Patriot Payroll is an online system designed to automate employee salary and tax deduction calculations. Its features include unlimited pay runs, contractor payments, an employee portal, and free access to expert support and payroll setup. Its basic and full-service payroll options―which cost $17 and $37 per month, respectively, plus $4 per employee―make it ideal for small nonprofits and mom-and-pop businesses looking for an affordable solution. In our evaluation of the best payroll software for small business users, Patriot Payroll earned an overall score of 4.06 out of 5.

Pros

- Budget-friendly pricing with multiple payroll packages and add-on options

- Unlimited pay runs

- US-based customer support with extended weekday hours

- Free payroll setup, expert support, and direct deposits

- ”Net to Gross Payroll” solution handles gross-up calculations of employee bonuses automatically

Cons

- Direct deposits require a four-day lead time (two-day direct deposits are for qualified clients only)

- Lacks access to employee benefits

- Multistate filings cost extra

- Limited third-party software integrations

- Time tracking and basic human resources (HR) solutions for managing employee data are paid add-ons

- Mom-and-pop businesses: Patriot Software offers an inexpensive solution for paying employees and computing payroll taxes. While you have to handle payroll tax filings with its basic option, the plan costs only $17 monthly plus $4 per employee—a viable option if you have a handful of employees. Alternatively, you can choose its full-service payroll priced at $37 monthly plus $4 per employee.

- Churches and small nonprofits: Church and nonprofit leaders typically wear multiple hats, and payroll is only a small part of their overall duties. Patriot’s easy setup process, along with its affordability, is why it makes sense. Patriot Payroll can help set up the system for free; new users simply need to provide basic business details. Those who prefer a do-it-yourself (DIY) solution can use its easy-to-follow payroll startup wizard.

- Employers that hire independent contractors: With Patriot Software, you don’t need to run separate payrolls for contractors. Its platform can handle payroll processing and direct deposit payments for both employees and independent contractors.

- Businesses looking for employee benefits: Unlike popular small business payroll providers such as Gusto, Patriot Payroll doesn’t offer health insurance plans or provide benefits program management. For more suitable options, check out our guide on the top HR payroll software, which usually offer benefits administration.

- Small and midsize businesses (SMBs) that require quick direct deposits: Patriot provides free direct deposits, but its standard processing is four days. While it also offers a two-day option, this is only for qualified companies. I recommend QuickBooks Payroll if you require next- and same-day direct deposits. Square Payroll is also a good choice since it offers next-day direct deposits via its Cash App and even instant payouts with its Instant Payments option.

- Companies with international employees: Patriot Payroll only handles employee pay processing for US-based companies. If you have a global workforce, then you should consider other payroll providers. Explore our guide on the best international payroll services.

Patriot Payroll Deciding Factors

Supported Business Types | Startups and SMBs (with up to 350 employees) that need a reasonably priced payroll software with full-service and DIY tax filing plans |

Free Trial | 60 days for new clients |

Pricing |

|

Discounts | None |

Standout Features |

|

Ease of Use | Platform is relatively easy to learn and use, especially if you’re familiar with how to run payroll |

Customer Support |

|

Are you looking for something different? Read our guide to the best payroll services for small businesses to find a service or software that fits your requirements.

Top Patriot Payroll Alternatives

Best for: Small businesses looking for full-service payroll and solid HR tools | Best for: QuickBooks accounting small business users | Best for: Square POS users, particularly retailers and restaurants |

Base monthly fee from: $40 | Base monthly fee from: $45 | Base monthly fee from: $35 |

Per-employee monthly fee from: $6 | Per-employee monthly fee from: $6 | Per employee monthly fee from: $6 |

Patriot Payroll pricing includes a full-service payroll package and a basic payroll option with DIY tax filings. All plans also come with unlimited payroll runs, paid time off (PTO) accruals, electronic Form W-2s, and free direct deposits. You can even use its basic and full-service options to pay contractors.

These features contributed to Patriot Payroll scoring perfect marks for pricing. It also doesn’t charge setup fees, even providing free setup assistance to new clients. Pricing is fully transparent, with payroll plans that don’t cost more than $50 per employee monthly. For its full-service payroll package, you only need to shell out $37 plus $4 per employee, monthly (or $17 plus $4 per employee monthly for its basic option).

Since our last update: Patriot Payroll has increased the base monthly fees of its payroll plans—from $10 to $17 for its basic package and from $30 to $37 for its full-service option. The cost of its accounting solution also changed, with its basic plan now priced at $20 per month (from $15) and the premium tier costing $30 monthly (from $25).

Basic Payroll | Full-Service Payroll | |

|---|---|---|

Base Monthly Fee* | $17 | $37 |

Per Employee or Contractor Pricing | $4 | $4 |

Unlimited Pay Runs | ✓ | ✓ |

PTO Accruals | ✓ | ✓ |

Free Payroll Setup | ✓ | ✓ |

Tax Payment and Filing Services | ✓ | ✓ |

Year-end Payroll Tax Reporting | ✓ | ✓ |

Tax Filing Accuracy Guarantee | N/A | ✓ |

1099 Filing Services (Optional) | With add-on fees | ✓ |

*Patriot will still charge you its base monthly fees for months you don’t run payroll.

Patriot Payroll Add-ons

What’s great about Patriot Payroll’s pricing scheme is the flexibility—you can purchase HR and time tracking tools, as well as 1099 filing services in case you only signed up for its basic option. Note, however, that its time tracking and basic HR solutions are add-on modules to Patriot Payroll and can’t be used as standalone systems.

If you need accounting tools, Patriot has accounting software that integrates seamlessly with its payroll module. Premium support services are also available if you need assistance handling amended tax returns, payroll tax filing for past or future quarters, and making data corrections or adjustments:

- 1099 e-filings (for Basic Payroll subscribers only): $20 for up to five 1099 e-filings; an additional $2 per 1099 is required for six to 35 filings (no additional charge for 36 or more)

- Multistate payroll tax filing: $12 monthly for each additional state

- Time tracking: $6 plus $2 per employee monthly

- Basic HR/employee data management tools: $6 plus $2 per employee monthly

- Accounting solution: $20 monthly for the basic option; $30 monthly for the premium version

- Premium support services

- Deposit and file taxes for past or future quarters: $37 for each past or future month

- Amended tax returns for quarters where Patriot’s full-service payroll was active: $100 per quarter for Q1, Q2, and Q3; $150 per quarter for Q4

- Payroll or accounting data corrections or adjustments: Custom-priced, depending on complexity

Patriot Payroll’s online tools aim to help SMBs process employee salaries easily and quickly. In addition to having an intuitive interface, its software is mobile-friendly. This allows you to run payroll directly from smartphones and tablets without having to download an app—provided there’s an available internet connection.

While this provider offers solid payroll tools, it didn’t get a perfect rating in this criterion. What pulled its scores down are the limited payment options and two-day direct deposits that are only available for qualified companies (those that don’t qualify get four-day direct deposits).

With Patriot Payroll, employers can run unlimited payrolls each month and pay employees, including contractors, via direct deposits or paper checks. Its platform can handle all pay frequencies—from weekly and biweekly to semimonthly and monthly. You can also add up to five pay rates for each hourly employee as well as create custom working hours, employee deductions, and repeating payment types, such as car and housing allowances.

In addition, its integration with Next Insurance allows you to pay workers’ compensation insurance premiums automatically during each pay run. If you’re operating out of Washington or Wyoming, Patriot will collect and file workers’ comp for you. Both features are available for free for Basic Payroll and Full Service Payroll subscribers.

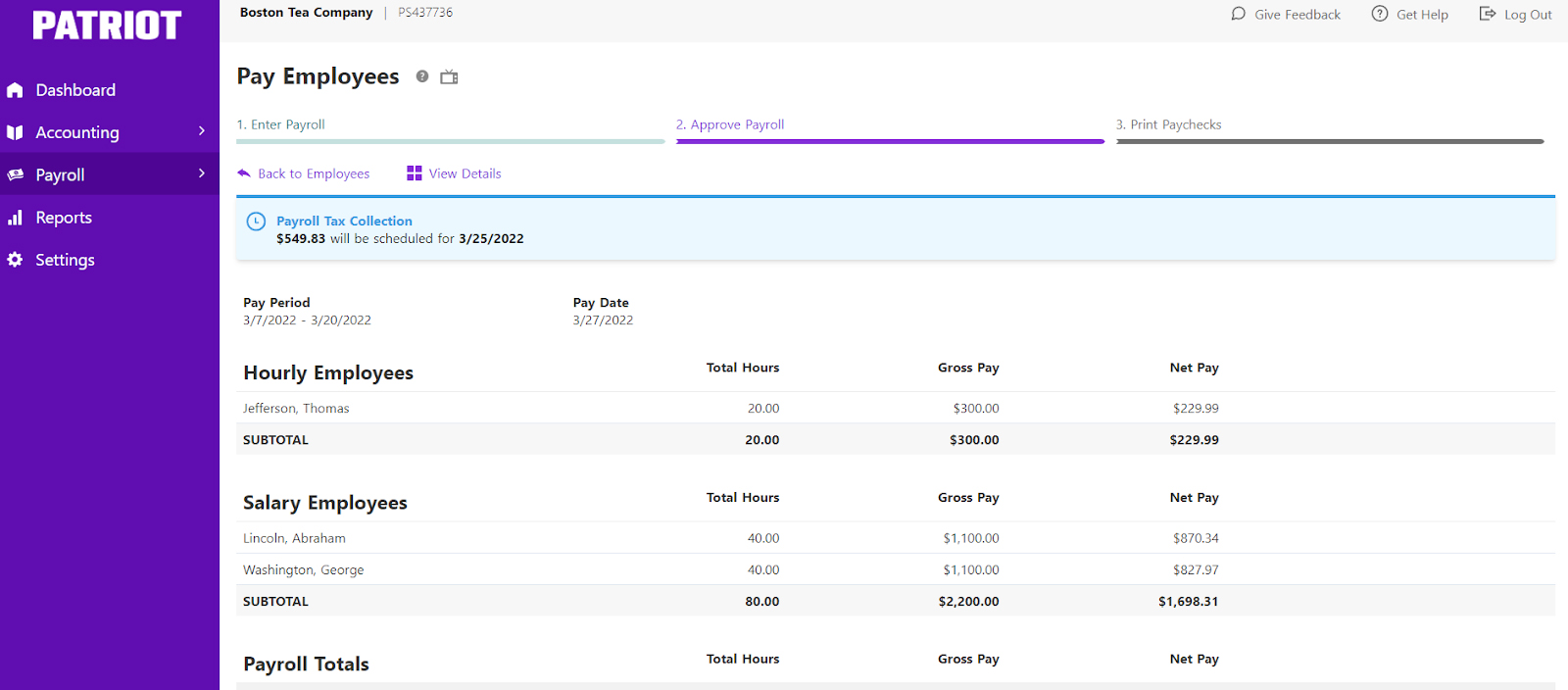

Patriot Payroll has a three-step process that lets you enter pay details, approve payroll, and print employee paychecks. (Source: Patriot Payroll)

While Patriot’s Basic Payroll plan requires DIY tax payments and filings, getting its Full Service Payroll option grants you access to automated payroll tax deposits and filings (for federal, local, and state taxes), including quarterly and year-end submissions of Forms 940, 941, W-2, and W-3. If you require multistate filings, note that its Full Service Payroll packages include tax filing for one state only. You have to pay $12 monthly for each additional state filing.

Patriot Payroll also makes managing payroll tax calculations easy for employers with staff across business locations. By assigning a primary work location to each employee in Patriot Payroll, its system will compute the applicable taxes automatically based on where your staff works.

Aside from tax filing services, Full Service Payroll users are covered by Patriot’s tax filing accuracy guarantee. This means that if its representative makes a mistake in depositing and filing payroll taxes, then Patriot will cover all the penalties and interest payments.

For those who employ independent contractors, Patriot Software has an optional 1099 e-filing feature in which it will submit 1099-NEC and 1099-MISC forms to applicable government agencies. This service is provided for free for Full Service Payroll clients, but charges add-on fees (starting at $20) for Basic Payroll subscribers.

With Patriot Payroll, you can pay employees and contractors via direct deposits. While it doesn’t charge extra for direct deposits, it has a four-day processing lead time. For those requiring faster processing timelines, Patriot offers two-day direct deposits. However, this is only available to established well-qualified companies, and you have to contact the provider for two-day direct deposit consideration.

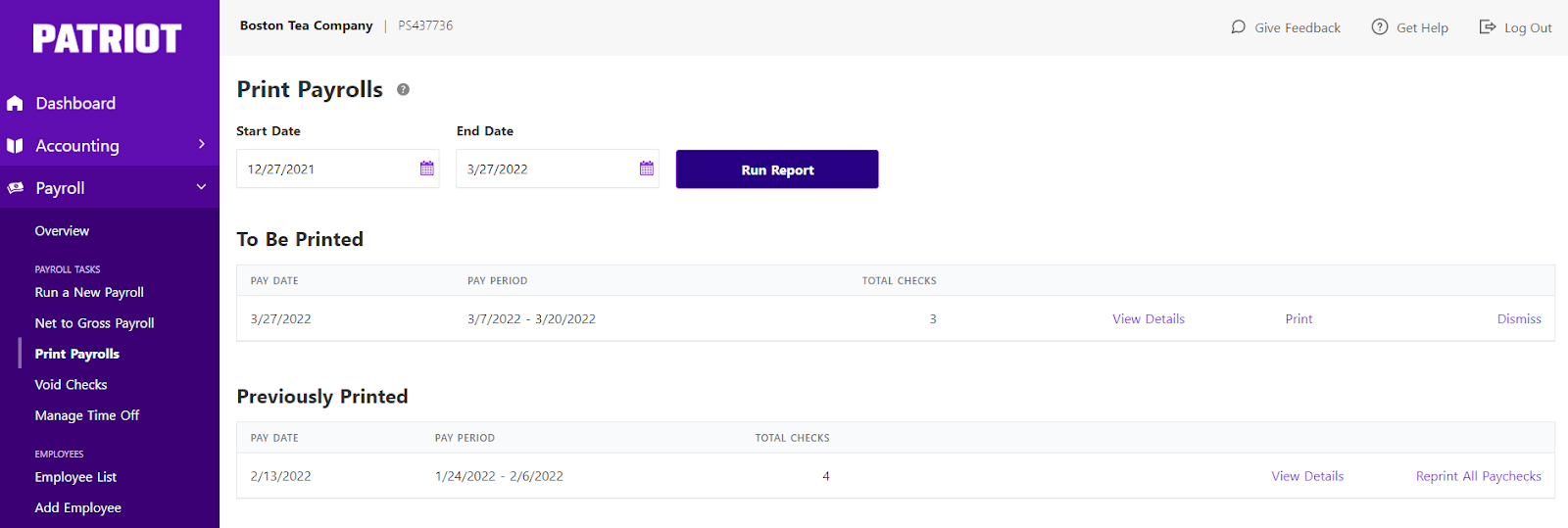

If you prefer to pay via manual checks, Patriot offers two check printing options: preprinted check stocks and blank check stocks. The first requires you to run a few sample prints to ensure that the needed information, such as date, employee name, and check number, are placed correctly on your preprinted checks. The second needs sample prints as well but also requires magnetic ink character recognition (MICR) toner for your printer.

Aside from printing new paychecks, Patriot Payroll allows you to reprint and void checks. (Source: Patriot Software)

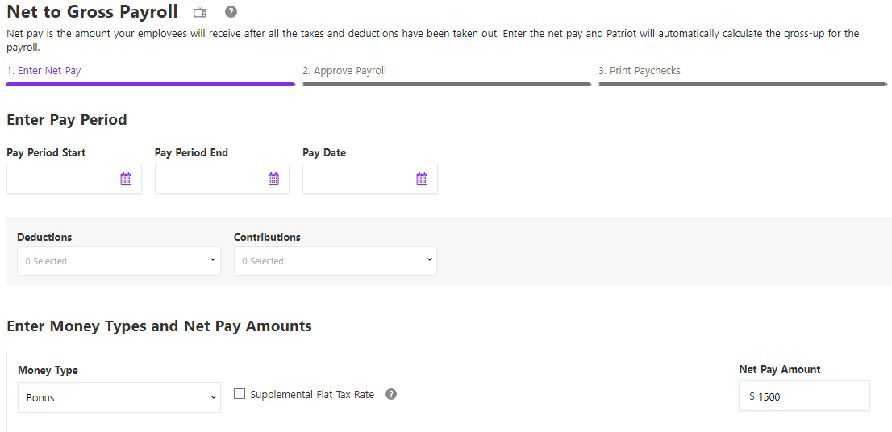

Let’s say you want to give employees a special bonus and you already have the net amount you want to pay in mind. Instead of manually calculating the gross pay, this tool will do the computation for you.

You start by entering the pay period, money type, such as bonus or commission, and the expected net pay amount directly into Patriot Payroll. Select the employees eligible to receive it and click the “Next Step” button; the system will do a reverse calculation to come up with the gross pay. If you approve the pay run, Patriot will then process the bonus or commission payout.

With Patriot’s “Net to Gross Payroll” tool, you input the net pay you want employees to receive and it will calculate the gross amount for pay processing automatically.

(Source: Patriot Software)

While this is a handy tool to have, it has some limitations. You won’t be able to do “Net to Gross Payroll” runs for:

- Savings Incentive Match Plan for Employees individual retirement account (SIMPLE IRA) contributions and deductions

- Tips owed and already paid

- Deductions with “Post-tax % Disposable Net Pay”

- “Post Tax” deductions with a method of “Percent”

- Employees who don’t reside and work in the same state

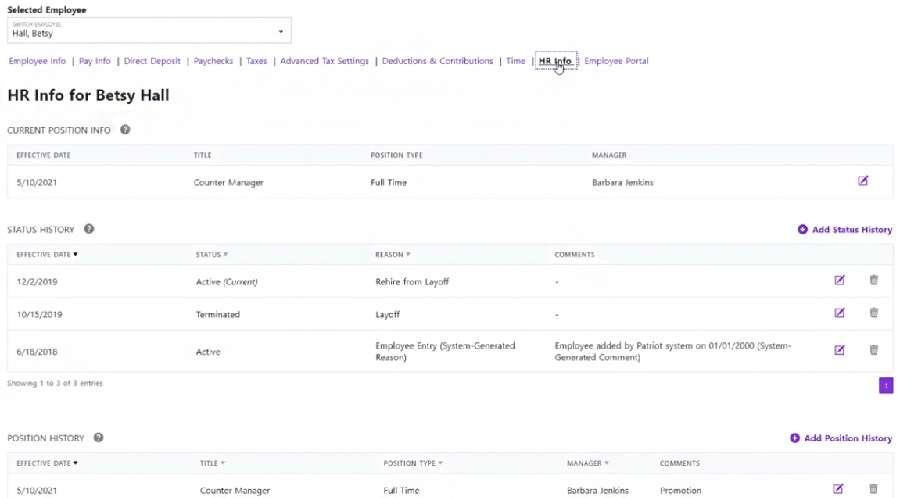

Compared to Gusto and Rippling, which both have feature-rich platforms, the HR solutions you get with Patriot Payroll are limited. It lacks HR advisory services, employee benefits plans, and state new hire reporting (it only generates the report). These factors prevented Patriot from getting a high score in this criterion.

While it offers time tracking and basic HR tools for managing employee information and documents, these modules cost extra. This is unlike similar payroll systems that provide these functionalities in this starter plan.

Patriot’s HR add-on allows you to manage and track employee data, salary history, documents, and more. (Source: Patriot Software)

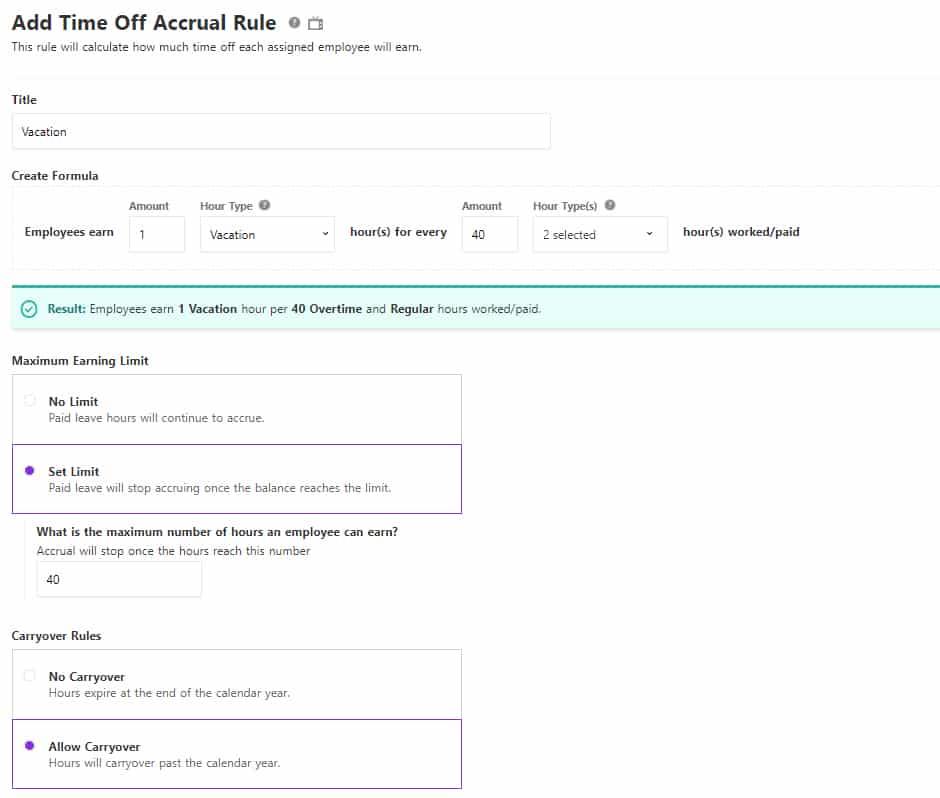

You can set up accrual rules on how many PTO hours an employee can earn based on the total number of actual hours worked. Patriot Software will then compute and add the PTO hours to each employee’s balance automatically.

Patriot Payroll lets you select earning limits and whether employees’ PTO hours will be carried over to the next calendar year. (Source: Patriot Software)

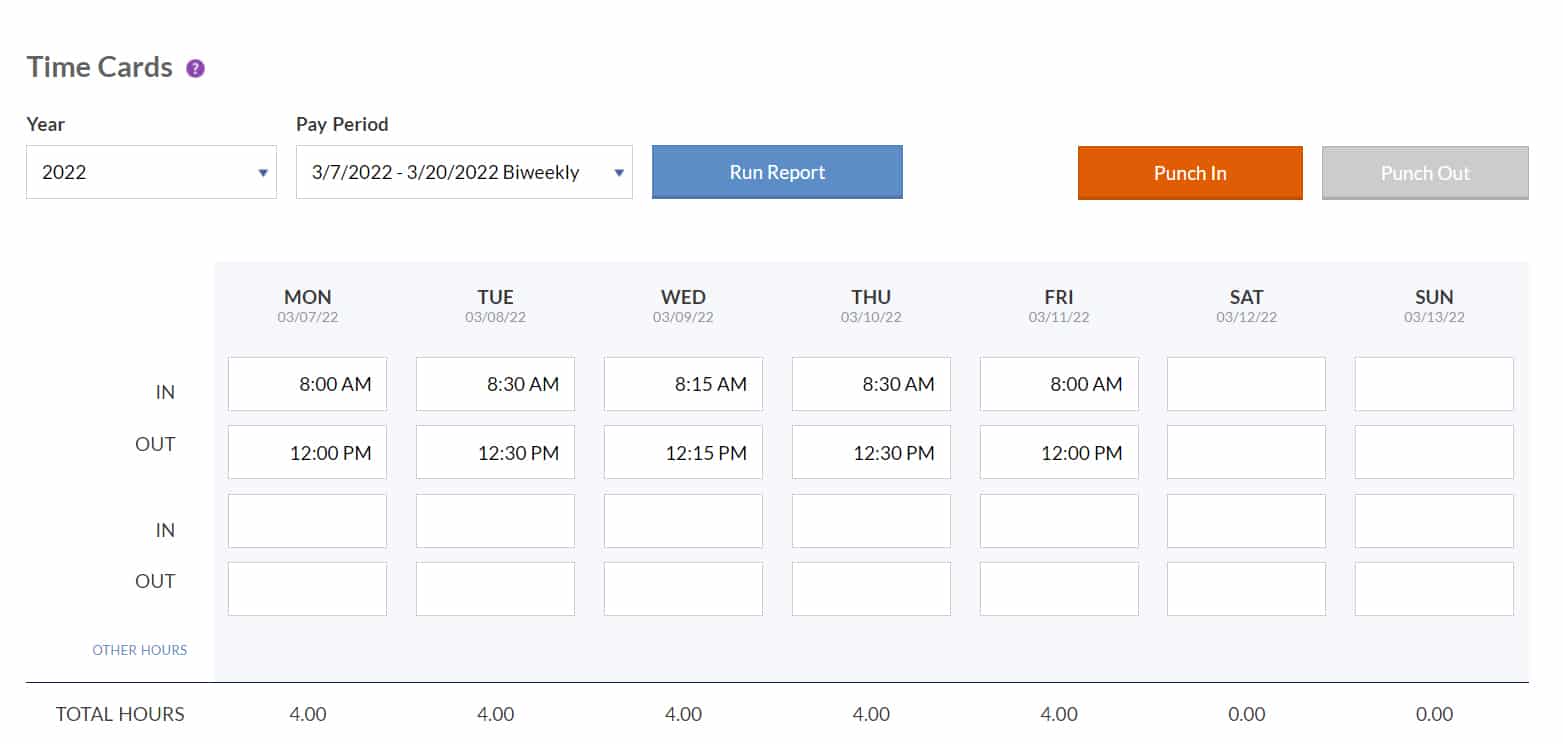

Regardless of whether you get Patriot Payroll’s basic or full-service option, you can purchase its time and attendance module for $6 plus $2 per employee monthly. In addition to viewing time sheets, this solution lets you check PTO balances and create custom overtime rules. Employees can also clock in/out via Patriot’s self-service portal, MY Portal. And given the seamless integration between Patriot products, all approved employee work hours are sent to its payroll module automatically for pay processing.

Aside from clocking in/out, employees can run reports via the Patriot Payroll online portal to view attendance data from previous pay periods. (Source: Patriot Software)

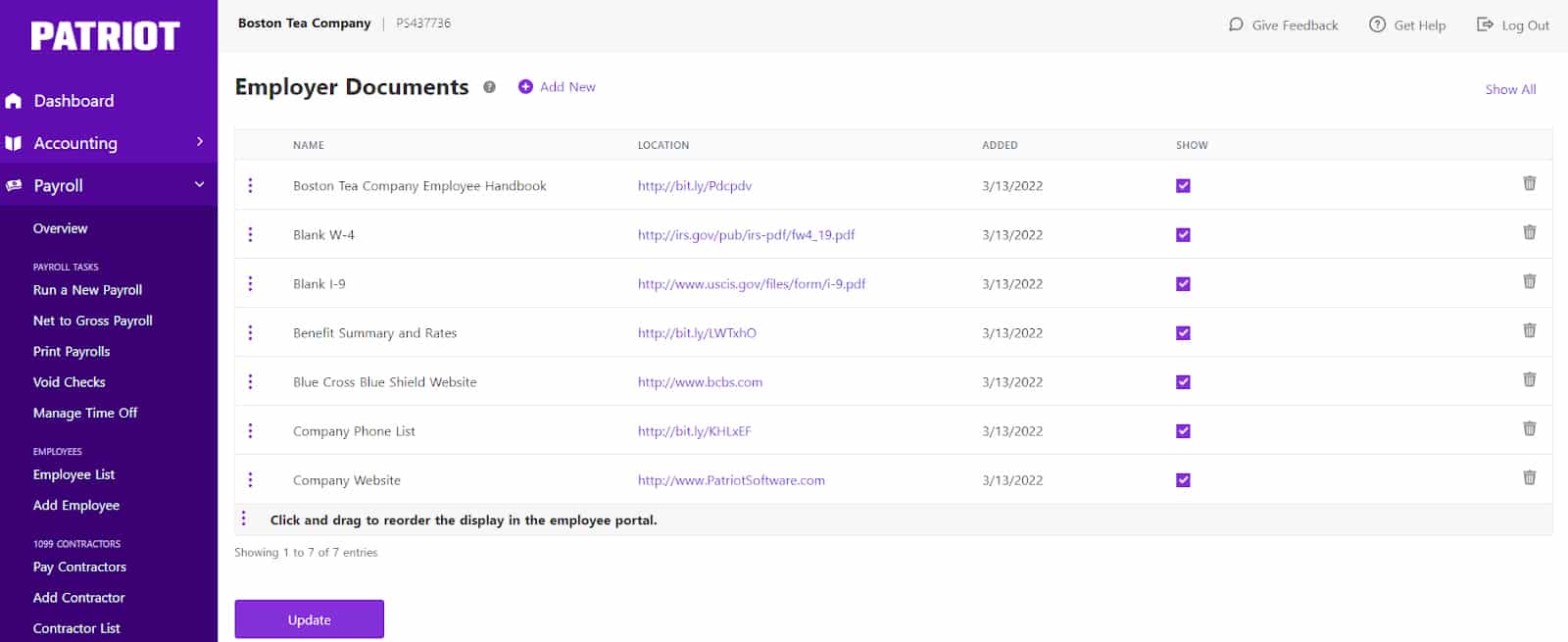

Patriot Payroll’s pricing for its HR solution is $6 plus $2 per employee monthly, and you can add this to your payroll plan or even to Patriot’s accounting module. It includes basic tools for managing employee information and storing documents, such as resumes, interview notes, performance review forms, health insurance plans, company policies, and your staff handbook. It also comes with a variety of HR reports—from retirement plan contributions and employee census to service anniversaries and state new hire reports (note that Patriot doesn’t file new hire reports for you).

Furthermore, if you designate employees as managers in the system, you can add direct reports to your people managers. Patriot will even keep a history of the movements, so you can track reporting line changes easily.

With Patriot Payroll’s HR solution, you can select the list of employer documents that will appear on the employee self-service portal. (Source: Patriot Software)

With Patriot’s online portal, MY Portal, your employees can check their payslips, view PTO balances, and access Form W-2s. If you subscribe to the provider’s time tracking add-on, then your employees can clock in/out via the online portal.

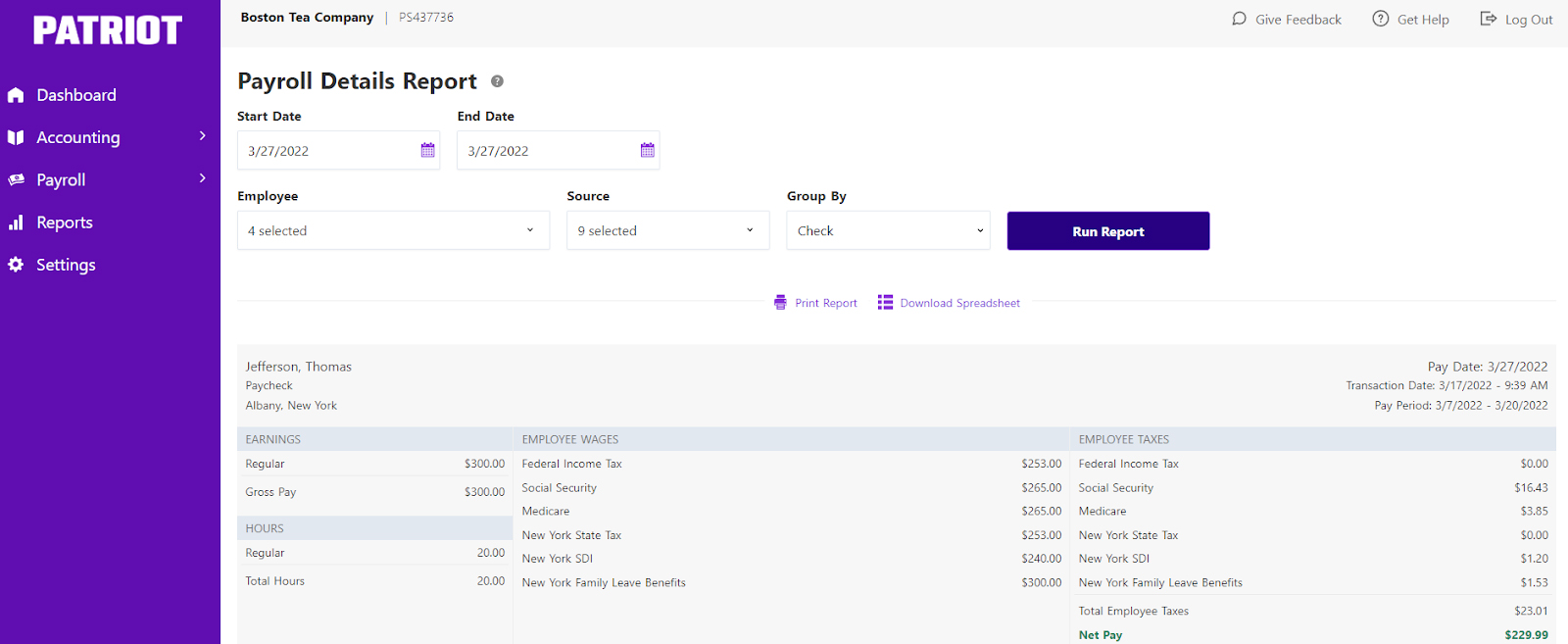

Patriot has a wide variety of reports, but some are included in its paid HR and time tracking add-ons. However, if you only need pay-related reports, its payroll module comes with standard options to help you check payroll tax computations, direct deposit payment details, employee information, and more. Here are some of its reports:

- Payroll register

- Payroll tax deposit report

- Payroll tax filing report

- Individual paycheck history

- Paycheck/deposit payment report

- PTO balances

- Assigned deductions report

- Payroll tax liabilities report

- W-2 summary report

Patriot Payroll lets you share and save reports either as PDF or CSV files. (Source: Patriot Software)

If you purchase Patriot’s HR and time tracking modules, you are granted access to reports showing your employees’ attendance, contact information, birthdates, retirement contributions, service anniversaries, and more. Accounting-related reports will also be made available to you if you get Patriot Accounting.

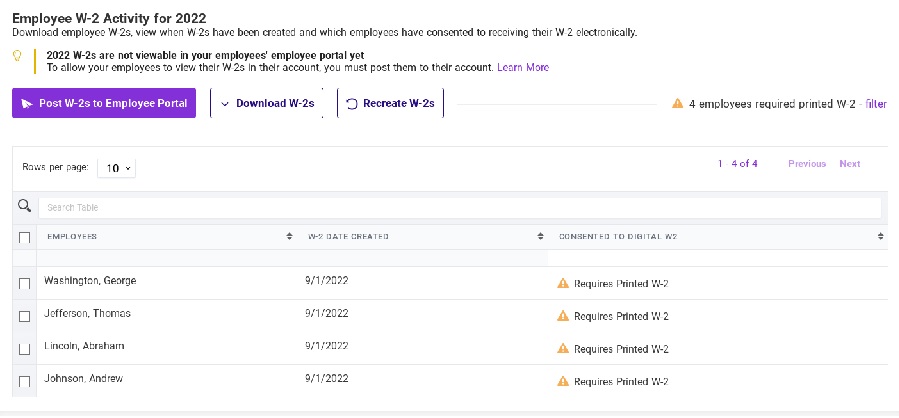

In addition, tax reports like W-2s are easy to generate via its system, allowing you to post the tax forms quickly to your employees’ online portals. Patriot Payroll will also alert you whenever corrections need to be made. This prevents tax filing errors and helps you save time from having to redo incomplete and incorrect forms.

With Patriot Payroll’s “Employee W-2 Activity” report, you can see which employees need W-2s easily and whether they require printed or digital forms. (Source: Patriot Software)

The provider didn’t get a perfect rating in this criterion because of its limited third-party integrations and customization options. However, Patriot Payroll is relatively easy to learn and use. Its online help center and FAQs also contain a wide range of how-to articles—some even come with video guides.

- Intuitive dashboard

- Mobile responsive platform

- Free and easy payroll setup

- Frequently asked questions (FAQs) and how-to guides

- Expert US-based support with extended weekday hours

Setting up its system is a breeze. Apart from an easy-to-follow DIY payroll setup wizard, Patriot’s representatives will walk new users through the setup process for free. Even if you subscribe to Patriot Payroll in the middle of the month or quarter, the provider can still help input your staff’s payroll history for you.

If you want to handle payroll setup yourself, Patriot has a setup wizard. The process isn’t difficult, plus you can opt to skip some of the steps and go back as needed. You can check out our guide on setting up and running payroll with Patriot, which includes a video walk-through.

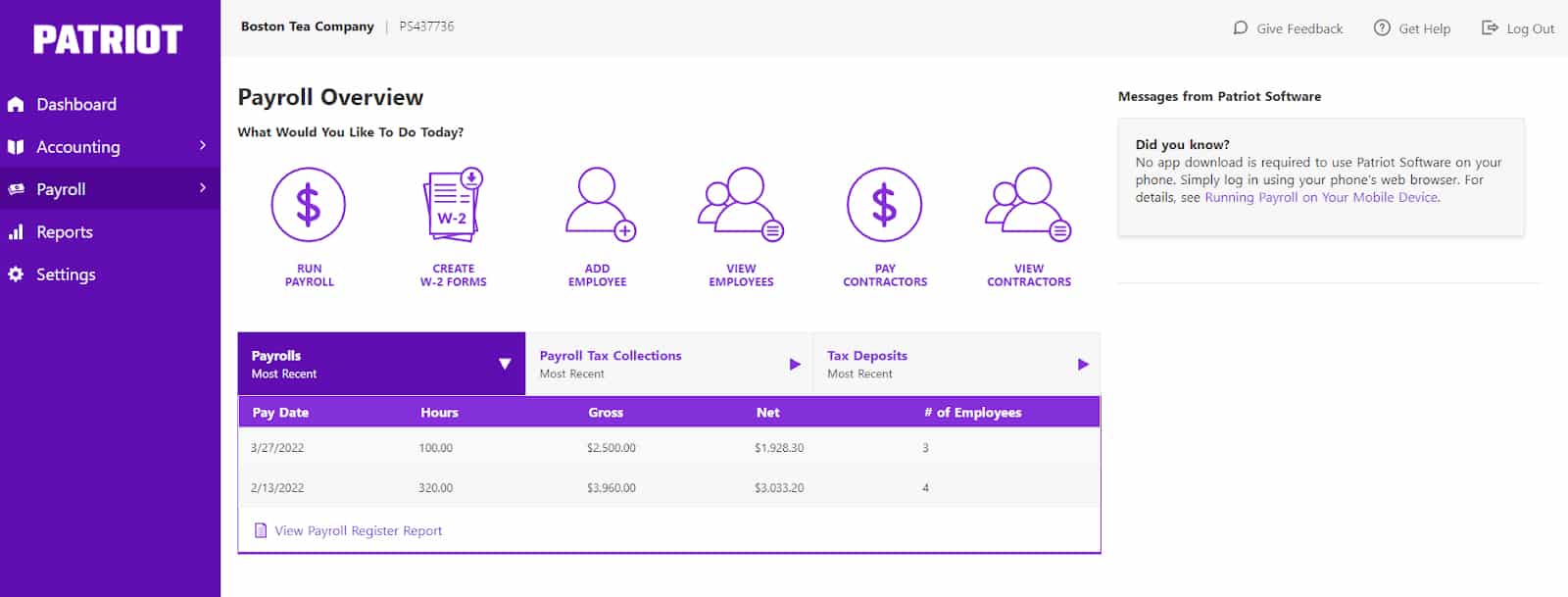

Aside from its user-friendly platform, what I also appreciate about Patriot Payroll is its mobile-friendly interface. This enables you to access the software from any tablet and smartphone device—provided an internet connection is available. Its payroll dashboard even contains helpful links for running payroll, adding new employees, creating W-2 forms, and processing contractor payments.

A screenshot of Patriot’s payroll dashboard (Source: Patriot Software)

If you need support, live expert help is available for all Patriot users at no extra cost. It has a US-based team you can contact via chat, email, and phone, from Mondays to Fridays, from 9 a.m. to 7 p.m. Eastern time.

For those who use third-party business software, note that Patriot Payroll has limited integration options. As of this writing, it integrates only with QuickBooks Time (formerly TSheets) and QuickBooks (both online and desktop versions).

Patriot Payroll is great for business owners looking for a solid payroll solution with plans and add-on modules that are reasonably priced. For $37 plus $4 per employee monthly, you can run unlimited payroll without having to worry about tax filings and payroll compliance. However, its HR functionalities are basic. You would need to invest in separate systems if you want additional features, such as job postings, applicant tracking, and staff scheduling.

| Users Like | Users Don’t Like |

|---|---|

| Affordability | Very limited integration options |

| Easy to set up and use | Lacks a mobile app |

| Helpful and knowledgeable support team | Occasional software glitches |

| Ease of running payroll and managing taxes | |

Many of the Patriot Payroll reviews online are positive. Users who left feedback on third-party review sites like G2 and Capterra highlighted its affordability, easy setup process, efficient payroll tools, and user-friendly interface as its best features. They also complemented its support team, citing the helpfulness of its customer representatives.

On the other hand, some reviewers said that while it has made payroll processing an easier task for them, they wished the provider offered more integration options and a mobile app. A few users also complained about having experienced software glitches from time to time.

At the time of publication, Patriot Payroll software reviews earned the following scores on these sites:

- Capterra: 4.8 out of 5 based on more than 3,100 reviews

- G2: 4.8 out of 5 based on 450-plus reviews

Methodology: How We Evaluated Patriot Payroll

For this Patriot payroll review article, we looked at the payroll features that the provider offers and whether it has the essential HR functionalities that SMBs need. We also considered whether it provides access to third-party integrations, employee benefits plans, and HR advisory services. In addition to ease of use and pricing transparency, we checked the feedback that users posted on popular review sites.

Click through the tabs below for our full evaluation criteria:

20% of Overall Score

We checked to see if the provider has transparent pricing, zero setup fees, and multiple plan options with unlimited pay runs. Those priced at $50 or less per employee monthly were also given extra points.

20% of Overall Score

We gave priority to those that offer multiple pay options, two-day direct deposits, tax payments and filings, year-end reporting (W-2s and 1099s), and a penalty-free tax guarantee.

20% of Overall Score

Payroll service and software should be simple to set up, customizable, and have a user-friendly interface. We also looked at whether the provider offers live support and integration options with online tools that most small and medium businesses (SMBs) use, such as accounting, time tracking, and scheduling software.

15% of Overall Score

Online onboarding, which means giving employees the option to fill out forms like W-4s electronically, is the top criterion, followed by state new hire reporting and the availability of a self-service portal where employees can view pay stubs, edit information, and access forms. Extra points were also given to providers that offer expert HR support, benefits options, time tracking, and health insurance plans that cover all US states.

15% of Overall Score

In this criterion, we assess whether the software’s ease of use, pricing, and the width and depth of its payroll and HR tools are ideal for SMBs.

5% of Overall Score

We considered user reviews, including those of our competitors based on a 5-star scale; any option with an average of 4-plus stars is ideal. Also, any software with 1,000-plus reviews on any third-party site is preferred.

5% of Overall Score

Preference was given to software with built-in basic payroll reports and customization options.

Bottom Line

Patriot Payroll is an ideal choice for small business owners looking for an inexpensive way to process employee salaries. It has a low-cost DIY option and full-service payroll packages that are reasonably priced. Plus, you get a lot of freebies that include direct deposits, payroll setup, expert support, and an online employee portal.

Sign up for Patriot Payroll’s 60-day free trial—no credit card required.