As the name suggests, startups are businesses that are in their initial stages. A startup begins with one or more individuals forming a business idea to fulfill a market demand with a single, unique product or service. The goal of a startup is to develop and grow into a revenue-generating business with the help of investors along the way.

Key Takeaways:

- A business is considered a startup if it has under $100 million in revenue, fewer than 100 employees, and below $2.5 billion in valuation.

- Startups are identified by their single big product or service and fast growth.

- Startups require continued funding in every stage of their growth.

- Joining a startup accelerator program can help founders network with the right investors.

Often described as “industry disruptors,” startup business ideas are geared towards innovating what is currently available in the market. These ideas include designs to solve the issue of a current product or create an entirely new product or service that consumers will find hard to resist.

Regardless of business type, not all startups succeed. A commonly cited statistic states that only 10% of startups become a full-fledged business and first-time startup founders have a success rate of 18%. While the risk of failure is high, successful startups are often rooted in a truly viable business idea combined with the founders’ passion and dedication to their product/service.

How a Startup Works

Three factors need to be considered to launch a startup: market demand, a business idea to fill the market demand, and a source of funds. While all businesses naturally require market demand to even be remotely viable, startups are unique because (1) they only develop one product or service, and (2) the cost of developing the product or service is high enough that it often requires outside investors.

Once an idea is turned into a product or service, startups continue into a series of stages—attracting investors, developing the product, establishing a customer base—until it becomes a fully viable, revenue-generating business. The lifecycle of a startup ends with the business either going public (IPO) or being sold to (or merging with) a larger organization.

Startup sources of funds:

- Bootstrapping: Self-funding or with family and friends

- Crowdfunding: Equity-based crowdfunding platforms like Start Engine

- Seed funding: From angel investors (someone who invests in the early stages of companies.)

- Series A, B, and C funding: From venture capitalists

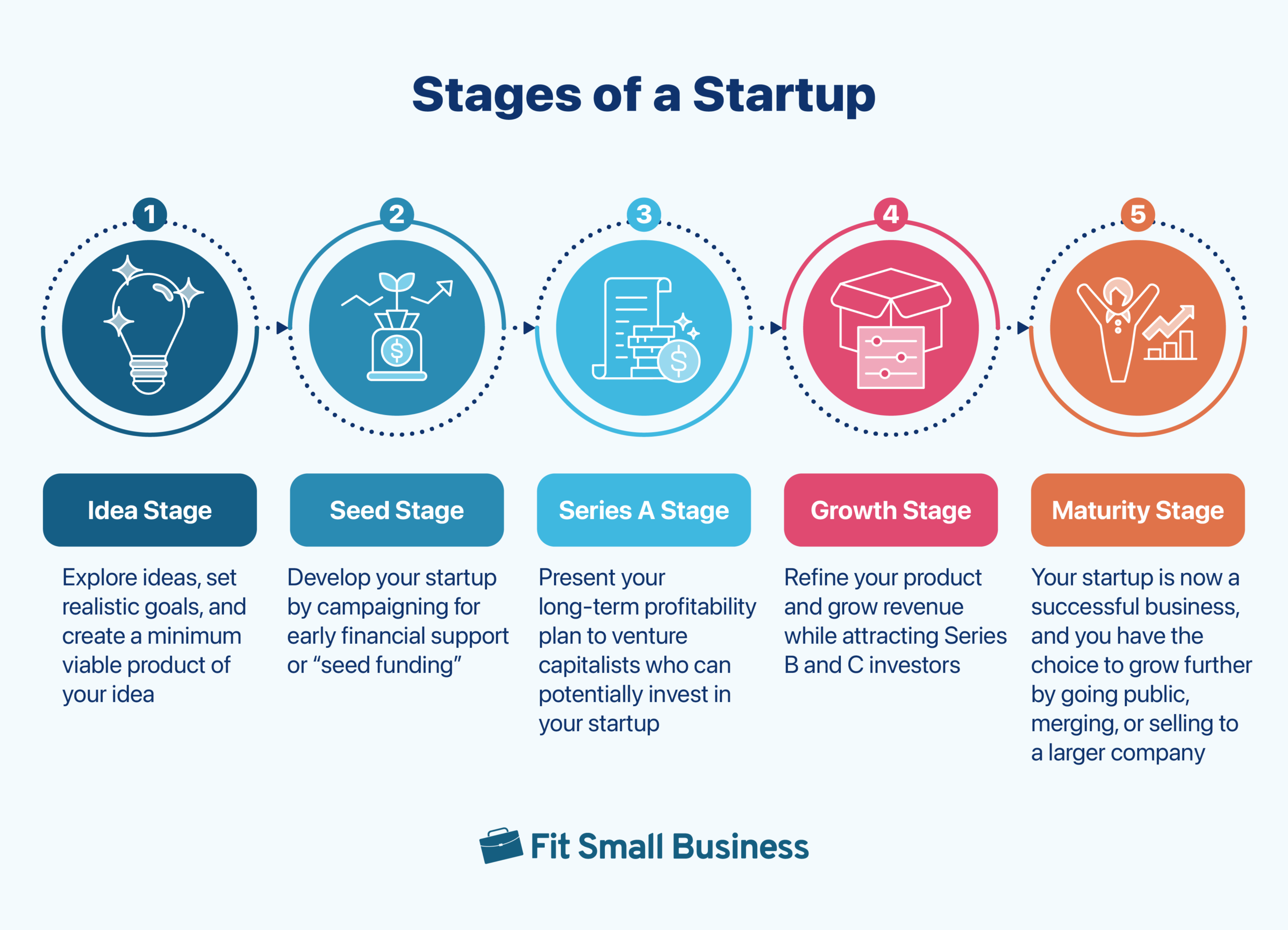

5 Stages of a Startup

The lifecycle of startups generally follows five stages. Each stage is made up of milestones that propel a startup’s growth.

Idea Stage

The idea stage includes researching (or discovering) a business idea and doing market research. The market research will help you have a general idea of your new business’ potential to succeed. You should be able to answer questions such as:

- Is my business idea an answer to a genuine issue?

- Are there any similar products or services that customers often use?

- Is my business idea comparably better than solutions currently on the market?

Timing is an essential factor when deciding on a product or service. Note how Airbnb grew during a recession in 2008 and contactless delivery business models rose during the COVID-19 pandemic.

Once you decide to push through with this venture, proceed to create a prototype (also called a minimum viable product or MVP a new product developed without any sophisticated engineering (stripped down version) but comes with all the necessary features that allows for full product testing ) of your product or service. Find your target users, ask them to test your prototype, and then improve your prototype based on their feedback. Repeat these steps until your target users confirm that you have perfected your product or service.

Lastly, but definitely an important step: file a patent, trademark, or copyright in this stage to protect your intellectual property.

Related reading:

Seed Stage

The seed stage is where a startup begins to campaign for initial business funding. In 2023, the average seed money investment US startups received was $2.5 million.

Prepare to reach out to angel investors, incubators, and join crowdfunding platforms by building a reliable team and creating a business plan. You will also need to prepare a white paper, a short presentation/demo, and a great pitch. Lastly, it’s important to take out insurance policies for your startup (an insurance policy absorbs some of the risk of a startup, making it more favorable to investors).

Series A Stage

After a successful seed stage, a startup would have developed a product, introduced it to the market, and created a customer base. This prepares the business for the Series A stage, which simply means looking for venture capitalists for more funding. In the US, the median funding for Series A rounds is $18 million.

The objective is to grow the business by improving the product or service and/or developing a wider marketing strategy to expand the customer base. Make sure to have a business expansion plan prepared (including potential return on investment), a product or service demo, and a report on your financials showing how the startup has grown since the seed stage.

Social media giant Facebook was once a startup, beginning as a small platform created in a dorm room, which suddenly gained a huge following and overtook MySpace and Friendster.

Bombas is the most successful startup on Shark Tank, now with over $225 million in lifetime sales. (Source: The Business Journals)

Bombas is another successful startup that went on the show Shark Tank in search of an investor. A sock company, Bombas’ founders identified socks as the most in-demand item of clothing among the homeless and created their business with the goal of donating one pair of comfort socks for every item sold.

Growth Stage

The successful Series A funding brings your startup to the growth stage. This is where scaling the business is your primary goal and can be done using the investment you received to improve your product or service. Hire and work with a reliable tech company, onboard more employees beyond the critical role, and devise a wider marketing plan to reach more customers.

You may also want to increase your insurance policy for the startup.

The growth stage is also where Series B, C, and D fundings take place mostly from investment banks and private equity firms. Platforms like Fundz provide a database of venture capital firms that invest in startups at its growth stage. Investors primarily look for business stability, which is why many investors choose to invest in startups that focus on profitability over revenue growth. Typically, quickly profitable startups are less risky; save a portion of profits to build a cash reserve.

Maturity Stage

Say, for instance, that after seven years of hard work, the startup becomes wildly successful—so successful that many are now considering it a company because it’s making over $100 million per year with 1,000 employees and is valued at $3 billion.

This is now the mature stage of a startup, meaning its product or service is already well-established in the industry and it has a solid customer base that brings in a steady revenue stream. At this point, the startup is considered successful.

There are no rules on what to do once a startup becomes successful. That said, here is when the founders have to make a key decision of either expanding or exiting the business.

Founders who decide to continue with the business tend to take the IPO route. IPO, or initial public offering, is where a business sells shares of stock in the stock market to bring in more investment.

Meanwhile, founders who decide to exit will look for larger companies to merge with or that would be willing to buy their startup. Amazon and Google, for example, often buy small startups that would fit into their company.

Startup Pros & Cons

| PROS | CONS |

|---|---|

| Fast growth | High risk of failure |

| Opportunity to learn | Will require you to raise capital |

| Full control | Stress from being fully invested in the business |

| Flexible hours | Competitors that may launch a similar idea |

| Potential for high return on investment | |

While considerable risk is involved when launching a startup, there are also many advantages. The common trait that defines a startup is growth—fast growth. Startups with the right product and strategy enjoy significant growth in a short amount of time. Achieving this requires hard work and dedication (Elon Musk says he worked 80- to 120-hour weeks and has slept on the factory floor to meet Tesla deadlines), but because those who are involved in startups are often driven by their passion for the product or service, it can also be a lot of fun.

The flexibility and versatility of a startup contribute to both the challenge and satisfaction of creating the business. Employees take on multiple roles and the culture is more open to mistakes (opportunities for learning) than an established business.

Frequently Asked Questions (FAQs)

These are some of the most common questions we encounter about startups.

A startup is any fledgling business in the early stages of development. In common use, though, most people use the term “startup” to refer specifically to young companies characterized by fast growth and large capital investments gained in a series of funding. Startups tend to start with an innovative product or service idea that answers an identified consumer need or disrupts an existing industry model.

The average monthly salary of startup founders ranges from $93,000 to $200,000. Exiting startup founders who sell their businesses earn a profit based on their current equity stake.

A unicorn is a startup that has achieved a rare $1 billion market valuation. As of this writing, US shopping site Jet.com, which reached its $1 billion valuation four months after its founding, holds the fastest unicorn status record.

Bottom Line

So, what, exactly, is a startup? It’s a business hyper-focused on quick, big growth. It creates a product that disrupts an industry and possibly changes our day-to-day life.

Creating a startup can feel like an emotional rollercoaster. Aside from being a high-risk, high-reward venture, no two founders experience a startup the same. However, a startup is defined by their shared experience—the excitement of coming up with an idea, fighting through challenges, and hoping that one day, you finally have a thriving business attractive to larger companies and worthy of a place in the stock market.