Finding payroll software that can help you manage employee and contractor payments can sometimes be challenging. If you’re on the hunt for the best payroll services for nonprofits, look for a provider that offers budget-friendly solutions with essential features, such as tax filing and quick payment options. The provider should also understand your needs as a nonprofit and streamline payroll processes so you can focus more on running your organization.

To find the optimal nonprofit payroll software, we evaluated 13 solutions and narrowed the list down to our top five recommendations.

- Gusto: Best overall nonprofit payroll software

- QuickBooks Payroll: Best for QuickBooks accounting users

- OnPay: Best for payroll compliance and delegating payroll tasks

- Rippling: Best for HR and payroll automation

- Patriot Payroll: Best for small nonprofits with simple pay processing needs

Summer Savings: Get 70% off QuickBooks for 3 months. Ends July 31th. |

|

Need more information about nonprofit payroll before choosing a provider? Check out our guide to understanding payroll for nonprofits, where we walk you through everything from unemployment taxes to labor laws.

Payroll Software for Nonprofits Compared

All the pay processing software we reviewed offer full-service payroll with tax filing services and access to year-end tax reports. Paid time off (PTO) tracking features are also available, including basic employee information management tools. Below are each of the providers’ pricing and key functionalities.

Looking for something more robust? Consider a professional employer organization (PEO) service like Justworks. It covers everything from hiring to retiring, handles payroll in multiple states, assumes tax liability, and generally takes HR worries off your hands. It’s No. 1 on our list of best PEOs for small businesses and, at $59 per employee monthly, is an affordable option. Plus, it offers discounts to nonprofits.

Gusto: Best Overall Payroll Software for Nonprofits

Pros

- Unlimited pay runs

- Customizable reporting

- Reasonably priced plans with a contractor-only payroll option

- Gusto Giving lets employees donate from their paycheck

- Supports international contractor payments in over 120 countries

Cons

- No pricing discounts for nonprofits

- Health insurance not available in all states

- Time tracking, paid time-off management, next-day direct deposits, and multistate payroll are included only in higher tiers

- Starter plan comes with single state pay processing

What We Like

Gusto’s excellent tools earned it first place in our guides to the best small business payroll software and the best payroll services. Its price point, ease of use, and integration with nonprofit management software earn it the top spot on this list as well. Its contractor-only payroll plan is a good option if you only work with contract employees. Gusto offers excellent tools for employees too, including Gusto Wallet, which makes it easy to budget, save, and even give to charities.

In our evaluation, Gusto earned an overall score of 4.45 out of 5. It earned high ratings in nearly all our criteria, with perfect marks for popularity and reporting. While Gusto doesn’t currently offer health insurance in all 50 states like OnPay and Rippling, it’s reasonably priced, easy to use, and highly regarded by users.

Users love Gusto’s easy interface. (Source: Gusto)

QuickBooks Payroll: Best for QuickBooks Accounting Users

Pros

- Seamless integration with QuickBooks Accounting

- Next- and same-day direct deposit

- Tax penalty protection that covers users’ errors up to $25,000 with Elite plan

- Unlimited pay runs with affordable plan for processing contractor payments

Cons

- Local tax filings and time tracking available only in higher tiers

- Doesn’t have mobile apps for employee self-service (only offers a workforce portal you can access online)

What We Like

QuickBooks Payroll nabbed the second spot on our list of best payroll services for nonprofits because of its fast payouts and reasonably-priced plans. With its payroll function easily accessible through the QuickBooks system, it saves QuickBooks users time from having to separately set up a chart of accounts and import pay-related data into its platform. The seamless connection between Intuit products is a huge competitive advantage, especially to those with very limited integration capabilities, such as Patriot Payroll.

With an overall score of 4.24 out of 5 in our evaluation, QuickBooks Payroll earned high ratings in nearly all of our criteria. It lost points for not having a pay card option and integrations with nonprofit management software. User popularity ratings were good but not as high as the others on our list. Overall, real-world users liked the software for ease of use—but said that its setup could take some time, and the support could be problematic at times.

QuickBooks lets you pay with direct deposit or print your own checks. (Source: QuickBooks)

OnPay: Best for Payroll Compliance & Delegating Payroll Tasks

Pros

- User-friendly interface

- Unlimited pay runs

- Feature-rich platform; provides access to benefits, onboarding, org charts, and full-service payroll with automated tax services

- Flexible permissions for delegating payroll tasks

Cons

- Lacks built-in time tracking tools

- Limited integration options (mostly connects with accounting, employee attendance, and scheduling solutions)

- Only offers email support on weekends for emergencies

- Eligibility for two- or four-day direct deposits depends on OnPay’s risk assessment

What We Like

OnPay makes it easy for nonprofit organizations to onboard new hires and pay different types of workers—from employees to contractors and volunteers. It can handle multiple pay rates, ensures compliance with county and other local jurisdiction tax rules, and automatically withholds the applicable federal and state taxes, including federal insurance contribution act (FICA) taxes. And, with its six levels of system permissions, you can choose who has visibility into payroll and HR, allowing you to securely delegate pay processing tasks.

In our evaluation, OnPay earned an overall score of 4.19 out of 5. Its ease of use, efficient HR tools, reasonably priced plan, and solid reporting functionality contributed to its high scores. However, its risk assessment to determine two- and four-day direct deposits cost it some points. And, while OnPay is highly rated on third-party review sites like G2 and Capterra, with reviewers liking its user-friendly platform, it received a low score in our popularity criterion because its average number of reviews on those websites is below 1,000.

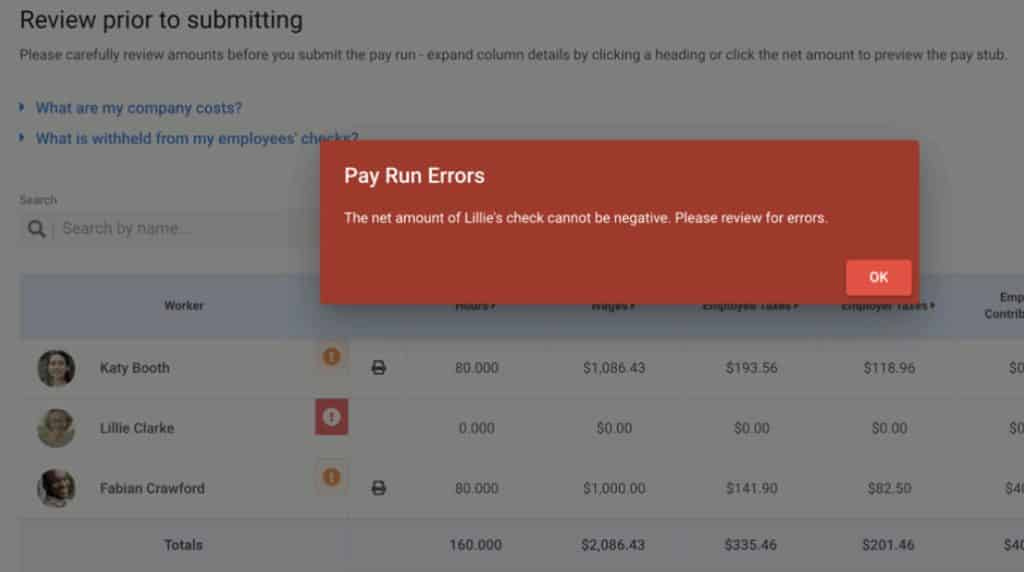

OnPay automatically alerts you of pay errors during payroll runs. (Source: OnPay)

Rippling: Best for HR and Payroll Automation

Pros

- Handles local and global payroll

- Unlimited pay runs

- Robust workflow and automation tools

- Feature-rich platform; has modular HR, IT, and finance solutions you can mix and match

- Offers PEO and employer of record (EOR) services

Cons

- You have to purchase its core workforce management platform before you can get other HR, IT, and finance solutions

- Pricing isn’t fully transparent; you have to call its sales team to discuss your requirements and get a custom quote

- Can get pricey as you add more features

- Getting phone support requires asking for a callback from its chat representatives

What We Like

Rippling takes the stress out of managing pay runs given its robust workflow and automation tools that sync all of your employee and HR data with payroll. You don’t have to manually input employee clock-ins/outs or benefits deductions—the system will capture and calculate these for you. Rippling is also equipped to handle a wide range of payroll services, from paying employees to processing contractor payouts. Its EOR services can even help you hire and pay global workers for your nonprofit.

Scoring 4.13 out of 5 in our evaluation, Rippling earned perfect ratings in reporting and user popularity. Its solid HR features, customizable pricing plan, and ease of use contributed to its high scores. However, it lost several points because of its paid HR advisory services, lack of paycard and pay-on-demand features, and the non-straightforward way of asking for phone support (this has to be scheduled via its chat representatives).

Rippling attests that it can run payroll in 90 seconds. (Source: Rippling)

Patriot Payroll: Best for Small Nonprofits Needing a Simple Payroll Solution

Pros

- Very affordable pricing

- Unlimited pay runs

- US-based customer support with extended weekday hours

- Do-it-yourself (DIY) tax filing option available

Cons

- Full-service garnishments or child support not available

- Limited integration options

- Some functions require its HR or time tracking add-ons

What We Like

Patriot Payroll is the only payroll for nonprofit we reviewed that offers a full-service option and a more affordable DIY version for doing payroll. It’s also the simplest on our list, with just the most basic payroll tools. Even the HR add-on is for employee data tracking and HR reports, whereas Rippling offers more HR tools and Gusto comes with hiring and performance reviews. However, with budgeting being such an important aspect of nonprofit financials, it is a great option for those looking for an affordable solution.

In our evaluation, Patriot Payroll scored a 4.04 out of 5, gaining top points for its budget-friendly software and popularity among users. It lost points for its limited HR features and only offering a four-day direct deposit funding period (the two-day option is only for qualified companies). Many other providers on our guide, such as Gusto, offer two-day funding in their starter tiers.

Patriot has a clean, bright interface that allows some customizations. (Source: Patriot)

How We Evaluated the Top Payroll Services for Nonprofits

We compared several of the most popular providers, focusing on features that would be most valuable for nonprofit organizations. We looked for payroll providers that offer unlimited pay runs, flexible direct deposit schedules, seamless integrations with third-party software, and the availability of both basic and customized payroll reports.

Click through the tabs below for a more detailed breakdown of our evaluation criteria.

35% of Overall Score

25% of Overall Score

20% of Overall Score

10% of Overall Score

The best payroll software for nonprofits includes basic HR tools, such as online onboarding, new hire reporting, and employee benefits. Self-service portals that allow your team to manage their information also hold a huge value.

5% of Overall Score

We considered online user reviews, including those of our competitors like G2 and Capterra, based on a 5-star scale, wherein any option with an average of 4-plus stars is ideal. Also, software with 1,000 or more reviews on third-party sites is preferred.

5% of Overall Score

Aside from having access to basic payroll summaries, users should be able to customize reports within the system. Reporting is especially important for nonprofits that need an easy way to determine their payroll costs.

How to Choose the Best Payroll Software for Nonprofits

In selecting the payroll software or payroll services for your nonprofit, consider the following factors:

- Features: Take stock of the features you need and prepare a payroll systems checklist so you don’t miss anything. Look for those that can handle multiple pay rates, direct deposit payments, automatic payroll and tax calculations, and tax filing services.

- Ease of use and scalability: The payroll system should be simple to set up, learn, and use. If you plan to grow into a large nonprofit organization, consider those that offer scalable payroll solutions that can handle the complex HR payroll processes that come with managing a large workforce.

- Budget: Don’t forget to consider your budget. The cost of payroll services varies depending on the provider and the features you want. Be ready to spend more if you want advanced tools like learning management, recruiting, or performance reviews.

- Compliance: Check if the provider has the expertise to handle the tax reporting and compliance requirements of nonprofit organizations. Plus, having access to tax payment and filing services can take the stress out of having to do this yourself.

- Support: 24/7 support is ideal, but if this isn’t available, look for those that provide live phone or chat support.

Nonprofit Payroll Frequently Asked Questions (FAQs)

Yes. Nonprofit organizations are exempt from federal unemployment taxes and, in some cases, state unemployment taxes. Be sure to check that your payroll software notes this to avoid adding undue expenses and complications.

Payroll service providers make it easy to pay employees, sometimes taking only minutes to complete a pay run. Plus, these providers offer automated checks to make sure you are error-free and in compliance with federal, state, and even local laws.

Yes. You must withhold federal, state, and local income taxes as well as FICA (Social Security and Medicare) taxes from all qualifying employees. The exception to this may be clergy, who are often considered self-employed for calculating FICA and, thus, you may not need to pay this on their behalf.

Yes, because minimum wage applies to all qualified employees. There are some exceptions. Check with the US Department of Labor (DOL) or your state for details. The minimum wage is currently $7.25 an hour or higher if your state or local municipality has its own rate.

Bottom Line

Whether you’re looking for a full-service payroll solution or a more DIY approach, it’s important you find a nonprofit payroll software with the features you need. Essential functionalities can range from quick direct deposits to compliance support. You also have to consider pricing and whether or not the nonprofit payroll service you’re considering meets your budget.

We found Gusto to be the best payroll software for nonprofits. It offers reasonably priced plans with a contractor-only package that’s optimal for organizations that mostly hire contract workers. Gusto is a crowd favorite among users given its user-friendly platform and solid payroll tools. Sign up for a plan today.