Patriot Accounting’s affordable price and strong features set the platform apart from other accounting software. It has two plans priced at $20 and $30 per month and is designed with small businesses in mind. Its reliable customer support provides ongoing assistance for setting up the platform, troubleshooting account issues, and answering questions.

On the whole, it’s an excellent option for businesses looking for basic features like tracking unpaid bills and issuing invoices. It offers a free 30-day trial if you would like to try the solution out before committing. Continue reading our Patriot Accounting review for more information about its features.

Pros

- User-friendly, with excellent customer service options

- Track income and expenses by department or class

- Prepare and e-file 1099s directly from the program

- Invoices are customizable

Cons

- No inventory tracking function

- No mobile app

- Requires an integration to track time

- No project accounting

- Mom-and-pop businesses that want do-it-yourself (DIY) payroll software: With Patriot Accounting, you have access to Patriot Payroll, which is a separate service that integrates with Patriot Accounting (monthly fees cost $17 or $37). We selected Patriot Payroll as one of the best small business payroll software, especially for mom-and-pop businesses. We also selected Patriot as a best alternative to QuickBooks Self-Employed for a simple accounting software with integrated payroll.

- Businesses on a budget seeking easy-to-use software and excellent customer support: Patriot Accounting is among the least expensive accounting software on the market, and it’s extremely easy to use. Not only that, but the customer service is quick and accessible—you can contact them by phone, live chat, or email.

- Freelancers and contractors that need strong invoicing software: Patriot Accounting allows you to customize your invoices, giving you the ability to upload a logo, change the invoice colors, and create a personalized message. You can also set up invoices to occur automatically on a monthly basis.

- Businesses that need inventory accounting: If you track inventory, Patriot Accounting isn’t a good fit. Instead, try QuickBooks Online Plus or Advanced. Its inventory management features allow you to capture product details, including product costs and stock on hand. It also keeps track of cost of goods sold (COGS) and computes ending inventories. Read our QuickBooks Online review for more information.

- Businesses that work remotely often and needing access to a mobile app: Since Patriot Accounting lacks a mobile app, you might want to consider Zoho Books, which tops our list of the best mobile accounting apps. Learn more about it through our Zoho Books review.

- Businesses seeking strong project accounting functions: FreshBooks is ideal for small businesses requiring project accounting features such as job costing. Our review of FreshBooks can help you decide if the platform fits the bill.

Comparison of Small Business Accounting Software

Software | Monthly Pricing | Users Included | Cost per Additional User | Track Locations & Classes | View Inventory Units & Cost | Compute COGS | Assign Costs to Projects |

|---|---|---|---|---|---|---|---|

$20 or $30 | Unlimited | N/A | Class only | ✕ | ✕ | ✕ | |

$30 to $200 | 1 to 25 | N/A | ✓ | ✓ | ✓ | ✓ | |

| $0 to $275 | 1 to 15 | $3 per month | ✓ | ✓ | ✓ | ✓ |

Free | Unlimited | N/A | ✕ | ✕ | ✕ | ✕ | |

If you’re interested in learning more about the above providers, check out our guide to the best small business accounting software.

Patriot Accounting Deciding Factors

Pricing |

|

Free Trial | 30 days |

Number of Users Included | Unlimited |

Free Expert Support | ✓ |

Income & Expense by Department | ✓ |

Full Service Payroll | Separate plan starting at $17 per month plus $4 per employee/contractor (read our Patriot Payroll review) |

1099 Printing & E-filing | ✓ |

Data Import | ✓ |

Fit Small Business Case Study

Our experts conducted a thorough evaluation of Patriot Accounting and compared it against QuickBooks Online and Wave. Our internal case study has several categories, and the results reflect Patriot Accounting’s capabilities, especially in terms of banking management, reporting, accounts payable (A/P), accounts receivable (A/R), inventory, and project accounting.

Based on the result, Patriot Accounting dominates QuickBooks Online and Wave in the Ease of Use category and also performs well in Banking, Tax, and A/R. While QuickBooks Online Plus beats Patriot in most categories, the version we tested is $85 per month compared to Patriot Premium’s $30 per month.

Patriot Accounting vs Competitors FSB Case Study

Touch the graph above to interact Click on the graphs above to interact

-

Patriot: Starting at $15 per month, $25 as tested

-

QuickBooks Online

-

Wave

The Patriot Accounting pricing page shows two subscription levels: Accounting Basic ($20 per month) and Accounting Premium ($30 per month). Before committing, you can sign up for a 30-day free trial.

Patriot also offers a payroll solution with two subscription levels: Basic Payroll and Full-Service Payroll.

- Basic Payroll: $17 per month plus $4 per employee or contractor—run your own payroll and handle payroll taxes yourself

- Full-Service Payroll: $37 per month plus $4 per employee or contractor—run your own payroll and Patriot will handle your payroll taxes

Patriot Accounting New Feature 2023

Patriot Software, the parent company, announced last year that it has successfully patented a “dual-ledger accounting” software feature. This is essentially a system and method for selectively displaying accounting data in both cash and accrual basis formats. This allows a user to track cash, modified cash, and accrual basis simultaneously, with the software writing transactions automatically in each method at the time of entry.

Patriot Accounting Features

Patriot Accounting offers a wide range of accounting features, depending on whether you subscribe to its Accounting Basic or Accounting Premium plans. Before checking out our detailed assessment of Patriot Accounting’s features, you might want to take a look at the table below to have an idea of what you’re entitled to from each subscription level.

Accounting Basic | Accounting Premium | |

|---|---|---|

Free Expert Support | ✓ | ✓ |

Unlimited Customers & Invoices | ✓ | ✓ |

A/P & A/R Tracking | ✓ | ✓ |

Unlimited Payments to Vendors | ✓ | ✓ |

Create, Print & E-file 1099s | ✓ | ✓ |

Accept Credit Card Payments | ✓ | ✓ |

Import Bank Transactions Automatically | ✓ | ✓ |

Payroll Integration | ✓ | ✓ |

Easy to Make Corrections | ✓ | ✓ |

Record Payments | ✓ | ✓ |

Account Reconciliation | ✕ | ✓ |

Create & Send Estimates | ✕ | ✓ |

Recurring Invoices | ✕ | ✓ |

Invoice Payment Reminders | ✕ | ✓ |

Custom Invoice Templates | ✕ | ✓ |

Unlimited Users With Permissions | ✕ | ✓ |

Manage Receipts & Documents | ✕ | ✓ |

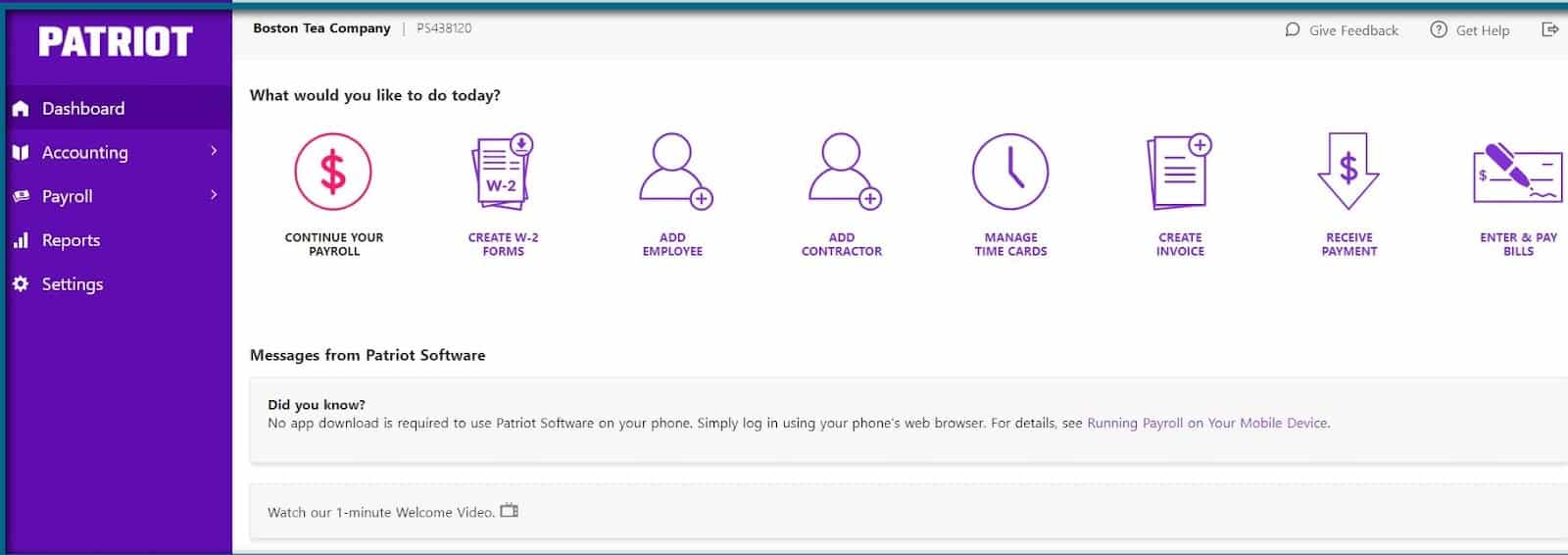

For low-priced software, Patriot Accounting is packed with plenty of useful features. It’s fairly simple to set up an account, and the dashboard allows you to manage users, create invoices, receive payments, and enter or pay bills. A toolbar on the left lets you navigate to more specific tasks.

The Accounting Premium plan also offers a couple of features that don’t normally come with low-priced software. This includes the ability to issue credit memos and print vendor checks.

However, Patriot Accounting is lacking in certain useful features, such as the ability to track income and expenses by location, although you can assign departments. It also doesn’t allow you to track inventory or income and expenses by job:

Patriot Accounting Dashboard (Source: Patriot Software)

Patriot Accounting General Features Video

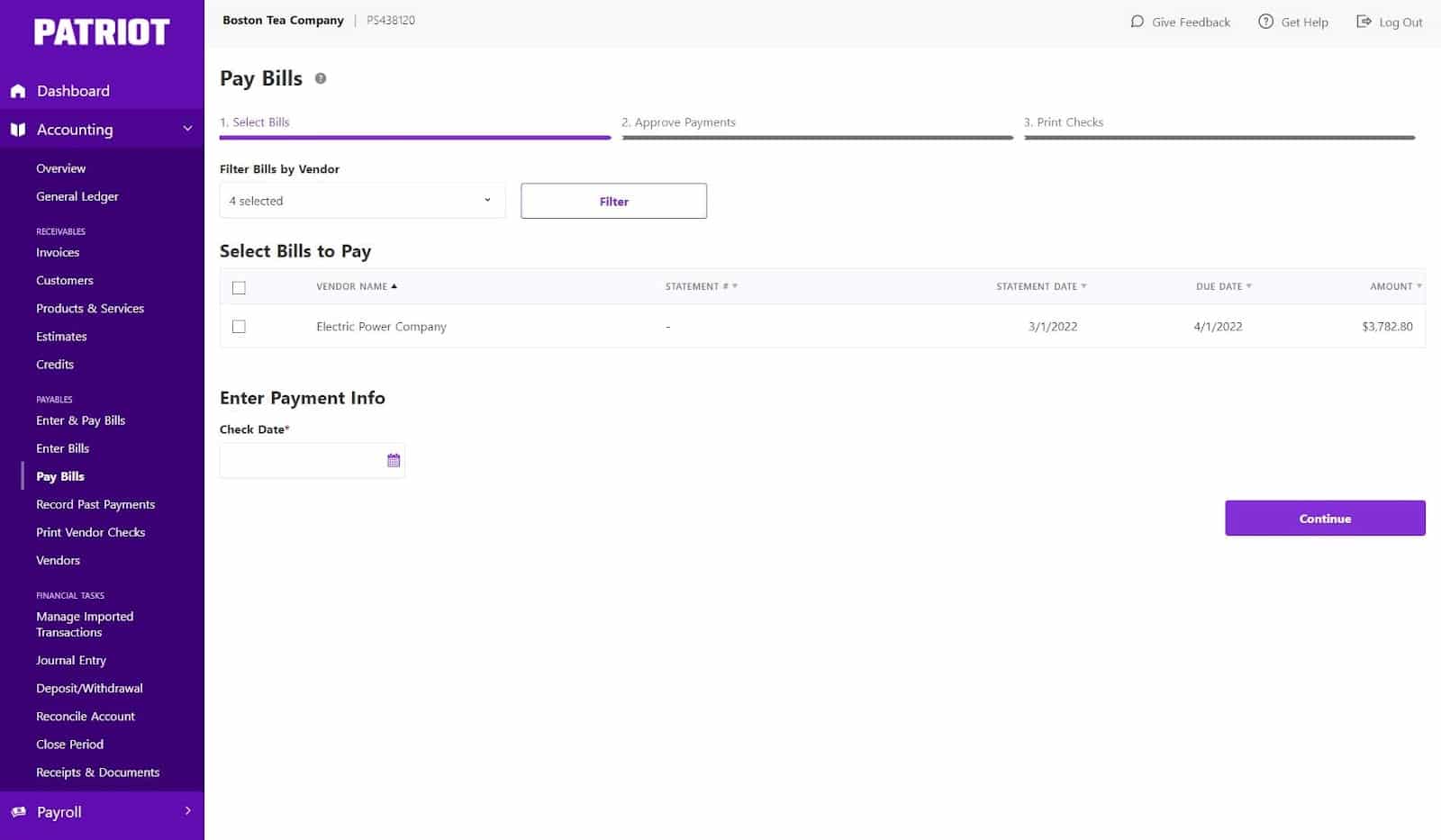

One of Patriot Accounting’s best features is the ability to make unlimited payments to vendors. The software also allows you to record an expense without paying, create bills for the purchase of inventory, and set a default sales price of service items.

With the Accounts Payable function, you must enter a credit card to use the bill pay service. You can’t create recurring expenses, and vendor accounting doesn’t allow you to enter a purchase order. Project accounting features are also lacking, as you can’t create a project within Patriot Accounting.

Patriot Accounting A/P (Source: Patriot Software)

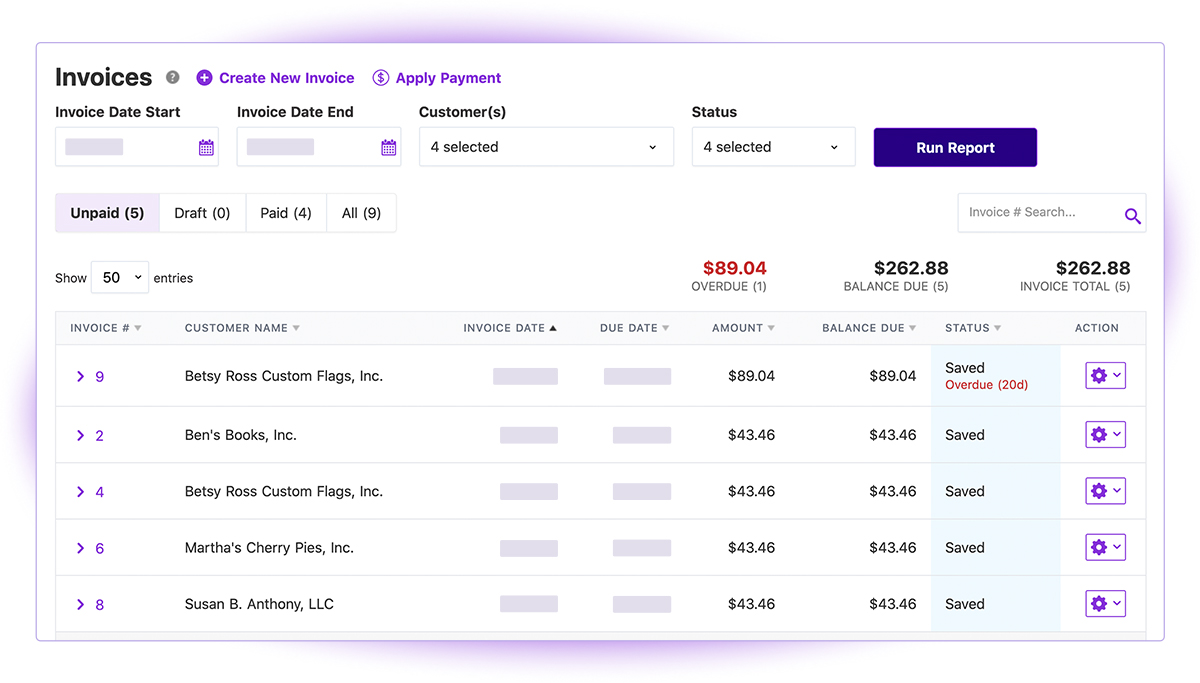

With both the Accounting Basic and Accounting Premium plans, you can create and track unlimited customers and invoices and accept credit card payments. With Accounting Premium, you can also set up recurring invoices and invoice payment reminders and create custom invoice templates with your company logo and colors of your choice. You also have access to automated payment reminders with Accounting Premium, which lets you establish rules for when to send past-due messages to customers.

Patriot Accounting doesn’t allow you to track inventory, but you can add inventory to an invoice and charge sales tax on the sale of inventory. It also won’t track billable expenses as you pay them, so you’ll need to keep track of these in a spreadsheet to add them to a customer invoice later. You also can’t issue a sales receipt for a sale paid immediately or combine multiple checks and/or cash in a single deposit.

Patriot A/R (Source: Patriot Software)

Patriot Accounting offers a strong set of features for banking and cash management, which include connecting to a bank account and uploading transactions, selecting transactions that have cleared the bank, and viewing outstanding transactions.

One of the software’s drawbacks is that, when setting up your account, Patriot Accounting doesn’t allow you to enter your beginning bank balances. You must instead create them with a journal entry. It’s also not possible to lock your books from a prior year.

Patriot Accounting allows you to create estimates, which can be useful when starting a project. Estimates can be customized with due dates, and it’s possible to show sales tax on an estimate. You can also convert the estimate directly to an invoice on the same screen.

However, Patriot Accounting doesn’t allow you to track income and expenses by project, so you’re fairly limited in what you can do in terms of project accounting. If you have a lot of projects, you should evaluate whether it would make more sense to find another application that has stronger project accounting features, such as QuickBooks Online Plus; you can learn more about this solution through our review of QuickBooks Online.

Patriot Accounting allows you to create sales tax items and charge sales tax on the sale of inventory. You can also include a sales tax adjustment on a credit memo. The software allows you to file a sales tax return electronically, or you can pay your liability by check.

If you have independent contractors, Patriot lets you track 1099 payments and you’ll find that Patriot Accounting pricing is very affordable. When it’s time to file your taxes, you can create, print, and e-file 1099s and 1096s. The fees for filing 1099s through Patriot are as follows:

- 1 to 5: $20

- 6 to 35: Additional $2 per 1099

- 36 or more: No additional charge

Patriot Accounting has very limited inventory features. You can create inventory items to add them to invoices quickly, but you can’t track inventory in any way. We recommend Zoho Books instead. It has strong inventory features and also integrates with Zoho Inventory for more complex needs. Our review of Zoho Books provides more details about our recommendation.

See our table below for the reports that Patriot Accounting offers and lacks:

Report Type | Included |

|---|---|

Balance Sheet | ✓ |

P&L Statement | ✓ |

A/R Aging | ✓ |

A/P Aging | ✓ |

Income/Loss by Class | ✓ |

General Ledger (GL) | ✓ |

Trial Balance | ✓ |

Statement of Cash Flows | ✕ |

Income/Loss by Month | ✕ |

Income/Loss by Customer | ✕ |

Income/Loss by Location | ✕ |

Income/Loss by Project | ✕ |

Unbilled Charges | ✕ |

Unbilled Time | ✕ |

Transaction List by Customer | ✕ |

Expenses by Vendor | ✕ |

Patriot Accounting is very user-friendly, and if you make a mistake, it is easy to correct it. Setting up the software for the first time is also easy with its set-up wizard. For further assistance, the Patriot website has a detailed accounting help section with training videos for every aspect of the software. There’s also a blog section with accounting tips, further training articles, and news about the platform.

Customer Service

Patriot Accounting’s customer service is its strongest feature. The company employs US-based customer support agents who are knowledgeable in each aspect of the software. They can guide you through each step of the installation and set-up process, and any other issues that may come up along the way. Hands-on, real-time support options include phone, email, and live chat, and experts are available to assist you Monday through Friday, 8 a.m. to 8 p.m. Eastern time.

Although Patriot Accounting doesn’t have a mobile app, the desktop version is optimized for mobile use, so you can still access your account via your smartphone. You can use all of the same features as the desktop version while you’re on the go, but perhaps not as easily as if you were on a mobile app.

Patriot Accounting Integrations

Patriot Accounting integrates with Patriot Payroll, which is one of our top picks for the best small business payroll software. You can add on time and attendance and/or HR software for $6 per month plus $2 per employee for each add-on, and both integrate seamlessly with Patriot Payroll. Check out our Patriot Payroll review for more information.

Users who left Patriot Accounting reviews GetApp1 (4.7 out of 5 based on around 350 reviews) praised the company’s reliable customer support. Users also like the software’s ease of use and invoicing features, especially with the Accounting Premium plan. One of the biggest drawbacks is its limited inventory and project accounting features. Other users wished that Patriot Accounting offered a mobile app.

Frequently Asked Questions (FAQs)

Yes, Patriot Accounting offers a 30-day free trial with no credit card required to sign up.

Patriot Accounting offers two pricing plans; Accounting Basic for $20 per month and Accounting Premium for $30 per month. You can also sign up for its payroll solution, which costs $17 per month for DIY and $37 per month for full-service payroll. An additional charge of $4 per employee/contractor applies to both plans.

Yes, Patriot Accounting offers free expert support through phone, email, and live chat, Monday through Friday, 8 a.m. to 8 p.m. Eastern time. You can also search for answers on your own in the online help center.

No, Patriot Accounting doesn’t currently offer a mobile app. However, the software has been optimized for use on mobile devices.

Bottom Line

Patriot Accounting is recommended for small businesses needing the flexibility to handle invoices and manage payments while also keeping close track of cash flow. Its ease of use, quick setup, seamless integration with Patriot Payroll, and stellar customer service separate it from its competition.

User review references: