Effective rent collection is an essential aspect of landlord success. From secure online payments to automatic reminders and detailed reporting, rent payment services provide landlords with the tools to improve their rental management experience and ensure smoother tenant-related financial transactions. Based on factors like cost, platform features, user-friendliness, customer service, and our expert opinion, my colleagues and I determined the seven best online rent payment services for landlords.

- Best for streamlining property financials: TenantCloud

- Best for free subscription and reporting tools: Baselane

- Best for rent collection and screening tools: Rentec Direct

- Best for automatic reminders and flexible payment options: Avail

- Best for secure rent collection: PayRent

- Best for business operations: TurboTenant

- Best for various forms of rent payment: Doorloop

All landlords need a system to manage their finances, find qualified tenants, and organize paperwork. TurboTenant is an all-in-one system that can accomplish those tasks and more. |

|

Best Online Rent Payment Services at a Glance

TenantCloud | |||

4.56 out of 5 | Starting price is $17 per month |

| |

Baselane | |||

4.50 out of 5 | Free |

| |

Rentec Direct | |||

4.48 out of 5 | Starting price is $45 per month |

| |

Avail | |||

4.47 out of 5 | Starting price is $0 per unit (or $7 per unit for paid plans) |

| |

PayRent | |||

4.35 out of 5 | Starting price is $0 for <10 units (or $19 per month for 10+ units) |

| |

TurboTenant | |||

4.25 out of 5 | Starting price is $0 per month (or $10.75 per month for paid plans) |

| |

Doorloop | |||

4.07 out of 5 | Starting price is $29.50 per month |

| |

Many online rent payment services are available to landlords to manage their properties. Take our quiz to see what the best fit is for you:

Which online rent payment service is right for you?

TenantCloud: Best for Streamlining Property Financials

Pros

- Manage rental listings

- Portal for tenant access

- Free rent ACH processing

Cons

- Customer service only during business hours

- No live chat support

- Customer relationship management (CRM) is not available for listing leads

TenantCloud Monthly Pricing*

- Starter plan: $17

- Growth plan: $32

- Pro plan: $55

- Business plan: Custom pricing

*Annual billing is also available for a discounted rate.

Our Expert Opinion on TenantCloud

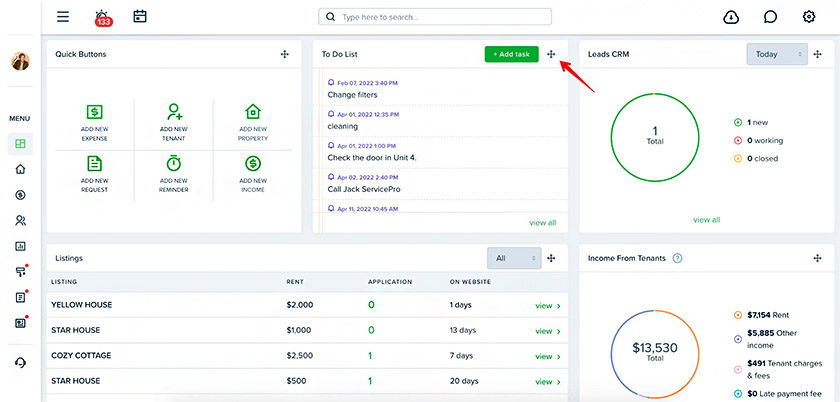

My team and I ranked TenantCloud as the best online rent payment service for its comprehensive and all-in-one property management features like rent collection, online tenant screening applications, listing marketing, and financial reporting. Overall, it helps landlords reduce the vacancy in their rental portfolio. TenantCloud also simplifies the rental management process to ensure seamless financial transactions and effective property oversight. I think TenantCloud could improve by adding live chat customer support features.

Customization dashboard (Source: TenantCloud)

- Maintenance request tracking: Simplifies communication between tenants and landlords by providing a platform to submit and track maintenance requests.

- Tenant screening: Offers robust tenant screening tools to help landlords make informed decisions and find reliable tenants.

- Lease management: Provides digital lease agreement templates that landlords can easily modify, sign, and store online.

- Accounting integrations: Seamlessly integrates with QuickBooks for easy tracking and managing rental income and expenses.

Many users have praised TenantCloud for its convenient online payment system. Landlords also appreciate the rental listing, maintenance, and scheduling tools that save time and help manage daily operations. With these features, TenantCloud has earned an impressive rating of 4.3 out of 5.

Some landlords have been disappointed with TenantCloud’s system navigation and payment transactions. One landlord said payment processing could be better as receiving money once a tenant pays takes almost seven days. Also, the maintenance screen is clunky. It is hard to navigate through all of the maintenance requests if you have many open requests simultaneously. For landlords wanting a fast payment system, we suggest Rentec Direct.

Read how our experts feel about this property management software in our TenantCloud review.

Baselane: Best Free Subscription With Reporting Tools

Pros

- Autopay feature

- Affordable pricing for landlords

- Apple and Google Pay support

Cons

- No rental applications

- No maintenance requests

- No partial payment option

Baselane Pricing

- Free for banking, online rent collection, and bookkeeping

Our Expert Opinion on Baselane

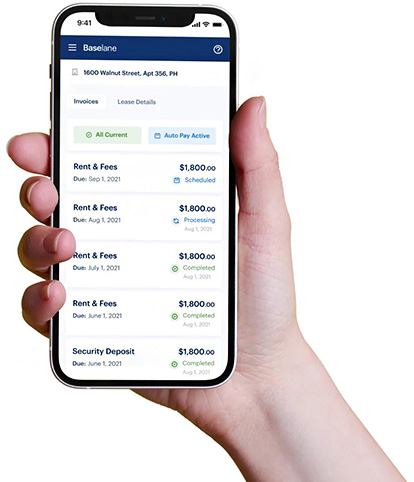

Baselane is one of the best online rent payment systems, and it is recommended by our team as it enables landlords to reconcile their accounts and gain insights into their property’s financial performance. It also provides printable lease agreements for various rental properties and has consolidated ledgers to see all transactions in one place. Another favorite feature of mine is at tax time, Baselane has auto-generated tax reports that landlords can share with their accountants. Baselane could add tenant tools to let landlords digitize rental application forms and leases.

Tenant mobile payments (Source: Baselane)

- Automatic rent reminders: No more manual emails to tenants to remind them to pay on time.

- Document storage: Offers secure cloud storage for essential property documents, such as leases, rental agreements, and payment receipts.

- Expense tracking: Enables landlords to track and categorize property-related expenses, making it easier to monitor profitability.

- Bank integrations: Landlords can integrate the platform with their current bank or open a new Baselane bank account.

Baselane has received positive reviews from satisfied users, achieving a customer review rating of 4.4 out of 5. Users have praised Baselane for its top-notch rent payment services and reporting tools. Landlords also appreciate the platform’s user-friendly interface and ability to simplify financial management. The convenience of generating detailed financial reports has been a standout feature for many users.

However, one user wished for Baselane to have a few other statements like Profit and Loss and more flexibility with setting late fees. Aside from these, many negative reviews indicate users’ disappointment with customer service response time. For those seeking more comprehensive customer support and accounting features, TenantCloud is recommended.

Read how our experts feel about this property management and rent payment service software in our Baselane review.

Rentec Direct: Best for Rent Collection & Screening Tools

Pros

- Ability to generate leases

- Accepts partial payments

- Mobile application available

Cons

- Applicant screening for additional fee

- No free plan

- Outgoing ACH has a fee of 50 cents

Rentec Direct Pricing

- Rentec Pro: Starting at $45 per month

- Rentec PM: Starting at $55 per month

Our Expert Opinion on Rentec Direct

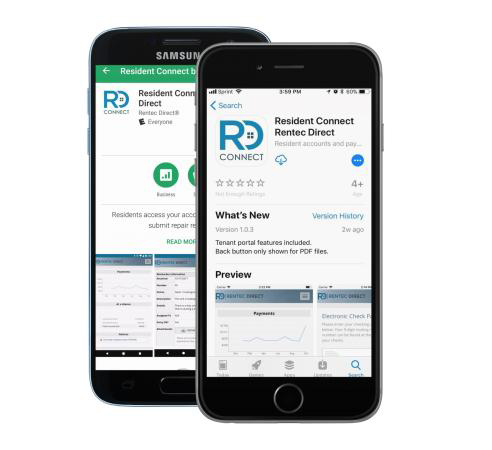

Rentec Direct offers a comprehensive solution that encompasses online rent collection, tenant screening, property accounting, and rental property maintenance tracking. We like that landlords can access a centralized hub for efficient property management to save time and enhance their financial control. Also, landlords can streamline their rent collection process while ensuring their tenants’ quality through comprehensive screening features. However, I believe that waiving the applicant screening fees could make the platform more competitive.

Mobile application (Source: Rentec Direct)

- Online rental applications: Offers an online platform for tenants to submit rental applications, simplifying the application process for landlords.

- Maintenance ticketing system: Provides a system for tenants to report maintenance issues and allows landlords to track and manage these requests.

- Tenant screening reports: Generates comprehensive tenant screening reports, including credit checks, criminal background checks, and eviction history.

- Vendor ACH payment: This allows landlords to process payments to vendors directly from the platform conveniently and securely.

Many users praised Rentec Direct for its ease of use and value for money. Landlords appreciate the rent collection, tenant screening, and property accounting tools. Users found these features to be highly convenient and time-saving. These positive aspects have contributed to Rentec Direct receiving a customer rating review of 4.6 out of 5.

Some users expressed frustration with the platform’s system updates and difficulties with its limited integrations. Some landlords said the ACH process was too slow and wished the money was received faster in their bank accounts. Additionally, one reviewer said it would be nice to have email reporting features that allowed landlords to see who opened their emails when sending mass emails. For a platform with 24/7 customer support and a free forever plan, landlords can consider PayRent as their rental payment platform.

Read how our experts feel about this property management and rent payment software in our Rentec Direct review.

Avail: Best for Automatic Reminders & Flexible Payment Options

Pros

- No technical skill required to launch platform

- Free plan available

- Rental application screening tools

Cons

- Additional fee for third-party integrations

- No mobile application

- Customer service during business hours only

Avail Pricing

- Unlimited: Free

- Unlimited Plus: $7 per unit, per month

Our Expert Opinion on Avail

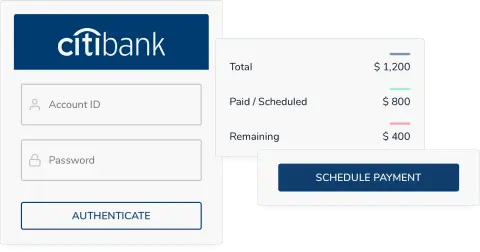

My colleagues and I commend Avail’s accounting features that make bookkeeping easy and allow landlords to handle rental income and expenses in the same platform used to manage their property. Landlords can set up automated rent payment reminders for their tenants to reduce the chances of missed or late payments. Additionally, Avail provides tenants with various payment options, such as credit cards and ACH transfers. Offering a mobile application could improve its system and accessibility.

Scheduling automated payment (Source: Avail)

- Maintenance coordination: Streamlines maintenance requests by providing a platform for tenants to submit requests and landlords to track and manage them.

- Comprehensive tenant screening reports: Provides in-depth insights into credit history, criminal background checks, and eviction records to make informed tenant selection decisions.

- Digital lease signing: A secure platform for landlords and tenants to digitally sign lease agreements, eliminating the need for physical paperwork.

- Rent price analysis: Valuable market insights and data-driven recommendations to help optimize rental pricing for properties.

Avail has received a customer review rating of 4.6 out of 5 for its convenient online payment system that allows small and large landlords to manage their rental portfolios. Many reviewers appreciate the online screening tools, digital signatures, and online application tools, encompassing most of what landlords have been looking for in their rent payment platforms. Customer service was also praised in the reviews, which have been knowledgeable, patient, and helpful with any questions asked.

Some users have expressed frustration with certain aspects of Avail. They found the platform was slow and lagged when updating information in the system. Timing of when payments clear the account also seems to take extra time. A tenant mentioned their landlord would always receive their payment late through the Avail payment system. For a system that receives payments the next day (similar to Avail), landlords can try Rentec Direct’s payment feature.

Read how our experts feel about this all-in-one property management software in our Avail review.

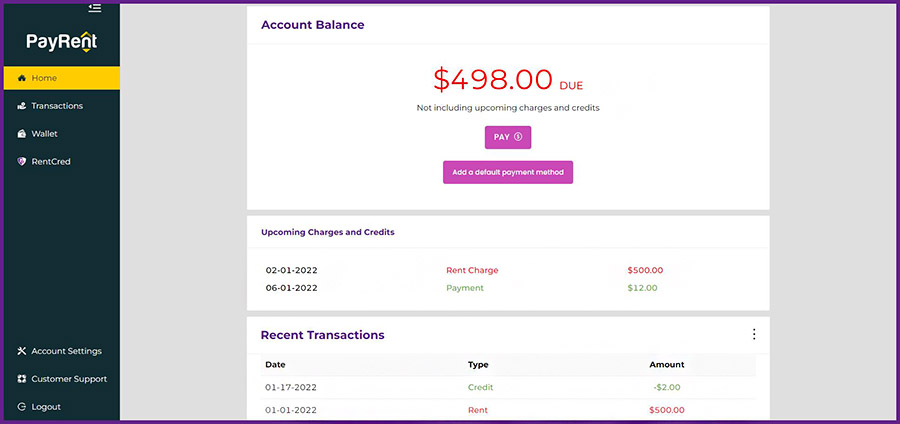

PayRent: Best for Secure Rent Collection

Pros

- Ability to collect security fees or deposits

- Automated late fee assessments

- Landlords can screen applicants

Cons

- There is no option to manage maintenance requests

- No tenant portal

- Expense tracking not provided

PayRent Pricing

- Pay-As-You-Go plan: Free for less than 10 units

- Do-It-Yourself plan: $19 per month for 10 or more units

- Go-Like-A-Pro plan: $49 per month for 25+ units

Our Expert Opinion on PayRent

With PayRent features like recurring payment options and direct deposit into landlords’ bank accounts, it ensures timely and reliable rent collection, which I know is essential for property management. The platform also ensures the safety of financial transactions through encrypted payment gateways and security measures. Landlords can set up recurring payments and receive funds directly into their bank accounts. For managing a rental portfolio, PayRent lacks a tenant payment portal to streamline maintenance requests and increase communication with tenants, which we recommend as an improvement point.

Tenant Payment Portal (Source: PayRent)

- Online application: The convenience of an online application allows landlords to fill their vacancies quickly.

- Bank account verification: Verifies tenant bank account information to prevent payment failures and ensure smooth transactions.

- Payment reminders: Sends automated reminders to tenants to make their rent payments to reduce the likelihood of late or missed payments.

- Split payments: Allows tenants to split their rent payments between multiple payment methods.

Positive reviews for PayRent on its Facebook page gave the platform a customer review rating of 3.7 out of 5. One user said adding property, tenants, leases, and process background checks in one platform was nice. Many reviewers said it was a straightforward platform to utilize as a landlord for rent collection.

Some negative reviews of PayRent mention concerns with confusing instructions and difficulty navigating the platform. One landlord said their tenants tried to link a bank account several times to avoid a transaction fee, but it wasn’t successful. Another reviewer said a mobile application would help manage payments on the go. TenantCloud may be a better alternative for those seeking property management software with a mobile application.

Read how our experts feel about this rental payment and management software in our PayRent review.

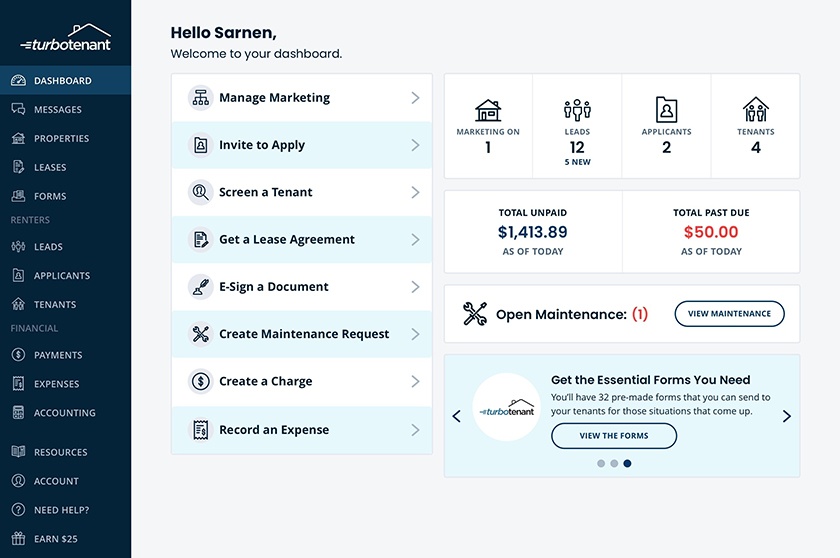

TurboTenant: Best for Business Operations

Pros

- Automatically charge late fees

- Send payment reminders to tenants

- Landlords can generate leases

Cons

- Tenant fee to process rental applications ($55)

- Payment not released next business day

- Limited customization features

TurboTenant Pricing

- Free plan: To connect only one bank account

- Premium plan: $10.75 per month to connect unlimited bank accounts

Our Expert Opinion on TurboTenant

I love that TurboTenant offers various robust features, including standard application, tenant management, and rent collections to simplify and optimize various aspects of the rental business. I also enjoy TurboTenant Academy, which provides a wealth of resources, including webinars, guides, and articles, covering a wide range of topics related to property management. TurboTenant could improve by making its integrations free of charge—helping create more seamless connections with property management CRM, tools, and systems.

TurboTenant dashboard (Source: TurboTenant)

- Rental listing syndication: Syndicates rental property listings to popular listing sites to expand the visibility of landlords’ rental listings.

- Lead tracking and management: Helps landlords track and manage leads interested in the available rental properties.

- Online rental applications: Offers an online platform to collect rental applications securely for easy application review and processing by landlords.

- Customizable tenant application: Allows landlords to add their own questions to the application screening process to help them approve applicants better.

Many landlords praised TurboTenant as it makes it easy to manage rental applications, lease agreements with electronic signing, money collections, and communications. The lead capture feature was also beneficial in providing new tenants. TurboTenant’s customer support was commended for being responsive and helpful, promptly addressing any inquiries or issues. Overall, TurboTenant earned a customer rating review of 4.8 out of 5.

Despite its positive aspects, some landlords found the system to have limitations regarding customization options and needed more advanced features for more extensive property management needs. One landlord mentioned that the platform doesn’t have good features for managing existing properties and expense tracking. For the ability to track expenses and more advanced features, users can expect these features from Baselane.

Read how our experts feel about this property management tool in our TurboTenant review.

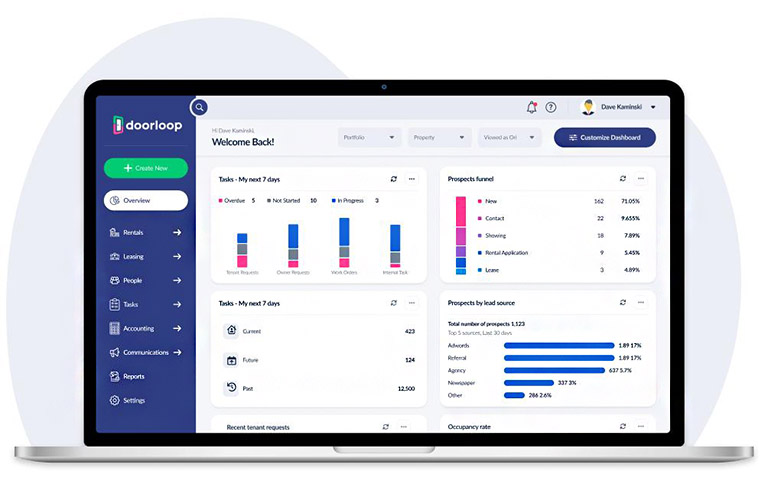

Doorloop: Best for Various Forms of Rent Payment

Pros

- Ability to generate leases

- Portal available for tenants

- Manage maintenance requests

Cons

- No free ACH payments

- Rent payments are not available the next business day

- Free trial and free plan not offered

Doorloop Pricing*

- Starter: Starting at $29.50 per month

- Pro: Starting at $59.50 per month

- Premium: Starting at $89.50 per month

*Annual billing is also available for a discounted rate.

Our Expert Opinion on Doorloop

Doorloop offers accounting, leasing, and property management features for landlords of all different real estate portfolio sizes. The platform lets landlords track rent payments, tenant communication, and maintenance requests all in one place. Doorloop is also a great option for landlords who accept payments via credit card, ACH, or e-check. Although ACH is an accepted payment method, we conclude that Doorloop could enhance the user experience by making payments available the next day or reducing the ACH fee.

Property management dashboard (Source: Doorloop)

- Mobile application: A convenient mobile application allows landlords to manage their rental properties on the go, access important information, and stay connected with tenants.

- File storage: The secure file storage capabilities let landlords easily store and organize important property documents, such as leases, maintenance records, and tenant information, all in one centralized location.

- Customer relationship manager (CRM): The platform includes a powerful CRM tool, allowing landlords to efficiently manage prospective new tenants.

- Online lease signing: Digital lease signings eliminate the need for paper documents and simplify the leasing process for both landlords and tenants.

With an average customer review rating of 4.9 out of 5, Doorloop customers appreciate the simplicity and convenience of the platform. One landlord said Doorloop made it easy to stay on track with all crucial aspects of their real estate investment business, and they love the ease of communication with all renters at once. Many users also commended its ability to have a lease signing program in Doorloop, as it allows for fewer mistakes.

With a high customer rating, there were a few negative reviews. One reviewer wished for units to be separated on the owner’s monthly report for ease of identification. Another user also remarked that the biggest problem he experienced with Doorloop was not being able to delete inactive bank accounts and other inactive things like past tenants, old prospective tenants, and old properties. Many users also wished all payment types, like ACH transactions, were free. For a platform offering free ACH, Baselane offers ACH at no additional charge.

Read how our experts feel about this property management software in our Doorloop review.

How We Evaluated the Top Online Rent Payment Services

To identify the best online rent payment service, we carefully evaluated various factors, including rent collection, tenant screening, reporting tools, payment flexibility, integration options, and usability. Based on these key criteria, we have selected the best online rent payment systems that cater to landlords’ needs for efficient rent collection and comprehensive property management.

TenantCloud has emerged as the best overall platform, achieving an impressive rating of 4.96 out of 5. With its exceptional ability to streamline property management functions, TenantCloud is a centralized hub for efficient rental property management. Its standout features, such as rent collection, maintenance request tracking, and tenant communication portals, contribute to its strong performance.

Other criteria used to evaluate the best online rent payment systems:

25% of Overall Score

Pricing is based on the cost structure, a la carte options, and availability of online rent payment services for landlords and tenants.

10% of Overall Score

It consists of various property management features like online payment collection and tenant screening for each tier to meet the specific needs of the property owners and tenants.

30% of Overall Score

Based on various rental payment features offered that help landlords and property managers simplify rent collection, improve cash flow, and secure rent transactions.

10% of Overall Score

Based on how easy it is to navigate the provider interface and if it provides hassle-free transactions and communication between property owners and tenants.

5% of Overall Score

We looked into the convenience and attainability of customer service for technical and customer support.

10% of Overall Score

Based on customer feedback for each platform, the functionalities that are most useful for property managers and areas that need further improvement.

10% of Overall Score

Our team’s expertise in the field and firsthand experience with the providers allow us to evaluate the standout features, value for the money, and ease of use for rent payment service software.

Frequently Asked Questions (FAQs)

Yes, most rent collection platforms offer the option to set up recurring payments. Landlords can establish automatic payment schedules, allowing tenants to make rent payments on a predetermined frequency without manual intervention.

Rent collection platforms provide convenient and efficient ways to collect rent from tenants, allowing for online payments, automatic reminders, and seamless recordkeeping. They help streamline the rent collection process and reduce administrative burdens.

Rent collection platforms often have built-in functionalities to handle late payments. They can send automated reminders to tenants for overdue rent, helping landlords to effectively manage late payments and ensure timely collections. Some platforms may even offer options to apply late fees or set up grace periods based on specific rules and policies.

Bottom Line

Chasing down rent at the start of each month is one of the most stressful tasks for landlords. With online rent payment software, you can efficiently track rent payments and automate rent collection. Whichever rent collection service you select, we hope this list of the best online rent payment services will assist you in choosing the one that will work best for your business and help you free up more time for the things that matter, like expanding your company or simply enjoying life.