QuickBooks Enterprise is desktop-based accounting software that provides powerful tools to manage complex accounting needs, like advanced inventory management, job costing, and customizable reporting. I find it an excellent choice for small to midsized companies—especially those with large inventories—but it’s too expensive and complex for very small businesses keeping their own books.

It contains all of the features of Pro and Premier, the other QuickBooks Desktop accounting products that have been discontinued for new users since October 1, 2024. Existing Pro and Premier users can still renew their subscriptions, but the only option available for new users is Enterprise, which I’ll evaluate in detail in this comprehensive QuickBooks Enterprise review.

Pros

- Most powerful QuickBooks Desktop accounting product

- Advanced inventory tools, like bin and location tracking and barcode scanning

- Industry-specific versions

- Consolidate financial statements from multiple companies

- Fixed asset management tools

- Ability to create custom pricing rules

- VIP customer support through Priority Circle membership

Cons

- Desktop program requiring installation, setup, and continuous updates

- Cloud access requiring additional hosting fees

- Too expensive and complex for very small businesses

- Limited mobile accounting app (only for receipt capture and mileage tracking)

- Complex upgrade process

Local Version Pricing |

All prices are for one user. |

|---|---|

Cloud Version Pricing |

All prices are for one user. |

Number of Users | |

Discounts | ✕ |

Free Trial | ✕ |

Money-back Guarantee | 60 days from the purchase date |

Ease of File Sharing | Requires you to make an Accountant’s copy to share with your accountant (acceptable but not as convenient as file sharing in QuickBooks Online, where you only need to send an invitation email to your accountant) |

Customer Support | Unlimited support through QuickBooks Priority Circle, community forums, live chat, chatbot, and self-help guides |

Average User Review Ratings |

- Small and midsize businesses: QuickBooks Enterprise supports up to 40 users and can track up to 1 million items, employees, customers, and vendors.

- Companies needing advanced inventory management: You can track inventory by location and bin and even generate customized barcodes to track an item.

- Businesses with a large volume of invoices: The batch invoicing feature lets you send out multiple invoices at once with one click.

- Companies managing fixed assets: QuickBooks Enterprise has a built-in Fixed Asset Manager that serves as your hub in managing fixed asset information, depreciation methods, groupings, and basis.

- Businesses with multiple entities: One license allows the accounting for unlimited entities, and QuickBooks Enterprise 24.0 lets you consolidate financial statements from multiple companies.

QuickBooks Enterprise Alternatives & Comparison

If you want to consider additional options, check out our roundups of the

| Users Like | Users Dislike |

|---|---|

| Robust feature set | Expensive |

| Extensive scalability and capacity | Not user-friendly |

| Advanced reporting | |

I browsed through many QuickBooks Enterprise reviews, and here are some of the key insights I gathered, along with my expert opinion.

- Feature-rich: One user explained that their experience with QuickBooks Enterprise is generally positive, highlighting that it is reliable and feature-rich. I agree with this, as it provides many advanced features that small to midsize companies need, like advanced inventory and customizable reporting.

- Availability of industry-specific editions: Another reviewer likes that Enterprise provides industry-specific versions for fields like manufacturing, construction, and retail. I also appreciate this functionality and want to highlight that it’s the only software I’ve reviewed that offers specialized editions for niche-specific uses.

- Is scalable and has high data capacity: Some praised Enterprise for its scalability and ability to handle large data volumes. I looked into it myself, and I found that the latest version of QuickBooks Enterprise lets me add up to 1 million names (customers, vendors, employees) and up to 1 million items (inventory, service items, etc.).

- Not user-friendly: I can relate to users who find Enterprise complicated. Some of its advanced features are difficult to learn, so I recommend setting aside some time for the learning process.

- Costly: Some reviewers mentioned that Enterprise is a bit expensive, especially for small businesses. One even pointed out that it’s more expensive than the other QuickBooks products and that it’s prohibitive, especially when considering the possible additional fees for payroll integration and cloud hosting for remote access.

I understand those concerns. However, I also want to highlight that Enterprise’s value and comprehensive features for larger, more complex businesses can make it worth the price.

As of this writing, here’s how QuickBooks Enterprise is rated on third-party review sites:

- Software Advice[1]: 4.5 out of 5 from over 20,000 reviews

- G2[2]: 4.2 out of 5 from about 1,000 reviews

Using the Fit Small Business accounting team’s expert-led internal case study, I was able to compare QuickBooks Enterprise with my top recommended alternatives—QuickBooks Online, Xero, and AccountEdge. The chart below sums up my findings.

QuickBooks Enterprise vs Competitors

Touch the graph above to interact Click on the graphs above to interact

-

QUICKBOOKS ENTERPRISE FROM $142 PER MONTH

-

QUICKBOOKS ONLINE PLUS $99 PER MONTH

-

XERO ESTABLISHED $80 PER MONTH

-

ACCOUNTEDGE PRO $20 PER MONTH

As you see from the chart above, Enterprise outclassed competitors for inventory management. It’s as powerful as QuickBooks Online in terms of banking, A/P and A/R management, and reporting, but Enterprise scored higher for project accounting because of its advanced job costing features.

It’s weaker than its competitors in some areas, like general features and sales tax management, but its biggest drawbacks are usability and mobile app. The dip in the usability score is due to its low rating for ease of use and bookkeeping assistance, which I’ll cover later.

The balance between pricing and value is why my Value rating for QuickBooks Enterprise is relatively high. While the tool’s a bit expensive, its robust features and overall capabilities make it well worth the price. Also, it offers tiered pricing, so you pay lower fees for each additional user after the first one.

QuickBooks Enterprise is available in four local editions, starting at $142 a month or $1,481 each year. You may also purchase the cloud version, with monthly prices from $180 for the Core edition’s Silver tier. There’s no free trial available, but Enterprise comes with a 60-day money-back guarantee.

Local Version

The table below provides a detailed pricing breakdown of the local QuickBooks Enterprise version based on the number of users.

Cloud Version

Enterprise offers a hosted version for those needing remote access to their files. There are three subscription options available, as summarized in the table below.

Before I discuss Enterprise’s key features based on our case study, I’ll show how the four plans compare in terms of functionality. All include core accounting features, such as A/P and A/R management, banking, inventory management, project accounting, advanced reporting, and access to QuickBooks Priority Circle.

However, there are significant differences, as outlined in the table below.

Silver | Gold | Platinum | Diamond | |

|---|---|---|---|---|

Maximum Number of Users | 30 | 30 | 30 | 40 |

Enhanced Payroll | ✕ | ✓ | ✓ | ✓ |

Advanced Inventory Management | ✕ | ✕ | ✓ | ✓ |

Advanced Pricing Management | ✕ | ✕ | ✓ | ✓ |

Intercompany Transactions | ✕ | ✕ | ✓ | ✓ |

Bill and PO? Workflow Approvals | ✕ | ✕ | ✓ | ✓ |

QuickBooks Desktop Assisted Payroll | ✕ | ✕ | ✕ | ✓ |

QuickBooks Time Elite | ✕ | ✕ | ✕ | ✓ |

Salesforce CRM Connector | ✕ | ✕ | ✕ | ✓ |

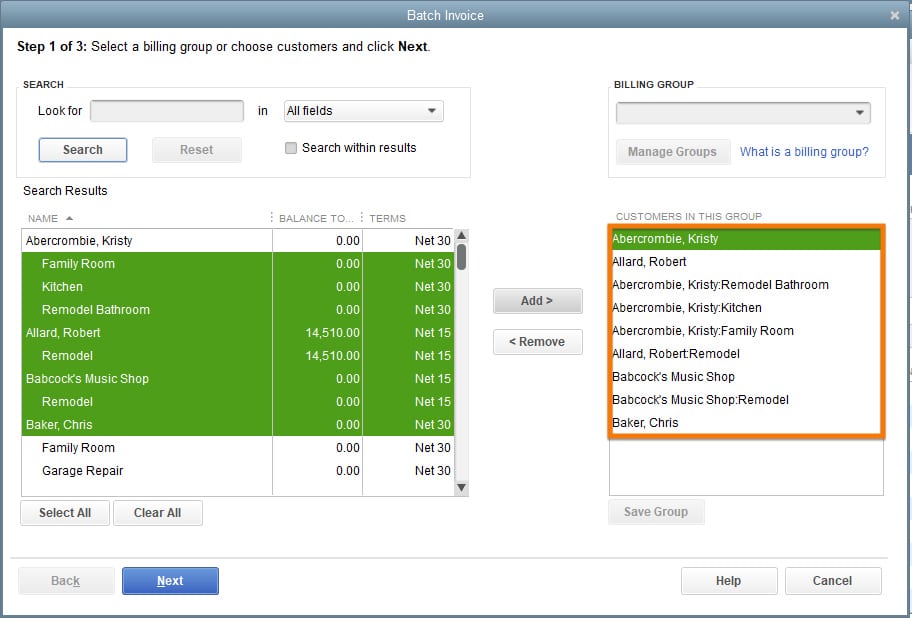

Invoicing with QuickBooks Enterprise is similar to other QuickBooks products—I can create and customize invoices and send them out as PDFs or emails. Enterprise even takes it one step further by allowing users to create and send invoices in batches—as opposed to entering information for each individual invoice manually.

Batch invoicing allows me to create invoices in bulk from a single-entry input, saving me time and effort. If you have multiple clients who are billed monthly for similar ongoing services, you can create all of their invoices at once.

Batch invoicing feature in QuickBooks Desktop Enterprise

I can easily track outstanding receivables by running an A/R aging report, which provides me with a detailed breakdown of unpaid invoices and their invoicing status. This helps me identify overdue accounts for follow-ups.

If needed, I can also send customer statements to remind clients of their outstanding balances. However, I’d like to see Enterprise add a new feature for automated payment reminders, something QuickBooks Online offers.

QuickBooks Enterprise Notable New Features for 2024

- Improved report readability: Enterprise now includes a zoom report feature that allows you to zoom out reports up to 75% and zoom in up to 225%. This is purely visual and doesn’t affect how your reports are printed.

- Link purchase orders (POs) to sales orders (SOs): You can now link SOs to their associated POs, helping you better manage the order fulfillment process. By linking these transactions, you can better track the status of each SO item, whether it has been received through an item receipt or a bill transaction.

- Inventory category view in reports: This new feature enables you to categorize and report items based on specific product categories, giving you more detailed insights into your inventory. For instance, I can use it to analyze how different product categories contribute to overall sales and profitability.

Enterprise took a hit in my assessment of this category because it has limitations.

For example, since it’s desktop software, it’s not very convenient to share files with my accountant as I have to create an Accountant’s Copy first. This isn’t as convenient as in cloud-based software like QuickBooks Online where I can simply send an email invitation to my bookkeeper. Also, while custom fields are available, I would prefer having the option to use custom tags for more detailed tracking, similar to what QuickBooks Online offers.

However, Enterprise still provides many of the general features that I wanted to see, such as the ability to set up a company profile, record entity type, and modify and import a chart of accounts from my previous accounting software. I can also set a closing date to lock prior-year transactions so that no one can accidentally or intentionally modify them.

Enterprise aced this criterion because it provides advanced tools for managing bank transactions, including automated bank feeds and bank reconciliation. For more flexibility, I can choose to connect my bank account (bank feeds) or upload my files of statements manually.

Another thing I like most is that QuickBooks has a streamlined Undeposited Funds account that holds separate invoice payments and sales receipts I want to consolidate to match the single deposit in my bank statement. Some accounting programs also have an Undeposited Funds account, but they aren’t as comprehensive as QuickBooks Enterprise’s.

The only reason I didn’t give Enterprise a perfect mark is the lack of a customer portal where clients can track invoices and make payments directly. This could have been a time-saving feature, especially for those with long-term customers who are likely to take advantage of the portal. However, aside from that, I love everything about Enterprise’s A/R features.

Invoicing with QuickBooks Enterprise is similar to other QuickBooks products—I can create and customize invoices and send them out as PDFs or emails. Enterprise even takes it one step further by allowing users to create and send invoices in batches—as opposed to entering information for each individual invoice manually.

Batch invoicing allows me to create invoices in bulk from a single-entry input, saving me time and effort. If you have multiple clients who are billed monthly for similar ongoing services, you can create all of their invoices at once.

Batch invoicing feature in QuickBooks Desktop Enterprise

I can easily track outstanding receivables by running an A/R aging report, which provides me with a detailed breakdown of unpaid invoices and their invoicing status. This helps me identify overdue accounts for follow-ups.

If needed, I can also send customer statements to remind clients of their outstanding balances. However, I’d like to see Enterprise add a new feature for automated payment reminders, something QuickBooks Online offers.

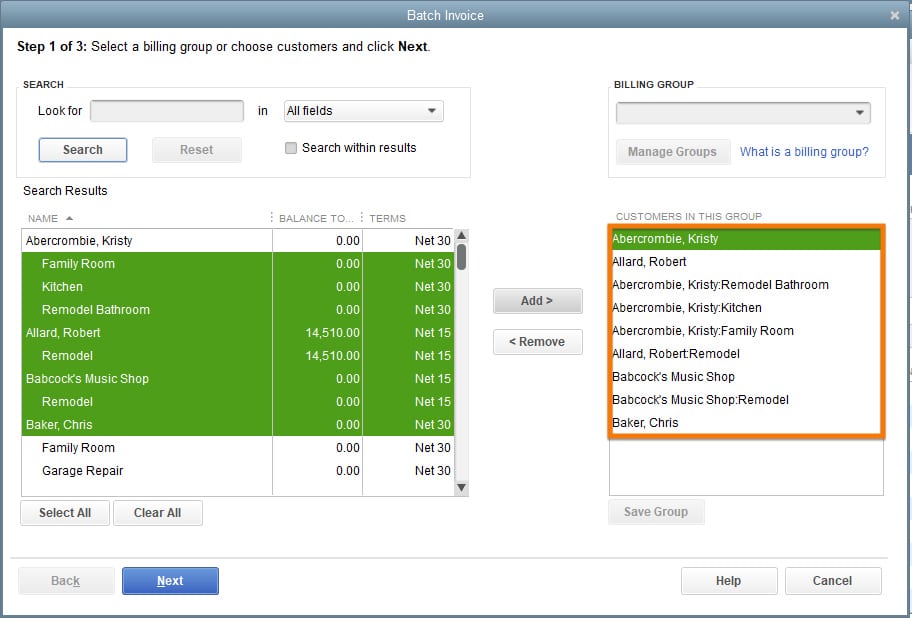

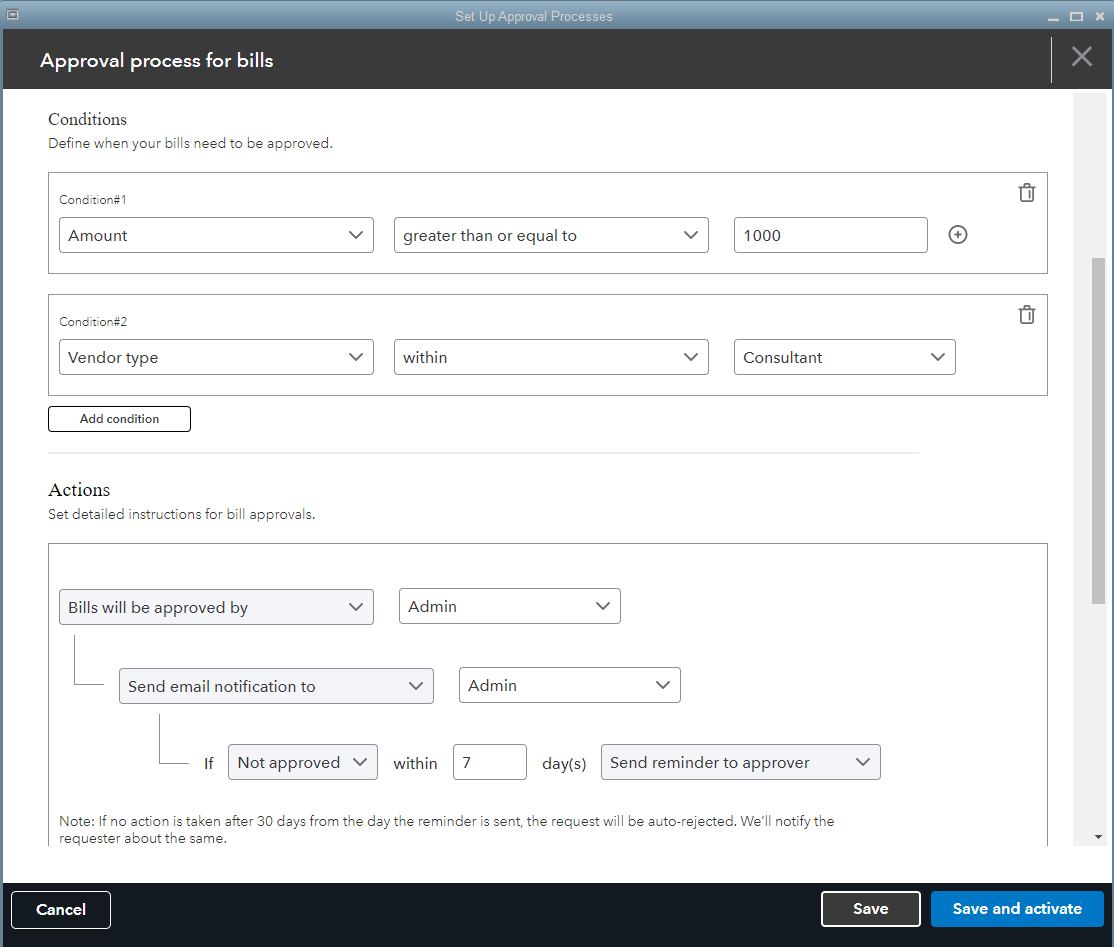

Enterprise would’ve nailed my evaluation of A/P management if it had a vendor portal where suppliers could easily submit bills and track payments. However, I don’t think it’s necessarily a deal-breaker, as Enterprise provides robust A/P management features.

It allows me to enter and pay bills and track outstanding bills until they’re paid. I can also record POs and convert them to bills when I receive the items I ordered. To simplify the payment process, I can set up online bill pay and make partial bill payments. Enterprise even allows me to create an audit trail for bills and POs to help me simplify the A/P management process.

If I upgrade to Enterprise Platinum or Diamond, I’ll be able to set up custom approval workflows for my bills and POs. This feature helps me gain complete control over the purchases made within my businesses, e.g., I can designate a team member as an approver of A/P transactions and track the status of each transaction that requires approval.

What’s more, I can set up a new approval workflow to streamline bill approval processes. As an example, I can set up a condition, such as any bill greater than $1,000 from a vendor who I classify as a service provider, and when that condition is met, the transaction must be approved by a designated approver. I can also specify what happens if the approver doesn’t approve the transaction within a certain period, such as sending a reminder email to the approver.

Setting up a new workflow approval process for bills

QuickBooks Enterprise has the strongest inventory management features of any accounting software I’ve reviewed. Its advanced inventory module provides enhanced features not found in the other QuickBooks products, including the ability to track inventory across locations.

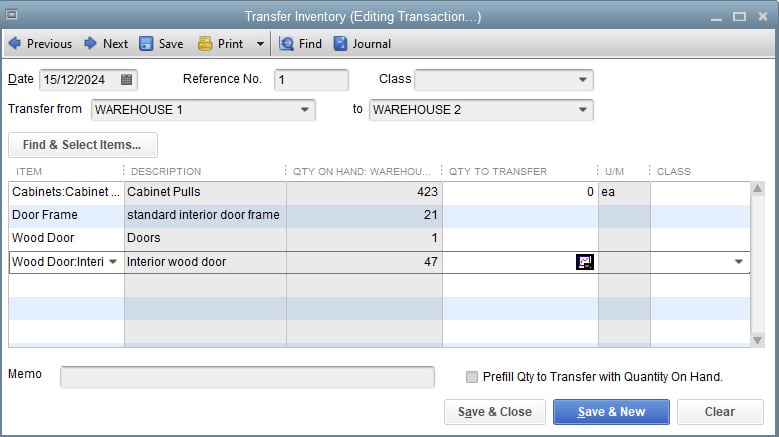

Multi-inventory tracking in Enterprise lets me set specific reorder points, so I’ll be alerted when to replenish stocks, create assemblies using parts from different locations or warehouses, and transfer items between locations.

Transfer inventory between locations in QuickBooks Desktop Enterprise

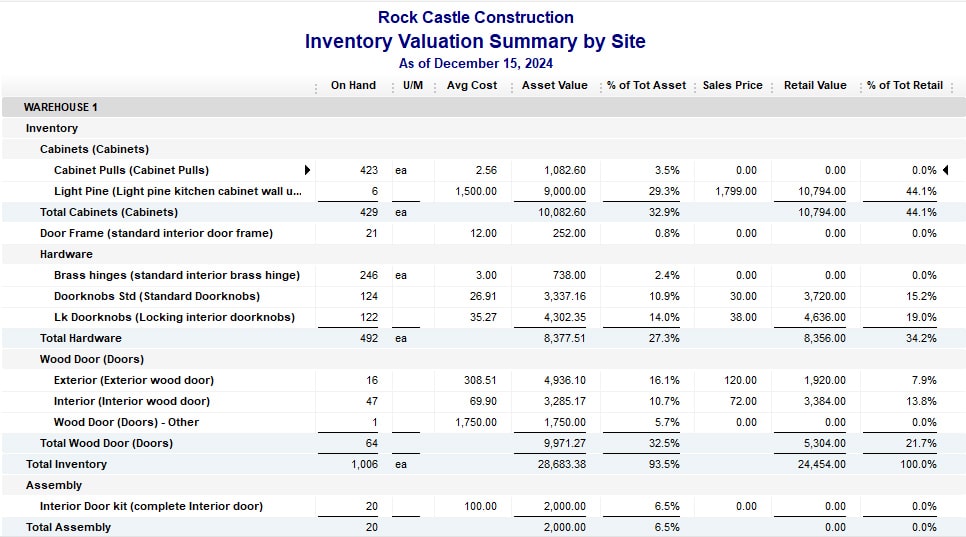

I can use mobile barcode scanning to automate data entry, track inventory by bin numbers, and create customized inventory reports, such as inventory stock by item, inventory valuation summary, and assembly shortage by item. With Enterprise, I also have the option to choose between the FIFO method and the average cost method to track inventory cost.

Another notable feature I want to emphasize is the ability to create pricing rules that automatically adjust pricing based on your specifications. For instance, I can set up a rule where my top 10 customers will receive a 20% discount automatically if they purchase 10 items or more.

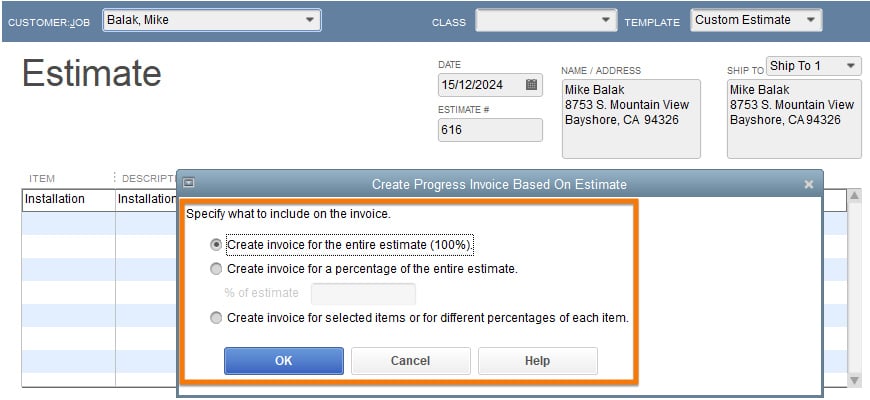

I find QuickBooks Enterprise ideal for project-based businesses like construction companies. I can create an estimate, and when that estimate is approved, I can convert it to an invoice instantly. I can also split estimates into as many invoices as needed (progress invoicing) instead of asking for a full upfront payment.

As I complete the needed service, I can simply add items from the original estimate to progress invoices. When creating a progress invoice from an estimate, I need to specify how much I want to charge for the selected items on the invoice.

Progress invoicing in QuickBooks Desktop Enterprise

I can create change orders by editing the original estimate if changes are needed to the scheduled construction work. QuickBooks will create a change order automatically based on the information entered.

Another important feature I want to highlight is the ability to compare estimated vs actual project costs. This helps me determine whether a project is profitable or if I need to make some adjustments to my budget and expenses.

I won’t say that QuickBooks Enterprise is the best tax management solution, as it doesn’t help you file sales tax returns. This is partly what cost it points in my review.

Also, I wish that it could automatically calculate sales tax rates to be added to an invoice, which would be incredibly useful for businesses that ship products across different states or regions. If you operate in multiple sales tax jurisdictions or face other sales tax complications, I recommend integrating QuickBooks Enterprise with Avalara, a great sales tax management system.

However, if you only need help with tracking your taxes, then the platform can still provide a good value. You can determine how much you owe in taxes easily using the Sales Tax Liability Report. Sales taxes can be added to your invoice, and the program will automatically apply the appropriate sales tax rate based on the type of product or service, customer, and location you indicate in your sales form.

The platform allows me to run all the important reports I need to track my business performance, whether these are standard reports, such as P&L statements, balance sheets, or cash flow statements. I can also create customized reports like job costing, sales by customer reports, and purchases by vendor reports.

Sample report on inventory by location in QuickBooks Enterprise

Sample report on inventory by location in QuickBooks Enterprise

One of the best reporting features of Enterprise is the ability to generate consolidated financial statements across multiple company files. This is particularly useful for businesses that manage several entities or subsidiaries and need a consolidated view of their financial performance. The program syncs data from all connected company files so that the data in the reports is always up-to-date.

This category took a huge hit in my evaluation because the mobile app is designed only to capture expense receipts and track business mileage. From my smartphone, I can snap a picture of my receipt and upload it to QuickBooks Desktop. The program will then record the information from the receipt automatically and match it with an existing transaction.

The mileage tracking feature lets me track my vehicle mileage automatically instead of manually recording odometer readings. Logged trips in QuickBooks Desktop are then available for approval by managers or supervisors. Once approved, I can bill them to the appropriate customer or process employee reimbursements.

However, there are several things I can’t do with the mobile app. I can’t send invoices and accept payments online, which is possible with similar software like Zoho Books and our other top mobile accounting apps.

I awarded QuickBooks Enterprise a perfect score because it provides sufficient integration options for essential business workflows, including payroll, time tracking, electronic bill payments, online payment processing, and sales tax management. Some of its most popular third-party integrations include Fishbowl Inventory, Gusto, Microsoft 365, and Webgility. It also integrates with other QuickBooks products, including QuickBooks Time and QuickBooks Payroll.

My usability evaluation focuses on these four key areas.

QuickBooks Enterprise is generally easy to set up, but some users may find some steps intimidating. Also, it may require extra time to customize the software to fit your specific business needs. The good thing is that Enterprise provides a comprehensive installation guide with helpful wizards and prompts, enabling you to set up your company files and initial settings efficiently.

QuickBooks Desktop Pro or Premier users will find QuickBooks Enterprise familiar. However, if you’re starting from scratch or transitioning from QuickBooks Online or other cloud accounting software, expect a steep learning curve. The features can be overwhelming and difficult if you don’t have bookkeeping experience. This makes QuickBooks Enterprise ideal for businesses working with experienced bookkeepers.

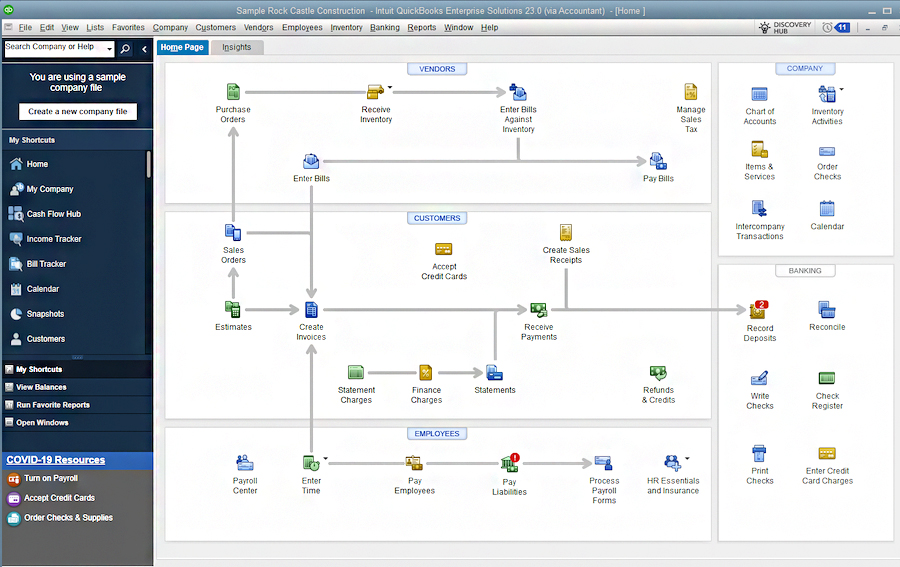

QuickBooks Desktop Enterprise homepage

QuickBooks Enterprise Gold, Platinum, and Diamond users can access 24/7 unlimited customer support through QuickBooks Priority Circle. This free VIP customer support program includes a dedicated account team, comprehensive product training, and 24/7 technical support. You can also request on-demand training.

QuickBooks Enterprise has no in-house bookkeeping service like QuickBooks Online, which provides a QuickBooks Live Bookkeeping add-on. If you need bookkeeping support, then the best way is to find a QuickBooks ProAdvisor who specializes in QuickBooks Desktop products. They can provide expert assistance, but finding and engaging with them requires more steps compared with QuickBooks Live Bookkeeping, which can be activated directly from within QuickBooks Online.

How I Evaluated QuickBooks Enterprise

I evaluated QuickBooks Enterprise using the scoring rubric below.

5% of Overall Score

We first determined a pricing score by assessing the software’s price for one, three, and five users. We also considered whether there was a free trial, monthly pricing, and a discount for new customers. After determining the pricing score, we assigned a value score based on the pricing score and the solution’s total score across all categories except Value.

5% of Overall Score

We evaluated general features like the flexibility of the chart of accounts, the ability to add and restrict the rights of users, and how your information can be shared with an external bookkeeper. We also searched for ways to provide more granular information like class and location tracking and custom tags.

10% of Overall Score

This assessed the ability to print checks, establish live bank feeds, and import bank transactions from a file. We also looked closely at the bank reconciliation feature. We wanted to see the ability to reconcile bank accounts with or without imported bank transactions and a list of book transactions that have not yet cleared the bank.

10% of Overall Score

In addition to the basics of issuing invoices and collecting customer payments, we evaluated the software’s ability to create customized invoices. We also assessed whether it could handle non-routine transactions like short payments, credit memos, and the refund of credit balances in customer accounts.

10% of Overall Score

The A/P score consisted of the basics like tracking unpaid bills, recording vendor credits, and short-paying invoices, but it also included some more advanced features—such as paying bills electronically, creating recurring expenses, and working with purchase orders. Receipt capture and the ability to automatically generate bills from captured receipts were also part of our A/P evaluation.

10% of Overall Score

10% of Overall Score

At the very least, we looked for software that could create multiple projects and separately assign income and expenses to those projects. We also searched for the ability to create estimates and assign those estimates to projects. Ideally, the program would then compare the actual expenses to the costs on the original estimate.

5% of Overall Score

Software should be able to track sales tax for multiple jurisdictions with varying tax rates. It’s helpful to have a function to easily record the remittance of the sales tax by jurisdiction. The very best tool will also help determine which jurisdictions sales are taxable to based on the address of the customer or delivery.

10% of Overall Score

I evaluated basic financial reports (such as a balance sheet, income statement, and general ledger) and common management reports (like A/R and A/P aging).

5% of Overall Score

Ideally, a mobile app should have all the same features as the computer platform, including the ability to capture receipts, send invoices, receive payments, enter and pay bills, and view reports.

5% of Overall Score

While it’s nice to have as many integrations as possible, we focused our evaluation on the four integrations we believe are most critical for small businesses: payroll, online payment collection, sales tax filing, and time tracking.

10% of Overall Score

The largest component of usability is the ability to find bookkeeping assistance when users have questions. This could be in the form of a bookkeeping service directly from the software provider or from independent bookkeepers familiar with the program. Other components of usability include customer service and ease of use.

5% of Overall Score

Our user review score is the average user review score reported by Capterra and G2. Other review sites might be used if a score from Capterra or G2 is unavailable.

Frequently Asked Questions (FAQs)

You should find Enterprise easy to use—if you’re familiar with Pro or Premier. However, if you’re used to a cloud-based program like QuickBooks Online, expect a steep learning curve.

No, they’re two completely different programs. QuickBooks Enterprise is a locally installed product, while QuickBooks Online is cloud-based.

Yes, QuickBooks Enterprise offers a cloud-hosted version with prices starting at $180 per month. Hosted QuickBooks Enterprise allows you to access all its features from a cloud server, giving you online access to your accounting files.

No, and it’s a bit expensive for very small businesses. If you need a scaled-down and more affordable solution, I recommend you check our evaluation of the best small business accounting software.

QuickBooks Enterprise is great for small to midsize businesses dealing with complex inventory management and those needing more flexibility in their pricing structure.

Bottom Line

QuickBooks Enterprise doesn’t skimp on features, and most of them are labeled “Advanced” for good reason. If you need reliable tools for managing complex inventory, pricing, and financial reports, QuickBooks Enterprise won’t fail you. However, it may not be the best fit for your business if you have minimal inventory or are on a budget.

User review references:

[1]Software Advice

[2]G2