PaymentCloud is a merchant account provider specializing in medium- and high-risk vendors and industries. The platform offers both traditional and ecommerce terminals, and users report excellent customer service. Pricing isn’t available online, which is to be expected for high-risk processors. While low-risk retail and ecommerce merchants can pay as low as $10 per month, high-risk merchants should expect to pay an average of $25–$45 monthly. There are no application or setup fees when signing up for an account.

In our review of merchant services, PaymentCloud earned an overall score of 3.78 out of 5. It offers fast and easy applications and approvals, affordable rates, and options for in-person and online transactions.

Pros

- Same-day setup upon approval

- Brick-and-mortar and ecommerce terminals available

- Customized high-risk payment gateway

Cons

- No publicly disclosed pricing

- Lengthy and comprehensive application process

- Difficult website navigation

When to Use PaymentCloud:

- If you have a high-risk business

- For retail credit card processing (PaymentCloud got a special mention)

- For merchants needing hands-on help

When to Use an Alternative

- For a low-risk ecommerce business, try our other merchant services

- If you want zero monthly fees, get a free merchant account

- For all-in-one payment processing solutions, try Square or Helcim, which offer free POS software in addition to other business tools

PaymentCloud is our best overall high-risk merchant account provider. It offers a full EMV credit card terminal, point-of-sale (POS) system, and mobile card reader. Hundreds of integrations are also available for in-person sales and online and mobile payments.

Its pricing is not readily available on the website, but sales agents can provide pricing quotes quickly. Customer support is also more personal, offering hands-on help from the initial application through setup and migration from existing platforms and ongoing assistance after you’re up and running.

Despite PaymentCloud’s various tools for retail processing, low-risk ecommerce businesses and businesses seeking an all-inclusive payment processing solution may find other options, such as Payment Depot or Helcim, more suited for their ecommerce needs. Aside from both providers not requiring a contract, Payment Depot does not charge any percentage markup, and Helcim offers free POS, customer relationship management (CRM), invoicing, and online store software.

PaymentCloud Deciding Factors

Supported Business Types | Flexible Medium- and high-risk businesses, subscription, professional services, retail, B2B |

Standout Features |

|

Monthly Software Fees |

|

Setup and Installation Fees | No application fees, setup fees, or annual fees |

Contract Length | Month-to-month |

Payment Processing Options | In-person, online, mobile, ACH and eCheck, ecommerce platforms, POS system, virtual terminals |

Payment Processing Fees |

|

Customer Support |

|

PaymentCloud Alternatives

| ||||

|---|---|---|---|---|

Best for | Low-risk Businesses processing $10,000-$20,000 monthly | High-risk online sellers | Individuals and new businesses | High-risk businesses looking for direct integrations |

Monthly fee | $79 | Low risk: $10–$15 Medium/high risk: custom | $0–$60 | $19–$45 |

Transaction Rates | Interchange + 8–18 cents | Interchange + 0.25%–2% | 2.5% + 10 cents–3.5% + 15 cents | From 2.49% |

Payment Gateway fee | $0 | $10–$15/month + 10 cents/transaction | $0 | $15/month + 25 cents/transaction |

Chargeback fee | $25 | $25–$30 | Waived to $250 | $25–$30 |

Looking for the lowest rates?

The payment processing rates you will pay can vary based on your business’s size, type, and average order value. To find the most affordable option and compare multiple processing rates, read our guide on the cheapest credit card processing.

PaymentCloud doesn’t advertise pricing online, which is typical for high-risk processors. To get estimated pricing for your small business, you’ll need to submit a free online application and review it with a specialist. All other fees associated with their services are only available when you ask for a quote.

Though PaymentCloud’s application process can be tedious, it is especially helpful for the medium- and high-risk businesses it caters to—as rates are more likely to vary between industries and clients.

To get more insight into their pricing method, we got in touch with PaymentCloud. It confirmed that it can adjust the pricing model based on client preference so you can negotiate rates and compare different processing options to find the most affordable.

Typical Fees for Merchants

Monthly fee* | $10–$45 |

Low-risk transaction fee | 2%–3.1% |

Ave. mid-risk transaction fee | 2.3%–3.4% |

Ave. high-risk transaction fee | 2.7%–4.3% |

Payment gateway fee | $15/month |

Virtual terminal fee | $15-$45 |

Chargeback fee | $25 |

Ave. rolling reserve | 0%–10% |

Early termination fee | Waived |

*Pricing is based on average mid-risk and high-risk merchant services.

As far as payment processing hardware goes, PaymentCloud has options for POS systems and full EMV credit card terminals that work well for physical retail stores. You can also use a mobile card reader in-store or on location at events, markets, and fairs, for example.

PaymentCloud’s team will also reprogram any existing POS system if you’re migrating over. It also works with other payment processing tools:

- Ingenico

- Verifone

- Pax

- Poynt

- Magtek

- Dejavoo

- First Data

- Clover

PaymentCloud offers month-to-month contracts for low-risk merchants, but by default, long-term contracts are provided when doing business with merchants with significant risk. Expect a minimum two-year contract if your business is classified as high-risk, usually when considerable underwriting risk and due diligence are involved. You can ask for a free quote and comparison before signing up for an account.

The pricing method is flexible, so you can request the model you are already familiar with (and most likely previously worked with), and PaymentCloud will provide you with a customized plan. There are no application or setup fees associated with a PaymentCloud merchant account. Early termination fees are also often waived. However, it does assign a rolling reserve requirement on a case-to-case basis at an average of 10%.

Most payment methods can be accommodated with PaymentCloud. In-person and online payments are possible with the availability of various readers and integrations. Customers can pay using any major card, ACH, eCheck, NFC devices (such as Apple Pay and Google Pay), QR codes, and even cryptocurrencies.

PaymentCloud integrates with all payment gateway platforms so merchants can continue using their providers without interruption. Aside from being able to set up advanced fraud/filtering and velocity filters, PaymentCloud, as a gateway-agnostic platform, can assist businesses with migrating to a more compatible payment gateway like Stripe or Authorize.net.

PaymentCloud offers options for POS systems and terminals to swipe, insert, and tap cards. While card readers and terminals are available for purchase from PaymentCloud, merchants who already have their own devices may have theirs reprogrammed by PaymentCloud to work with its system.

You can accept contactless payments via NFC devices like Apple Pay and Google Pay. In addition, the PaymentCloud-owned Paysley makes it possible to accept payments via text messages and QR codes.

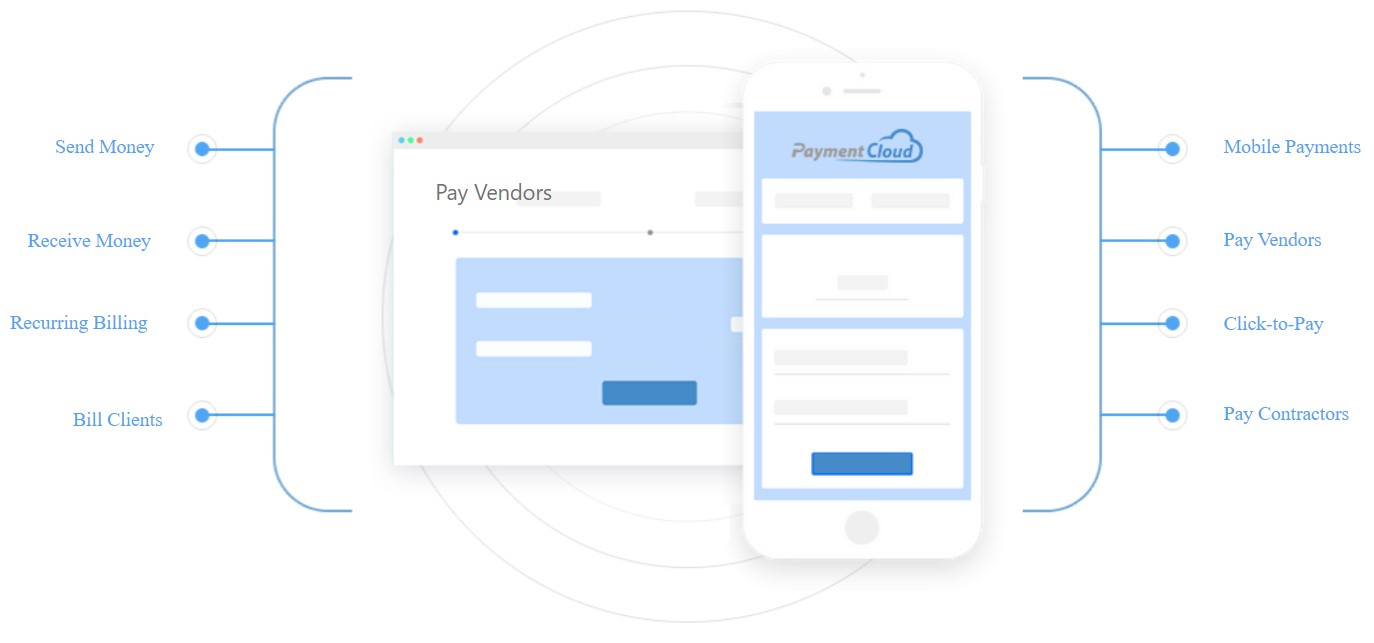

PaymentCloud can process payments using readers and NFC devices. (Source: PaymentCloud)

PaymentCloud makes it easy to set up your business to accept payments online. It can be integrated with many popular ecommerce platforms such as BigCommerce, Shopify, WooCommerce, WordPress, and Shift4Shop.

Aside from adding a shopping cart or buy button to your website, you may send customized payment pages or links to your customers. Virtual terminals for accepting payments by typing in the card information are also available.

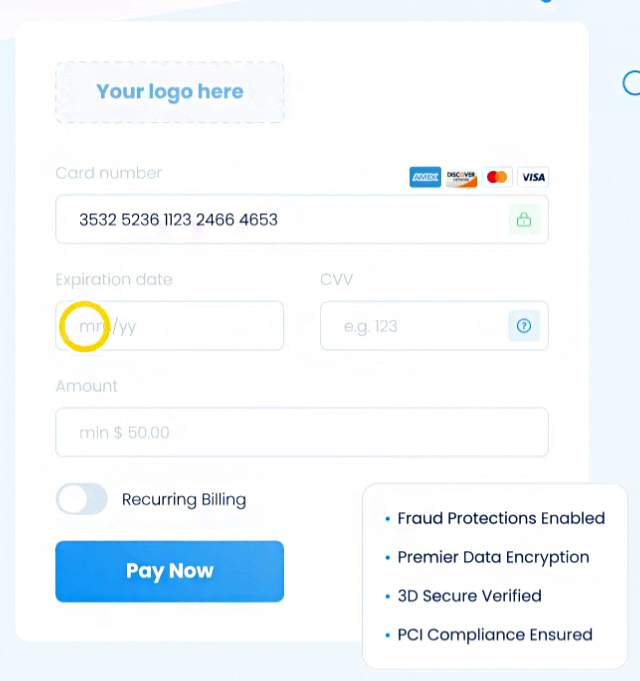

PaymentCloud’s virtual terminal makes it easy to accept payments online. (Source: PaymentCloud)

PaymentCloud also makes it possible for businesses to accept payments by ACH transactions and eCheck. Its ACH and eCheck payment solutions allow invoicing, recurring billing, and subscriptions.

PaymentCloud supports easy ACH and eCheck payment processing. (Source: PaymentCloud)

With PaymentCloud, you can easily add a bitcoin checkout option on your payment page. This option requires setting up a bitcoin merchant account, which is all handled by PaymentCloud.

Cryptocurrency transaction fees are different from regular payment processing fees. Like with PaymentCloud’s other fees, price quotes are available upon request.

PaymentCloud offers cryptocurrency payment processing. (Source: PaymentCloud)

PaymentCloud is a reliable and reputable merchant service provider for merchants that find it hard to sign up with payment processors. Account approval can take some time, especially if the nature of the business requires considerable checking and underwriting.

Once approved, PaymentCloud is widely acknowledged for its ease of use by users and industry experts. The hands-on customer support team will help you get up and running, and the interface is intuitive enough even for people who aren’t technically savvy.

PaymentCloud stands out because it specializes in medium- and high-risk industries that other payment processors are less likely to service. It has one of the most extensive lists of approved high-risk industries, citing a 98% approval rating with its 10+ banking partners. It works with tobacco, e-cigarettes, topical CBD, electronics, dropshipping, bail bonds, firearms, and more.

PaymentCloud works with the following industries classified as high-risk. (Source: PaymentCloud)

Chargeback protection is especially important for high-risk businesses, so PaymentCloud offers robust dispute resolution support. It partners with Chargeback Gurus to detect, track, and resolve disputes on behalf of merchants.

PaymentCloud partners with Chargeback Gurus to get instant dispute alerts and tracking, plus dispute cause analyzer and prevention analysis tools. (Source: PaymentCloud)

PaymentCloud is PCI-compliant and uses industry-standard Address Verification System (AVS) technology, tokenization, P2PE data encryption, and 3D Secure technology to validate cardholders at the point of purchase. It also implements temporary payment halts to pause suspicious transactions pending verification. This feature is easy to integrate and comes with no additional application or fees required.

PaymentCloud supports a number of fraud detection tools to help fight suspicious transactions. (Source: PaymentCloud)

PaymentCloud offers next-day funding to all of its merchant account holders. Though no additional fees were mentioned for this service, it’s still important to confirm this with PaymentCloud’s executive helping you set up your account.

PaymentCloud customer support is available via phone or email from 7 a.m.–6 p.m. Pacific time, Monday through Friday. Some customers dislike the fact that support isn’t available 24/7. When you can’t get in touch with a customer service agent, you can check out its online support center with an FAQ section and find links to various support departments’ email addresses.

Overall, getting in touch with PaymentCloud support is a bit difficult, but they’re extremely helpful once you do.

We gave PaymentCloud perfect scores for its popularity and the wide and easy integrations it offers. It also has a good reputation among high-risk merchants. Its ability to accept almost any payment type was another consideration that brought up its score.

Pricing and ease of use slightly pulled down our marks for PaymentCloud. Its rates and fees are not publicly available, and you will need to contact the sales team for a quote. Although many users find it easy to use, it would be beneficial, especially for new merchants, if PaymentCloud offered its own hardware options, such as readers and POS systems.

What Users Say in PaymentCloud Reviews

Most PaymentCloud users enjoy using the platform. Many reviews praise its customer support and its ease of using PaymentCloud. However, there are also some comments about how long the application takes to process, though this is common and often expected in high-risk businesses.

- Capterra: Around 20 users rated PaymentCloud with an overall average 4.6 out of 5 stars, mainly receiving commendation for its customer service experience.

- Trustpilot: Reviews on Trustpilot have improved since our last update, with PaymentCloud receiving a 4.5-star rating from over 300 users. As with Capterra, users raved about customer service, but some noted issues with rate transparency and application processing.

We noticed the following trends when reading through PaymentCloud reviews:

| Users Like | Users Don’t Like |

|---|---|

| Responsive and helpful customer service | Lengthy application process |

| Efficient and user-friendly system | Rate and fee transparency |

Methodology: How We Evaluated PaymentCloud

We test each merchant account service provider ourselves to ensure an extensive review of the products. We then compare pricing methods and identify providers that offer zero monthly fees, pay-as-you-go terms, and low transaction rates. Finally, we evaluate each according to a range of payment processing features, scalability, and ease of use.

The result is our list of the best overall merchant services. However, we adjust the criteria when looking at specific use cases, such as for different business types and merchant categories. This is why every merchant services provider has multiple scores across our site, depending on the use case you are looking for.

Click through the tabs below for our overall merchant services evaluation criteria:

20% of Overall Score

We awarded points to merchant account providers that don’t require contracts and offer month-to-month or pay-as-you-go billing. Additionally, we prioritized providers that don’t charge hefty monthly fees, cancellation fees, or chargeback fees and only included providers that offer competitive and predictable flat-rate or interchange-plus pricing. We also awarded points to processors that offer volume discounts and extra points if those discounts are transparent or automated.

PaymentCloud received average scores for this criteria, mostly because of the lack of transparency regarding its rates and pricing.

30% of Overall Score

The best merchant accounts can accept various payment types—including POS and card-present transactions, mobile payments, contactless payments, ecommerce transactions, and ACH and eCheck payments—and offer free virtual terminal and invoicing solutions for phone orders, recurring billing, and card-on-file payments.

We gave PaymentCloud perfect scores for this criteria except for the stored-payments sub-criteria, which is not possible with their system. Besides this, PaymentCloud can handle all payment types, including cryptocurrency payments.

25% of Overall Score

We prioritized merchant accounts with free 24/7 phone and email support. Small businesses also need fast deposits, so payment processors offering free same- or next-day funding earned bonus points. Finally, we considered whether each system has affordable and flexible hardware options and offers any business management tools, like dispute and chargeback management, reporting, or customer management.

PaymentCloud received an average score for this criteria. Although general support is not readily available, clients seem satisfied with the personal customer support provided by their individual agents.

25% of Overall Score

We judged each system based on its overall pricing and advertising transparency, ease of use (including account stability), popularity, and reputation among business owners and sites like Better Business Bureau. Finally, we considered how well each system works with other popular small business software, like accounting, point-of-sale, and ecommerce solutions.

We gave PaymentCloud perfect scores for its popularity among high-risk merchants and the wide integrations it offers. It received near-perfect scores for ease of use and pricing. Many users find the system easy to use with adequate customer support.

PaymentCloud Frequently Asked Questions (FAQs)

PaymentCloud is a merchant services provider that offers support for high-risk businesses. It is our top pick for high-risk merchant services providers with its wide range of payment solutions and hands-on customer support.

PaymentCloud offers payment gateway services through easy integration with popular payment gateways such as Stripe or Authorize.net.

PaymentCloud is a legitimate merchant services provider. It is PCI compliant and uses industry-standard Address Verification System (AVS) technology, tokenization, P2PE data encryption, and 3D Secure technology.

Bottom Line

Overall, PaymentCloud is one of the best high-risk merchant accounts for small businesses. The processor offers helpful customer support and protection against fraud and chargebacks. Plus, it offers plenty of hardware and solutions for online, storefront, and mobile sellers.