Point-of-sale (POS) reconciliation is the process of manually checking your POS sales records against your cash on hand and credit card processing statements to ensure there are no discrepancies. Not difficult but often tedious, it is a key part of the cash-handling process and helps prevent chargeback disputes.

Most service and retail businesses will only reconcile their POS at the end of a business day—before credit card transactions are batched and sent to their card processor. High-volume businesses, like restaurants operating with separate teams during different parts of the day, typically reconcile at least twice daily.

This article will walk you through the steps involved in POS reconciliation. We also provide a free template for logging your reconciliation sessions further below.

With a modern POS, POS reconciliation becomes less of a chore. To find your best fit, check out our ranking of the best POS systems for small businesses. For POS reconciliation, we like Square’s easy-to-read reports, which can really speed up your process. Visit Square to learn more.

Step 1: Close All Checks

Before you can begin your reconciliation, you want to ensure there are no open checks in your register or POS. If you have multiple ticket types that come from phone orders, online sales channels, or different types of on-premise sales, check under all categories. An open check can be one of the first things that throw off your reconciliation. Restaurants that accept online orders should also want toggle off incoming orders until the reconciliation is complete.

Step 2: Gather the Materials You’ll Need

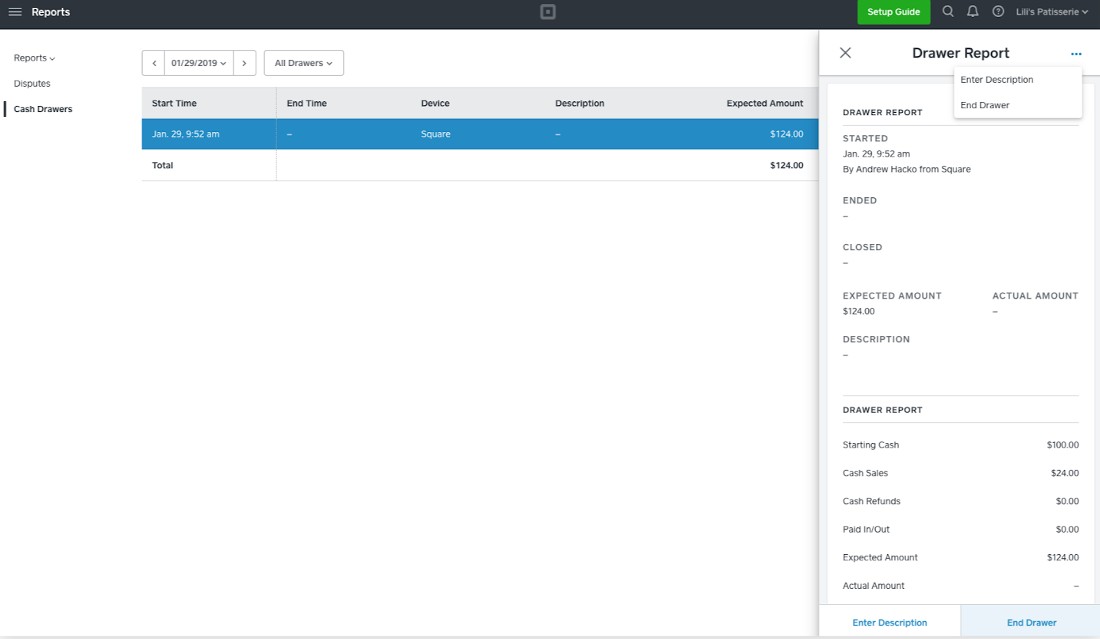

To start, you’ll need a full record of the day’s (or shift’s) POS sales transactions. The name of this report will vary by POS brand; most will call it an end-of-day register, cash report, transaction report, close-of-day report, or Z report. You’ll also need credit card processing batch statements, your cash drawer ready for counting, and receipts or logs from any cash paid into or out of the till throughout the day. Most modern POS systems prompt your staff to enter pay-ins and pay-outs as they process them and log them all on an easy-to-read report.

Square’s cash drawer report makes it clear how much cash to expect at the end of the day. (Source: Square)

What are pay-ins and pay-outs?

Pay-ins and pay-outs are non-sales-related cash amounts that are added or removed from the till during a shift. Pay-ins usually happen on busy days when the tills are running low on small bills and coins, so you add more cash to make change. Pay-outs commonly happen when a manager removes large bills to place in the safe, a cash tip is paid to a staff member, or petty cash is disbursed.

Accounting for pay-ins and pay-outs is part of your reconciliation process, so you should keep a record of these cash movements.

If your business is a bar or restaurant where several cash-handling employees hold on to cash transactions outside of a till, you’ll use their individual shift reports to reconcile their cash and credit card payments. But other than the report you use, the reconciliation process will be the same.

POS systems, including Square, will typically have end-of-shift reports as well as tools for managing and paying tip out or tip pools. This helps reduce manual counting and reduces discrepancies. Visit Square to learn more about its tip management system.

Step 3: Compare Card Transactions to Statements & Note Discrepancies

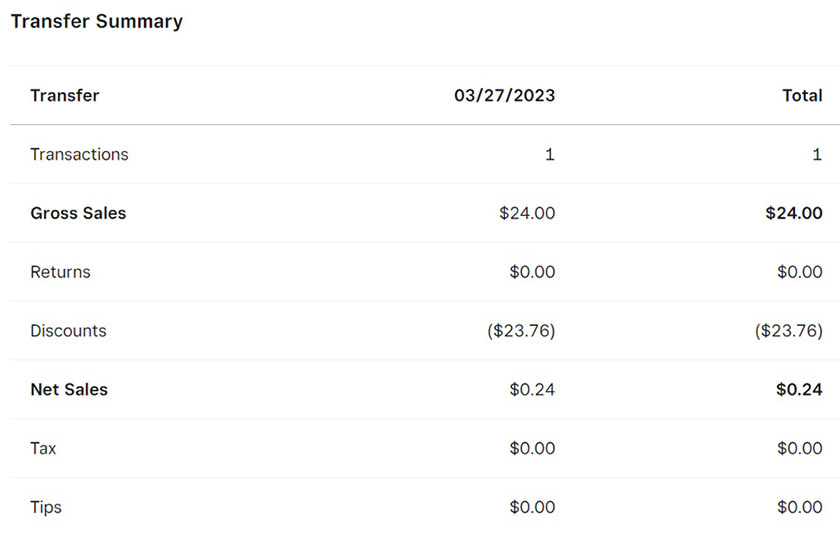

Look through your POS’s detailed transaction lists for each sale or refund for the period you’re reconciling. Cross-reference with your credit card batch statements and mark them if they match. If they don’t line up, make a note of it.

Remember that checks and echecks may take additional time to process. If these types of transactions make up a large portion of your business, you may want to do a separate reconciliation for these payment types.

Step 4: Compare Cash Transactions to Cash on Hand & Note Discrepancies

Add up all the cash sales for the day or shift and compare the total to the actual cash you have in the register. As we note in the best practices below, it’s good to start each day with the same amount of cash; this makes it easier to balance a cash register during end-of-day POS reconciliation.

Your POS system should keep track of all your transactions and transfers over a given time period and present these in a report.

Note any discrepancies you see. These could be simple errors in change counting, or they could reveal a pattern of theft.

Always count cash behind a locked door. You might take tills to the back office (if you have one) to audit, or lock your customer entrance until your count is complete. You never want to leave an open till on the sales counter while you tend to a customer or a staff issue. If you are alone in your building or close late in the evening—like a convenience store or nightclub—you should put two locked doors between your cash and the street.

Step 5: Correct Any Obvious & Reparable Errors

This is where a bit of detective work comes in. If you see any discrepancies in your reports or credit card batch, you should try to determine what it means before you close your operation for the day. Not every discrepancy will have a clear reason or fix. Each business is different, but by reconciling your POS every day, you’ll notice patterns in overages and know how to reconcile them.

For example, in spas, restaurants, or other tip-handling businesses, a $20–$40 card charge not associated with a specific transaction (and therefore showing as a cash overage) might be a tip that needs to be distributed to an employee. If you permit customers to add valet charges to their checks, overages might be cash that is owed to the valet service. Businesses that accept personal checks from customers might see a shortage of cash if a check got lodged at the back of the register drawer.

Depending on your POS system, you may have the ability to adjust credit and debit card transactions until the end of the business day. Many POS systems don’t send your credit card transactions to the bank the moment they are tapped, dipped, or swiped. Instead, those transactions are pre-approved and “batched.” So, POS users typically have time to correct credit and debit charges until the batch is finalized and sent to your processor.

Your credit card batch typically finalizes automatically when you run the end-of-day process in your POS. The sooner you spot errors like overcharges, double charges, or misentered tip amounts, the easier it is to reconcile them. Take the time to correct these erroneous charges before a customer calls you to complain of an overcharge (or, worse, initiates a chargeback dispute).

Speaking of chargebacks: If you are using a POS, be sure that your credit cards are clearly processed under your business name; otherwise, you’ll get a lot of confused customers initiating disputes when they see the phrase “POS” on their bank statement. POS is a common term in the retail and restaurant world, but can be confusing to customers.

Learn more about preventing chargebacks in our guide.

Step 6: Create a Log for Each POS Reconciliation Session

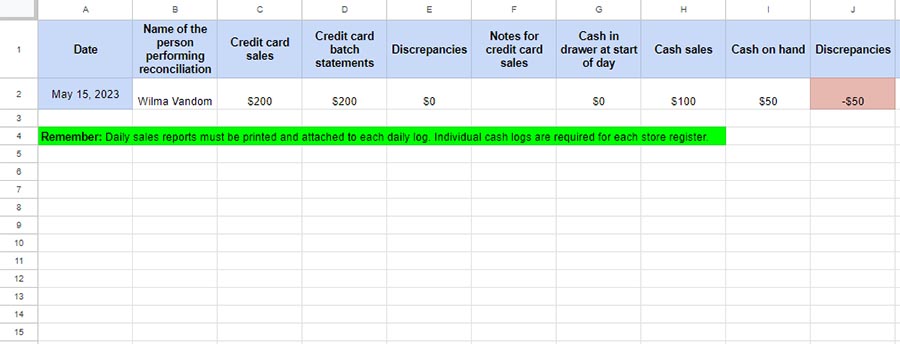

This log can be a spreadsheet or a simple sheet of paper that you use every day to note the day’s POS reconciliation. Be sure to note the date, any discrepancies, and the totals for credit card statements and cash sales.

You should organize the reports you used to perform your reconciliation neatly with this log so there is a clear record if questions arise. Your bookkeeper or accountant will be eternally grateful. And, if there are any unresolved errors, they will have all the relevant information to help you solve them.

POS Reconciliation Log Template

Download this free template you can use to log your POS reconciliation.

Step 7: Provide POS Reconciliations to an Accountant or Tax Professional

Keep your POS reconciliation documents neatly filed and close at hand for at least a year. Your accounting professional may request your logs regularly or when it’s time to handle taxes. Provide them when needed.

Tip: You can keep your end-of-day reports and reconciliation logs neatly stored in a binder with a sheet protector for each day’s documents. If you want, you can even store deposit slips or any receipts from petty cash purchases as well. Bars and restaurants that have lots of daily POS reconciliations may prefer bank boxes. Keep these records in a locked safe or filing cabinet.

Benefits of Performing POS Reconciliation

One of the best features of a POS system is that it automatically produces analytics and reports to give you clear insight into your business’ health and let you keep track of all transactions settled via various forms of payment. So, why bother with the manual process of POS reconciliation? Because when you cross-reference each transaction with your POS logs, you’ll have a better understanding of your business needs, spot patterns and trends that help maximize your efficiency, and prevent long-term accounting errors.

Here are six of the biggest benefits of POS reconciliation:

Keeping your books accurate is vital for business longevity as well as staff accountability. Each time you compare your transactions and cash-on-hand with your POS reports, you’ll be able to identify discrepancies—and possibly find patterns so you can stop the errors, whether these are due to honest mistakes or malicious action.

This is not a trivial issue, as more than 30% of fraud incidents in small businesses are connected to the business’ employees—they either became careless with security measures, or abused their access or privileges.

While credit and debit cards are popular payment methods at point-of-sale, cash payments are still significant and shouldn’t be ignored. Cash is still a frequently-used method of payment, roughly tied with digital wallets and still in wider use than methods like Buy Now, Pay Later.

Thus, you need to know how much cash you receive in payments every day. Balancing all your transactions daily ensures that your deposit amounts are accurate. If you discover a mistake only after you deposit your cash, it’s a much bigger headache to correct it.

A large percentage of chargebacks (15%–35%) are due to merchant error. If you made the error, you cannot dispute the chargeback. At $25–$100 per chargeback, plus the lost revenue and processing fees, this can add up. You can save yourself time and money by performing daily audits.

Aside from simply catching errors and unauthorized transactions, regular reconciliation can give you a clearer picture of your business and its performance. You’ll become familiar with hot-selling items and each day’s sales volume, so you can make better-informed decisions for your business.

POS reconciliation will help you see which of your employees are your top sellers. On the flip side, you’ll also be able to tell who’s making mistakes with transactions or possibly identify thieves among your workforce.

POS Reconciliation Best Practices

If you haven’t been performing regular POS reconciliation, it’s OK. You’re committing to doing it now, and it’s important that you follow a few best practices for POS reconciliation. These tips will help ensure your books are accurate and you’re not losing money.

- Use integrated credit card processing: When you use the best POS hardware, you should see few errors because they typically include integrated payment processing terminals. The fewer tasks employees have to do manually, the fewer errors you’ll see.

- Limit one employee per till: If you designate one employee per register, it’ll be easier to identify issues when you do POS reconciliation. If you have more employees than registers, look for a POS system that supports dual cash drawer tills. (Toast and Revel Systems are two examples.) This allows you to assign individual cash drawers to staff who use the same register. Or, in the case of a bar or restaurant, ensure that all employees have their own login code to use when processing transactions. You’ll also want to stay on top of setting appropriate POS permissions for each employee to reduce the possibility of unauthorized transactions or transfers.

- Have a manager conduct audits: As the owner, you could perform POS reconciliation, or you could assign the task to a trusted manager, department head, or even your accountant.

- Open with the same amount of cash every day: Start each day with the same amount of cash on hand and the same amount of cash in each till. This makes it much easier to spot overages and other errors at the end of the day or shift.

- Tailor procedures to your business: Small retailers and service businesses may review all the day’s transactions on a single transaction report. Restaurants and retailers with multiple tills and cashiers, however, will typically audit their cash and credit card transactions by staff member. This breaks up the reconciliation tasks into smaller chunks throughout the day, as you’ll reconcile each POS and till as your payment-processing staff members complete their shifts and clock out. Whichever procedure you decide to adopt, ensure that you perform reconciliation regularly and account for every dollar that changes hands.

- Be consistent: If you want to do daily POS reconciliation, don’t skip a day. Smaller businesses that process fewer payments may opt to reconcile weekly, bimonthly, or monthly.

POS Reconciliation Frequently Asked Questions (FAQs)

Every business should reconcile their POS and transactions at the end of each business day. High-volume businesses like busy restaurants may reconcile their POS and cash drawers multiple times per day, typically to coincide with a shift change.

POS reconciliation should be performed by a business owner, manager, or shift leader.

Sales reports, credit card processing statements, your cash drawer, and records of any pay-ins, pay-outs, tips, or other cash movements.

The term “POS” on a bank statement refers to a “point-of-sale” purchase, typically made in-person with a debit card. It is best practice for merchants to make sure their business name and/or phone number appear on bank statements. However, sometimes businesses forget to change it and appear as a DBA, their merchant account provider, or the point-of-sale system they are using.

Bottom Line

When you regularly compare and balance your expected sales (those in your POS software) with the actual numbers from your credit card processing statements and cash drawers, you’re warding off potentially big accounting errors. You could spot patterns of theft or small discrepancies that, over time, add up to significant losses.

Performing POS reconciliation may be one of the more mundane tasks of a business owner’s life, but it’s also rewarding. You’ll have better insight into your business’s health and see who’s excelling or struggling with sales, what’s selling and what isn’t, and, possibly, what’s slowly picking at your profits. By regularly absorbing all the transaction data, you’ll be able to make better-informed decisions for your business.