Poppins Payroll offers an easy and affordable way to manage payroll for nannies, senior caregivers, housekeepers, and other household staff. Priced at $49 monthly for one worker, it handles all nanny payroll and tax processes—from depositing payments to employee accounts and remitting payroll taxes to electronically filing tax forms for you. However, this provider didn’t rank on our list of the best nanny payroll service providers because its services aren’t available in all 50 states.

As of this writing, Poppins Payroll’s nanny pay services only cover:

- Alabama

- Arizona

- California

- Colorado

- Connecticut

- District of Columbia

- Florida

- Georgia

- Idaho

- Illinois

- Indiana

- Kansas

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Missouri

- Nevada

- New Hampshire

- New Jersey

- New York

- North Carolina

- Ohio

- Oklahoma

- Oregon

- South Carolina

- Tennessee

- Texas

- Utah

- Virginia

- Washington

- Wisconsin

Pros

- Handles nanny payroll tax payments and filings

- Offers employer registration assistance to new household employers

- Tax accuracy guarantee covers all penalties for tax payment and filing errors that its representatives make

- Tracks paid time off (PTO) balances

Cons

- Nanny payroll services aren’t available in all states

- Lacks access to employee benefits plans

- Doesn’t have a help center with online guides on how to use its dashboard and tools

- Support is limited to weekdays only

What We Recommend Poppins Payroll For

Want to learn more about nanny payroll taxes? Read our nanny taxes guide to know the different types of taxes levied against household employees and how these are paid.

Poppins Payroll Deciding Factors

Supported Business Types | Household employer needing registration support and solid payroll services to handle nanny payments and taxes—provided you’re located in a state where its pay services are available* |

Free Trial | One month |

Pricing | $49 monthly for one household employee; plus $10 monthly for each additional worker |

Standout Features |

|

Ease of Use | Poppins Payroll’s services and solutions are generally easy to use, but having basic knowledge of what payroll is will be helpful |

Customer Support |

|

*As of this writing, Poppins Payroll’s services are unavailable in Alaska, Arkansas, Delaware, Hawaii, Iowa, Kentucky, Louisiana, Maine, Mississippi, Montana, Nebraska, New Mexico, North Dakota, Pennsylvania, Rhode Island, South Dakota, Vermont, West Virginia, and Wyoming | |

Looking for something different? Read our guides to the top payroll software and best payroll services for small businesses to find a software or service that is right for you. If you’re unsure what features to look for, check out our guide to choosing a payroll solution for helpful tips.

How Poppins Payroll Compares With Top Alternatives

Best For | Starter Fees | Tax Filing Services | Our Review | |

|---|---|---|---|---|

| Employers needing an affordable outsourced nanny payroll service | $49 monthly for one employee (plus $10 for each additional worker) | None | |

| Families wanting unlimited and automatic nanny pay runs | $59 monthly for one employee (plus $10 for each additional worker) | $9.99 for OH/PA local tax filings | |

Employers looking for full-service nanny payroll with benefits | $35 monthly for one household employee* | For year-end reports (Custom-priced) | ||

| Families requiring HR and tax support | $245 per quarter for one worker paid on a weekly basis (plus $65 per quarter for each additional worker) | $110 for year-end tax prep | No Review Yet |

*Pricing is based on a quote we received

If you want to see how the above software compares with other nanny payroll providers, read our best nanny payroll services guide.

Poppins Payroll Pricing

Poppins Payroll offers a flat rate of $49 per month for all of its services. This covers one employee, but you can add more by paying $10 per additional worker monthly. It also doesn’t charge extra for quarterly and annual tax filings, unlike other nanny payroll service providers do.

With Poppins Payroll, you won’t be asked to follow a minimum contract period. This allows you to cancel your plan at any time. However, you will be charged tax filing fees if you want the provider to handle the quarter-end and/or year-end taxes after the month you quit.

- Quarterly taxes: $49 for paying and filing quarter-end taxes

- Annual taxes (if you cancel in December): $110 for generating and filing year-end documents like Schedule H, W-2, and W-3

Poppins Payroll HR Features

Poppins Payroll may not have a wide suite of HR solutions, but it offers the essential tools that household employers need to manage workers. Its online dashboard allows you to update employee pay records, view tax forms, print paychecks, and set up leave policies. While it will track the PTO and sick leave balances, you have to manually input the number of days that your employees went on leave into its system.

If you have new household staff, Poppins Payroll will handle state new hire reporting for you. Sample employment contracts for nannies and senior caregivers are also available, although these are for information purposes only. You will need to consult a lawyer before creating your own contract and entering into an agreement with household employees.

Nanny agreement templates are free to download from Poppins Payroll’s website. (Source: Poppins Payroll)

Poppins Payroll Pay Processing Tools

If you are located in one of the states where its nanny pay services are available, Poppins Payroll will manage all payroll and tax computations, including payroll tax payments and filings, for you. You’re even covered by a tax accuracy guarantee, wherein the provider will handle all penalties for tax filing mistakes that its representatives make.

To know more about its pay processing features, click the tabs below.

Poppins Payroll supports multiple payroll schedules, allowing you to run payroll either on a weekly, bi-weekly, monthly, or semi-monthly basis—provided your state doesn’t have pay period requirements. The provider also sends email alerts to remind you of upcoming deadlines.

For any pay adjustments—like new pay rates, additional pay items, or changes in the number of hours that your employees worked for a pay period—the provider allows you to input all the applicable details via its online dashboard anytime during the pay period and for two days after the period closes. Its system will automatically capture all changes and add the adjustments to the pay run.

It can also handle deductions for benefits. The process is similar to adding pay adjustments, wherein you enter all the information needed on its dashboard. Note, however, that you need to find your own benefits provider for health plans. Poppins Payroll only offers workers’ compensation insurance via its partner provider, Bhalu Insurance.

If you don’t expect any changes to your pay runs, you can set Poppins Payroll to automatically process payroll every pay period. It will use the payroll settings you added to calculate your household employees’ earnings, deductions, and taxes.

If you prefer to pay household employees via direct deposits, it can handle the transfers for you at no extra cost. The system also has check printing capabilities if you want to print paychecks yourself. Poppins Payroll will provide the pay amount details you need to prepare the checks.

Poppins Payroll has a secure online library where it will keep all of your tax and payroll documents. It even has a retention period of five years, allowing you to easily access and print tax records within the said period.

You don’t have to worry about printing paystubs and distributing these to your household staff. Poppins Payroll will email the payslips to your workers. Not only will it include details about their salaries and taxes for a pay period, but it will also contain a list of their PTO and sick leave balances.

Poppins Payroll Ease of Use

- User-friendly interface

- Employer registration assistance

- Online FAQs and guides

- Digital tax forms with an electronic signature tool

- Weekday phone support

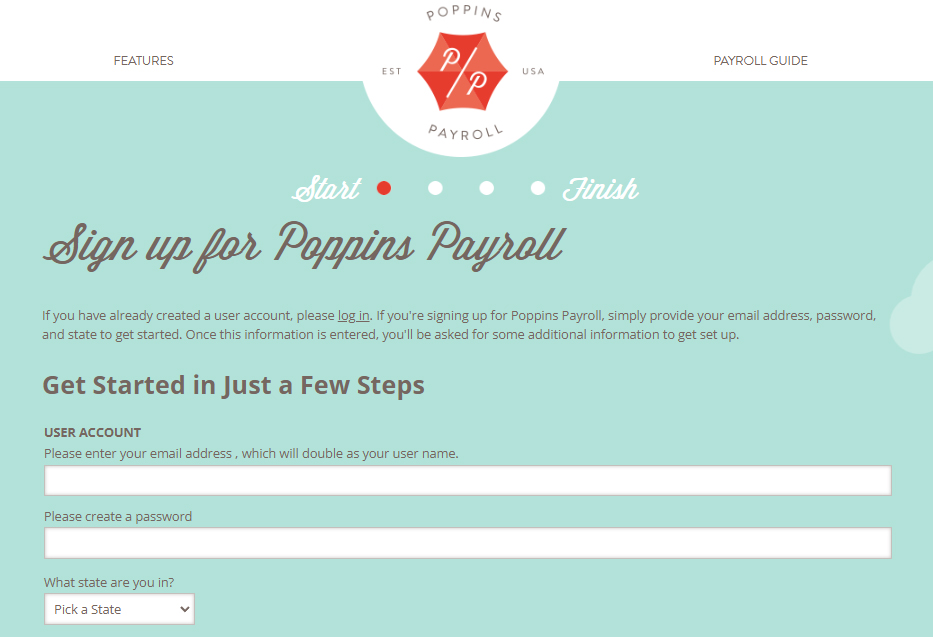

One of the things we appreciate about Poppins Payroll is its user interface. Aside from online tools that are easy to use, its interface has a colorful design that makes it enjoyable to navigate through. Setting up your account is also a breeze, provided you have all the necessary information available, like your EIN, address, and your employee’s details (such as full name, hire date, tax status, and Social Security number). The last step of the process will require you to e-sign authorization documents that Poppins Payroll will need to manage your nanny payroll.

Poppins Payroll claims that the online signup process will take up to 10 minutes to complete. (Source: Poppins Payroll)

If you need help or have questions about its payroll services, you can contact Poppins Payroll’s support team via phone from Mondays to Fridays, 8 a.m. to 5 p.m. Mountain time. You can also complete an online form on its website if you want its support team to contact you via email, or you can navigate to its FAQ section if you want to know more about its features.

It even provides access to an online payroll guide that contains basic information that new household employers will need to know, such as nanny payroll tax requirements and the Internal Revenue Service’s definition of a household employee. If you require state-by-state payroll guides, Poppins Payroll provides helpful resources for states where its services are available.

Poppins Payroll’s state-by-state guides contain everything a household employer should know about paying employees. (Source: Poppins Payroll)

Popularity: What Users Think About Poppins Payroll

There are very few up-to-date Poppins Payroll reviews online. Those we found are mostly positive, with users highlighting its solid nanny payroll tools and excellent support as its best features. Many reviewers like that they can easily contact a customer representative to help them with their tax queries and payroll concerns. Several users also appreciate its user-friendly interface, quick setup process, and affordable nanny payroll services.

On the other hand, we only found one user who complained about Poppins Payroll’s services not being available for small businesses. However, that can’t be considered a valid complaint because the provider only specializes in nanny payroll.

At the time of publication, Poppins Payroll reviews earned the following scores on these review sites:

- Better Business Bureau: 4.69 out of 5 stars based on nearly 30 reviews

- Yelp: 5 out of 5 stars based on more than 10 reviews

How We Evaluated Poppins Payroll

For this Poppins Payroll review article, we looked at the payroll and HR features that we believe are crucial in managing payments for nannies and household employees. We also considered transparency in pricing, affordability, compliance tools, and customer support. Ease of use is another area that we checked, including the feedback that actual users posted on third-party review sites.

Bottom Line

Poppins Payroll provides an affordable payroll service for household employers needing to pay nannies, senior caregivers, and housekeepers. It handles all payroll calculations and tax filings for you. It even keeps track of payroll compliances to ensure that you’re always up-to-date with the latest regulations. First-time household employers also receive registration assistance, making it easy for them to get their EINs.

If you want solid nanny payroll tools with excellent customer support, sign up for a Poppins Payroll today.