PayPal Business offers a simple in-person and online payment processing solution. Its features include invoicing, mobile payments, recurring payments, more than 20 currencies, chargeback and seller protection, and an embeddable “buy now” button. In our review of the best merchant services providers, PayPal earned an overall score of 3.86 out of 5 and came out as the best processor for occasional and online sales.

Although signing up for PayPal is free, with no hidden fees, its pricing and fees for other services can be confusing, and users have complained of unpredictable freezing of funds. Our PayPal Business review finds that it is a cost-effective solution best suited for occasional sellers and businesses that process less than $5,000 in monthly sales or those wanting to increase online conversions.

PayPal Business at a Glance

Pros

- Seamless online checkout integration

- Known and trusted platform by consumers

- Instant deposits into your PayPal account

Cons

- Unpredictable freezing of funds

- Confusing pricing

- Few POS features and benefits

When to Use PayPal

- For a quick and easy way to accept payments online

- For international payment processing

- For nonprofit payment processing

When to Use an Alternative

- If you have an existing merchant account and only need a standalone payment gateway

- If you need a virtual terminal without extra fees

- If you are a high-risk merchant

- For retail shops processing more than $5,000 in-person sales

Supported Business Types | Flexible Ecommerce, professional services, B2Bs, retail, nonprofit |

Standout Features |

|

Monthly Software Fees | Very Competitive $0 to $30 |

Setup and Installation Fees | $0 |

Contract Length | Month-to-month |

Point-of-Sale Options | PayPal Zettle |

Payment Processing Fees | Very competitive for small businesses

|

Customer Support |

|

| ||||

|---|---|---|---|---|

Best for | Occasional sales | Online payments | Processing less than $10,000 monthly transactions | Low-cost payment processing |

Monthly fee starting at | $0 | $0 | $0 | $0 |

Card-present transaction fee | Starts at 2.29% + 9 cents | 2.7% plus 5 cents | 2.6% + 10 cents | Interchange plus 0.1% to 0.3% + 5 to 8 cents |

Ecommerce transaction fee | Starts at 2.59% + 49 cents | 2.9% plus 30 cents | 2.9% + 30 cents | Interchange plus 0.2% to 0.5% + 10 to 25 cents |

Looking for an in-depth comparison of PayPal with other alternatives? Here are some of our articles:

- PayPal vs Authorize.net

- Stripe vs PayPal

- Square vs PayPal

- Stripe vs Square vs PayPal

- 14 Alternatives to PayPal for Small Businesses

In the News: PayPal announces new features in its “PayPal First Look” event held January 25th, 2024.

If you want the lowest rates: The payment processing rates you will pay can vary based on your business size, type, and average order value. To find the most affordable option for you and compare multiple processing rates, read our guide on the cheapest credit card processing companies.

PayPal does not require monthly fees or contracts to get started—simply sign up, complete any validation requirements, and you can start receiving payments. However, transaction fees can be costly if you are a high-volume business. It lost a few points for the optional monthly virtual terminal fee and other fees for its online card payment services.

Commercial Transaction Rates

PayPal’s commercial transaction rates apply to any goods, services, or any type of commercial transaction. These rates are the standard rates for receiving domestic transactions.

Applied When: Accepting payments where customers use various PayPal Checkout options—including Pay Later, Pay with Rewards, Crypto, and Venmo—and alternative payment methods (APM) such as Apple Pay.

Monthly Fees | Local Transaction Rates | Add-on for International Transactions | |

|---|---|---|---|

Standard Debit/Credit Card Payments | $0 | 2.99% + 49 cents | 1.50% |

PayPal Checkout/Guest Checkout | $0 | 3.49% + 49 cents | 1.50% |

Invoicing | $0 | 3.49% + 49 cents | 1.50% |

Venmo | $0 | 3.49% + 49 cents | 1.50% |

QR code | $0 | 2.29% + 9 cents | 1.50% |

Apple Pay | $0 | 2.59% + 49 cents | 1.50% |

Cryptocurrency conversion | $0 | 1% | N/A |

PayPal Online Card Payment Services

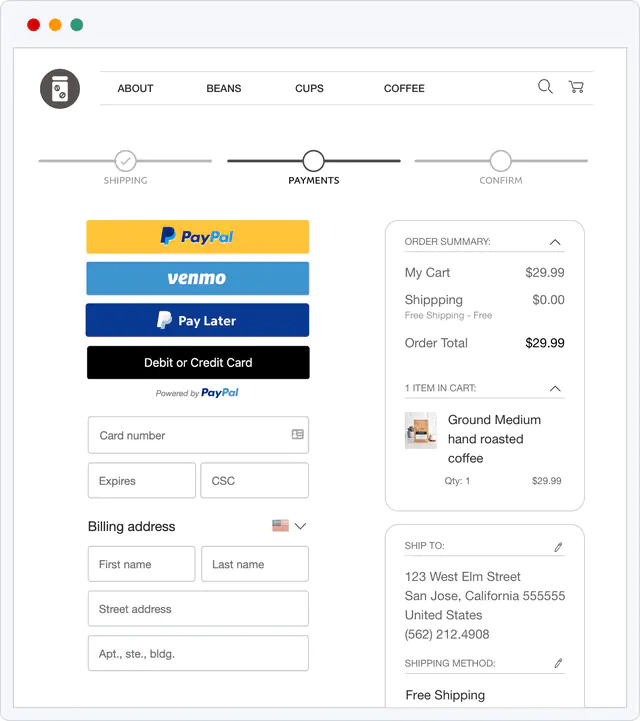

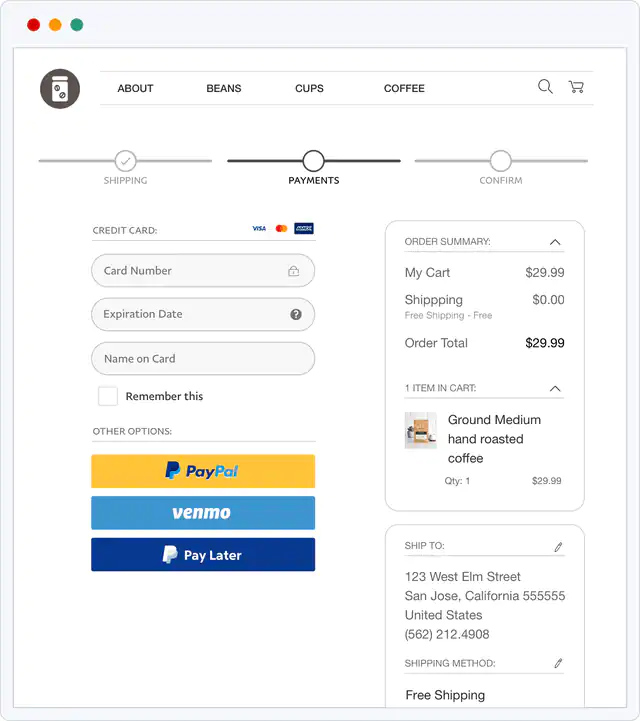

A PayPal Business account lets you accept debit or credit card payments for your products or services. PayPal Payments Pro is PayPal’s fully customizable payment system that can be integrated with popular online shopping carts, while Payments Advanced allows you to receive payments via a PayPal-hosted page.

Applied When: Accepting payments where customers key in their credit and debit card details on a PayPal checkout service.

Monthly Fee | Local Transaction Rates | Add-on Fee for International Transactions | |

|---|---|---|---|

Advanced Debit and Credit Card Payments | $0 | 2.59% + 49 cents | 1.50% |

Payments Pro | $30 | 2.89% + 49 cents | None |

Virtual Terminal | $30 | 3.09% + 49 cents | None |

Payments Advanced | $5 | 2.89% + 49 cents | None |

Payflow Pro (Payment Gateway)

Payflow Pro is PayPal’s payment gateway for merchants who want to use a different payment processor. If you want to stay within PayPal’s ecosystem, you also have the option to use PayPal’s processor, Payments Pro. Although merchants can still use PayPal’s hosted checkout pages, Payflow allows merchants to host their own checkout pages and send transactions via an API.

Applied When: Accepting payments through a templated (Payflow Link) or customized (Payflow Pro) checkout page.

Gateway Monthly Fees | Recurring Billing Monthly Fees | Per Transaction Fee | Fraud Protection Services Monthly Fees | |

|---|---|---|---|---|

Payflow Pro Gateway | $25 | $10 | +10 cents | Basic: $0 Advanced: $10 + 5 cents in excess of monthly transaction fee Buyer Authentication+: $10 + 10 cents in excess of monthly transaction fee |

Payflow Link Gateway | $0 | $10 |

|

PayPal Zettle

PayPal Zettle is PayPal’s point-of-sale (POS) system. There are no additional fees to use the POS software but you will need to purchase one of PayPal Zettle’s hardware to receive card payments. You only incur fees for every transaction using the POS system.

Applied When: Accepting in-person transactions through PayPal Zettle.

Monthly Fee | Local Transaction Rates | Add-on Fee for International Transactions | Monthly Processing Volume Limit | |

|---|---|---|---|---|

Card present | $0 | 2.29% + 9 cents | None | None |

Keyed-in | 3.49% + 9 cents | None | ||

QR code | 2.29% + 9 cents | None | ||

Invoicing | 3.49% + 9 cents | None |

Donation & Nonprofits

Payments are categorized as a “donation” when the payment is sent via the “Donate Button”, the PayPal Checkout for Donations, and PayPal Fundraisers. Any other transactions through other means are not considered donations and will be charged the regular processing fees.

Applied When: Accepting donations as a business (donation) or as a PayPal-approved charitable organization (nonprofit).

| As a Business | As a Nonprofit |

|---|---|---|

Monthly Fee | $0 | $0 |

Donate Button | 2.89% + 49 cents | N/A |

PayPal Fundraisers (Listed Fundraisers) | 2.99% | N/A |

PayPal Fundraisers (Unlisted Fundraisers) | No Free | N/A |

PayPal Checkout for Donations | 2.89% + 49 cents | N/A |

Charity Transactions | N/A | 1.99% + 49 cents |

International Payments | +1.5% | +1.5% |

Micropayments

Businesses that process payments below $10 can apply for micropayment rates. The rates are applied to all commercial transactions and start at 4.99% + 9 cents per local transaction and an additional 1.50% for international transactions.

Other Fees

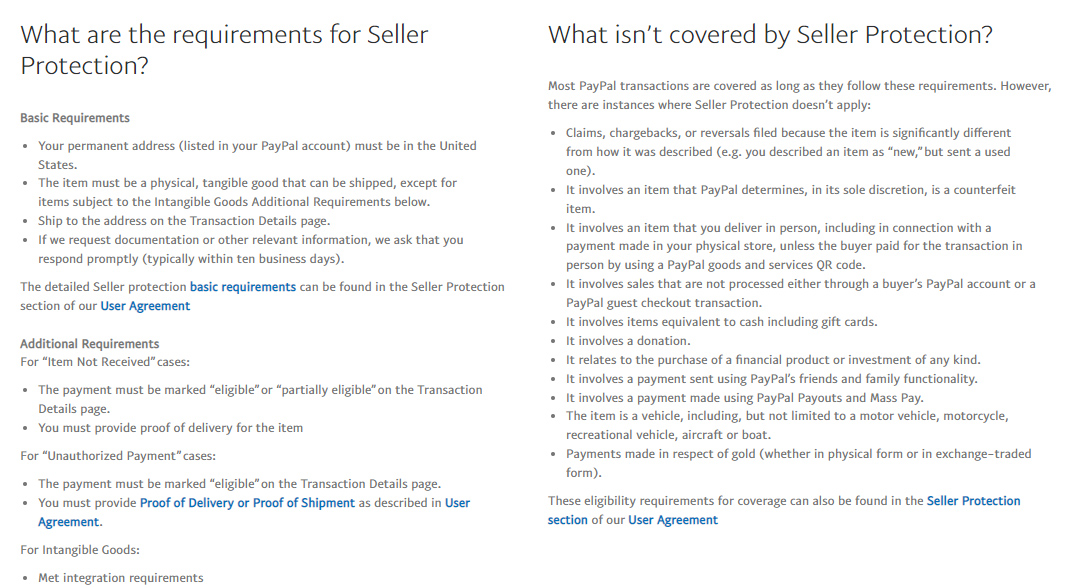

- Chargeback fees: $20 for transactions not processed through a buyer’s PayPal account or through guest checkout.

- Dispute fees: $15 Standard or $30 for high-volume transactions.

- E-check fees: 3.49% capped at $300

- Instant withdrawal of funds to linked card or bank account: 1.50% of the amount transferred

- Recurring billing service: $10/month optional service available for PayPal Online Card Payment Service and Payment Gateway users

- Recurring payment tool: $30/month optional service available for PayPal Online Card Payment Service users

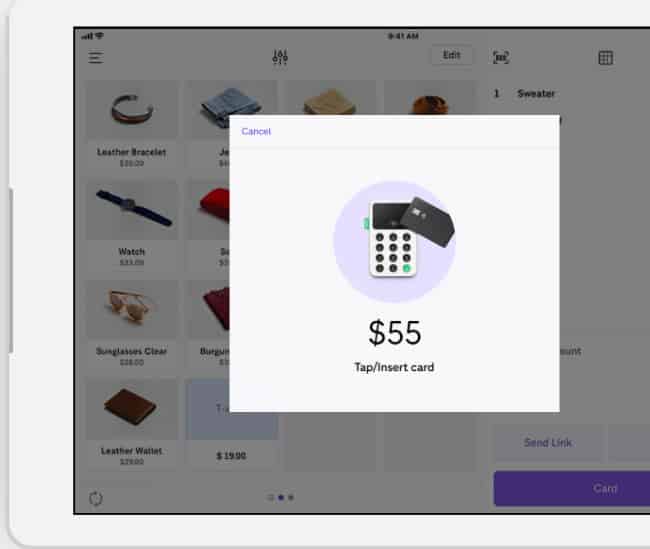

Merchants that require an in-person payment solution through PayPal can sign up for PayPal Zettle. Features include a proprietary mobile card reader and other hardware to support its built-in point-of-sale app.

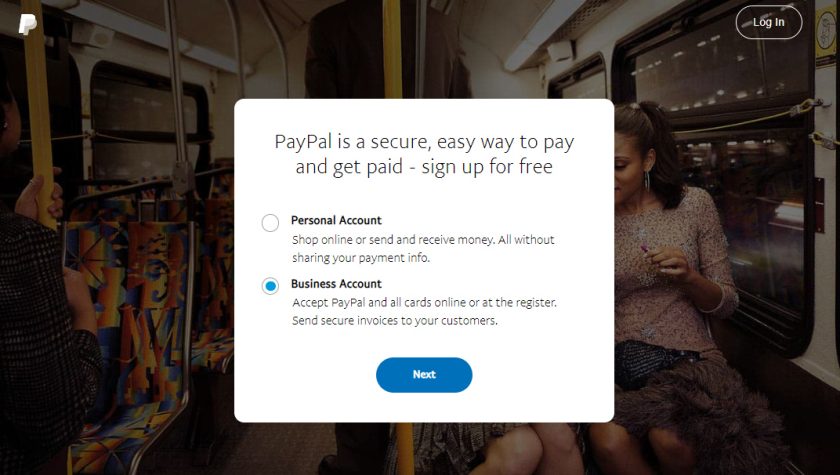

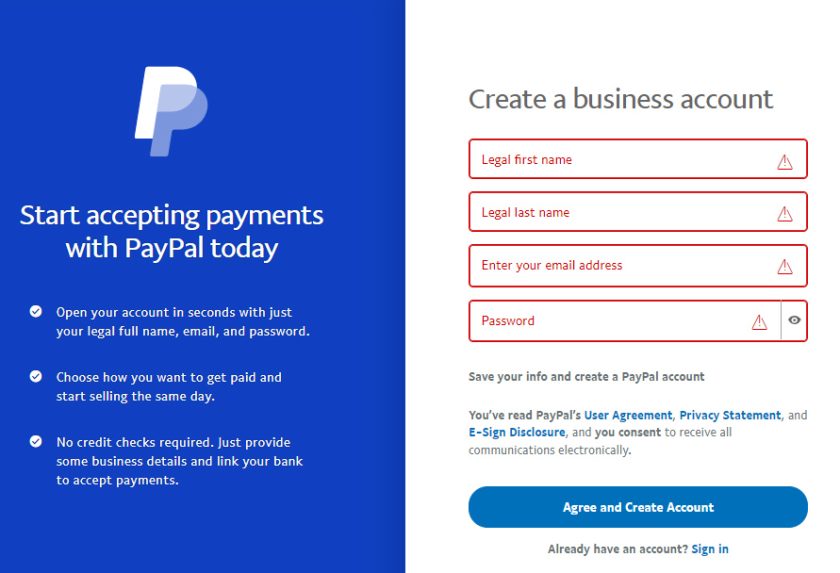

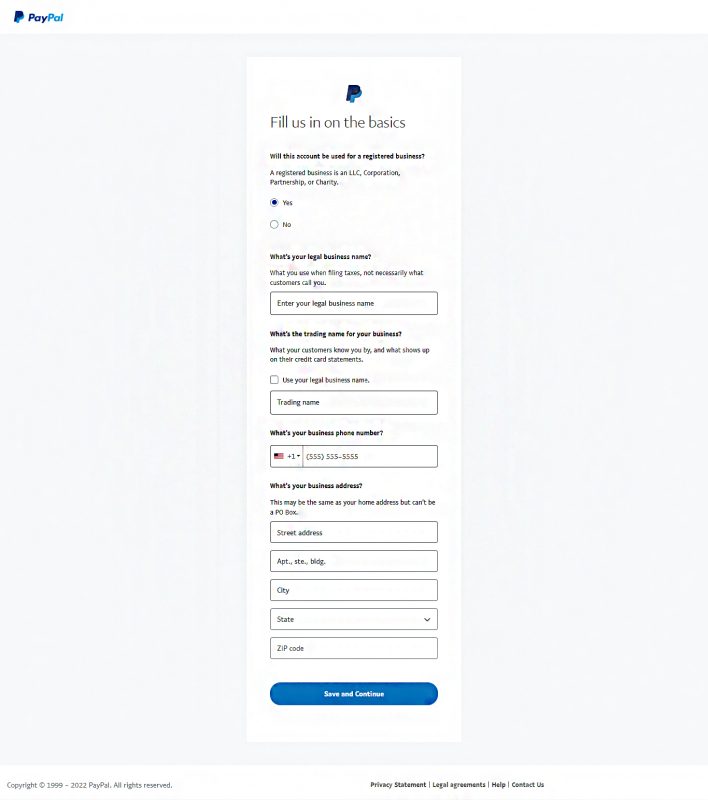

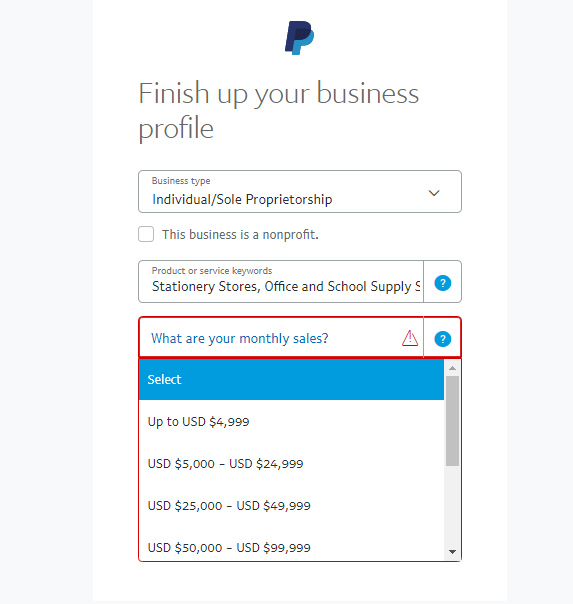

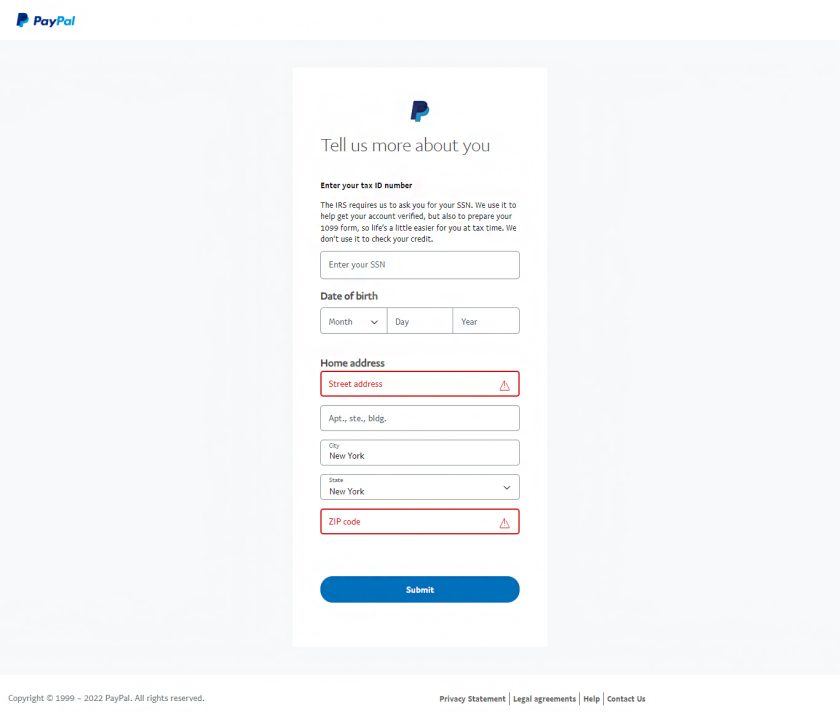

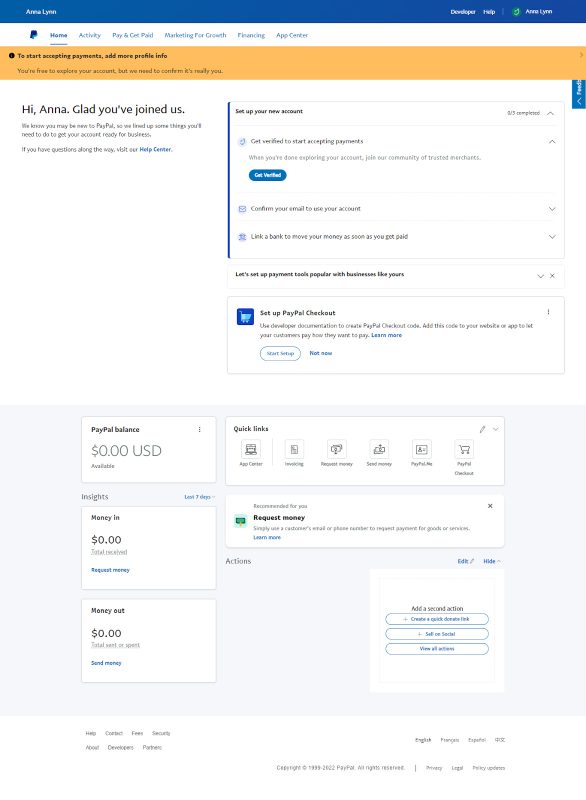

PayPal has a simple and straightforward application and setup process, especially compared to other payment processing options. All you have to do is sign up, connect your business account, and start accepting payments.

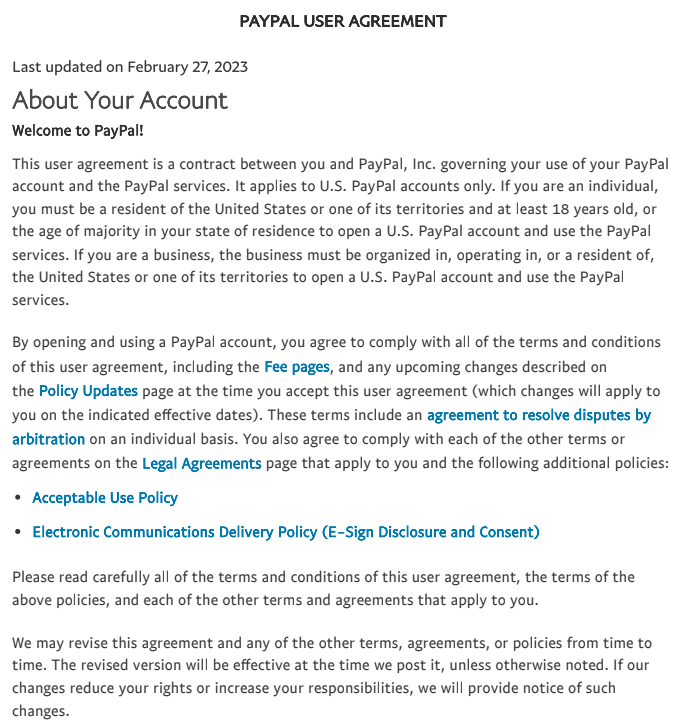

PayPal’s user agreement is provided on the website while signing up for a PayPal account. It includes standard terms and conditions you would find on a merchant account aggregator, such as disclosure of personal information, service level agreements, restrictions, and terms for opening, verifying, and closing your account.

Some terms and conditions to note are:

- While not yet verified, you can begin accepting payments on your PayPal account—however, in the event that your account, for some reason, could not be verified, your PayPal balance can only be withdrawn by transferring the amount to your linked bank account. (You can also request for a check to be sent, subject to a $1.50 fee.)

- You may hold funds in a different currency, but you will have to request for the amount to be converted into dollars in order to withdraw. This will be subject to PayPal’s currency conversion fee.

- Accepting e-checks will take 3–5 business days for approval.

- A high-volume dispute fee will be imposed if transaction disputes reach 1.5% or you had more than 100 disputed sales transactions in the past three months.

- “Fund Hold” will be at the sole discretion of PayPal and based on its risk decisions. This usually happens when an account is new, your business is considered high-risk, or when you have received a high number of disputes.

In the event that your account reaches certain processing limits or begins to add certain business activities, PayPal will require you to enter a “Commercial Entity Agreement” as stipulated by the card networks. The Commercial Entity Agreements will then be applied to succeeding payments you process through PayPal.

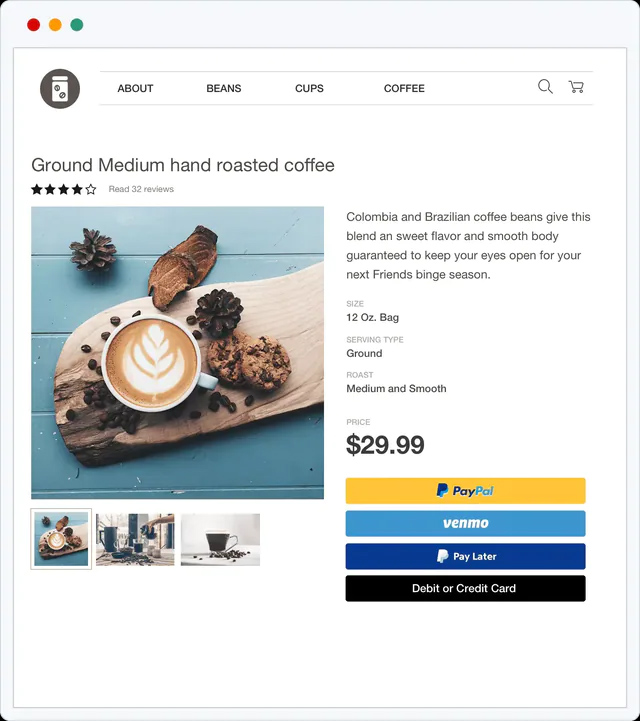

PayPal offers a wide range of payment options. Most ecommerce platforms offer easy integration with PayPal with just a few clicks and your PayPal business account details. If you do not have an online website, receiving payments is easy by sending invoices, using the virtual terminal, or with PayPal Zettle for in-person transactions. PayPal can accept most debit and credit cards, Venmo, ACH transfers, and mobile wallets. The wide range of payment types earned PayPal above-average scores for this category.

The PayPal checkout provides you with simple tools to integrate with your product, cart, and payment pages. This way, you give customers a variety of PayPal payment options that are secure, flexible, and well-trusted by many, increasing chances of conversion. Choose an integration format that presents the most relevant payment type to your customers, depending on your business needs.

PayPal also offers a virtual terminal solution when you sign up for a PayPal Payments Pro service. This feature allows you to accept in-person or over-the-phone payments anywhere with an internet connection and a browser. Note, however, that you will be charged a monthly fee of $30 to use this platform.

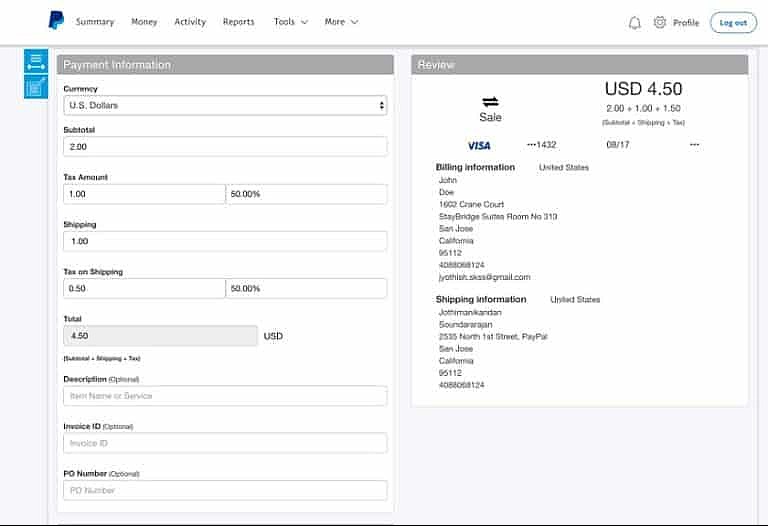

You can accept credit or debit card payments by keying in your customer’s card details or connecting a card reader to your desktop. (Source: PayPal)

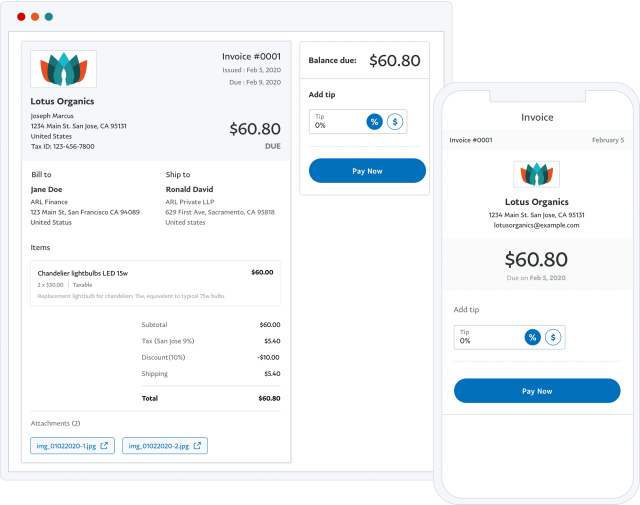

Create and customize digital invoices with PayPal’s invoicing tools for small businesses. You can access this feature on any device, customize your templates to fit every customer, and send the invoice through email or with a shareable link. You can also track unpaid invoices and send reminders from any device via your PayPal Business App.

Create PayPal estimates and convert them into invoices with a few clicks once your customers approve your proposal. (Source: PayPal)

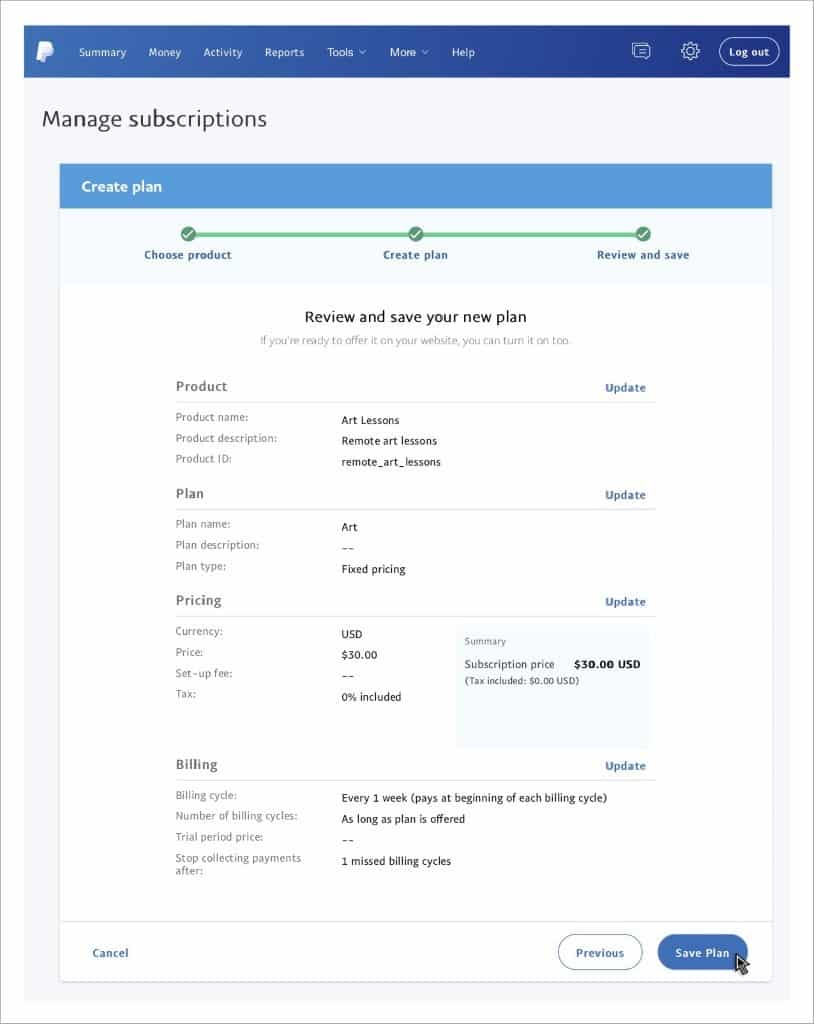

PayPal allows you to create scheduled or recurring invoices that can be delivered automatically at regular intervals. Subscription tools enable you to design flexible subscription plans, such as fixed or quantity pricing, add discounted trial periods, and manage your subscriptions from a central dashboard. You also get real-time reports and updates from the dashboard.

PayPal will take you through a step-by-step process on creating subscription plans. (Source: PayPal)

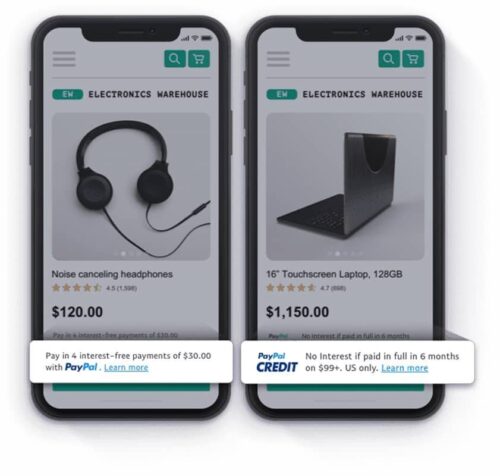

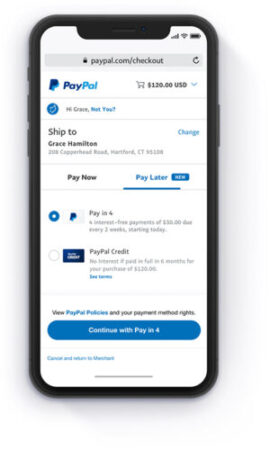

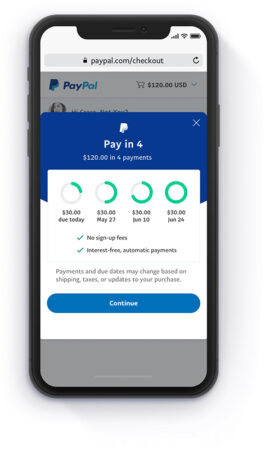

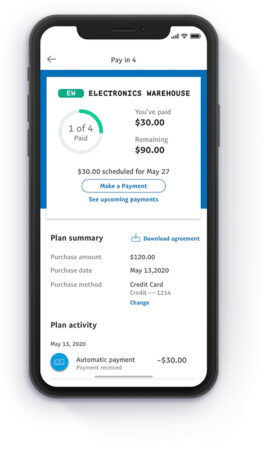

PayPal has partnered with a number of brands to offer PayPal Pay Later plans. This customer financing exclusive gives your customers the option between paying in four interest-free installments or with PayPal Credit, both appearing on your PayPal checkout page. What’s great about this setup is that you also get paid upfront while your customers pay later.

Here’s how:

Did you know?

PayPal also now offers Pay Monthly, a BNPL option for purchases worth $199 to $10,000. With Pay Monthly, customers can have the option to pay into monthly installments over a 6- to 24-month period.

PayPal allows you to include a “Checkout with Crypto” as a payment method. When a customer chooses to pay in cryptocurrency, their crypto assets will be converted to fiat currency and credited to your account. The usual fee for online transactions (3.49% plus 49 cents) applies plus an additional spread (fee) of 1%..

PayPal is included in our list of the best crypto payment gateways for small businesses.

PayPal earned above-average scores for its management features. It has excellent integration options and makes accepting local and international payments easy, which is why it is among the most popular and widely used payment platforms in the industry. Customers and shoppers recognize it as a secure platform for sending and accepting payments online. However, it would have performed better if there were no extra fees for some of the features, such as its chargeback protection.

PayPal is now more than just sending and receiving card payments. It also includes a range of tools for managing your day-to-day business operations.

- Taxes: You can set up PayPal to calculate taxes for every transaction. It can also track the payment volume of your business account and send a Form 1099-K to its user if it crosses the IRS thresholds in a given calendar year.

- Small Business Financing: Merchants in need of extra capital can get a small business loan directly from PayPal. It works with WebBank to offer fixed-term loans, payable in weekly installments. Anyone interested can visit PayPal’s website and click on the “Check Eligibility” button, which takes you to a 5–10 minute online questionnaire. You can also customize loan terms and loan amounts. Once your application is approved, funds are transferred directly into your PayPal Business account as early as the next business day.

- Reporting and Analytics: PayPal’s reporting and analytics feature provides useful shopping insights to help improve your sales and plan your marketing strategy. It gives you a list of reports, from a history log to sales insights and details on disputes and chargebacks.

- Shipping Label Tools: PayPal partners with UPS and USPS, which also gets you discounts on their daily shipping rates. And because it’s integrated with PayPal, you can purchase and print shipping labels and track your packages from PayPal.

PayPal Business will make received funds available instantly in your PayPal Business account. Withdrawing funds from your PayPal account to your linked bank account and credit card is free and usually takes three to five business days. Instant withdrawals are also available for a 1.5% fee of your withdrawn amount and have a minimum fee of 50 cents. The maximum withdrawal per transaction to a bank account is $25,000, while the table below shows the withdrawal limit for cards.

Frequency | Maximum (up to) |

|---|---|

Per transaction | $50,000 |

Per day | $100,000 |

Per week | $250,000 |

Per month | $500,000 |

PayPal uses tools such as a two-sided network, a machine learning engine that monitors card transactions on your website, and analytics to stay up-to-date with existing fraud and evolving cyber threats that can compromise your account. This toolkit is available for PayPal Business account holders with integrated advanced debit and credit card payments.

PayPal offers extended business hours for live customer and technical support. Its phone support is available 6 a.m. Pacific time to 6 p.m. PT, Monday through Sunday.

It also provides an extensive knowledge base which includes step-by-step guides, troubleshooting, and developer documentation.

PayPal Business received perfect scores for its pricing, popularity, and integrations. It is a secure platform with simple payment methods and provides integration with almost any popular online platform. Unless you need some of the other added features, you don’t need to pay any fees to use PayPal Business to receive payments.

However, minor points were deducted in the ease of use sub-criteria mainly because of the possibility of having your funds withheld or frozen.

PayPal Business User Reviews

Many small business owners that left PayPal Business a review had positive feedback on it. Reviewers consistently rate it as a user-friendly platform with a simple checkout process.

- G2: About 2,000 users rated PayPal with 4.4 out of 5 stars, mostly citing that when it works, it’s great—but when you have an issue, it’s tough to get a solution.

- Capterra: PayPal received an overall rating of 4.7 stars, with reviews from nearly 24,000 users following a similar theme as those on G2.

Generally, merchants love that it’s a familiar and well-liked platform, especially for customers. However, it’s worth noting that PayPal doesn’t function well offline. Support is difficult to reach, and funds may inexplicably become unavailable.

| Users Like | Users Don’t Like |

|---|---|

| Simplified and easy transaction process | Frequently frozen accounts due to security concerns |

| Integrations with other apps | Higher transaction rates |

Methodology—How We Evaluated PayPal Business

We test each merchant account service provider ourselves to ensure an extensive review of the products. We then compare pricing methods and identify providers that offer zero monthly fees, pay-as-you-go terms, and low transaction rates. Finally, we evaluate each according to a range of payment processing features, scalability, and ease of use.

The result is our list of the best overall merchant services. However, we adjust the criteria when looking at specific use cases, such as for different business types and merchant categories. This is why every merchant services provider has multiple scores across our site, depending on the use case you are looking for.

Click through the tabs below for our overall merchant services evaluation criteria:

25% of Overall Score

We awarded points to merchant account providers that don’t require contracts and offer month-to-month or pay-as-you-go billing. Additionally, we prioritized providers that don’t charge hefty monthly fees, cancellation fees, or chargeback fees and only included providers that offer competitive and predictable flat-rate or interchange-plus pricing. We also awarded points to processors that offer volume discounts, and extra points if those discounts are transparent or automated.

PayPal Business did well in this category, getting perfect scores for not having a contract or cancellation fee and for having its own hardware. It lost a few points for charging other fees for some of its other services.

30% of Overall Score

The best merchant accounts can accept various payment types—including POS and card-present transactions, mobile payments, contactless payments, ecommerce transactions, and ACH and e-check payments—and offer free virtual terminal and invoicing solutions for phone orders, recurring billing, and card-on-file payments.

PayPal Business scored really well in this category because of the wide payment options it accepts. A few points were docked because some payment methods, such as for virtual terminal, ACH/echeck, and stored payments, require additional fees.

25% of Overall Score

We prioritized merchant accounts with free 24/7 phone and email support. Small businesses also need fast deposits, so payment processors offering free same- or next-day funding earned bonus points. Finally, we considered whether each system has affordable and flexible hardware options and offers any business management tools, like dispute and chargeback management, reporting, or customer management.

PayPal Business’ score is lowest in this category because of the slower deposit speed for payouts outside of PayPal and the difficulty in getting quality customer support when you need it.

20% of Overall Score

We judged each system based on its overall pricing and advertising transparency, ease of use (including account stability), popularity, and reputation among business owners and sites like Better Business Bureau. Finally, we considered how well each system works with other popular small business software, like accounting, point-of-sale, and ecommerce solutions.

PayPal Business earned mostly perfect scores in this category except for ease of use because of issues with funds being withheld or frozen.

PayPal Business Frequently Asked Questions

There are no fees to set up a PayPal Business account and you can immediately start using your account to receive payments upon submission of the verification requirements. However, there are payment processing fees for every payment you receive, starting from 1.9% + 10 cents.

To open a PayPal Business account, you will need to prepare your full legal name, your email address, a password, your Social Security number (SSN) or tax ID, business description, and business bank account details.

PayPal Business is not a good fit for large-volume businesses because PayPal’s transaction fees are generally slightly higher than other payment processors. Its chargeback fees are also higher than most, and there is a high risk of account suspension. Other things users don’t like are its slow deposit speeds (for payouts outside of PayPal) and hard-to-reach customer support.

You need a PayPal Business account to be able to use PayPal’s merchant features. With a PayPal Business account, you cannot send payments to family and friends and use it for online purchases.

Bottom Line

Overall, PayPal Business is a valuable payment processor if you’re just getting started with payments and if you sell in-person only seasonally or sporadically. Compared to Stripe, PayPal also offers a number of user-friendly payment processing tools that are useful if you need to get set up quickly. Because it’s so versatile, flexible, and well-recognized, it can help boost trust and conversion rates. PayPal has no monthly fees or contractual obligations, so you can try it with low risk.

PayPal Zettle Terminal is an all-in-one standalone terminal. The Zettle POS app is built-in and it comes with an activated sim card. It can process payments using major debit and credit cards, PayPal, Venmo, payment links, QR codes, and contactless payments like Apple Pay and Google Pay.

PayPal Zettle Terminal is an all-in-one standalone terminal. The Zettle POS app is built-in and it comes with an activated sim card. It can process payments using major debit and credit cards, PayPal, Venmo, payment links, QR codes, and contactless payments like Apple Pay and Google Pay. The PayPal Zettle Card Reader 2 is designed to be paired with the Zettle POS app on your smartphone or tablet. It connects to your device via Bluetooth and accepts card and contactless payments.

The PayPal Zettle Card Reader 2 is designed to be paired with the Zettle POS app on your smartphone or tablet. It connects to your device via Bluetooth and accepts card and contactless payments. PayPal offers a full store kit to get your business up and running. Designed to be used with the PayPal Zettle Reader 2, these accessories are optional purchases to complete your store POS system.

PayPal offers a full store kit to get your business up and running. Designed to be used with the PayPal Zettle Reader 2, these accessories are optional purchases to complete your store POS system.

Connect PayPal Business to Facebook and Instagram and make your offerings available for purchase to social media users. PayPal hosts your listings, so you can create and share this on social media using a shareable link, without the need for an ecommerce platform.

Go to the “Sell on Social Dashboard” page to add your product details, including shipping and tax rates, then click the create button to produce a payment link. The next step will give you the option to click on the Facebook or Twitter icons to share your product listing automatically.

You can also copy your payment link and send it out through email, blogs, and messaging apps. (Source: PayPal)