In a nutshell, electronic fund transfer (EFT), sometimes called “pay by bank,” is a broad term used to classify all types of digital exchange of funds between two banks. While EFTs are generally slower to process than card payments, EFT payments (such as ACH and e-checks) are cheaper and equally secure as card payment transactions.

EFTs are used for sending and receiving remittances, paying bills remotely, and paying for an item or service. Actions like retrieving money from an ATM, debit transactions at the point of sale, and direct deposits are also EFT transactions.

These transactions are governed by the Electronic Funds Transfer Act (EFTA), which protects payors and includes guidelines such as fee transparency, consumer’s right to receipts and periodic statements, stop payments, and confidentiality.

Key Takeaways:

- Electronic fund transfers refer to any digital bank-to-bank transaction.

- Bank-to-bank transfers can be between any two entities—individuals, businesses, nonprofits, or government organizations.

- Unlike credit card payments, EFTs are cheaper but take up to 48 hours to process and fund.

Types of EFT Payments

Because EFT is a catch-all phrase, there are different types of transactions under this umbrella term. This also means not all EFT payments work the same. Merchants may be familiar with some methods (like e-checks), while others are simple bank-to-bank transfers between individuals.

Did You Know? If given the right incentives, 40% of consumers are open to using pay-by-bank payment methods (EFTs).

This makes EFT payments an ideal payment method—particularly for large-volume transactions and businesses that do not rely heavily on instant payments. But exactly what types of EFTs can be used to accept customer payments?

Wire Transfers

A wire transfer is a simple bank-to-bank fund transfer often used to send large amounts either internationally or locally. Transactions can be processed within the day or up to a few days, depending on the sending and receiving banks’ policies, such as cut-off times and location.

The average cost of accepting (incoming) wire transfers is $15 but it may cost more depending on where your client is located. International wholesalers, manufacturers, and businesses that sell large-ticket items such as real estate, jewelry, and automotive often use international wire transfers.

Digital Wallet/Digital Banking Payments

Online banking apps are a form of digital wallet, which allows users to pay for their purchases simply by logging on to the app, capturing the seller information, and sending payment. The transaction approval is instant, making digital wallet payment methods popular among retailers.

To set up, merchants only need access to an online banking app where they have signed up for a business bank account. However, online banking apps can only save credit and debit cards issued by the same brand—unlike ApplePay and other non-bank wallets.

Debit Card Payments

Debit card payments are transactions where customers use their debit card to complete a payment. Traditional debit cards (issued by a bank) are used for payments at the checkout counter such as at supermarkets and convenience stores. Similar to an ATM, customers have to enter their PIN on a card terminal’s PIN pad to authorize the transaction instantly.

There are also co-branded debit cards (debit cards in partnership with a card network brand such as Visa and Mastercard) that can be used to complete online payments and set recurring payments. However, note that doing the latter will charge you a credit card fee instead of the low flat rate for debit transactions.

ACH Payments

Unlike other EFTs that employ a simple direct bank transfer method, Automated Clearing House (ACH) payments are transactions that go through the ACH rail. The ACH rail is an electronic network that processes and approves all qualified ACH transactions.

There are two types of ACH payments:

- Payments deposited directly to a receiver’s bank account, such as an employee’s paycheck, a person paying taxes, or e-checks deposited to a merchant’s bank. Only the payor initiates and completes the transaction.

- Direct payments where both payor and payee are involved in the transaction. Examples are Zelle, Venmo, and recurring payments.

Merchants often use direct ACH payments as alternative payment methods. It’s particularly useful for recurring payments because ACH is significantly cheaper than using credit cards for multiple transactions. E-checks, though not as popular, are also less expensive for online payments.

To learn how e-checks and ACH payments work, read our guides:

- What is an E-check & How Does It Work?

- Small Business Guide to ACH Payments

- ACH vs EFT Payments Explained

Phone (IVR) Payments

A phone payment is different from manual transactions where clients call in and provide their payment details as the merchant enters the information on a virtual terminal. A pay-by-phone or Interactive Voice Response (IVR) system is a computerized transaction accessed via a specific phone number provided by the user’s bank.

Because it is a fully self-service terminal, clients are guided with a series of menu prompts using touch-tone, allowing them to enter their payment information. To use the service, merchants will need a dedicated phone line and provide customers with a unique transaction reference number for payment processing.

While EFT phone payments are cheap, the cost of investing in an IVR system can be significant. This is why not many small businesses use phone payments as the return on investment is better for large, enterprise types.

ATM Transfers

ATM transfers are simply electronic transactions via an ATM, allowing users to transfer funds from one bank account to another. However, this type of EFT is used mostly for personal banking instead of sending merchant payments simply because it is less convenient than remote methods such as wire transfers, ACH, and digital banking.

Local Bank-to-Bank Transactions

Local bank transfers are funding requests electronically sent from one entity to another, with both entities located in the same country. Ironically, local bank transfer is also one method used for cross-border payments, where a client can deposit to a foreign bank account. This is more commonly known as international or Global ACH.

Global ACH is made possible through financial intermediaries, such as the National Automated Clearing House Network (NACHA) in the US, working and sharing data with similar electronic payment networks in other countries, such as the Single Euro Payments Area (SEPA) in the European Union and the Bankers’ Automated Clearing System (BACS) in the United Kingdom.

Instead of an international wire transfer, businesses can accept international ACH payments, which are significantly cheaper. However, the clearing takes an average of three business days.

EFTs vs Credit Card Payments

Electronic fund transfers are different from credit card transactions primarily because the two differ in the source of funds. This distinction is clearly stated in EFTA.

EFT Payments | Credit Card Payments | |

|---|---|---|

Source of funds | Payor’s bank account | Payor’s line of credit |

Processing method | By batch | Per transaction or batched, depending on merchant services provider |

Purpose | Remittances, bill payments, purchases | Purchases, bill payments |

Identifier | Bank routing number, payor bank account number | Payor credit card details |

Accessibility | Acceptance depends on the payor’s bank | Global acceptance |

Looking at the table, it’s understandable why credit cards are preferred over EFTs as a payment method. The transaction process is faster (instant) and is accepted globally thanks to card network brands.

However, the main benefit of EFT payments is its fees, which are significantly cheaper than credit card payments for the following reasons:

- The source of funds is secure, so the risk accepted by the financial institution is lower

- Fewer intermediaries that impose their own fees

- Fee is charged by batch, not per transaction

Other benefits of EFT payments include:

- Faster alternative to paper-based bank transactions such as paper checks

- Convenience provided by 24/7 accessibility of electronic submission forms instead of being limited to banking hours

- Highly secured transactions backed by industry-standard encryptions and policies implemented by regulatory bodies

How EFT Payments Work for Merchants

Earlier, we talked about how EFT payments vary. Except for digital wallet/digital banking and debit card transactions, EFTs take longer to process. Some go through intermediaries for clearing before settlement, while others are simply a direct exchange of funds between two banks.

That said, there are steps common to EFT transactions when used by merchants to accept payments.

For remote payments:

- Step 1: Business sends invoice to customer

- Step 2: Customer prepares fund transfer request and/or authorization form

When paying via wire transfers, local bank transfers, and IVRs:

- Step 3: Customer sends payment request to their bank

- Step 4: Customer’s bank transfers funds to merchant’s bank

When paying via ACH (echecks, recurring payments, global ACH)

- Step 3: Business receives payment details and signed authorization form, forwards to NACHA

- Step 4: NACHA clears the transaction

- Step 5: Funds are transferred to merchant’s bank

For debit card payments at the point of sale:

- Step 1: Cashier rings up customer’s items

- Step 2: Customer provides debit card for payment

- Step 3: Cashier inserts debit card in the card terminal and inputs total amount

- Step 4: Customer inputs PIN to authorize transaction

- Step 5: Funds are transferred to merchant’s bank

EFT Payments Best Practices

The following are merchant guidelines for accepting EFT payments:

Invoices

Except for in-person EFTs (digital wallet and debit card payments), merchants must send the customer an invoice that shows the purchase details as well as invoice and transaction numbers to serve as a reference when creating a fund request.

Related reading:

Authorization Forms

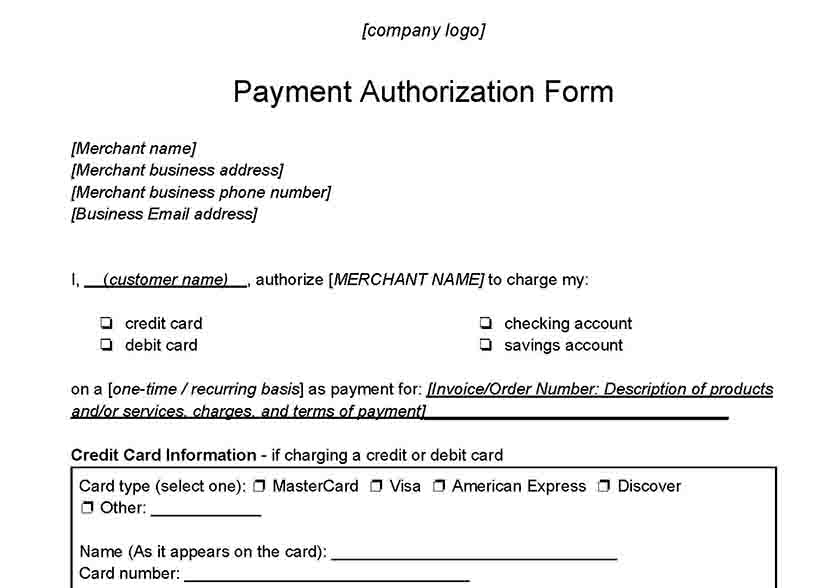

Merchants should always include a signed authorization form before sending a payment request to a customer’s bank. These are required documentation even for credit card transactions, especially for large ticket or recurring payment setups.

Below is a standard authorization form template:

Thank you for downloading!

Want a payment processor with credit card authorization tools and more already built-in? Visit Square to see why it is our top-recommended payment processor.

Compliance

EFT payments are monitored by regulatory agencies and are required to comply with standards to protect consumer rights and information.

Among them are:

- EFT Act (Regulation E): Established according to the guidelines of the Electronic Funds Transfer Act for the protection of consumer rights.

- Payment Card Industry Data Security Standard (PCI DSS): The PCI DSS are standards established by the PCI Security Standards Council to strengthen payment security measures across the globe.

- National Automated Clearing House Association (NACHA): A US regulatory agency responsible for approving and clearing the transfer of funds between financial institutions using the ACH network.

- Bank Secrecy Act (BSA): Established by the federal government to protect banks and other financial institutions from being used for money laundering.

Frequently Asked Questions (FAQs)

These are some of the most common questions we encounter about EFT payments.

Yes, there are several EFT transaction types that can be used to accept customer payments.

EFT payments cost anywhere from $0 to $15 on average, depending on your bank’s terms and the type of EFT payment being used. Wire transfers are the most costly while digital wallets and local bank transfers can be free especially if you are using the same bank as your customer.

Compared to credit card transactions, EFT payments generally take longer to process. For example, ACH transactions take between 3–5 business days while wire transfers take 24–48 hours. There are same-day ACH options but availability depends on both the merchant and customer’s bank. The exceptions are digital wallets/banking and debit card payments used for in-person transactions.

Bottom Line

Electronic fund transfers are great alternatives to credit card payment methods mainly because they cost considerably less to process without sacrificing security. However, most EFTs take slower to settle so they are not ideal for certain business types. That said, payment technology is steadily catching up and will hopefully become a more viable payment method for small businesses in the near future.