Real-time payment (RTP) is the process of accelerating the transfer of funds between businesses and individuals from a few days to a matter of minutes. While this is the norm for credit card transactions, bank-to-bank real-time payments have been impossible until recent advancements in payment technology.

For small businesses, this means faster payment processing, better customer service, and more efficient cash flow. In this article, we take a look at the real-time payments market, growth, and adoption in the business sector.

Key takeaways:

- Global real-time payment transactions reached $97 billion in 2023 and are expected to reach $376 billion by 2030.

- RTP networks are present in almost 80 countries across the globe.

- RTP is available 24/7 including weekends and bank holidays. Funds are processed immediately (not by batch).

- Instant rail is a term that refers to the unique process used to complete real-time payments.

- Digital payments technology such as account-to-account (A2A) platforms helped grow real-time payment adoption for non-card transactions.

Real-time Payment Adoption Across the Globe

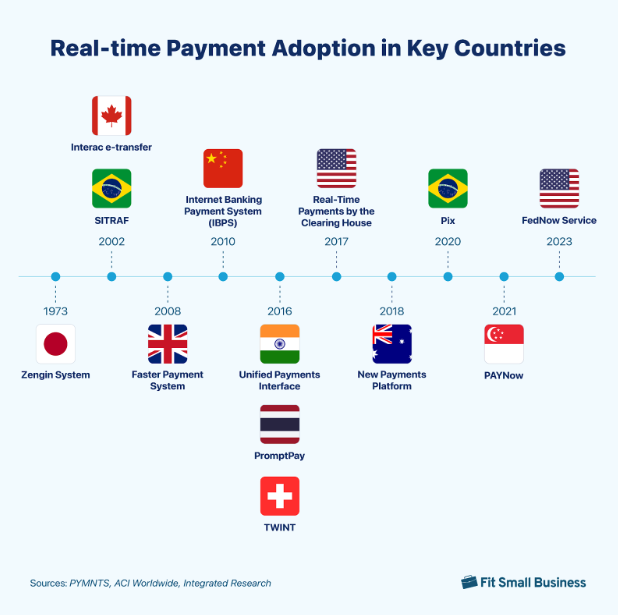

Real-time payments for non-card transactions have been around since 1973. However, it wasn’t until the recent advancement of digital payment technology such as A2A applications

Bank-driven apps that make direct, bank-to-bank payments possible

that more retail payment networks were launched around the world.

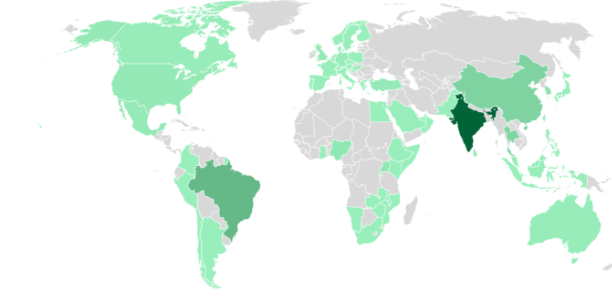

According to the latest PYMNTS research, nearly 80 countries worldwide had at least one real-time payment solution in 2023 (from only 56 in 2020), resulting in transactions reaching $97 billion. RTP is forecast to grow at a rate of 289%, valued at $376 billion in transactions by 2030.

The mode of implementation differs among countries—in some, it is led by central banks and government regulators; other countries allow independent firms to develop their RTP infrastructure.

In 2022, India and Brazil were the top countries for real-time payments. India processed $89 billion, accounting for 46% of the global RTP transactions. Brazil registered a 228.9% growth in RTP adoption in the same year, reaching $ 29.2 billion and contributing 15% of all global RTPs. By 2027, transactions are projected to reach $235 billion for India and $111.2 billion for Brazil.

India led countries that have adopted retail-payment in 2023, registering $107.96 billion in RTP transactions. (Source: Pymnts.com)

Real-time Cross-border Payments

The launch of ISO 20022 standards Established best practices for real-time cross border payments for cross-border RTPs helped boost the emergence of secure technologies for harnessing consumer data. Members include payment associations, payment service providers, financial institutions, international and domestic clearing houses, payment schemes, and regulators in 17 countries.

In 2022, Indonesia, Thailand, Singapore, Malaysia, and the Philippines launched a memorandum on Regional Payment Connectivity Cooperation, making the Asia-Pacific region among the leaders in cross-border RTP.

The proliferation of mobile financial services also contributed to RTP growth. In fact, the latest Juniper research on mobile financial services growth found that mobile network operators are looking into extending international remittances via partnerships with merchants and money transfer operators. This move is projected to drive transactions up by 80% in the next five years.

With increased payment transparency and control over these types of payments, fintech experts look at 2024 as a pivot point for real-time cross-border transactions. For small businesses, access to real-time cross-border payments will create a wider opportunity for growing revenue without the risk associated with deferred payments.

Real-time Payments for SMBs

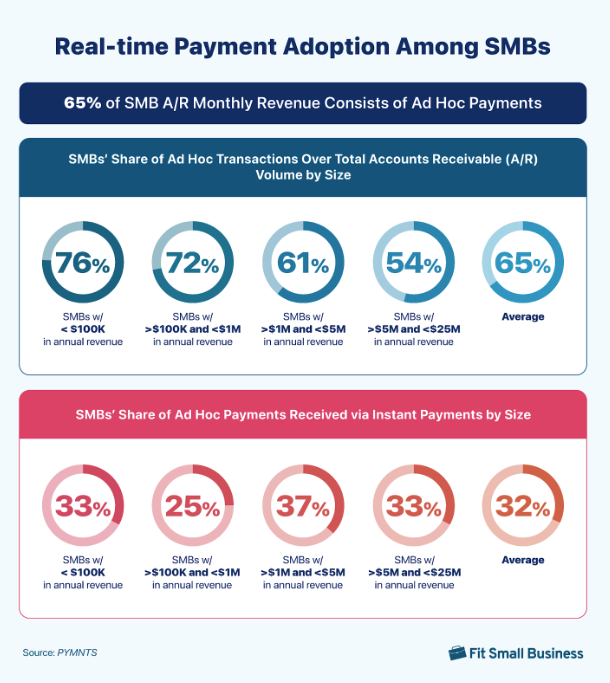

The adoption of real-time payments for SMBs is a huge step toward an overall faster business process—whether sales, inventory, or managing operational expenses. One research shows that 70% of SMBs choose real-time payments to help improve their cash flow.

For instance, traditional banking causes delays in collecting accounts receivable (AR) and settling accounts payable (AP). This uncertainty in cash flow creates an unfavorable standing for SMBs applying for business loans necessary for investing in equipment, additional inventory, expansion, and more.

The same research also found that 65% of SMBs rely heavily on one-time AR collections for revenue. Imagine how delayed funding with traditional banking processes and how real-time payments can significantly affect cash flow. So much so that 35% of SMBs are willing to pay fees just to receive instant payments.

With real-time payments, SMBs gain better financial control and liquidity, avoiding uncertainties resulting from overdrawn accounts and limited cash on hand.

What Prevents SMBs From Adopting Real-time Payments?

Awareness is the biggest challenge in real-time payment adoption for SMBs. In the US, only around 280 banks and credit unions implement RTP from a total of 4,600 banks and 4,700 credit unions in operation. This limited implementation also directly affects the availability of real-time payments in small businesses.

Thankfully, fintechs are filling the niche of providing RTP payment methods. For instance, new payment technology such as digital wallets and other payment apps like Zelle made real-time payments possible for casual sellers and freelancers. That said, this does not mean SMBs are entirely aware of the potential of RTPs except for receiving payments faster using certain payment apps.

The benefits of real-time payments for SMBs include:

- Improving merchant cash flow

- Faster loan receipts and repayments

- Better payroll management

- Providing employees with instant access to earned wages

- Faster lease payments

- Moving funds faster with digital wallets

- Keeping corporate credit cards funded

As technology becomes more accessible, strong government mandates supporting real-time payments have also begun to grow with the help of ISO 20022 Real-Time Payments Group (RTPG). Participated by more than 70 stakeholders across 17 countries, this inter-country cooperation for payment connectivity is expected to boost SMB awareness of RTPs and drive adoption rates even further in 2024 and beyond.

Real-time Payments for B2Bs

Accounting for 80% of cross-border transactions, the business-to-business (B2B) sector is considered as one of the biggest beneficiaries of real-time payments.

Currently, around 70% of B2B transactions are supported by real-time rails but these are mostly large businesses. Hopes are high, however, for more small and midsize B2Bs to use RTPs as partnerships develop among RTP-capable countries and fintechs.

- In November 2022, the pioneer B2B platform Fintecture received investments valued at 26 million euros from several venture capitalists like RTP Global and Allianz Trade.

- Just November, global Fintech company ACI Worldwide partnered with Mexipay to develop an ISO 20022-compliant payment system. Expected to launch this year, the partnership is aimed to provide small and medium businesses access to real-time payments.

- In December 2023, global Fintech company Melio, also partnered with J.P. Morgan to deliver real-time B2B payments to smaller businesses.

A Deloitte study projects that in the US alone, real-time payment volume for B2Bs can grow anywhere between $18.9 trillion and $37 trillion in 2028, replacing Automated Clearing House (ACH) and check transactions.

Manufacturing companies, in particular, are keen to use real-time payments. As much as 96% of manufacturing firms predict RTPs will soon replace legacy methods such as checks for making and accepting payments.

Aside from fast access to funds, real-time payments are expected to provide more transparency and better insights into B2B transactions that can be used to create value-added merchant services.

Real-time Payment Adoption in the US

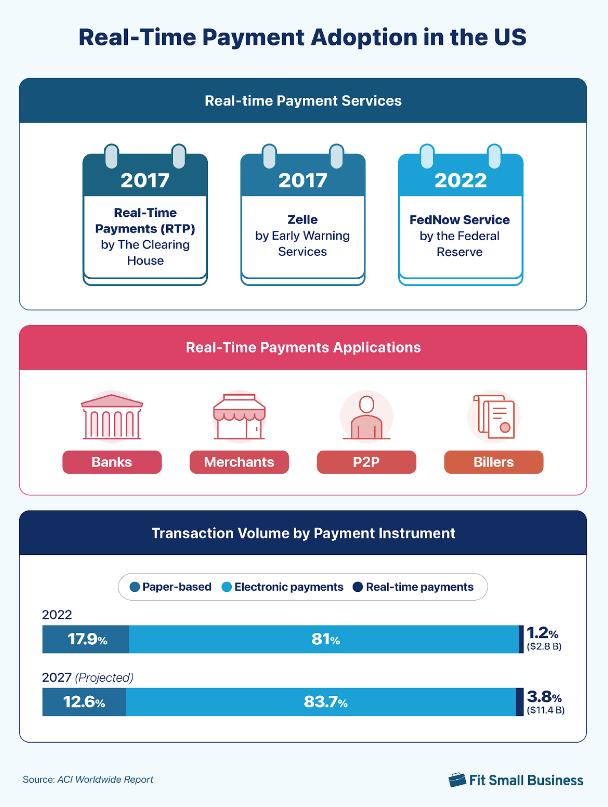

The US now has two real-time payment networks:

- Real-Time Payments (RTPⓇ) by the Clearing House launched in 2017

- FedNow Service by the Federal Reserve launched in 2023

Research shows that consumers are open to using real-time pay-by-bank methods when given the chance to learn about the system. More than half of consumers who were interviewed for a study by PYMNTS said they do not know how to use pay by bank or A2A apps that support real-time payments, but 40% of the same respondents said they are willing to use A2A if given the right incentives such as cashbacks, rewards, and discounts.

The US has been somewhat slower to adopt real-time payments. Aversion to risk prompts many local businesses to still rely on legacy payment methods that take funds an average of 23.5 days to be fully settled. In 2022, only 1.2% (amounting to $2.8 billion) of the total transaction volume for the year was made via real-time payments.

According to PYMNTS Intelligence research in local B2B transactions, checks still comprised 15% of both retailers’ and manufacturers’ B2B payments in 2023.

That said, the addition of FedNow in 2023 to RTPⓇ as a local real-time payment service network is proving to be a game changer. More than 480 financial institutions participate in RTPⓇ, while over 470+ banks have adopted FedNow’s real-time payment network.

So, it’s no surprise that as much as 68% of US merchants expect to use either network for real-time payments over the next couple of years. And with Zelle in the mix, local SMBs are expected to pick up the adoption rate of RTPs in the country.

Did you know?

Zelle is a real-time payment platform. Merchants with a Zelle business account will benefit from the app’s zero processing fees and instant payment capabilities. Learn more about Zelle for business.

What the US Needs to Drive Real-time Payment Adoption

The Clearing House and the Federal Reserve are two independent institutions with different real-time payment rails. While both support bank-to-bank processing, this setup makes instant payments impossible between two businesses or individuals using financial services from either network.

But thanks to ISO 20022, the problem between FedNow and RTP’s lack of interoperability is close to being resolved through open message exchange, making a fully real-time payment system in the country possible in the near future.

Another factor that needs to be addressed is user experience. For instance, China’s AliPay, Brazil’s Pixl, and India’s UPI all worked with third parties to develop a product carrying the real-time payments network to its users.

With FedNow and RTPⓇ in operation, partnering with fintechs that can provide a sleek and secure user interface is crucial to attract both merchants and consumers in using the service.

Major Players in the Real-time Payments Market

- ACI Worldwide, Inc.

- Fidelity National Information Services, Inc. (FIS Inc.)

- Finastra

- Fiserv, Inc.

- Mastercard, Inc.

- Montran Corp.

- PayPal Holdings, Inc.

- Temenos AG

- Visa Inc.

- Volante Technologies Inc.

- Wirecard AG

- Worldpay, Inc.

Frequently Asked Questions (FAQs)

Here are some questions we commonly encounter about real-time payments and their adoption and growth among businesses.

PayPal is a service provider that can provide instant payments but it’s not an official part of the Real-Time Payments (RTPⓇ) Network itself.

The adoption of real-time payments depends on the availability of payment technology, productization for user experience, changing customer preferences, and existing government regulations to support RTP.

Small businesses benefit from the faster funding times brought about by real-time payments. It facilitates better cash flow, increases transparency of transactions, and even generates savings from lower processing costs.

Bottom Line

As the number of countries adopting real-time payments grows around the globe, both the challenges and benefits become even clearer. Global real-time payment adoption can bring about economic growth, and integrating RTP into the current payment landscape is key. However, one major roadblock is how each country utilizes a different implementation approach based on its current financial infrastructure.

That said, 2024 is the year for small businesses to consider the possibility of adding real-time payments into their payment system. Faster funding and lower fees compared to credit card transactions are great reasons to include this payment method option. Setting up will be easy if you work with a payment processor like Stripe that already supports real-time payment methods.