Nanny payroll software is essential for families that prefer not to handle payroll themselves, as it helps them comply with federal, state, and local tax laws. The software should also include features, such as the preparation of Schedule H and other tax forms. It would even be better if the solution provides a self-service portal to allow household staff access to their payslips and tax information.

We assessed several nanny payroll solutions, ranging from full-service providers with tax filing services to DIY programs. Then, we selected the top five services with features for paying domestic workers:

- SurePayroll by Paychex: Best overall nanny payroll service

- Paychex: Best full-service nanny payroll with comprehensive benefits

- QuickBooks Payroll: Best nanny payroll with tax error protection

- HomeWork Solutions: Best nanny payroll tax support, including back taxes

- HomePay: Best compliance and customer support for household employers

Top Nanny Payroll Services Compared

The nanny payroll software on our list offer automatic pay runs, new hire reporting, online payslips, direct deposit payments, Schedule H form preparation (apart from QB Payroll), and tax filing services. Some providers also offer basic benefits, such as health insurance and dental insurance. Here are some of the standout features of each provider:

Free Trial | Pricing Starts At | Available in All 50 States | Tax Filing Fees | |

|---|---|---|---|---|

| 6 months free * | $49.99/month $10/additional employee* | ✓ | ✕ |

6 months free** | $39/month + $5/employee/month | ✓ | Request for quote | |

30 days | $75/month + $6/employee/month*** | ✓ | ✕ | |

| ✕ | $245/quarter (weekly payroll) or $220/quarter (biweekly payroll) $65/additional employee/quarter | ✓ | $110/year |

| ✕ | $75/month | ✓ | $100/year |

*SurePayroll by Paychex currently offers up to 6 months free payroll if you sign up now. **Paychex currently offers 6 months free if you register now. ***QuickBooks Payroll currently offers 70% off the base fee for 3 months if you opt out of the 30-day trial period. | ||||

Best Nanny Payroll Service Quiz

Which Nanny Payroll Service is Right For You?

SurePayroll by Paychex: Best Overall Nanny Payroll Service

Pros

- Unlimited and automatic pay runs

- Files your 1040-ES and provides a signature-ready Schedule H form

- Tracks PTO and sick leaves

- Two-day direct deposits

Cons

- No free state registration or federal tax ID setup for new household employers

- Local tax payments and filings in Ohio and Pennsylvania cost extra

Pricing

- $49.99 monthly for one household employee

- $10 monthly for each additional household employee

- 3 months free trial

Add-ons

- Time clock integration: $4.99 plus $3 per employee monthly

- Accounting software integration: Starts at $4.99 monthly

- Ohio and Pennsylvania local tax filings: $9.99 monthly

SurePayroll by Paychex is a cloud-based payroll software that can handle the pay processing needs of small businesses, including household employers. It has direct deposit payments, unlimited pay runs, and payroll tax filings. On top of that, it’s the only nanny payroll service that has Spanish-speaking support (in addition to English) available through chat and phone, Monday to Friday, from 7 a.m. to 8 p.m., and Saturday, from 9 a.m. to 1 p.m., Central time.

SurePayroll by Paychex earned 4.31 out of 5 on our evaluation, earning the top spot of this buyer’s guide. Unlike HomeWork Solutions, users can create and customize reports on SurePayroll by Paychex. Additionally, it got a perfect score from our expert review. Users who left feedback on third-party review sites like G2 and Capterra like the platform’s straightforward navigation.

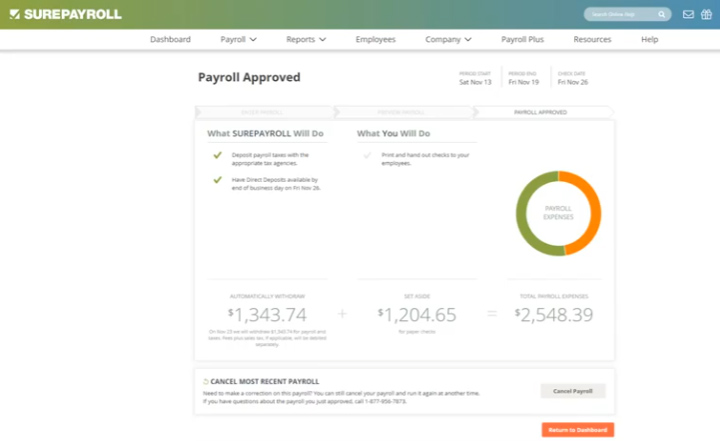

With SurePayroll by Paychex, you can process and approve payments for your household employees with just a few clicks. (Source: SurePayroll by Paychex)

SurePayroll by Paychex Features

Here’s an in-depth look at some of SurePayroll by Paychex’s features:

While SurePayroll by Paychex doesn’t help get your federal employer identification number (EIN), it efficiently handles the rest of your payroll needs. It calculates nanny pay with withholdings and benefits and pays household employees via direct deposits. If you hire a new nanny, it handles state new hire reporting for you. It also offers compliance resources and guides to help you stay on the right side of the law.

Like Paychex and HomeWork Solutions, SurePayroll by Paychex offers access to employee benefits plans you can provide to your staff. It also supports deductions for Medicare, Social Security, and unemployment state insurance in all 50 states.

SurePayroll by Paychex is a better option than HomePay for nanny payroll services because it automatically withholds, pays, and files taxes on the federal, state, and local levels. This includes local filing for Ohio and Pennsylvania, which HomePay does not offer. SurePayroll by Paychex also offers quarterly and year-end tax filings for free, while HomePay and other services charge extra for these services.

It works seamlessly with QuickBooks Online, Xero, Intacct, AccountEdge, Less Accounting, Zoho Books, and Sage 50-US Edition.

Paychex: Best Full-Service Nanny Payroll With Comprehensive Benefits

Pros

- Reasonably priced

- Dedicated payroll specialist

- Online and mobile payroll processing

- Benefits options include health plans, 401(K) plans, and workers’ comp

Cons

- Pricing isn’t all transparent

- You need to pay for year-end tax report prep and online delivery (W-2s and Schedule H)

- Employee benefits cost extra

Pricing

- Essentials ($39/month + $5/employee): Access to plans and payroll tax filing services have additional fees, 24/7 support

- Select (custom pricing): Everything in Essentials + one-on-one support, employee training and development system

- Pro (custom pricing): Everything in Essentials and Select + full-service setup

We chose Paychex as the best nanny payroll service with comprehensive benefits. It can help you set up and administer benefits for your nanny, such as health insurance, dental insurance, and 401(k) plans. The service also ensures that your payroll taxes are filed correctly and on time, helping you avoid costly penalties. It also offers a mobile app, allowing you to manage your payroll on the go.

It earned an overall rating of 4.13 out of 5 in our evaluation, with perfect marks in user popularity and high scores in nearly all of our criteria. However, its pricing details are not readily available, and it charges for year-end tax filing services. Nonetheless, users praised its intuitive platform and efficient payroll tools.

Paychex Flex lets you easily update employee payment options—from direct deposits to check payments and vice versa. (Source: Paychex)

Paychex Features

Here are some of Paychex’s features:

Paychex makes it easy to run payroll with just two clicks from your desktop or mobile device. You can pay your employees via direct deposit or live check, and Paychex even offers check-signing services. Paychex also supports multiple pay schedules, which is not always the case with other providers like HomeWork Solutions and HomePay.

Paychex (like all the nanny payroll services we reviewed, except SurePayroll) can help you set up your tax accounts and file taxes for your household employees. It can do this in all 50 states and for local areas. However, it does charge for some of its payroll tax services.

Paychex stands out from other nanny payroll service providers on our list by offering a wider range of features. In addition to basic tasks like new hire reporting and PTO tracking, Paychex also allows you to offer health plans and other benefits for your employees, purchase workers’ compensation insurance, and integrate time tracking into its platform. These features are not included in the base price of Paychex, but it may be worth the investment if you have multiple full-time household employees.

Paychex and SurePayroll are the only nanny payroll services in this guide that offer free mobile apps for household employees. These apps allow employees to access their payslips, update their personal information, and more. HomePay does not offer a mobile app, but it does have a mobile time tracker solution.

Paychex offers a team of compliance experts and payroll specialists who can provide knowledgeable advice on tax and labor regulations. It is the only provider on this list that also offers consultation service, a dedicated representative, and 24/7 customer and technical support via phone and chat.

QuickBooks Payroll: Best for Tax Error Protection

Pros

- Integrates with QuickBooks Accounting seamlessly

- Same- and next-day direct deposits

- Protection from tax payroll penalties

- Low-cost contractor payments

Cons

- No Schedule H preparation

- Local tax filings not included in the basic plan

- No app for employee self-service

- Can be complicated for first-time users

Pricing

- Core: $75 base fee + $6/employee/ month

- Premium: $105 base fee + $6/employee/month

- Elite: $1270 base fee + $8/employee/month

- Contractor only: $15/month for 20 contractors; plus $2/additional work

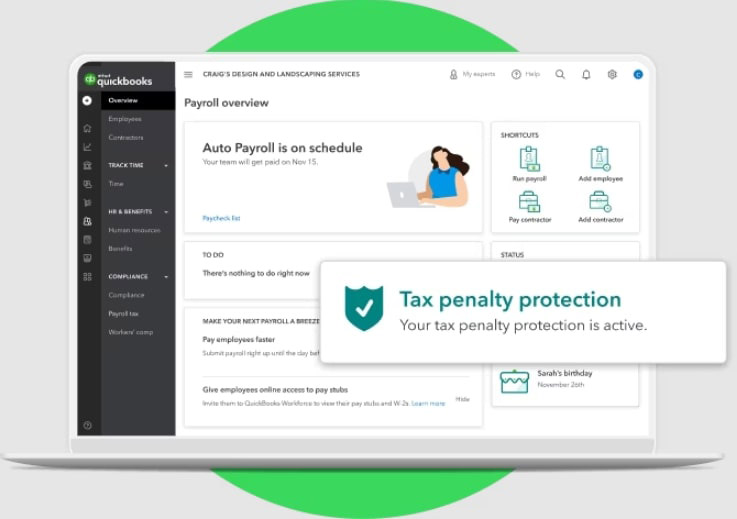

While most providers on this list guarantee to shoulder any penalties caused by a tax filing error on their part, only QuickBooks mentioned the specific coverage amount (up to $25K). It also provided step-by-step information on what to do in case such an error happens. This is an essential feature for those who employ people who work at their homes.

It got a 3.62 rating out of 5, with perfect scores in its reporting features. Like SurePayroll by Paychex, it has unlimited pay runs at no extra cost. Unlike SurePayroll by Paychex, however, it does not issue Schedule H, which significantly affected its score. QuickBooks Payroll also offers automated taxes, paycheck and tax calculations, and next-day direct deposit. But most importantly, it can help you stay compliant with all the relevant tax laws. To get a more in-depth look on how you can use it, check out our What is QuickBooks article.

QuickBooks Payroll streamlines your payroll process and simplifies tax management. (Source: QuickBooks)

QuickBooks Payroll Features

Below are some of QuickBooks Payroll’s features that simplify your payroll processes and drive your business forward:

QuickBooks Payroll uses a variety of factors to calculate the amount of taxes that need to be withheld from an employee’s paycheck, including the employee’s filing status, number of allowances, and pay frequency. It also takes into account the current tax laws, so you can be sure that you are withholding the correct amount of taxes.

In addition to withholding taxes, QuickBooks Payroll also calculates and remits the employer’s share of payroll taxes. This includes Social Security and Medicare taxes, as well as federal and state unemployment taxes.

QuickBooks Payroll is the only payroll service on this list that offers live support. When you enroll in the Elite plan and do not try the 30-day free trial, you can get the one-time live setup support within the first 30 days after you sign up. A QuickBooks expert will guide you through the entire setup process, including setting up automations, connecting your bank accounts and credit cards, and learning best practices. If you encounter any problems after that, it offers 24/7 live chat support.

QuickBooks Payroll offers a wide range of reports, including payroll billing summary, payroll deductions and contributions, payroll tax liability, total pay, workers’ compensation, and more. You have the flexibility to customize these reports by adding or removing columns according to your preferences before generating them. Additionally, you can mark any report as a favorite for easy access with just a single click in the future. Moreover, you have the option to export the reports to Microsoft Excel or directly print them as needed.

HomeWork Solutions: Best for Employers Looking for Solid Nanny Tax Support

Pros

- Complete nanny payroll service and a tax filing-only plan

- Federal ID and tax account setup services for new household employers

- Back taxes assistance

- Dedicated payroll specialist

- Payment options include direct deposits, live checks mailed to household staff, and direct payments from employer to employee

Cons

- One-time setup fees

- New account setup takes five to seven days

- Year-end tax preparation and back taxes management cost extra

Pricing

Complete Payroll:

- $220 per quarter for one employee’s biweekly payroll

- $245 per quarter for one employee’s weekly payroll

- $65 per quarter for each additional employee

Essential Payroll (tax prep and filing services only): $165 per quarter

Setup fee: $110

Add-ons

- Year-end tax form prep: $110 per employee

- “Back taxes” assistance for previous quarter: $225

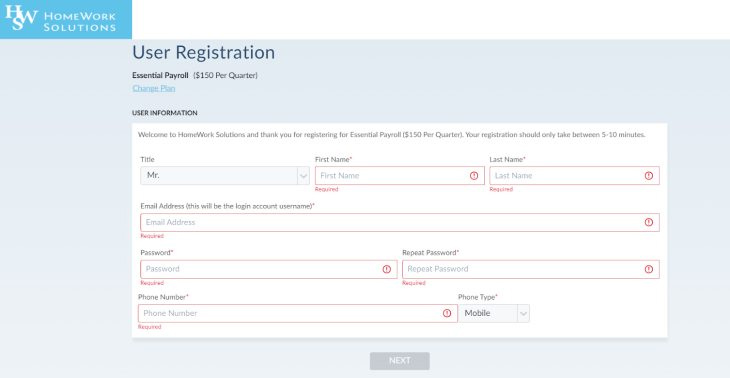

HomeWork Solutions is an all-in-one payroll and tax compliance software that offers flexible plans. It has a full-service payroll option and a tax filing option for household employers who only need tax assistance. It also has a dedicated payroll representative, sets up federal ID and tax accounts for new household employers, and can calculate the previous quarter’s nanny payroll taxes for an additional $225 fee.

In our evaluation, HomeWork Solutions scored 3.61 out of 5. It scored high (4 and up) in payroll functionalities and our expert assessment of whether it is a good nanny payroll service option. While it has very few reviews online, users commended HomeWork Solutions for its reliability and responsiveness when there are issues. However, its setup and year-end tax prep fees, as well as its lack of onboarding tools, in-house workers’ compensation plan, and benefits options, prevented it from ranking higher.

HomeWork Solutions has an online registration wizard to help new users set up their online accounts. (Source: HomeWork Solutions)

HomeWork Solutions Features

Below are some of HomeWork Solutions’ features:

HomeWork Solutions has both a do-it-yourself (Essential) plan and a full-service (Complete) payroll package. The Essential plan provides you the option to outsource payroll tax calculation and form preparation, including tax payments and filings, and simply handle nanny salary payouts yourself. Meanwhile, its Complete payroll package lets you choose between weekly and biweekly pay runs and includes payroll and tax calculations and tax payment and filing services.

Like SurePayroll and Paychex, HomeWork Solutions offers automatic payroll tools. If you prefer to handle payments yourself, it can send you the calculated net payroll (less taxes and other deductions) so that you can pay your nanny directly. It can also pay your household staff via direct deposits and checks mailed to the employee. While Paychex has live check printing capabilities and offers check signing services, it doesn’t mail checks like HomeWork Solutions does.

HomeWork Solutions can help you set up your household employer account with the IRS and relevant state tax authorities. HomePay also offers this service, while Paychex walks you through the process.

HomeWork Solutions automatically files and pays employment taxes at all levels (federal, state, and local). This is unlike HomePay, which does not handle local taxes. For an additional $225, HomeWork Solutions can also calculate back taxes for the previous quarter. This is a service that none of the other providers on our list offer.

HomeWork Solutions ensures employer compliance with state-specific new hire reporting rules. Similar to Paychex, it can connect you with insurance partners to assist with workers’ compensation requirements. Both HomePay and SurePayroll also offer workers’ compensation insurance and other benefits, but charge extra.

Similar to Paychex, HomeWork Solutions has a dedicated payroll representative who can come to your aid whenever you need it. It also provides unlimited “concierge” support that you can reach either online, by email, or by phone from Mondays through Fridays, 8 a.m. to 7 p.m., Eastern time.

HomePay: Best for Employers Needing Compliance & Customer Support

Pros

- Sets up federal and state tax accounts for new household employers

- Tracks PTO accruals and other reimbursements

- Unlimited chat, email, and phone support with audit assistance, if needed

- Experts on staff for advising on compliance issues

- Access to Care.com’s network of caregivers and household staff

- Offers a “happiness” guarantee: new clients unhappy with HomePay’s services within the first six months can ask for a refund

Cons

- Doesn’t prepare, file, and remit local taxes

- Year-end tax preparation costs extra

- Lacks access to employee health insurance plans

Pricing

- $75 per month for one household employee, billed quarterly

- $100 for year-end tax preparation

HomePay by Care.com is the most expensive option on our list of best nanny payroll services. That might make sense since it manages the entire process, from setting up your employee in its system to processing payroll and managing taxes. It also has experts on staff who are available to advise on compliance issues. It has a self-service portal for your employee and gives you lifetime access to pay stubs and other payroll records—none of the other nanny payroll services we reviewed do that (except Paychex).

The solution scored 3.57 out of 5 in our evaluation, with a perfect score in its reporting capabilities. It would have gotten a higher score in payroll functionalities if it offered payroll tax services for all levels. With HomePay, only federal and state taxes are filed, and you need to pay for year-end tax preparation—unlike SurePayroll by Paychex, which doesn’t charge extra for this. It also scored the lowest in popularity because it doesn’t have user reviews on popular review sites like G2 and Capterra as of this writing.

HomePay offers a mobile-friendly payroll solution so you can easily set up automatic payments, adjust your nanny’s pay rate, and more. (Source: HomePay)

HomePay Features

Here are some additional details about HomePay’s features:

HomePay will only require your nanny’s email address to set up an online profile in its system. The provider will even collect the household employee’s personal information, W-4 withholding elections, and bank account information for you. Aside from HomePay, only Paychex offers this level of onboarding support.

HomePay calculates and facilitates employee payments automatically through direct deposit or manual paycheck. If you want to monitor your household staff’s attendance, HomePay has a mobile time-tracker app. The other nanny payroll service providers we reviewed lack time tracker apps (except Paychex, but it costs extra), although SurePayroll can integrate with time clock software.

It will also calculate and withhold applicable taxes or payments that need to be made for each pay period. However, unlike the other nanny payroll services on our list, HomePay handles federal and state taxes only.

Aside from new hire reporting, HomePay tracks PTO accruals and reimbursements. HomePay will also maintain general nanny information and payroll record-keeping for you.

HomePay’s self-service portal allows your household staff to view their payroll records and pay stubs online. You are also granted lifetime access to payroll and tax records.

Similar to the other providers in this guide, HomePay offers a service accuracy guarantee where it will handle any incurred tax penalties for mistakes its representatives make. On top of that, its “happiness” guarantee reimburses clients who are unsatisfied with HomePay’s quality of service within their first six months. None of the other providers on our list offer this.

HomePay’s connection with Care.com enables you to access its network of caregivers, tutors, nannies, and other household staff. It also provides online tools to help you find and hire household employees.

With HomePay, you can reach its customer support via phone, chat, or email on weekdays.

Special Mention—Poppins Payroll: Best for Households on a Budget

Pros

- Federal EIN setup

- Has paper check and direct deposit payment option

- Flat-rate fee

- Extensive bookkeeping

- Easy to use

Cons

- Services are available only in select states

- Support is only available during weekdays

Pricing

- $49/month

- $10/additional user

Poppins Payroll is the only payroll service on our list that does not charge extra for other additional services—everything is included in the monthly fee. It is also very easy to use, and even users not familiar with payroll can navigate it. Compared to the other providers on this list, it is not available in all 50 states—but it deserves special mention because it does not charge extra for its additional services, making it an ideal choice for households on a budget.

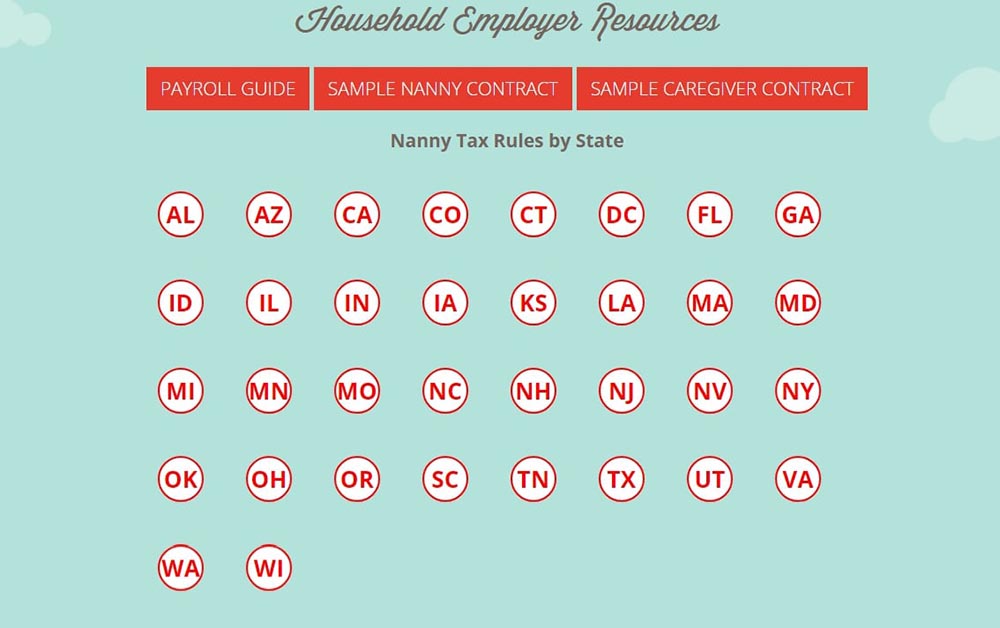

Poppins has an extensive resource where it answers questions related to payroll and tax in each state. (Source: Poppins Payroll)

Poppins Payroll Features

Poppins offers a variety of standout features including:

Poppins’ FAQs section is well-organized and easy to use, and it is regularly updated with new questions and answers. It is a valuable resource for users as it can help them find the information they need without having to contact customer support.

Poppins Payroll and HomePay are the two providers on this list that have this feature. However, Poppins has a wide range of sample nanny contracts to offer. These can be customized to fit the specific needs of each household. The contracts cover a variety of topics, including hours of work, pay, benefits, and termination. These are a valuable resource for users, as it can help them create a contract that is fair to both the nanny and the household.

Poppins Payroll has a secure online library that stores all of your tax and payroll documents. This includes your nanny’s W-4 form, your payroll reports, and your tax filings. The library is accessible to you at any time, from anywhere. It also keeps your data for five years, allowing you to access and print them when needed.

How We Chose the Best Nanny Payroll Service

To find the best nanny payroll service, we compared 18 nanny payroll services against features we believe are most important for those hiring household employees. Aside from pricing, we looked at pay and tax processing functionalities specific to nanny payroll. We also considered ease of use and customer support since household employers don’t usually have much experience with processing payroll.

Click through the tabs below for our full evaluation criteria.

30% of Overall Score

We prioritized providers that offer unlimited payroll runs, direct deposit payments, paper checks, and tax payment and filing services, including year-end tax form submissions (W-2 and Schedule H).

15% of Overall Score

We looked at the monthly costs and setup fees of the providers, as well as whether their pricing details are readily available on their websites. We gave preference to those that charge less than $50 per month for one employee and don’t have setup fees.

10% of Overall Score

A payroll service should allow homeowners to create payroll reports, customize them, and be able to export or import these reports.

15% of Overall Score

Payroll service and software should be easy to access and set up and have a user-friendly interface. We gave points to those that provide a dedicated representative, employer ID and tax set-up assistance, and live phone support that resolves issues promptly.

15% of Overall Score

This criterion reflects how well we think the software works for families in particular as far as price, tax prep, and ease of use.

10% of Overall Score

We prioritized providers that handle onboarding and offer a self-service portal for nannies to see payments made, edit information, and/or print forms. We also looked for providers that offer workers’ compensation and other employee benefits options, as well as access to experts who can advise users on compliance issues.

5% of Overall Score

We considered online user reviews from third-party sites like G2 and Capterra. We looked for providers with an average of 4+ stars and at least 1,000 reviews.

Nanny Payroll Frequently Asked Questions (FAQs)

Expand the sections below to get answers to some of your most frequently asked questions about nanny payroll.

Paying your nanny (or other household employees) is different from paying a casual babysitter or neighborhood kid to do your lawn. There are laws around having a domestic worker on your payroll—particularly if you pay them more than $2,400 in wages in a calendar year.

It’s important that you get nanny payroll correct. Partnering with a provider that offers nanny payroll services/software can help you navigate the intricacies of managing payments for household employees. Aside from ensuring that you remain compliant with federal and state laws, these providers have the essential tools to calculate wages and deductions accurately and prepare the required tax forms for filing to the IRS.

No, nannies cannot be considered independent contractors because the amount of control over their work hours and environment qualifies you as an employer according to the IRS. Thus, you are responsible for tax withholdings, Social Security and, in some states, workers’ compensation.

Beyond the legalities, registering yourself as a household employer and registering your nanny or other household workers as an employee offer some benefits. These include:

- Building your employment history

- Enabling household staff to collect unemployment insurance

- Building your Social Security

- Helping household staff qualify for loans

- Potential tax breaks for household employers under the Dependent Care Assistance Program (DCAP) and the Child and Dependent Care Tax Credit

You need a federal EIN from the IRS. Tax accounts with state and local agencies may also be needed, so it’s best to check the relevant guidelines in your area. In addition to your and your nanny’s name and Social Security numbers, you’ll be asked to provide your email address, the physical address where household staff will provide service, and the phone number associated with the physical address.

It is also important that you get new hire documents from your household staff to help confirm their identity and if they are authorized to work in the United States. Note that you shouldn’t employ workers who are unable to provide these documents. You should also verify the information they provided through E-Verify.

No, you can’t. It is illegal to process payments for your household staff through your business payroll.

Bottom Line

As a domestic employer, you have responsibilities, which include paying payroll taxes and providing certain benefits. Failure to do so, even in ignorance, can cost you hundreds of dollars in penalties. The best nanny payroll service provides you with the information and tools you need to handle your household employee payroll correctly and keep yourself compliant with federal, state, and local laws.

We found that SurePayroll by Paychex offers all the features that household employers need to manage nanny payroll. It has the expertise of working with small businesses but has a special program specifically for nannies and other household employees. It provides payroll, tax filing and payment services, and benefits. Sign up for a SurePayroll by Paychex plan and get one month free.