QuickBooks Premier Nonprofit is a special version of QuickBooks Desktop Premier designed to support the needs of small and midsize nonprofits and churches. It comes with a unified chart of accounts (UCOA) for nonprofit accounting and class tracking to help organizations keep track of revenue and expenses by program service.

The Nonprofit edition has the same annual prices as the general business edition of QuickBooks Desktop Premier, which range from $799 for one user to $1,999 for five users. While it can be potentially expensive for a single user, it becomes relatively affordable when you reach the five-user tier. Discover whether QuickBooks Premier for nonprofits is right for you through our detailed QuickBooks Premier Nonprofit review.

QuickBooks Premier will no longer be available for new users after September 30, 2024 and on October 1, 2024 the annual price for existing subscribers will increase to $1,399. It has already been removed from the QuickBooks website, so you’ll need to call QuickBooks customer service to subscribe. QuickBooks Enterprise is not being discontinued and comes in the same industry versions as Premier with the same industry-specific features discussed below.

We are driven by the Fit Small Business mission to provide you with the best answers to your small business questions—allowing you to choose the right accounting solution for your needs. Our meticulous evaluation process makes us a trustworthy source for accounting software insights. We don’t just scratch the surface; we immerse ourselves in every platform we review by exploring the features down to the finest nuances.

We have an extensive history of reviewing small business accounting software, and we stay up-to-date with the latest features and enhancements. Our first-hand experience, guided by our internal case study, helps us understand how the different products compare with each other and how they work in real-world scenarios.

Pros

- Has a UCOA for nonprofits

- Provides details needed for Form 990 or 990-EZ

- Lets you monitor pledges and create receipts for donations received

- Allows you to create donor letters

- Tracks grants, other revenues, and expenses by function and program service

Cons

- Has limited nonprofit management features

- Is not as user-friendly as cloud-based accounting solutions

- Is not designed to handle fund accounting

- Can be difficult for nonbookkeepers to use

Is QuickBooks Premier Nonprofit Right for You?

Is QuickBooks Premier Nonprofit for You?

QuickBooks Premier Nonprofit Alternatives & Comparison

Are you looking for something else? If you think that a general-purpose bookkeeping solution is suitable for your nonprofit, explore our list of the best small business accounting software.

QuickBooks Premier Nonprofit Reviews From Users

| Users Like | Users Dislike |

|---|---|

| Can keep the books of churches | Is a bit costly for small businesses |

| Is easy to use after enough practice | Is not cloud-based |

| Has nonprofit management tools like donation tracking | |

One user who left a positive QuickBooks Premier Nonprofit review commented that they use the edition for their church and that they like that it keeps their books organized. We believe that QuickBooks Premier for nonprofits indeed offers features that are relevant for churches, such as tracking donations and facilitating compliance with nonprofit reporting requirements.

The reviewer also noted that the platform has become more user-friendly with practice. However, we would like to emphasize that it does have an initial learning curve and that we recommend it for nonprofits working with an in-house bookkeeper.

On the flip side, one user complained that it is a bit costly for small businesses that are just starting out. We believe that the price can be expensive for a single user, but the discounted prices for multiple users appear to be relatively reasonable. Moreover, another reviewer pointed out that a significant drawback is the lack of cloud-based functionality, which aligns with our assessment of the software’s ease of use.

As of this writing, QuickBooks Desktop Premier earned the following average ratings on top review sites:

- Capterra[1]: 4.5 out of 5 based on around 100 reviews

- TrustRadius[2]: 8.2 out of 10 based on over 400 reviews

QuickBooks Premier Nonprofit Pricing

QuickBooks Premier earned an average score in our evaluation as the starting price ($799 per year for one user) is a bit high. However, when considering the discounted prices for three to five users, it becomes relatively affordable.

The QuickBooks Nonprofit pricing structure is the same as that of QuickBooks Desktop Premier general business edition, which is summarized in the table below:

Number of Users | Pricing ($/Year) | Access to Accounting and Nonprofit Features | 60-day Money-back Guarantee |

|---|---|---|---|

1 | $799 | ✓ | ✓ |

2 | $1,099 | ✓ | ✓ |

3 | $1,399 | ✓ | ✓ |

4 | $1,699 | ✓ | ✓ |

5 | $1,999 | ✓ | ✓ |

If you’re considering other QuickBooks Desktop solutions for your organization, we compare the QuickBooks Desktop products to help you decide which version is right for you.

QuickBooks Premier Nonprofit New Features for 2023

- Cash Flow Hub: You can use the new Cash Flow Hub to track pledges and donations and run a financial forecast to predict your revenue and expenses in the future.

- Contactless payments: If you’re using QuickBooks Payments, then your donor can send donations through credit or debit card payments and mobile payment processors, like Google Pay and Apple Pay. Read our review of QuickBooks Payments to see if the platform’s right for you.

QuickBooks Premier Nonprofit Accounting Features

QuickBooks Premier Nonprofit Edition has the same accounting features as the general business edition, which are evaluated using our internal case study. The results of our case study—including the rubric scores across each criterion—are thoroughly explained in our QuickBooks Premier review. We’ll use the remainder of this review to discuss its features specific for nonprofits.

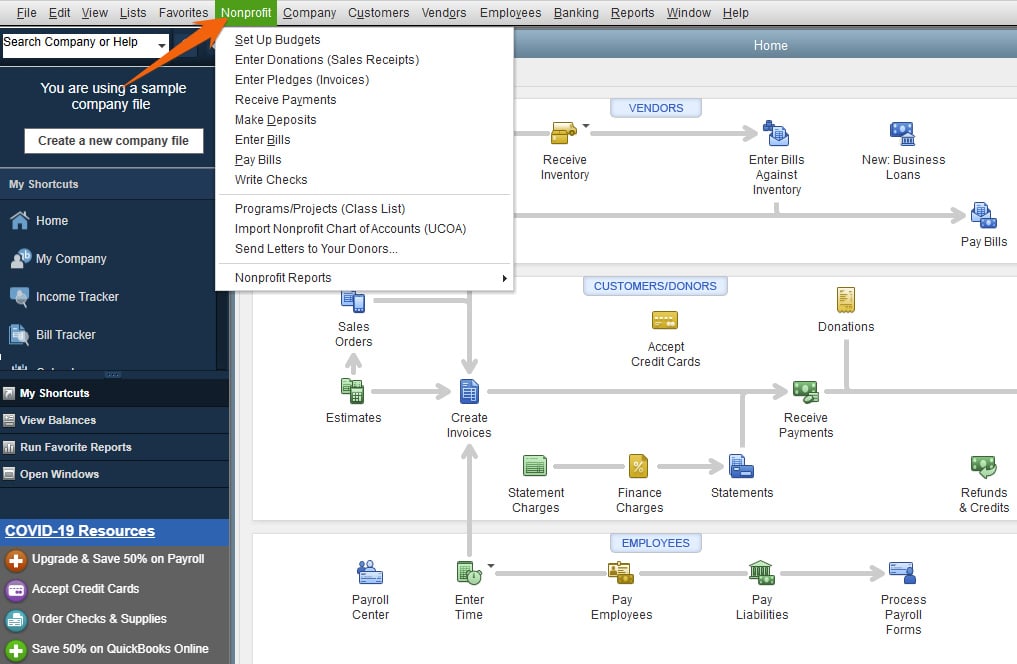

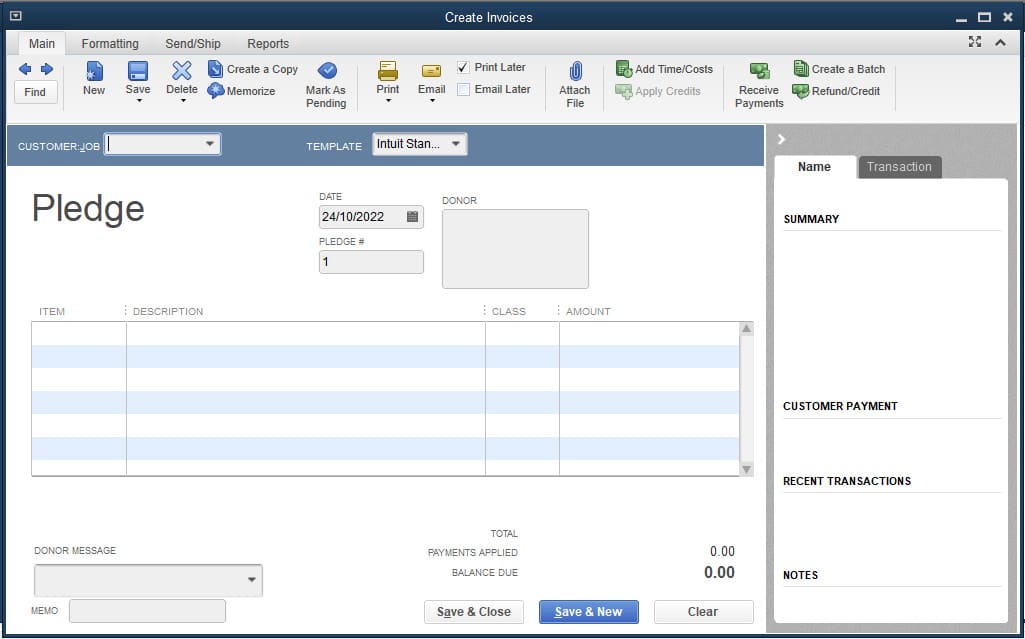

QuickBooks Premier Nonprofit Edition Features

In addition to the general accounting features in our QuickBooks Premier review, Nonprofit Edition has industry-specific features that are useful for nonprofits and churches.

Good accounting at any organization starts with a good COA, and nonprofits should use the UCOA. The custom-designed COA aligns with the reporting requirements of both the IRS and generally accepted accounting principles (GAAP).

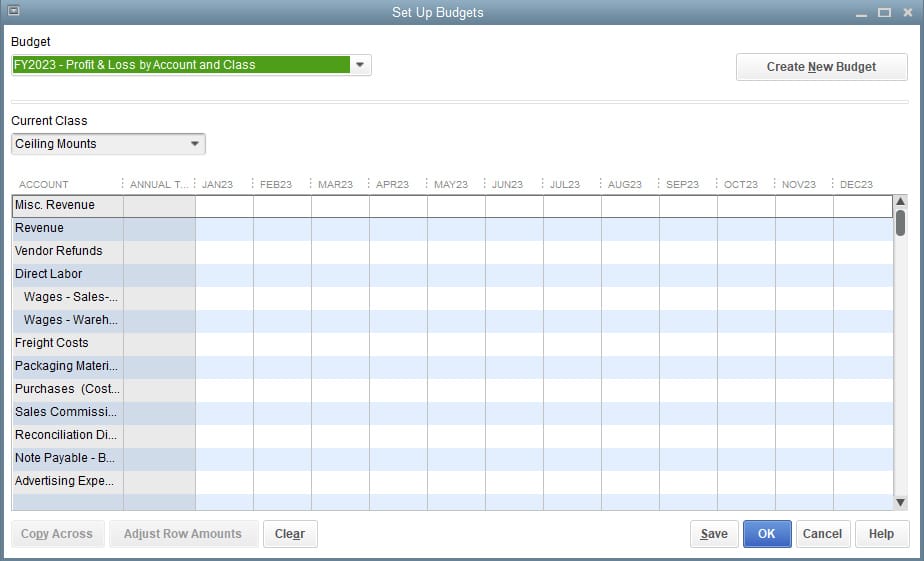

QuickBooks Desktop Premier Nonprofit’s budgeting feature lets you predict your expenses and the revenue you expect to receive over a certain period. You can create a budget from scratch or by using prior year numbers as a reference point. The budget you created can create important reports, such as Budget vs Actual, to help you better track the financial standing of your organization.

Budgeting module in QuickBooks Premier Nonprofit

Donations your organization receives can easily be recorded in QuickBooks. You can keep track of all donations made by check, e-check, credit card, debit card, and cash. QuickBooks Premier records donations using the sales receipt form, where you’ll be able to select an existing donor or add a new one, indicate the donation amount, and add a donor message, among others.

Enter donations as sales receipts in QuickBooks Premier Nonprofit

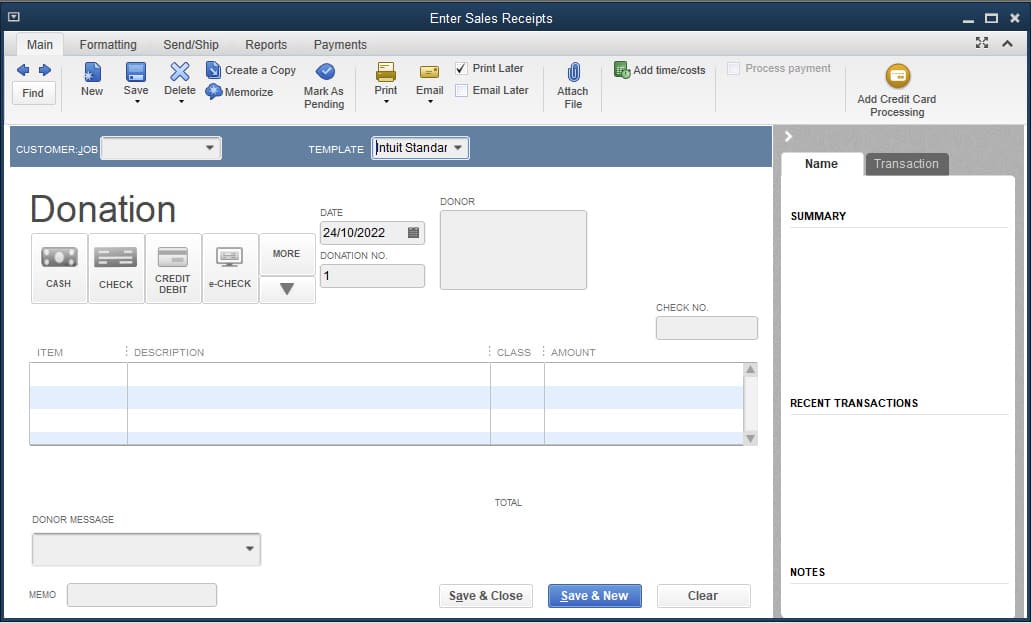

QuickBooks Premier Nonprofit allows you to enter pledges or promised donations. If your organization receives pledges regularly, then it’s important to record them to keep your finances accurate. Pledges are entered using the invoicing form, which means it’s recorded as receivable and can be tracked until paid.

Post pledges as invoices in QuickBooks Premier Nonprofit

If your church offers services like renting facilities, special services like weddings or funerals, or columbarium spaces, the A/R module can help you keep track of receivables from church members. Nonprofits can also use the A/R module to record receivables from nonprofit products and services. For example, nonprofits offering financial products can use it to record customer information, track payments, and create aging schedules.

Income tracker in QuickBooks Premier Nonprofit

Nonprofits and churches can use the A/P module to monitor accrued expenses like telecommunication bills, utility bills, and other payables. You can also use purchase orders (POs) if your nonprofit or church orders office supplies, church supplies, and inventories for sale.

Bill tracker in QuickBooks Premier Nonprofit

You can create, print, and send donor letters easily with QuickBooks Desktop Premier and Enterprise. You can use a preexisting template or customize a template to make it truly your own.

The platform has class tracking features that can be customized based on your needs. Nonprofits can use class tracking to monitor income and expenses from nonprofit activities like fundraisers, charity work, donation drives, community outreach, and promotions. You can even create an income statement by class to see net contributions or donations after deducting necessary expenses.

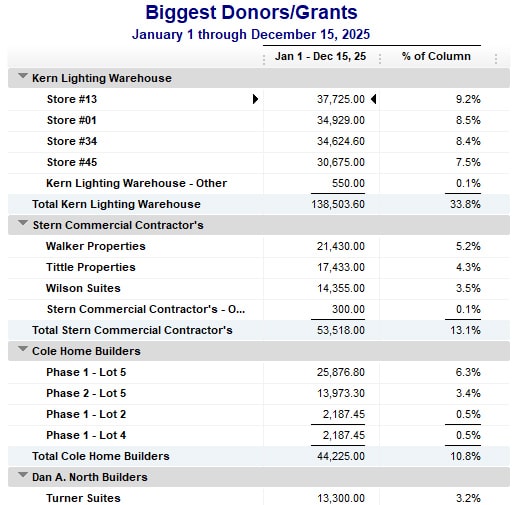

QuickBooks Premier Nonprofit comes with nonprofit-specific reports like basic financial statements and other management reports. You can generate a statement of financial position, a statement of activities, a statement of functional income and expense, and a cash flow statement. You can also generate an income statement per class, donor contribution summaries, biggest donors or grants reports, balance per class, and much more.

Sample report on biggest donors/grants in QuickBooks Premier Nonprofit

QuickBooks Premier Nonprofit Ease of Use

QuickBooks Premier Nonprofit received an average score in our evaluation primarily because it’s not cloud-based software. It features a traditional, desktop-based user interface that can feel outdated when compared to the more modern and user-friendly interfaces of cloud-based accounting software. Unless your organization has a dedicated bookkeeper, we believe an easier-to-use alternative is a cloud-based software like QuickBooks Online.

QuickBooks Premier Nonprofit Customer Support

We find QuickBooks Premier Nonprofit’s customer support generally effective—meaning there are different ways for users to seek assistance, such as phone support (callback), live chat, online resources, and user communities. The platform would have scored higher in our evaluation if users had the option to directly call a support agent instead of having to initiate a support request and wait for a callback.

How We Evaluated QuickBooks Premier Nonprofit

We assessed QuickBooks Premier Nonprofit using the same criteria we used in our evaluation of the general business edition of QuickBooks Premier, based on the rubric provided below.

5% of Overall Score

Software is rated based on its price for various levels of users, including one, three, and five users. It is also awarded points if it offers a free trial or discount for new users and if monthly vs annual plans are available.

53% of Overall Score

10% of Overall Score

5% of Overall Score

A good mobile app should be able to perform all the same functions as the computer interface.

20% of Overall Score

7% of Overall Score

We include the average user review score for each software collected from large third-party websites dedicated to the collection of user reviews, such as Software Advice, SourceForge, and G2.

QuickBooks Premier Nonprofit Frequently Asked Questions (FAQs)

Nonprofits are often financed by grants and donations, so they have strict accounting standards to follow. Accounting software can help nonprofits track those grants, meet strict reporting requirements, and manage their revenue and expenses.

The right platform for your operation depends on your needs. Our evaluation of the best nonprofit accounting software can help you choose one that fits the bill.

QuickBooks Desktop supports any type of nonprofit organization, including charities, clubs, societies, and churches.

Bottom Line

QuickBooks Premier Nonprofit can’t handle fund accounting, but it’s useful for managing pledges, donations, and grants. Its class tracking feature comes in handy if you often conduct multiple programs to raise money for your organization. Plus, the customized COA helps you make nonprofit reporting as easy as possible.