PayPal is one of the most popular financial technology companies that lets users send and receive money. Businesses use PayPal to accept payments, create and send invoices, process payments on their website, and as a point-of-sale (POS) solution.

We’ve put together 20 PayPal statistics to help you better understand how it is used by individuals and other businesses.

Key takeaways:

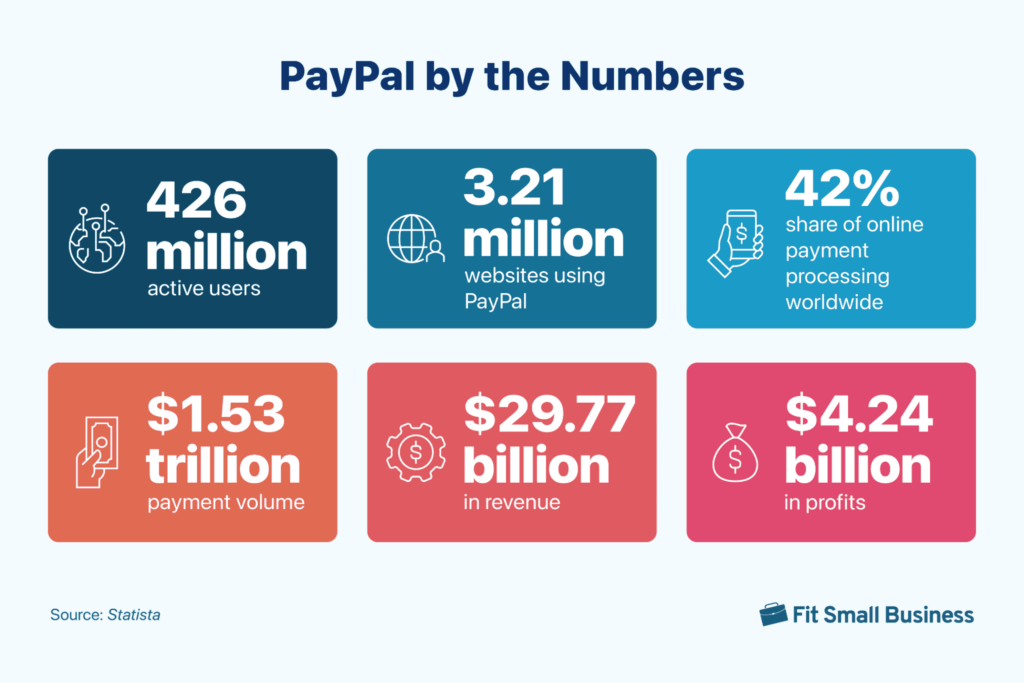

- PayPal maintains a massive base of 426 million active users around the world and has a transaction volume of $1.53 trillion.

- Consumers place a high level of trust in PayPal—it is the leading payment processing provider in the world.

- PayPal continues to diversify and grow by expanding its services into other products such as its “Pay in 4” buy now, pay later (BNPL) option.

PayPal Overview

1. PayPal has 426 million active users

Around 426 million PayPal accounts were active at the end of 2023. While this is a slight decrease of 2.1% from 435 million active users at the end of 2022, PayPal’s wide user base presents a huge opportunity for business owners to tap into a large and diverse customer pool.

2. There are 3.21 million websites in 165 countries that accept PayPal for online payments

As of February 2024, 3.21 million websites in 165 countries accept PayPal for online payments, with 32.82%, or 1.06 million, of these websites being merchants in the US alone. This widespread acceptance of PayPal highlights its accessibility and versatility as an online payment method. Integrating this payment option can broaden your business’s reach in both domestic and international markets.

Related: PayPal Business Review: Is It Right for You?

3. PayPal is the leading provider of online payment processing technology in the world

As of February 2024, PayPal has 45% of the market share of digital payment providers worldwide, followed by Stripe with 21%. PayPal’s dominant position among digital payment providers signals its unparalleled reach and influence in the industry. Partnering with PayPal can offer businesses access to a vast network of potential customers and provide a trusted and seamless payment experience, ultimately enhancing customer satisfaction and driving revenue growth.

4. PayPal processed a total of $1.53 trillion in payments in 2023

A total of $1.53 trillion in payment volume was processed by PayPal in 2023, rising 12.5% from $1.36 trillion in payment volume in 2022. The substantial increase from the previous year indicates a growing reliance on PayPal by both consumers and businesses, emphasizing the platform’s reliability and potential for facilitating secure and seamless transactions.

5. Around $29.77 billion in revenue and $4.24 billion in profits were reported by PayPal for 2023

In 2023, PayPal generated an 8.18% increase in revenue from $27.52 billion in 2022 to $29.77 billion in 2023, and an increase of 75.21% increase in profits from $2.42 billion in 2022 to $4.24 billion in 2023. PayPal’s substantial revenue and profit figures for 2023 reflect its continued financial strength and growth trajectory.

6. PayPal’s global average transaction fee is 1.95%

Based on PayPal’s 2023 total payment volume of $1.53 trillion and revenue of $29.77 billion, its global average transaction fee is 1.95%.

7. PayPal is expected to have an average revenue growth of 11.1% over the next 5 years

Projections for PayPal’s revenue growth forecast over the next five years are expected to average 11.1%. For businesses considering PayPal as its payment processing solution, this projected average revenue growth indicates reliability and potential to benefit from PayPal’s expansion of services.

8. PayPal has collected over $20 billion in donations

According to a PayPal report, PayPal enabled more than 270 million donations in 2022, which brought the total funds donated through PayPal to more than $20 billion and helped to support 1.4 million nonprofits and other causes.

PayPal Business Statistics

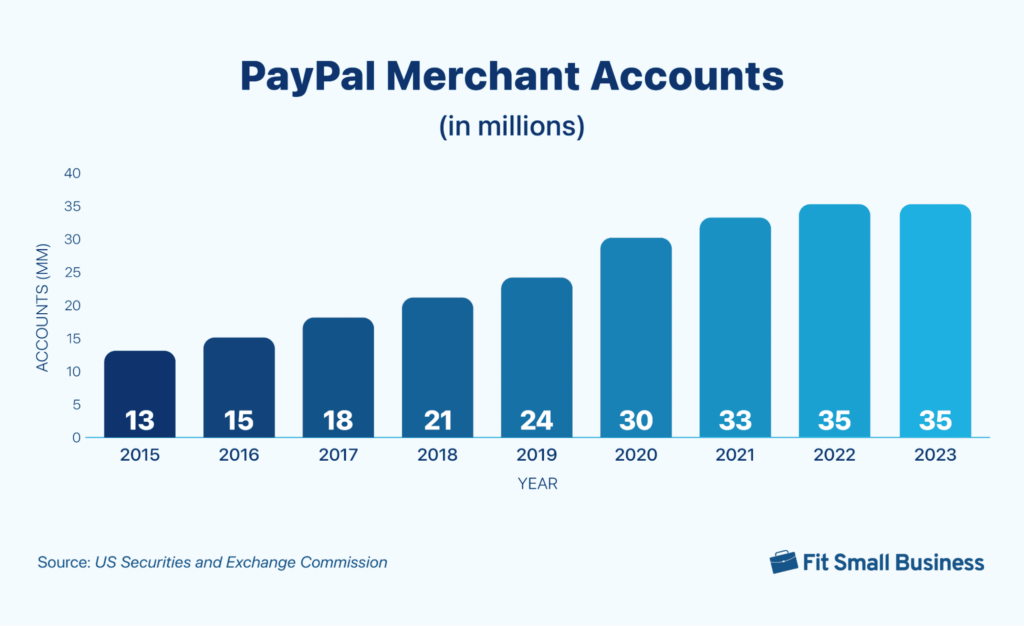

9. There were 35 million merchant accounts on PayPal in 2023

Merchant accounts on PayPal have been on a growth trajectory in the last decade. Compared to 13 million in 2015, there were 35 million merchant accounts on PayPal in 2023. This shows the platform’s widespread adoption among businesses.

Related: PayPal Business Review: Is It Right for You?

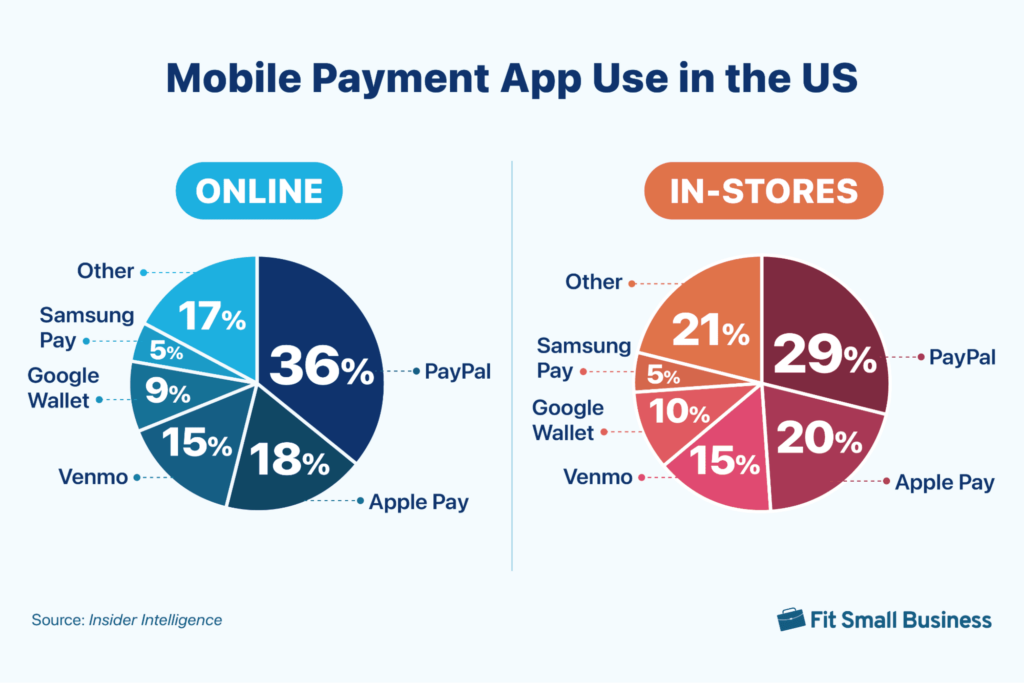

10. PayPal is the most used mobile payment app/wallet in the US

In a July 2023 survey, 36% of respondents said that PayPal is their most used mobile payment app for online purchases, followed by Apple Pay with 18%. PayPal is also the most used mobile payment app for in-store purchases with 29%.

Related: What Are Mobile Payments & How They Work for Small Business

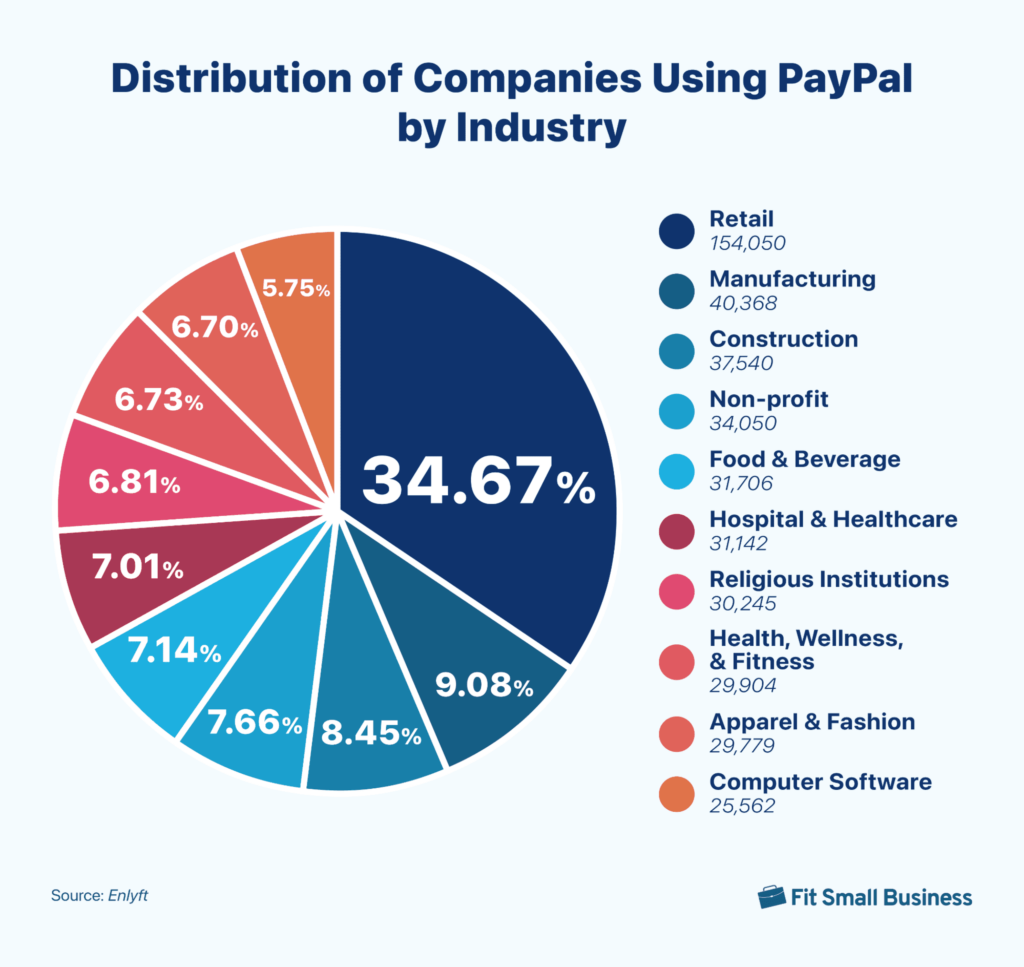

11. PayPal is most used in the retail industry

According to a report on the top industries that use PayPal, the largest segment that uses PayPal is the retail industry with 34.67%.

12. PayPal is most popular among small businesses with less than 10 employees

According to a report, 68.39% are small businesses with 10 or less employees. 20.89% are companies with 10 to 50 employees, 8.39% have 50 to 200 employees, and 2.33% have more than 200 employees.

13. PayPal is the most commonly used cross-border payment method in the US

In a 2022 survey, 35% of online cross-border shoppers used PayPal as their payment method for online purchases abroad. Online platforms like PayPal often offer competitive exchange rates and lower fees. This is followed by debit cards with 32%.

Related: Cross-Border Payments: Small Business Guide

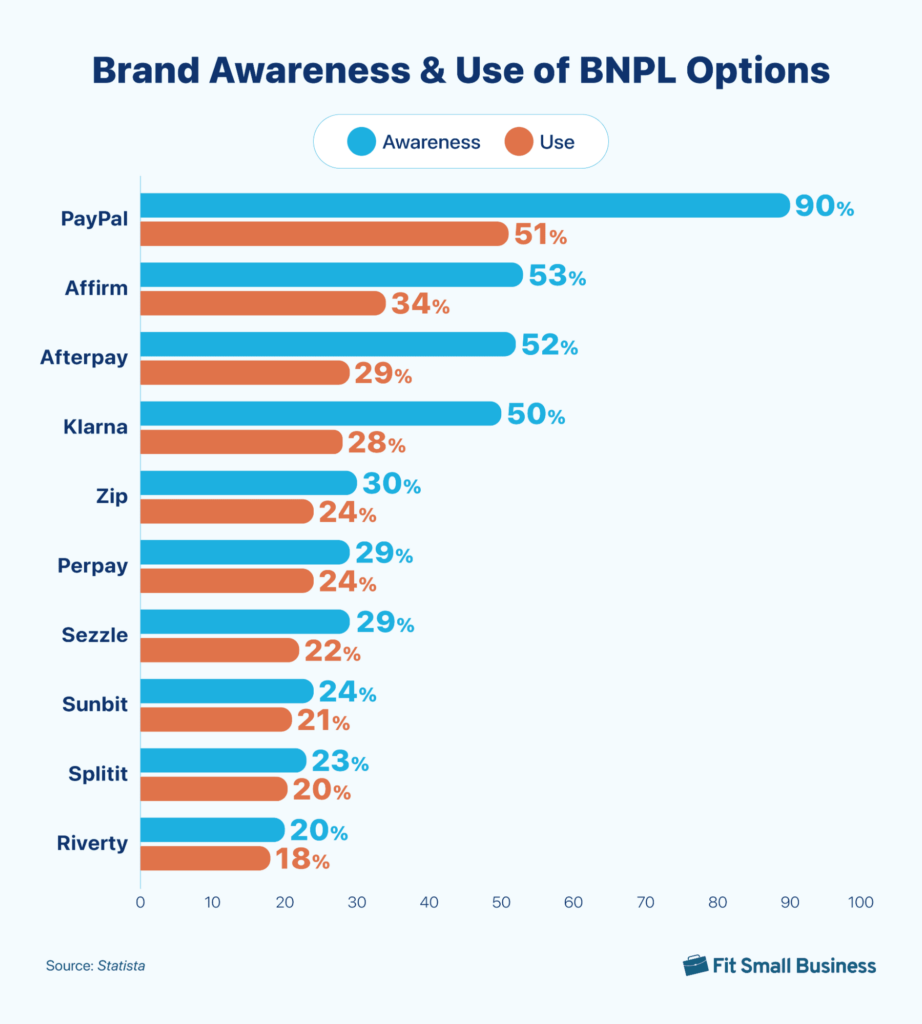

14. PayPal’s “Pay in 4” is the most recognized and used Buy Now, Pay Later (BNPL) option in the US

In a November 2023 survey of US BNPL users, an overwhelming 90% said they know and are aware of PayPal, while 53% responded with a yes for Affirm. PayPal, with its interest-free “Pay in 4” option, is also the most used platform—68% of respondents said they had used it for BNPL in the last 12 months. In terms of using BNPL services, 51% have used PayPal’s interest-free “Pay in 4” option, followed by Afterpay with 34%.

Related:

PayPal Customer Experience Statistics

15. A typical PayPal user increased their use of PayPal by around 14% from 2022 to 2023

The number of transactions per active PayPal account grew from 51.4 in 2022 to 58.7 in 2023, an increase of around 14%. This highlights the growing reliance of many consumers on PayPal for transactions. This trend suggests that integrating PayPal as a payment option could enhance customer engagement and potentially drive higher sales volumes for businesses.

16. Consumers trust PayPal and other fintechs more than their banks for storing payment information

According to a PYMTS study, consumers’ trust in their banks as a vault service provider has decreased from 58.5% to 57.0% from September 2022 to November 2022, while it increased for PayPal from 40.2% to 44.0%. In addition, among consumers who are very interested in using vault services, 60.3% say they will trust PayPal to provide vault services, closely followed by 59.6% of consumers who trust their banks as a vault service provider.

17. Customers are 25% more likely to buy if they can pay using PayPal

According to Nielsen research, offering PayPal as a payment option may increase the likelihood of a purchase because customers are 25% more likely to buy when paying with PayPal compared to other payment methods. This emphasizes the importance of businesses offering diverse payment methods. Integrating PayPal does not require any upfront costs while potentially improving conversion rates and customer satisfaction.

Related: Is PayPal Good for Small Businesses? Pros & Cons

18. Customers are 28% more likely to have a positive purchase experience when paying with PayPal

There are higher chances of having return customers when they pay with PayPal because they are 28% more likely to have a positive purchase experience. This underscores the importance of offering PayPal as a payment option. Providing a seamless and secure payment experience through PayPal can foster customer satisfaction and loyalty, potentially increasing repeat business and overall revenue for businesses.

19. PayPal is a popular payment method among customers both online and in-store

In a Q3 2023 survey, 79% of respondents claimed to have used PayPal to pay for online purchases while 58% said they used it to pay for in-person purchases through a point-of-sale (POS) system.

20. PayPal is widely used by millennials and Gen-Xers in the US

In the US, around 81% of millennials (around 27 to 43 years old) and 79% of Gen-Xers (around 44 to 59 years old) use PayPal.

Generation | Percentage That Use PayPal |

|---|---|

Gen-Z (12 to 27 years old) | 65% |

Millennial (27 to 43 years old) | 81% |

Gen-X (44 to 59 years old) | 79% |

Baby Boomers (60 to 78 years old) | 68% |

PayPal and Fraud

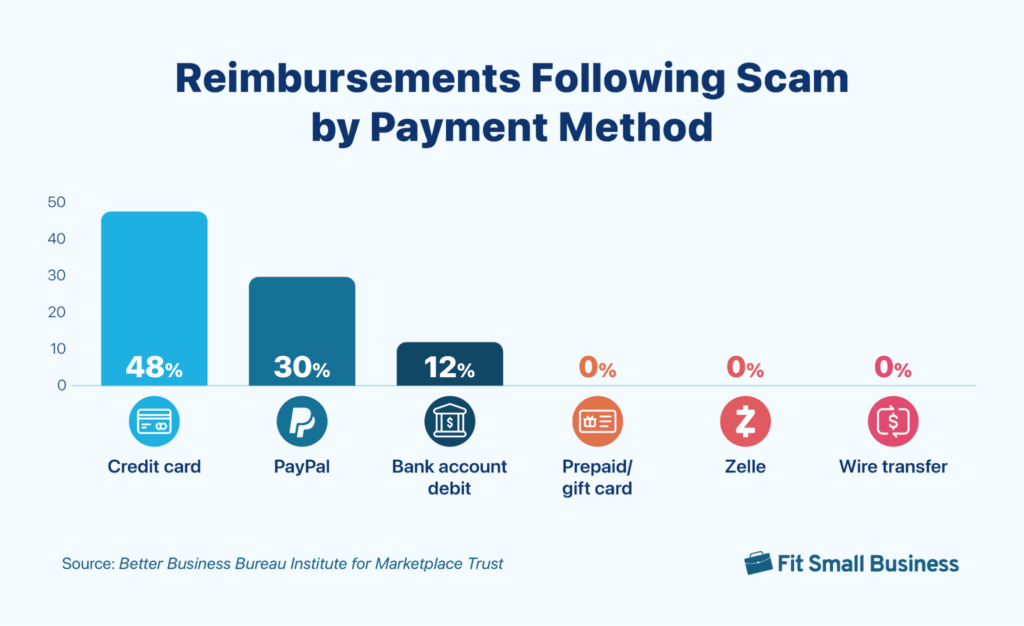

21. Online scams have increased by 87% and 30% of PayPal users who experience online scams get their money back

The recent rise in fraud underscores the importance of robust fraud protection measures. Among those who experienced online scams, 48% who used credit cards were able to receive reimbursements while 30% of those who used PayPal were also able to get their money back. This highlights PayPal’s commitment to safeguarding its users’ transactions, potentially boosting confidence among businesses and consumers in utilizing PayPal as a secure payment platform.

22. PayPal’s annual transaction loss rate for 2023 was 0.09%

As payment fraud continues to rise, PayPal’s fraud risk management capabilities evolve to protect consumers. PayPal’s buyer and seller protection programs helped maintain their low transaction loss rate of 0.09% for 2023.

Year | Annual Transaction Loss Rate |

|---|---|

2020 | 0.12% |

2021 | 0.09% |

2022 | 0.09% |

Related:

Bottom Line

PayPal has established a solid foothold in the field of digital payment processing. Through its extensive user base, impressive transaction volume, and dominant market share, PayPal has solidified its position as a trusted leader in the financial technology industry. It continues to innovate and expand to meet evolving consumer and business needs. With its consistent and steady growth over the years, PayPal is poised to continue to remain a pivotal player in the digital payment landscape.