PayRent is one of the top rental payment and management software, earning a 4.34 out of 5 rating. It empowers landlords to automate and manage rent collection from any location as long as they have an internet connection. With PayRent, landlords can offer tenants a convenient payment portal that supports multiple payment methods. This ensures flexibility and convenience for both landlords and tenants.

Our PayRent review analyzes the platform’s general and advanced features, ease of use, pricing, support, customer reviews, and our expert opinion to help you decide if PayRent is right for your real estate business.

Pros

- Offers multiple payment methods, such as debit card and credit card

- Allows bill-splitting

- Sends automated messages to landlords and tenants to keep all transactions

Cons

- ACH available but with a fee

- Does not have expense tracking

- No option to manage maintenance requests

Recommended For

- Landlords who are looking to streamline rent collection and automate payment processes.

- Landlords seeking an online application solution for efficient tenant screening and vacancy filling.

- Landlords who prefer direct deposit and recurring payment options.

Not Recommended For

- Landlords managing commercial properties, as its features are more focused on residential rentals.

- Landlords with few units may find PayRent’s platform offers more features and complexity than necessary for their operations.

- Landlords looking for maintenance request management and lease tracking features.

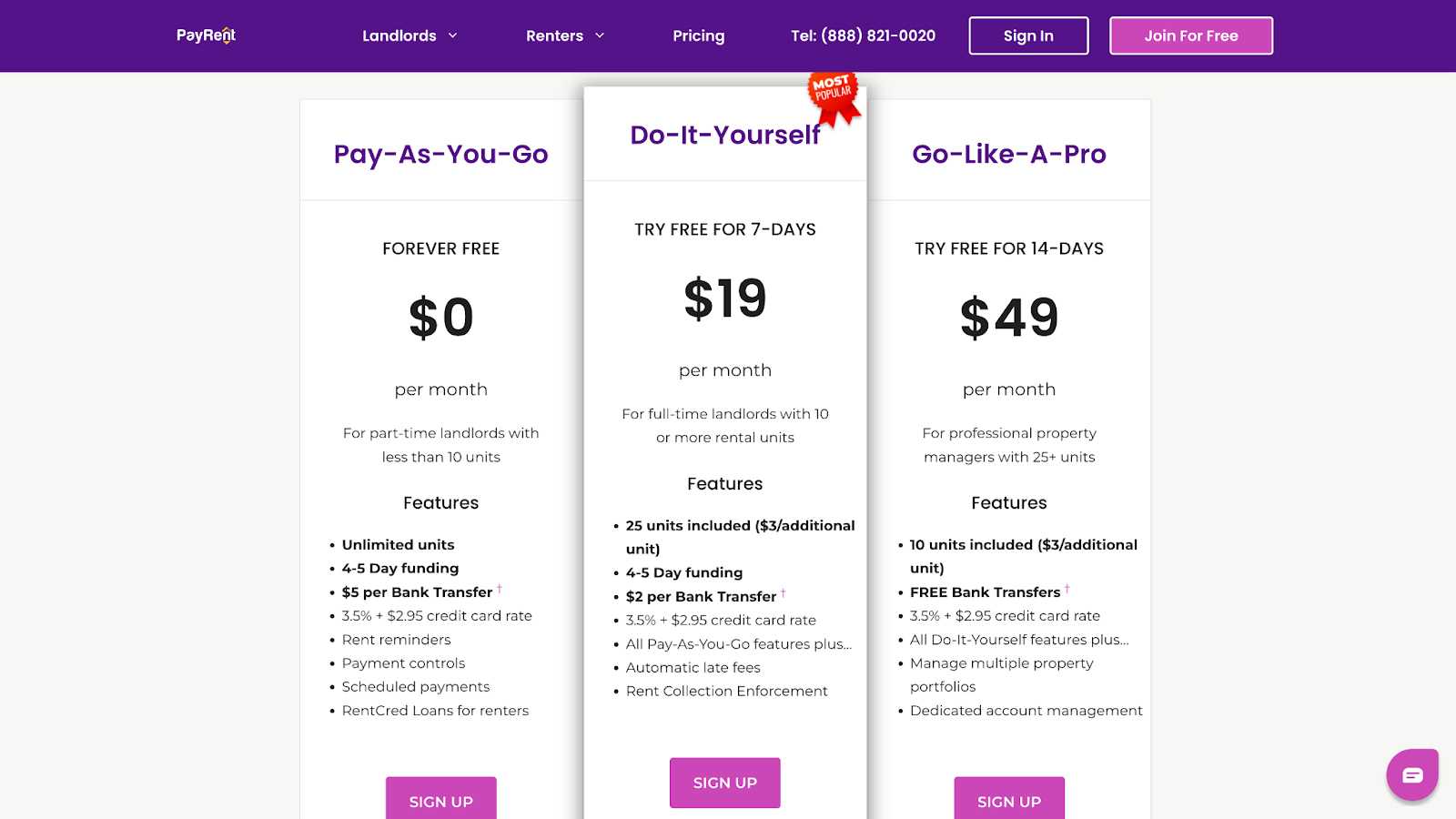

- Pay-As-You-Go: Forever free

- Do-It-Yourself: Try free for 7 days, then $19 per month

- Go-Like-a-Pro: Try free for 14 days, then $49 per month

There are only a few third-party PayRent reviews, but those reviews praised PayRent as a user-friendly platform. Users emphasized how effortless it was to set up and navigate, even for individuals with limited technical expertise. PayRent’s robust security measures were also highly regarded, ensuring the protection of personal and financial data. Moreover, reviewers highlighted PayRent’s reliability, noting its consistent availability and the convenience it offers by enabling online rent payments around the clock.

- Facebook: 3.6 out of 5 based on 22 PayRent reviews

- Trustpilot: 1 out of 5 based on 1 PayRent review

- Sitejabber: 2 out of 5 based on 11 PayRent reviews

There have been concerns raised about PayRent’s customer service. Some users have expressed frustration over extended wait times when seeking assistance, unresponsiveness from customer service representatives, and occasional issues with platform functionality. It is important for PayRent to address these concerns and improve its customer service experience to ensure prompt and effective support for its users.

In our expert opinion, PayRent is a commendable platform for landlords and property managers looking to streamline their rent collection and rental management processes. With features such as online rent payments, applicant screening, and rental listing management, PayRent offers a comprehensive solution for efficient property management.

One notable advantage of PayRent is its emphasis on security and reliability. The platform ensures secure and encrypted payment transactions, providing peace of mind to both landlords and tenants. The ability to accept direct deposit and offer free ACH payments further enhances convenience and flexibility for landlords in receiving rental income.

PayRent’s advanced features, such as automated late fees and partial payment acceptance, demonstrate its commitment to addressing common pain points in rent collection. These features promote timely rent payments and provide a level of flexibility that can foster positive tenant-landlord relationships.

However, it’s important to note that PayRent may not be the most suitable option for landlords managing commercial properties or those seeking property management features beyond rent collection. Additionally, while PayRent’s ease of use and mobile app are advantageous, the absence of certain features, like portals for maintenance requests, may be limiting for some users. An alternative is TenantCloud, which is good if you want to optimize productivity through property financial refinement.

PayRent Alternatives

Below are PayRent alternatives to help you decide the right platform for you, depending on your preferences.

Software | ||||

|---|---|---|---|---|

Best For | Refining property financials for improved efficiency | Streamlined tools for rent collection and tenant screening | Landlords and property managers seeking a seamless and cost-effective solution for rent collection | Optimal choice for its exceptional automatic reminders and flexible payment options |

Key Features |

|

|

|

|

Starting Pricing | $15 per month | $45 per month | Free | Free |

Learn More |

PayRent pricing offers three distinct plans, each tailored to different needs and budgets. The first plan, available at no cost, provides unlimited units, four to five-day funding, and a $5 fee per bank transfer. For more extensive requirements, the second plan starts at $19 and includes 15 units, with each additional unit costing just $3. The third plan, priced at $49, already covers 10 units, and additional units can be added for $3 each.

With these flexible options, PayRent received a perfect score, ensuring that landlords can choose a plan that aligns perfectly with their specific requirements.

An overview of PayRent’s different subscriptions (Source: PayRent.com)

Plans | Pay-As-You-Go | Do-It-Yourself | Go-Like-a-Pro |

|---|---|---|---|

Who Plan Is Best For | Landlords with less than 10 units | Landlords with 10 or more rental units | Professional property managers with more than 25 units |

Monthly Pricing ($/Month) | $0 | $19 | $49 |

Number of Units | Unlimited units | 25 units included ($3/additional unit) | 10 units included ($3/additional unit) |

Funding | 4- to 5-day funding | 4- to 5-day funding | N/A |

Bank Transfer Fee | $5 per transaction | $2 per transaction | Free |

Credit Card Rate | 3.5% + $2.95 credit card rate | 3.5% + $2.95 credit card rate | 3.5% + $2.95 credit card rate |

Rent Reminders | ✓ | ✓ | ✓ |

Automatic Late Fees | ✕ | ✓ | ✓ |

Dedicated Account Manager | ✕ | ✕ | ✓ |

Additional Features | Payment controls | Automatic late fees | Manage multiple property portfolios |

- Rental listing management

- Rental applications

- Applicant screening

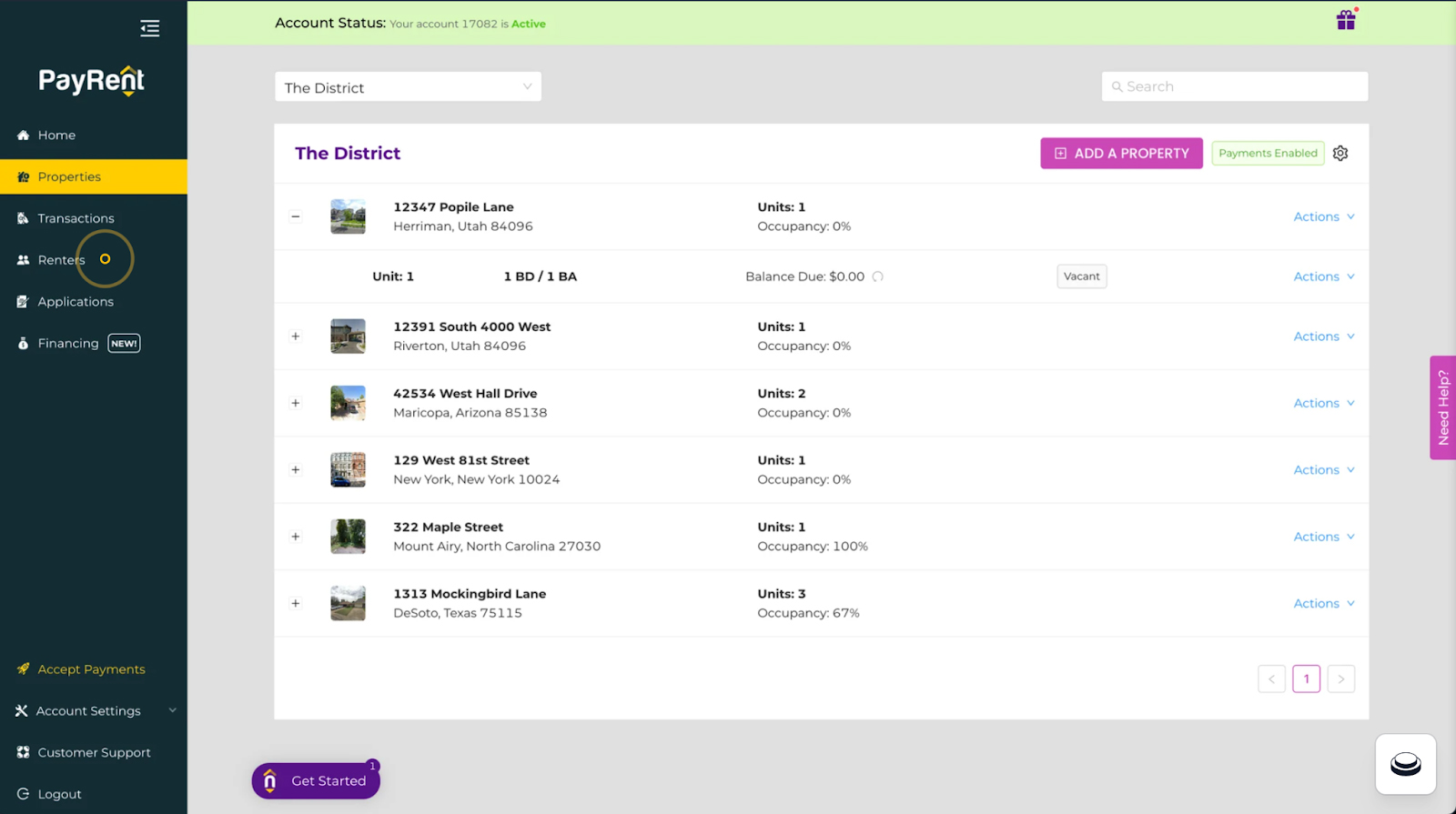

PayRent offers general features with every subscription package. The rental listing management feature allows landlords to create, update, and manage their property listings effortlessly—ensuring accurate and up-to-date information is readily available to potential tenants. This saves valuable time and effort, streamlining the process of attracting suitable tenants.

The rental applications feature simplifies the application process by providing a user-friendly platform for prospective tenants to submit their information securely and conveniently. Landlords can then review and evaluate applications swiftly, expediting the tenant selection process.

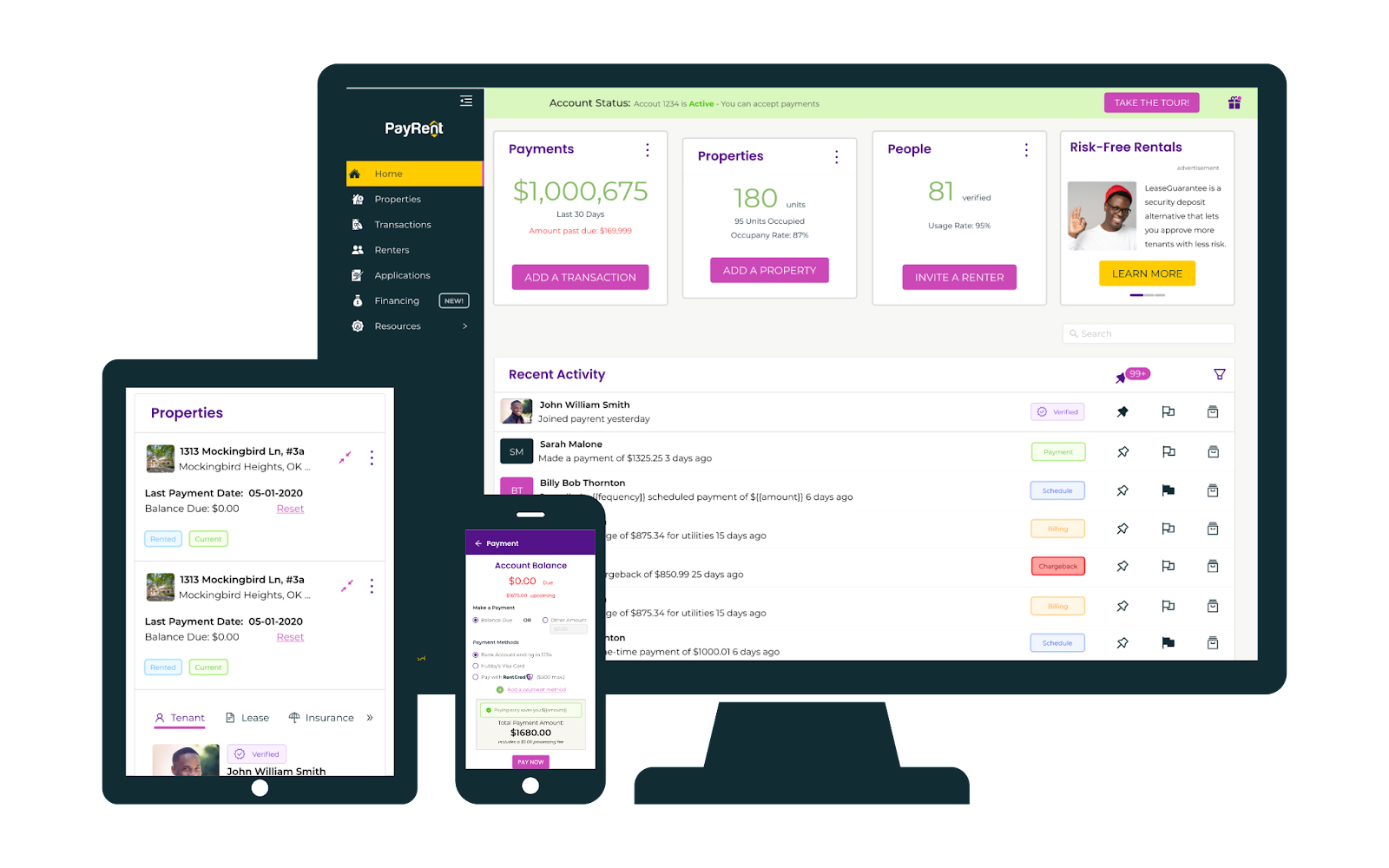

PayRent dashboard on desktop, mobile, and tablet (Source: PayRent)

Additionally, the applicant screening feature assists landlords in conducting thorough background checks on applicants, enabling them to make informed decisions and select reliable tenants. With PayRent, landlords can significantly reduce the risk of potential rental issues, such as payment defaults or property damage.

PayRent received 3.25 rating because it doesn’t offer maintenance requests or a tenant portal. These features are important as they organize the communication process between tenants and property managers. This ensures prompt maintenance resolution and convenient access to essential information and services.

PayRent owes its advanced feature high rating to its exceptional online rent payment services that cater to the diverse needs of landlords. With an array of advanced features, such as direct deposit, autopay, free ACH, the ability to collect security deposits, and automated payment reminders, PayRent empowers landlords to streamline their rental processes, boost efficiency, and maximize their returns on investment in the real estate business.

By leveraging these cutting-edge tools, landlords can effortlessly manage their cash flow, ensure prompt and hassle-free rent collection, and foster positive tenant relationships, thus solidifying PayRent’s position as an invaluable asset in their real estate ventures.

Click on each arrow below to read more about the PayRent feature:

- Streamlined rental collection

- Automated direct deposit

- Cash flow management

- Secure and reliable payment method

By enabling direct deposit of rental payments into their designated bank accounts, landlords can enjoy a streamlined and efficient rental collection process. This feature eliminates the need for manual collection of checks or cash, reducing administrative burdens and the risk of payment delays or errors. Landlords can conveniently access their funds directly, enhancing cash flow management and ensuring timely availability of rental income.

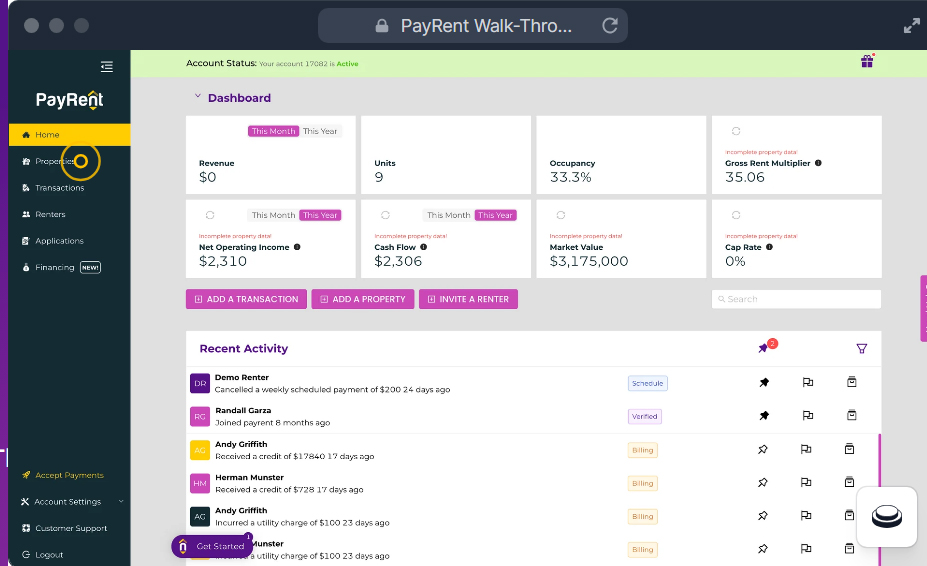

PayRent dashboard displaying funds (Source: PayRent)

Additionally, the direct deposit feature provides a secure and reliable payment method, minimizing the risks associated with handling physical payments. It also enhances transparency by maintaining a clear payment transaction record, simplifying financial tracking and reporting for landlords.

- Automated recurring payment schedules

- PayRent app

- Consistent and reliable cash flow

- Simplified payment process

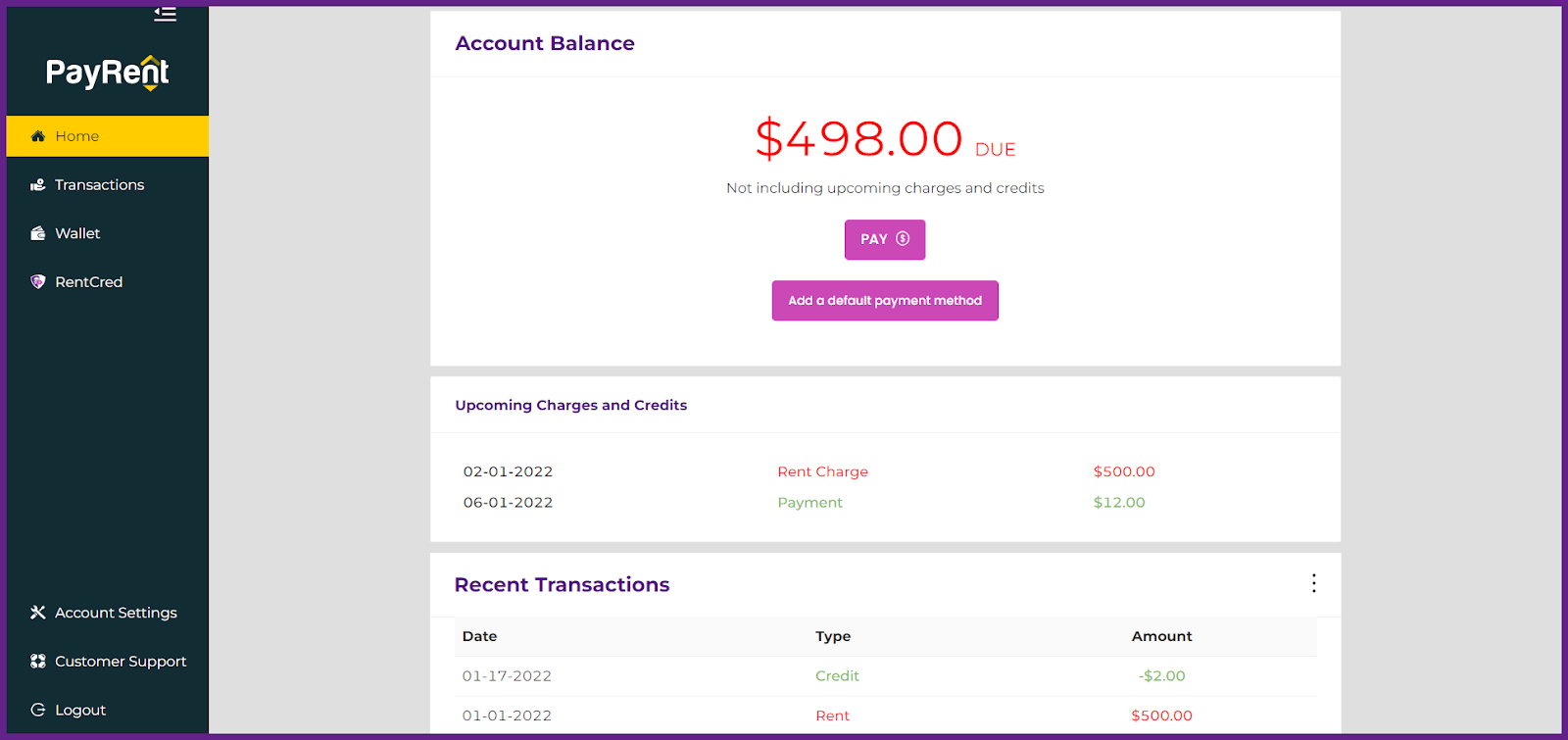

With Autopay, landlords can set up recurring payment schedules for tenants, ensuring that rental payments are automatically deducted from tenants’ accounts on specified dates. This feature offers convenience and peace of mind by eliminating the need for manual follow-ups and reminders for rent collection.

Tenant payment portal (Source: PayRent)

Landlords can enjoy a consistent and reliable cash flow as payments are automatically processed, reducing the risk of late or missed payments. Moreover, Autopay simplifies the overall payment process for both landlords and tenants, promoting efficiency and minimizing administrative tasks.

- No transaction fees for electronic fund transfers

- Cost-effective for landlords, maximizing rental income

- Convenient and efficient payment process without extra costs

By providing free Automated Clearing House (ACH) transactions, this feature eliminates transaction fees typically associated with electronic fund transfers. Free ACH provides landlords with cost savings and convenience, allowing them to maximize rental income and avoid transaction fees. This feature not only streamlines the payment process but also contributes to overall profitability and financial stability for investors and landlords.

- Security deposit and pet fee collection

- Enhanced rental agreement compliance and property protection

- Financial records

This feature allows landlords to effortlessly collect security deposits and pet fees from tenants, ensuring compliance with rental agreements and protecting their property. By providing a streamlined platform for collecting these fees, PayRent simplifies the payment process, eliminates the need for manual collection, and reduces administrative burdens.

At the same time, landlords can also conveniently track and manage the collection of security deposits and pet fees, maintaining accurate financial records. It promotes transparency and mitigates potential risks associated with damages or breaches of lease agreements.

- Automated late fee imposition for overdue rental payments

- Time-saving process for landlords, reducing manual intervention

- Promotes payment discipline and ensures transparency in rentals

This feature automates the process of imposing late fees on tenants who fail to make timely rental payments. By setting up predefined rules within the platform, landlords can ensure that late fees are applied consistently without manual intervention.

This feature not only saves time and effort for landlords but also helps enforce payment discipline among tenants, reducing the occurrence of late or missed payments. Additionally, the automated late fees feature promotes transparency and fairness in the rental process, as the rules for late fees are predefined and applied uniformly to all tenants.

- Flexible acceptance of partial rental payments

- Non-payment risk mitigation and partial payment management

The partial payments accepted feature offered by PayRent empowers landlords to accept partial payments from tenants who are unable to make the full rental payment. This feature promotes a cooperative and flexible approach to rental collections, fostering positive tenant-landlord relationships while minimizing potential disputes.

By accommodating partial payments, landlords provide tenants with a practical means to partially meet their financial obligations, thereby reducing the risk of complete non-payment. With the ability to track and manage these partial payments within the platform, landlords can maintain accurate recordkeeping, ensuring transparency and accountability in rental transactions.

- Rental payment tracking and monitoring

- Timely identification of missed or late payments

- Rental payment history

This feature enables landlords to effectively track and monitor rental payments, ensuring accurate recordkeeping and financial management. With payment tracking, landlords can easily identify any missed or late payments, allowing them to promptly address any issues and take appropriate actions.

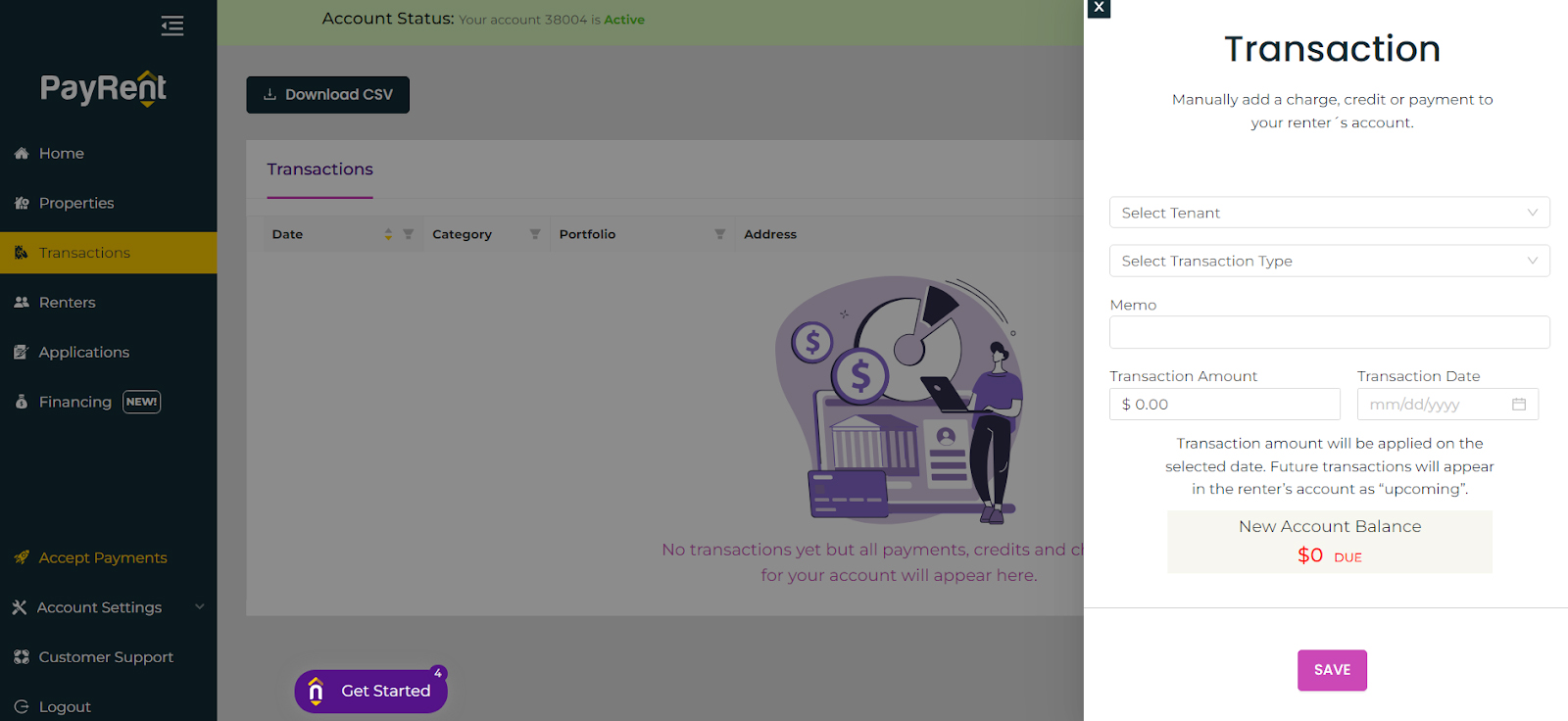

Collect and record transactions

Additionally, the reporting functionality of this feature allows landlords to generate comprehensive reports on rental payment history. This feature enhances transparency, simplifies accounting processes, and enables landlords to make informed decisions based on accurate payment data.

PayRent’s platform prioritizes user-friendly design, ensuring a seamless experience for landlords and tenants alike. The website and mobile app are intuitive and straightforward, facilitating easy navigation and efficient rent payment processes.

Landlords benefit from a comprehensive dashboard where they can effortlessly manage tenant accounts, set up recurring payments, and access detailed payment history. However, the platform lost points because they don’t have a mobile app that will make it easier for landlords to use it anytime.

PayRent’s dashboard is easy to use, which helps users even without tech experience. (Source: PayRent)

Tenants, on the other hand, enjoy a hassle-free interface that enables them to conveniently pay rent, review their balance, and update their contact information with ease. PayRent goes the extra mile by integrating with popular third-party services like Venmo, PayPal, and Stripe, providing flexibility for users to choose their preferred payment method when submitting rent payments. This commitment to usability and convenience makes PayRent an ideal choice for streamlined rental management.

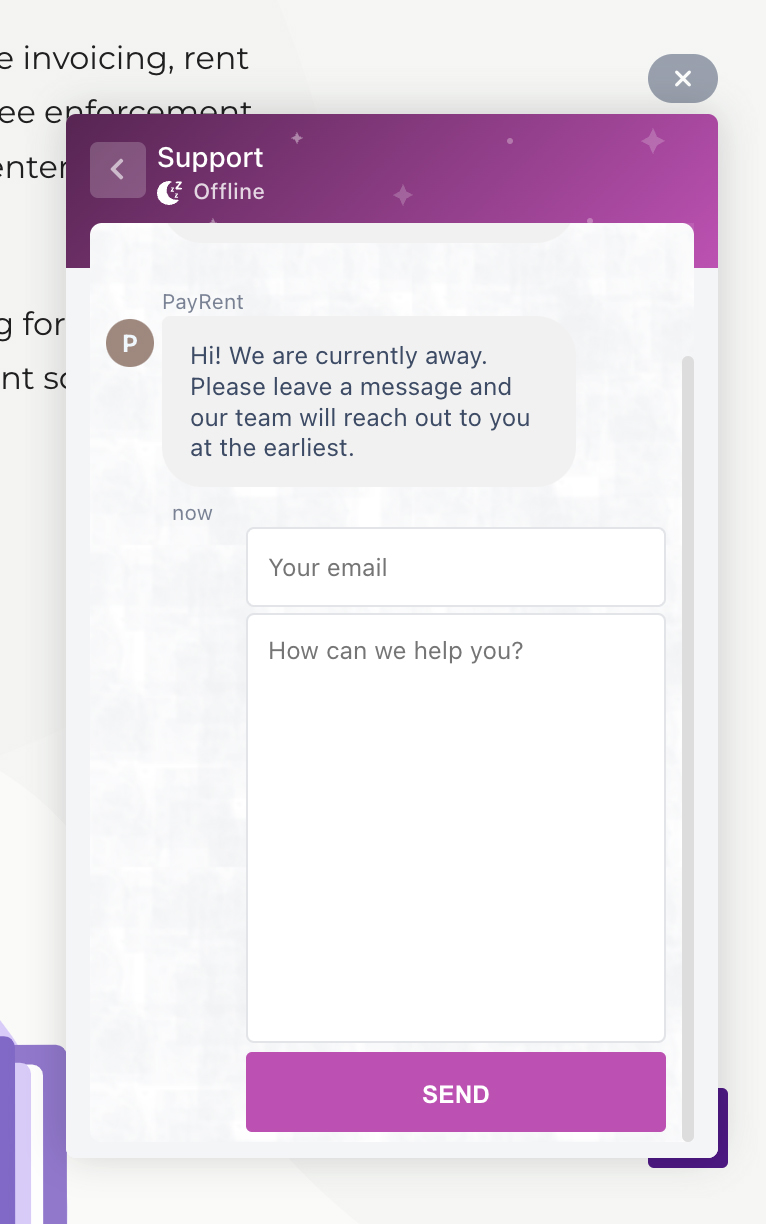

PayRent received a favorable rating due to their provision of phone, live chat, and email support, which facilitates ease of communication for tenants and landlords, especially when addressing concerns or issues. However, the score was not perfect, as support is limited to business hours.

Message support through chat on PayRent’s website (Source: PayRent)

How We Evaluated PayRent

In order to provide a comprehensive evaluation of PayRent, we conducted a thorough analysis encompassing a range of factors. Our assessment encompassed an in-depth examination of PayRent’s general and advanced features, taking into account their strengths and weaknesses. We also scrutinized the overall user experience and considered valuable insights from customer reviews.

Additionally, we carefully assessed PayRent’s pricing structure, integrations with other platforms, and the intuitiveness of its user interface. Our examination aimed to determine the viability of PayRent, especially if you’re about to invest in real estate.

To delve deeper into each of the criteria we analyzed, please navigate through the informative tabs below:

30% of Overall Score

We scrutinized the value of subscribing by evaluating advanced features such as direct deposit, autopay, and free ACH.

25% of Overall Score

Our assessment considered subscription plan costs, availability of a free plan, scalability options, and monthly or annual payment choices.

10% of Overall Score

We examined essential property management software features, including applicant screening, lease generation, maintenance requests, and tenant portal.

10% of Overall Score

We evaluated platform usability, setup simplicity, learning curve, and integration with third-party applications.

10% of Overall Score

User feedback, product reviews, and provider popularity were considered to ensure user satisfaction.

10% of Overall Score

Our expertise and firsthand experience allowed us to evaluate standout features, value for money, and ease of use for each platform.

5% of Overall Score

We assessed the convenience and availability of customer service for technical support, onboarding, and training.

Bottom Line

PayRent offers a range of features that simplify the rent collection process for landlords, providing convenience and flexibility. With its user-friendly platform, landlords can automate rent collection, access comprehensive tenant screening reports, facilitate digital lease signing, and benefit from rent price analysis to optimize their rental pricing.

These PayRent features streamline operations and contribute to efficient property management. However, it is essential to consider PayRent’s pros and cons. While PayRent receives praise for its ease of use, security, and convenience, there have been occasional complaints about customer service responsiveness and platform functionality issues. Nevertheless, PayRent remains a valuable tool for landlords seeking a streamlined and efficient rent collection solution.