A payroll register includes vital pay data you need to ensure accurate employee payments and maintain compliance. It also plays a crucial role in financial planning and budgeting, helping you track labor costs and monitor changes over time.

Included as a standard report in most payroll software, a payroll register is a document that contains all employee payment details for a specific pay period. This detailed record makes it easier for you to submit quarterly taxes, make payroll tax deposits, and provide information to the Social Security Administration (SSA) and the Internal Revenue Service (IRS).

Why your business needs a payroll register

Now that you know the answer to the “What is a payroll register” question, your next one may be, “Why should you use it?” When doing payroll, you’re not just paying employees — you’re also required to withhold taxes and report information to the SSA and IRS. A payroll register can help with that and more. It offers several benefits:

- Accuracy and transparency: It ensures you get a detailed record of your workers’ pay data for every pay period, providing a transparent record for employees and management. This transparency builds trust with your workers and helps you maintain clear and precise financial records.

- Legal compliance: Labor and tax laws require businesses to keep detailed payroll reports. A payroll register helps meet federal and state record-keeping requirements, such as completing your company’s IRS Form 941 (quarterly tax) payments. This saves you from potential legal complications and penalties down the line.

- Financial planning and budgeting: Having a clear picture of your total labor costs is invaluable when it comes to financial planning and budgeting. By understanding your payroll expenses, you can calculate the cash required to pay employees and cover payroll tax deposits. It also helps you make informed budget-related decisions about hiring, wages, and benefits.

- Audit readiness: In case of audits, you will need to provide detailed payroll records. A comprehensive payroll register allows you to easily furnish this information to auditors, reducing stress and the risk of fines or penalties.

Keep in mind that payroll registers will only have accurate information if you’ve entered the correct data. To reduce errors from manual inputs, use a payroll system like Gusto. It automatically calculates all payments and deductions and generates the necessary payroll reports. To learn more, read our Gusto review or check out its website.

What is on a payroll register

Here’s the data you should generally see on your payroll register:

- Name of each employee

- Pay period

- Pay date

- Regular hours worked for each employee

- Overtime hours worked for each employee, if applicable

- Each employee’s pay rate

- Each employee’s earnings for regular and overtime hours worked

- Each employee’s gross pay

- Federal, state, and local taxes withheld

- Employee portion of Social Security and Medicare taxes

- Employer portion of the above FICA taxes

- Any other applicable payroll deductions

- Each employee’s net pay

- Employer benefits contributions, if applicable

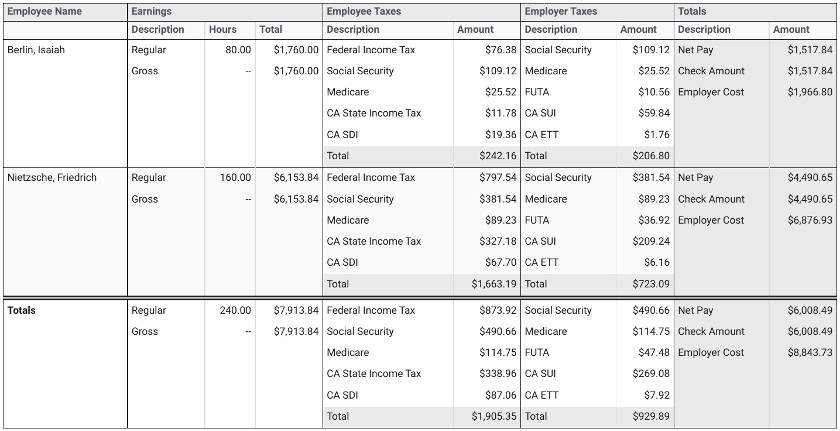

Sample payroll register indicating regular pay, deductions, total net pay, and employer costs. (Source: Gusto)

In addition to the employee-specific data shown above, you’ll also see totals on your payroll register for each line item. It shows the total hours worked for all team members, including the total gross pay for the pay period, allowing you to calculate the overhead costs of employing your team.

You can add other information, such as time off or vacation/sick leave details. You can even have different formats depending on the types of employees you have. Let’s say you only have exempt employees who are not eligible for overtime pay. You can remove the overtime hours and overtime pay details from your report.

After you define payroll register structures for specific pay runs, ensure that these will meet Fair Labor Standards Act (FLSA) requirements. The reports must include identifying employee information, such as their full name, hours worked for each pay period, pay rate, taxes withheld, pay period dates and paycheck date, and pay frequency.

The FLSA also requires each covered employer to keep payroll records for at least three years. While it doesn’t mandate that you use a payroll register, it’s simply a natural fit to do so.

Payroll register vs payroll journal vs wage summary

Payroll registers, payroll journals, and wage summaries may be payroll terminologies you’ve heard before. These three may sound similar, but each contains slightly different information. Further, specific individuals in the organization can only access these reports.

Payroll Register | Payroll Journal | Wage Summary | |

|---|---|---|---|

Purpose | Records detailed payroll data for each employee | Summarizes total payroll expenses for accounting | Provides individual wage information |

Level of Detail | Specific payroll details of all employees | Company-wide totals only | Single employee data |

Restricted to: |

|

|

|

Best practices for using a payroll register

This payroll report is more than just a record-keeping tool; it’s also a strategic resource. Here are four ways to use it effectively:

Payroll reconciliation

Use the register to reconcile payroll data with bank statements and financial records. Compare the report’s totals with the amount you paid to employees, tax agencies, and healthcare or retirement providers. This ensures that all payments are accounted for and helps identify discrepancies early.

Compliance checks

Regularly review the register to ensure payroll compliance. Verify that all required deductions, regular and overtime hours, and payment calculations are correct.

You should also keep track of the effective dates of new or revised labor laws and federal regulations. This is crucial to ensure that you captured all pay-related changes, such as adjustments to FICA taxes and minimum wage rates, at the correct pay period. Failing to implement changes to minimum wage rates on time can lead to costly back pay and penalties.

Verify employee information

You can use the payroll register to check if it contains the correct employee details, such as pay rates, benefits deductions, bonus payouts, and tip payments. Don’t forget to review each worker’s tax information, especially if you process multi-state payroll.

You may need to access several software or reports to audit employee payroll-related information. If you use a payroll system, you can get most of the data from there. If you include expense reimbursement claims in your pay runs, you can get a report from your accounting team or accounting system. You can also spot-check an actual reimbursement claim to compare the approved amount with the amount paid to the worker for the specific pay period.

Trend analysis

Look for patterns in payroll data, such as increased overtime costs in specific departments or changes in employee turnover rates. It can also show how much your company’s benefits cost as you grow your headcount. This information can help you identify areas for improvement and optimize your workforce management.

Payroll register frequently asked questions (FAQs)

Yes, you should. You can use a payroll register for audits or to identify the money you need to set aside for employee payments and taxes. It’s also a good tool for tracking all payroll-related transactions and promoting transparency around employee compensation.

A payroll system can easily generate the payroll record you need. But if you don’t use one, you can create this manually. However, I don’t recommend it if you have more than five employees. Given the many details you need to manually track and input for each employee — such as wages, hours worked, deductions, and taxes — the probability of making mistakes increases significantly.

A payroll register does not include information about the employee’s job description, position title, hire date, and contact details. It also doesn’t include estimates for future payroll expenses or expected deductions.

It’s essential to address these errors and inconsistencies immediately to maintain accurate financial records and ensure fair employee compensation. Depending on the nature of the error, you may need to update an employee’s pay rate, correct hours worked, or adjust a tax deduction. It might also be helpful to review your payroll processes to identify how the error occurred and implement measures to prevent similar mistakes in the future.