U.S. Bank Merchant Services provides banking solutions, supporting card, check, and cash payments for small businesses. It provides its own processing service (Elavon) and point-of-sale software and hardware system (talech) but also works with numerous payment gateways, ecommerce platforms, and other POS systems. U.S. Bank Merchant Services also processes Zelle business payments.

While U.S. Bank Merchant Services did not land on our list of merchant service providers, it earned an overall score of 3.93 out of 5, with high marks for its affordable startup plans, supported payment types, and same-day funding tools. It would have scored higher if more features were available in the free plan. That said, U.S. Bank Merchant Services is a suitable option for small businesses looking for basic payment processing and growth with a recognizable bank.

For new customers who enroll by Aug. 31, 2024, and start processing payments by Oct. 31, 2024, U.S. Bank is offering 2.5% back on transaction fees through the end of 2025. Visit U.S. Bank

Member FDIC

to learn more about this limited-time offer. |

U.S. Bank Merchant Services Overview

Pros

- Provides proprietary POS with free plan

- Free same-day funding

- Hardware rental with no long-term contract

- Surcharging and debit card optimization programs

Cons

- Limited features using Talech free plan

- Limited user reviews

- Full features and integration options not advertised on website; call for consultation

Deciding Factors

Supported Business Types | Flexible Retail, restaurants, professional services, healthcare, mobile businesses, automotive, B2B manufacturing, wholesale |

Standout Features |

|

Monthly Fees | $0–$99 |

Setup and Installation Fees | $0–$99 |

Contract Length | Month-to-month |

Point-of-Sale Options | talech POS system, Oracle, Aloha, CenPOS, NRS, most payments-agnostic POS systems, and those operating on the Elavon network. Contact U.S. Bank for information on specific integrations |

Payment Processing Fees |

|

Customer Support |

|

Visit U.S. Bank Merchant Services

Is U.S. Bank Merchant Services Right for You?

Most traditional merchant account providers offer merchant services that are only better suited for large businesses. Despite being one of the largest banks, U.S. Bank Merchant Services’ offerings accommodate smaller businesses, especially those who already have accounts with U.S. Bank.

Moreover, U.S. Bank Merchant Services can be integrated with other business management solutions. You can consult directly with a U.S. Bank representative and request U.S. Bank payments on most POS systems that are payments-agnostic or are compatible with the Elavon network. However, for ease of setup, U.S. Bank payment processing comes natively built into the talech POS.

U.S. Bank’s merchant services is best for:

- Those with a U.S. Bank account: Same-day funding is available for those with a U.S. Bank checking account.

- Basic payment processing with a traditional merchant account: U.S. Bank Merchant Services is a good option for those who need a traditional merchant account with just basic payment processing.

- Free simple mobile POS: U.S. Bank Merchant Services’ POS starting plan is completely free and includes a basic mobile POS system.

U.S. Bank is not ideal for:

- Multiple payment or point-of-sale devices: U.S. Bank Merchant Services charges an extra $29 each month for every additional device (license fee). Look for alternatives among our list of top retail payment processors or the best retail POS systems.

- High-risk merchants: Businesses in the high-risk categories are not supported by U.S. Bank Merchant Services. Find alternatives in our list of the best high-risk merchant account providers.

U.S. Bank Merchant Service Alternatives

Best for | Monthly Fee From | |

|---|---|---|

| Traditional merchant account with better integration options | $0 |

| New and small businesses, free POS | $0 |

| Low rates: interchange-plus pricing with no monthly fee | $0 |

Are you looking for the lowest rates? Leading merchant service providers offer custom payment processing rates based on your business size, type, and average order value. To find the most affordable option for you and compare multiple processing rates, read our guide on the cheapest credit card processing companies.

U.S. Bank Merchant Service User Reviews

There are not a lot of reviews online specifically for U.S. Bank Merchant Services. U.S. Bank itself was previously rated A- on Better Business Bureau. Most BBB reviews centered around its banking services, so they do not accurately reflect the merchant services provided by U.S. Bank.

We also looked at user reviews of its POS solution provider, talech, and payments processor, Elavon. A lot of negative talech reviews centered around technical issues with the POS system and not receiving adequate help to solve it. On the other hand, Elavon also did not fare well among user reviews, with complaints that are focused on extra fees being charged and not being able to access their account.

- U.S. Bank on Trustpilot[1]: 1.3 out of 5 stars from 850+ reviews

- Talech on Trustpilot[2]: 1.5 out of 5 stars from 100+ reviews

- Elavon on Trustpilot[3]: 1.3 out of 5 stars from 200+ reviews

U.S. Bank Merchant Services Pricing

While looking at U.S. Bank Merchant Services fees, another traditional merchant account provider comes to mind—Chase Payment Solutions. Like Chase, U.S. Bank Merchant Services offers zero monthly fees (for its base plan) and similar processing rates.

We like that it requires no contract and has zero cancellation fees, however, merchants will incur higher fees if they need more than a mobile POS and additional hardware—factors that pulled down its score. This contrasts Chase, where all payment methods available are included without additional fees.

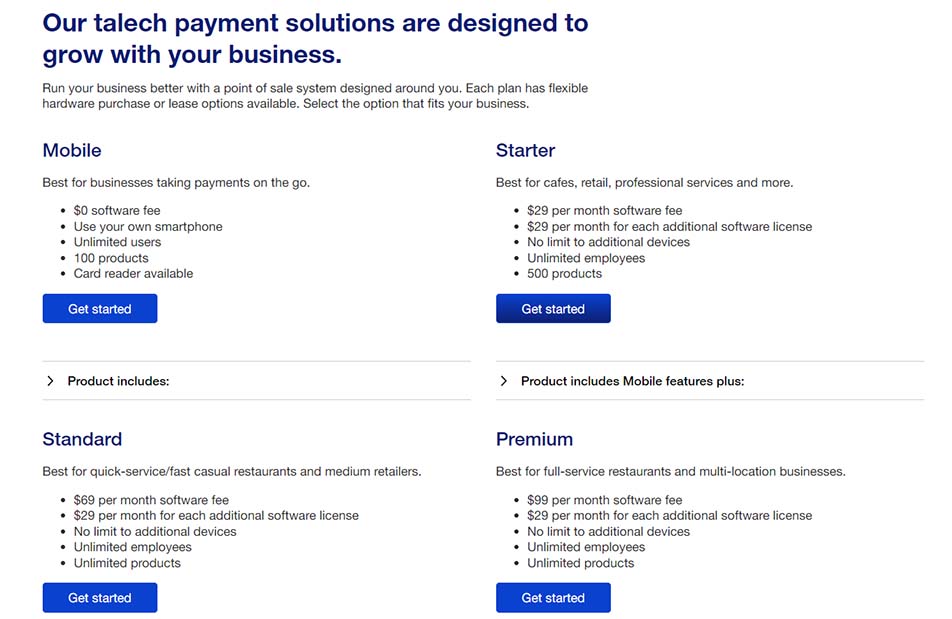

The basic monthly plan offered by U.S. Bank Merchant Services has zero monthly fees and allows merchants to accept payments on their mobile devices. It offers three other higher plans with varying features that are suited for retail or restaurant businesses. The processing fees are competitive and depend on the type of transaction.

Plan | Mobile | Starter | Standard | Premium |

|---|---|---|---|---|

Monthly fee | $0 | $29 | $69 | $99 |

Setup fee | $0 | $99 (optional) | $99 | $99 |

POS product limit | 100 products | 500 products | Unlimited products | Unlimited products |

Transaction Fees:

- In-person transactions: 2.6% + 10 cents

- Keyed-in transactions: 3.5% + 15 cents

- Online transactions: 2.9% + 30 cents

U.S. Bank Merchant Services’ card transaction fees are very competitive for small businesses, and are, in fact, exactly the same as the transaction fees of one of our most recommended processors, Square. Note that U.S. Bank offers “meet and beat” pricing, especially for those switching from other processors. Interchange plus pricing is available for large-volume businesses.

Additional Fees:

- Online ordering: $49 per month (free for Premium plans)

- Additional device: $29 per month

Some features, such as same-day funding and ACH processing, are only available to U.S. Bank checking account holders. Its basic checking account requires a minimum deposit of $100 and zero monthly maintenance fee. This is a huge advantage over Chase Payment Solution, where a $2,000 minimum balance is required.

U.S. Bank Merchant Services offers a range of card readers through its talech POS solutions. The options range from a basic mobile card reader to a full POS set-up.

The hardware options are priced with a monthly rental fee. Should merchants want to cancel the services, only a written notice is needed and the equipment needs to be returned within 10 days of the termination date. Merchants are required to insure the hardware or pay an additional monthly fee of $4.95 to cover insurance. There is an option to purchase the devices instead—contact U.S. Bank Merchant Services for details.

Ingenico Moby/5500 card reader

|  |

Newland N910 terminal card reader

|  |

Station Bundle

|  |

Station Bundle with Customer Display

|  |

Add-on Equipment

|  |

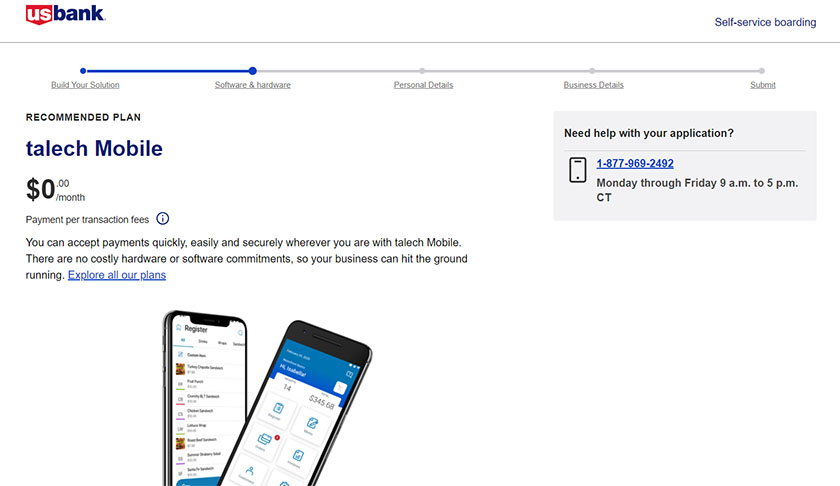

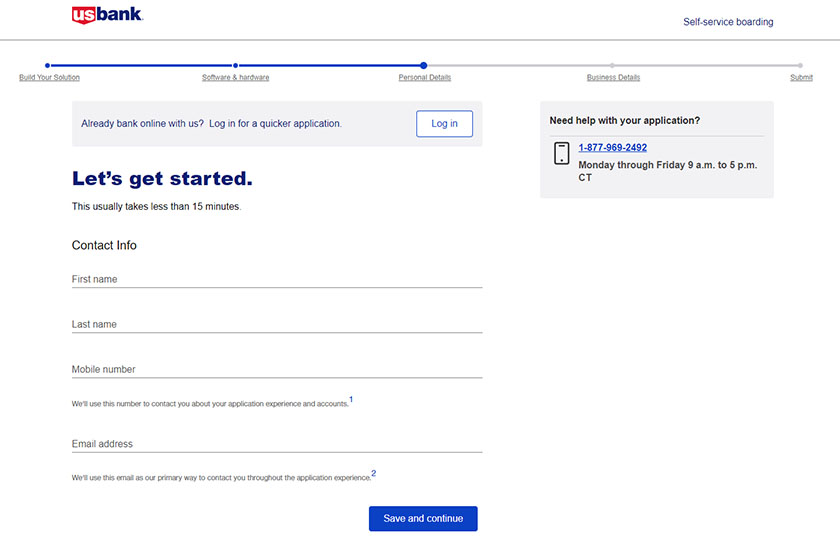

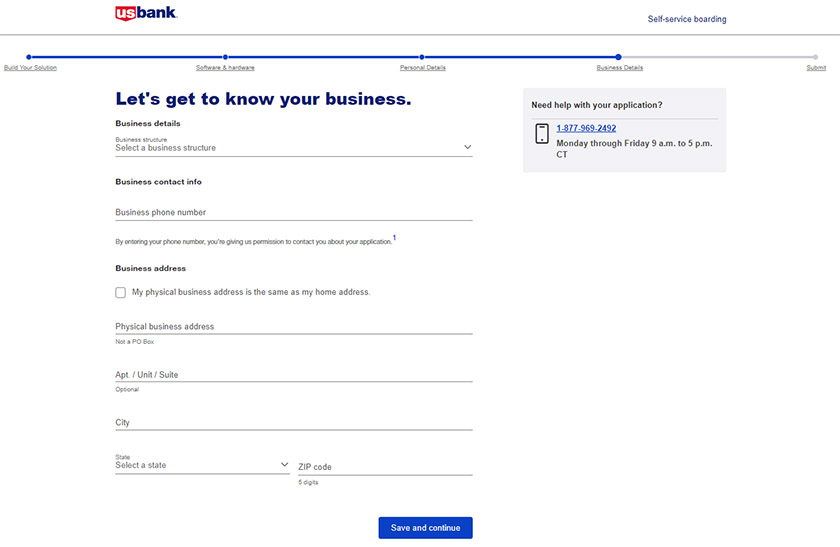

Signing up with U.S. Bank Merchant Services is easy. The website has a self-service boarding procedure that guides you through the steps and provides adequate information to help you decide on the right plan.

After submitting your application, it will be assessed by U.S. Bank. If your application is approved, you will need to set up your mobile app to start accepting payments. For the Starter plan, there is optional set-up assistance, which incurs a one-time setup fee of $99. For the Standard and Premium plans, assisted onboarding is required but still comes with the one-time setup fee.

That said, note that U.S. Bank Merchant Services does not only integrate with the talech POS system. It will, however, require a phone consultation with a representative to find out if your preferred business solution can work with U.S. Bank payments.

U.S. Bank Merchant Services does not require any long-term contracts—even if you are renting the equipment instead of purchasing outright. All plans are on a month-to-month basis, and there are no cancellation fees.

Because of the wide customization options, the terms of service (TOS) will depend on your preferred POS system. If you choose to use talech, you will receive a separate talech TOS on top of the U.S. Bank payments TOS.

Visit U.S. Bank Merchant Services

Payment Types Compatible With U.S. Bank

U.S. Bank Merchant Services offers all the payment types we considered in our evaluation. However, it did not receive full points for some payment types because of limited functionality or the need to upgrade to a higher plan, which will incur higher monthly fees as well.

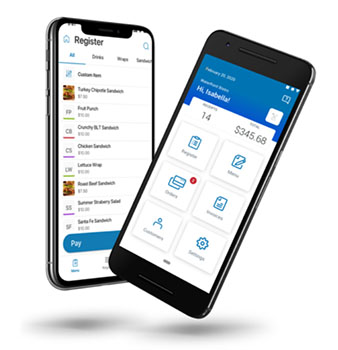

The easiest and most convenient payment method that U.S. Bank Merchant Services provides is mobile payment processing. The basic plan only offers the capability of processing payments through the talech mobile app. Users may either accept payments using their mobile phones or by connecting to the Bluetooth card reader. The mobile app can accept credit or debit cards, Apple Pay, and Google Pay.

The mobile app can process card payments by manually entering the card details into the app or by connecting a mobile card reader. (Source: U.S. Bank Merchant Services)

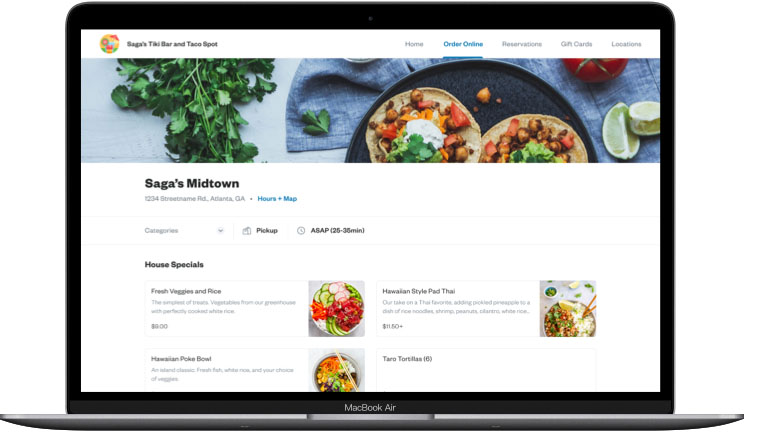

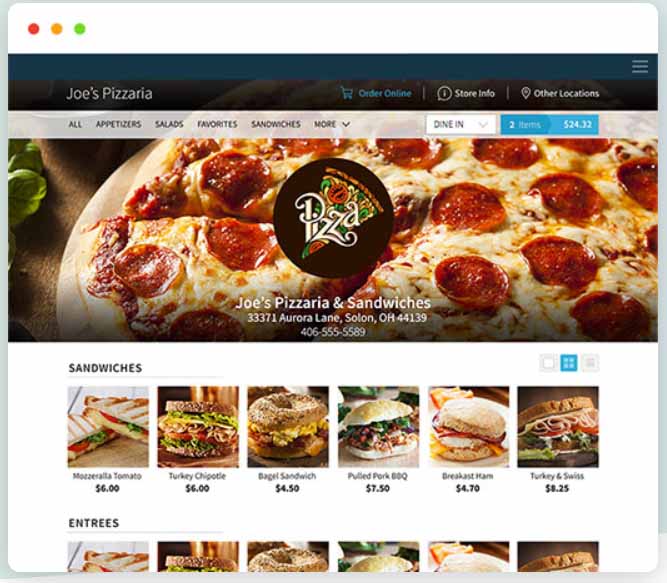

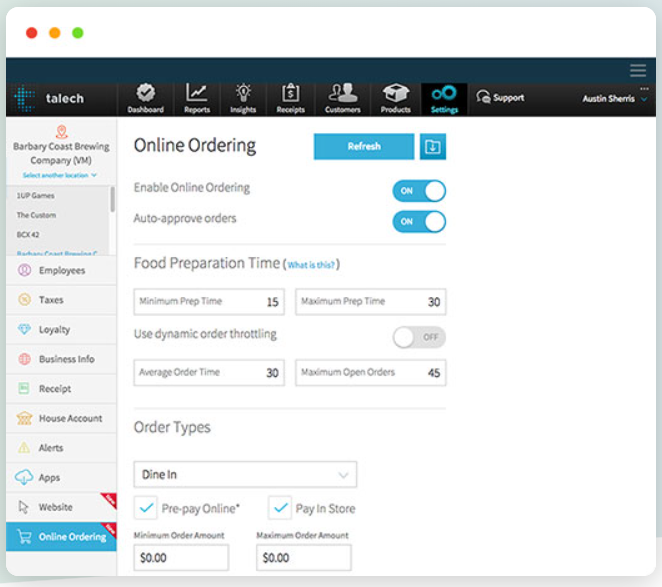

U.S. Bank Merchant Services offers an online ordering system that allows customers to create their own simple ordering website. This comes with an additional fee for the three lower plans and is included for free in the highest plan.

The online ordering system is suitable for full-service restaurants and multi-location businesses. However, the simple ordering website may be insufficient for businesses that require different customizations. Unfortunately, other ecommerce integrations are not available with any of the plans.

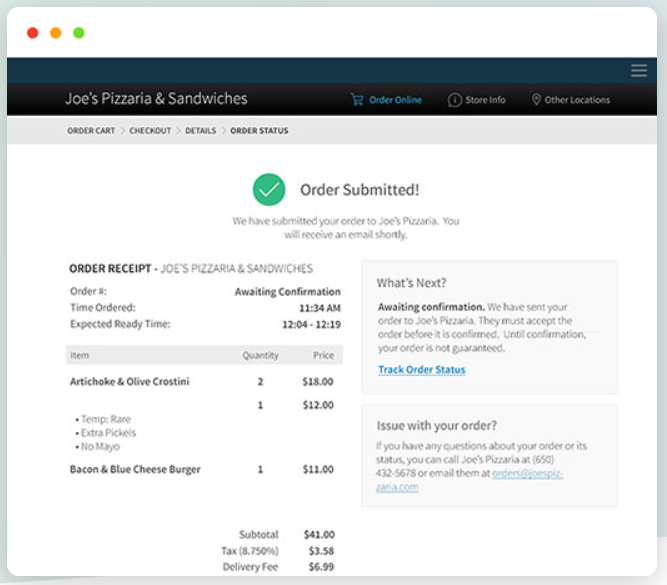

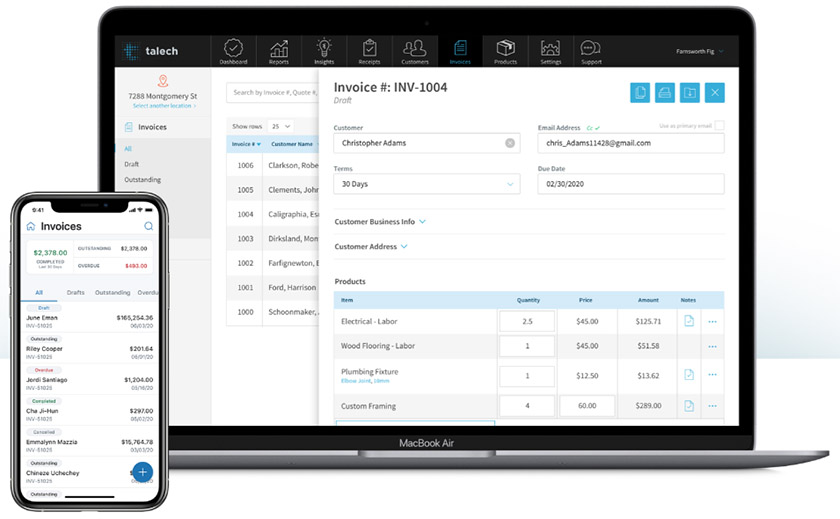

Merchants can create invoices easily and send them to the customers for payment. The invoices can be sent via email and notifications may be sent whenever the invoice is updated.

Reminders may be set to be sent out automatically, and it is easy to sort and manage invoices on the app.

The POS app also has an invoicing feature that allows you to create, send, track, and manage invoices. (Source: talech)

Although U.S. Bank Merchant Services does not mention ACH processing in its merchant services pages, U.S. Bank offers a different service for receiving and sending ACH payments.

The Zelle app is free to use for those with U.S. Bank accounts. It is easy to use, and unlike other ACH payment processors, you can receive the funds in just minutes. However, this payment method is only available for customers who also use the Zelle app.

U.S. Bank Merchant Services is geared toward providing a POS solution for businesses. After the basic plan, which only allows merchants to accept payments via a mobile card reader, the three other plans include hardware options to help merchants build a full POS system that can receive in-person payments, print receipts, manage inventories and customers, and generate reports.

The POS system, whether on mobile, a terminal reader, or the countertop display, can function as a virtual terminal where merchants can manually enter a customer’s card details to process a transaction.

Only very few merchant services providers are able to offer the capability of processing check payments. U.S. Bank Merchant Services has Remote Deposit Capture (RDC), where businesses can take photos of the check remotely and then send those images to the bank. The funds can appear in your U.S. Bank account on the same day.

U.S. Bank Merchant Services Features

U.S. Bank Merchant Services earned good scores for its same-day funding and 24/7 customer support. Being a large bank, U.S. Bank is also able to offer many other banking and business services. However, some of these services may come with additional fees.

U.S. Bank Merchant Services works with numerous business solutions for ecommerce such as Wix and Shopify, shopping carts such as Ecwid and X-Cart, and payment gateways such as NMI and Authorize.net. If you are using talech, other integrations such as Xero, Sage, and QuickBooks for accounting, Homebase for employee management, and Epson and Fresh KDS for kitchen display systems also become available. Aside from talech, merchants using other POS systems like Aloha and WooPOS can also work with U.S. Bank’s payment processing services. U.S. Bank also offers merchant account services to businesses in the automotive, healthcare, and B2B wholesale industries. Talk to a U.S. Merchant Services representative for your particular business needs to get the best recommendation. U.S. Bank Merchant Services offers fraud protection services to help minimize the risk of fraud. The fraud protection services include PCI compliance, fraud and chargeback management, check risk management, and ACH filter and block. However, the fraud protection services will incur additional fees. Contact U.S. Bank Merchant Services for specific pricing of this feature. One good feature to look for in POS systems is offline processing, which allows you to process orders and payments even when the system is offline. This makes the talech POS app a good option for those who need to process payments on the go and in locations where there might be unpredictable mobile connectivity. U.S. Bank Merchant Services is one provider that offers surcharging. Merchants located in states that allow surcharging can easily do it with U.S. Bank Merchant Services’ payment processing. Surcharging is the practice of passing on the costs of accepting credit card payments to customers. Learn more about credit card surcharging U.S. Bank Merchant Services offers same-day funding through its Everyday Funding service. This allows merchants to have access to their funds within hours instead of days. It is free for merchants who also have a U.S. Bank checking account. We recommend opening a U.S. Bank checking account if you sign up with U.S. Bank Merchant Services. The basic checking account does not require any monthly maintenance fee, and you can open one with a $100 deposit. U.S. Bank Merchant Services offers 24/7 customer support via email or phone. It has various customer service numbers on the website that make it easy to connect with the right department. The website also has an extensive knowledge base and options to make an appointment or find a branch.

U.S. Bank Ease of Use & Expert Score

With its self-service onboarding, simple setup, and 24/7 year-round support, we gave U.S. Bank Merchant Services an above-average score as well for ease of use. And while we avoid recommending payment hardware rentals, it’s also rare to find a hardware lease agreement that does not lock you into a long-term contract or impose an early cancellation fee.

However, although U.S. Bank is a reputable and long-standing bank, we struggled to find good user reviews online specifically for its merchant services. Also, their list of available integrations is not on the website, which may cause potential clients who prefer self-service sign-ups over phone conversations to miss out on U.S. Bank Merchant Services offerings.

Overall, we were pleasantly surprised with what U.S. Bank Merchant Services has to offer. While most traditional merchant accounts impose lengthy contracts and high monthly fees, U.S. Bank Merchant Services offers options for small businesses to start accepting payments with zero initial costs. However, if you want to go beyond its basic plan, you’ll have to pay monthly fees, along with set-up and device fees. This caused us to dock some minor points for pricing and affordability.

Methodology

We test each merchant account service provider ourselves to ensure an extensive review of the products. We also took a closer look into pricing methods and identified providers that offer zero monthly fees, pay-as-you-go terms, and low transaction rates. Finally, we evaluated the range of payment processing features, scalability, and ease of use to compare the overall cost-effectiveness of each product.

The result is our list of the best overall merchant services. However, we adjust the criteria when looking at specific use cases, such as for different business types and merchant categories. This is why every merchant services provider has multiple scores across our site, depending on the use case you are looking for.

Click through the tabs below for our overall merchant services evaluation criteria:

30% of Overall Score

Transaction fees weighed heavily here. We also awarded points for month-to-month or pay-as-you-go billing and no monthly, cancellation, or chargeback fees. and only included providers that offer competitive and predictable flat-rate or interchange-plus pricing. We also awarded points to processors that offer volume discounts.

30% of Overall Score

The best merchant accounts can accept various payment types, including POS and card-present transactions, mobile payments, contactless payments, ecommerce transactions, and ACH and e-check payments, and offer free virtual terminal and invoicing solutions for phone orders, recurring billing, and card-on-file payments.

20% of Overall Score

20% of Overall Score

Frequently Asked Questions (FAQs)

These are some of the most common questions we get around U.S. Bank Merchant Services.

Yes, U.S. Bank offers merchant services to businesses of all sizes, in addition to its checking, credit card, and other business banking solutions.

U.S. Bank owns a cloud-based POS system, talech, that supports POS services to merchants by default. However, you can speak with a U.S. Bank Merchant Services representative if you need a different or have a particular business solution in mind.

Elavon is a payment processor and provides payment processing services to U.S. Bank. However, note that there are other payment gateways and processors that can integrate with U.S. Bank Merchant Services.

Bottom Line

U.S. Bank is a large, well-known bank that offers merchant services and various business solution integrations. Its merchant services include a very basic plan that requires zero monthly fees with no contract and a free mobile card reader, making it a suitable option for very small businesses and startups.

Visit U.S. Bank Merchant Services