QuickBooks Bill Pay is an accounts payable (A/P) automation tool within QuickBooks Online. It allows you to send checks and ACH payments to vendors, and your vendors can accept the payments without enrolling in QuickBooks Bill Pay. I find it similar to other online bill pay services like BILL and Melio, but QuickBooks Bill Pay is built exclusively for QuickBooks Online users.

Its free plan is included with any QuickBooks Online subscription and provides up to five monthly ACH payments. Paid plans offer additional tools like approval workflows, and prices start at $15 per month in addition to your QuickBooks Online subscription. Find out if it’s right for you through my detailed QuickBooks Bill Pay review.

Pros

- Can be set up and used directly within QuickBooks Online

- Lets you schedule payments in advance and set reminder

- Can accommodate multiple users in payment approval processes

- Allows you to assign user roles and permissions in the Elite plan

- Provides unlimited filing of 1099s for Premium and Elite users

Cons

- Requires a monthly subscription to QuickBooks Online, which starts at $35 per month

- Can’t process international payments

Monthly Pricing for QuickBooks Bill Pay |

|

Monthly Pricing for QuickBooks Online |

|

Free Trial | QuickBooks Online has a 30-day free trial during which you can use the free version of QuickBooks Bill Pay. |

Discounts | 50% off for three months without the free trial (applies to any QuickBooks Online plans and all paid QuickBooks Bill Pay plans) |

Customer Support | Phone support, live chat, chatbot, online resources, and access to assistance from product experts focused on QuickBooks Bill Pay |

Average User Review Rating | No user reviews as of this writing |

- QuickBooks Online users with a high volume of contractor work: Its automated 1099 tracking and unlimited 1099 filing in Premium and Elite Plans help you easily manage frequent contractor payments.

- QuickBooks Online users needing to send only a few ACH payments each month: The Basic plan allows you to process up to five ACH transactions monthly for free.

- QuickBooks Online users requiring multi-step approval processes: When you upgrade to the Elite plan, you can set up multiple team members to authorize or review payments before processing.

QuickBooks Bill Pay Alternatives & Comparison

QuickBooks Bill Pay Reviews From Users

I couldn’t find any QuickBooks Bill Pay reviews as of this writing, but you can check back in our next update to see if any become available. In the meantime, you can read what users have said about QuickBooks accounting software in our detailed QuickBooks Online review.

QuickBooks Bill Pay Pricing

QuickBooks Bill Pay comes in three subscription options, as summarized in the table below.

Basic | Premium | Elite | |

|---|---|---|---|

Monthly Cost | $0 | $15 | $90 |

ACH Payments ($/Transaction) | Unlimited | ||

Expedited ACH Payments ($/Transaction) | $10 | $10 | $10 |

Check Payments ($/Transaction) | $1.50 | $1.50 | $1.50 |

Automated Bill Creation | ✓ | ✓ | ✓ |

Auto-match Transactions | ✓ | ✓ | ✓ |

Unlimited 1099 Filing | ✕ | ✓ | ✓ |

Roles & Permissions | ✕ | ✕ | ✓ |

Bill Approval Workflows | ✕ | ✕ | ✓ |

QuickBooks Bill Pay offers a 50% discount on its paid plans. While you can test Bill Pay using the free Basic plan, there isn’t a free trial to try features in the paid plan. Also, as I mentioned earlier, you need an active QuickBooks Online subscription to use QuickBooks Bill Pay. If you don’t have one yet, you can choose from four subscription options:

- Simple Start: $35 per month for only one user

- Essentials: $65 per month for up to three users

- Plus: $99 per month for up to five users

- Advanced: $235 per month for up to 25 users

QuickBooks Bill Pay Features

QuickBooks Online Integration

Since QuickBooks Bill Pay is embedded within QuickBooks Online, payment data syncs automatically across all accounts involved. For instance, when a payment is completed in QuickBooks Bill Pay, QuickBooks Online updates the vendor’s account with the transaction, records it in the general ledger as an expense, and adjusts the cash balance in the cash flow statement.

Payment Processing via ACH or Checks

QuickBooks Bill Pay lets you send payment via ACH or check and also offers expedited ACH payments (usually by the next business day) for an additional $10 per transaction. Check payments are $1.50 each, and depending on your plan, you have between five and unlimited ACH payments included.

Batch Payment Processing

You can consolidate multiple payments to a single vendor into a single transaction instead of processing separate payments for each invoice. I find this feature beneficial for businesses that process a large volume of vendor bills, such as those in retail or wholesale business.

1099 Filing

QuickBooks Bill Pay captures all of your vendor information in one place so that you can view everyone who needs a 1099 in one place, which will help you to stay compliant. Will Bill Pay Premium or Elite, you can file and issue 1099s to your contractors for no additional fee.

Customized User Roles & Permissions

If you want to give members of your team access to bill payments but limit access to other areas of QuickBooks Online, you can assign user roles and permissions to decide who can create, approve, and pay bills. This feature is available with the Elite plan.

Approval Workflows

Available with the Elite plan, you can set up bill approval workflows to reduce unauthorized payments. You can assign specific team members who will create, review, and approve bills before they are processed.

QuickBooks Bill Pay Ease of Use

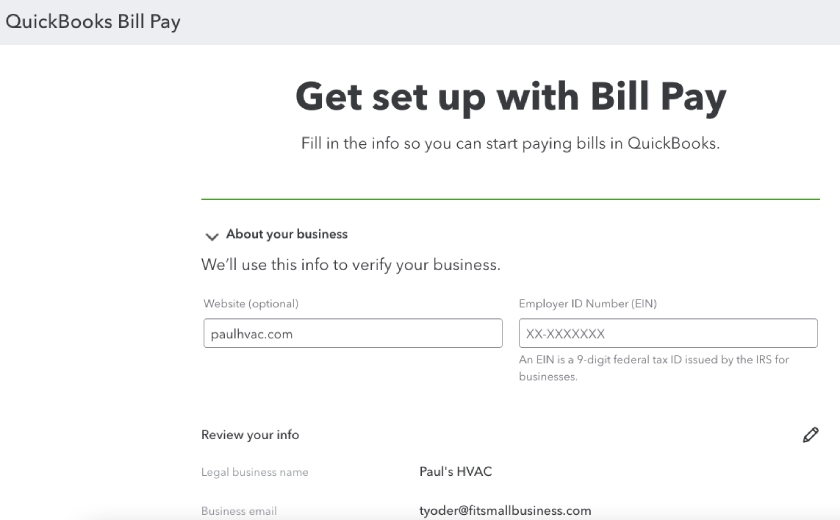

QuickBooks Bill Pay is easy to use because it’s built inside the familiar QuickBooks Online interface. I was able to access and sign up for it directly from my QuickBooks Online account through the Schedule payment button on the bill payment screen.

It took me to the QuickBooks Bill Pay signup page, and after selecting a plan, I was able to set up QuickBooks Bill Pay by providing important details like company information and bank account details.

Setting up QuickBooks Bill Pay from within QuickBooks Online

QuickBooks Bill Pay Customer Support

In addition to the standard customer support included in your QuickBooks Online subscription (e.g., phone and live chat), you’ll have access to specialized support from product experts who specifically focus on QuickBooks Bill Pay. You can talk to them through live chat or by sending a callback request and waiting for an agent to call you. For Advanced subscribers, you’ll be able to contact support directly over the phone.

How I Evaluated QuickBooks Bill Pay

When evaluating QuickBooks Bill Pay, I looked into important factors, including:

- Ease of Use: I checked whether QuickBooks Bill Pay is easy to set up and use, especially for those who have no dedicated accounting or A/P staff. I also determined whether the key functions are as intuitive and consistent with QuickBooks Online’s other features.

- QuickBooks Online Integration: Since it’s designed for QuickBooks Online users, I tested whether QuickBooks Bill Pay seamlessly integrates with the other QuickBooks features. For example, I checked whether payment statuses are updated automatically in QuickBooks Online when processed through QuickBooks Bill Pay.

- Core A/P Features: I looked into essential A/P features, like real-time payment tracking, automated invoice capture, international payment processing, and customizable approval workflows. I also checked what features are missing in QuickBooks Bill Pay that are offered in other similar products like BILL and Melio.

- Pricing: I reviewed QuickBooks Bill Pay’s pricing structure to see if each plan offered good value for the features provided.

- Customer Support: I assessed whether QuickBooks Bill Pay includes essential customer support options to assist users with both general and bill-specific questions and concerns. There should be specialized assistance through product experts focused on QuickBooks Bill Pay.

Frequently Asked Questions (FAQs)

No. While both are direct integrations with QuickBooks Online, Bill Pay is an automated A/P service, while Payments helps streamline your A/R process by accepting payments via cards, digital wallets, ACH, PayPal, and Venmo.

Yes, all QuickBooks Online plans automatically include basic bill management features. If you want to send more than five ACH payments to contractors and vendors using QuickBooks, you’ll need to select a Bill Pay plan.

Yes, QuickBooks Online uses advanced encryption and authentication technologies, including secure sockets layer (SSL), digital certificates, and RSA Security, Inc. (RSA) encryption to protect the security and privacy of your financial information.

QuickBooks Bill Pay lets you send checks and ACH payments to vendors. Vendors don’t need to be enrolled in QuickBooks Bill Pay to receive payments. Before signing up for QuickBooks Bill Pay, you’ll need a subscription to QuickBooks Online, which you can learn more about in our QuickBooks Online Review.

Bottom Line

QuickBooks Bill Pay seamlessly integrates with QuickBooks Online, allowing you to automate bill payments and better track your accounts payable. I like that it has a free plan, but its paid options are relatively higher compared with more affordable options like Melio.