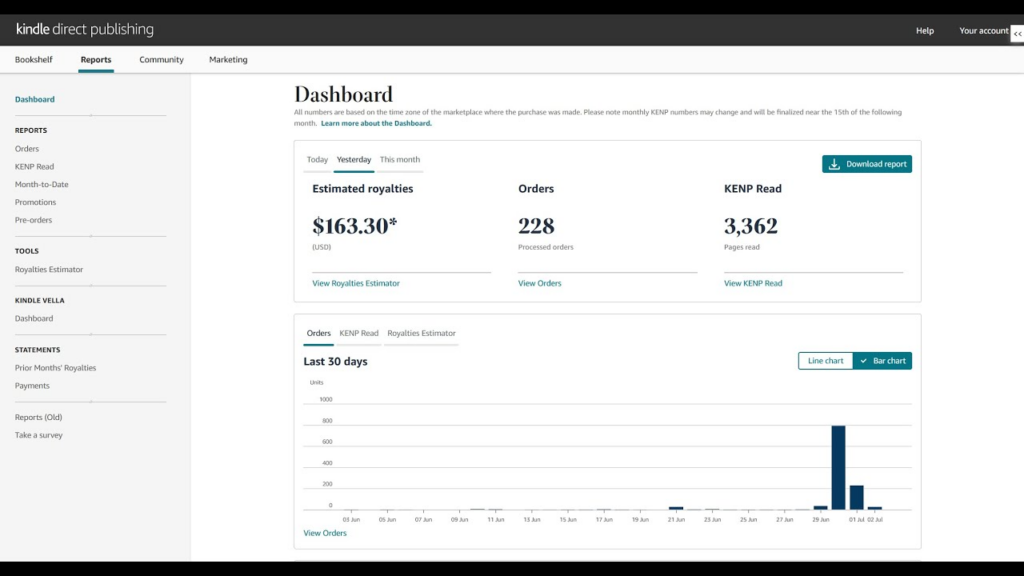

E-books and digital guides offer another low-barrier entry point, and it is included in our list of best business ideas for beginners. Self-publishing has never been easier, and platforms like Amazon KDP give you instant access to millions of potential customers. The key is addressing specific pain points your target audience faces — the more specialized your knowledge, the less competition you’ll encounter.

Amazon’s Kindle Direct Publishing allows anyone to self-publish their books. (Source: Amazon KDP)

Templates and digital tools

Templates, tools, and software subscriptions can transform your internal business solutions into products others will pay for. That customer onboarding process you’ve perfected? Package it as a template. The spreadsheet that streamlines your operations? Sell it to others facing similar challenges. With subscription models, these can become true “set it and somewhat forget it” income sources.

Some of the most popular ideas for passive income through templates include Canva designs, budget and financial planning, meal planning, travel planning, and fitness and workout. Common platforms you can use to sell your templates are Etsy, Canva, and Creative Market.

Stock photography

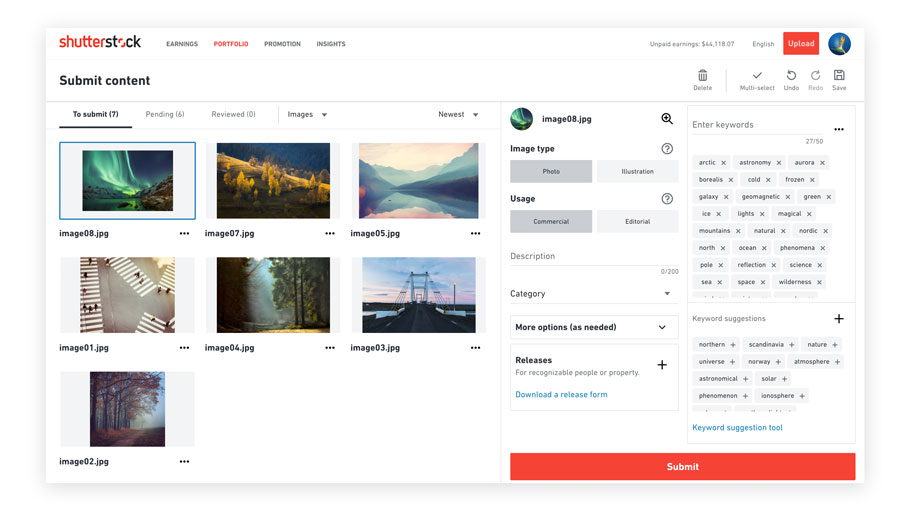

Stock photography presents an excellent opportunity for visually inclined entrepreneurs. If you have photography skills, you can build a portfolio of high-quality images that businesses, bloggers, and marketers need regularly.

Sites like Shutterstock, Adobe Stock, and newer platforms with more favorable commission structures allow you to upload once and earn royalties every time someone downloads your images. The trick is identifying underserved niches or trending visual styles that align with market demand.

Stock photography sites like Shutterstock allow users to submit content that can earn royalties. (Source: Shutterstock)

2. Earn through affiliate marketing

Affiliate marketing is a passive income business idea that lets you earn commissions by promoting other companies’ products or services. Instead of creating your own offerings, you can recommend relevant products to your audience through blog posts, social media, or email marketing. When someone makes a purchase using your unique affiliate link, you earn a percentage of the sale — without handling inventory, customer service, or fulfillment.

One of the biggest advantages of this passive income business idea is that it works in nearly any niche. Whether you’re in tech, fashion, fitness, or finance, there’s an affiliate program that aligns with your audience’s interests. Popular affiliate networks like Amazon Associates, ShareASale, and CJ Affiliate make it easy to find and promote high-converting products.

How to get started with affiliate marketing

You can learn more about this passive income business idea in our affiliate marketing guide, but here’s a quick overview to get you started:

- Start with your niche: Choose products that align with your expertise or audience’s needs. A well-matched recommendation feels natural and converts better.

- Build a content strategy: Blogs, YouTube videos, and social media posts are great platforms for affiliate links. Evergreen content, like “best-of” lists or product reviews, can generate commissions long after they’re published.

- Track and optimize: Use tools like Google Analytics or affiliate dashboard reports to see which links drive the most conversions and adjust your strategy accordingly.

Best platforms for affiliate marketing

Here are some of the best platforms you can use for affiliate marketing:

- Blogs and niche websites: Writing product reviews, comparisons, or guides can attract organic traffic and drive affiliate sales over time.

- YouTube and social media: Video reviews, tutorials, and social media recommendations are effective ways to convert followers into buyers.

- Email marketing and newsletters: Sending curated product recommendations to a targeted email list can boost affiliate earnings with minimal ongoing effort.

Since affiliate marketing requires little maintenance once your content gains traction, it can provide a steady income stream with minimal ongoing effort, making it a smart choice for business owners looking to monetize their existing platforms.

3. Generate rental income

If you’re looking for ways to make passive income, renting out property, equipment, or even digital assets can be a smart passive income business idea that turns idle resources into steady cash flow. Unlike traditional businesses that require constant management, rentals often involve minimal upkeep once everything is set up.

Real estate rentals

Owning rental properties remains one of the most time-tested passive income business ideas. Whether it’s a long-term rental, a vacation home, or even a single spare room on Airbnb or Vrbo, real estate can generate consistent revenue with relatively low day-to-day involvement. Property management services can further reduce your workload by handling tenant communication, maintenance, and rent collection.

Vehicle and equipment rentals

If you own high-demand equipment — like cameras, construction tools, or party supplies — you can rent them out through platforms like Fat Llama or local classifieds. Similarly, if you have an extra vehicle, renting it through services like Turo or Getaround is one of the best ways to earn passive income. Plus, these platforms handle bookings and payments, making the process nearly hands-off.

Digital asset rentals

Not all rentals involve physical property. If you own a high-traffic website, premium domain, or digital billboard space, businesses may pay to advertise on your platform. Even renting out email list placements to relevant brands can be a way to generate passive income.

4. Start businesses with passive elements

Some businesses require an initial setup and occasional maintenance but largely run on autopilot. While these businesses aren’t entirely passive, they leverage automation, self-service models, or outsourced operations to generate revenue with minimal day-to-day involvement.

Vending machines and automated retail kiosks

Vending machines and self-service kiosks offer a reliable income stream with minimal staffing needs. Once you secure high-traffic locations, restocking and maintenance become your primary responsibilities. Smart vending machines with cashless payments and remote monitoring make operations even more hands-off.

Learn more in our guide on how to start a vending machine business.

Modern vending machines have contactless payment options that increase convenience for customers and reduce maintenance for business owners.

Laundromats and car wash operations

Self-service laundromats and car washes generate steady cash flow with limited oversight. While the initial investment can be high, these businesses require little staffing, and revenue is largely automated. Modern technology, like cashless payments and remote monitoring, can further streamline operations.

Dropshipping with fulfillment services

Dropshipping enables you to sell products online without managing inventory or handling shipping. With the right fulfillment partner, orders are processed automatically and shipped directly to customers. This hands-off model allows e-commerce businesses to operate with minimal daily effort, though your success depends on strong product selection and marketing strategies.

Learn more in our guide on how to start a dropshipping business.

5. Monetize a membership or subscription service

A membership or subscription model is a great way to make passive income by offering exclusive content, resources, or community access in exchange for recurring payments. Instead of relying on one-time sales, you can build a steady revenue stream with minimal ongoing effort. With the right setup, earning a passive income through memberships and subscriptions can be both scalable and sustainable.

Subscription-based content

If you create valuable content, consider putting it behind a paywall using platforms like Patreon, Substack, or Memberful. Whether it’s industry insights, business coaching, or niche-specific guides, a well-structured membership can generate consistent revenue. The key is to offer something subscribers can’t easily find for free, such as in-depth tutorials, exclusive Q&A sessions, or premium templates.

Private communities and coaching groups

People are willing to pay for access to exclusive communities where they can connect, learn, and network. Platforms like Circle and Discord allow you to create paid membership groups for like-minded professionals, hobbyists, or entrepreneurs. If you have specialized knowledge, you can also offer tiered memberships with group coaching sessions, live Q&As, or downloadable resources.

Subscription boxes and digital services

If you prefer a product-based approach, consider a subscription box model with curated products in your niche. Alternatively, digital subscriptions — like access to stock photo libraries, workout programs, or AI-generated tools — can provide continuous income with minimal upkeep after launch.

6. Invest in financial assets

Investing is one of the most traditional ideas for passive income, generating long-term, low-effort income. While market conditions fluctuate, a well-diversified portfolio can provide steady returns with minimal ongoing management.

Dividend stocks

Dividend stocks pay shareholders a portion of a company’s profits, typically on a quarterly basis. Investing in reliable, dividend-paying companies can create a passive income stream while also offering potential stock value appreciation over time.

Bonds

Bonds are fixed-income investments where you lend money to corporations or governments in exchange for periodic interest payments. While returns are generally lower than stocks, bonds offer stability and predictable income, making them a solid option for diversification.

Peer-to-peer (P2P) lending

P2P lending platforms like LendingClub and Prosper connect investors with borrowers, allowing you to earn interest by funding personal or business loans. Returns can be attractive, but it’s important to assess risk and diversify across multiple loans to minimize potential losses.

High-yield savings vehicles

High-yield savings accounts, money market accounts, and certificates of deposit (CDs) provide safe and accessible ways to earn interest on your cash reserves. These investment products are included in our list of small investment ideas that require very little money. While returns are lower compared to other investments, these vehicles offer liquidity and protection against market volatility.

Passive income frequently asked questions (FAQs)

Click through the sections below to read the answers to common questions about passive income ideas:

Yes, passive income is taxed. The tax rate and type depend on the income source. Rental income is subject to regular income tax but may qualify for deductions. Dividends and capital gains have different tax rates, while some forms of passive income, like royalties or affiliate earnings, are taxed as self-employment income. Always check with a tax professional for specific regulations.

Passive income is earnings with minimal effort, typically from rentals, dividends, interest, or businesses you don’t actively manage. The IRS defines it as income from rental activities or businesses where you don’t materially participate.

Active income is money earned through direct involvement, such as wages, salaries, commissions, and business profits from active participation. It requires ongoing effort to generate earnings.

Bottom line

Building passive income streams requires an upfront investment of time or money but creates long-term financial freedom for small business owners. The best passive income ideas align with your existing skills and resources — whether selling digital products, utilizing affiliate marketing, investing in rentals, or launching subscription services.

While no income is truly 100% hands-off, these strategies minimize ongoing effort while maximizing returns. Start with one approach that fits your situation, then gradually expand your passive income portfolio to build wealth that works for you even when you’re not working.