QuickBooks Premier Retail Edition, an industry-specific version of QuickBooks Premier desktop accounting software, is designed to support the needs of retailers. It helps retail businesses manage accounting functions, such as sales, inventory, and invoicing. It includes all the features of QuickBooks Premier, plus additional inventory tools and industry-specific reports. Pricing starts at $799 per year for one user.

I haven’t found a single QuickBooks Premier Retail Edition review, but the general business edition of Premier earns mostly positive feedback due to its strong automation features and extensive reports. A possible downside to using the QuickBooks retail accounting software is that it has limited integrations with point-of-sale (POS) and ecommerce accounting solutions.

QuickBooks Premier will no longer be available for new users after September 30, 2024 and on October 1, 2024 the annual price for existing subscribers will increase to $1,399. It has already been removed from the QuickBooks website, so you’ll need to call QuickBooks customer service to subscribe. QuickBooks Enterprise is not being discontinued and comes in the same industry versions as Premier with the same industry-specific features discussed below.

Our writers are experts in evaluating niche-specific business tools, like retail accounting software. We delve into the nuances of each feature and test how they perform in real-world scenarios so that we can thoroughly understand their strengths and weaknesses. This approach helps us provide meaningful insights to address the unique needs and challenges of retail businesses and provide the best answers to small business questions in general—aligning with our Fit Small Business Editorial Policy.

Pros

- Integrates with QuickBooks Point of Sale

- Allows you to quickly record daily sales summaries from any POS system

- Can automate and customize special pricing rules, such as major customer or family discounts

- Includes retail-specific reports like Gross Margin by Inventory Item

- Offers desktop-only and cloud-hosted software (for a fee)

Cons

- Requires installation and setup

- Requires a third-party add-on for first-in, first-out (FIFO) accounting for inventory cost

- Requires users to purchase an additional license for each simultaneous user (maximum of five)

- Doesn’t calculate sales tax rates automatically based on customer’s location

QuickBooks Retail Edition Alternatives & Comparison

| Users Like | Users Dislike |

|---|---|

| Wide range of accounting features | A bit costly |

| Extensive reports | Unresponsive customer support |

As mentioned earlier, I haven’t found a specific QuickBooks Premier Retail Edition review. However, to give you insights into QuickBooks Premier user experiences, I explored feedback on the general business edition, which has the same user interface.

I found that QuickBooks Premier is generally commended for its robust general accounting features and extensive reports. I agree that the general accounting features are great, but I am more impressed that it has a wide range of retail-specific tools, like pricing management, sales tax tracking, and inventory management. You can also run customized retail reports, like inventory valuation summary and inventory stock status by item reports.

On the downside, some users complained that it is a tad expensive and that its customer support is rather unresponsive. It is likely that the reviewer who commented about pricing purchased multiuser access as Premier is affordable for one or two users. Also, I understand their frustration with Premier’s customer support, but I believe the quality of customer service depends on the specific agent assigned to you. Some provide excellent support while others may not be that helpful.

Here’s how QuickBooks Premier is rated by top review sites:

- Capterra[1]: 4.5 out of 5 based on around 100 reviews

- TrustRadius[2]: 8.2 out of 10 based on more than 400 reviews

QuickBooks Retail Edition vs Competitors

We compared QuickBooks Retail with QuickBooks Online and Xero, and here’s the result:

QuickBooks Premier Retail Edition vs QuickBooks Online and Xero FSB Case Study

Touch the graph above to interact Click on the graphs above to interact

-

QuickBooks Premier Retail From $799 per year

-

QuickBooks Online From $30 per month

-

Xero From $15 per month

QuickBooks Retail Edition is equally as great as QuickBooks Online and Xero in terms of general accounting features. However, it trails behind QuickBooks Online in retail features because it doesn’t automatically track sales tax rates based on the customer’s location. QuickBooks Retail Edition’s biggest weakness is ease of use, which isn’t surprising since it’s a locally installed software.

We aren’t that impressed with the QuickBooks Premier Retail pricing scheme because it doesn’t offer monthly plans, and you have to pay a fee for each additional user. Below is a quick breakdown of QuickBooks Retail Edition pricing:

Number of Users | Pricing (Cost per Year) | Access to Accounting and Retail Features | 60-day Money-back Guarantee |

|---|---|---|---|

1 | $799 | ✓ | ✓ |

2 | $1,099 | ✓ | ✓ |

3 | $1,399 | ✓ | ✓ |

4 | $1,699 | ✓ | ✓ |

5 | $1,999 | ✓ | ✓ |

As a point of comparison, QuickBooks Online Plus costs $90 per month for one to five users. So, if you need five users, QuickBooks Online will be much less expensive, but for a single user, QuickBooks Premier Retail Edition is a great value.

QuickBooks Retail Edition New Features

- Inventory categorization: You can now group item lists by categories so that you can manage your stock better and access them easily.

- Contactless payments: If you’re using QuickBooks Payments (payment gateway), you can now accept contactless payments, with the data being recorded in QuickBooks Premier automatically. Read our QuickBooks Payments review to learn more.

- Cash Flow Hub: Just like the standard business edition, QuickBooks Premier Retail now has a Cash Flow Hub that you can use to track incoming and paid invoices, payments, sales receipts, and credit memos.

QuickBooks Retail Edition deserves a perfect score because it offers a wide range of general accounting features, including A/P, A/R, and bank reconciliation. The retail edition includes all the core features of the QuickBooks Desktop Premier general business edition, which we tackle in detail in our QuickBooks Desktop Premier review.

Here are some of the most notable QuickBooks Premier Retail features.

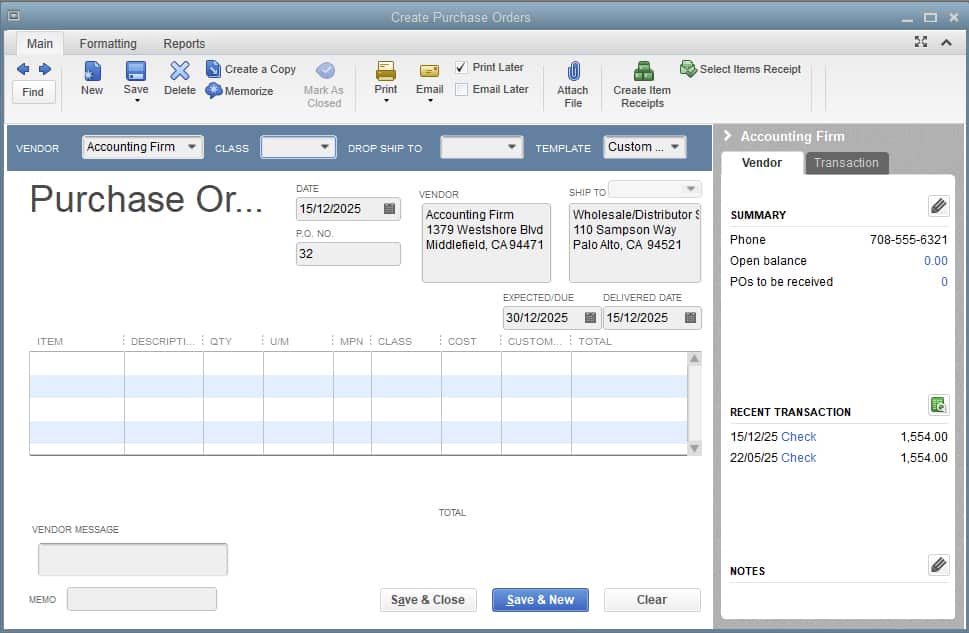

QuickBooks Retail Edition, just like the general edition, lets you enter and pay vendor bills directly from the platform. The system provides reports that show your outstanding bills so that you can stay on top of your payables. Additionally, QuickBooks Retail enables you to monitor payment deadlines, set up recurring expenses, create purchase orders (POs) and convert them to bills, and more.

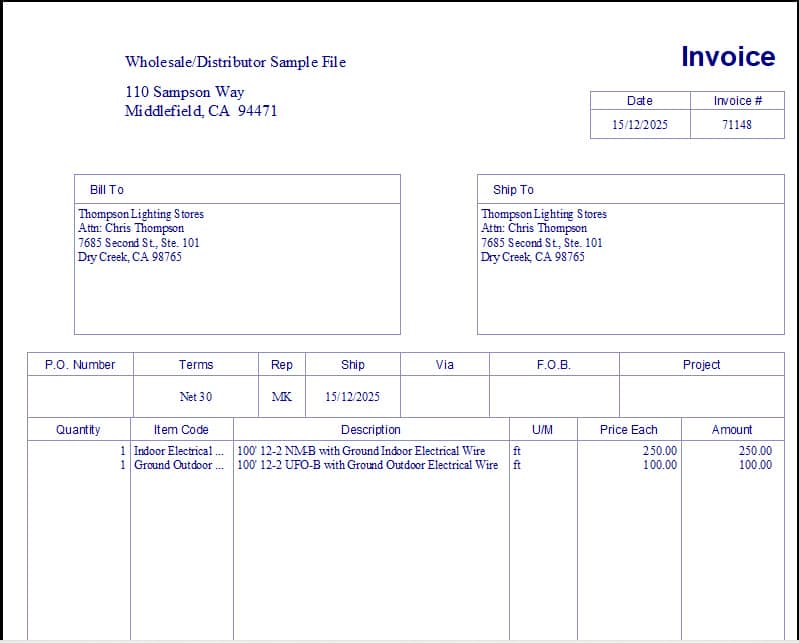

With the QuickBooks Desktop retail accounting software, you can create and send invoices and track outstanding customer balances and payments received. You can create an invoice from scratch, a sales order, or an estimate. When creating an invoice, you need to enter important information, such as the customer name, date, item descriptions, and amount.

QuickBooks Retail Edition lets you choose from different invoice templates, with the ability to change colors and add a logo of your brand. However, invoices in QuickBooks Retail Edition aren’t as good-looking as those in QuickBooks Online. Below is a sample invoice created in QuickBooks Retail.

Sample invoice in QuickBooks Retail Edition

You can connect your bank and credit card accounts to QuickBooks Premier so that your transactions automatically flow into the platform instead of having to manually record them. The program automatically categorizes your transactions based on default rules, but you can customize those rules to better suit your accounting needs.

One feature I like is the Undeposited Funds account, which helps you manage and organize received payments before they are deposited into your bank account. This is particularly useful for businesses that receive multiple payments daily and make a single deposit at their banks.

QuickBooks Premier has a mobile accounting app, but it’s limited to capturing expense receipts. If mobile accounting is important to you, then you might stick with QuickBooks but switch to QuickBooks Online. You might also want to consider Zoho Books, our overall best mobile accounting app.

QuickBooks Retail Edition offers many specialized features for retail businesses, including sales tax tracking and inventory management. The only reason it didn’t get a perfect score is that it has limited integrations with POS and ecommerce accounting systems. For instance, the Shopify Connector by QuickBooks, Intuit’s official Shopify connector, isn’t compatible with QuickBooks Retail Edition.

Nonetheless, QuickBooks Retail Edition offers useful retail-specific features, including:

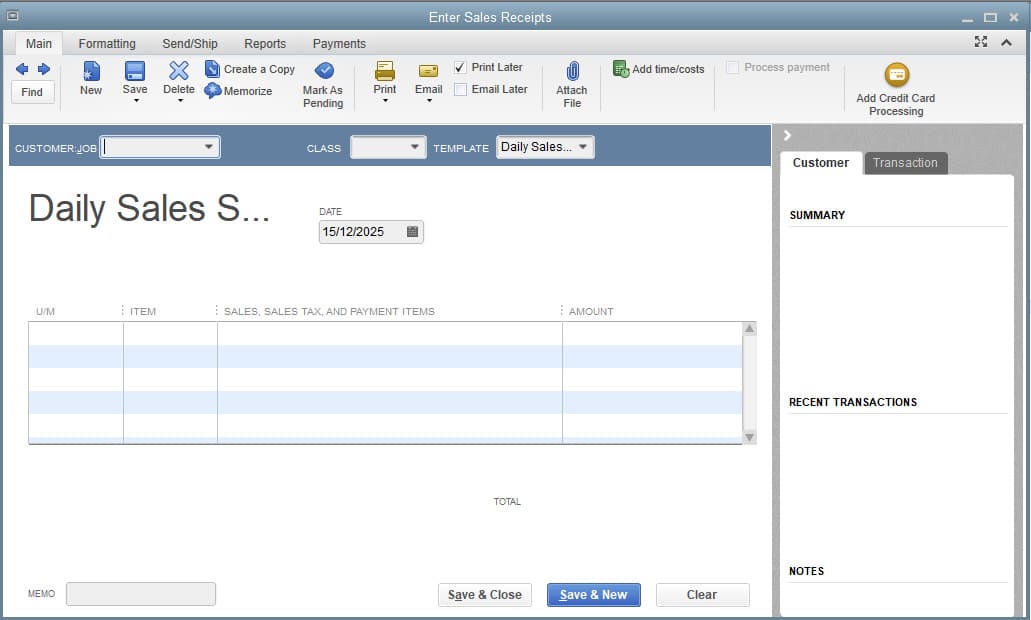

QuickBooks Premier Retail Edition uses sales forms, such as invoices and sales receipts, to record sales transactions. When a sales payment is expected to be processed at a later date, you can use invoices to record the transaction.

If you have an immediate sale, you can create a sales receipt quickly by using the Enter Daily Sales feature under the Retail menu on your QuickBooks Desktop homepage. The information is recorded in QuickBooks, which is useful when creating financial reports.

Enter Sales Receipts form in QuickBooks Desktop

If your retail business is subject to sales tax, QuickBooks Retail allows you to set up and track sales taxes. A downside to using QuickBooks Premier is that it doesn’t calculate sales tax rates automatically based on your customer’s location, which is possible in QuickBooks Online.

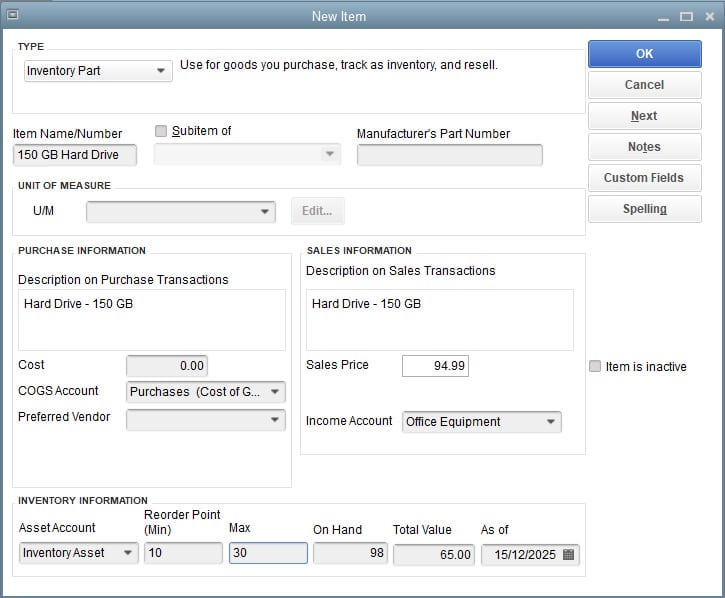

QuickBooks Retail Edition has strong inventory management features, such as the ability to:

- Set up inventory by item: You can set up each of your products as a separate inventory item. You can indicate a standard cost and sales price per item that will populate POs and invoices automatically, but you can still make changes on those forms if the price varies.

Sample inventory item in QuickBooks Retail Edition

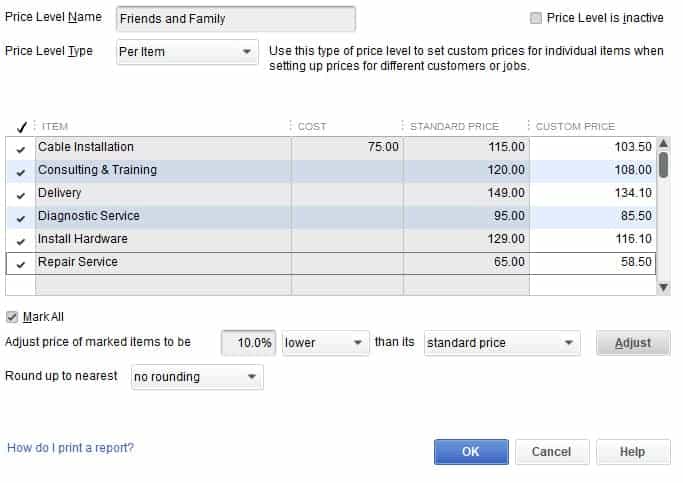

- Specify price levels: You can set special price levels for individual inventory items or set a special price level rule that will be applied to all inventory items. For instance, you might enter a special Family and Friends price level that reduces the sales price of all inventory items by 10%. After you create a custom price level, you can choose to apply the standard price or custom price level when creating invoices and sales receipts:

Setting up price levels in QuickBooks Retail Edition

- Create POs when ordering inventory: The units on POs will show in the inventory item screen so you know there are more units on the way. To create a PO, go to the Vendors menu and click on Create Purchase Orders. Complete the Create Purchase Orders form and click the Save & Close or Save & New button.

Create a new PO in QuickBooks Retail Edition

- Adjust inventory shrinkage: Shrinkage is an inevitable part of retail sales. You can record shrinkage by entering either the amount of the adjustment―for instance when you know an item was broken―or actual units of inventory on hand. QuickBooks will make an adjustment to record the shrinkage expense based on the average cost per unit.

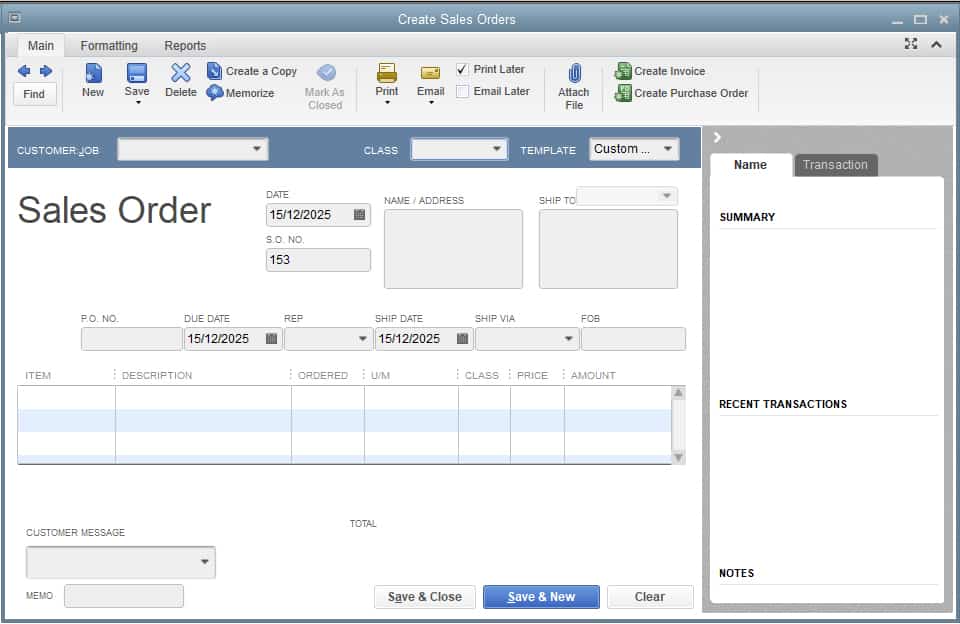

- Create sales orders: Creating sales orders will help QuickBooks ensure you have sufficient inventory. Inventory needed to fulfill open sales orders is subtracted from units on hand in determining the units available. When available units drop below the minimum you specify, QuickBooks will notify you that it’s time to reorder.

Create a new sales order in QuickBooks Retail Edition

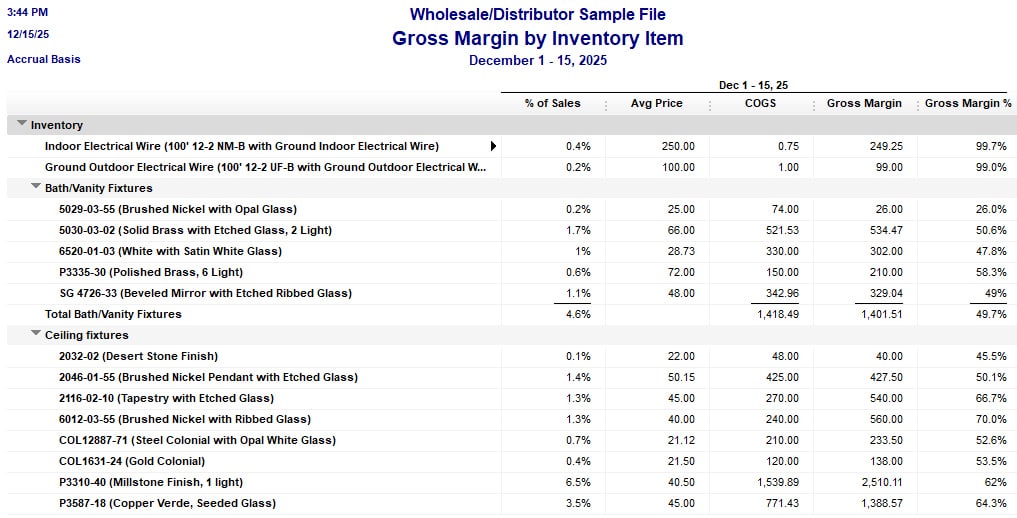

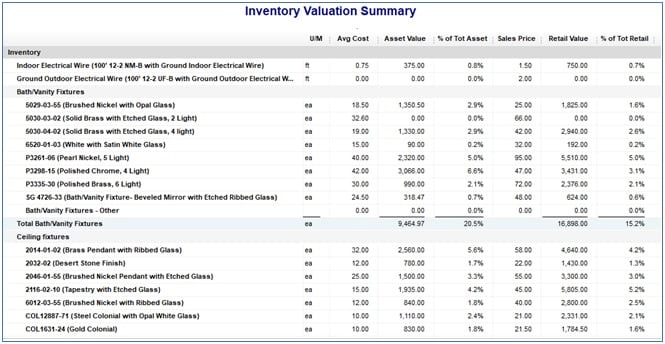

In addition to all the usual accounting reports and financial statements like the balance sheet and statement of profit and loss (P&L), retailers will find these QuickBooks Retail reports useful:

- Gross Margin by Inventory Item: This breaks down the sales of inventory by inventory item and reports the quantity sold, average sales price, COGS, gross margin (or profit), and gross profit percentage. It’s very helpful in determining which of your products are the most profitable and deserving of prime floor space (or website placement for online stores):

Sample Gross Margin by Inventory Item report in QuickBooks Retail

- Inventory Valuation Summary: This not only shows you the quantity of inventory you have on hand but also the total cost and total retail value:

Sample Inventory Valuation Summary report in QuickBooks Retail

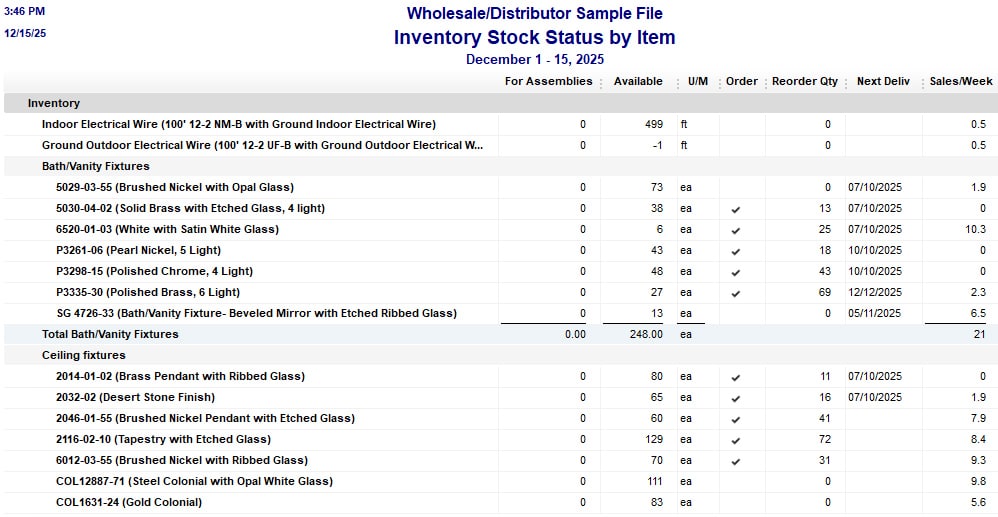

- Inventory Stock Status by Item: This is very helpful for determining when to reorder inventory. It provides, by inventory item, not only the units on hand, on sales orders, and on POs, but also the average weekly units sold.

Sample Inventory Stock Status by Item report in QuickBooks Retail

QuickBooks Retail isn’t that easy to use, especially if you are used to a cloud-based interface like that in QuickBooks Online. It uses a workflow-based desktop navigation interface, which can be overwhelming for new users and those without accounting experience. Additionally, sharing files with your accountant involves creating and sending an “Accountant’s Copy,” which can be a bit of an extra step. A more straightforward approach is to send an email invitation to your accountant—which is the case in QuickBooks Online.

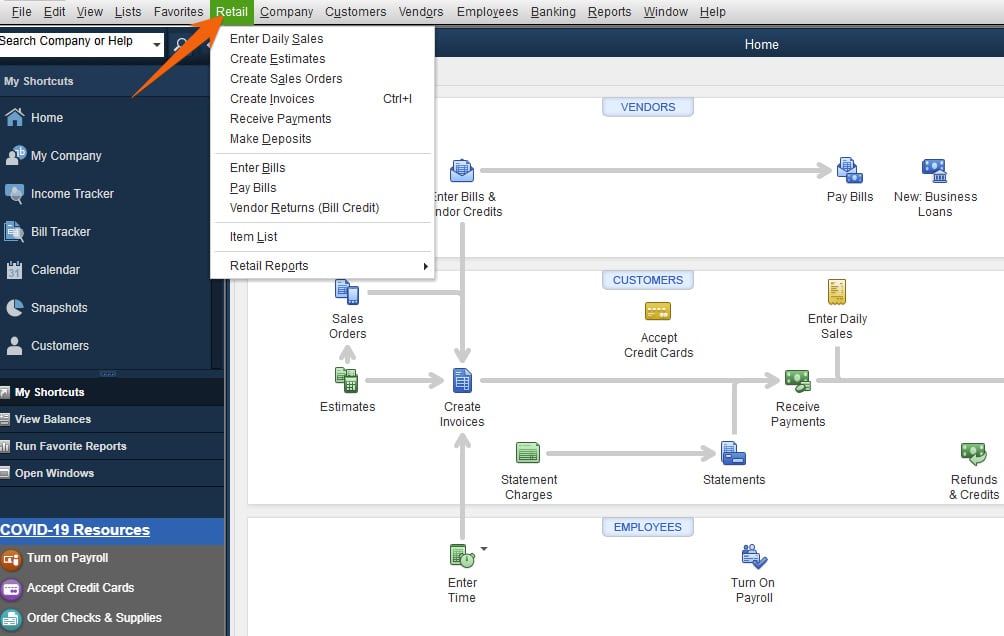

However, if you have used QuickBooks Premier, then you’ll have no problems transitioning to the retail edition. QuickBooks Premier Retail’s dashboard is similar to the standard business edition except that you’ll see a Retail menu on the top of the homepage. This is where you access features useful for retailers, such as Enter Daily Sales, Pay Bills, and Vendor Returns.

Dashboard in QuickBooks Retail Edition

QuickBooks Retail didn’t do well in customer service primarily due to the lack of direct phone support. You have to submit a support request first and wait in a queue for a call back. In other similar providers like Zoho Books, you can make a direct phone call to a support representative for immediate assistance. Another concern is that QuickBooks Premier doesn’t offer email support, which could have been useful for non-urgent inquiries.

How We Evaluated QuickBooks Retail Edition

We evaluated QuickBooks Retail Edition using the internal scoring rubric below.

10% of Overall Score

We looked into the transparency of the pricing plans and whether the provider offers scalable monthly options without the need to pay for additional costs to accommodate additional users.

20% of Overall Score

A good retail accounting software must have essential accounting features, such as A/P, A/R management, banking and cash management, and reporting.

40% of Overall Score

We assign the heaviest weight to this category given that our focus is on the retail sector. Some of the retail-specific features we looked at include sales tracking, inventory management, and retail-specific reports.

10% of Overall Score

The best retail accounting software should be easy to set up and use. We give special credit to cloud-based software because we believe they are generally more accessible and easier to use than desktop-based software.

10% of Overall Score

We assessed the software providers based on the availability of essential support channels, like phone and email support, live chat, user guides, and user communities.

10% of Overall Score

We checked out user feedback on popular review sites.

Frequently Asked Questions (FAQs)

If you’re a small or medium-sized brick-and-mortar retailer needing specialized tools for inventory, pricing management, and industry-specific reporting, then QuickBooks Retail Edition is right for you.

QuickBooks Retail Edition is a bit difficult to use compared to cloud-based software like QuickBooks Online. If you’re familiar with a QuickBooks Desktop product, then you should be able to use Retail easily as its interface is essentially the same; the only difference is that the retail edition has a “Retail”’ menu on the dashboard.

QuickBooks Premier is available in five industry-specific editions: Retail, Manufacturing and Distribution, Professional, Contractor, and Nonprofit.

Bottom Line

QuickBooks Retail Edition is a powerful, industry-specific version of QuickBooks Premier. It can help you manage your inventory better and adjust product prices and price levels easily, allowing you to leverage promotional pricing for your business.

Although it’s a powerful desktop application, it’s best if it’s used by an experienced in-house bookkeeper. Once you purchase QuickBooks Premier, be sure to download the QuickBooks Retail Edition at no additional cost and start using its industry-specific features.

[1]Capterra

[2]TrustRadius